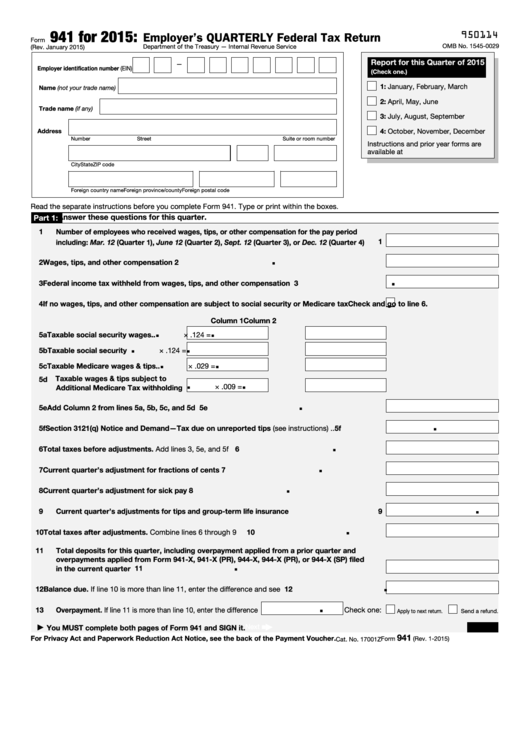

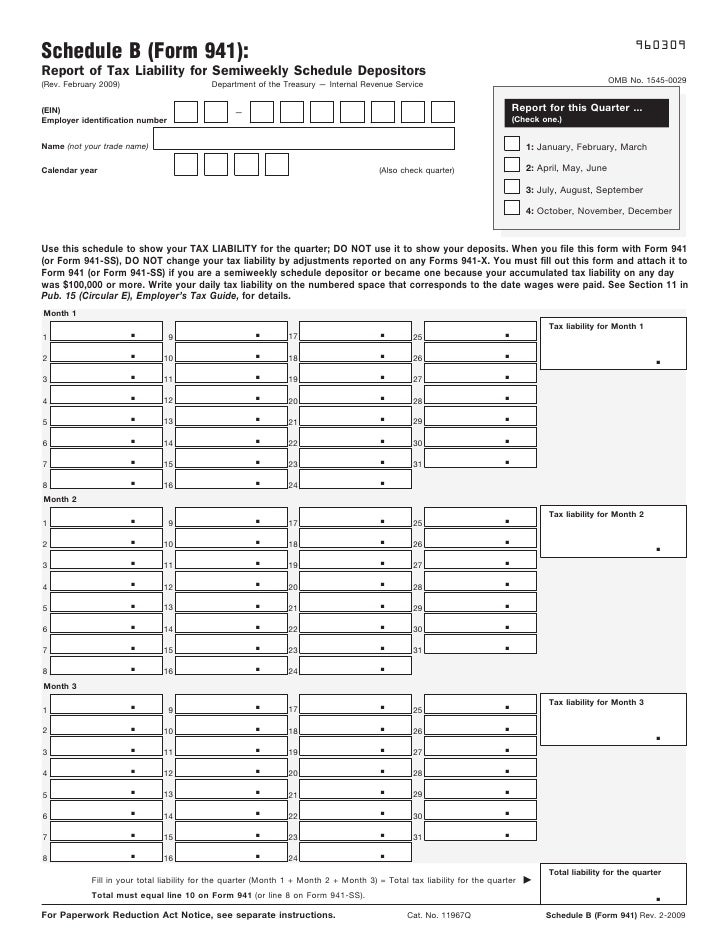

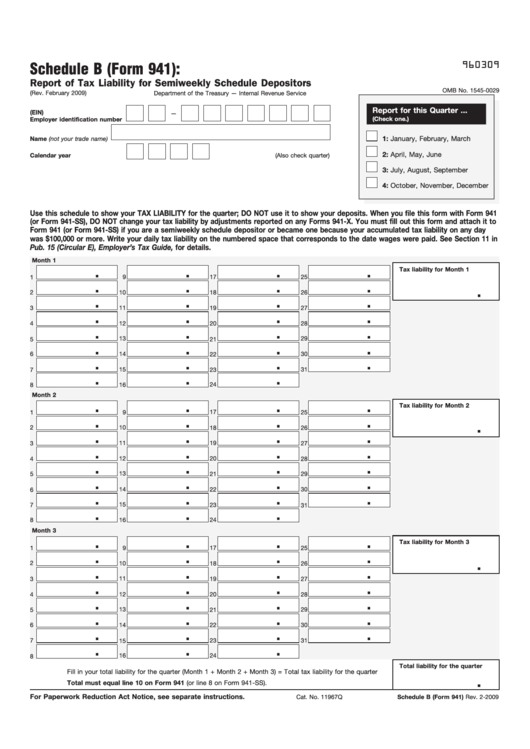

941 Schedule B Printable Form If you check this box deposit your payroll taxes semiweekly including Schedule B and attach it with Form 941 Part 3 Part 3 is where the employer must disclose whether the business closed or stopped paying wages and whether the business is seasonal The signer must also print their name and title e g president and include the date

