1099 Int Form Free Printable The 1099 INT is used to report interest income paid on Savings accounts Some checking accounts U S savings bonds Treasury bills Who Uses a 1099 INT Form 1099 INT is filed by any entity that pays interest to investors such as a government agency or financial institution

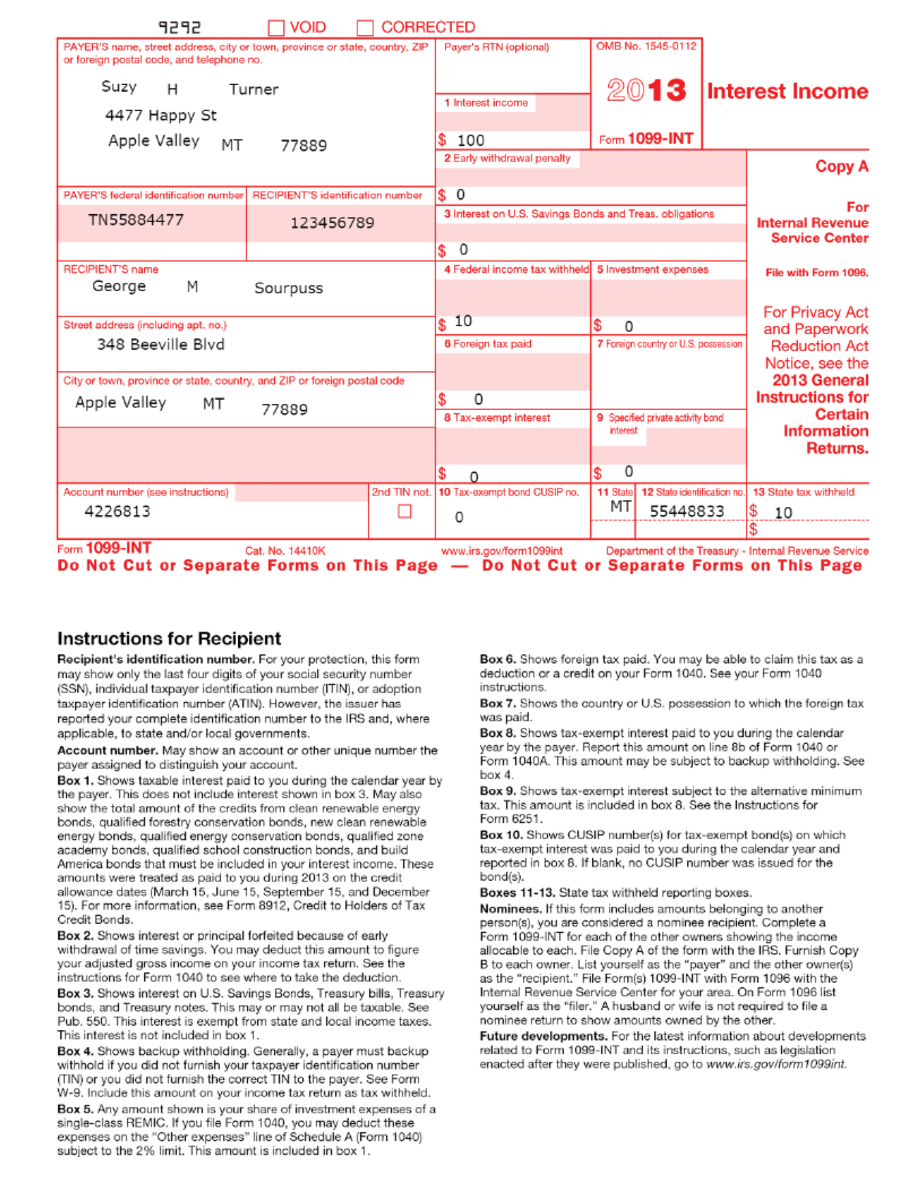

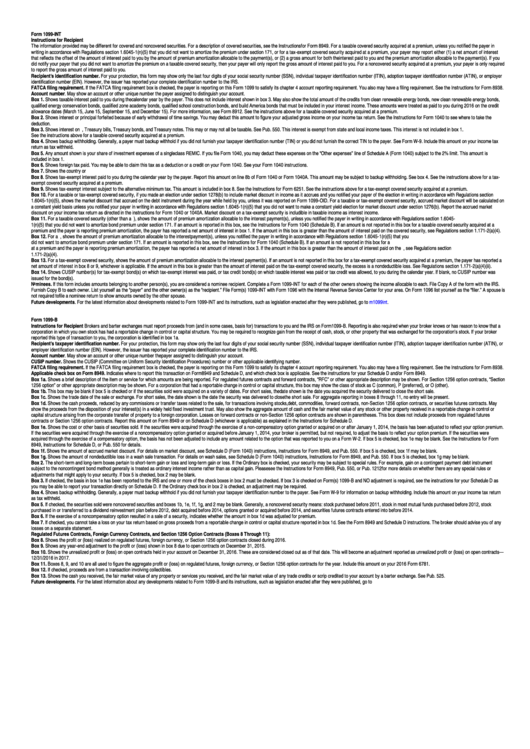

Current Revision Form 1099 INT PDF Instructions for Forms 1099 INT and 1099 OID Print Version PDF Recent Developments None at this time Other Items You May Find Useful All Form 1099 INT Revisions About Publication 938 Real Estate Mortgage Investment Conduits REMICs Reporting Information Any payer of interest income should issue a 1099 INT Form by January 31st of the following year to any party paid at least 10 of interest The form details interest payments related expenses and taxes owed 1099 INT for 2022 2021 2020 Download 1099 INT Form for 2023 What is a 1099 INT How do I fill out a 1099 INT Form

1099 Int Form Free Printable

1099 Int Form Free Printable

https://d1qmdf3vop2l07.cloudfront.net/big-tiger1.cloudvent.net/compressed/5dfd15c0d94b65cc4e7c2552768efb21.png

