1120s Irs Printable And Saveable Form The corporation can view print or download all of the forms and publications it may need on IRS gov FormsPubs please follow up by calling 800 829 4933 Don t file Form 1120 S for any tax year before the year the election takes effect Relief for late elections If you haven t filed Form 2553 or didn t file Form 2553 on time you may be

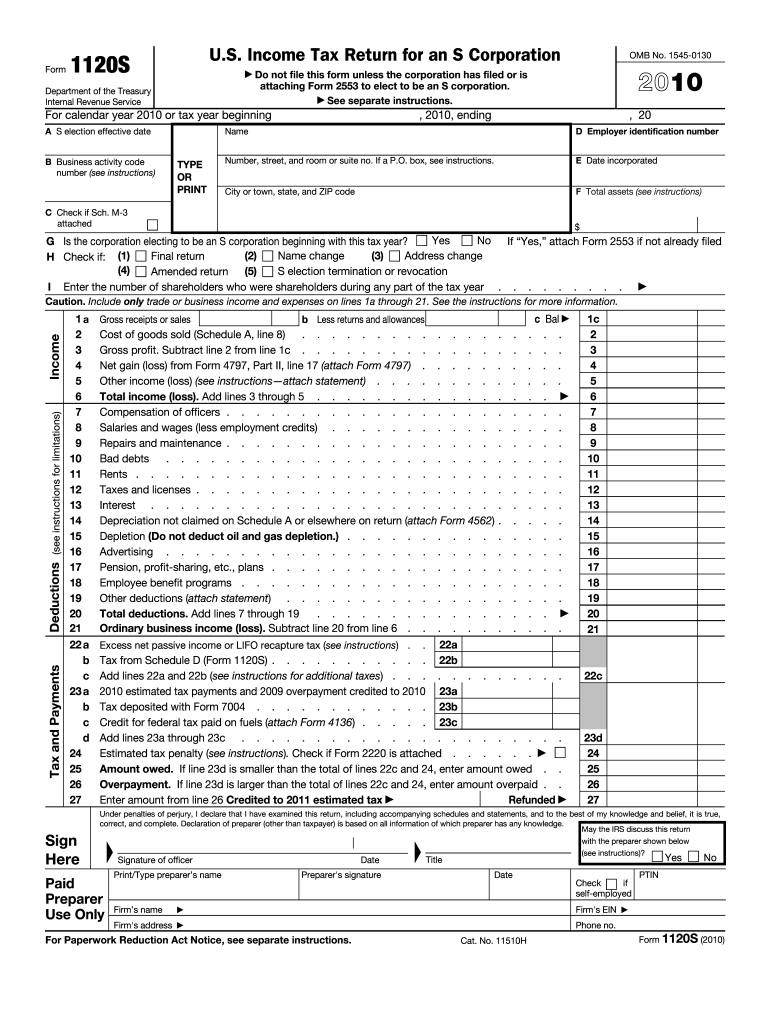

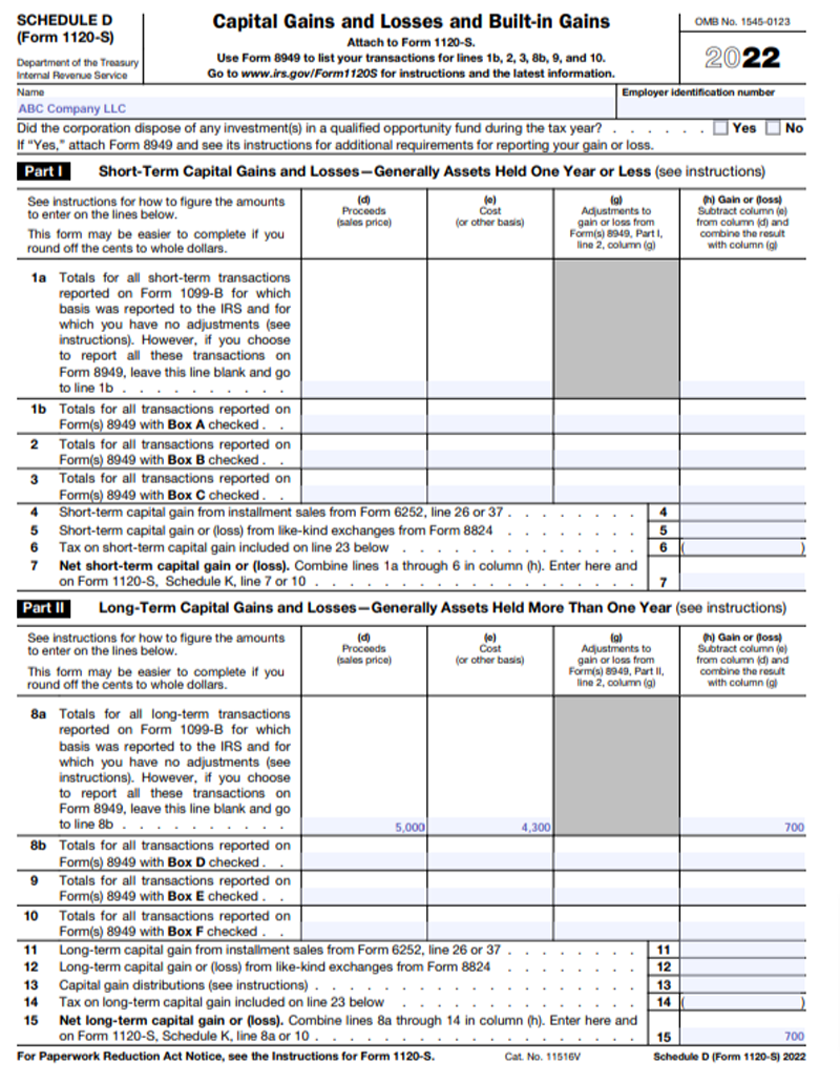

Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation Current Revision Form 1120 S PDF Instructions for Form 1120 S Print Version PDF Recent Developments This policy includes forms printed from IRS gov and output on high quality devices such as laser or ink jet printers unless otherwise specified on the form itself Forms that must be ordered from the IRS are labeled for information only and can be ordered online Find out how to save fill in or print IRS forms with Adobe Reader

