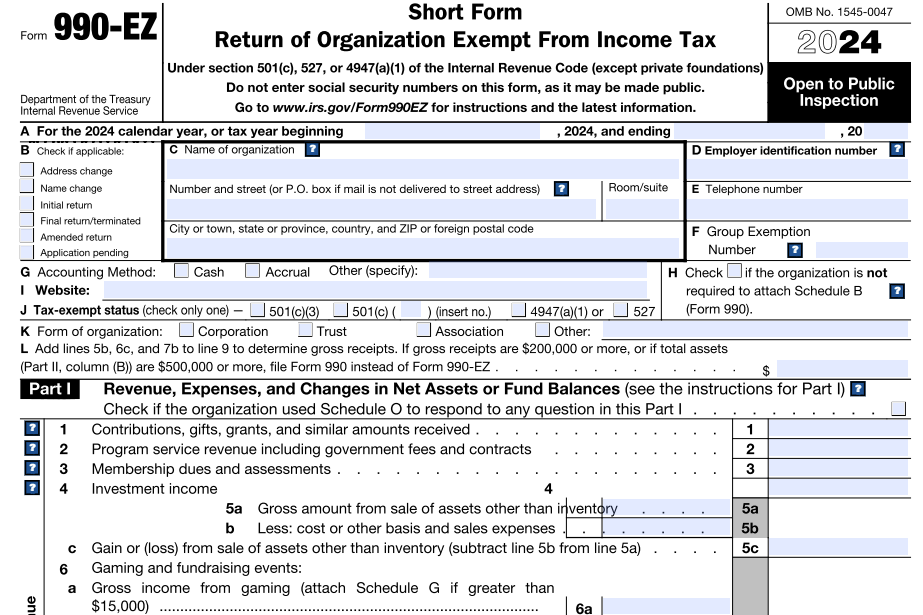

990 Ez Printable Form Schedule A 990 EZ 2021 Short Form Return of Organization Exempt From Income Tax Open to Public Inspection Part I Revenue Expenses and Changes in Net Assets or Fund Balances Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public