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

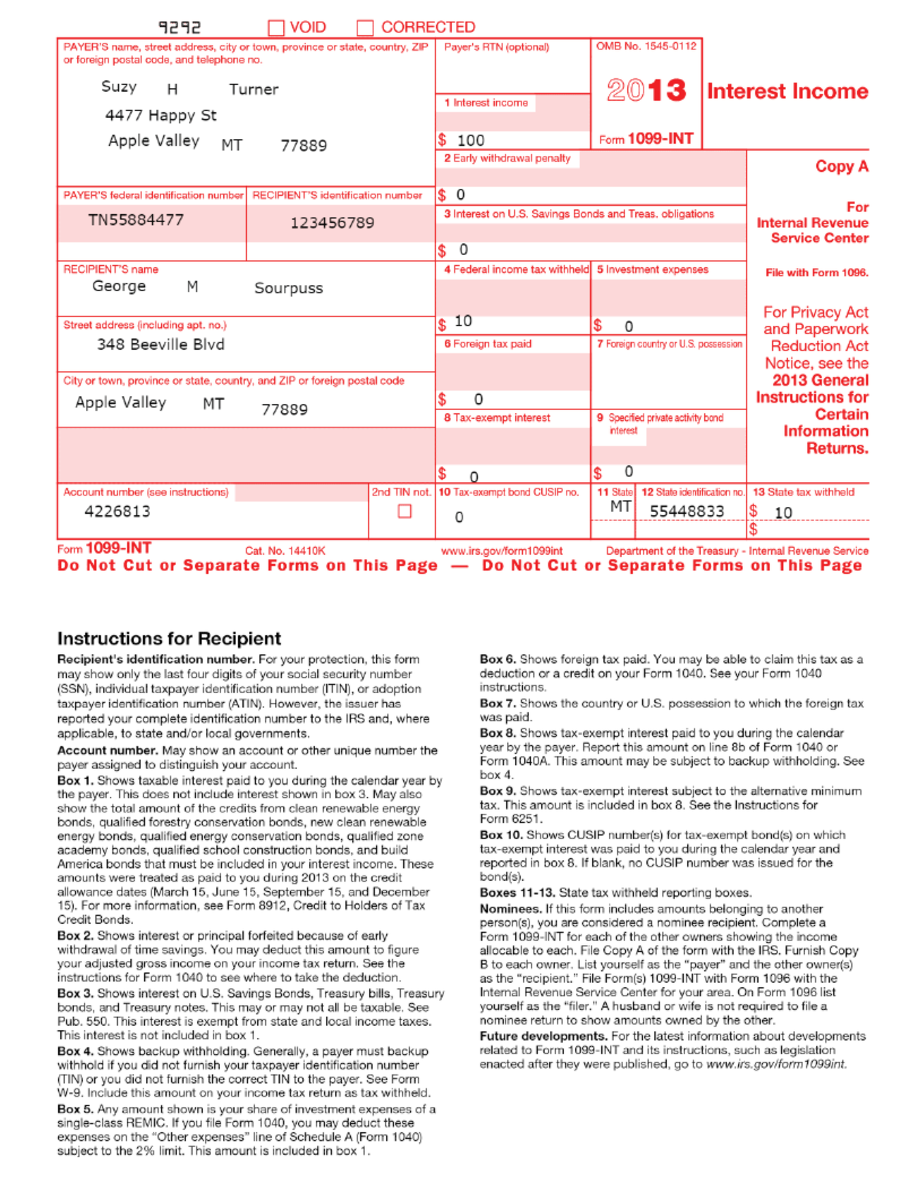

Form 1099 INT Interest Income Definition

https://www.investopedia.com/thmb/OGUDDvaXzzUl5Mccne0mYit28VM=/1668x1103/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png

