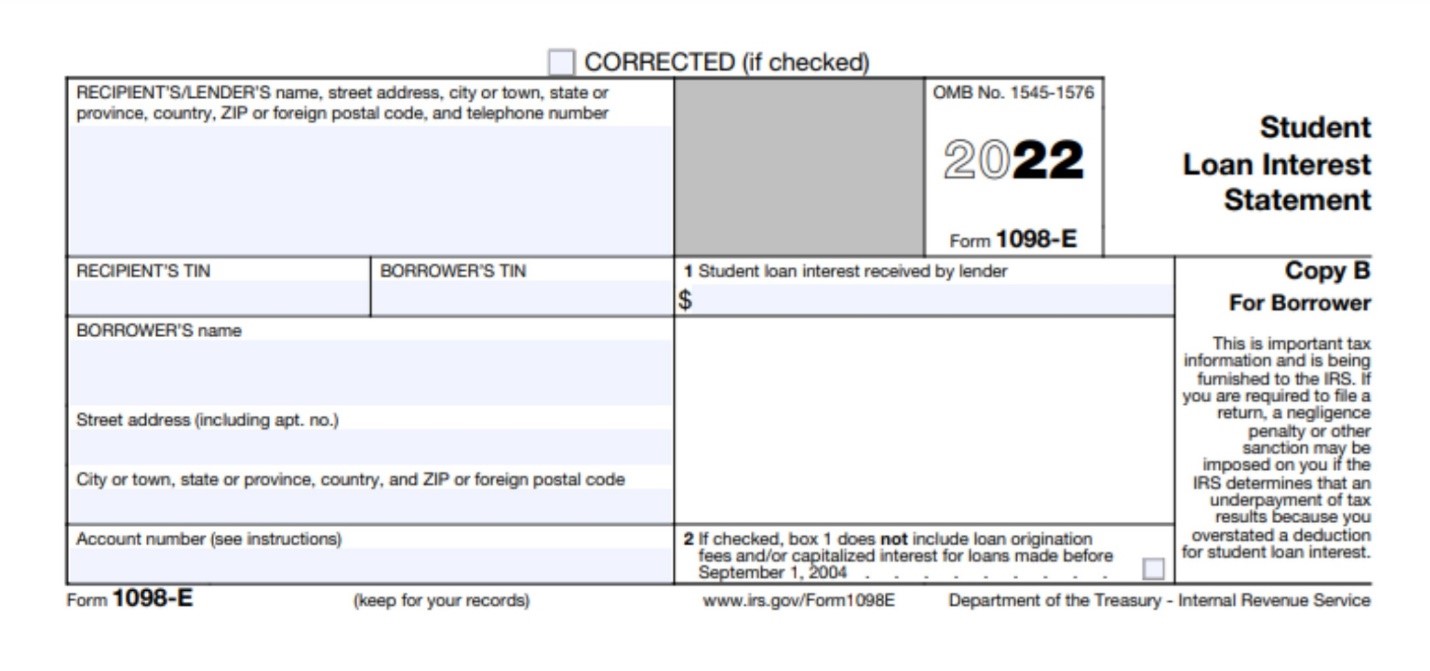

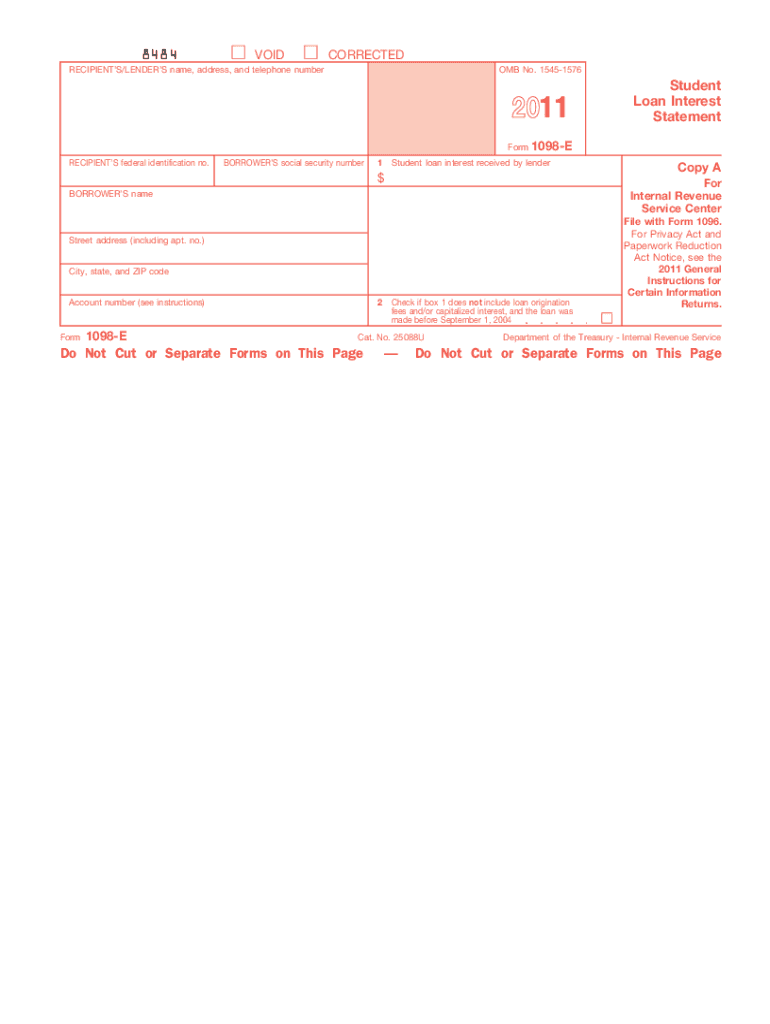

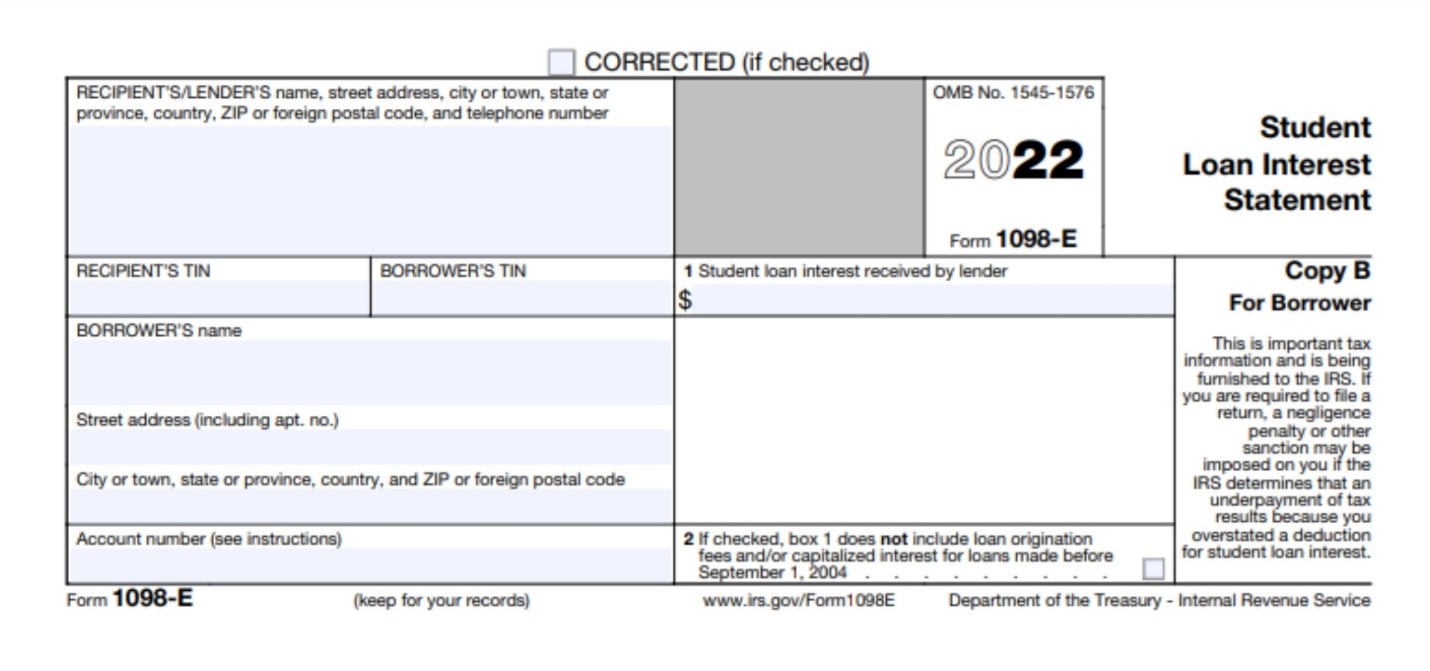

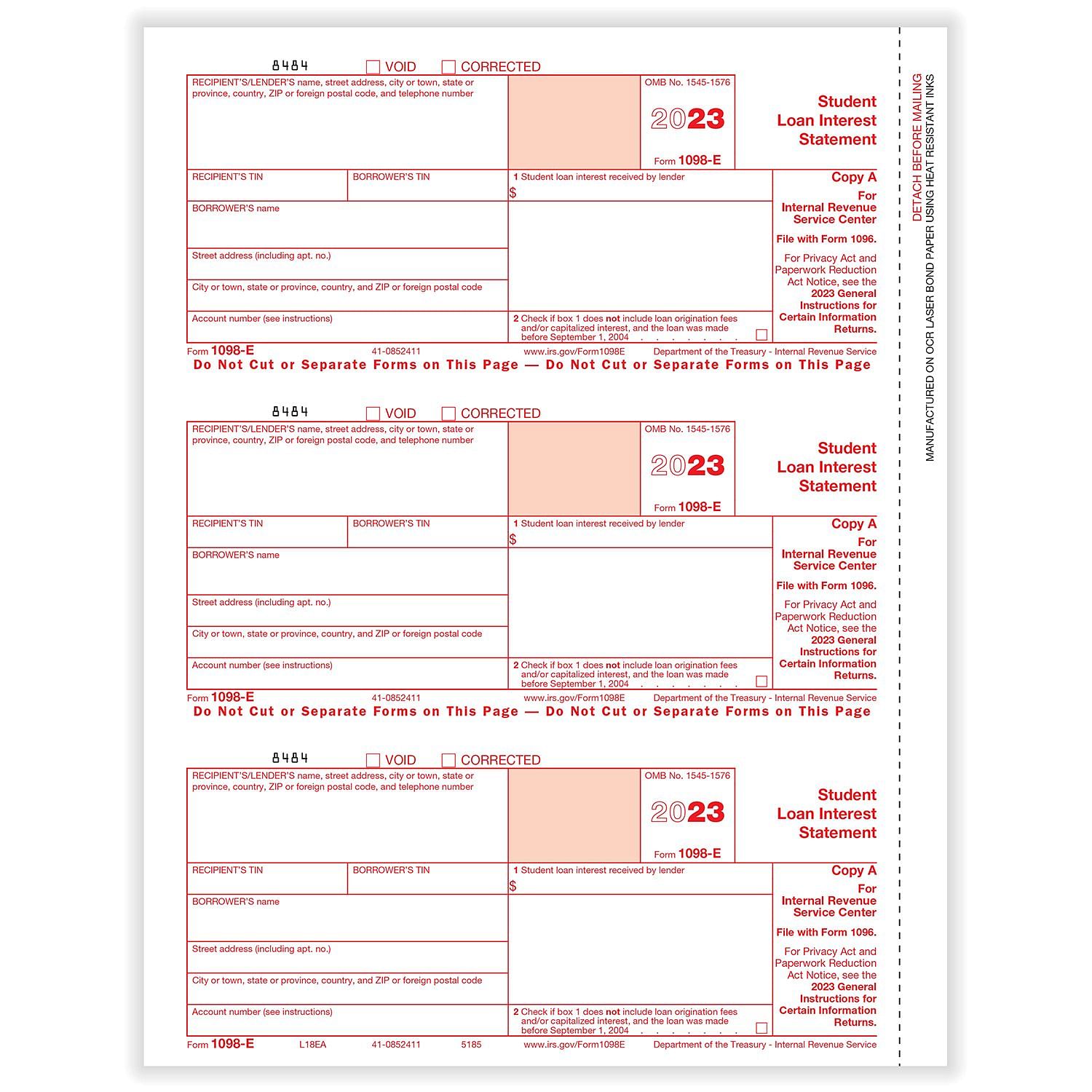

1098 E Tax Form Printable Student Loan Servicer Your student loan servicer who you make payments to will send you a copy of your 1098 E via email or postal mail if the interest you paid in 2022 met or exceeded 600 Even if you didn t receive a 1098 E from your servicer you can download your 1098 E from your loan servicer s website

