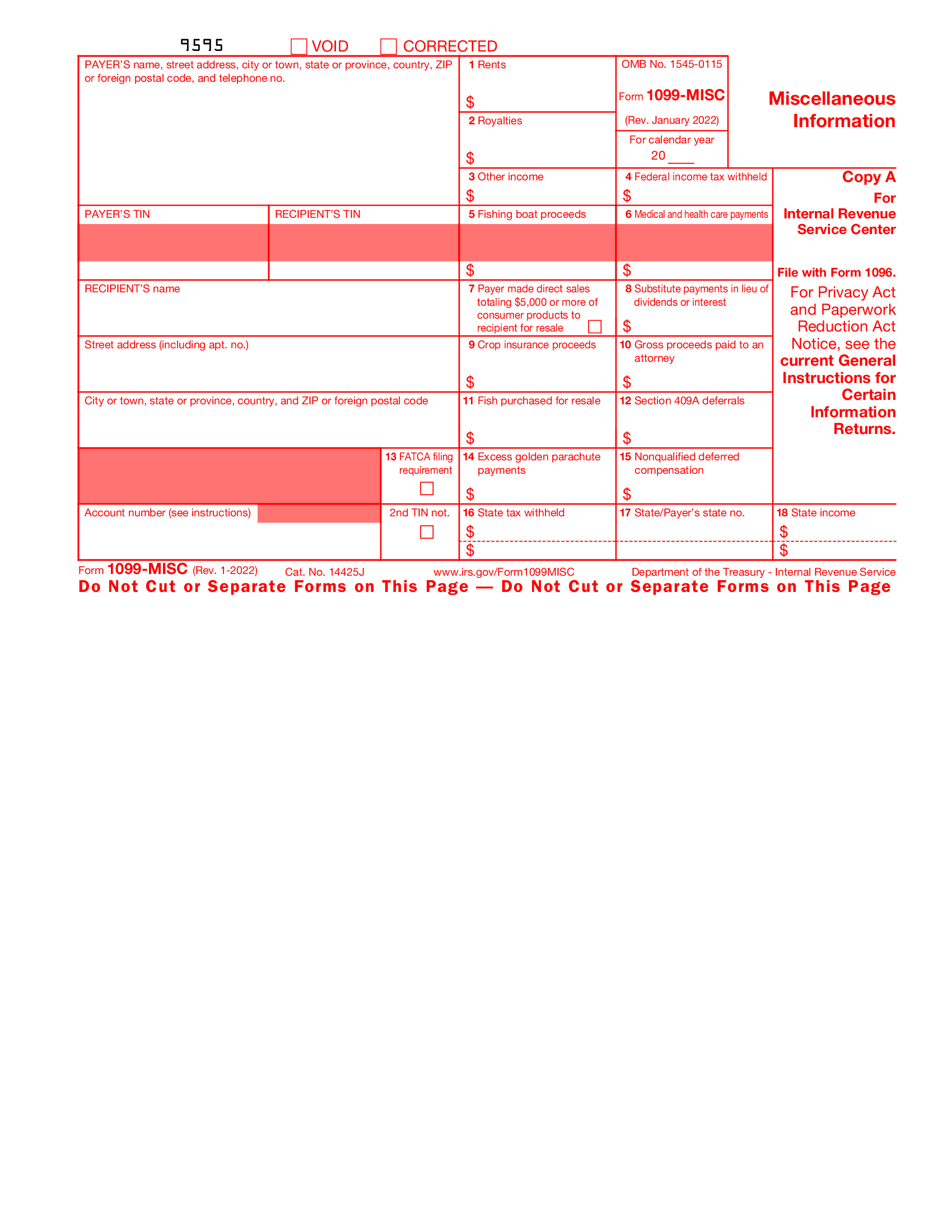

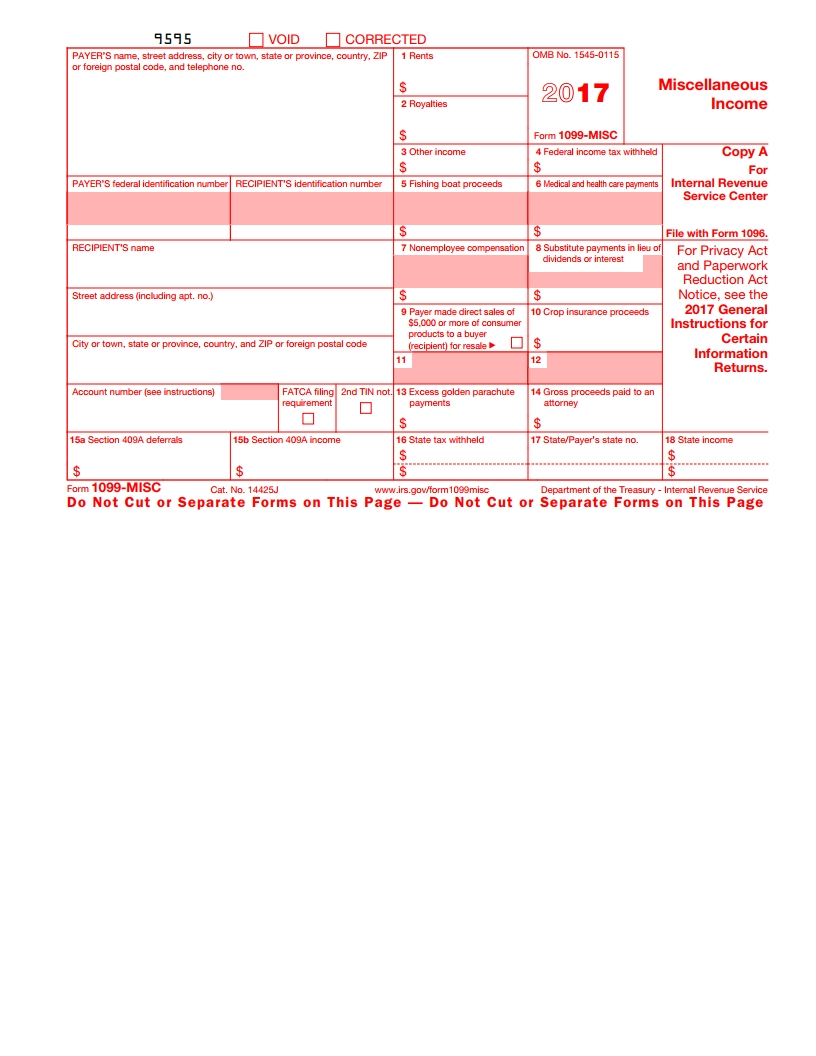

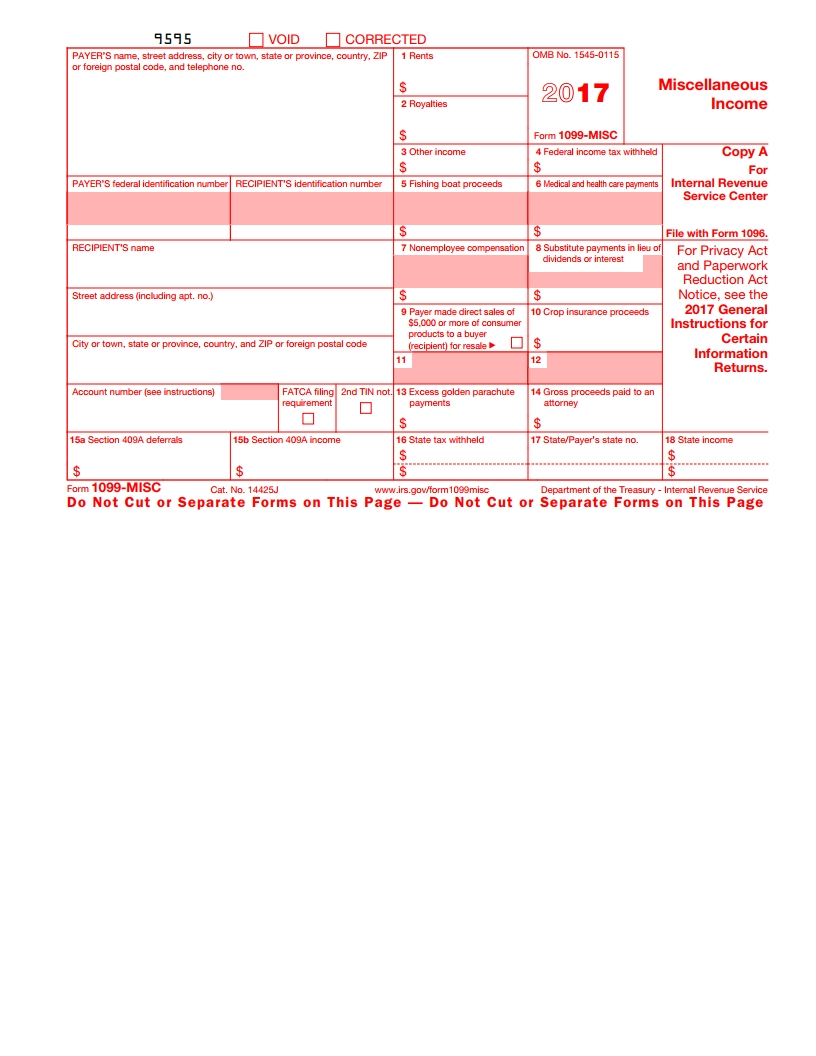

1099 Cancelled Form Irs Printable Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

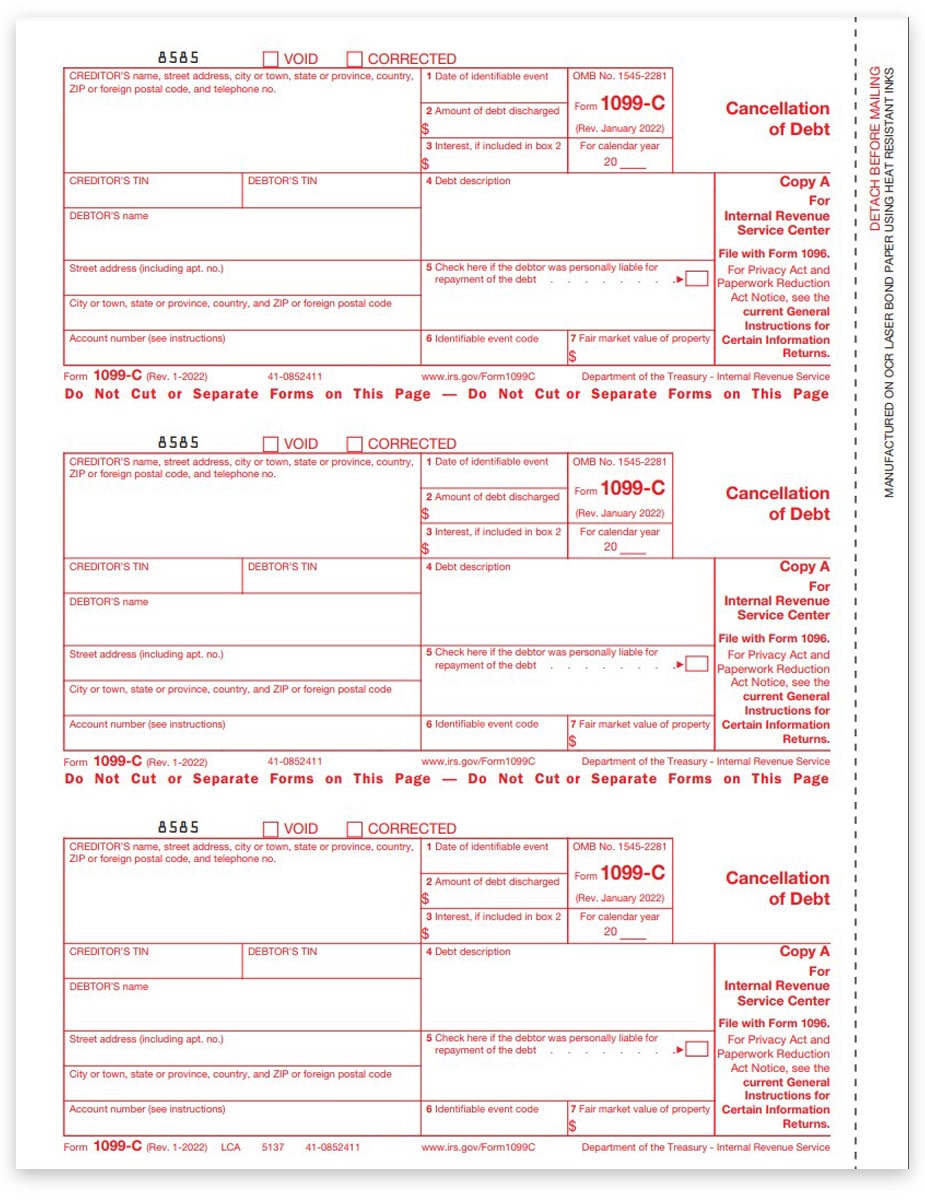

Form 1099 C Rev January 2022 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not You can e file any Form 1099 for tax year 2022 and later with the Information Returns Intake System IRIS The system also lets you file corrections and request automatic extensions for Forms 1099 For system availability check IRIS status There are 2 ways to e file with IRIS E file through the IRIS Taxpayer Portal

1099 Cancelled Form Irs Printable

1099 Cancelled Form Irs Printable

https://alleviatefinancial.com/app/uploads/2019/05/Screen-Shot-2019-05-27-at-4.45.57-PM.png

1099C Tax Form For Cancellation Of Debt IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1099C-Form-Copy-A-Federal-Red-LCA-FINAL-min.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)

1099 Cancelled Form Irs Printable Printable Forms Free Online

https://www.investopedia.com/thmb/hnsDTUkdP_Fyp_wvVPEtpi0xalU=/1622x760/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png