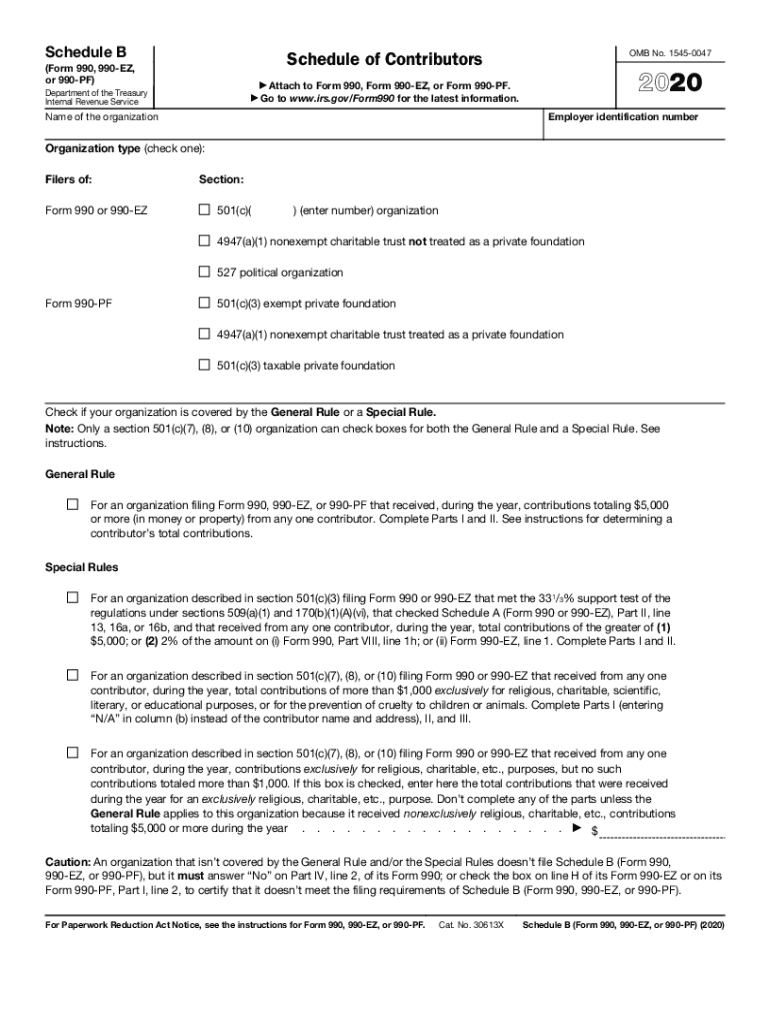

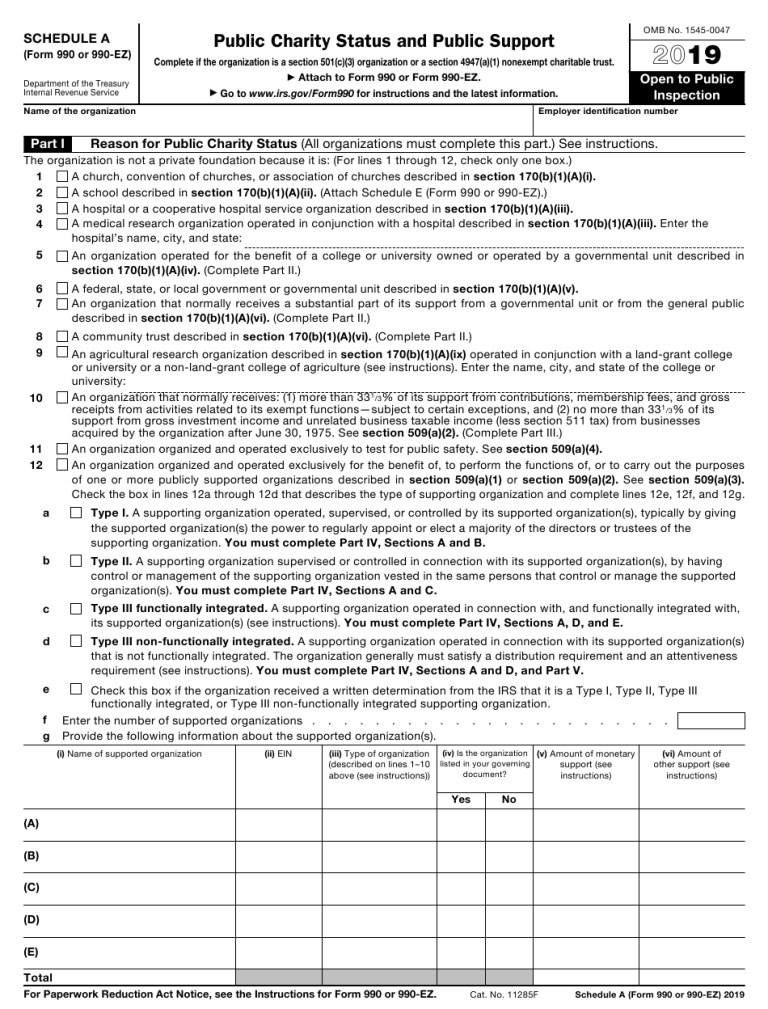

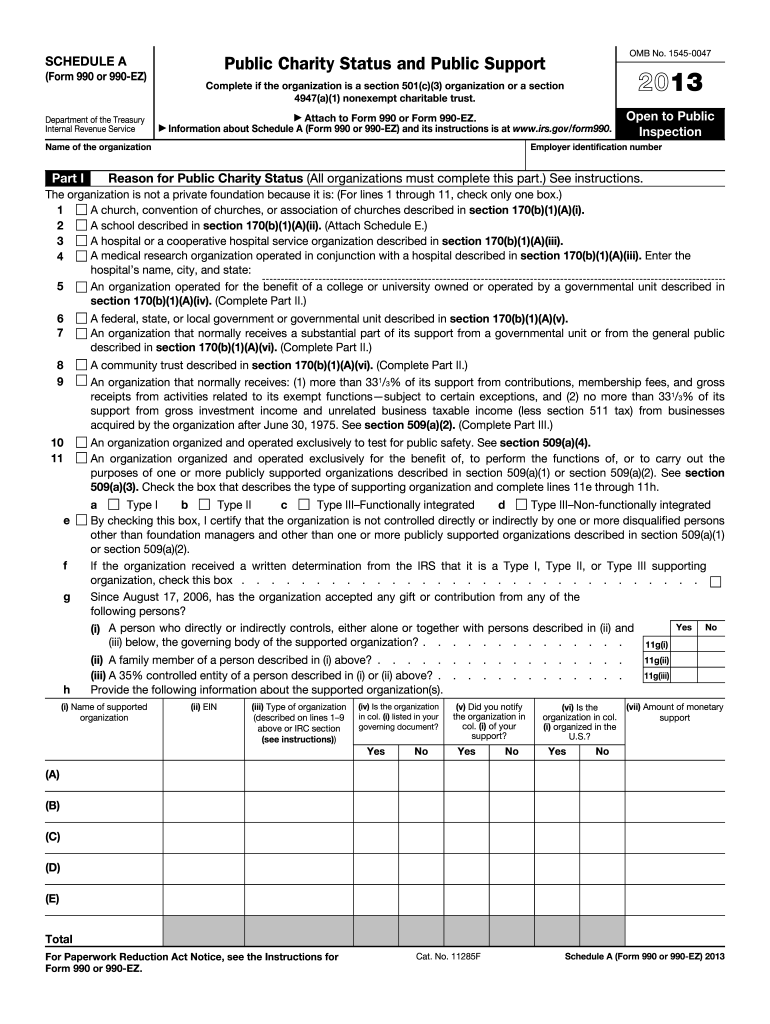

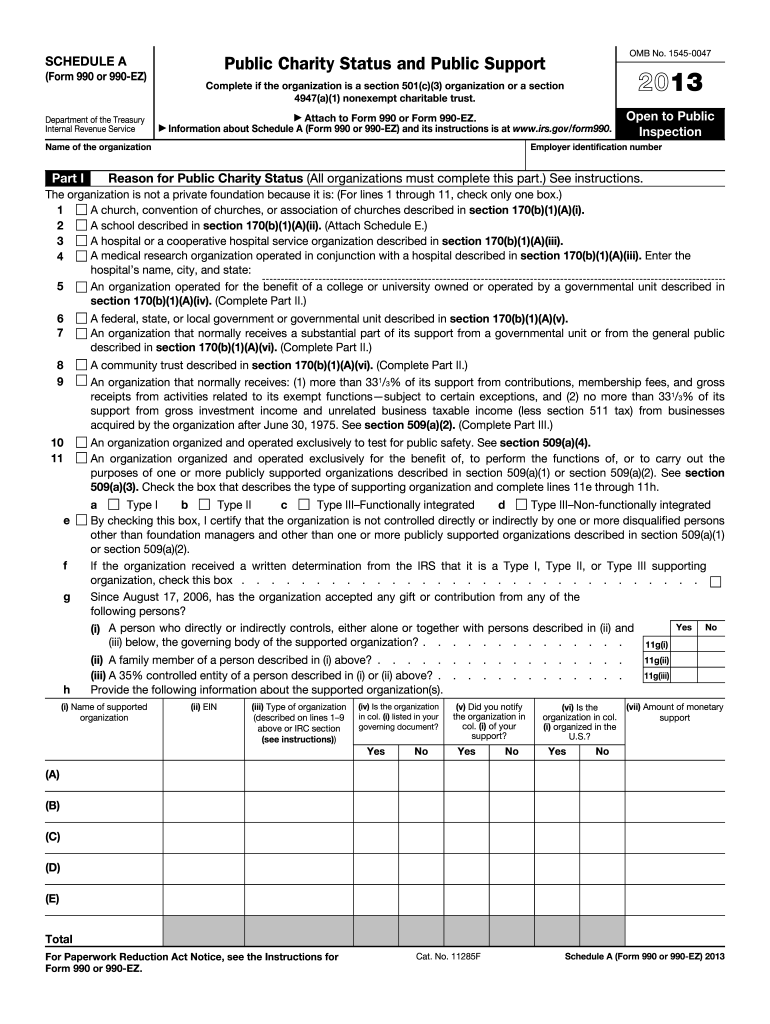

While filing Form 990 Schedule A with Form 990 990 EZ then the organization should use the same accounting method that is checked on the following lines IRS Form 990 Part XII line 1 IRS Form 990 EZ line G In some cases the organization s accounting method is changed from the prior year the organization must provide an explanation in A Schedule A Form 990 or 990 EZ is also known as a Public Charity Status and Public Support form This form is used for tax filing purposes and it will be sent to the United States Internal Revenue Service Tax exempt organizations non exempt charitable trusts and certain political organizations will need to include this form with their

990 Ez Printable Form Schedule A

990 Ez Printable Form Schedule A

https://www.pdffiller.com/preview/538/649/538649464/large.png

Printable 990 Ez Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/533/156/533156855/large.png