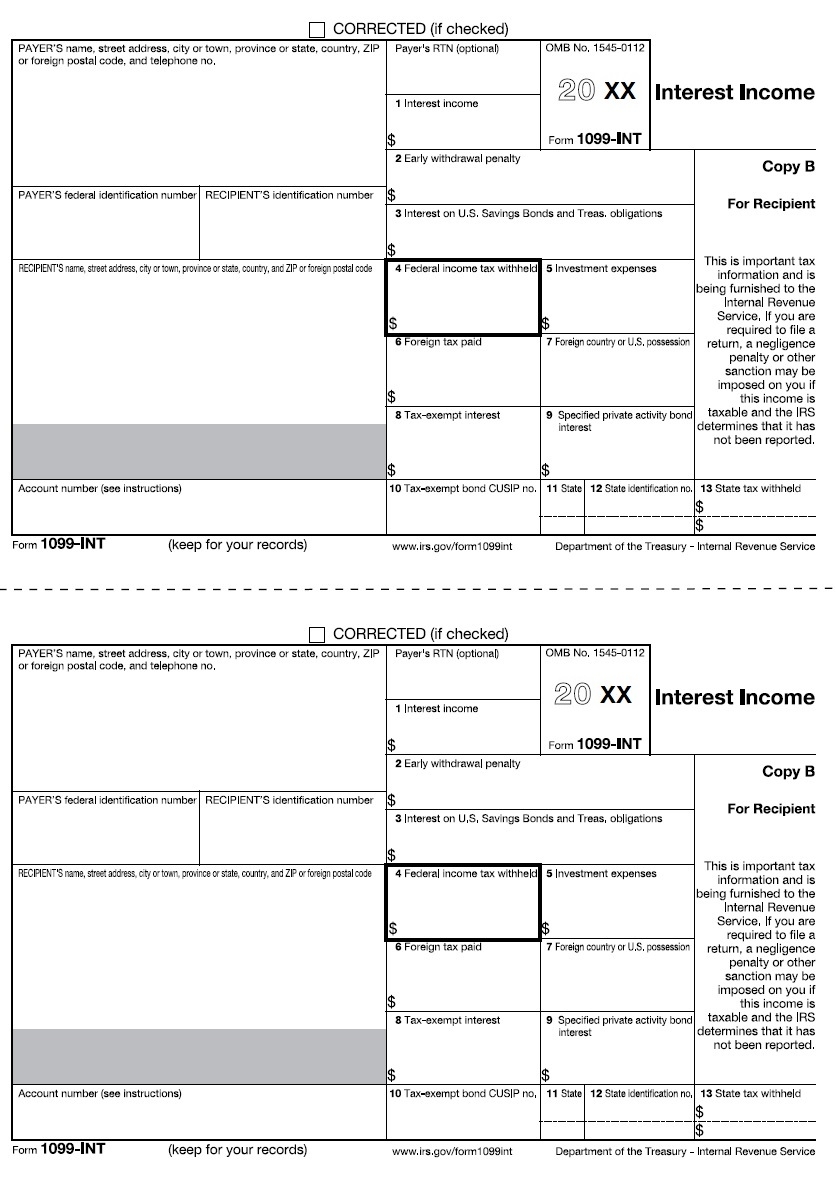

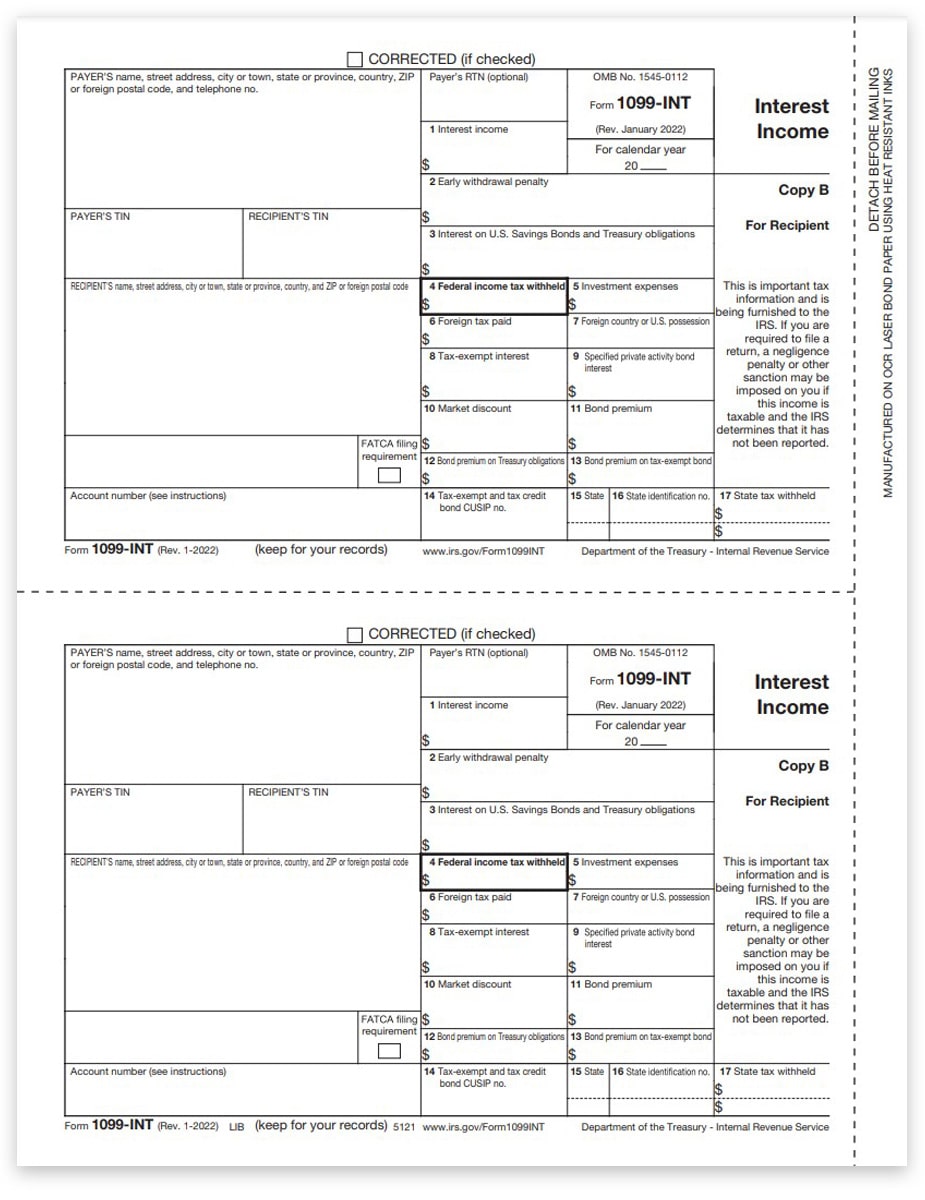

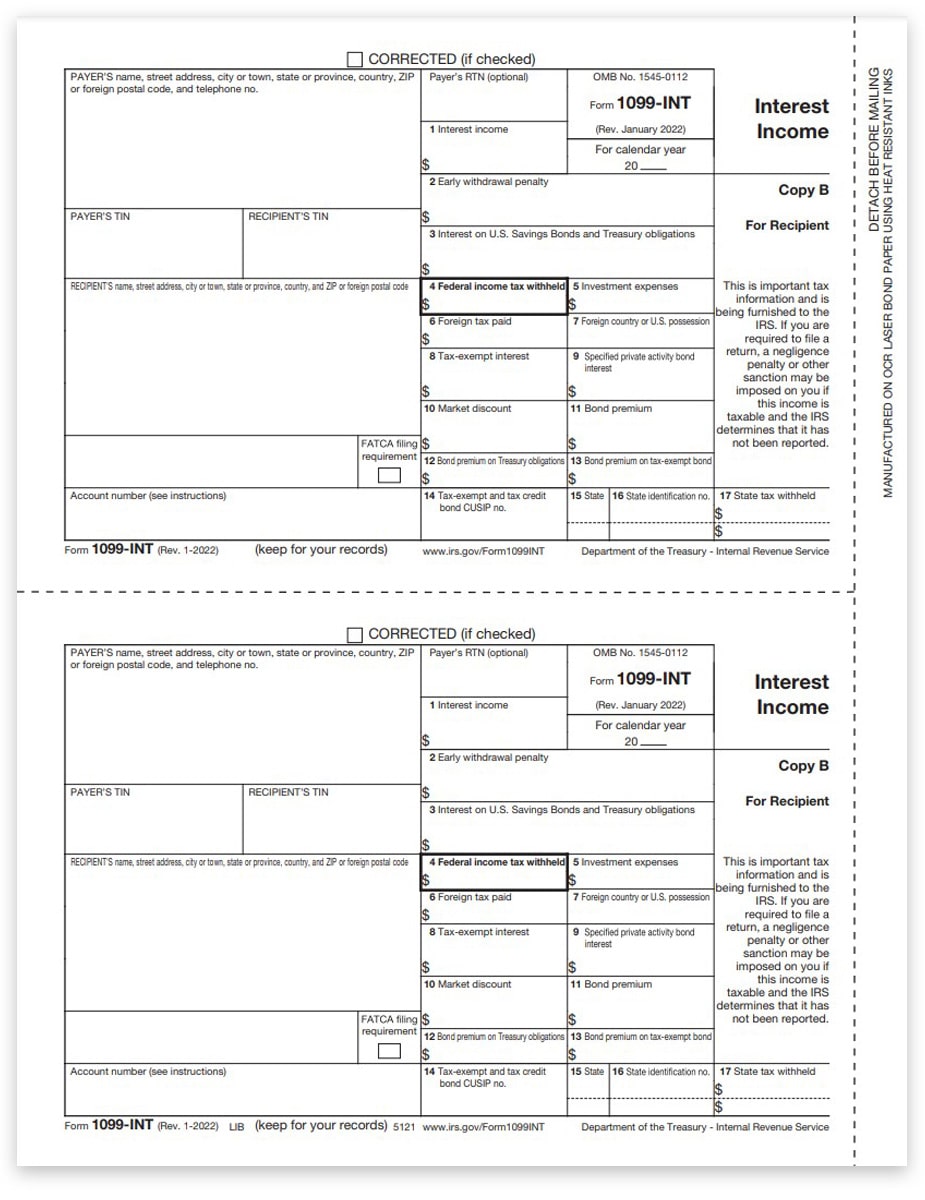

1099 INT Recipient Copy B

https://www.formsmall.com/media/catalog/product/cache/1/image/5e06319eda06f020e43594a9c230972d/1/0/1099-Int-3up-copy-B.jpg

The 1099 INT is a type of IRS form that outlines how much interest an entity paid you throughout the year You might receive this tax form from your bank because it paid you interest on OVERVIEW If you receive a 1099 INT the tax form that reports most payments of interest income you may or may not have to pay income tax on the interest it reports However you may still need to include the information from it on your return TABLE OF CONTENTS Interest income 1099 INT filing requirements Taxation of interest Click to expand

1099 NEC You ll receive a 1099 NEC nonemployee compensation for income you receive for contract labor or self employment of more than 600 Note Prior to tax year 2020 this information was reported on Form 1099 MISC If you work for more than one company you ll receive a 1099 NEC tax form from each company Form 1099 INT The form issued by all payers of interest income to investors at year s end Form 1099 INT breaks down all types of interest income and related expenses Payers must issue Form 1099

More picture related to 1099 Int Form Free Printable

Form 1099 Int Rev 10 2013 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/21/158/21158127/large.png

