1099 Nec Form Free Printable Important facts IRS Form W 9 Use to collect information needed for a 1099 NEC Deadline Must be submitted to recipients and IRS by January 31st Threshold Only contractors paid 600 or more need a 1099 NEC Filing Forms can be filed online by mail if less than 10 or through software Official Copies If mailing only file official copies with the IRS don t download

All Form 1099 NEC Revisions Other Current Products Page Last Reviewed or Updated 29 Dec 2023 Information about Form 1099 NEC Nonemployee Compensation including recent updates related forms and instructions on how to file There are a few ways to file 1099 NEC forms including Online You can e file your 1099 NEC Form with the IRS through the Information Returns Intake System IRIS Taxpayer Portal This is a free filing method that allows you to electronically file your 1099 NEC Form as well as apply for extensions make amendments and more

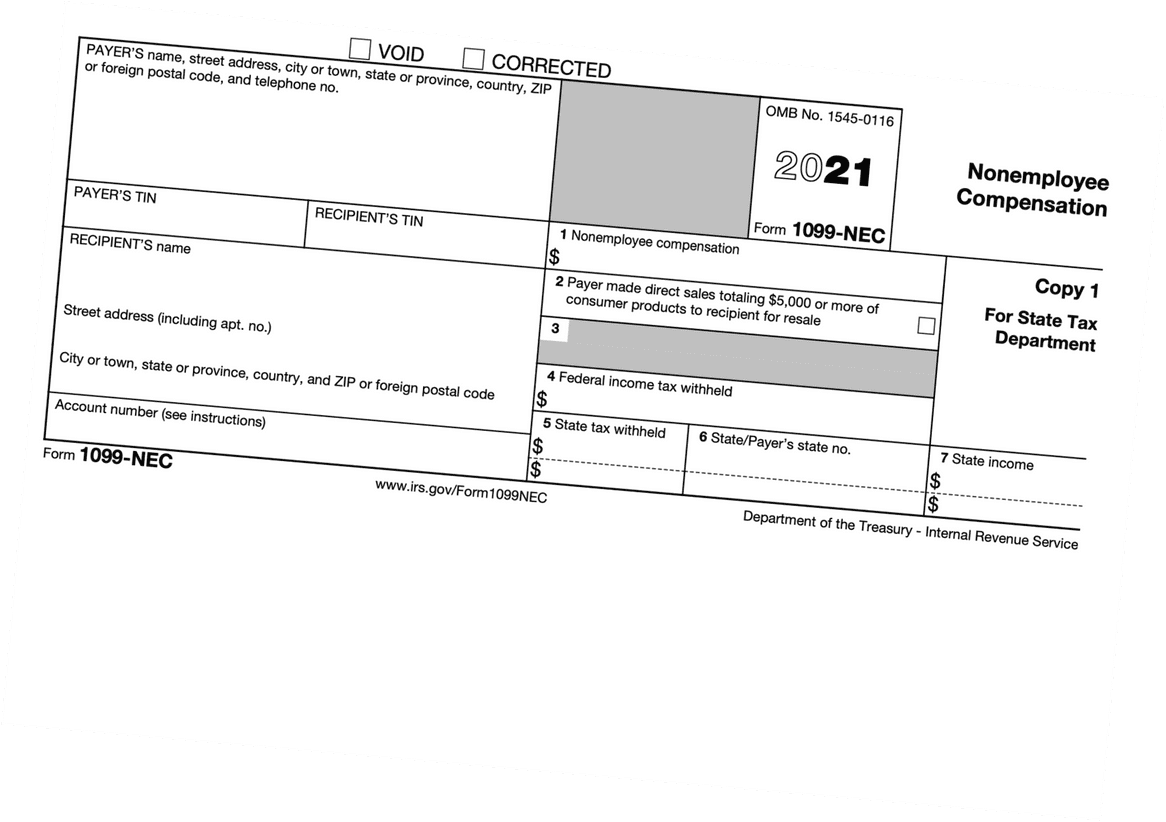

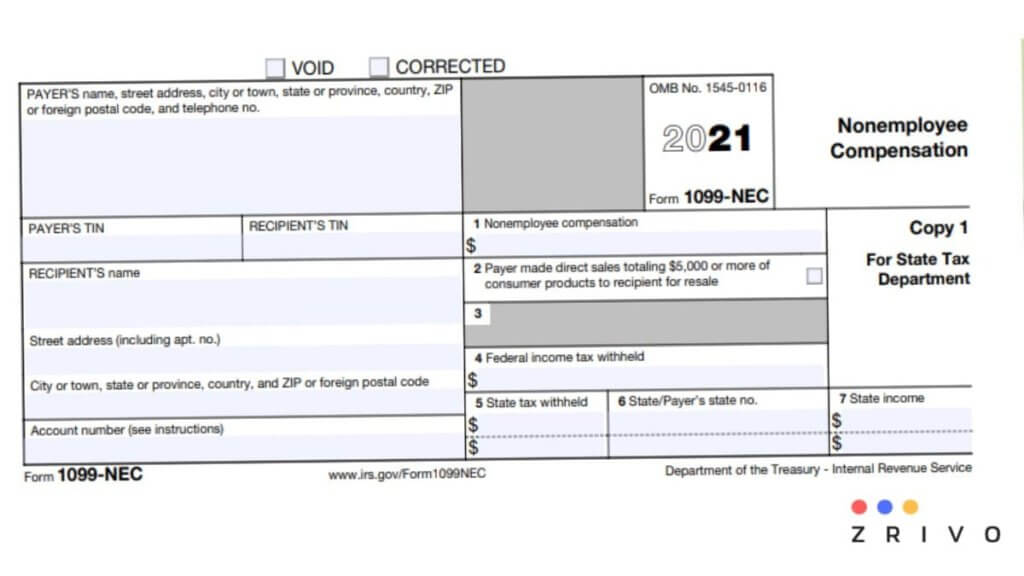

1099 Nec Form Free Printable

1099 Nec Form Free Printable

https://i.etsystatic.com/25616924/r/il/53e8da/4486482592/il_1080xN.4486482592_n0gk.jpg

2021 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/533/156/533156765/large.png

How To File Your Taxes If You Received A Form 1099 NEC

https://forst.tax/wp-content/uploads/2020/01/1099-nec.jpg