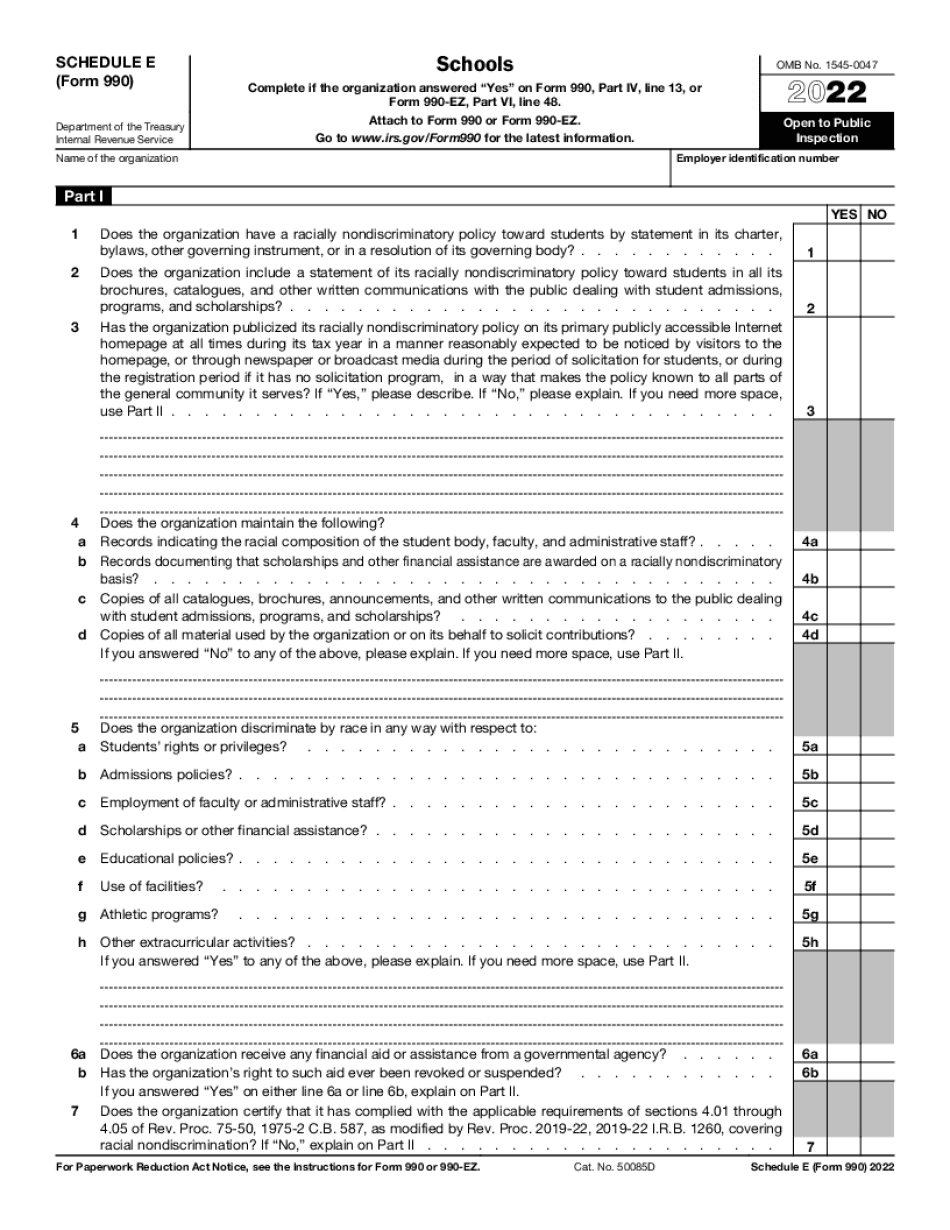

2021 Form IRS 990 Or 990 EZ Schedule E Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/575/719/575719704/large.png

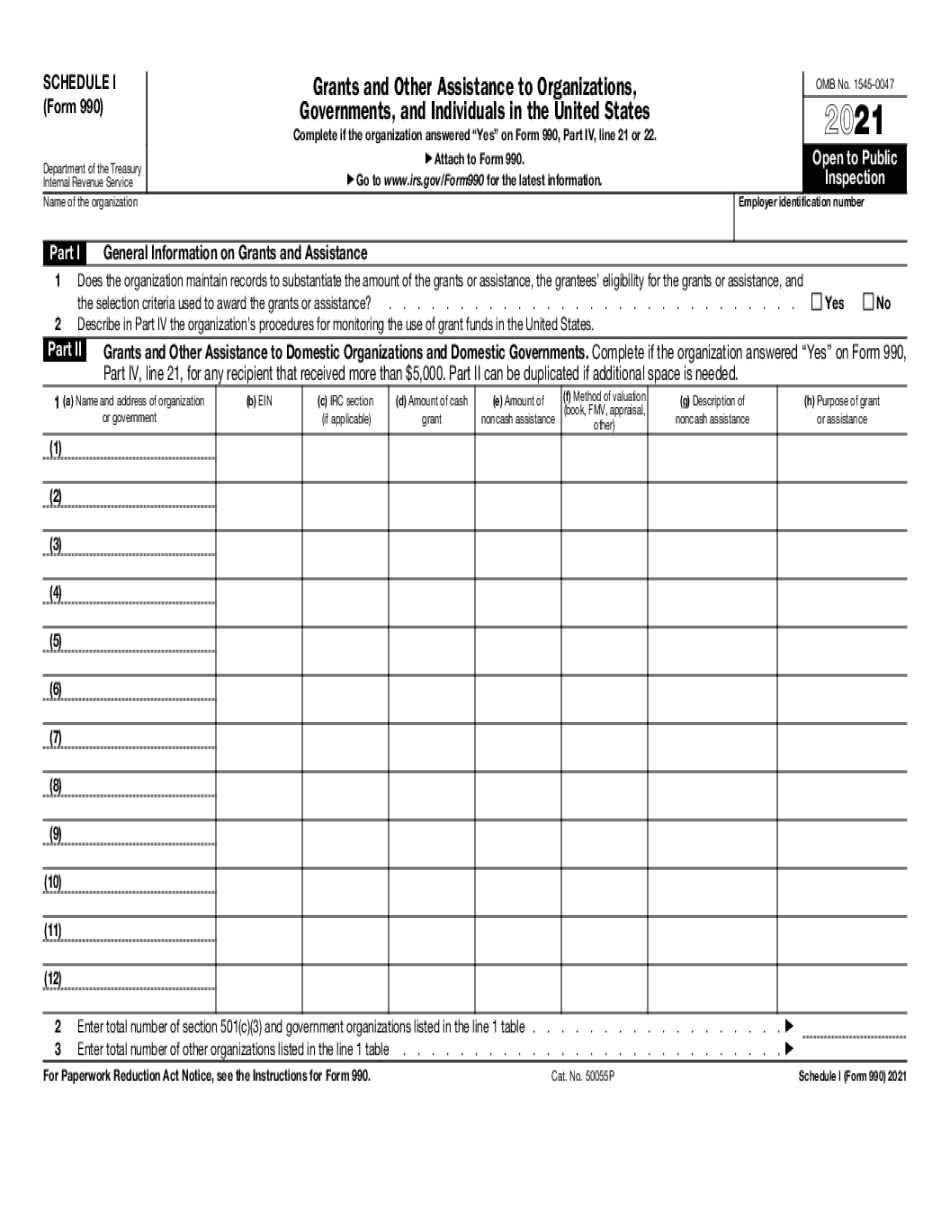

Purpose of the Schedule Schedule A is used by nonprofit and tax exempt organizations that file Form 990 or 990 EZ to report required information about public charity status and public support Who Must File The 990 EZ is an annual tax information filing completed by many organizations that fall under the 501 c series of statuses of the tax code exempting them from the duty of paying taxes The 990EZ is just one type of 990 offered for small to mid sized nonprofit organizations For nonprofits like yours all of your funds will be reinvested in

Open to Public Department of the TreasuryGo to www irs gov Form990EZ for instructions and the latest information Inspection Internal Revenue Service A For the 2022 calendar year or tax year beginning 2022 and ending BCheck if applicable C DEmployer identification number Address change Name change Cat No 10642I Form 990 EZ 2021 Form 990 EZ Department of the Treasury Internal Revenue Service Short Form Return of Organization Exempt From Income Tax Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public