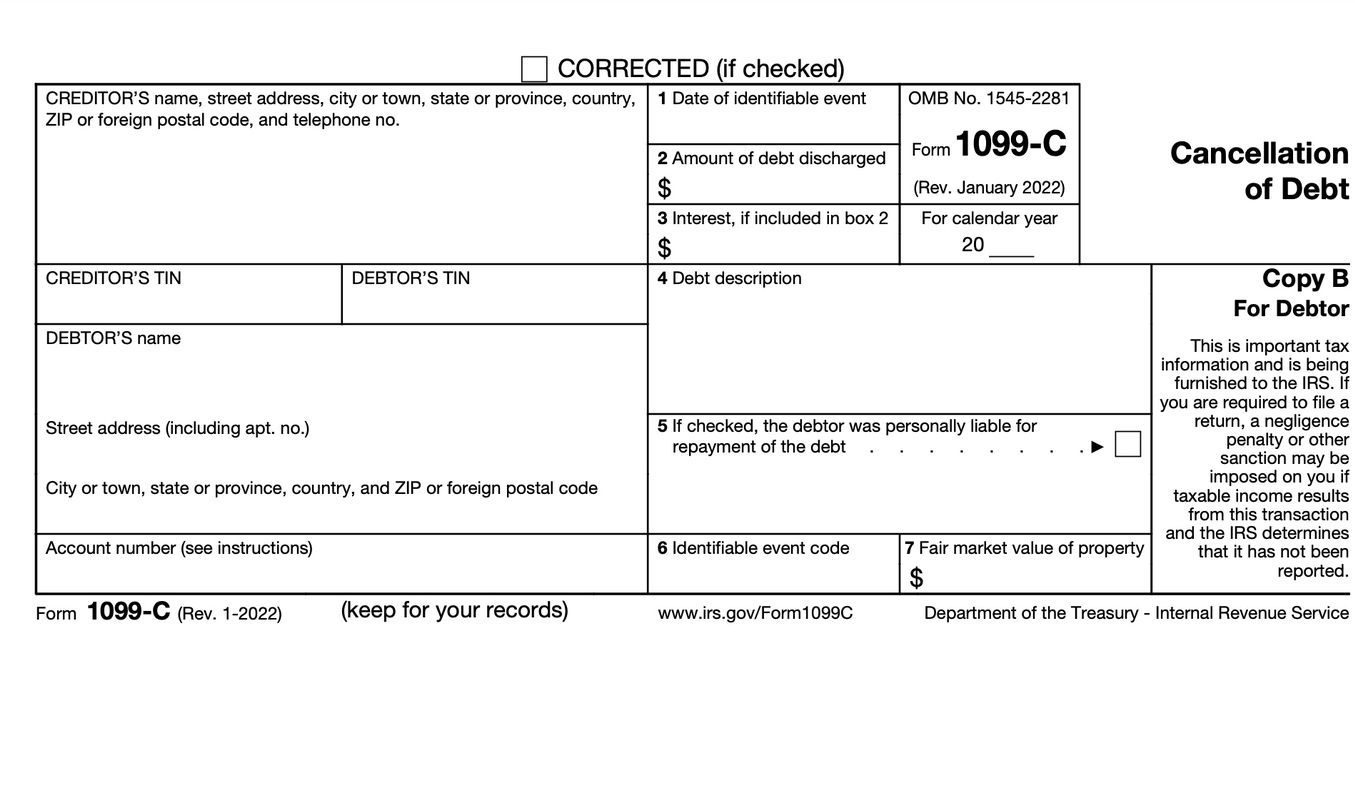

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use You received this form because a federal government agency or an applicable financial entity a creditor has discharged canceled or forgiven a debt you owed or because an identifiable event has occurred that either is or is deemed to be a discharge of a debt of 600 or more

In general if you re liable for tax because a debt was canceled forgiven or discharged you ll receive a Form 1099 C Cancellation of Debt from the lender or the person who forgave the debt You may receive an IRS Form 1099 C while the creditor is still trying to collect the debt If so the creditor may not have canceled it What is a 1099 C The 1099 C form reports a cancellation of debt creditors are required to issue Form 1099 C if they cancel a debt of 600 or more Form 1099 C must be issued when an identifiable event in connection with a cancellation of debt occurs Who files a 1099 C A lender files a 1099 C with the IRS and they ll send you a copy of

