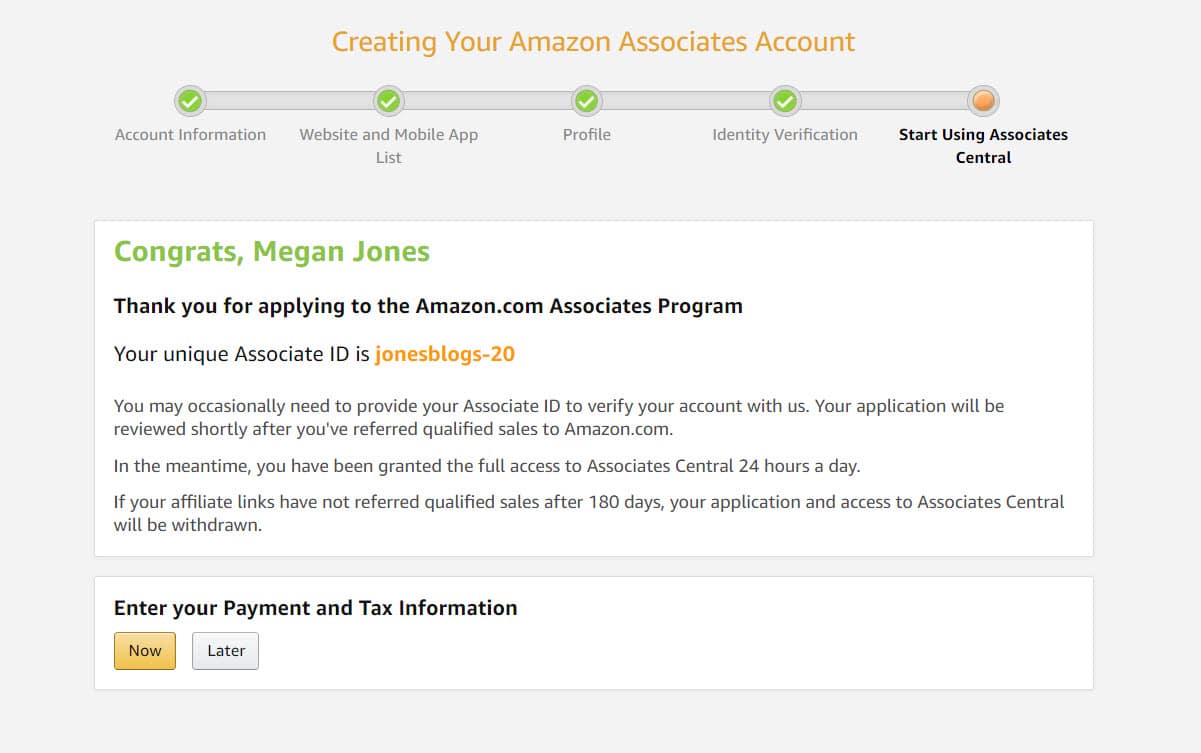

Amazon Associates Tax Form Printable U S law requires Amazon to collect tax information from Associates who are U S citizens U S residents or U S corporations and certain non U S individuals or entities that have taxable income in the U S We re obligated to have this information on file in order to make payments