1099 INT Form Fillable Printable Download 2022 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/check-boxes-2x.png

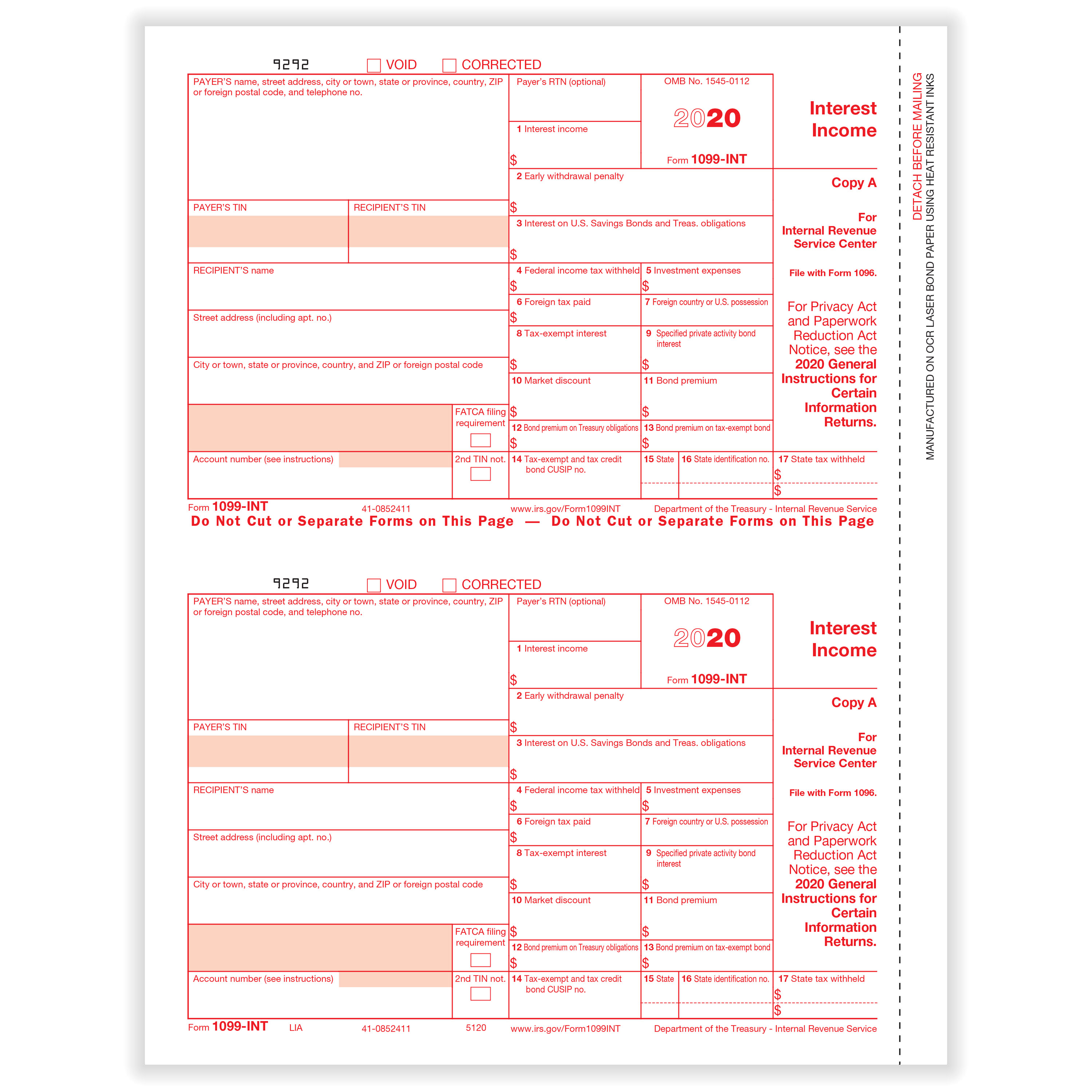

1099 Int Federal Form 1099 INT Formstax

https://cdn.formstax.com/Images/Products/L0143-5120-2020-1099INT-Federal-Copy-A-LSR_xl.jpg