Where To Get Form 1099 NEC You can get 1099 NEC forms from office supply stores directly from the IRS from your accountant or using business tax software programs You can t use a template 1099 NEC form that you find on the internet because the red ink on Copy A is special and can t be copied You must use the official form Form 1099 NEC is a common type of 1099 form 1099 NEC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment such as contractors Then print or share Create Error Free 1099 NEC Forms Every Single Time with Form Pros

The 1099 NEC is the new form to report nonemployee compensation that is pay from independent contractor jobs also sometimes referred to as self employment income Examples of this include freelance work or driving for DoorDash or Uber Previously companies reported this income information on Form 1099 MISC Box 7 Form 1099 NEC nonemployee compensation is for businesses to report payments of at least 600 they ve issued to self employed individuals within a specific tax season Some self employed individuals that companies create 1099 NECs for include service providers consultants freelancers attorneys and independent contractors

More picture related to 1099 Nec Form Free Printable

How To Fill Out And Print 1099 NEC Forms

https://www.halfpricesoft.com/1099-nec-software/images/1099-nec-3-per-page-big.jpg

Fill Out A 1099 NEC

https://assets.website-files.com/5fbc22d336f673712db66095/5fbc25f076bd933980bbf983_progress-1099nec-img-2x-p-1080.png

