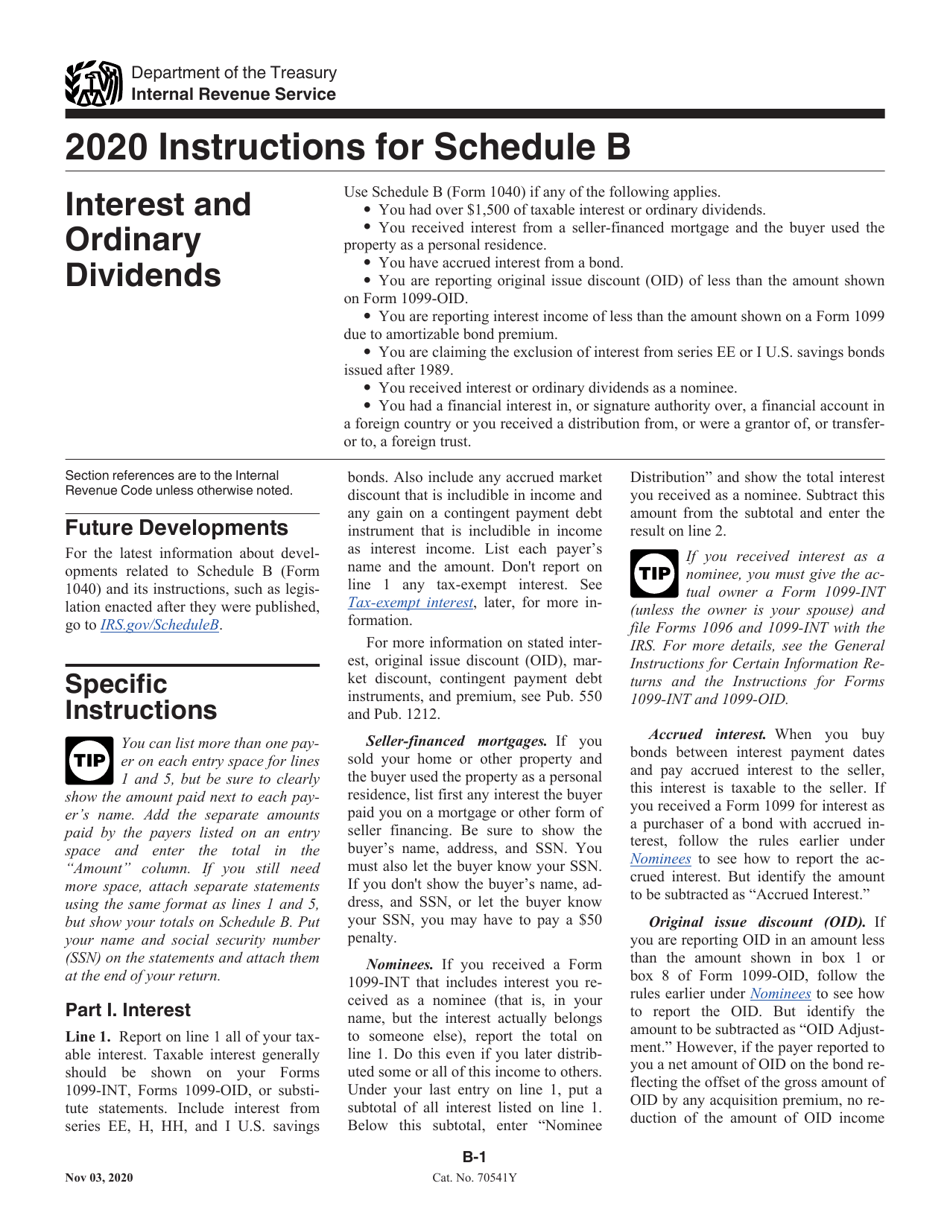

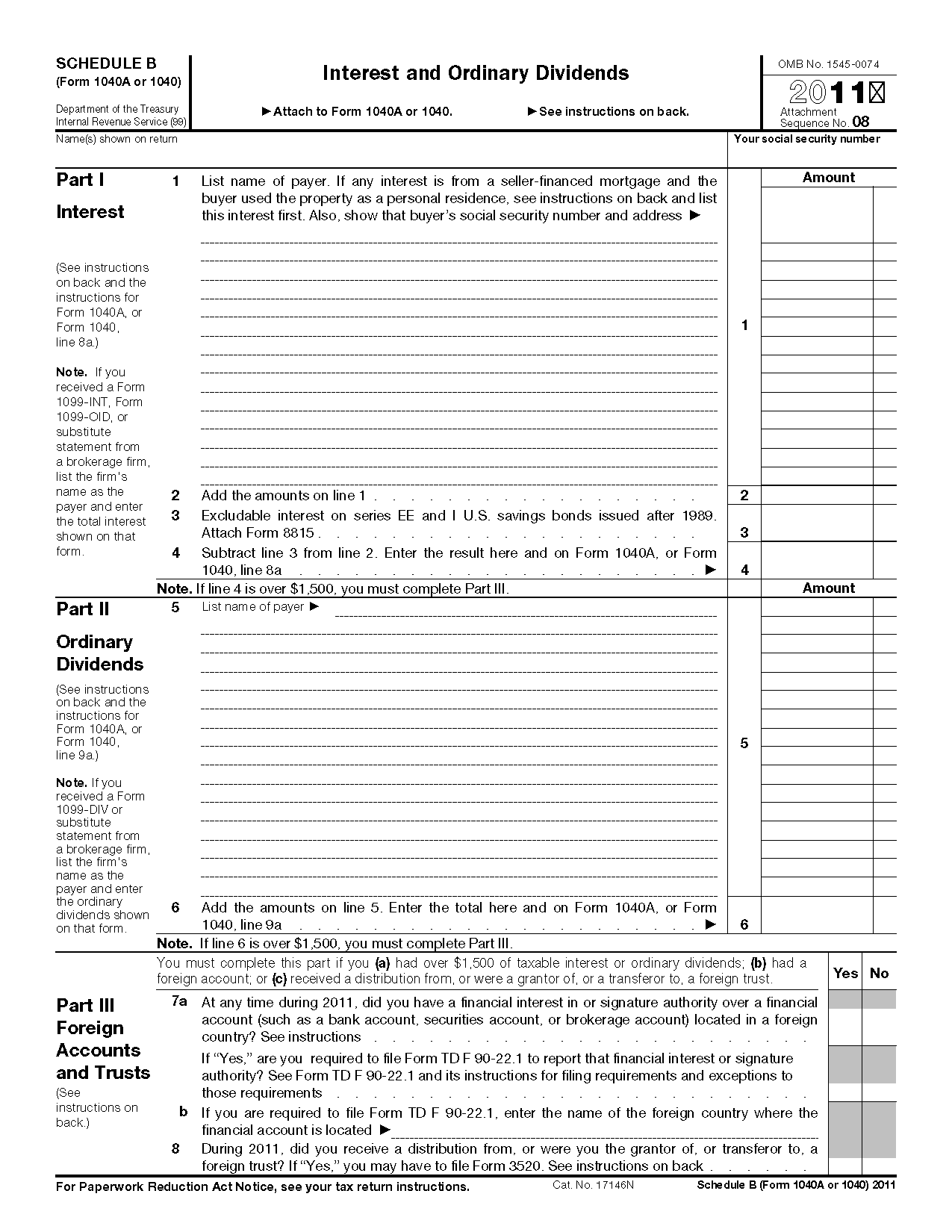

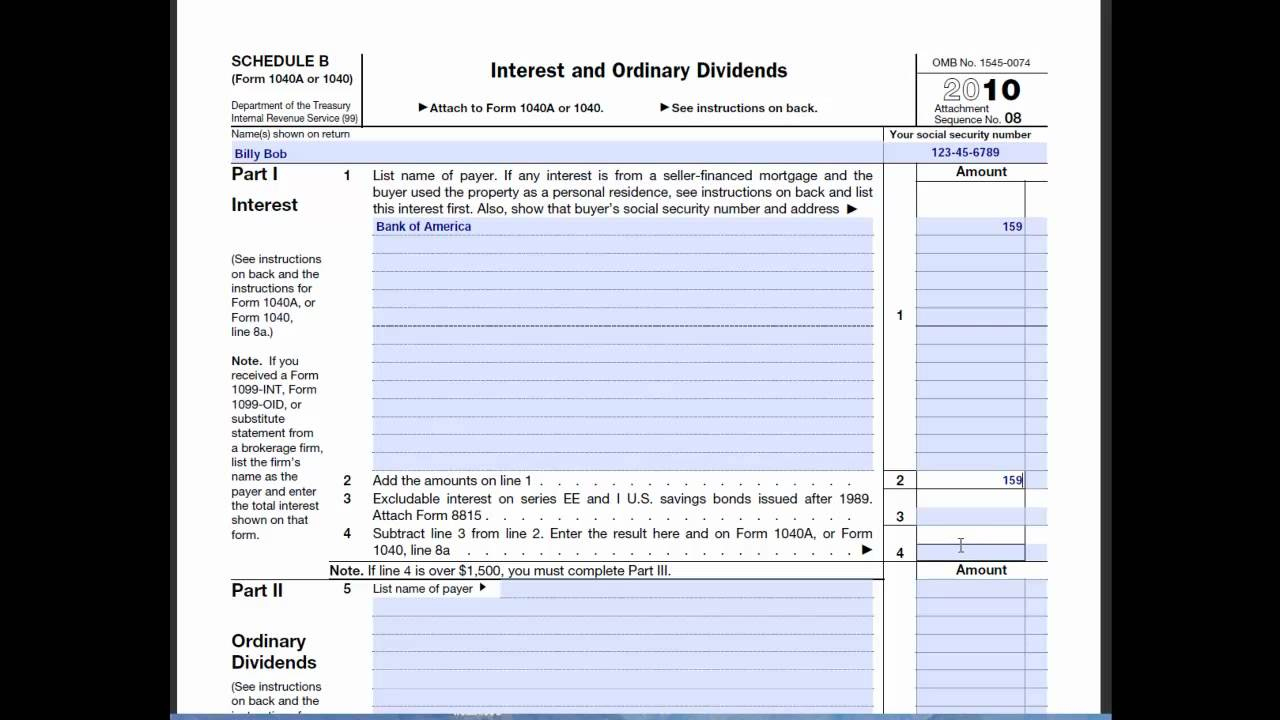

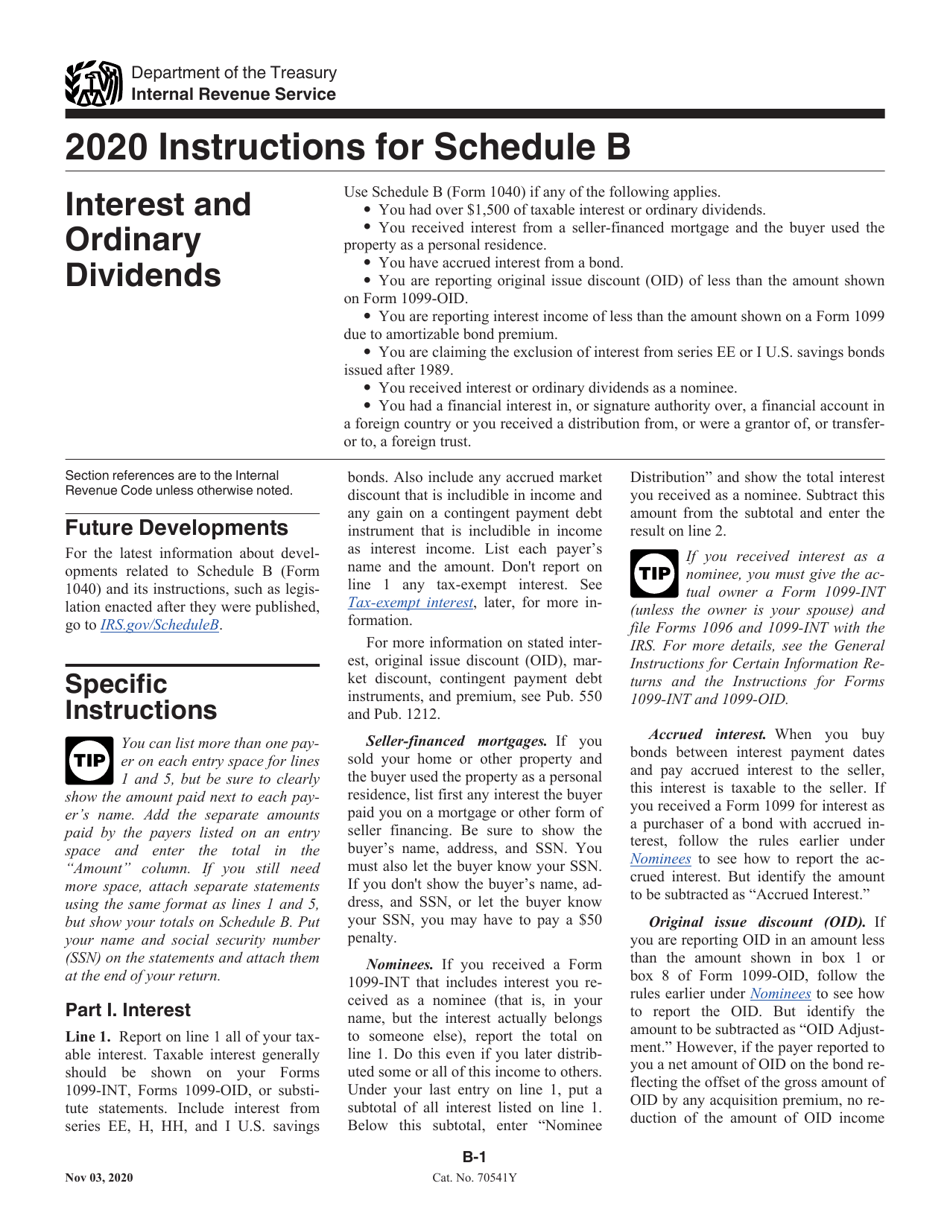

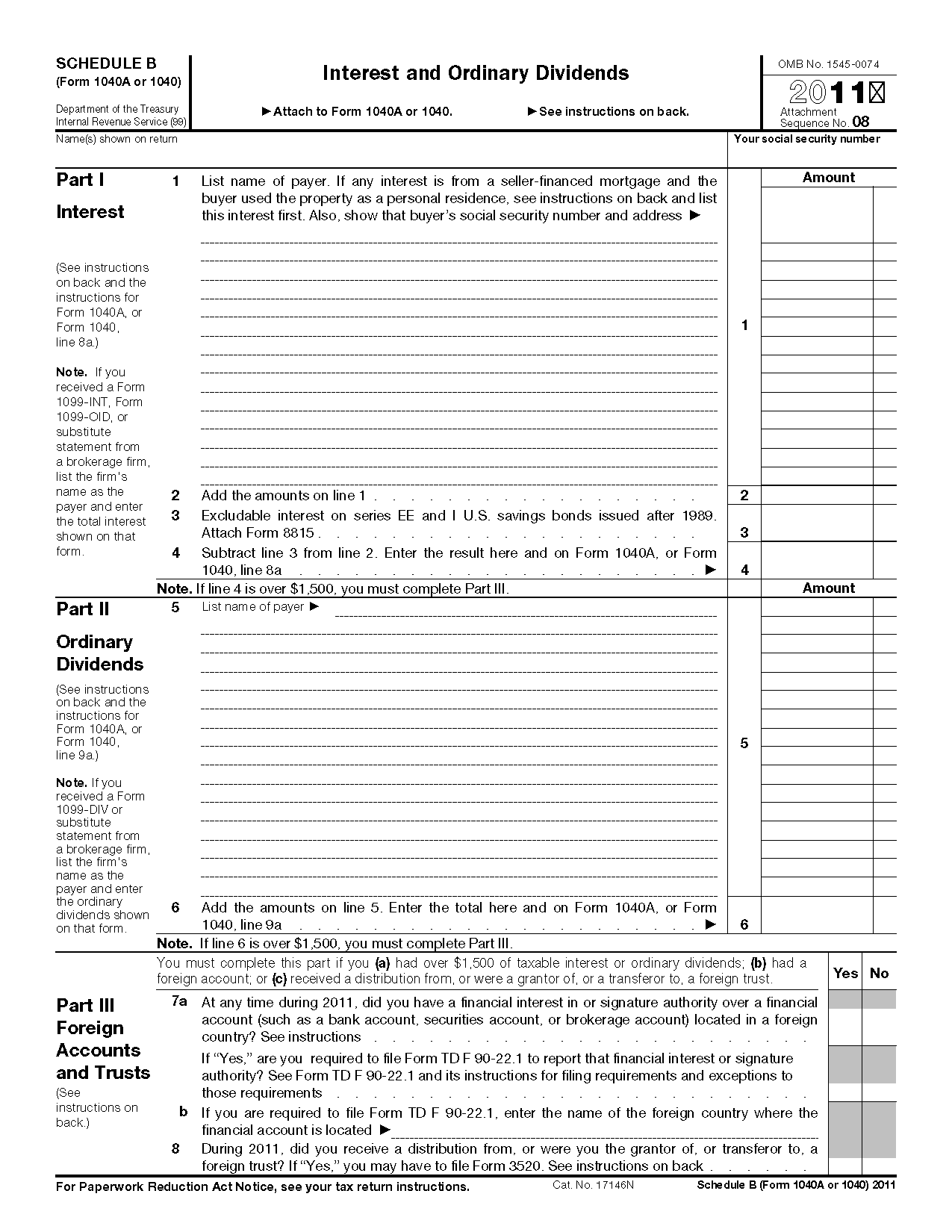

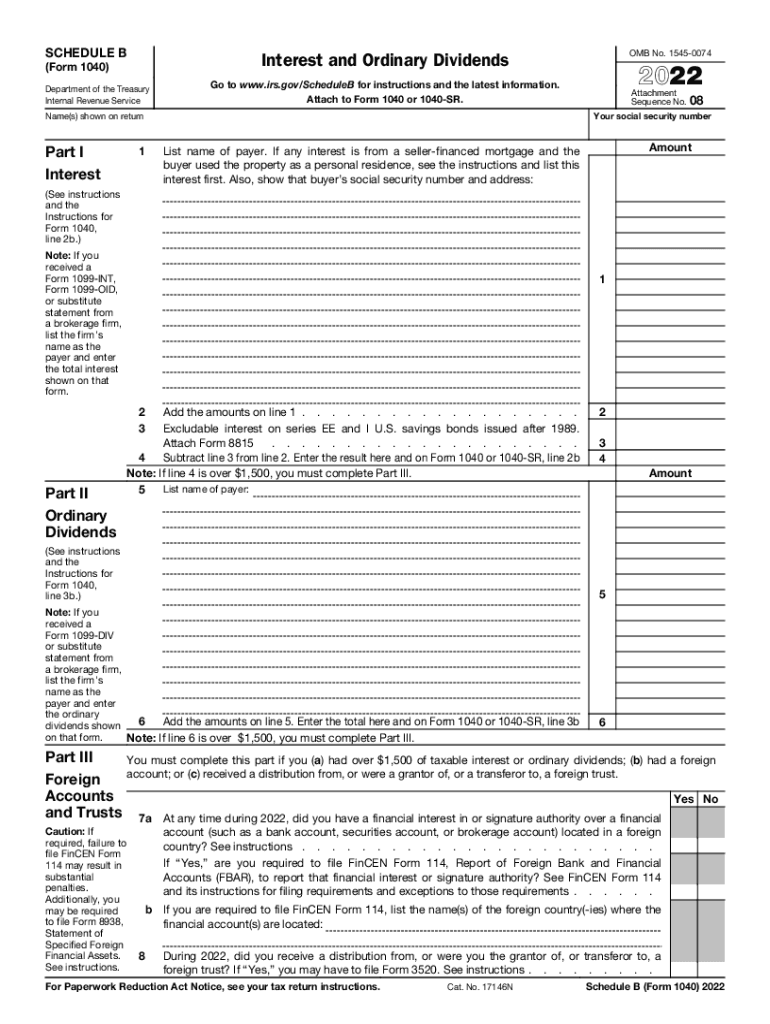

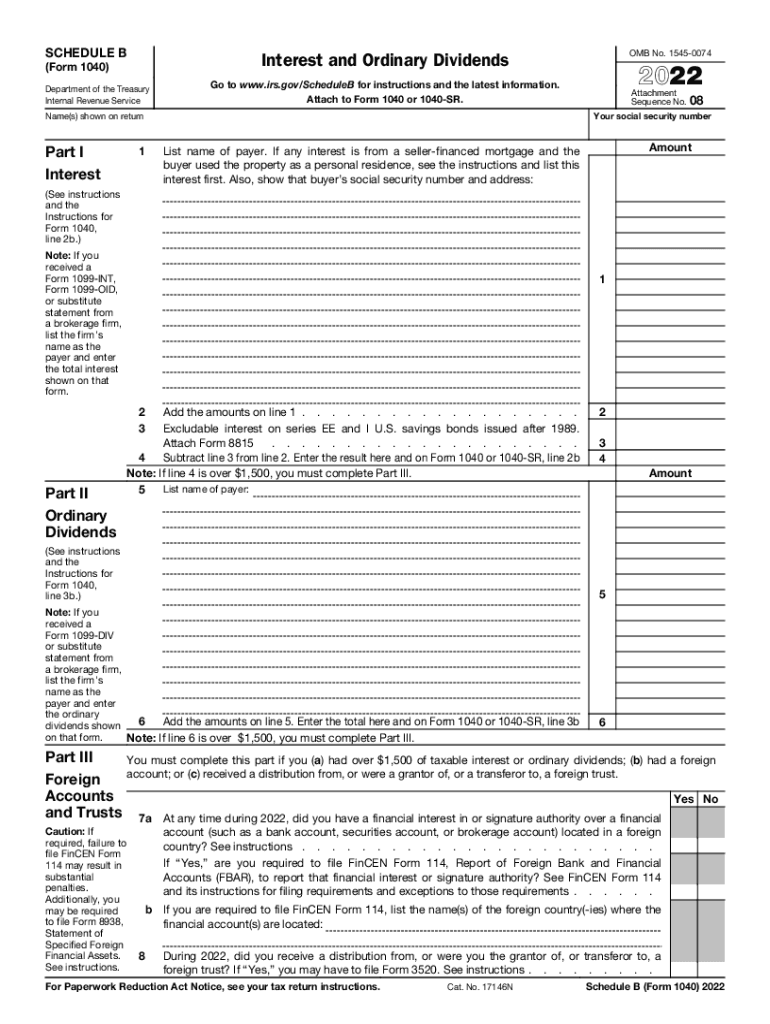

1040 Schedule B Printable Form Who Must File Form 1040 Schedule B Over 1 500 of