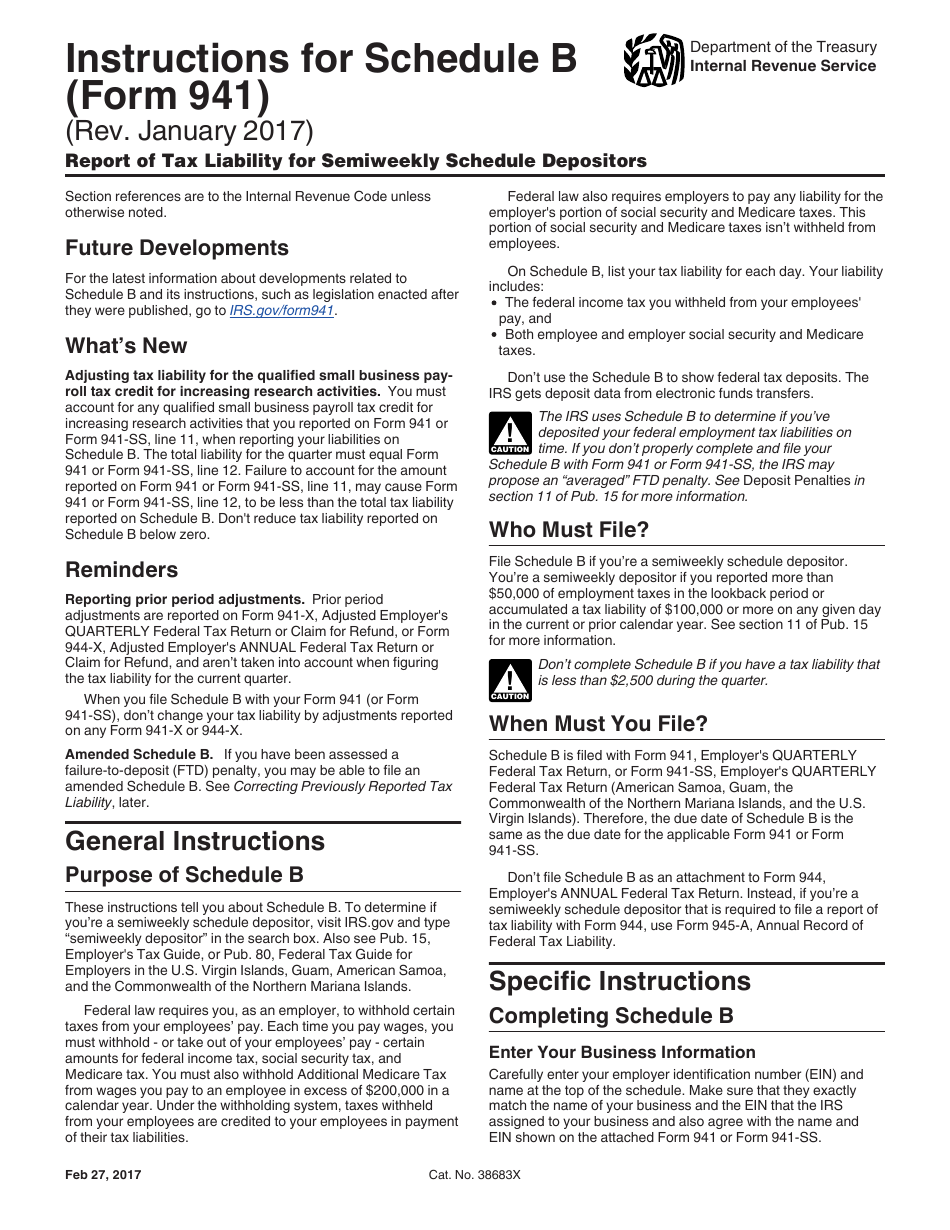

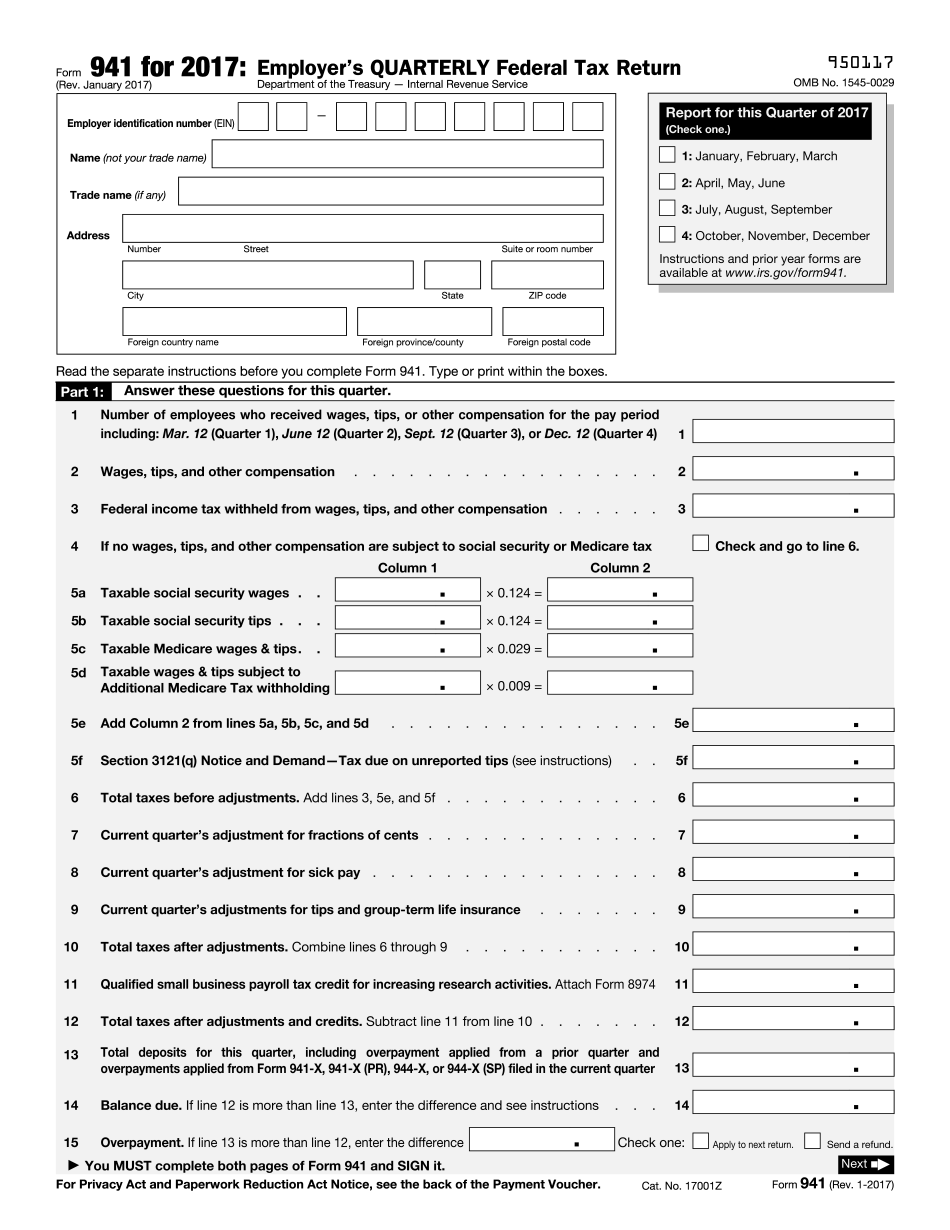

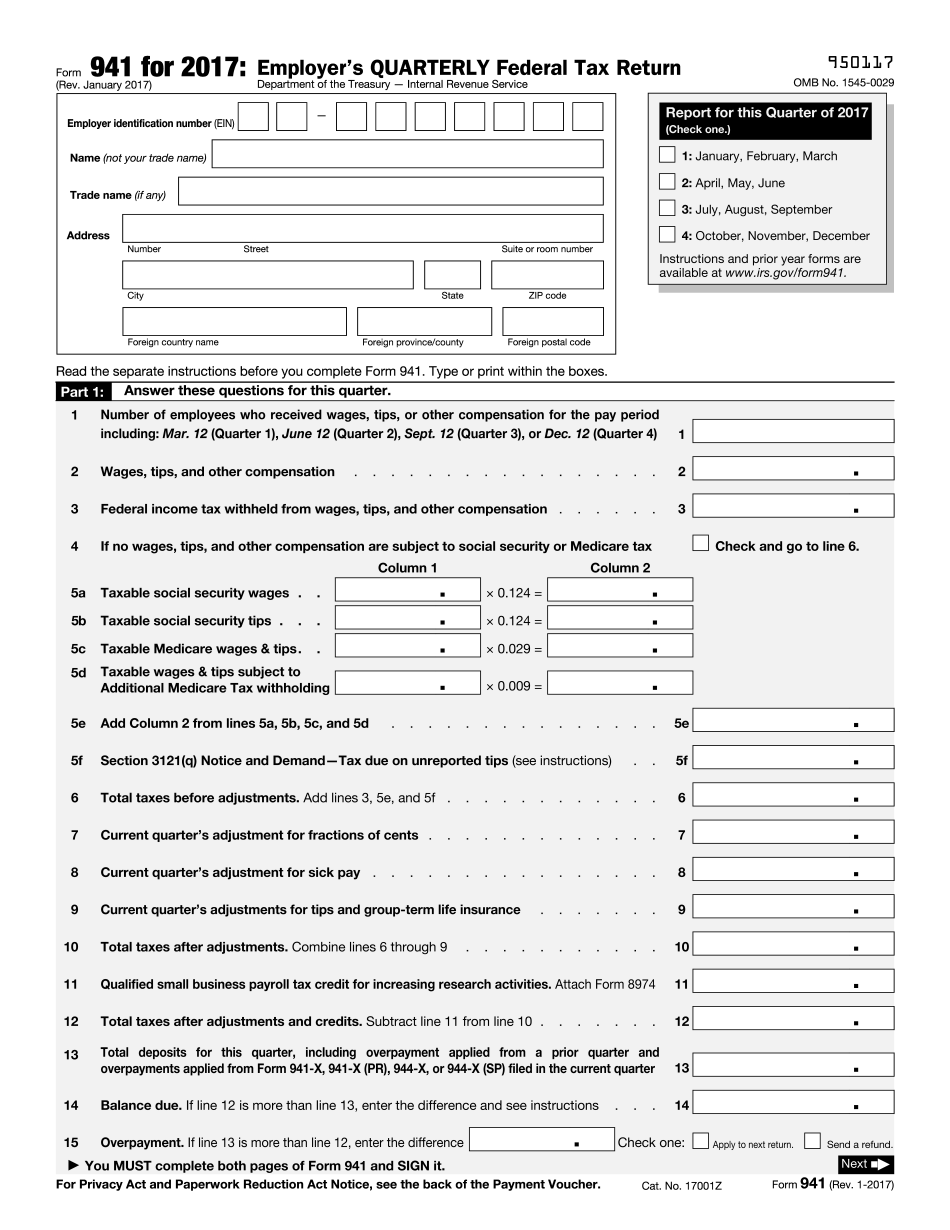

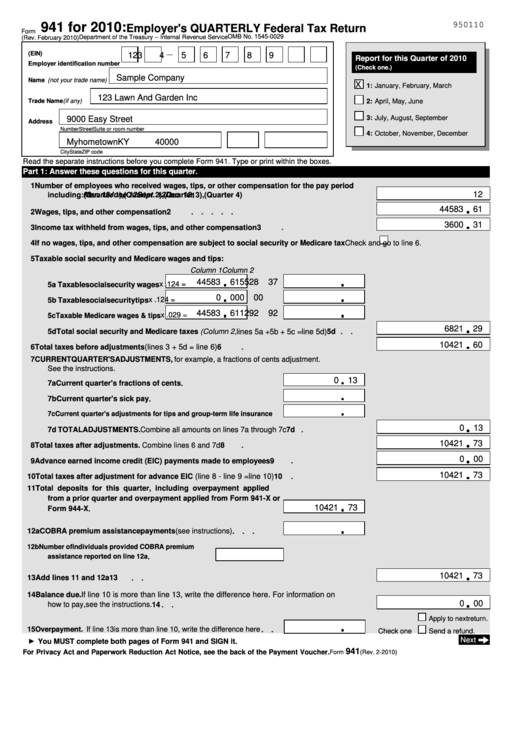

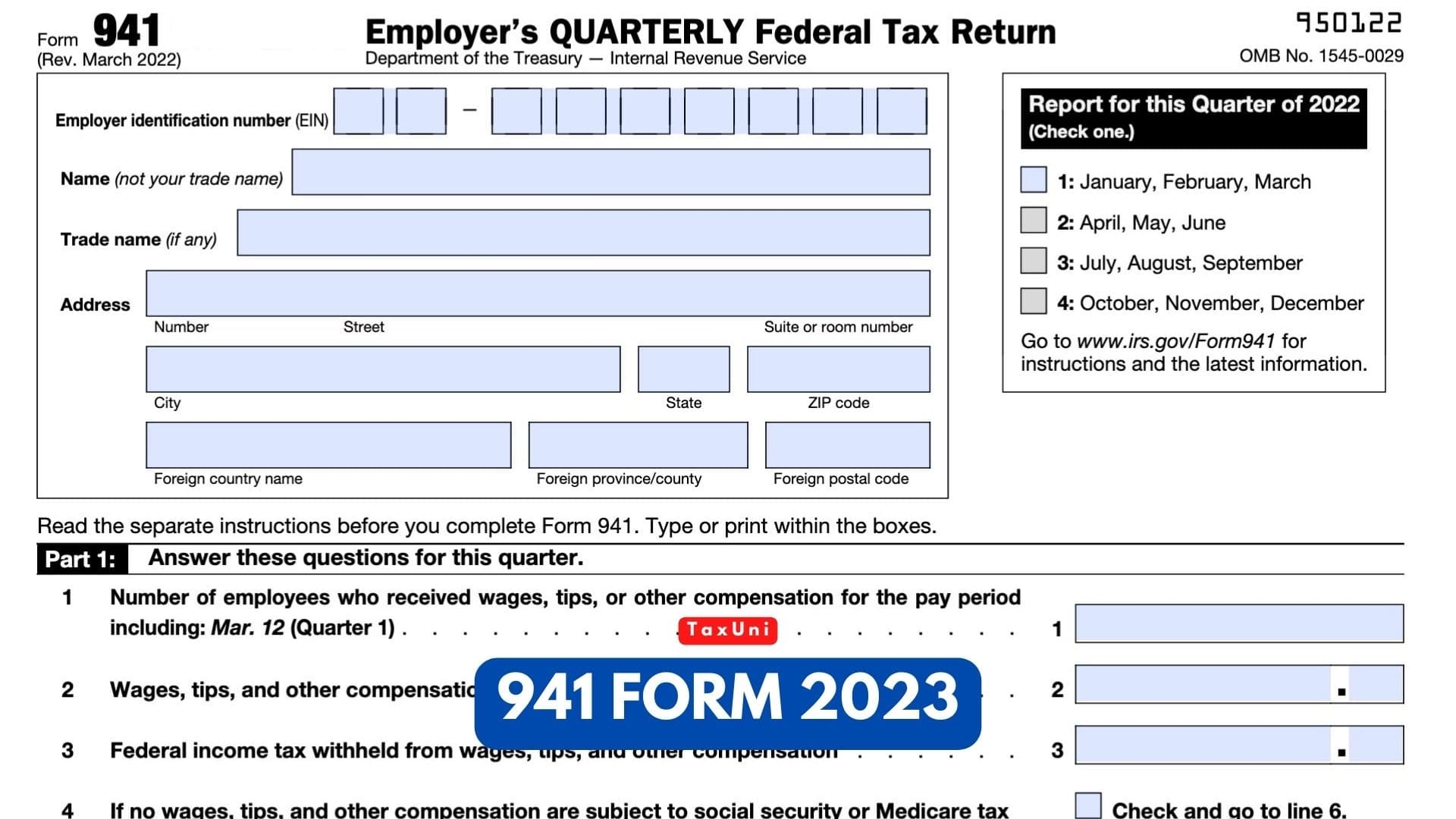