More picture related to 1099 Cancelled Form Irs Printable

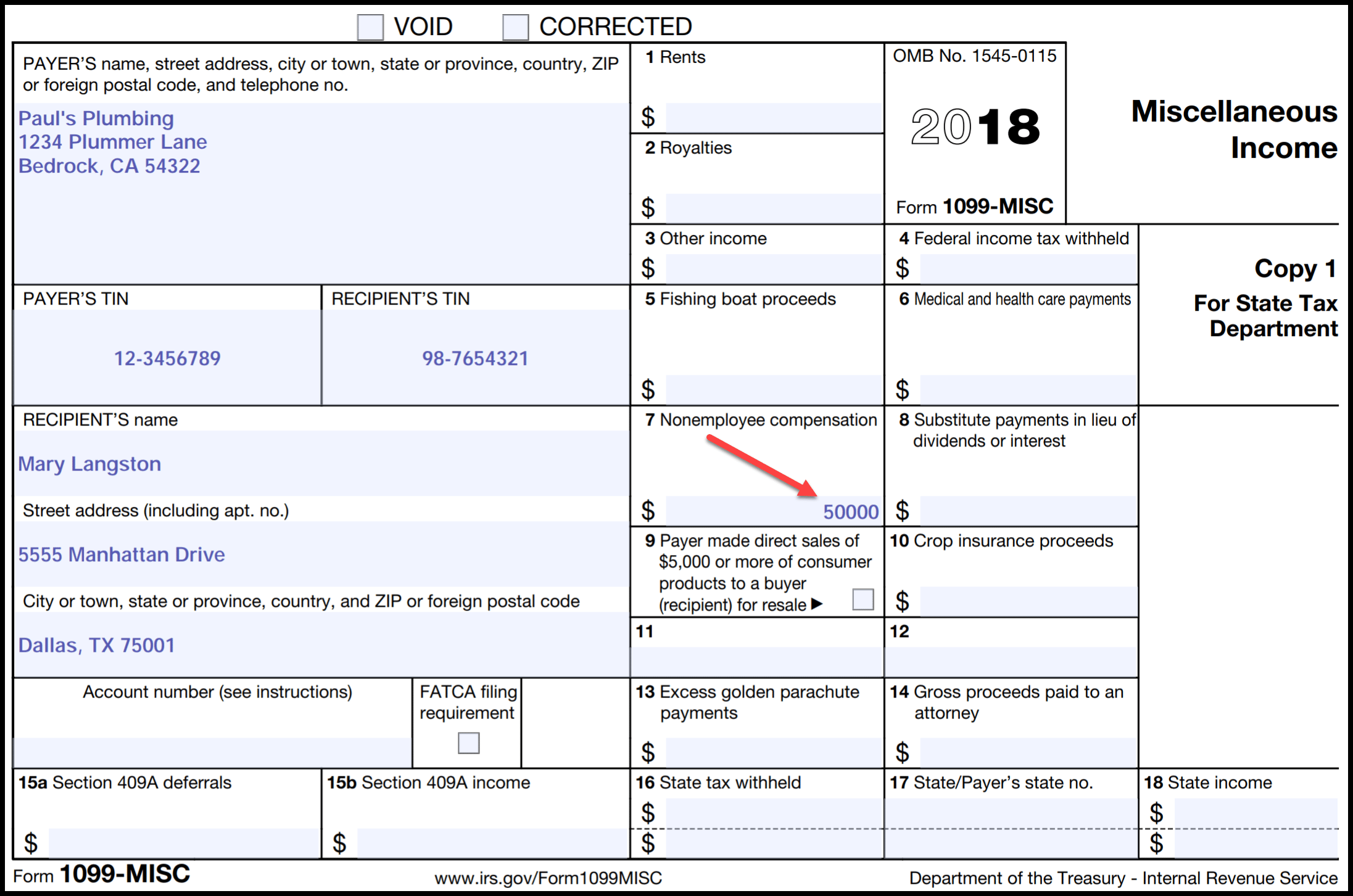

Fillable 1099 Misc Irs 2022 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/09/fillable-1099-misc-irs-2022.png

IRS Form 1099C Cancellation Of Debt Wiztax

https://www.wiztax.com/wp-content/uploads/2023/01/1099c-1355x803.jpeg

1099 Printable Forms

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

A lender that cancels or forgives a debt of 600 or more must send Form 1099 C to the IRS and the borrower If you receive a 1099 C you may have to report the amount shown as taxable If you receive a Form 1099 C this year it s likely because one of your creditors canceled a debt you owe meaning the company writes it off and you no longer have to pay it back In some cases you may need to include the amount of debt your 1099 C reports on your tax return as income However there are a number of exceptions and exemptions

Generally if a taxpayer receives Form 1099 C for canceled credit card debt and was solvent immediately before the debt was canceled all the canceled debt will be included on Form 1040 line 21 Other Income No additional supporting forms or schedules are needed to report canceled credit card debt example Form 1099 C Lenders or creditors are required to issue Form 1099 C Cancellation of Debt if they cancel a debt owed to them of 600 or more Generally an individual taxpayer must include all canceled amounts even if less than 600 on the Other Income line of Form 1040 However under certain circumstances a taxpayer may not have to

1099 Cancelled Form Irs Printable Printable Forms Free Online

https://printable-map-az.com/wp-content/uploads/2019/07/irs-1099-misc-form-free-download-create-fill-and-print-1099-misc-printable-template-free.png