More picture related to 990 Ez Printable Form Schedule A

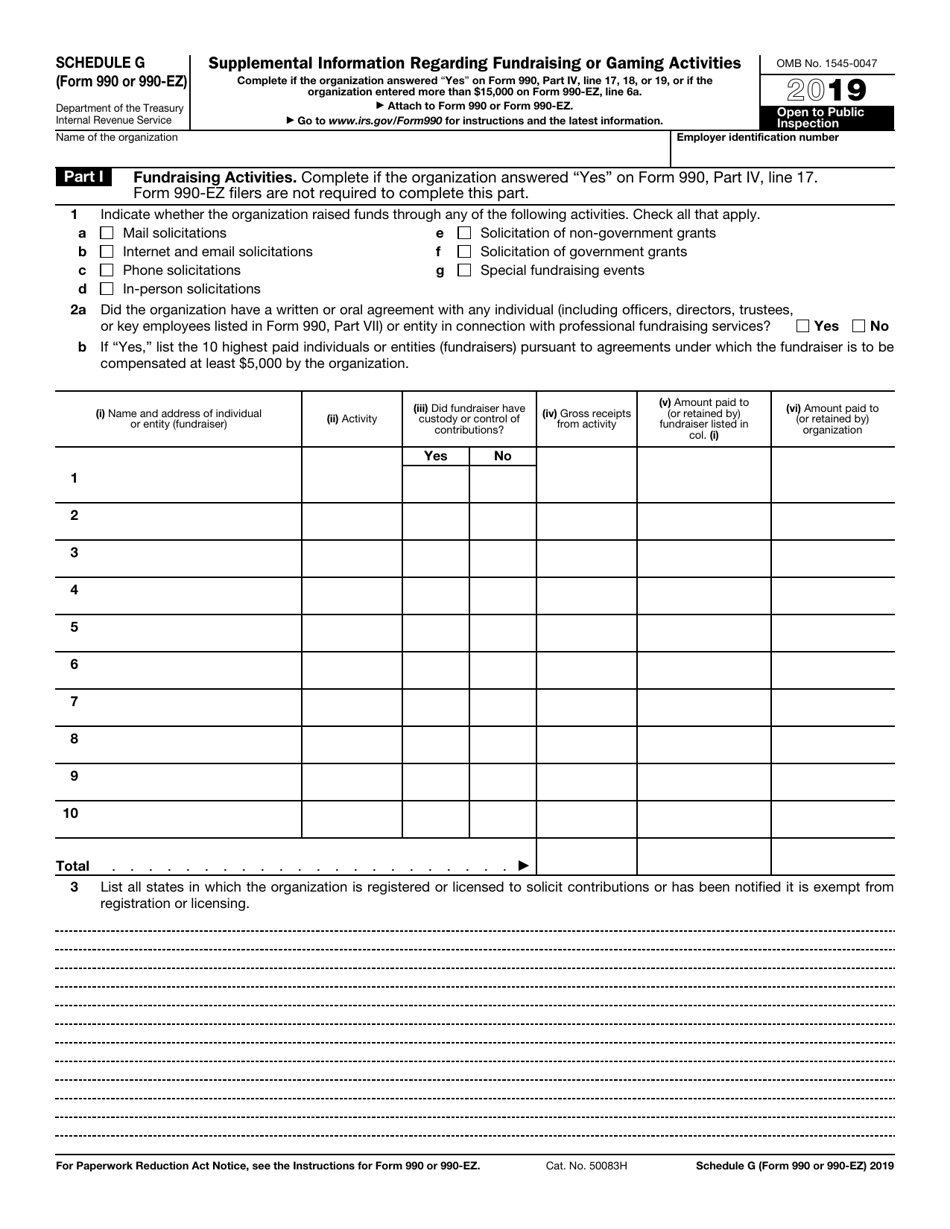

IRS Form 990 990 EZ Schedule G Download Fillable PDF Or Fill Online Supplemental Information

https://data.templateroller.com/pdf_docs_html/1932/19322/1932201/irs-form-990-irs-form-990-ez-schedule-g-supplemental-information-regarding-fundraising-or-gaming-activities_print_big.png

Form 990 Schedule L 2023 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/620/588/620588779/big.png

Fillable 2022 Schedule A 990 Ez Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/07/fillable-2022-schedule-a-990-ez-768x1009.png