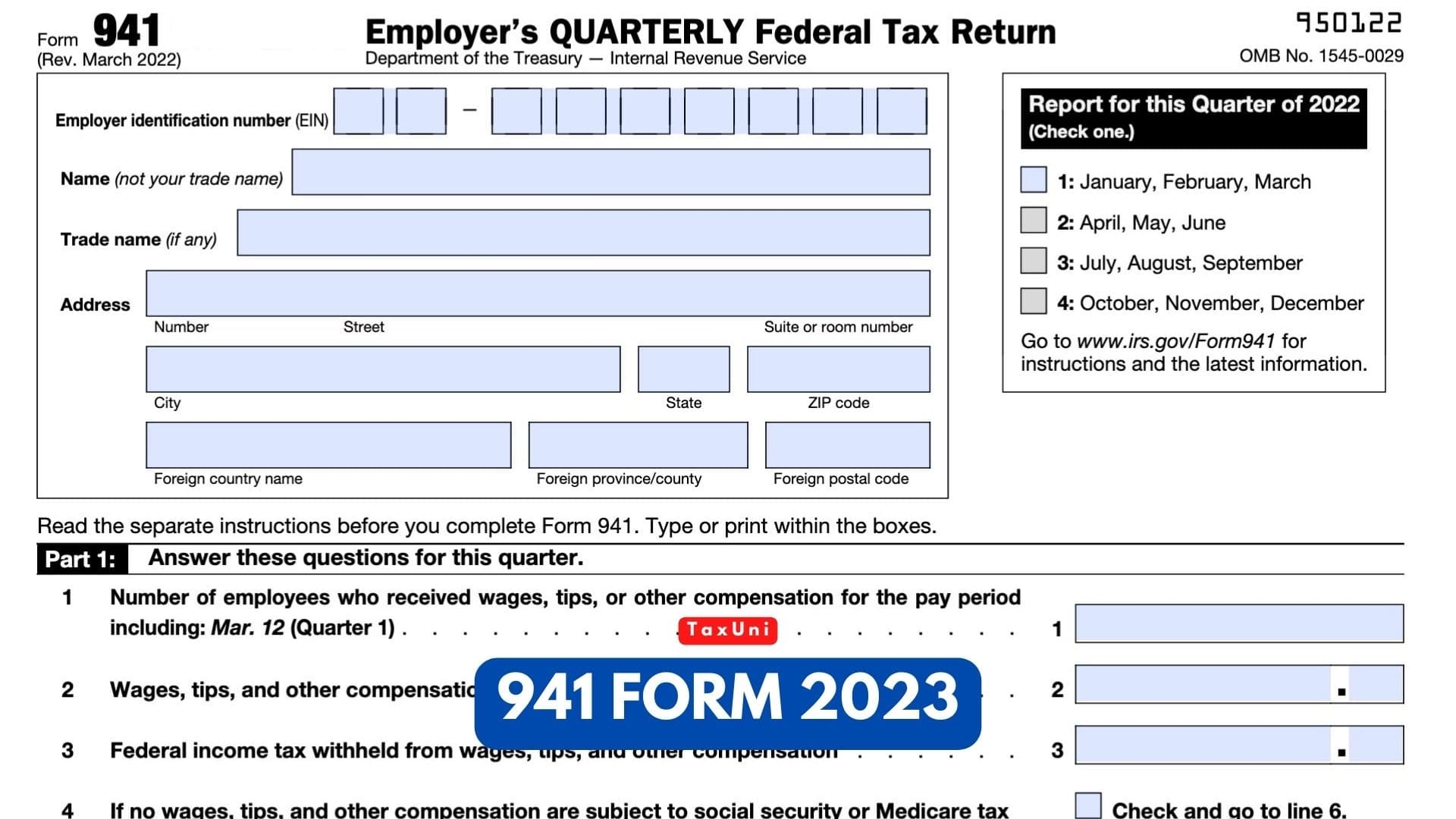

When you file Schedule B with your Form 941 Employer s QUARTERLY Federal Tax Return or Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands don t change your current quarter tax liability by adjustments reported on any Form 941 X or 944 X Am Here s a step by step guide and instructions for filing IRS Form 941 1 Gather information needed to complete Form 941 Form 941 asks for the total amount of tax you ve remitted on behalf of your