Free Irs Form 1099 Printable Printable Templates

https://www.pdffiller.com/preview/445/723/445723799/big.png

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

https://www.irs.gov/pub/irs-pdf/f1099c.pdf

Form 1099 C Rev January 2022 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

What Is Form 1099 NEC And Who Needs To File 123PayStubs Blog

1099 Cancelled Form Irs Printable Printable Forms Free Online

Irs Printable 1099 Form

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

Free 1099 Fillable Form Printable Forms Free Online

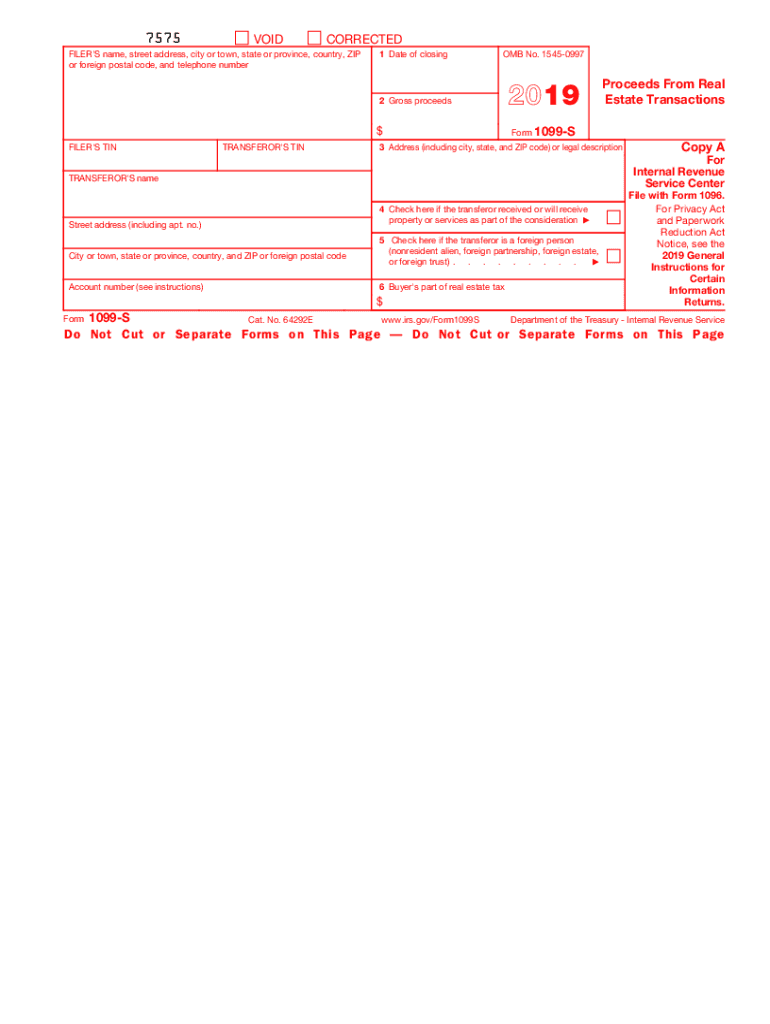

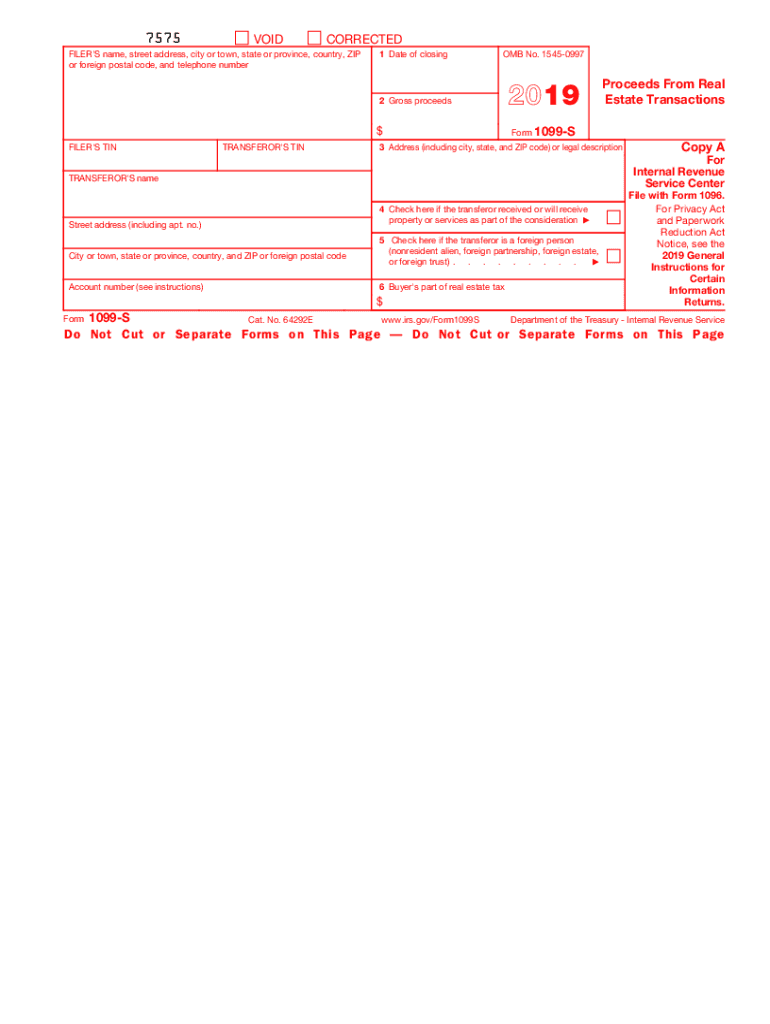

