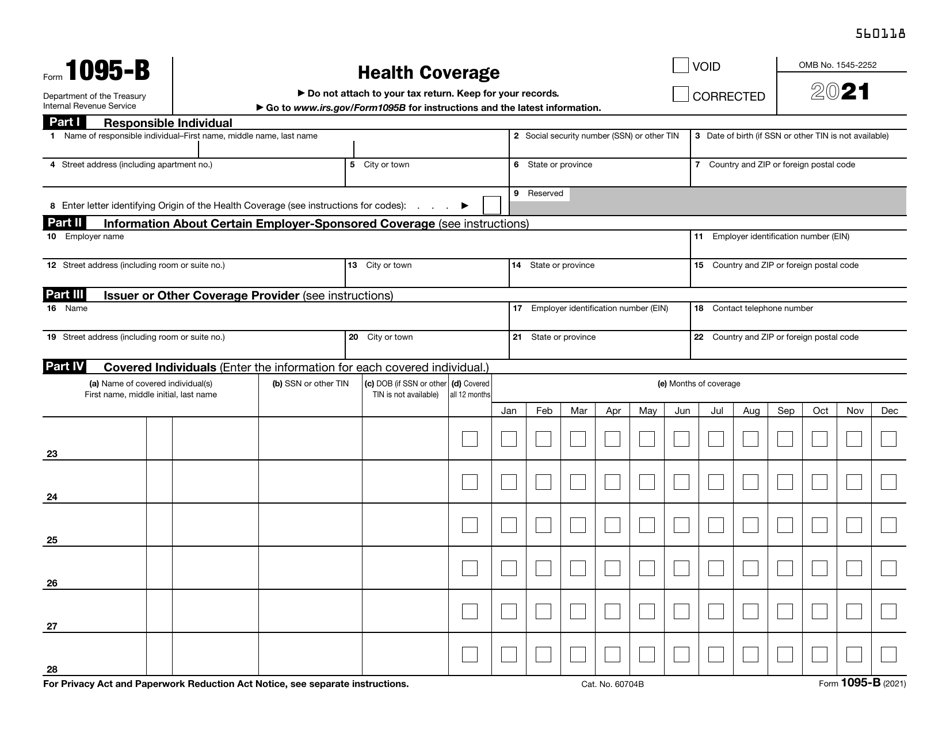

1095 B Tax Form Printable Instructions for Recipient This Form 1095 B provides information about the individuals in your tax family yourself spouse and dependents who had certain health coverage referred to as minimum essential coverage for some or all months during the year

Form 1095 B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Forms 1094 B and 1095 B Print Version PDF For forms filed in 2024 reporting coverage provided in calendar year 2023 Forms 1094 B and 1095 B are required to be filed by February 28 2024 or April 1 2024 if filing electronically See Statements Furnished to Individuals later for information on when Form 1095 B must be furnished

