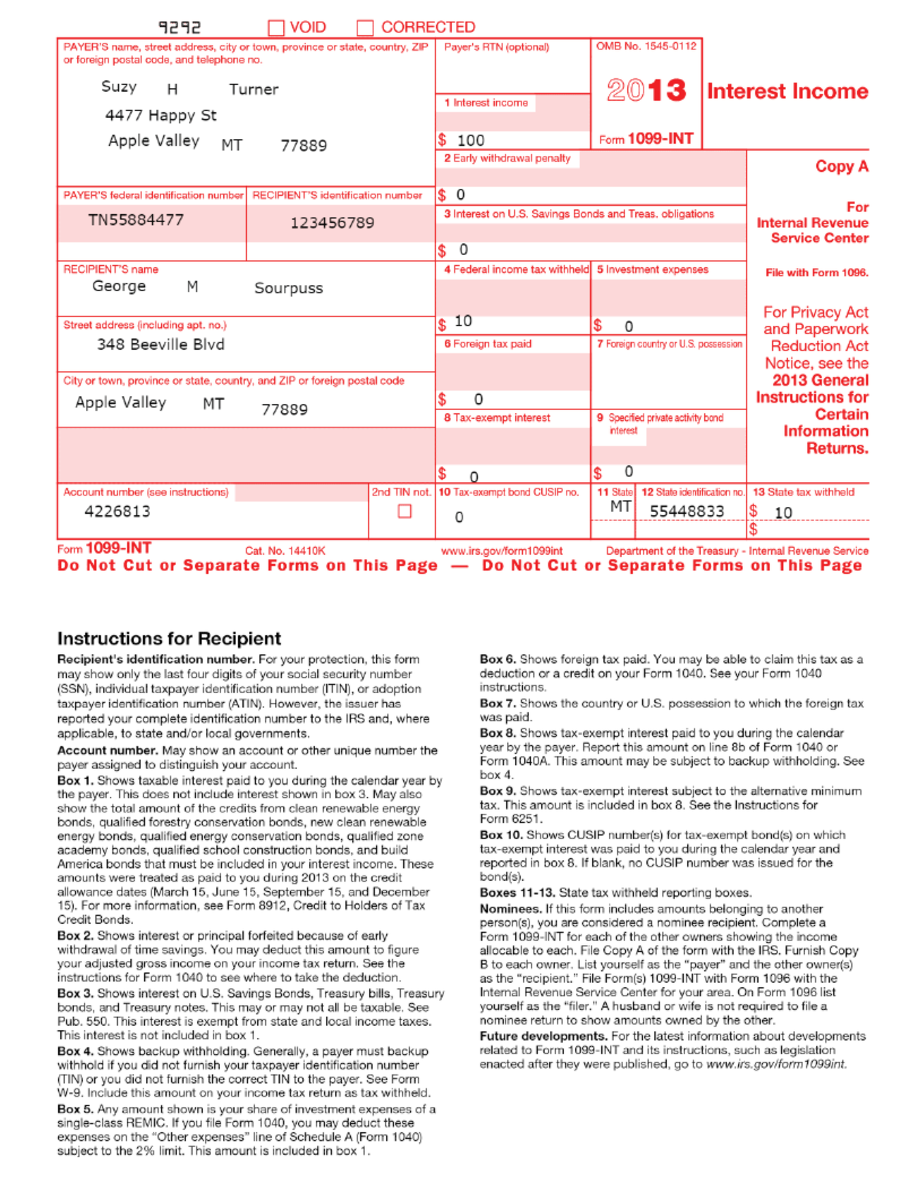

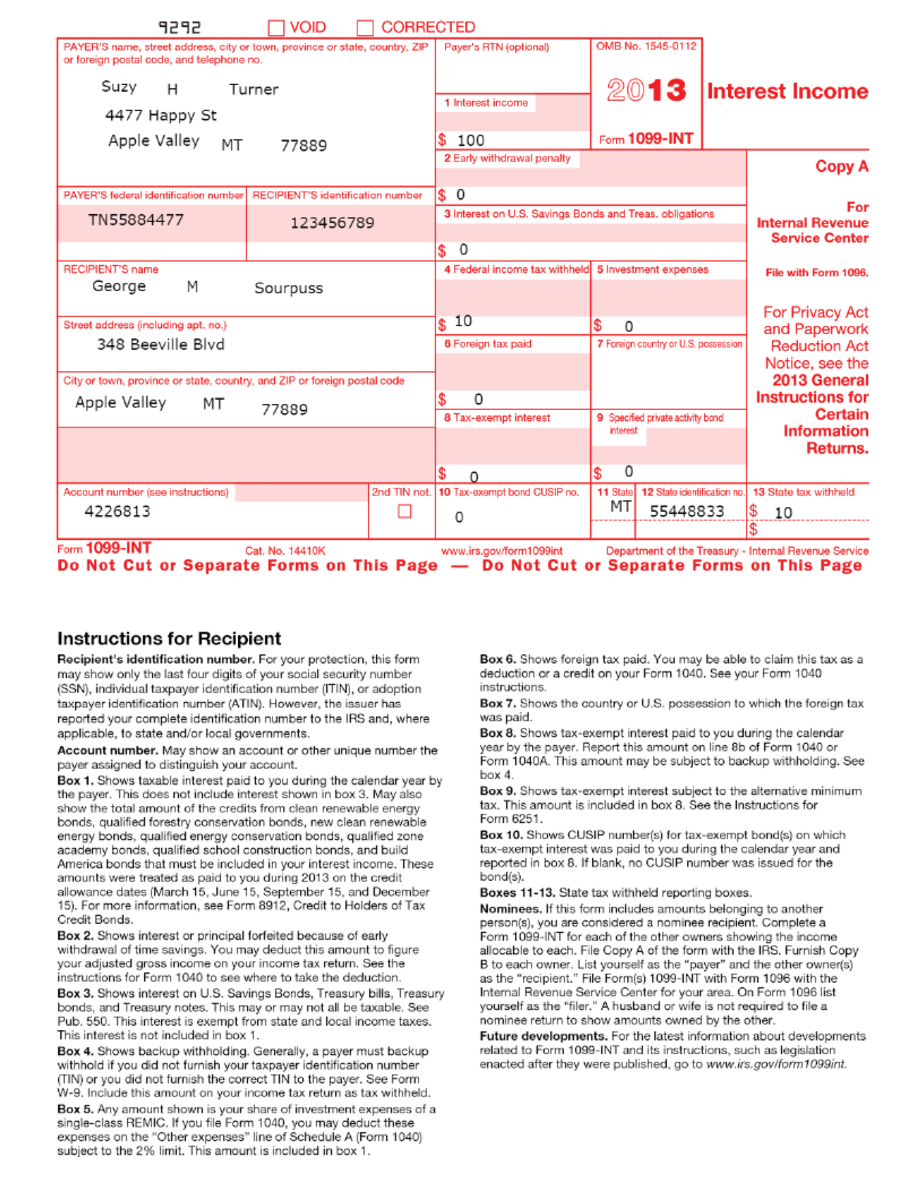

1099 Int Tax Form Printable The 1099 INT is used to report interest income paid on Savings accounts Some checking accounts U S savings bonds Treasury bills Who Uses a 1099 INT Form 1099 INT is filed by any entity that pays interest to investors such as a government agency or financial institution

Any payer of interest income should issue a 1099 INT Form by January 31st of the following year to any party paid at least 10 of interest The form details interest payments related expenses and taxes owed 1099 INT for 2022 2021 2020 Download 1099 INT Form for 2023 What is a 1099 INT How do I fill out a 1099 INT Form If you receive a 1099 INT the tax form that reports most payments of interest income you may or may not have to pay income tax on the interest it reports However you may still need to include the information from it on your return TABLE OF CONTENTS Interest income 1099 INT filing requirements Taxation of interest Click to expand Key Takeaways

1099 Int Tax Form Printable

1099 Int Tax Form Printable

https://g.foolcdn.com/editorial/images/472740/1099-int.PNG

1099 Int Template Create A Free 1099 Int Form

https://d1qmdf3vop2l07.cloudfront.net/big-tiger1.cloudvent.net/compressed/5dfd15c0d94b65cc4e7c2552768efb21.png

Form 1099 Int Rev 10 2013 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/21/158/21158127/large.png

Form 1099 INT The form issued by all payers of interest income to investors at year s end Form 1099 INT breaks down all types of interest income and related expenses Payers must issue Form 1099 The 1099 INT is a type of IRS form that outlines how much interest an entity paid you throughout the year You might receive this tax form from your bank because it paid you interest