1120s Irs Printable And Saveable Form

1120s Irs Printable And Saveable Form

https://www.pdffiller.com/preview/584/735/584735907/large.png

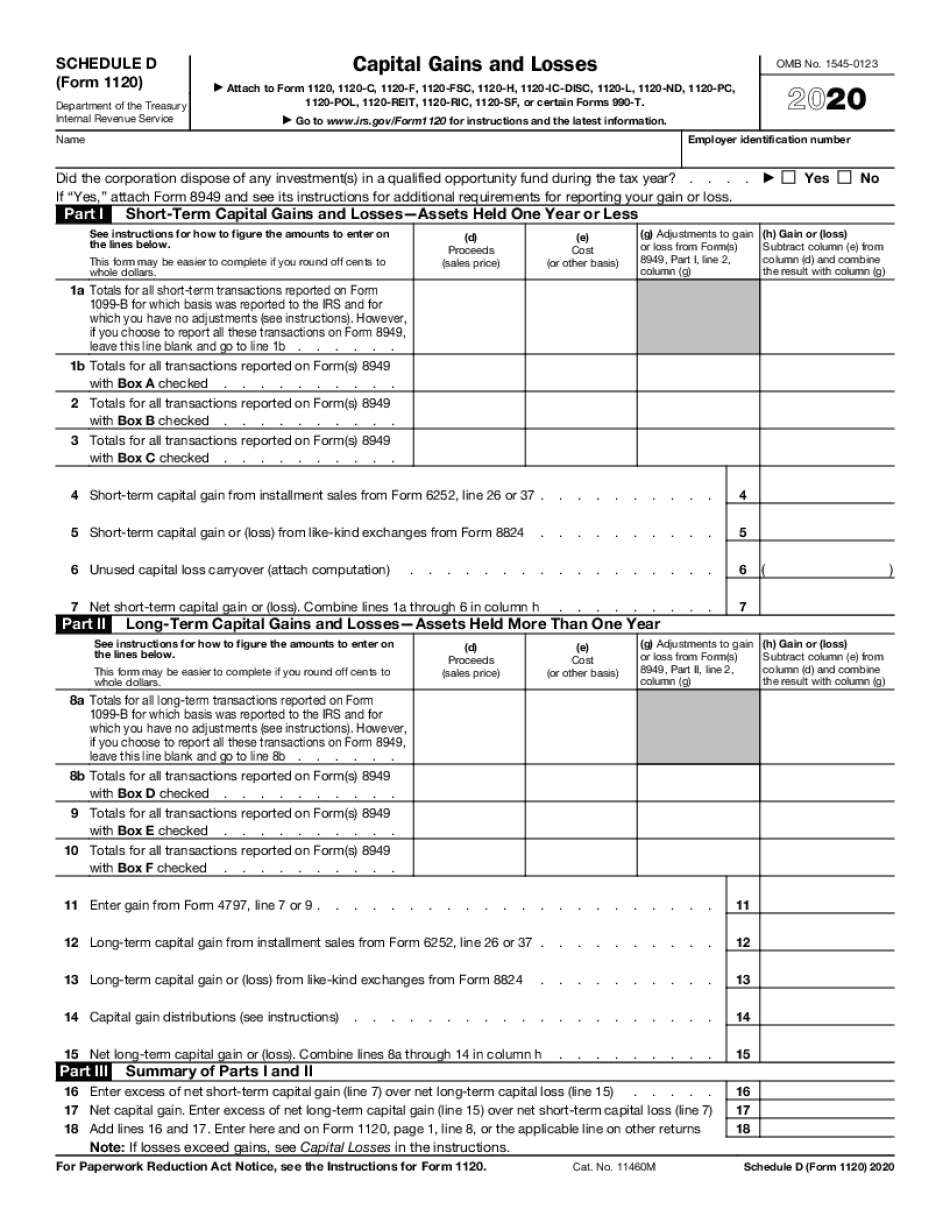

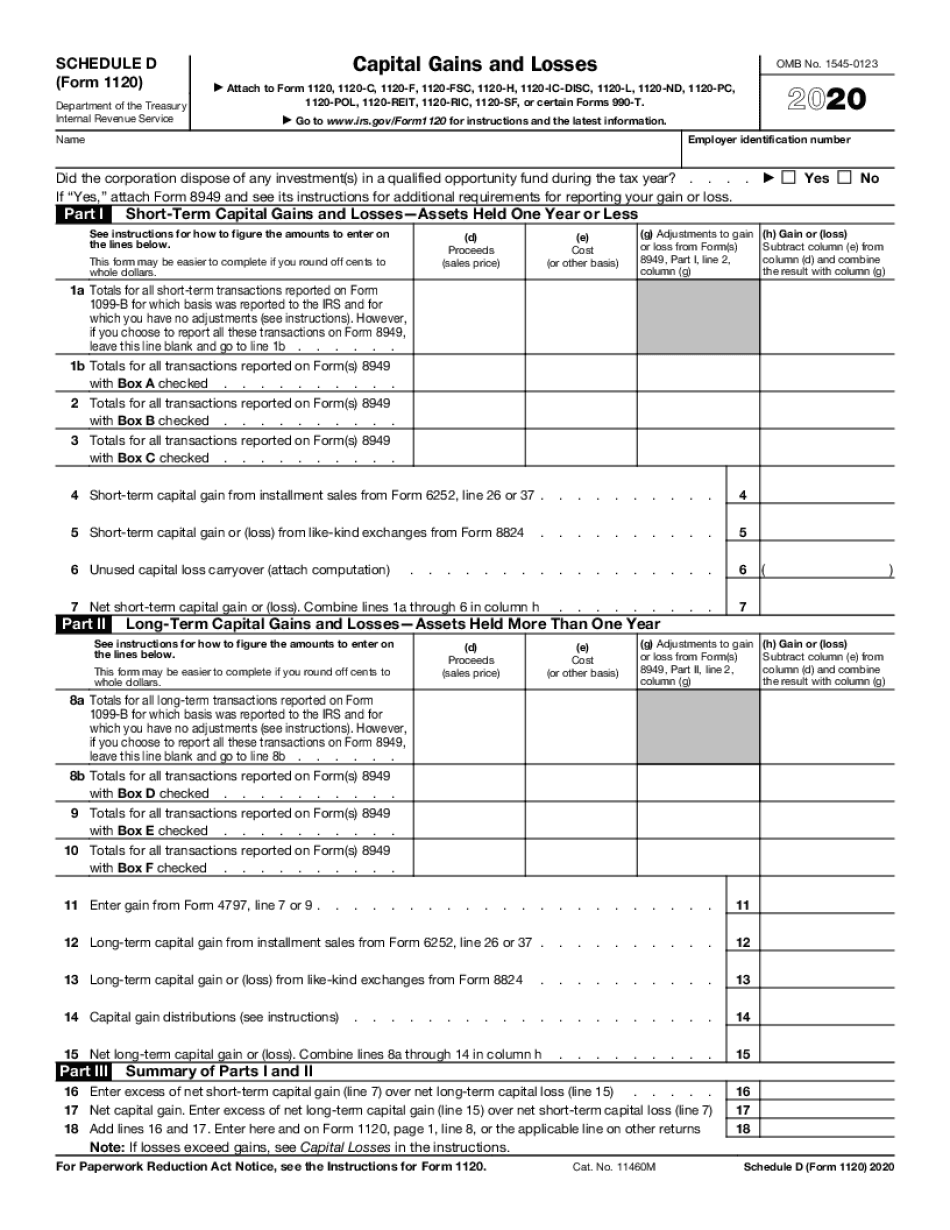

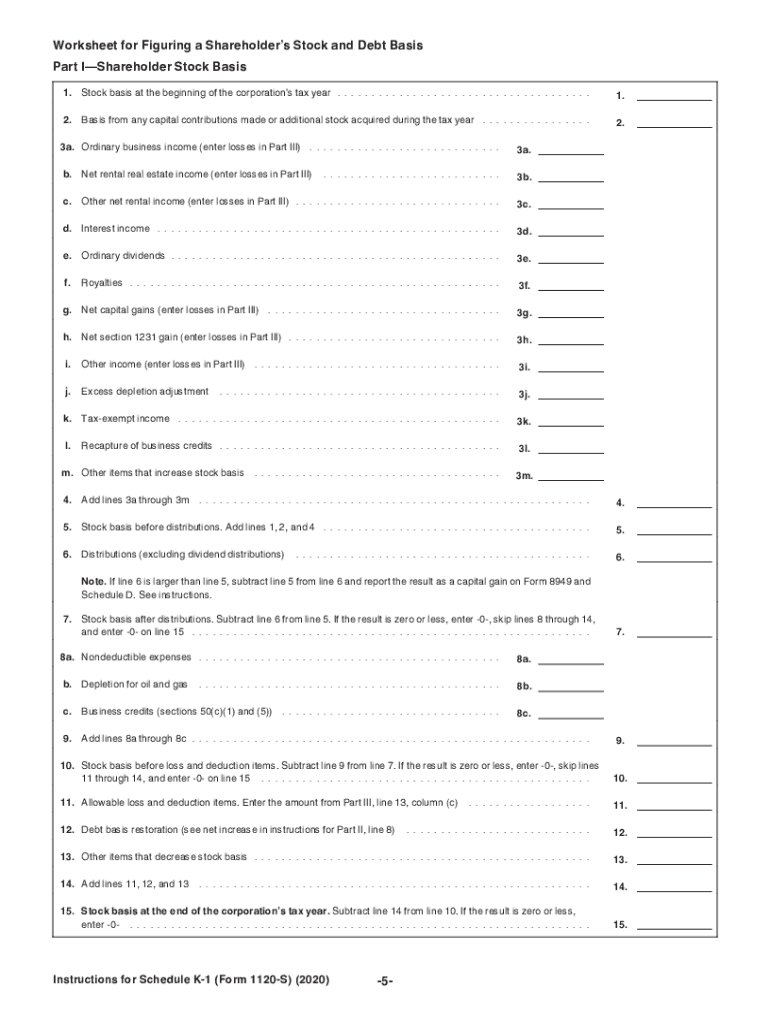

2019 1120s Fill Online Printable Fillable Blank Form 1120 schedule d

https://www.pdffiller.com/preview/535/781/535781017/big.png

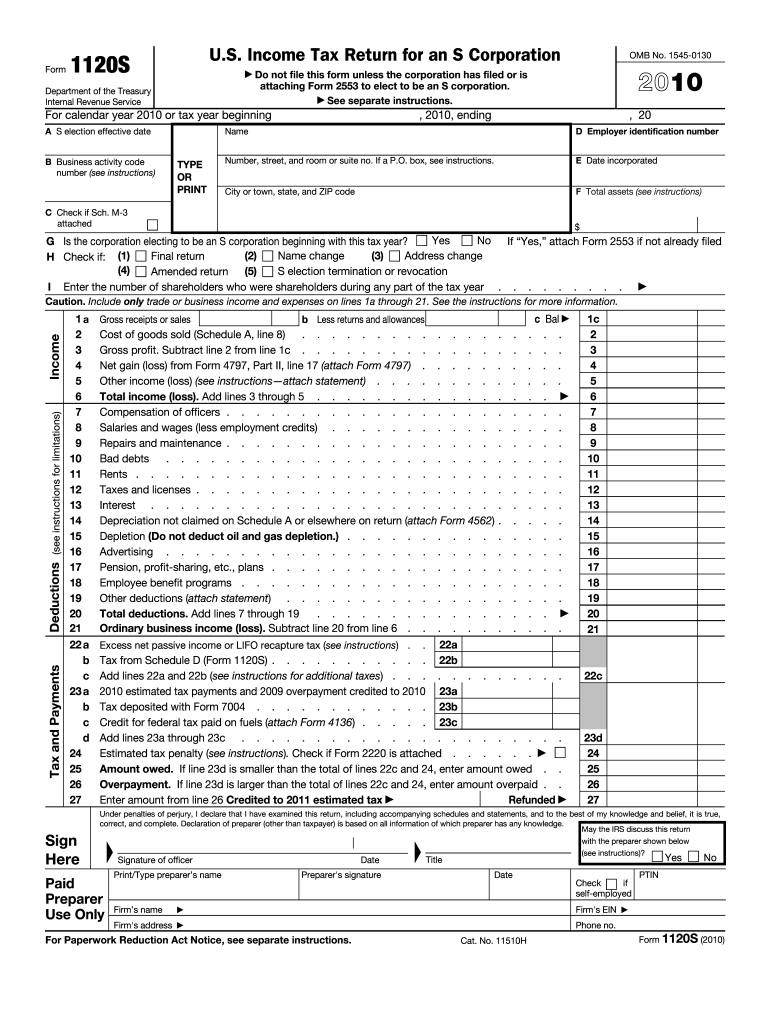

2011 Form IRS 1120S Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/302/302396/large.png

Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20 Go to www irs gov Form1120 for instructions and the latest information OMB No 1545 0123 2023 TYPE OR PRINT Name Number street and room or suite no If a P O box see instructions Schedule UTP Form 1120 asks for information about tax positions