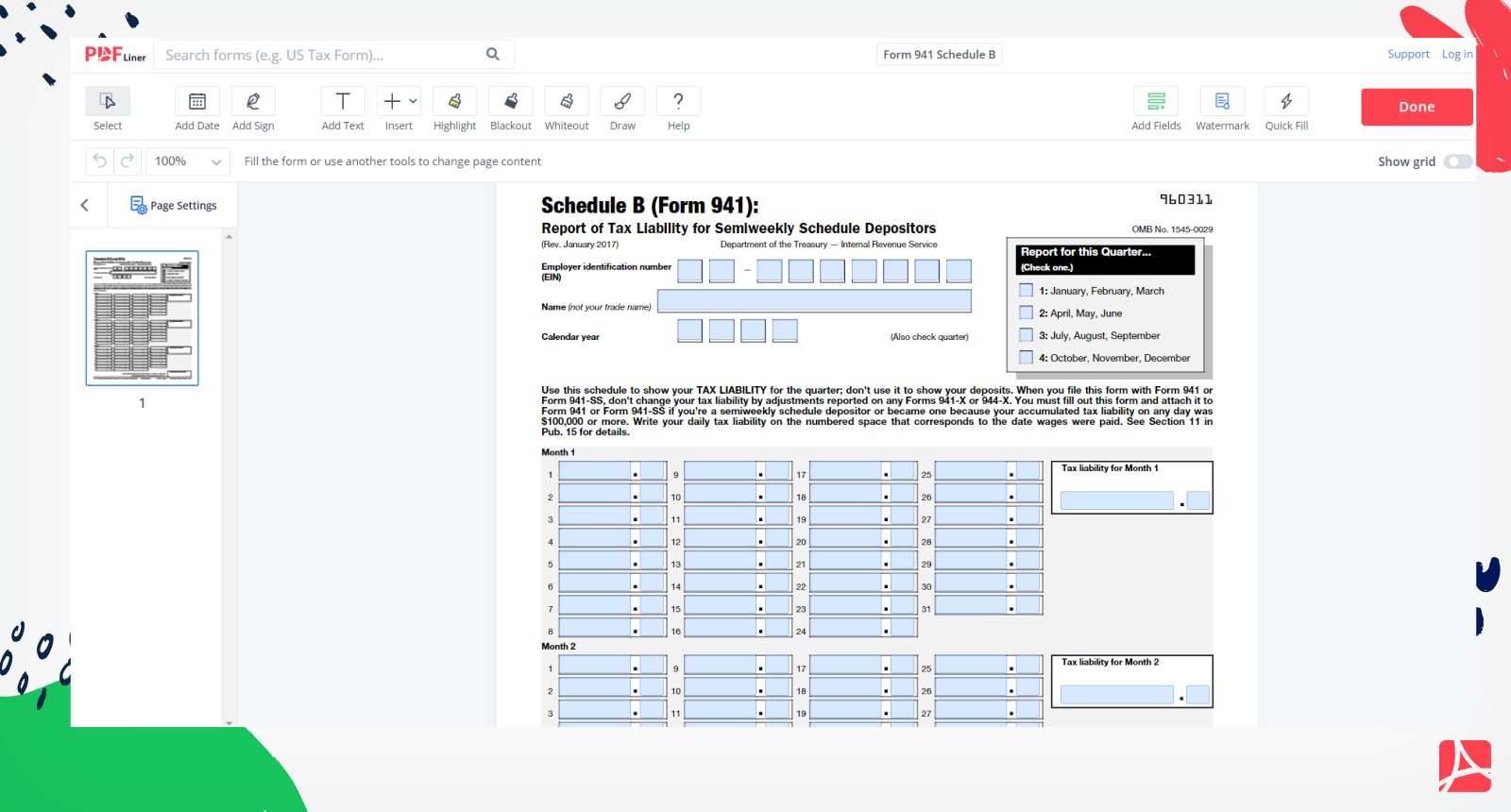

941 Schedule B Printable Form

941 Schedule B Printable Form

https://pdfliner.com/ckeditor/images/JasMlo9qIuiwvn7SYDGNXzqV3tGe8pyL5x4QTxTh.png

2021 Form IRS Instructions 941 Schedule B Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/578/929/578929620/large.png

Form 941 Schedule B Report Of Tax Liability For Semiweekly Schedul 2012 Form Irs 1040 Schedule

https://images.sampletemplates.com/wp-content/uploads/2016/11/14151754/Schedule-B-Form-941.jpg

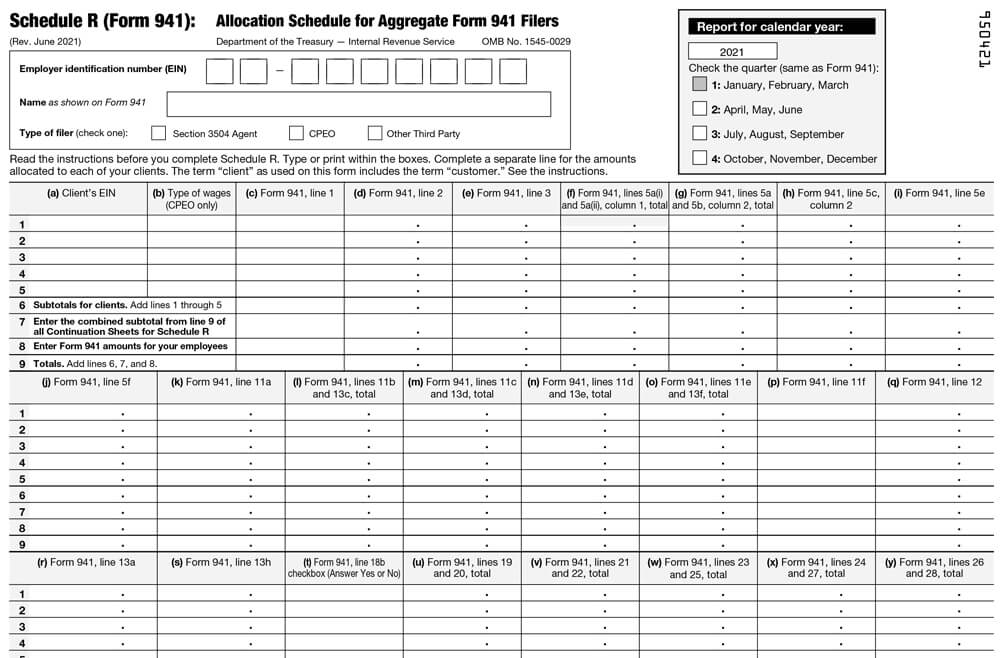

Form 941 SS Employer s Quarterly Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands and Form 941 PR Planilla para la Declaraci n Federal Trimestral del Patrono will no longer be available after the fourth quarter of 2023 On March 9 the IRS released the 2021 Form 941 Employer s Quarterly Federal Tax Return and its instructions The IRS also revised the instructions for Form 941 Schedule B and the instructions for Form 941 Schedule R When the IRS released the instructions Congress was considering changes to COVID 19 tax relief