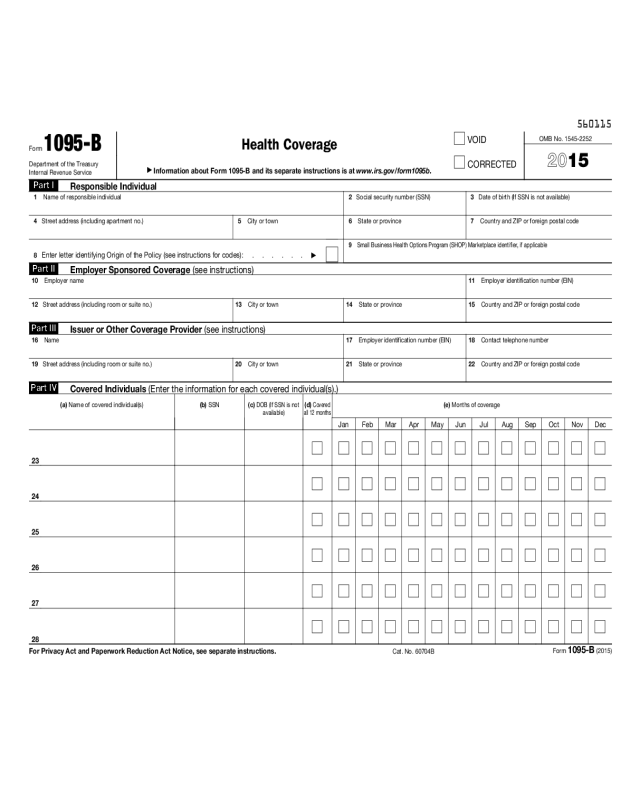

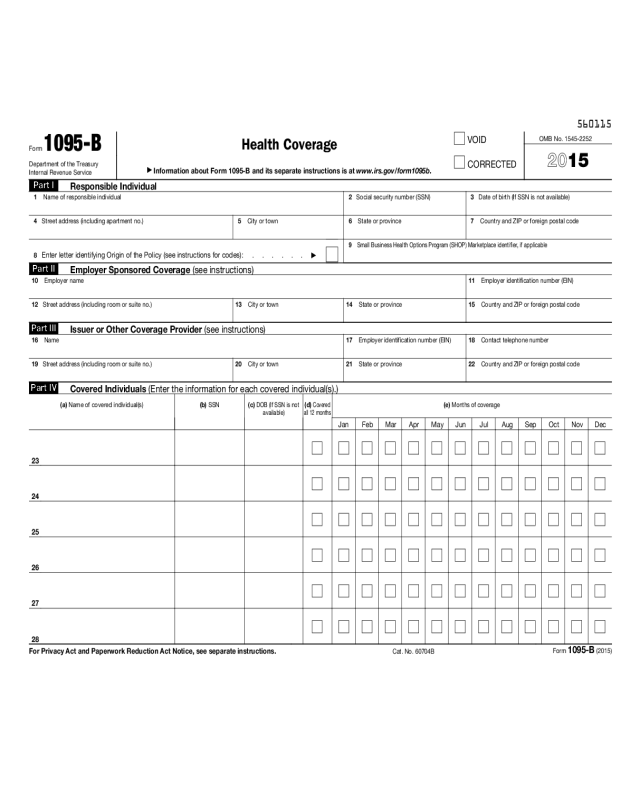

1095 B Tax Form Printable

1095 B Tax Form Printable

https://data.templateroller.com/pdf_docs_html/2251/22510/2251099/irs-form-1095-b-health-coverage_print_big.png