taxable interest income Over 1 500 of ordinary dividend income Accrued interest from a bond Exclusion of interest from series EE or I US savings bonds Financial account or trust in a foreign country FBAR Interest income from a seller financed mortgage Printable Form 1040 Schedule B

According to the IRS Schedule B is required for taxpayers who received more than 1 500 of taxable interest or ordinary dividends during the tax year The form is also required for taxpayers who received any foreign accounts or trusts or who had any foreign financial assets over a certain threshold You can download or print current or past year PDFs of 1040 Schedule B directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

1040 Schedule B Printable Form

1040 Schedule B Printable Form

https://data.templateroller.com/pdf_docs_html/2117/21171/2117170/instructions-for-irs-form-1040-schedule-b-interest-and-ordinary-dividends_print_big.png

Fillable Form 1040 Schedule B Printable Forms Free Online

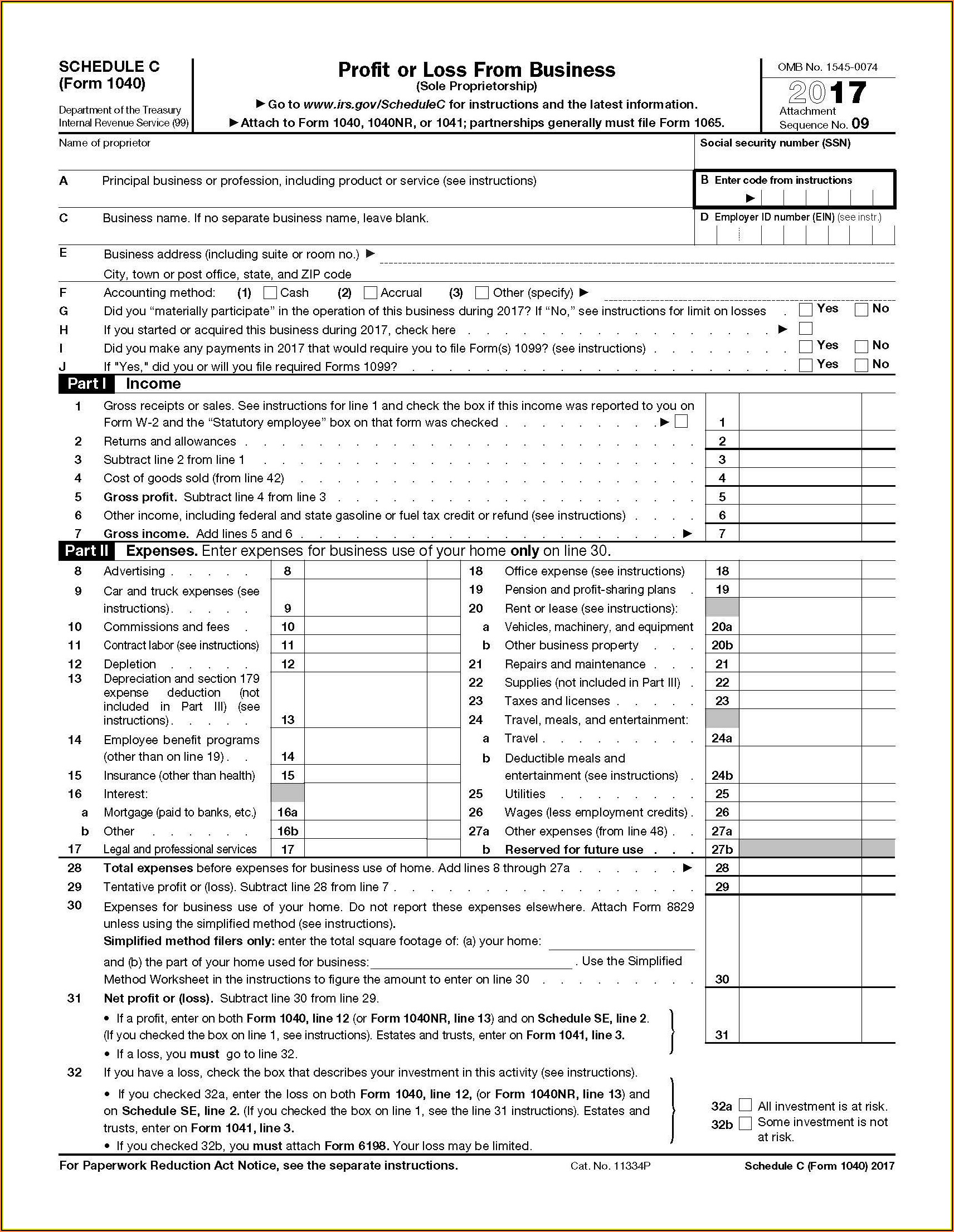

https://www.contrapositionmagazine.com/wp-content/uploads/2020/04/www.irs_.gov-form-1040-schedule-c.jpg