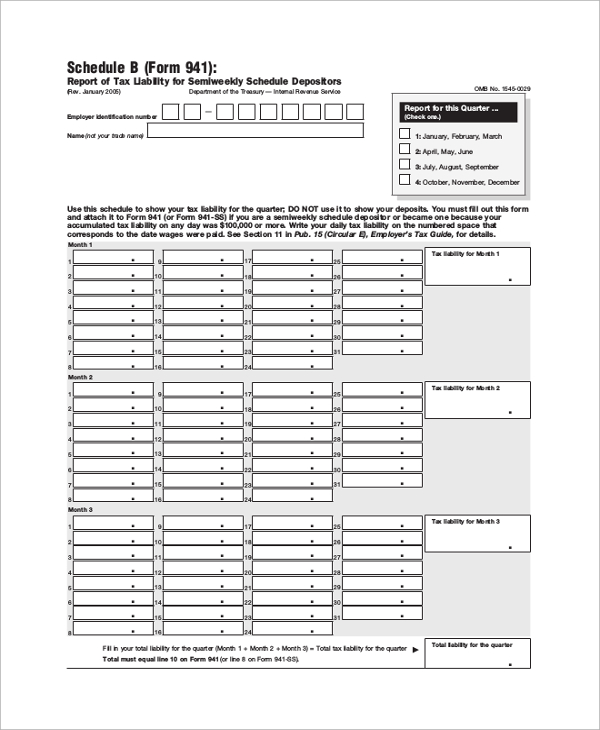

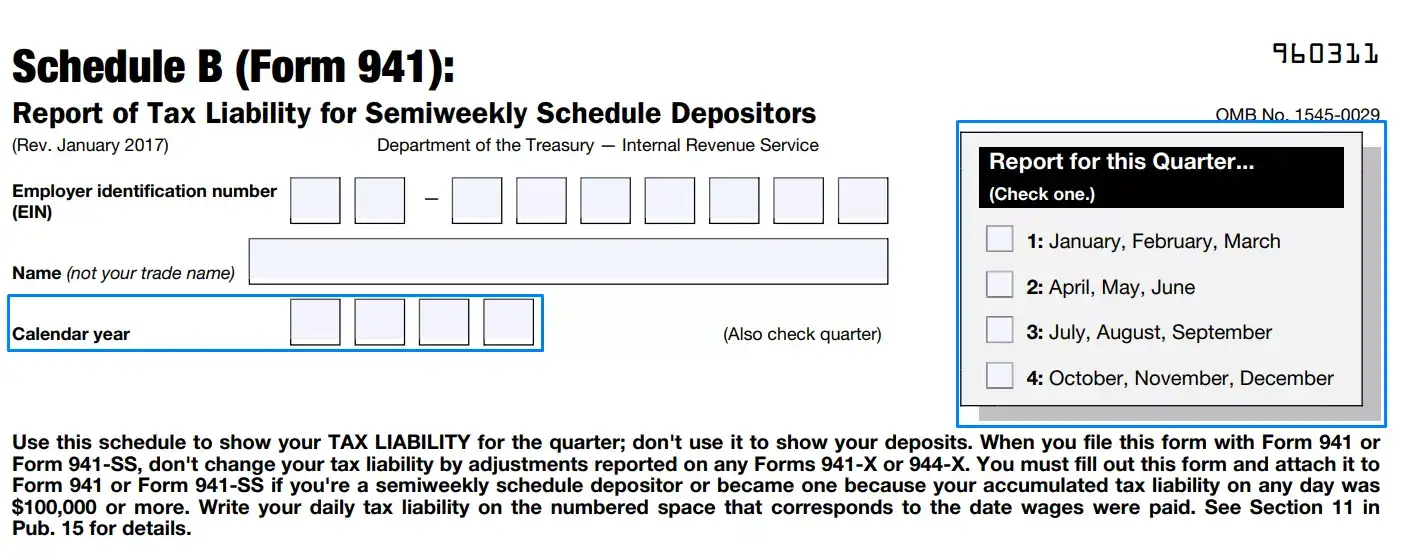

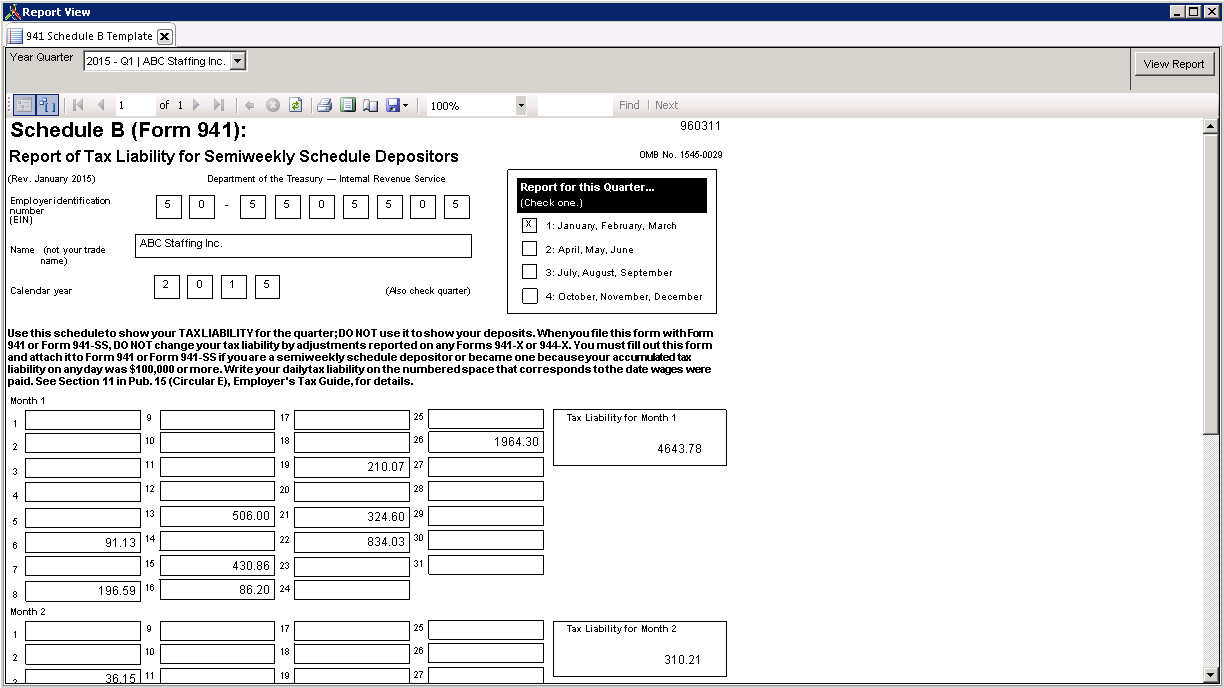

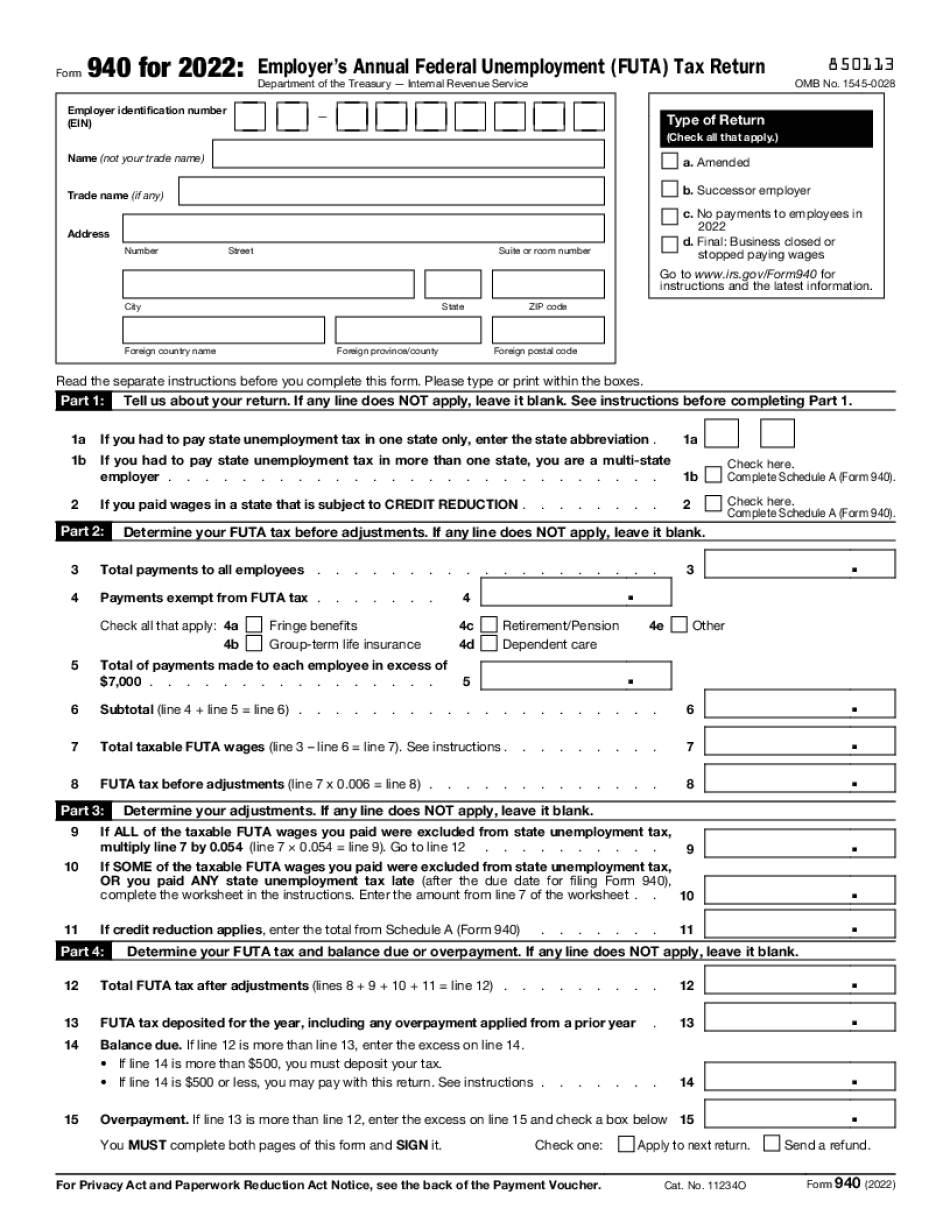

A Schedule B Form 941 also known as a Report of Tax Liability for Semiweekly Schedule Depositors is a form required by the Internal Revenue Service It is used by those who are semi weekly schedule depositors who report more than 50 000 in employment taxes or if they acquired more than 100 000 in liabilities during a single day in the tax year Cause Resolution In order to have access to latest tax forms you must be using a supported version of Sage 100 refer to KB article ID 31477 DocLink Sage 100 Supported Versions This is the basic process to print the Federal 941 with schedule B for quarterly reporting

More picture related to 941 Schedule B Printable Form

Form 941 Schedule B 2022

https://data.templateroller.com/pdf_docs_html/688/6880/688089/instructions-irs-form-941-schedule-b-report-tax-liability-semiweekly-schedule-depositors_print_big.png

Printable 941 Tax Form Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/fillable-form-941-employer-s-quarterly-federal-tax.png

Schedule B Form 941 For 2023 Printable Forms Free Online

https://formspal.com/wp-content/uploads/2021/04/step-2-determine-term-filling-out-irs-schedule-b-form-941.webp