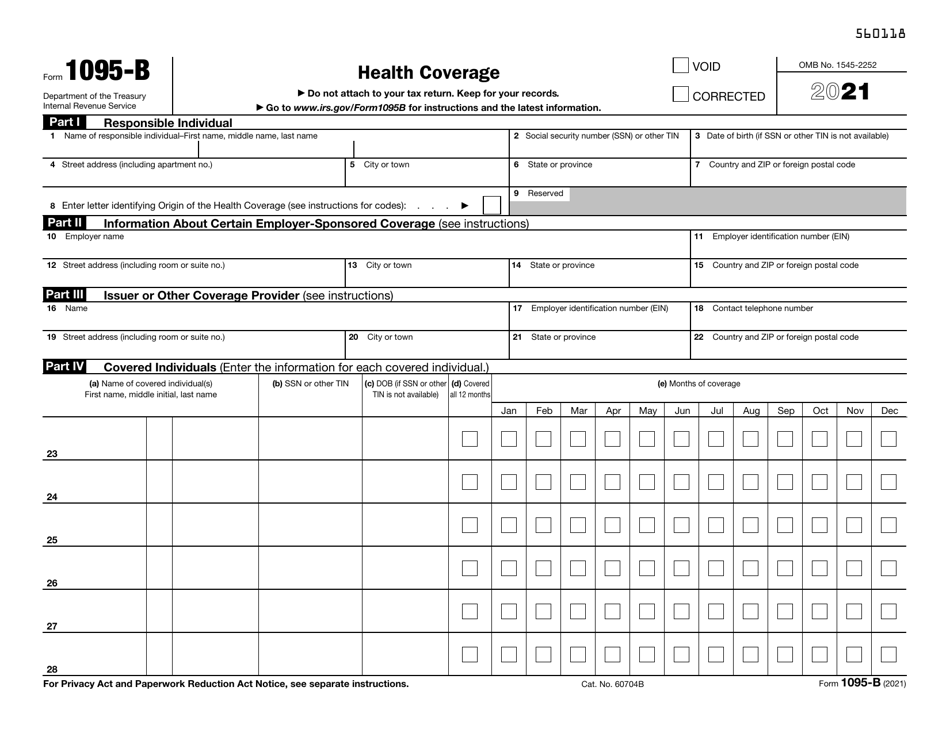

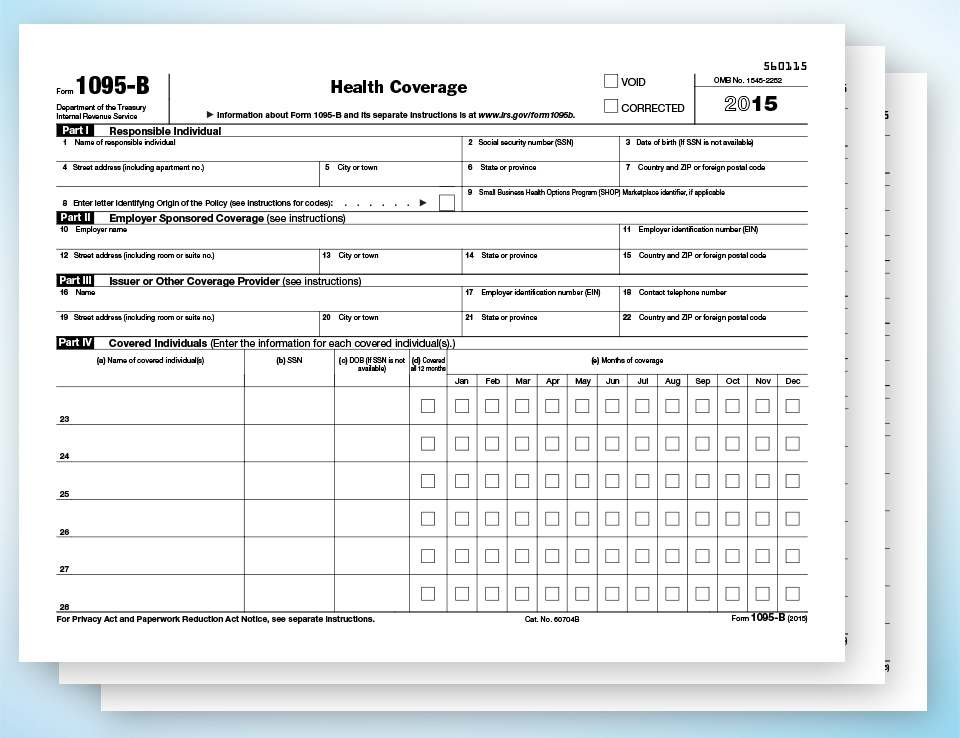

Form 1095 B Instructions Line By Line 1095 B Instruction Explained

https://www.taxbandits.com/content/images/form/form-1095b-2022.png

It s Tax Season What You Should Know About Form 1095 B Exact Insure

http://2016.exactinsure.com/wp-content/uploads/2018/02/1095B.jpg

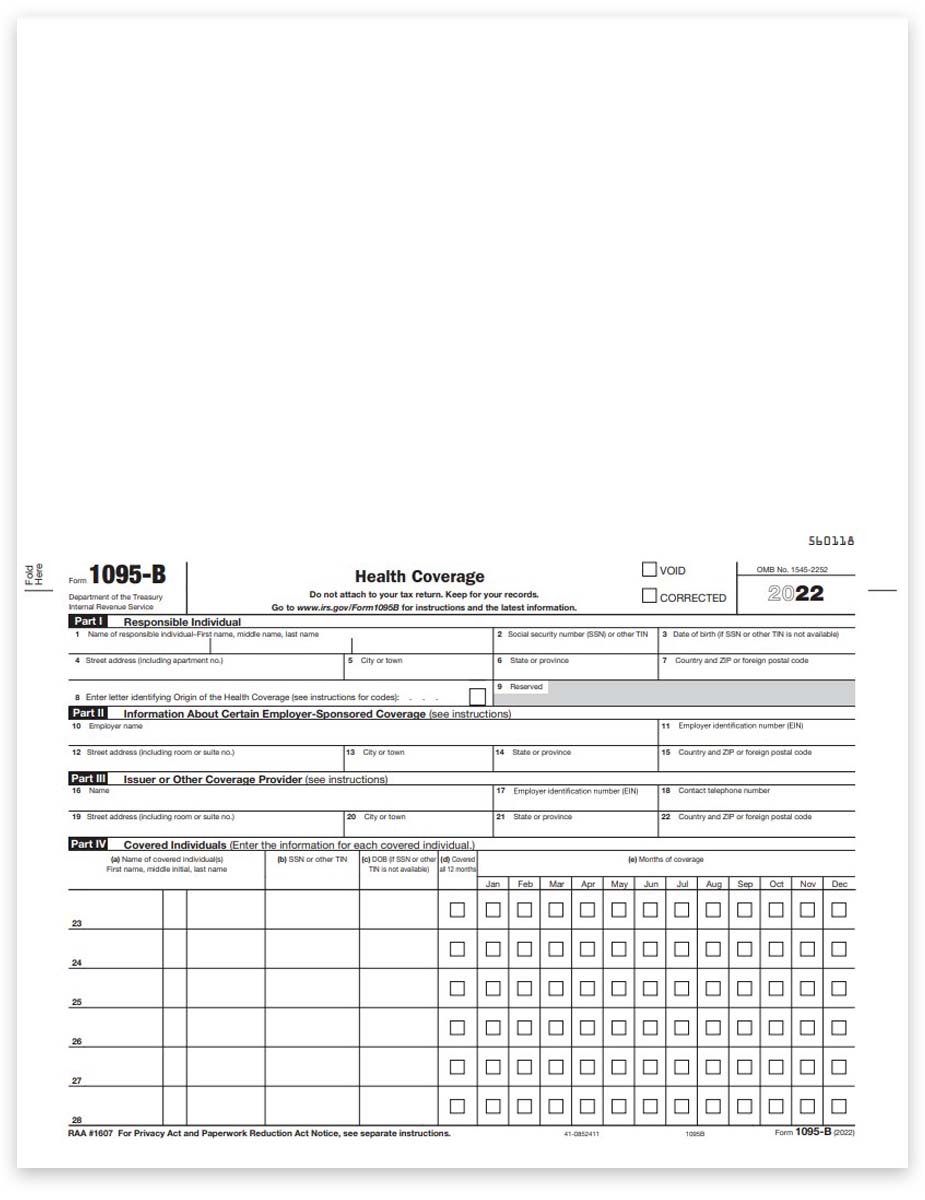

OVERVIEW Form 1095 B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage TABLE OF CONTENTS You may receive a Form 1095 A 1095 B or 1095 C depending on the type of health insurance you received If you receive Form 1095 B you may have questions about how it works and tax filing requirements Form 1095 B is a tax form used to show proof of health insurance coverage during the year It includes the following information

The Qualifying Health Coverage QHC notice lets you know that your Medicare Part A Hospital Insurance coverage is considered to be qualifying health coverage under the Affordable Care Act If you have Part A you can ask Medicare to send you an IRS Form 1095 B In general you don t need this form to file your federal taxes Form 1095 B An IRS Form sent to individuals who received minimum essential coverage as defined by the Affordable Care Act