Legacy Treasury Direct Getting your IRS Form 1099 If you still have securities in Legacy Treasury Direct we mail you a 1099 at the beginning of each year If you need a duplicate 1099 INT form for the current tax year call 844 284 2676 free call or from outside the United States 1 304 480 6464 To request 1099 INT forms for earlier tax IRS Form 1099 INT is a crucial document for anyone who has earned interest income during the tax year Banks and other financial institutions use this form to report the amount of interest of 10 or more paid to investors which helps the IRS track income that may be subject to taxation

More picture related to 1099 Int Tax Form Printable

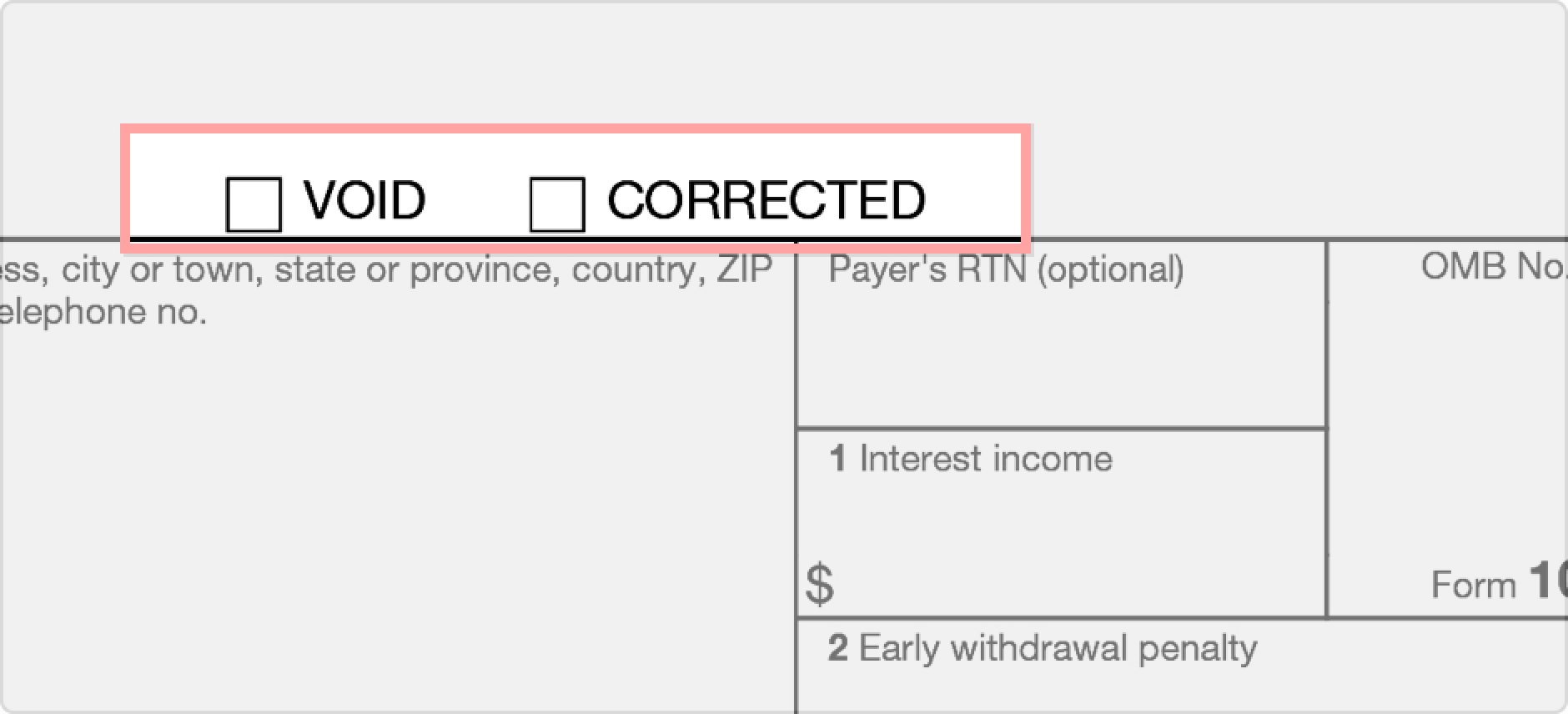

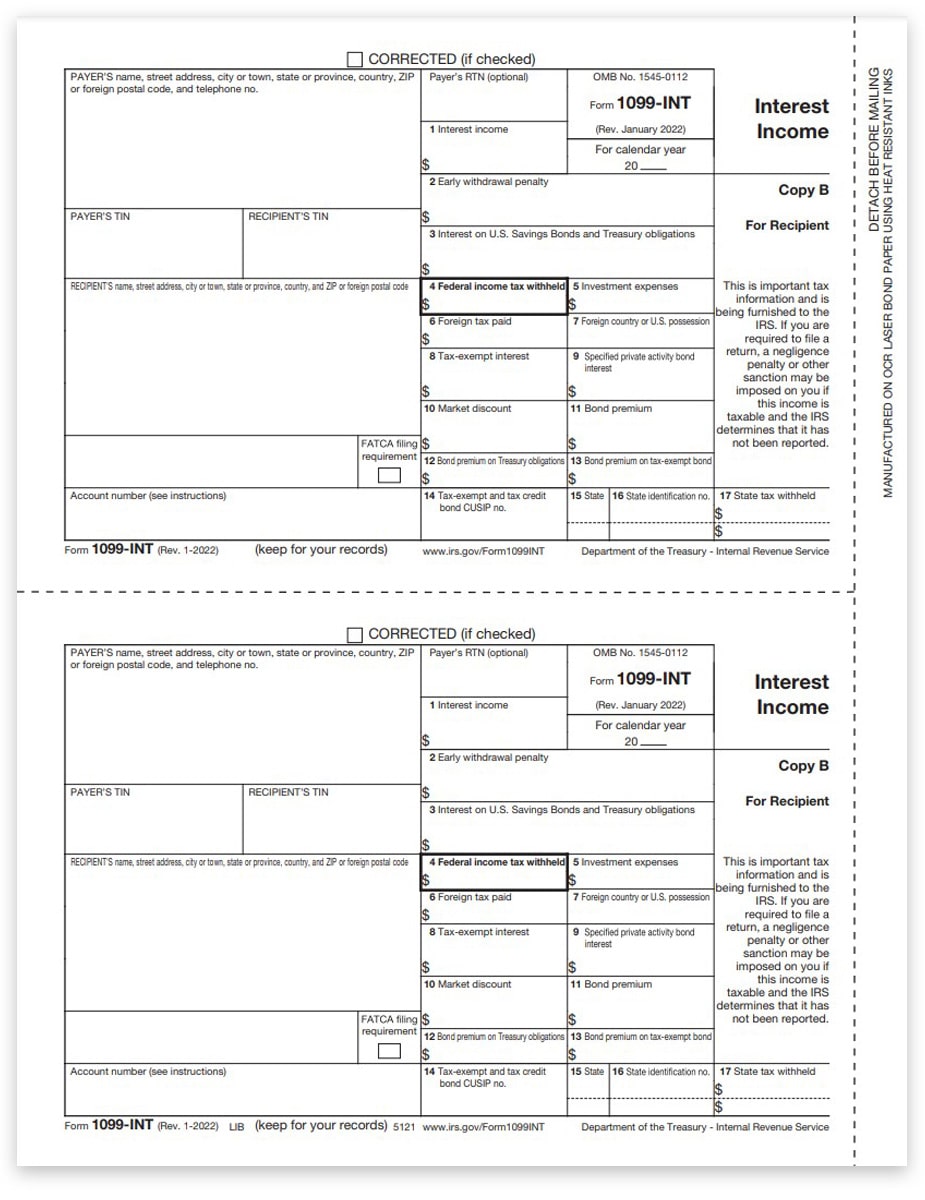

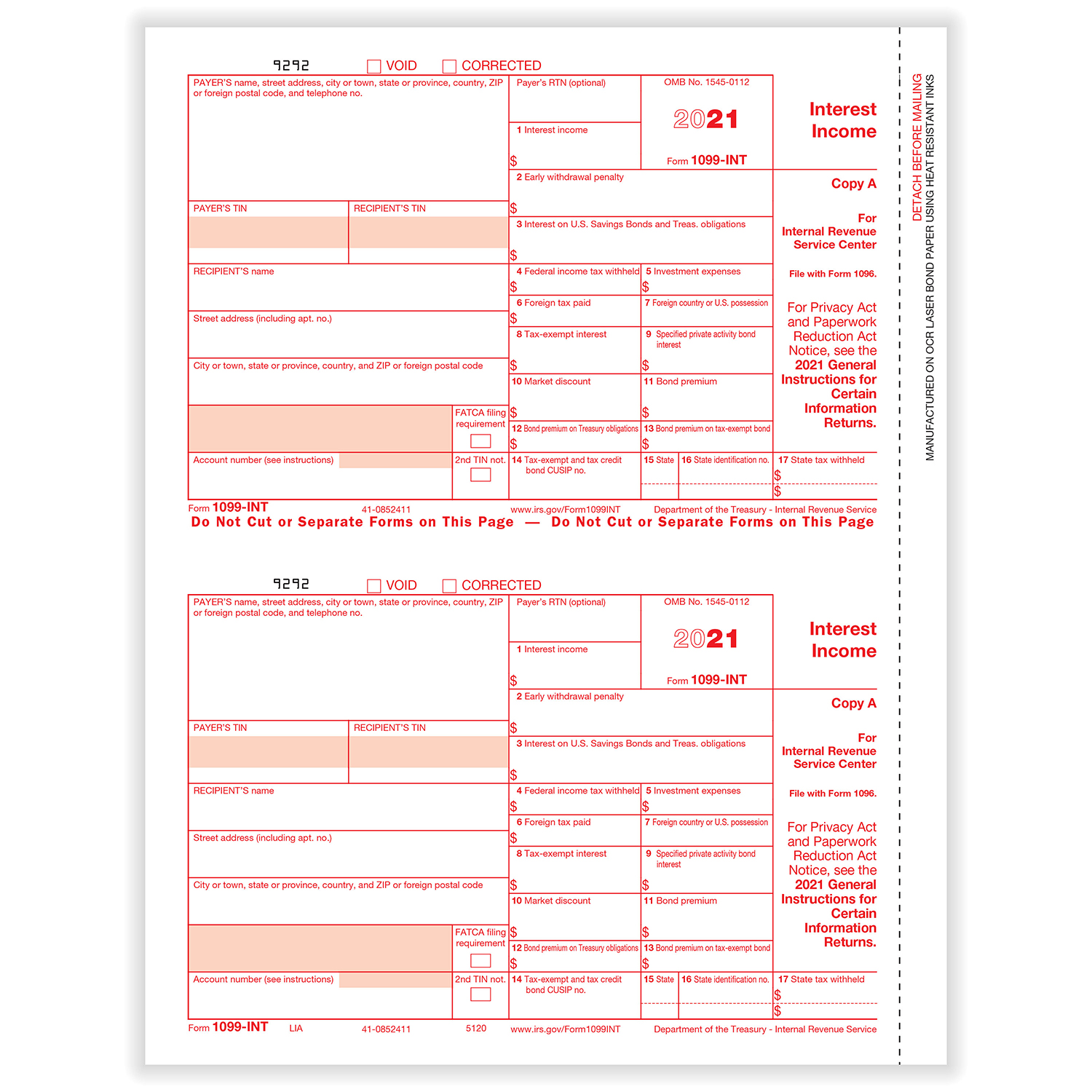

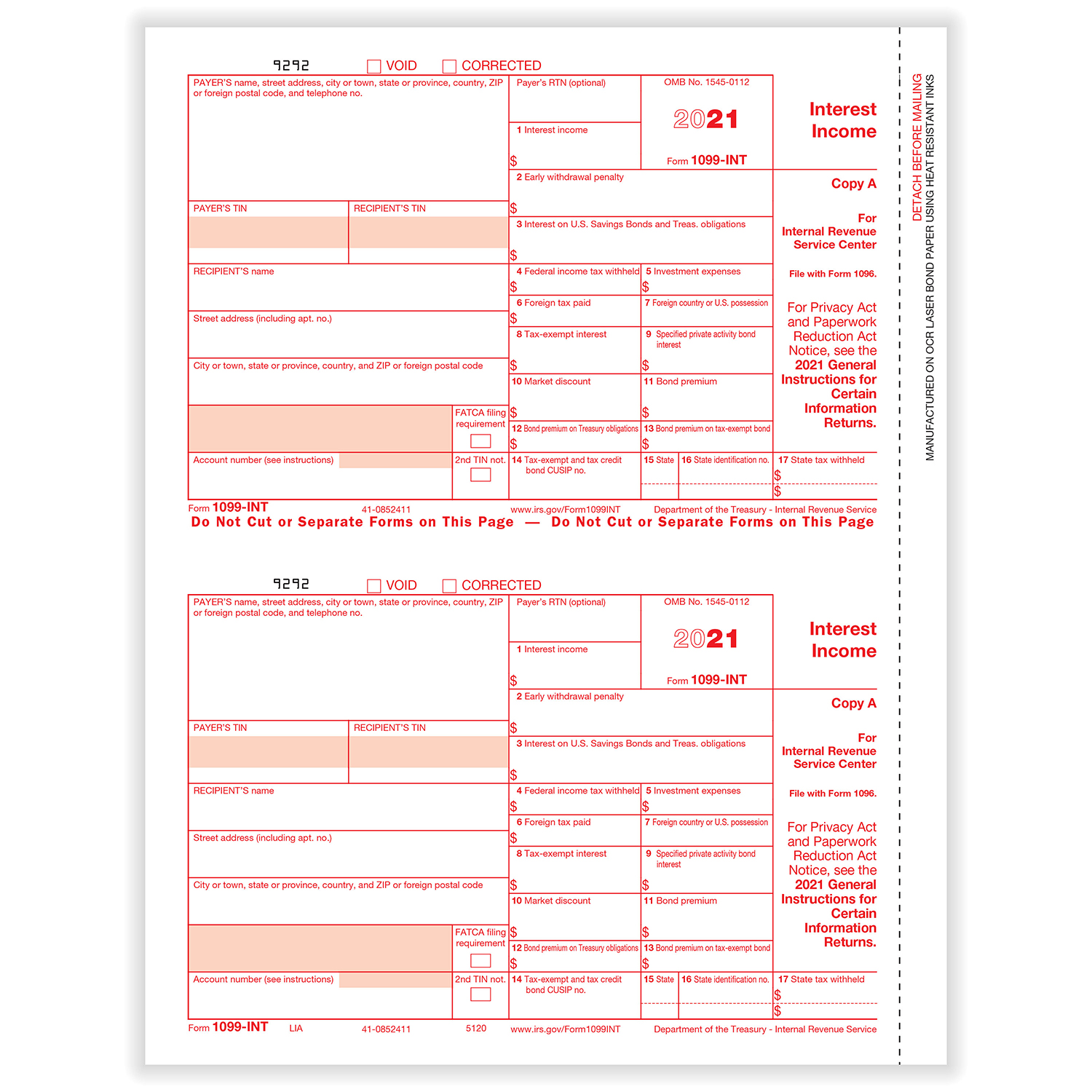

1099 INT Form Fillable Printable Download 2022 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/check-boxes-2x.png

How To Print And File 1099 INT Interest Income

https://www.halfpricesoft.com/1099s_software/images/fill-1099-INT-form.jpg

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

Formulaire 1099 INT D finition Des Revenus D int r ts

https://www.investopedia.com/thmb/bE_9myDYpTA0pDYP4iyjYp0lX-o=/1668x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png

This form Print 1099 INT Form for 2022 With Instructions Get Form File the 1099 INT Tax Form With Confidence Using Our Tips 1099 INT is a tax form used in the United States to report interest income paid to individuals or businesses by banks brokers and other financial institutions IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

1099 INT Tax Forms at Office Depot OfficeMax Shop today online in store or buy online and pick up in stores 40 off 75 qualifying purchase of Print Services Shop Now 43 99 Multi Use Print Copy Paper 10 rm Case Shop Now Products Office Supplies Furniture Cleaning Breakroom Computers Accessories Go to Vendors then select 1099 Forms then Print E file 1099 Forms Create your 1099s In the Choose a filing method window select Print 1099 NEC or Print 1099 MISC Specify the date range for the forms then choose OK Select all vendors you wish to print 1099s for Select Print 1099 Select Print 1096s instead if printing Form 1096