This checklist is a comprehensive tool to use when preparing Form 990 EZ Short Form Return of Organization Exempt From Income Tax Under Sec 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations The AICPA Tax Section s Annual Tax Compliance Kit provides a variety of resources to help you comply with tax laws and effectively serve your clients Instructions for Schedule A These instructions are intended for local PTAs to help clarify the Instructions for Schedule A 990EZ as published by the Internal Revenue Service They are not intended to replace those instructions This is a required form for all 501 c 3 organizations if a 990 EZ is completed

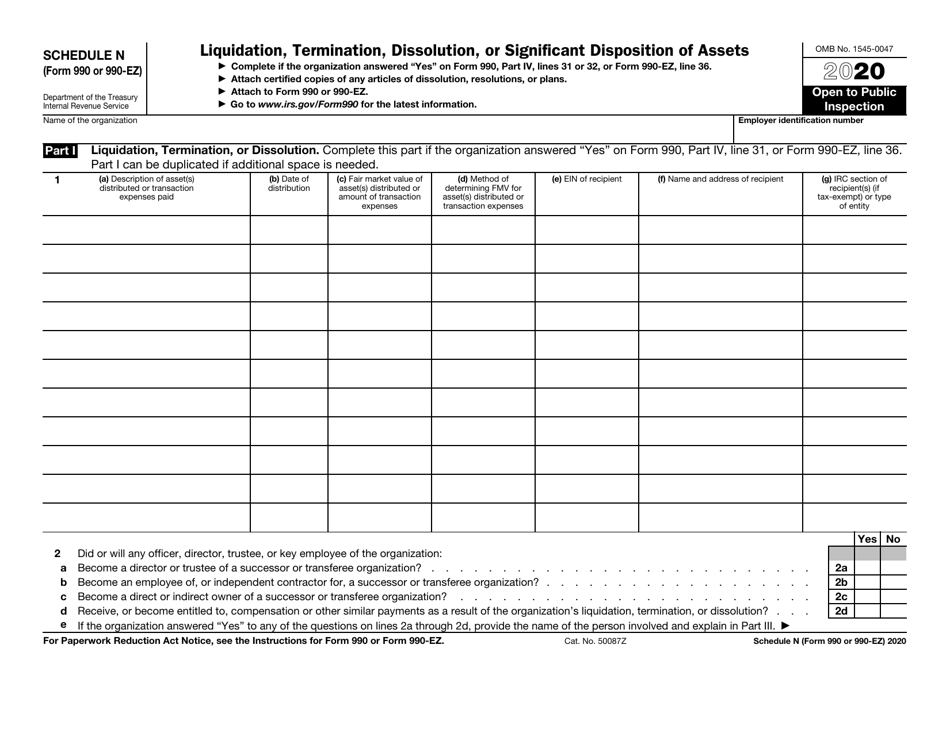

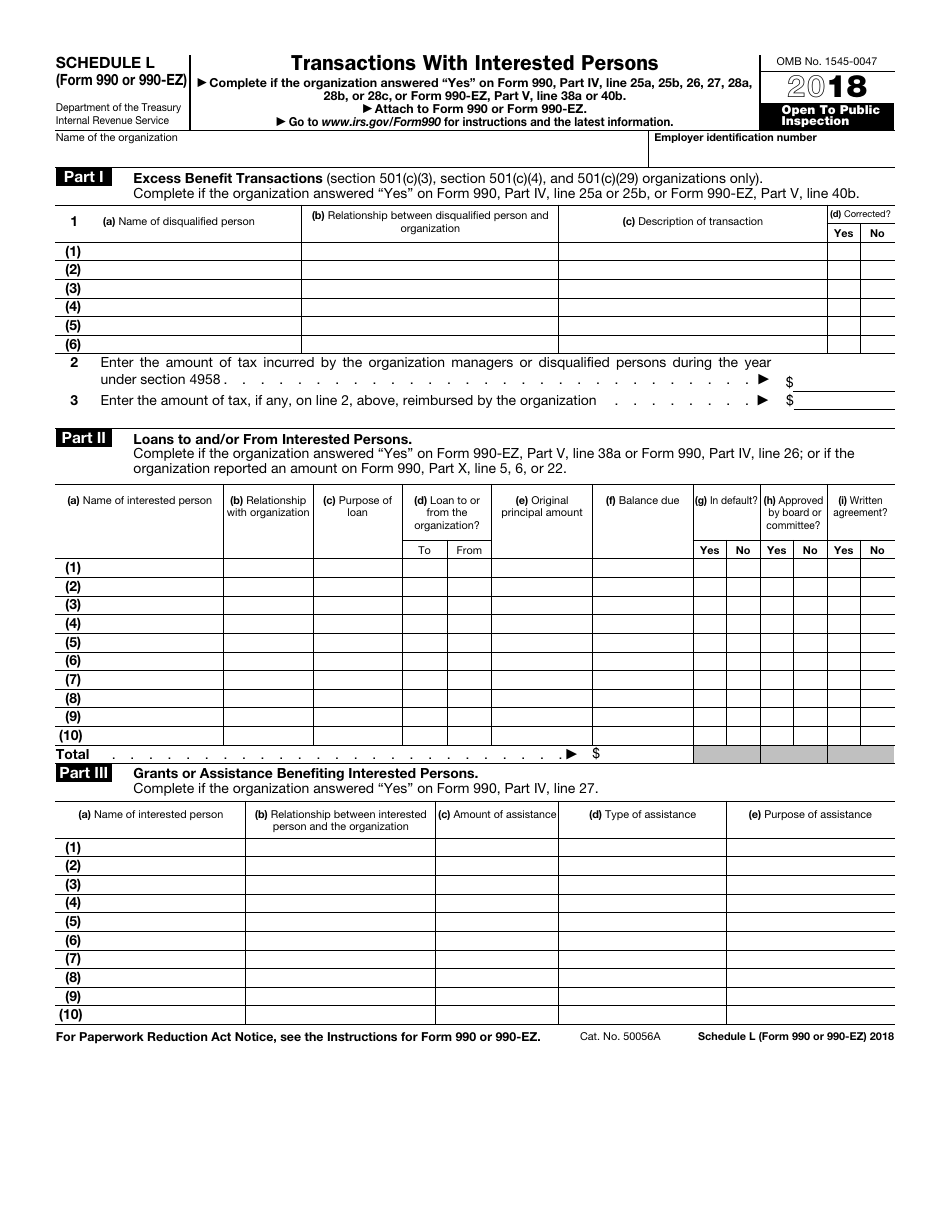

Form 990 Form 990 EZ or Schedule A Form 990 or 990 EZ for the tax year but should file Form 990 PF instead Line 1 Check the box for a church convention of churches or association of churches Pub 1828 Tax Guide for Churches and Religious Organizations provides certain characteristics generally attributed to churches These attributes of File your Form 990 return using our Tax990 software with the required schedules Form 990 N E postcard for Small Exempt Organizations Form 990 EZ Short Form Return of Tax Exempt Organizations Form 990 CA Form 199 Schedule L Frequently Asked Questions

990 EZ Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/954/6954826/large.png

Form 990 Ez Printable Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2117/21172/2117237/irs-form-990-990-ez-schedule-n-liquidation-termination-dissolution-or-significant-disposition-of-assets_print_big.png