2019 Form IRS 1099 S Fill Online Printable Fillable Blank PdfFiller

2019 Form IRS 1099 S Fill Online Printable Fillable Blank PdfFiller

1099 Printable Form

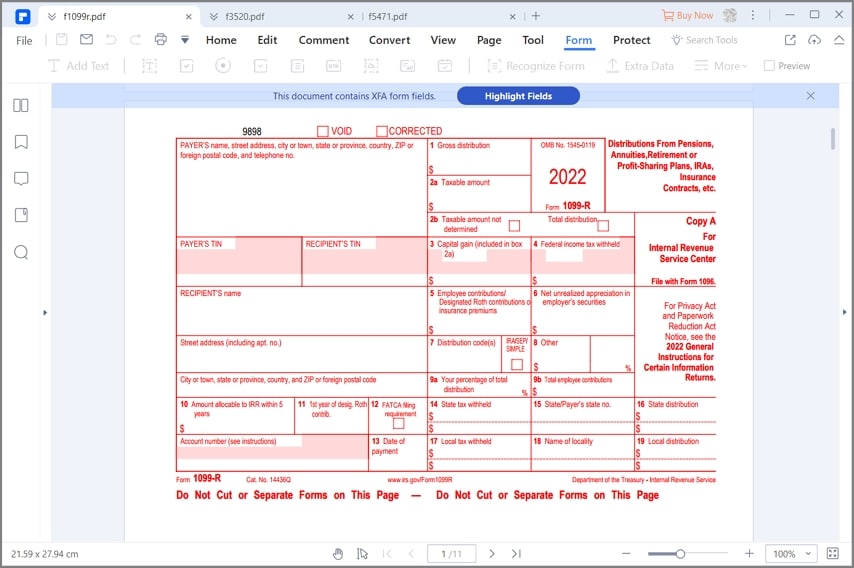

Formulario 1099 R Del IRS C mo Rellenarlo Bien Y F cilmente

Irs Printable 1099 Form Printable Form 2023

1099 Cancelled Form Irs Printable - If you have debt that is canceled by a lender you may receive IRS Form 1099 C Although you are no longer liable to repay the debt you can t simply forget about it The IRS may consider the forgiven amount as which means you may owe tax on the full amount that was forgiven