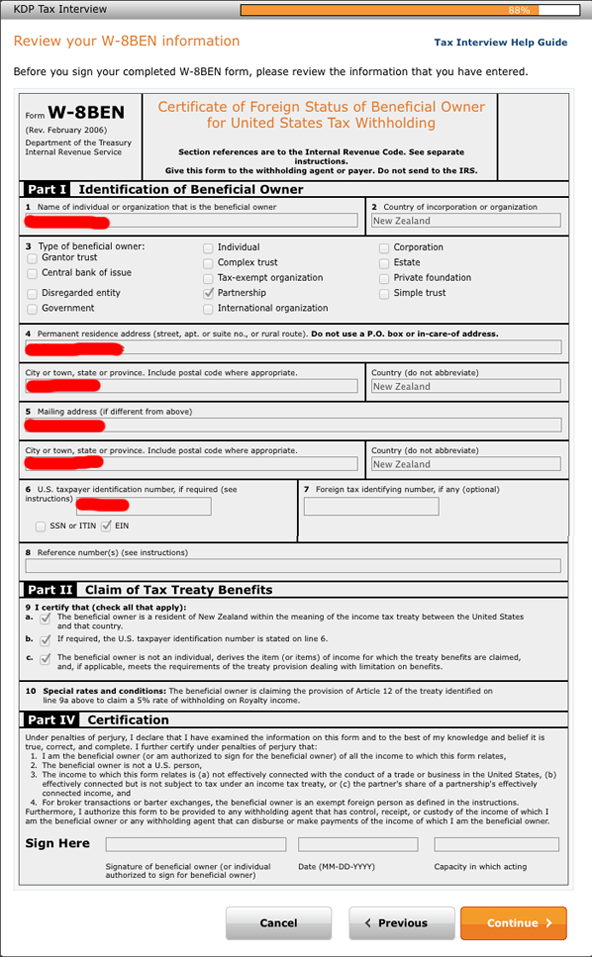

Getting Started The interview is designed to obtain the information required to complete an IRS W 9 W 8 or 8233 form to determine if your payments are subject to IRS Form 1099 MISC or 1042 S reporting In order to fulfill the IRS requirements as efficiently as possible answer all questions and enter all information requested during the interview We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity

Amazon Associates Tax Form Printable

Amazon Associates Tax Form Printable

https://makeawebsitehub.com/wp-content/uploads/2019/04/Billing-and-Tax.jpg

How To Add Tax Information In Amazon Associates Program Fill Tax Information On Amazon

https://i.ytimg.com/vi/Nc4ToUXifYo/maxresdefault.jpg

How To Fill Up Amazon Tax Information Form As A Non USA Person A Success Partner For You YouTube