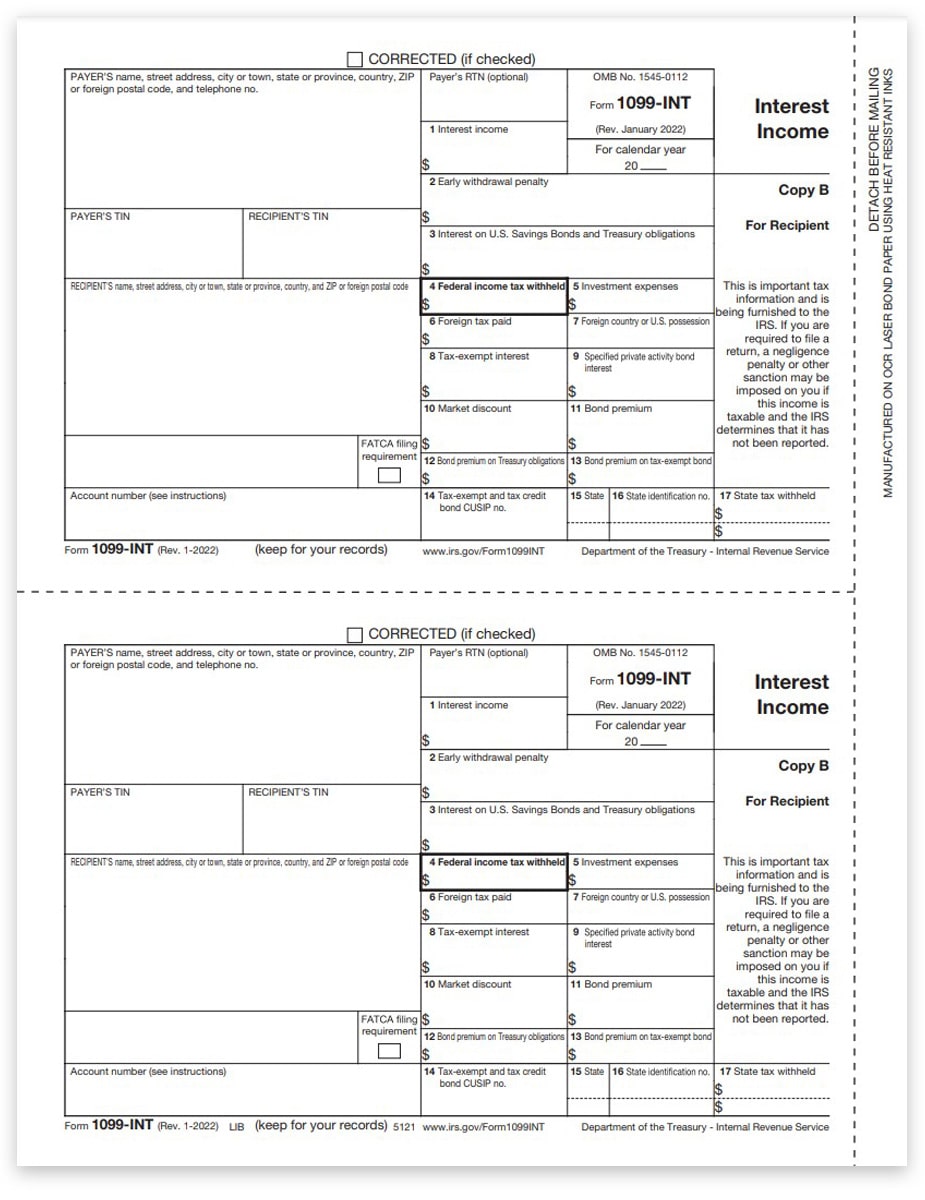

1099INT Tax Forms 2022 Recipient Copy B DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099INT-Form-Copy-B-Recipient-LIB-FINAL-min.jpg

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

https://eforms.com/irs/form-1099/int/

The 1099 INT is used to report interest income paid on Savings accounts Some checking accounts U S savings bonds Treasury bills Who Uses a 1099 INT Form 1099 INT is filed by any entity that pays interest to investors such as a government agency or financial institution

https://formswift.com/1099-int

Any payer of interest income should issue a 1099 INT Form by January 31st of the following year to any party paid at least 10 of interest The form details interest payments related expenses and taxes owed 1099 INT for 2022 2021 2020 Download 1099 INT Form for 2023 What is a 1099 INT How do I fill out a 1099 INT Form

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099INT Tax Forms 2022 Recipient Copy B DiscountTaxForms

Irs Form 1099 Int Instructions Universal Network

1099 INT Forms Filing TaxFormExpress

1099 Printable Form

1099 Int Federal Form 1099 INT Formstax

1099 Int Federal Form 1099 INT Formstax

IRS Form 1099 Reporting For Small Business Owners

1099 Int Template

Free Form 1099 MISC PDF Word

1099 Int Tax Form Printable - The 1099 INT Tax Form Purpose The 1099 INT tax form must be filed by anyone who has received 10 or more as interest from a bank brokerage or other financial institution If you re the sort of person who gets a chunk of change from these sources you ll need to get a copy of the 1099 INT and submit your details Let s take an example