1099 Nec Free Template

https://cdn.hrdirect.com/Images/Products/L0205-1099-NEC-rec-copy-b-sheet_xl.jpg

The nonemployee compensation reported in Box 1 of Form 1099 NEC is generally reported as self employment income and is usually subject to self employment tax Payments from your trade or business to individuals that aren t reportable on the 1099 NEC form would typically be reported on Form 1099 MISC The IRS provides a more comprehensive list Any nonemployee who made 600 or more will receive a 1099 NEC You ll receive the 1099 NEC by early February as businesses are required to send them out by Jan 31 Form 1099 NEC is a tax

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC When you hire contractors they must fill out Form W 9 That way you have the information you need like their TIN name and address to accurately fill out Form 1099 NEC Hopefully you kept Form W 9 in your accounting records Once you find it scan for Part I Taxpayer Identification Number TIN

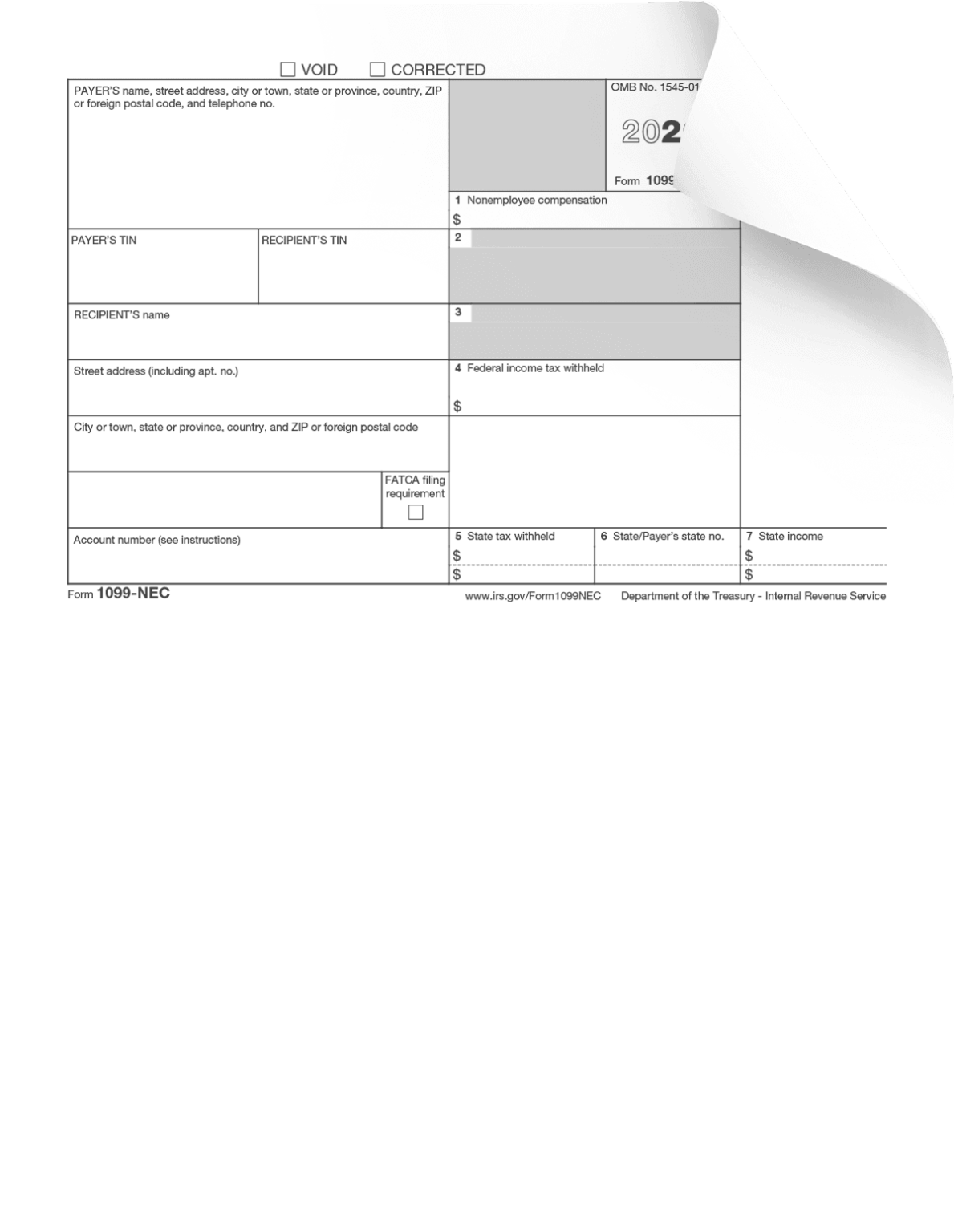

1099 Nec Form 2020 Printable Customize And Print

https://www.chortek.com/wp-content/uploads/2019/08/1099-nec-2020-draft.png

Free Printable 1099 NEC File Online 1099FormTemplate

https://d9hhrg4mnvzow.cloudfront.net/www.1099formtemplate.com/1099-nec-printable/ecff6d62-1099-nec-long-5_10we0mu000000000000028.png

https://eforms.com/irs/form-1099/nec/

Important facts IRS Form W 9 Use to collect information needed for a 1099 NEC Deadline Must be submitted to recipients and IRS by January 31st Threshold Only contractors paid 600 or more need a 1099 NEC Filing Forms can be filed online by mail if less than 10 or through software Official Copies If mailing only file official copies with the IRS don t download

https://www.irs.gov/forms-pubs/about-form-1099-nec

All Form 1099 NEC Revisions Other Current Products Page Last Reviewed or Updated 29 Dec 2023 Information about Form 1099 NEC Nonemployee Compensation including recent updates related forms and instructions on how to file