What you use it for You use the 1098 E to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income as long as you meet certain conditions The interest was your legal obligation to pay not someone else s Your filing status is not married filing separately The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal loan servicers still send 1098 E s to borrowers who paid less than that If you paid less than 600 in interest to a federal loan servicer during the tax year and

1098 E Tax Form Printable

1098 E Tax Form Printable

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-1098-e-instructions.jpg

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax Preparation Bookkeeping And

https://www.pctaxservice.com/esp/images/forms/1098E.jpg

IRS 1098 2020 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/458/655/458655028/large.png

Use the 1098 E Form to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income if you meet the following requirements A former student can still take this deduction even if the actual student loan payment was made by either a nonprofit where the individual works or a Download or print the 2023 Federal Form 1098 E Student Loan Interest Statement Info Copy Only for FREE from the Federal Internal Revenue Service Toggle navigation TaxForm Finder IRS Tax Forms

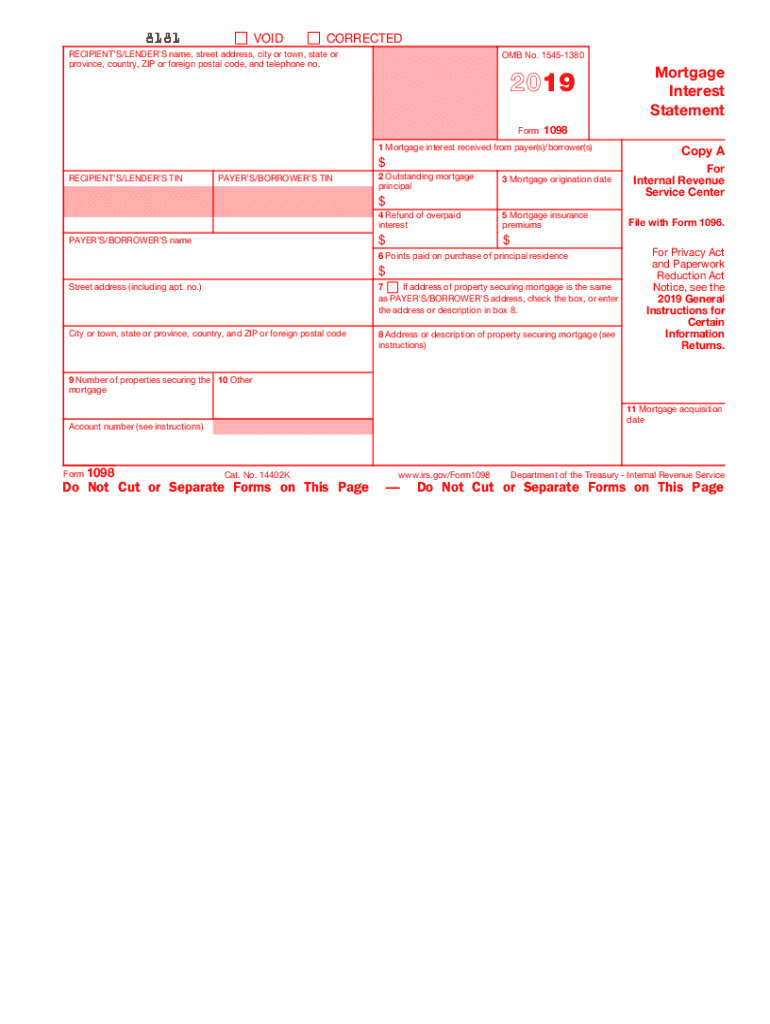

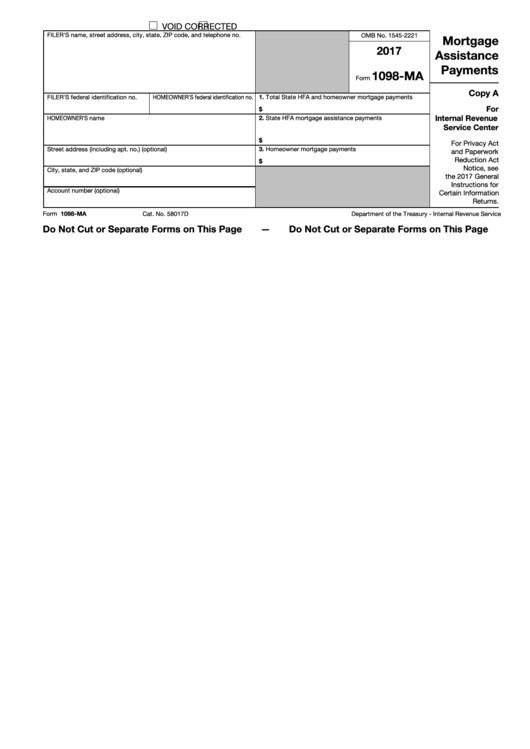

IRS Form 1098 is an essential document that serves as a mortgage interest statement for taxpayers in the United States It is issued by a mortgage lender to the borrower detailing the amount of interest and related expenses paid on a mortgage during the tax year IRS Form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year Lenders file a copy with the IRS and send another copy to the payer of the interest A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid

More picture related to 1098 E Tax Form Printable

2011 Form IRS 1098 E Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/976/976683/large.png

1098 E 2018 Public Documents 1099 Pro Wiki

https://wiki.1099pro.com/download/attachments/43974780/2018-1098E.JPG?version=1&modificationDate=1523570882310&api=v2

1098 E Tax Form Printable Printable Forms Free Online

http://res.cloudinary.com/mp-assets/image/upload/f_auto/v1529684132/minespress/catalogassets/0015929_0.png