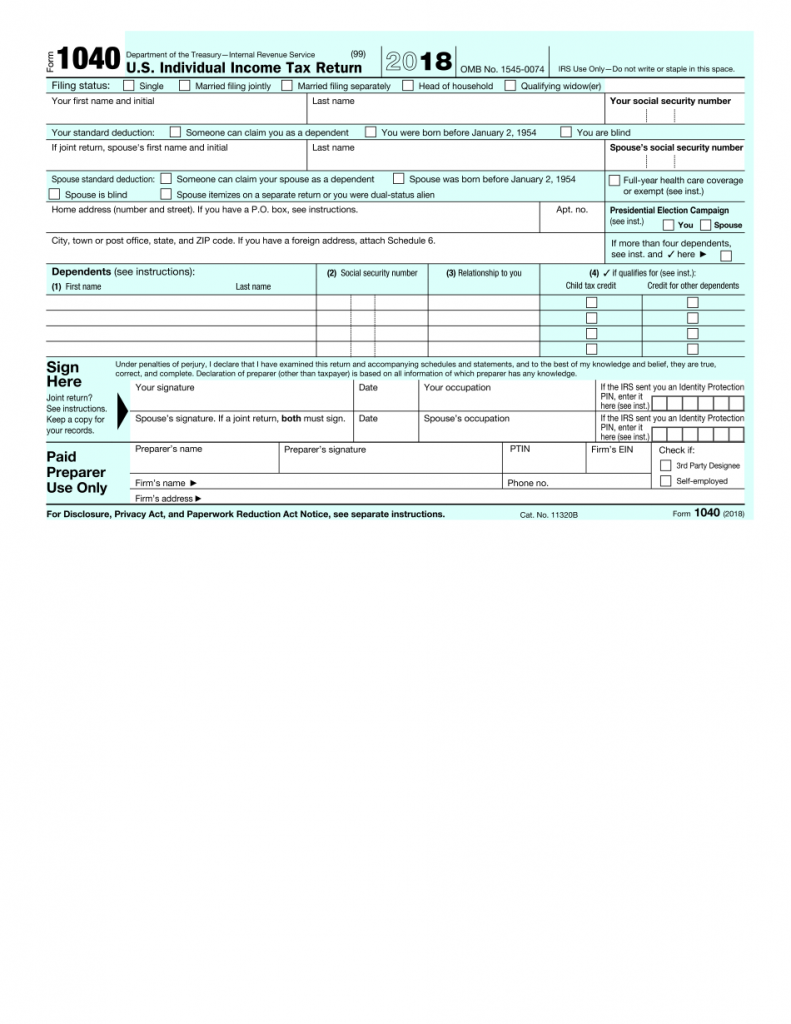

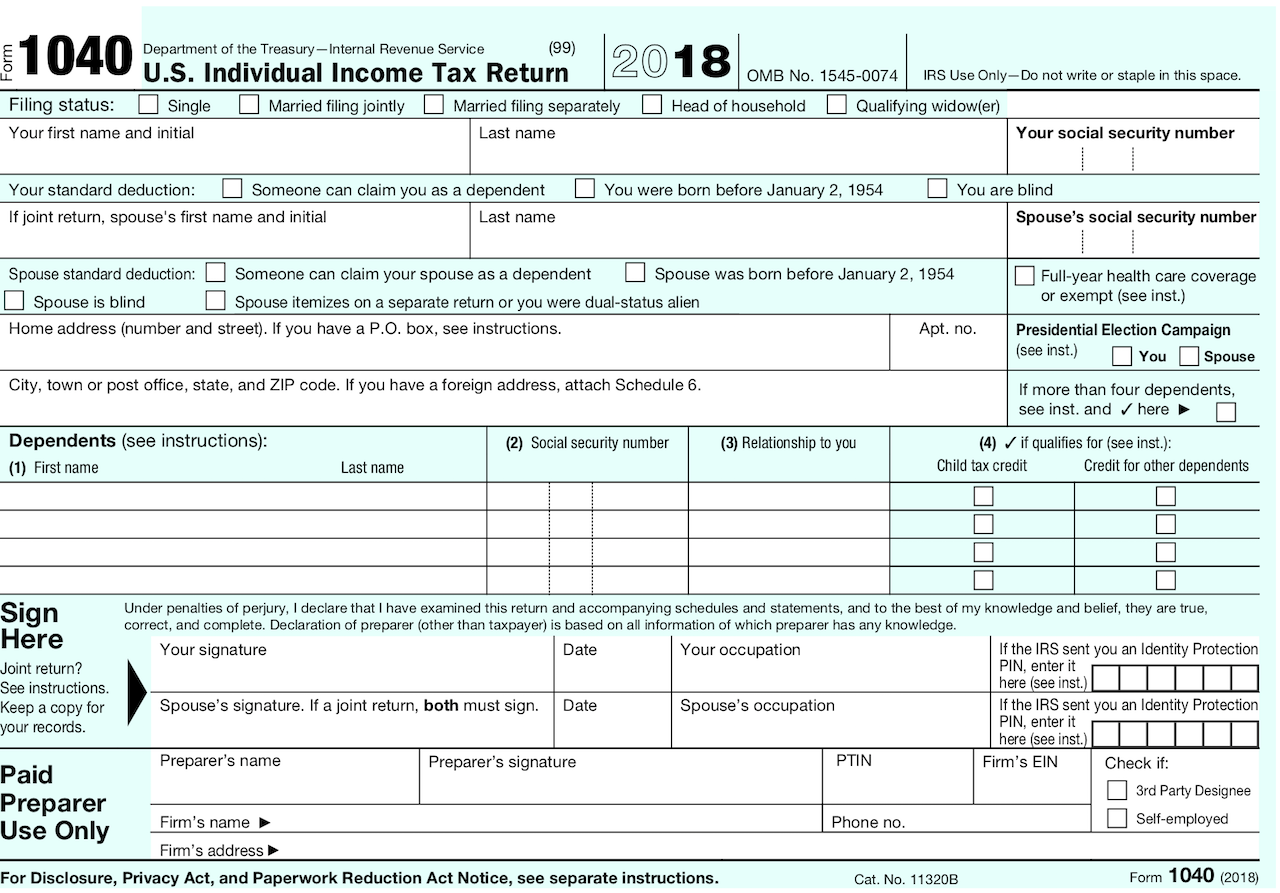

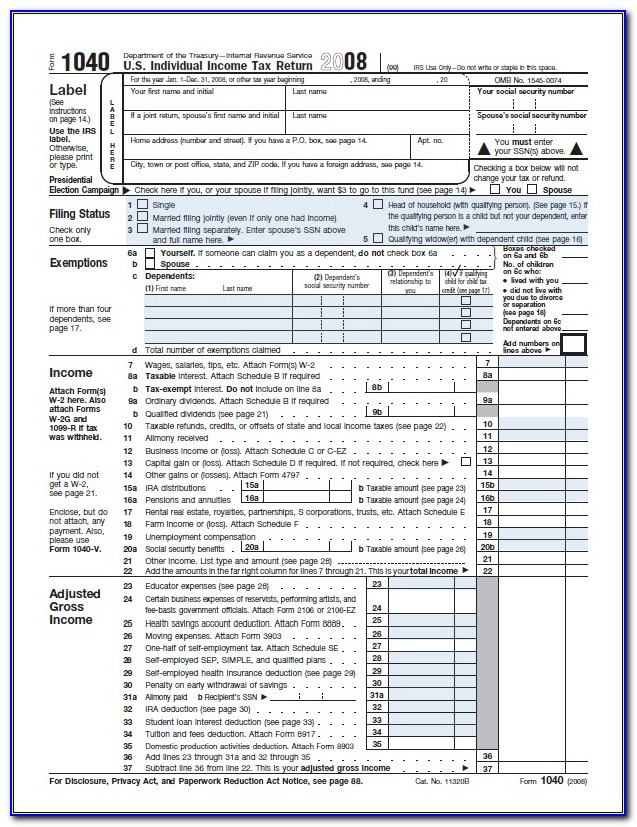

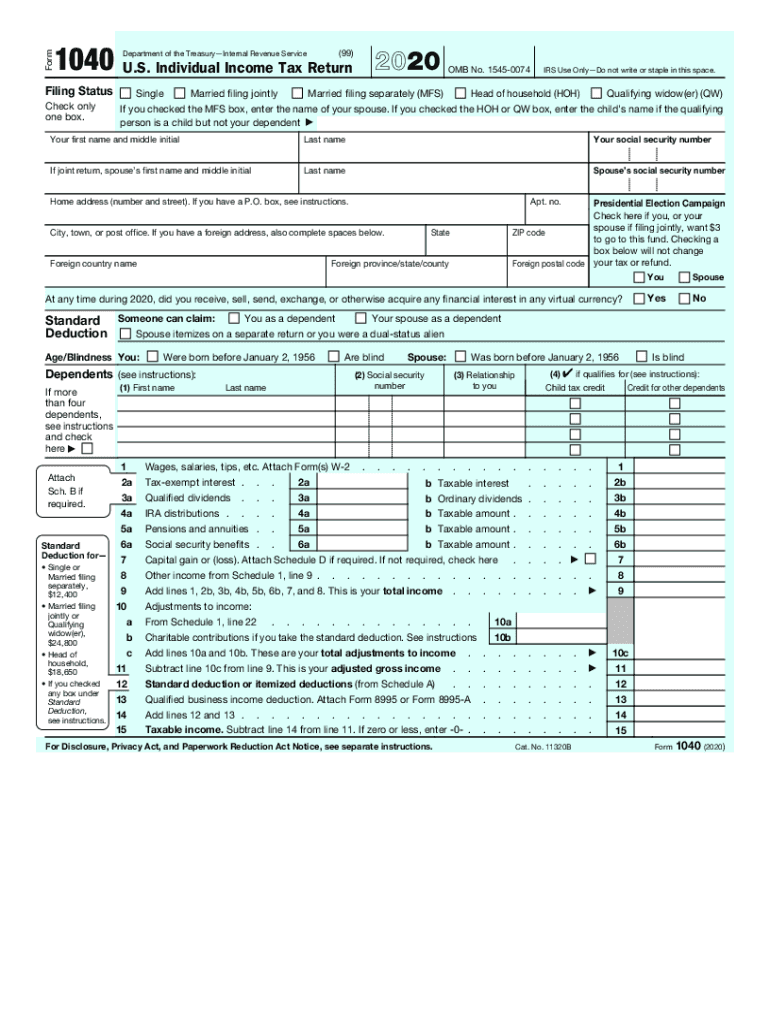

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

https://www.printableform.net/wp-content/uploads/2021/07/irs-1040-form-fillable-printable-in-pdf-1-791x1024.png

New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Schedule B reports the interest and dividend income you receive during the tax year However you don t need to attach a Schedule B every year you earn interest or dividends It is only required when the total exceeds certain thresholds For most taxpayers a Schedule B is only necessary when you receive more than 1 500 of taxable interest

Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule b pdf and you can print it directly from your computer More about the Federal 1040 Schedule B eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms Schedule B is an IRS tax form that must be completed if a taxpayer receives interest income and or ordinary dividends over the course of the year of more than 1 500 The schedule must accompany a