that affect the U S federal income tax liabilities of certain corporations that issue or are included in audited financial statements and have assets that equal or exceed 10 million Schedule UTP Form 1120 PDF Instructions for Schedule UTP Form 1120 Print Version PDF

WRITTEN BY Lea Uradu J D Form 1120S includes six schedules All S corporations S corps must complete Schedules B D and K The other three Schedules L M 1 and M 2 depend on whether the corporation has more than 250 000 in income and assets Haste could make waste Form 1120 S could easily be confused with Form 1120 which is a U S Corporation Income Tax Return appropriate for a C Corp but not an S Corp Watch the calendar The deadline to file Form 1120 S is on the 15th day of the third month which is usually March 15 unless March 15 lands on a holiday or weekend If filing the 1120 S form by the deadline isn t feasible the

More picture related to 1120s Irs Printable And Saveable Form

Irs Form 1120 Pol Fill Out And Sign Printable Pdf Template 090

https://www.pdffiller.com/preview/463/15/463015324/big.png

Formulario 1120 Irs Actualizado Septiembre 2023

https://unformulario.com/wp-content/uploads/2021/10/formulario-1120-irs.png

How To Complete Form 1120s S Corporation Tax Return Heading

https://images.ctfassets.net/ifu905unnj2g/5w14Hif2akkIcgQa6QgSkk/ba522649e4382133bec2ff9301b05ff6/IRS_Form_1120S.png

EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax Related Federal Corporate Income Tax Forms January 3 2024 Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs that are taxed as S corps What s Bench Online bookkeeping and tax filing powered by real humans Learn more