Form 1098 E Student Loan Interest Statement This form is only for the borrower and provides the amount of interest paid on eligible student loan s during the calendar year Cosigners of eligible borrowers will receive a tax information letter not a Form 1098 E Form 1098 E will include all eligible interest payments received by December 31 The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year To access your Form 1098 E log in to your account and select Tax Statements in the left menu Or call 844 NAVI TAX 844 628 4829 and get your eligible interest amount through our automated voice system Navient s Tax ID Number 46 4054283 Tip

Form 1098 Mortgage Interest Statement is an Internal Revenue Service IRS form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax If you do not receive your 1098 E or if you lose your copy contact PHEAA Default Collections at 1 800 233 0751 PHEAA cannot advise you on tax matters If you have questions contact a tax professional or the IRS at 1 800 829 1040 or IRS gov My loans just transferred to AES

How To Print And File Tax Form 1098 Mortgage Interest Statement

https://www.halfpricesoft.com/1099s_software/images/1098_recipient_copy.jpg

How To Enter Form 1098 E Student Loan Interest Statement In A Tax Return

https://kb.erosupport.com/assets/img_60be4d74e3bf2.png

https://www.ed.gov/1098-e

Student Loan Servicer Your student loan servicer who you make payments to will send you a copy of your 1098 E via email or postal mail if the interest you paid in 2022 met or exceeded 600 Even if you didn t receive a 1098 E from your servicer you can download your 1098 E from your loan servicer s website

https://turbotax.intuit.com/tax-tips/college-and-education/what-is-form-1098-e-student-loan-interest-statement/L2KV1FPmw

What you use it for You use the 1098 E to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income as long as you meet certain conditions The interest was your legal obligation to pay not someone else s Your filing status is not married filing separately

TFP 1098 E Federal Copy A Pack Of 100

How To Print And File Tax Form 1098 Mortgage Interest Statement

Free Fillable 1098 Forms Printable Forms Free Online

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

Free Printable 1098 Form FREE PRINTABLE TEMPLATES

Form 1098 E Student Loan Interest Statement

Form 1098 E Student Loan Interest Statement

Laser Tax Form 1098 E Recipient Copy C Free Shipping

Form 1098 E Student Loan Interest Statement IRS Copy A

1098 T Form 2023 Printable Forms Free Online

1098 E Tax Form Printable - Use the 1098 E Form to figure your student loan interest deduction You can deduct up to 2 500 worth of student loan interest from your taxable income if you meet the following requirements A former student can still take this deduction even if the actual student loan payment was made by either a nonprofit where the individual works or a