More picture related to 1040 Schedule B Printable Form

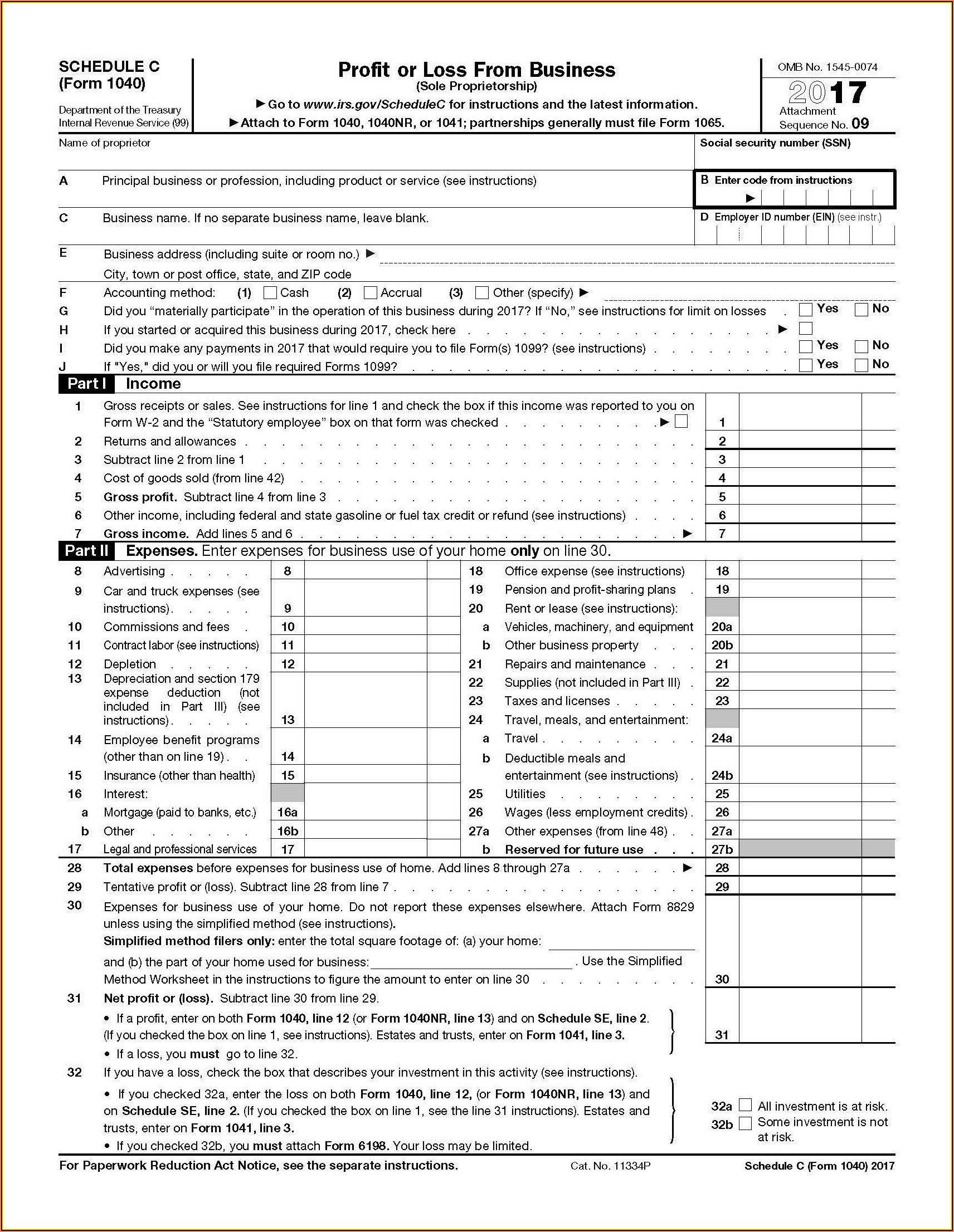

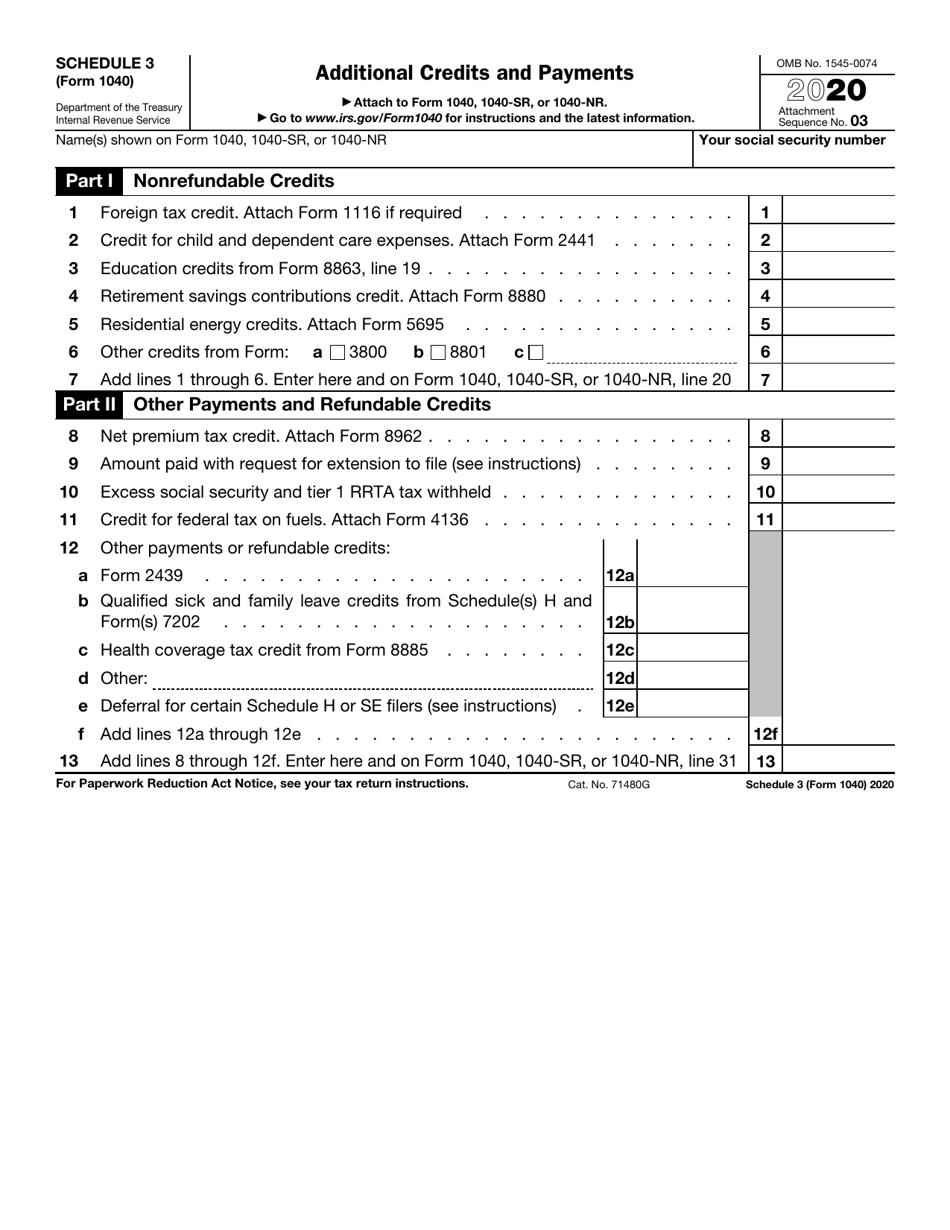

Describes New Form 1040 Schedules Tax Tables

https://images.squarespace-cdn.com/content/v1/579a29a5414fb501f0e42ef7/1544798304694-KI8WSC8TEICLT0O9J12Z/f1040+p1.png

Printable Irs Form 1040 Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/07/how-to-fill-out-irs-form-1040-with-form-wikihow-free-1.jpg