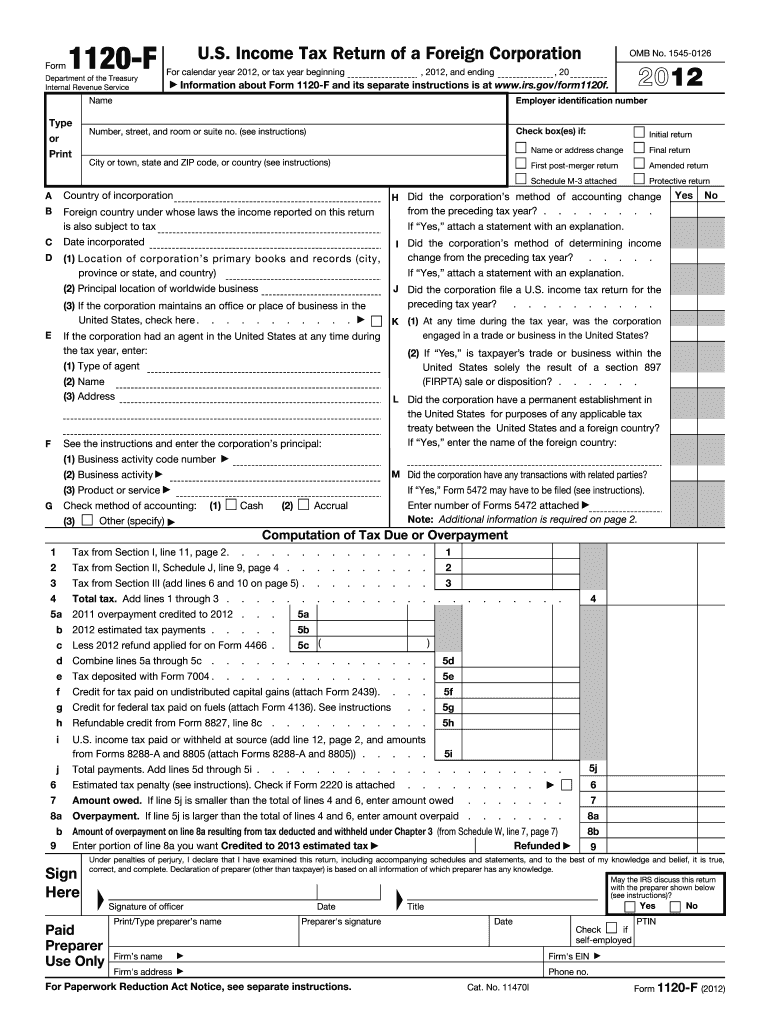

2021 Form 1120 S For calendar year 2021 or tax year beginning 2021 ending 20 S election effective date Name D Employer identification number Business activity code number see instructions TYPE OR PRINT Number street and room or suite no If a P O box see instructions Providers and Large Taxpayers authorized to participate in the Internal Revenue Service e file program can file Forms 1120 U S Corporation Income Tax Return 1120 F U S Income Tax Return of a Foreign Corporation and 1120 S U S Income Tax Return for an S Corporation through Modernized e File This site provides information on the MeF

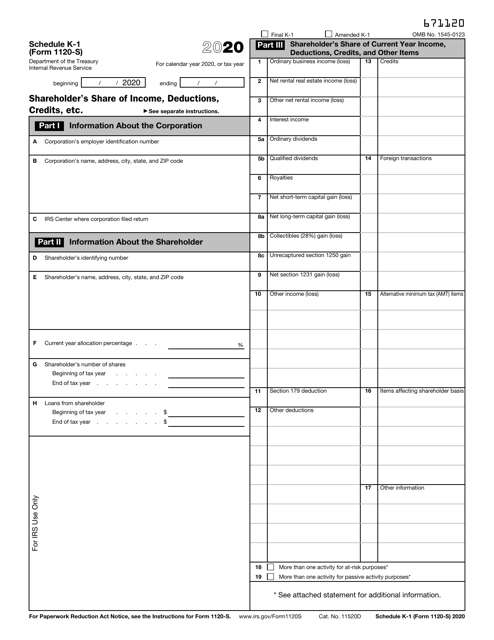

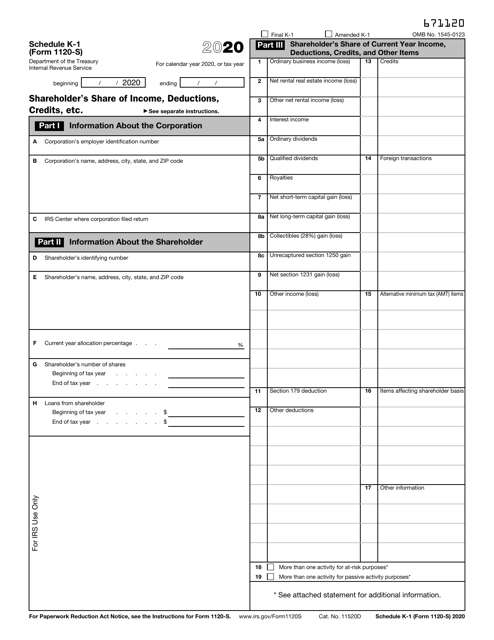

IRS Form 1120 S Schedule K 1 Download Fillable PDF Or Fill Online Shareholder s Share Of Income

https://data.templateroller.com/pdf_docs_html/2117/21172/2117293/irs-form-1120-s-schedule-k-1-shareholder-s-share-of-income-deductions-credits-etc_big.png

Ir s Form 1120 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/949/6949237/large.png

https://www.irs.gov/instructions/i1120s

The corporation can view print or download all of the forms and publications it may need on IRS gov FormsPubs please follow up by calling 800 829 4933 Don t file Form 1120 S for any tax year before the year the election takes effect Relief for late elections If you haven t filed Form 2553 or didn t file Form 2553 on time you may be

https://www.irs.gov/forms-pubs/about-form-1120-s

Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation Current Revision Form 1120 S PDF Instructions for Form 1120 S Print Version PDF Recent Developments