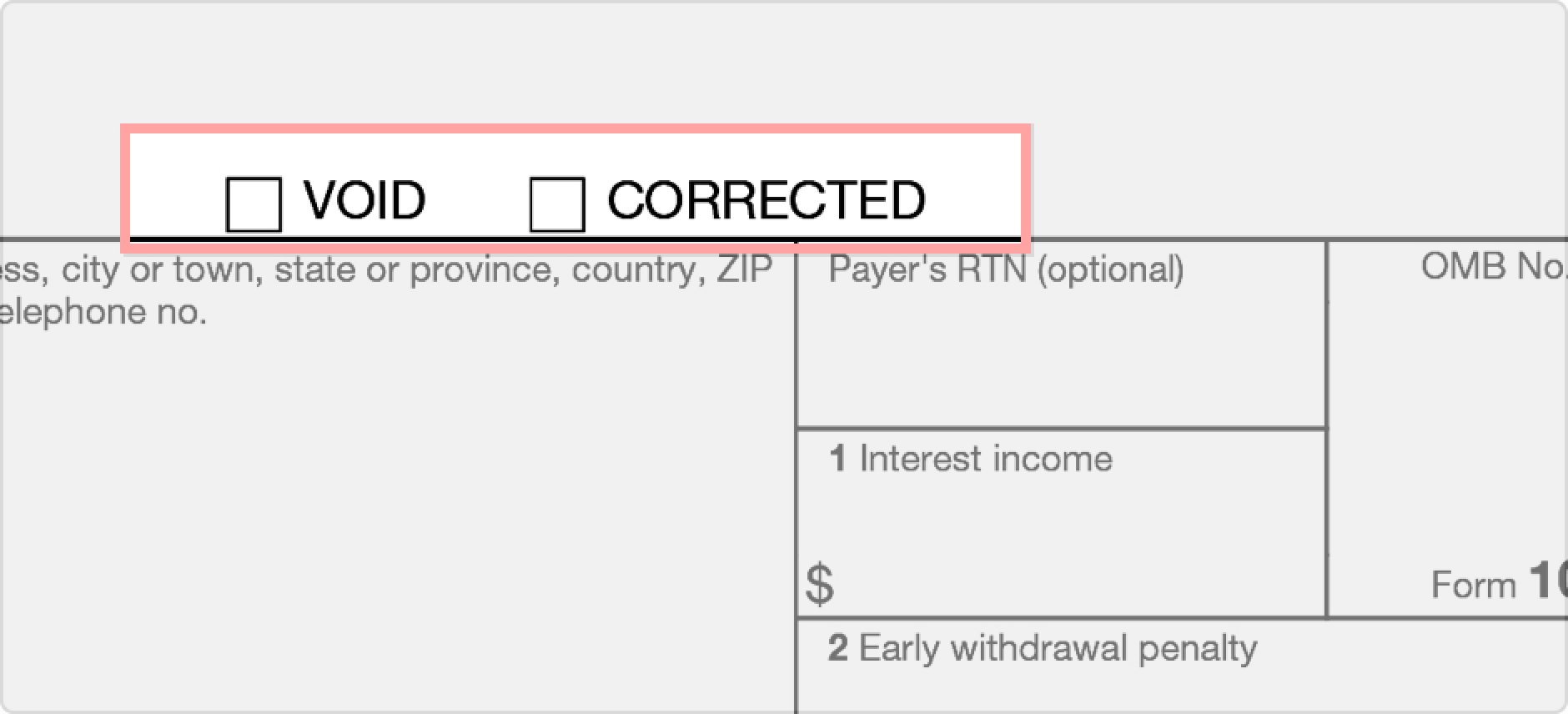

If you send the IRS a 1099 that you ve printed on plain paper you ll be charged a penalty just as if you d failed to file the form at all 1099s get printed at least three times sometimes four These are called copies A B C and 1 and here s who gets them Copy A For the IRS Copy B For the person you paid Copy C For your own records IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form Legacy Treasury Direct Getting your IRS Form 1099 If you still have securities in Legacy Treasury Direct we mail you a 1099 at the beginning of each year If you need a duplicate 1099 INT form for the current tax year call 844 284 2676 free call or from outside the United States 1 304 480 6464 To request 1099 INT forms for earlier tax

E File 1099 File Form 1099 Online Form 1099 For 2020

https://www.expressirsforms.com/Content/Images/form-1099-int.jpg

1099 INT Forms Filing TaxFormExpress

https://www.taxformexpress.com/wp-content/uploads/2014/06/LIB-2022.jpg

https://eforms.com/irs/form-1099/int/

The 1099 INT is used to report interest income paid on Savings accounts Some checking accounts U S savings bonds Treasury bills Who Uses a 1099 INT Form 1099 INT is filed by any entity that pays interest to investors such as a government agency or financial institution

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png?w=186)

https://www.irs.gov/forms-pubs/about-form-1099-int

Current Revision Form 1099 INT PDF Instructions for Forms 1099 INT and 1099 OID Print Version PDF Recent Developments None at this time Other Items You May Find Useful All Form 1099 INT Revisions About Publication 938 Real Estate Mortgage Investment Conduits REMICs Reporting Information

How To Print And File 1099 INT Interest Income

E File 1099 File Form 1099 Online Form 1099 For 2020

Form 1099 Int Instructions For Recipient Printable Pdf Download

Free Form 1099 MISC PDF Word

Irs Printable 1099 Form Printable Form 2023

1099INT Tax Forms 2022 Recipient Copy B DiscountTaxForms

1099INT Tax Forms 2022 Recipient Copy B DiscountTaxForms

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Printable 1099 Tax Forms Free Printable Form 2024

IRS Form 1099 Reporting For Small Business Owners

1099 Int Form Free Printable - Capital One tax forms Capital One Help Center Get to know the tax forms that are applicable to your financial life so you know what to expect from us