https://i.ytimg.com/vi/yFm6wOt8E0Y/maxresdefault.jpg

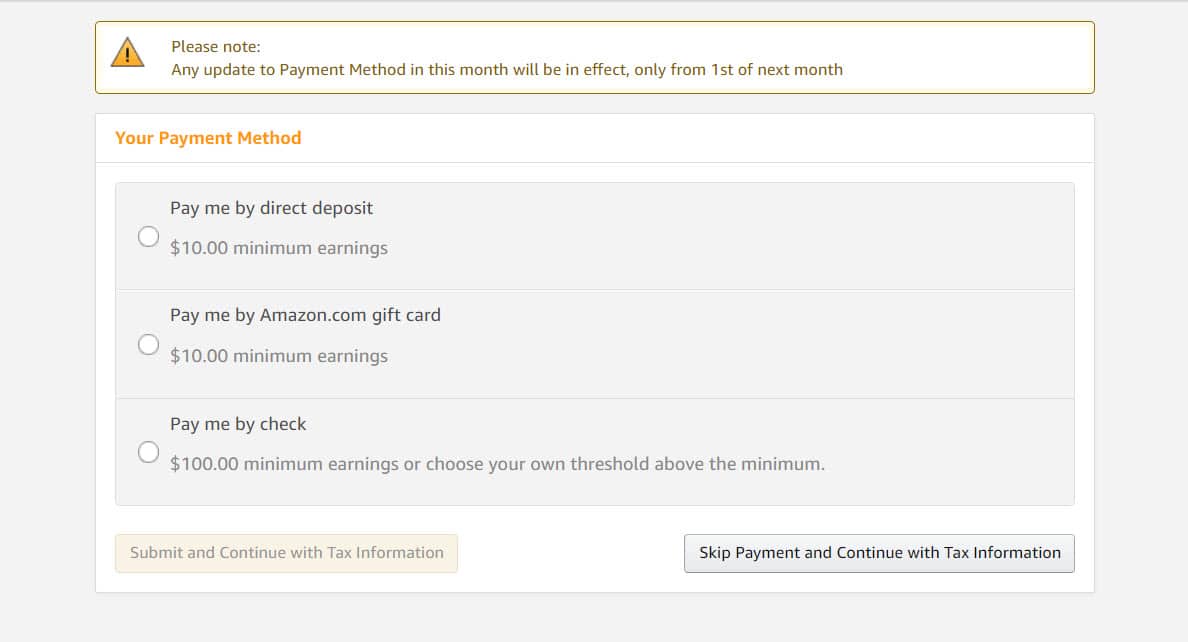

Are you an Amazon Associates member looking to optimize your earnings and reduce your tax liability In this comprehensive video tutorial we ll guide you th In order to document that a sale has been made to an agent of the U S government Amazon requires a copy of one of the following to enroll in Amazon s Tax Exemption Program ATEP Federal tax ID certificate Certificate of exempt status or affidavit Government voucher For additional information on how to enroll in ATEP please visit Amazon

How to fill in Amazon associates tax form And enable your affiliate account SUBSCRIBE TO THIS CHANNEL http bit ly mrhackioBest tech gadgets https a Amazon affiliate program is one of the best ways to earn money from affiliate marketing You can earn money by increasing sales of amazon or generating leads

More picture related to Amazon Associates Tax Form Printable

Everything You Need To Know About Amazon s Affiliate Program Affpub

https://cdn.business2community.com/wp-content/uploads/2019/10/Amazon-Associates-form.png

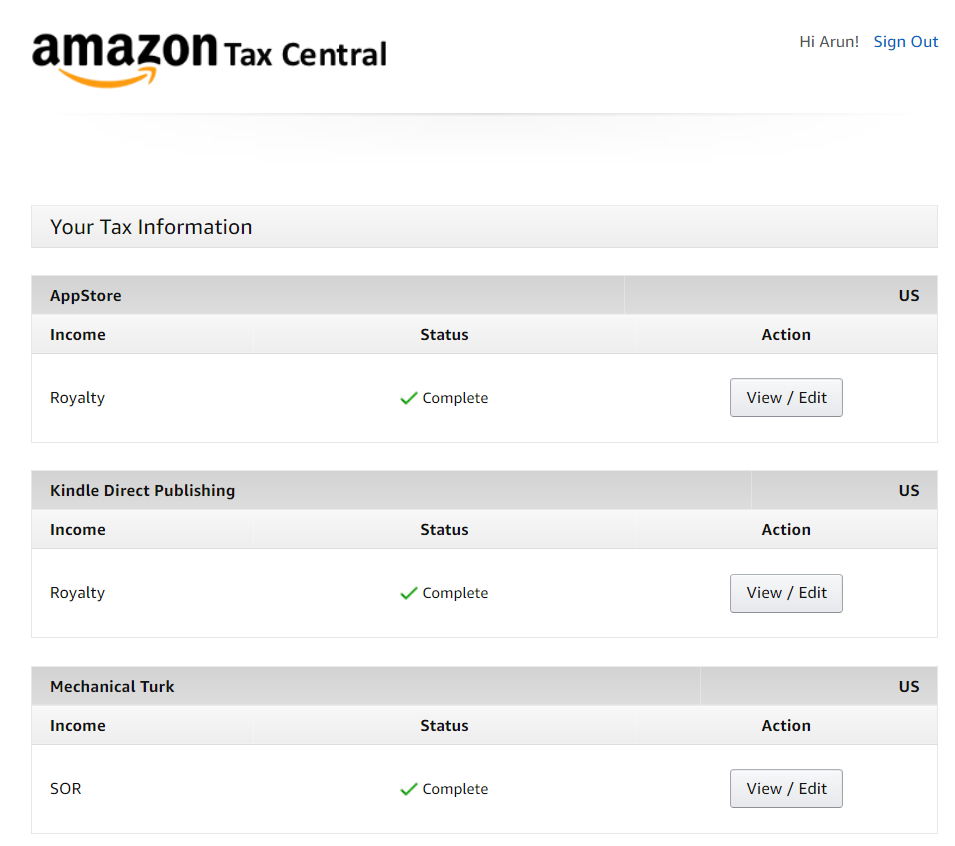

View All Your Amazon Tax Information At One Place

https://dl.dropbox.com/s/bqx1jp7009xoek7/view all tax information and forms for amazon tax central.PNG?dl=0