More picture related to 1095 B Tax Form Printable

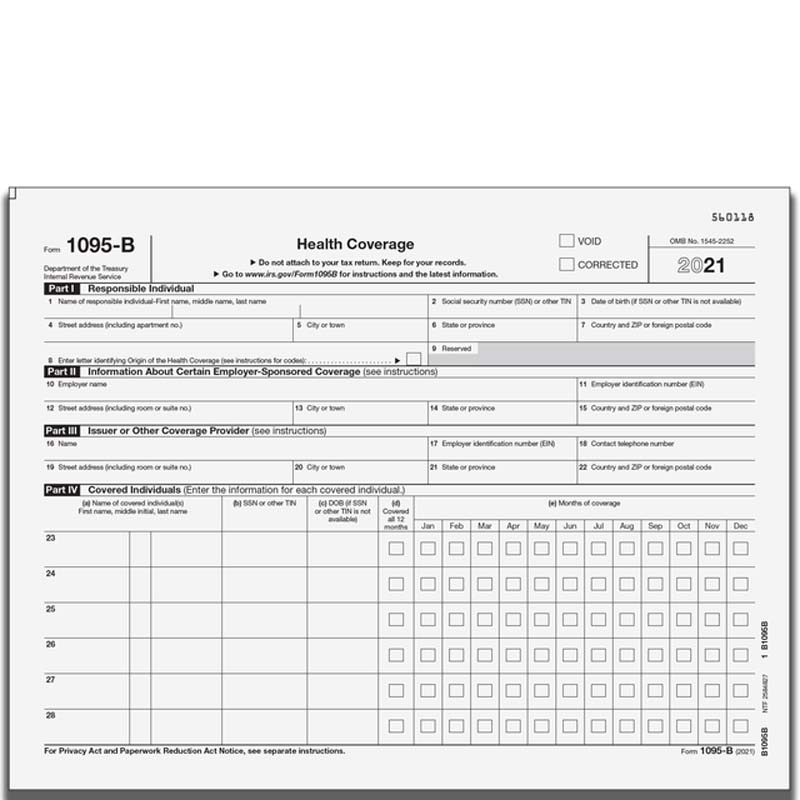

Fillable Form 1095 B Health Coverage Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/141/1410/141042/page_1_thumb_big.png

1095 B Pre printed With Instructions

https://computerforms.biz/uploads/image/Product_Images/L1095B.jpg

Ez1095 Software How To Print Form 1095 B And 1094 B

https://www.halfpricesoft.com/aca-1095/images/form_1095B.jpg

For additional information about the Affordable Care Act individual shared responsibility provisions please visit the Internal Revenue Service website or contact your tax advisor If you have questions about the Form 1095 B you receive from EmblemHealth call 866 517 5804 from 9 am to 5 pm Monday through Friday excluding major holidays Important tax document information for 1095 B Kaiser Permanente is changing the annual tax mailing process for the 2023 tax year This means 1095 B forms for proof of minimal essential coverage will no longer be automatically mailed If you need a copy of your 1095 B form you may request one by calling Member Services at 1 844 477 0450

Here s how you can request your Form 1095 B Health Coverage as needed You can send a request By mail to Blue Cross and Blue Shield Service Benefit Plan 750 9th Street NW Washington DC 20001 4524 By calling the number on the back of your member ID card By accessing the form through your MyBlue account The information on your Form 1095 B is incorrect please contact Kaiser Permanente at 844 477 0450 The hours of operation are from 8 a m to 6 p m Monday through Friday and 7 a m to 3 p m Saturday and Sunday Pacific Time lost or need another copy of your Form 1095 B the form is available through your personal documents page