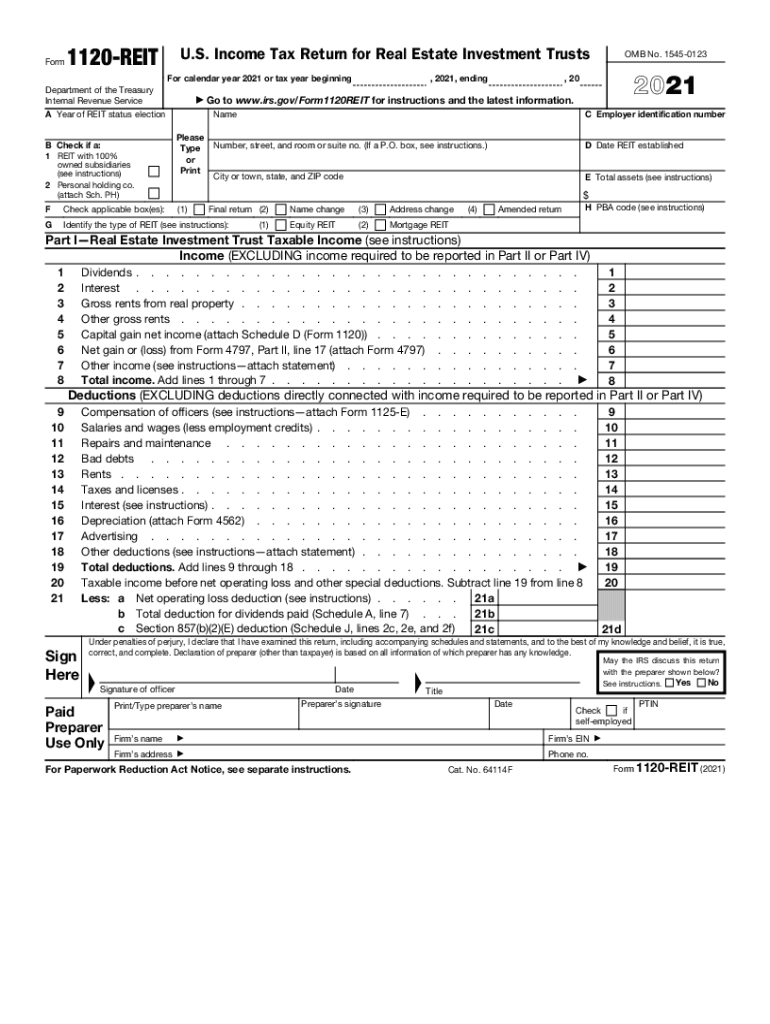

2021 Form IRS 1120 REIT Fill Online Printable Fillable Blank PdfFiller

IRS Form 1120 S Schedule K 1 Download Fillable PDF Or Fill Online Shareholder s Share Of Income

