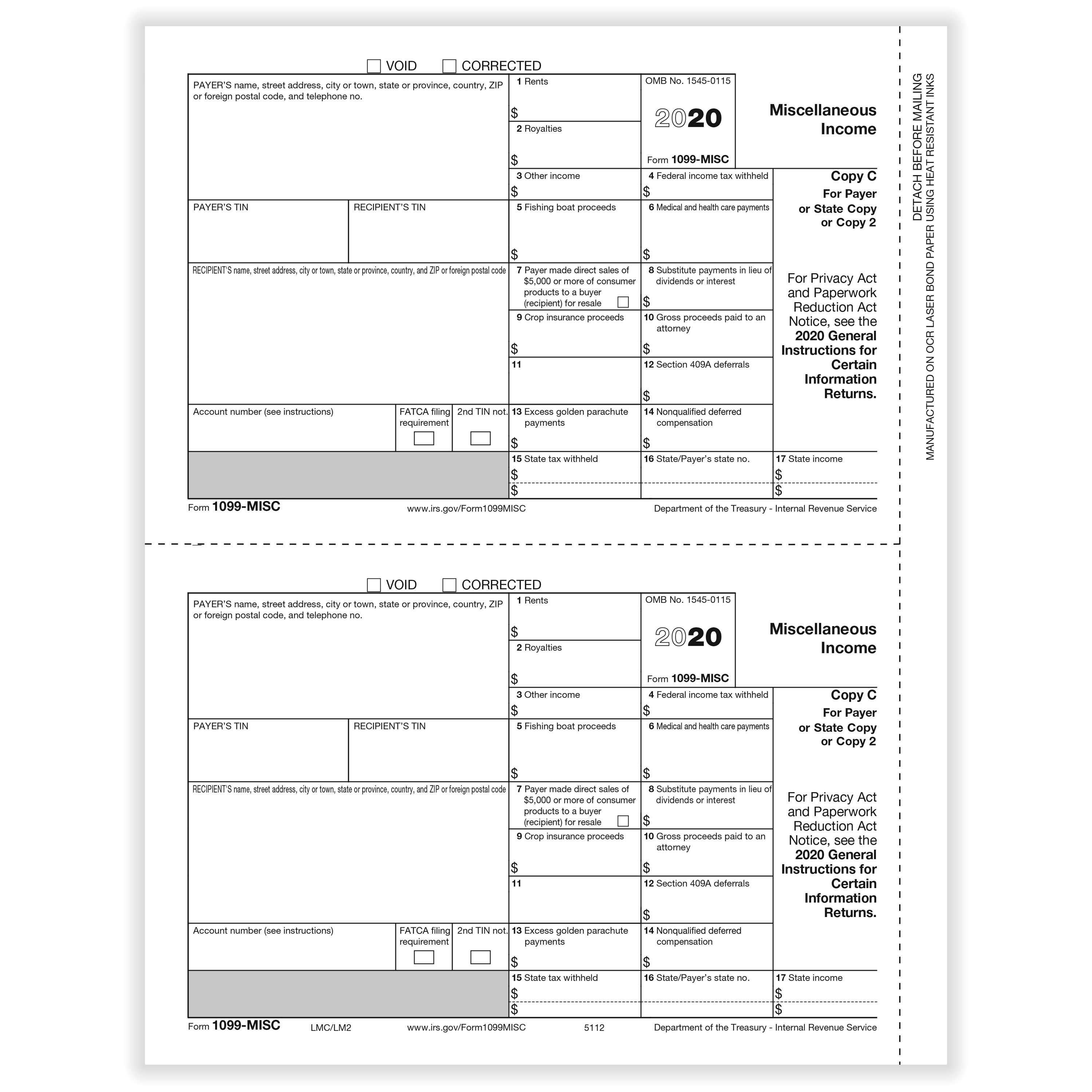

1099 Misc Free Printable Forms What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

1099 Misc Free Printable Forms

1099 Misc Free Printable Forms

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-6-box1-2x.png

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

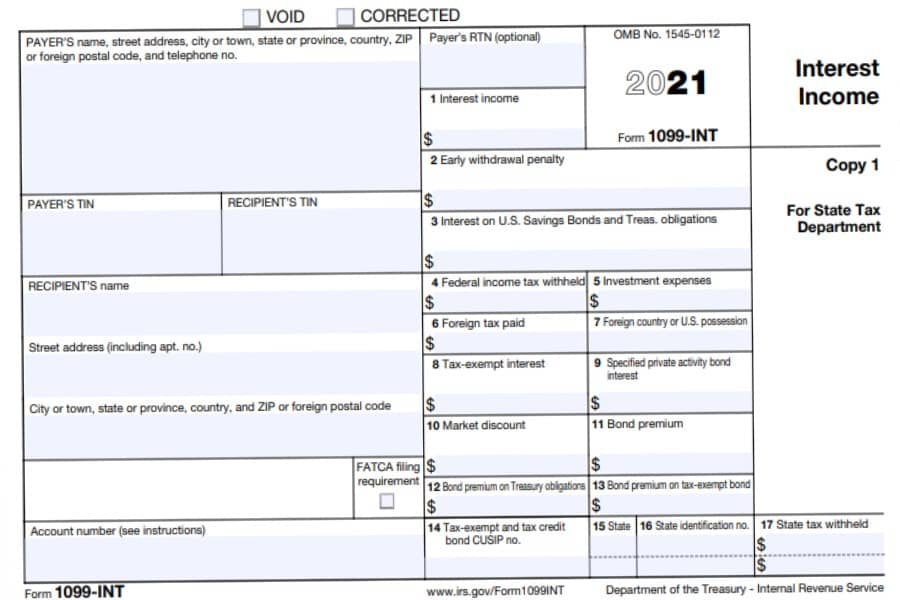

Lowest Price Pay only 2 75 form the lowest price in the industry to e file 1099 MISC directly with the IRS No hidden charges Form Validation Get your forms scanned and validated for basic errors and ensure that you have transmitted returns error free to the IRS Instant Notifications IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

More picture related to 1099 Misc Free Printable Forms

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

https://gusto.com/wp-content/uploads/2020/12/1099-MISC-1024x663.png

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

Prior Year After You File File your 1099 with the IRS for free Free support for self employed income independent contractor freelance and other small business income Landlords are typically required to file 1099 MISC forms for payments made to property managers contractors attorneys repair professionals and anyone else who performs services for your property and does not qualify as your employee You report instances where these payments equal 600 or more during the year

As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pandadoc.com/app/uploads/form-1099-misc.png

Form 1099 Misc Fillable Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-1099-misc-fillable.jpg

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

https://legaltemplates.net/form/1099-misc/

Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information

How To Fill Out And Print 1099 MISC Forms

Printable 1099 Misc Tax Form Template Printable Templates

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

1099 MISC 3 Part Continuous 1 Wide Formstax

Printable 1099 Tax Forms Free Printable Form 2024

Printable 1099 Tax Forms Free Printable Form 2024

1099 Misc Printable Template Free Printable Templates

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

Printable Form 1099 Misc For 2021 Printable Form 2023

1099 Misc Free Printable Forms - 2023 Pre Printed 1099 MISC Kits Starting at 58 99 Use federal 1099 MISC tax forms to report payments of 600 or more for rents royalties medical and health care payments and gross proceeds paid to attorneys These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you