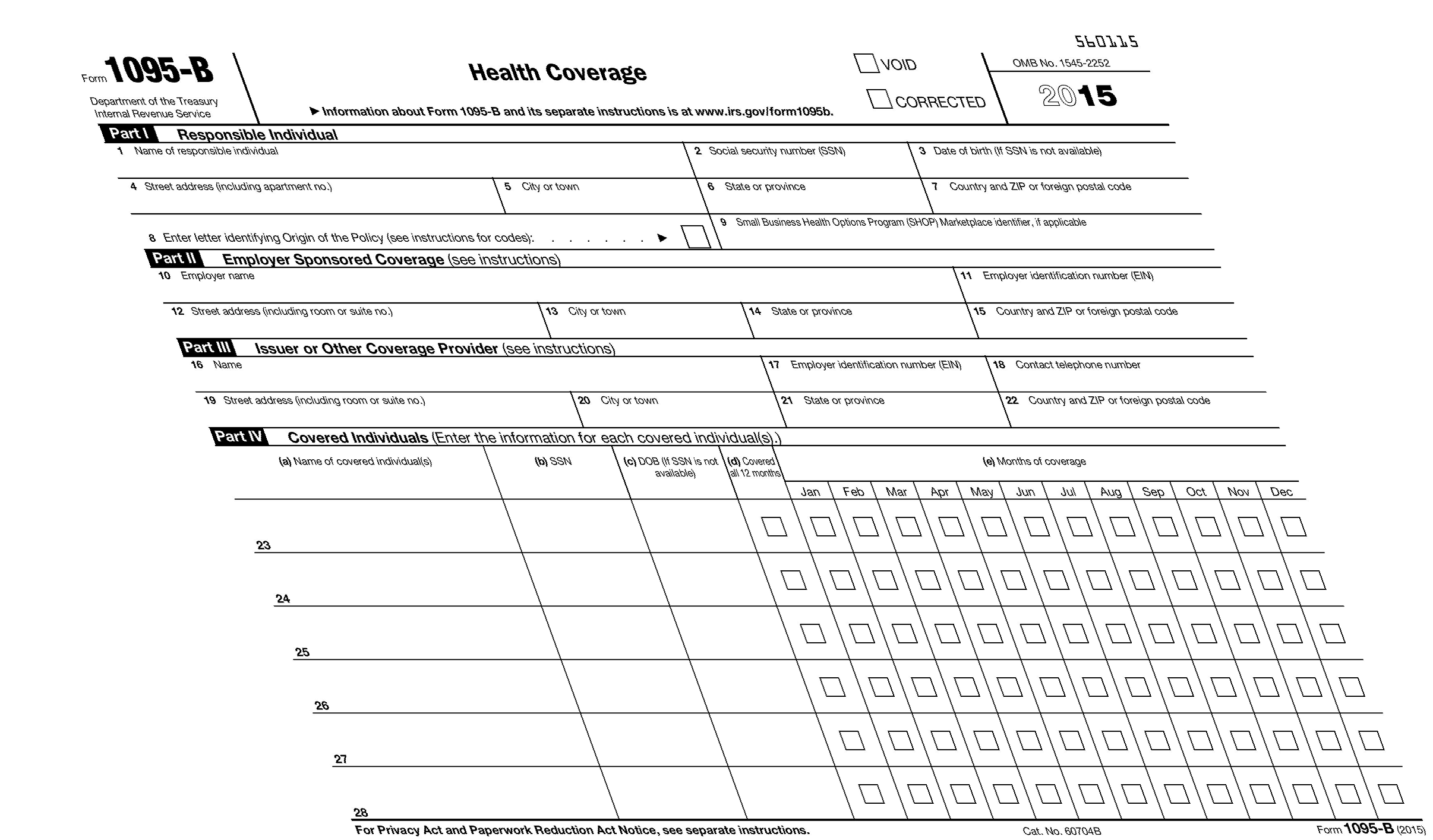

Printable 1095 B Form TUTORE ORG Master Of Documents

https://handypdf.com/resources/formfile/images/10000/form-1095-b-health-coverage-2015-page1.png

E file ACA Form 1095 B Online How To File 1095 B For 2020

https://www.taxbandits.com/Content/Images/form1095b-flow5.jpg

https://www.irs.gov/pub/irs-pdf/f1095b.pdf

Instructions for Recipient This Form 1095 B provides information about the individuals in your tax family yourself spouse and dependents who had certain health coverage referred to as minimum essential coverage for some or all months during the year

https://www.irs.gov/forms-pubs/about-form-1095-b

Form 1095 B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Forms 1094 B and 1095 B Print Version PDF