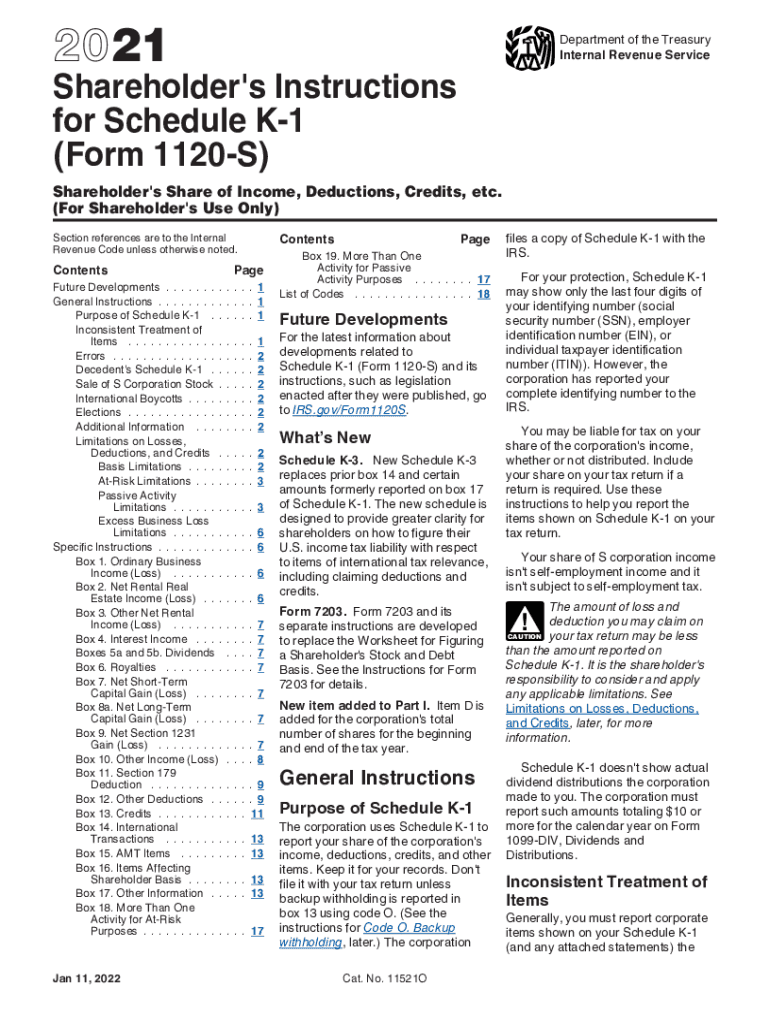

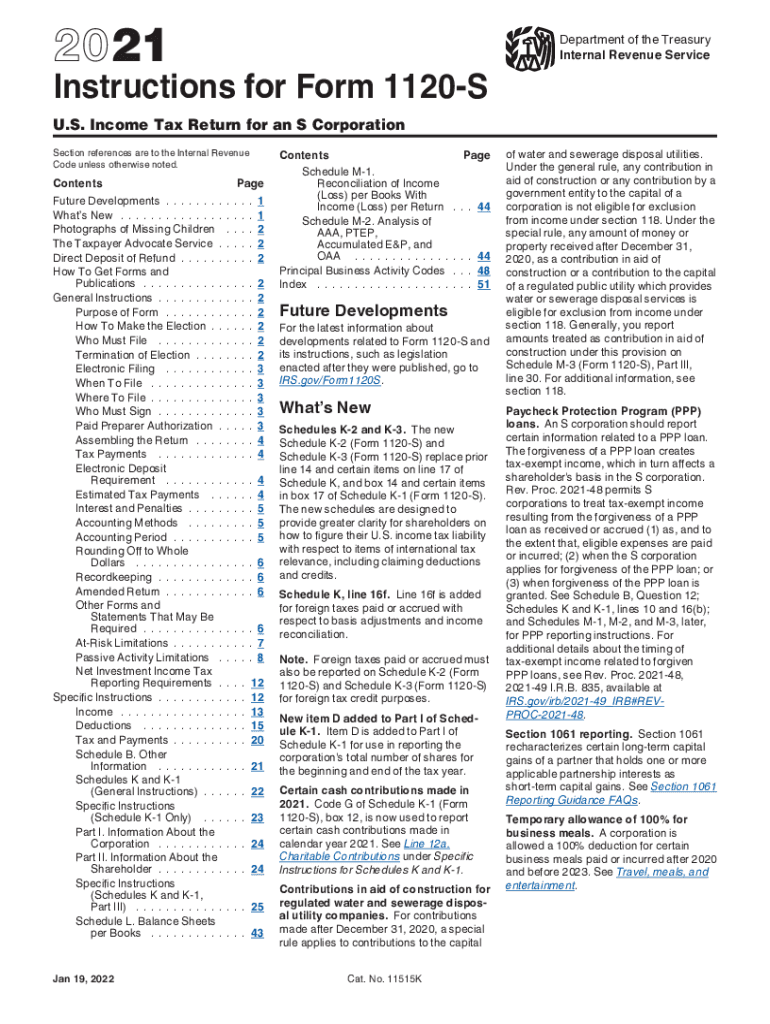

2021 Form IRS Instructions 1120S Fill Online Printable Fillable Blank PdfFiller

2021 Form IRS 1120 C Fill Online Printable Fillable Blank PdfFiller

IRS Form 1120 W Download Fillable PDF Or Fill Online Estimated Tax For Corporations 2022

2010 Form IRS 1120S Fill Online Printable Fillable Blank PdfFiller

2010 Form IRS 1120S Fill Online Printable Fillable Blank PdfFiller

Instructions For IRS Form 1120S Schedule M 3 Net Income Loss Fill Online Printable

2020 Form IRS Instruction 1120S Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

How To Complete Form 1120S Schedule K 1 Free Checklist

1120s Irs Printable And Saveable Form - Haste could make waste Form 1120 S could easily be confused with Form 1120 which is a U S Corporation Income Tax Return appropriate for a C Corp but not an S Corp Watch the calendar The deadline to file Form 1120 S is on the 15th day of the third month which is usually March 15 unless March 15 lands on a holiday or weekend If filing the 1120 S form by the deadline isn t feasible the