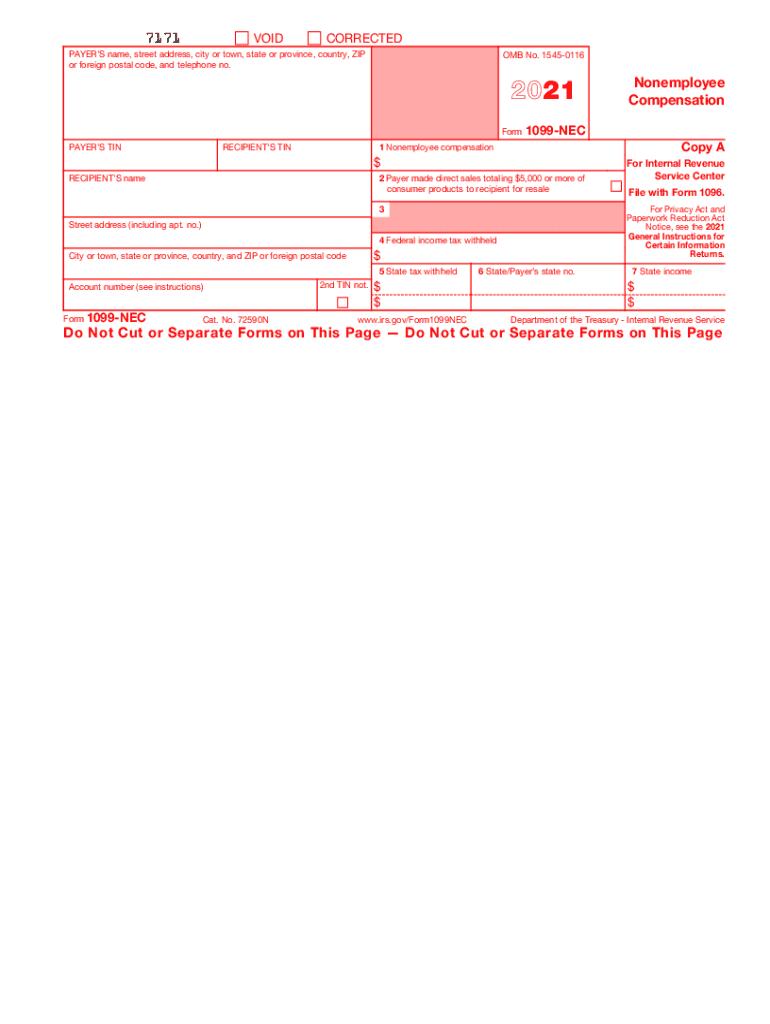

Blank 1099 Nec Form 2020 Printable Fill Out And Sign Printable PDF Template SignNow

1099 Nec Form 2020 Printable Customize And Print

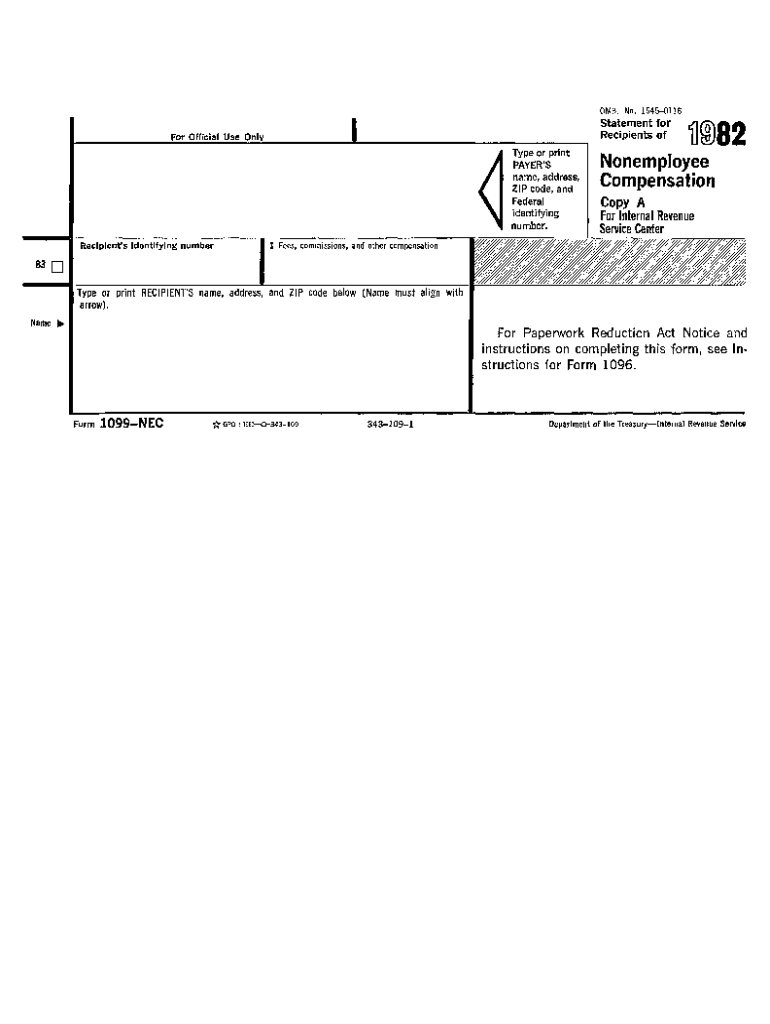

1099 Nec Printable Form Francesco Printable

1099 Nec Word Template

Fillable 1099 nec Form 2023 Fillable Form 2023

Printable 1099 Nec Form

Printable 1099 Nec Form

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

Printable 1099 nec Form 2021 Customize And Print

Printable 1099 nec Form 2021 Customize And Print

1099 Nec Form Free Printable - Form 1099 NEC nonemployee compensation is for businesses to report payments of at least 600 they ve issued to self employed individuals within a specific tax season Some self employed individuals that companies create 1099 NECs for include service providers consultants freelancers attorneys and independent contractors