https://www.guidestar.org/ViewEdoc.aspx?eDocId=8365357&approved=True

990 EZ 2021 Short Form Return of Organization Exempt From Income Tax Open to Public Inspection Part I Revenue Expenses and Changes in Net Assets or Fund Balances Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public

https://www.tax990.com/form-990-schedules/schedule-a/

While filing Form 990 Schedule A with Form 990 990 EZ then the organization should use the same accounting method that is checked on the following lines IRS Form 990 Part XII line 1 IRS Form 990 EZ line G In some cases the organization s accounting method is changed from the prior year the organization must provide an explanation in

990 Ez 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

990 EZ Form Fill Out And Sign Printable PDF Template SignNow

Printable Form 990 Schedule I Sunnyvale California Fill Exactly For Your City

2023 Form 990 Ez Schedule A Instructions Fill Online Printable Fillable Blank

2023 Form 990 Ez Schedule A Fill Online Printable Fillable Blank

2022 Form IRS Instructions Schedule A 990 Or 990 EZ Fill Online Printable Fillable Blank

2022 Form IRS Instructions Schedule A 990 Or 990 EZ Fill Online Printable Fillable Blank

2022 IRS Form 990 EZ Instructions How To Fill Out Form 990 EZ

IRS Form 990 990 EZ Schedule L 2018 Fill Out Sign Online And Download Fillable PDF

Form 990 Schedule F And Form 990 Schedule D Main Differences

990 Ez Printable Form Schedule A - Cat No 10642I Form 990 EZ 2021 Form 990 EZ Department of the Treasury Internal Revenue Service Short Form Return of Organization Exempt From Income Tax Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public