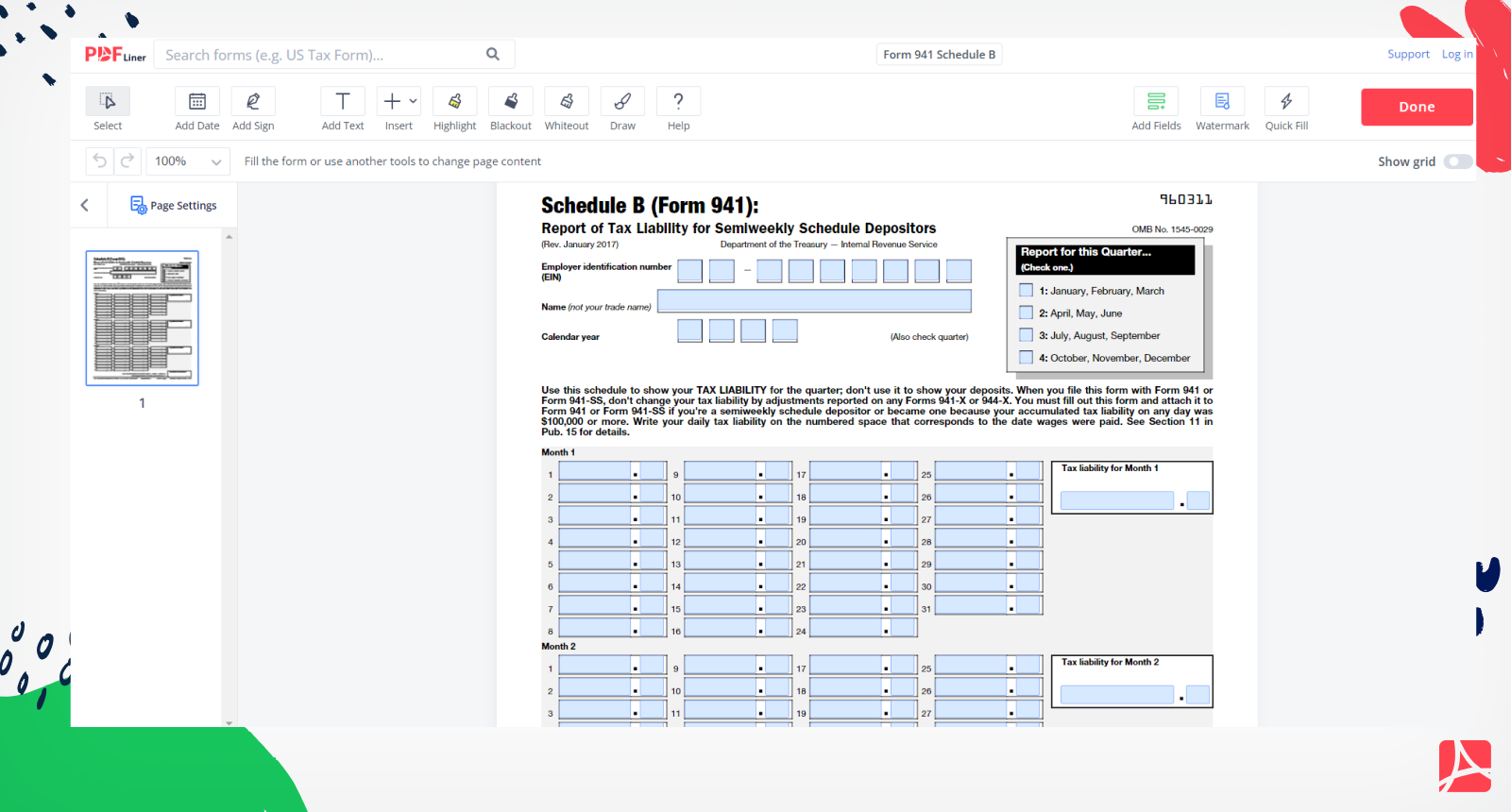

When you file this form with Form 941 or Form 941 SS don t change your tax liability by adjustments reported on any Forms 941 X or 944 X You must fill out this form and attach it to Form 941 or Form 941 SS if you re a semiweekly schedule depositor or became one because your accumulated tax liability on any day was 100 000 or more Form 941 Schedule B Report of Tax Liability for Semiweekly Schedule Depositors Federal law requires you as an employer to withhold taxes from your employees paychecks Schedule B and print the form s Generate 941 Forms returns three forms Form 941 Schedule B if you are required to file

Schedule B is filed with Form 941 or Form 941 SS References to Form 941 in these instructions also apply to Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands unless otherwise noted Adjusting tax liability for nonrefundable credits 941 Schedule B US QuickBooks Community QuickBooks Q A Taxes 941 Schedule B Anita27 Level 1 posted March 15 2021 08 22 AM last updated March 15 2021 8 22 AM 941 Schedule B I did not receive the update for the year 2021 on the 941 Sch B although all of my other forms have been updated QuickBooks Desktop Payroll Cheer Join the conversation

Get IRS 941 Schedule B 2017 2023 US Legal Forms Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/400/414/400414967/big.png

Standard Report 941 Schedule B Template Avionte Classic

https://avionteclassicsupport.zendesk.com/hc/article_attachments/360063116634/941schedulebtemplate.png

https://www.paychex.com/articles/payroll-taxes/form-941-information-and-guide

If you check this box deposit your payroll taxes semiweekly including Schedule B and attach it with Form 941 Part 3 Part 3 is where the employer must disclose whether the business closed or stopped paying wages and whether the business is seasonal The signer must also print their name and title e g president and include the date

https://www.reginfo.gov/public/do/DownloadDocument?objectID=103448201

When you file Schedule B with your Form 941 Employer s QUARTERLY Federal Tax Return or Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands don t change your current quarter tax liability by adjustments reported on any Form 941 X or 944 X Am

Form 941 Employer s Quarterly Federal Tax Return Form 941 Employer

Get IRS 941 Schedule B 2017 2023 US Legal Forms Fill Online Printable Fillable Blank

Schedule B Form 941 2022

Form 941 Employers Quarterly Federal Tax Return Schedule B Form 941 Report Of Tax

941 Tax Form Fill Online Printable Fillable Blank

941 Form 2023 Fillable Form 2023

941 Form 2023 Fillable Form 2023

Printable Form 941 Web Create A Printable Form 941 In A Few Simple Steps 1 Choose Tax Year And

IRS Form 941 Schedule B 2024

Schedule B Form 941 Report Of Tax Liability For Semiweekly Schedule Depositors 2009

941 Schedule B Printable Form - File Now with TurboTax We last updated Federal 941 Schedule B in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government