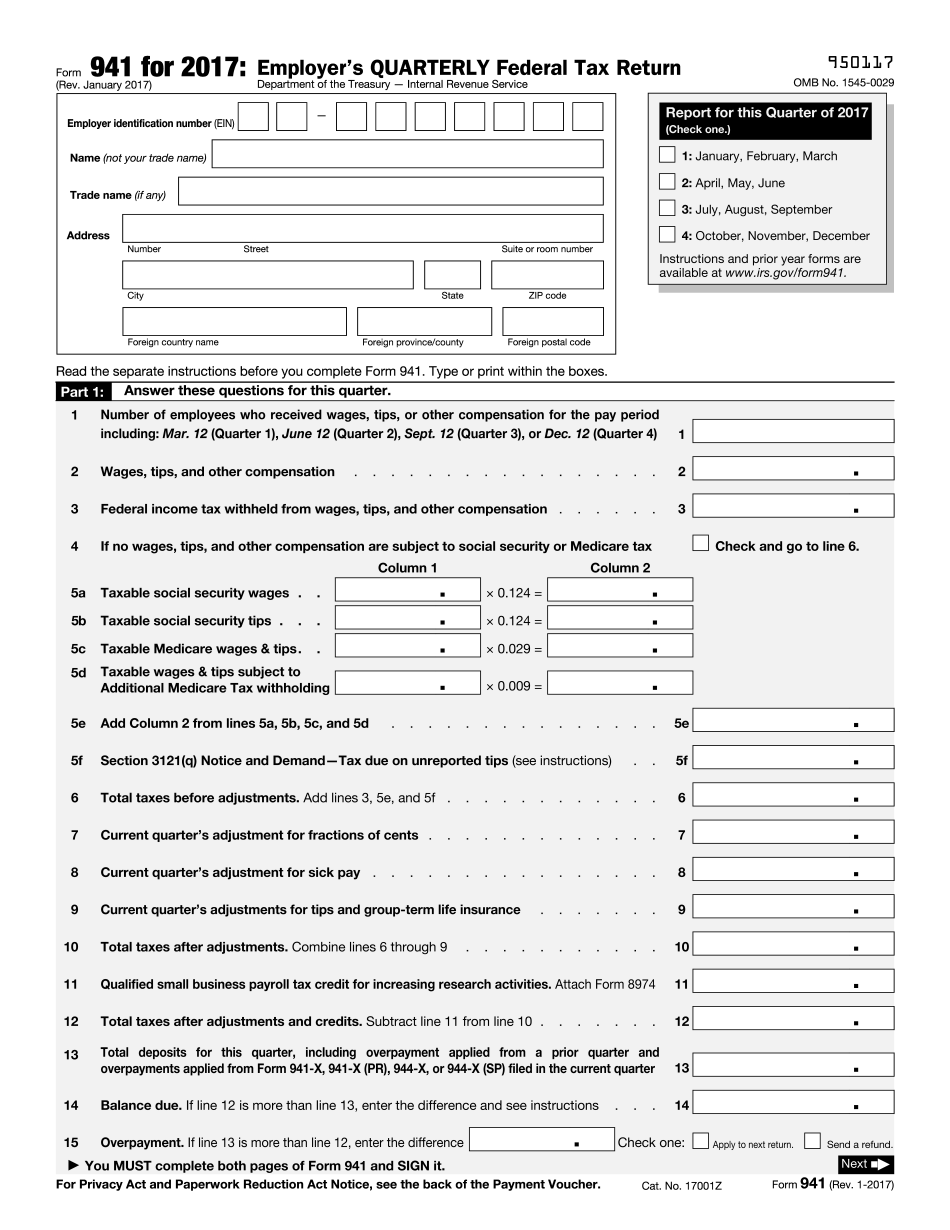

2017 2024 Form IRS 941 Schedule B Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/400/426/400426550/large.png

One such form is Schedule B Form 1040 which is used to report interest and ordinary dividends earned during the tax year Schedule B is an IRS form that accompanies Form 1040 the individual income tax return Its primary purpose is to report interest and ordinary dividends earned from various sources such as savings accounts bonds mutual Printable Federal Income Tax Schedule B You should use Schedule B if any of the following apply You earned over 1 500 of taxable income You received interest from a seller financed mortgage and the buyer used the property as a personal residence

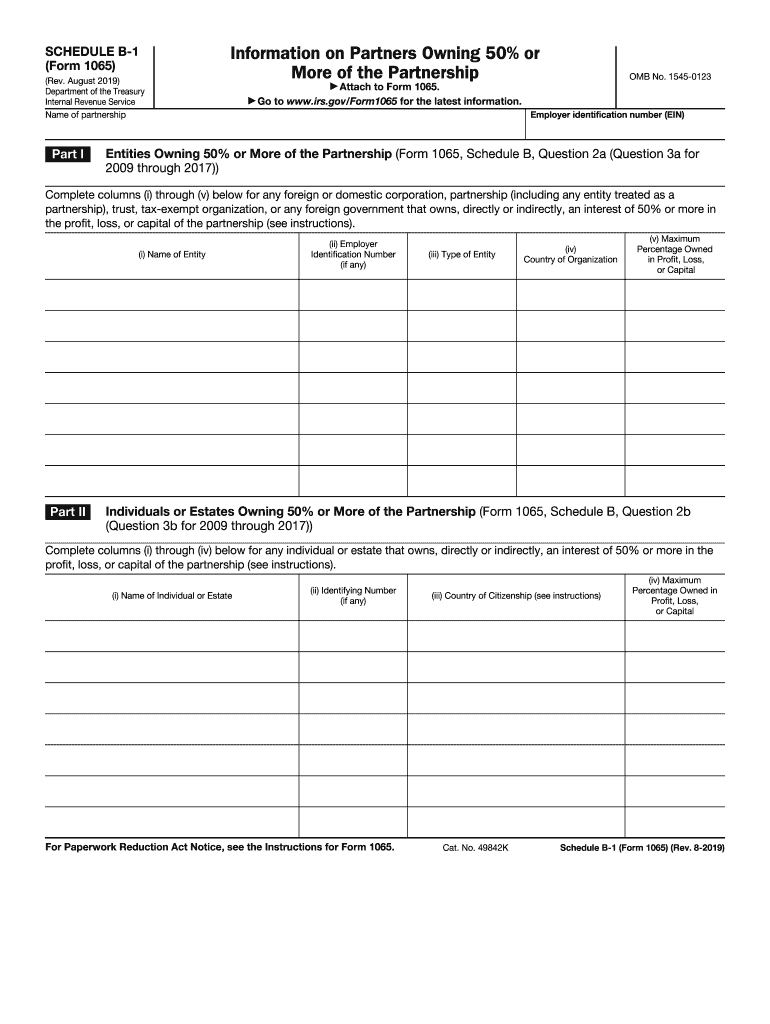

SCHEDULE B Form 1040 Interest and Ordinary Dividends OMB No 1545 0074 Go to www irs gov ScheduleB Department of the Treasury Internal Revenue Service Name s shown on return for instructions and the latest information Attach to Form 1040 or 1040 SR Attachment Sequence No 2022 08 Your social security number on that form To print Schedule B at least 1 of the following will need to be included Series EE and I bonds eligible for Form 8815 Complete the other columns as necessary note To always print Schedule B regardless of these conditions select Setup 1040 Individual Tax Return Schedule B in the return collation you want then select

Form 1040 Schedule B Instructions Bond Premium 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/form-1040-schedule-b-interest-and-ordinary-dividends-1.png

Us Tax Form 1040 Schedule B 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/schedule-b-form-1040-youtube-35.jpg

https://www.incometaxpro.net/tax-form/schedule-b.htm

Who Must File Form 1040 Schedule B Over 1 500 of taxable interest income Over 1 500 of ordinary dividend income Accrued interest from a bond Exclusion of interest from series EE or I US savings bonds Financial account or trust in a foreign country FBAR Interest income from a seller financed mortgage Printable Form 1040 Schedule B

https://www.einpresswire.com/article/678832057/new-irs-schedule-b-tax-form-instructions-and-printable-forms-for-2023-and-2024-announced-by-harbor-financial

According to the IRS Schedule B is required for taxpayers who received more than 1 500 of taxable interest or ordinary dividends during the tax year The form is also required for taxpayers who received any foreign accounts or trusts or who had any foreign financial assets over a certain threshold

Printable I R S Forms Schedule B Printable Forms Free Online

Form 1040 Schedule B Instructions Bond Premium 2021 Tax Forms 1040 Printable

Fillable Irs Form 1040 Es Form Resume Examples J3DWMEROLp

Form 941 Schedule B Report Of Tax Liability For Semiweekly Schedul 2012 Form Irs 1040 Schedule

2019 Schedule Example Student Financial Aid

Schedule B 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

Schedule B 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

Irs Printable Form Schedule B Printable Forms Free Online

Schedule B 1040 Fillable Form Printable Forms Free Online

Irs Tax Forms 2022 Schedule B TAX

1040 Schedule B Printable Form - Schedule B is an IRS tax form that must be completed if a taxpayer receives interest income and or ordinary dividends over the course of the year of more than 1 500 The schedule must accompany a