1095 B Submit Your 1095 B Form OnlineFileTaxes

Printable 1095 B Form TUTORE ORG Master Of Documents

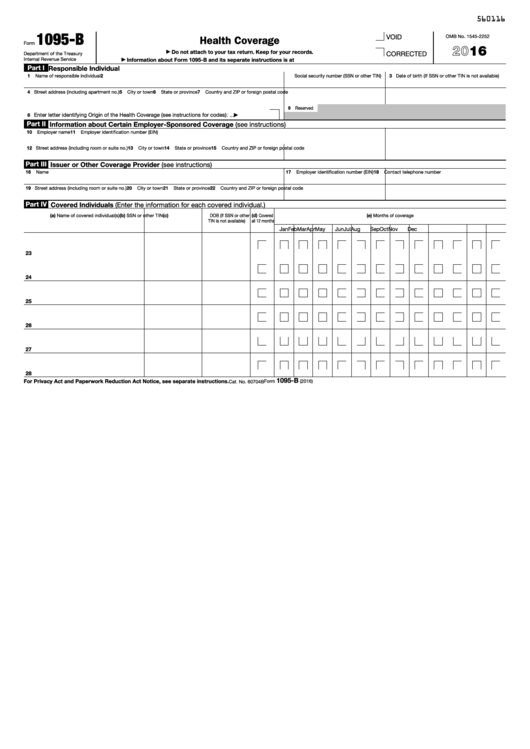

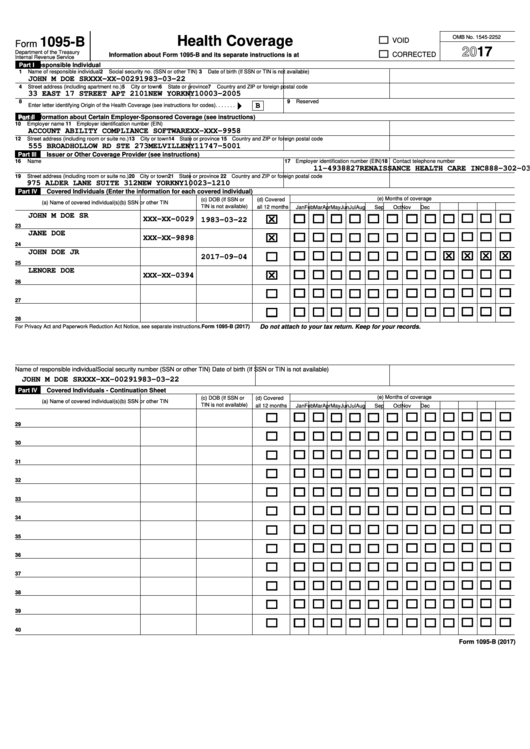

Fillable 2015 Form 1095 B Health Coverage Printable Pdf Download

Form 1095 B For Health Insurers Clarity Software Solutions

1095 B Forms ComplyRight Format Discount Tax Forms

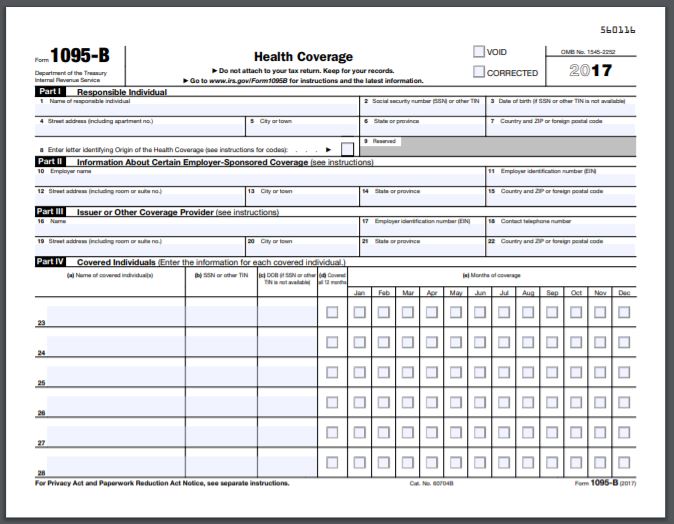

1095 b 2017 Pdf Fill Online Printable Fillable Blank Form 1094 b

1095 b 2017 Pdf Fill Online Printable Fillable Blank Form 1094 b

Formulario B Consejos

Form 1095 B Health Coverege 2017 Printable Pdf Download

1094 B 1095 B Software 599 1095 B Software

1095 B Tax Form Printable - OVERVIEW Form 1095 B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage TABLE OF CONTENTS