A Guide To The Amazon Associates Program

https://makeawebsitehub.com/wp-content/uploads/2019/04/Amzon-Associates-Program.jpg

If you have not received your Form W 2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W 2 Wage and Tax Statement Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible There may be a delay in any refund due while the information is verified The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or qualifying surviving spouse 20 800 for head of household Find the standard deduction if you re Over 65 or blind A dependent on someone else s tax return If you re married filing separately you can t

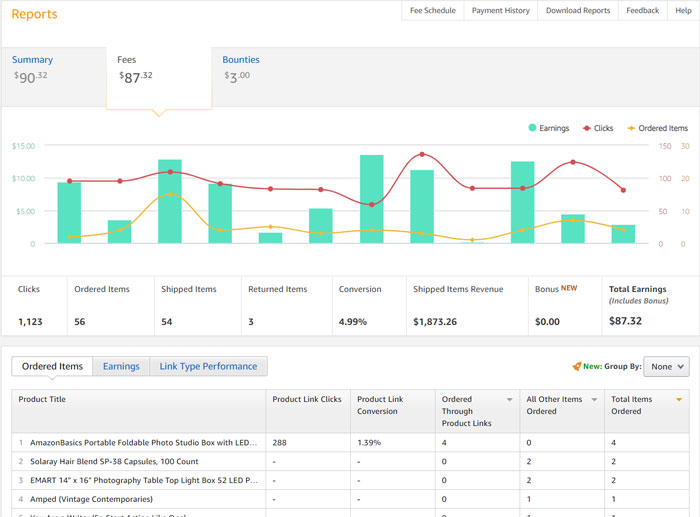

You can provide Amazon with your tax information via your Seller Central account under tax information Where can I find my 1099 K form If you re an active seller on Amazon and you meet the 1099 K qualifications chances are Amazon has emailed you already To access a digital copy of your form please follow these steps Log in to Amazon Associates Hover over your email address displayed in the top right corner and select Account Settings Scroll down to Payment and Tax Information Click on Find Forms at the bottom of the page Download the applicable forms Was this information helpful Yes No

How To View All The Amazon Tax Forms at One Place YouTube

https://i.ytimg.com/vi/P9HC9dgHB4w/maxresdefault.jpg

Amazon Tax Information For Non US How To Setup Digimanx

https://i0.wp.com/digimanx.com/wp-content/uploads/2019/05/Screen-Shot-2019-05-02-at-13.00.02.png?w=516&ssl=1

https://affiliate-program.amazon.com/help/node/topic/GYJB2LE2AB473W2L

U S law requires Amazon to collect tax information from Associates who are U S citizens U S residents or U S corporations and certain non U S individuals or entities that have taxable income in the U S We re obligated to have this information on file in order to make payments

https://affiliate-program.amazon.com/tax-interview/help?nodeId=201588330&locale=en_US

Getting Started The interview is designed to obtain the information required to complete an IRS W 9 W 8 or 8233 form to determine if your payments are subject to IRS Form 1099 MISC or 1042 S reporting In order to fulfill the IRS requirements as efficiently as possible answer all questions and enter all information requested during the interview

Amazon Associates Central

How To View All The Amazon Tax Forms at One Place YouTube

Tax Information For Amazon

Amazon Associates Tax Form Printable Printable Forms Free Online

Amazon FBA Tax Filing What You Need To Know Sageseller

Amazon Flex Take Out Taxes Augustine Register

Amazon Flex Take Out Taxes Augustine Register

Amazon Tax Identity And Payment Information Zype Help Center

Amazon Associates Tax Form Printable Printable Forms Free Online

How To Find And Understand Your Amazon Sales Tax Report YouTube

Amazon Associates Tax Form Printable - Are you an Amazon Associates member looking to optimize your earnings and reduce your tax liability In this comprehensive video tutorial we ll guide you th