Bb T 1098 Tax Forms Printable Tax forms Higher education billing clerks can prepare 1089 T forms for students and the Internal Revenue Service Tax information is dynamically calculated based on transactions that have taken place within Billing management Billing management allows Billing clerks to Automatically assemble a legally valid 1098 T document using data recorded throughout Billing management

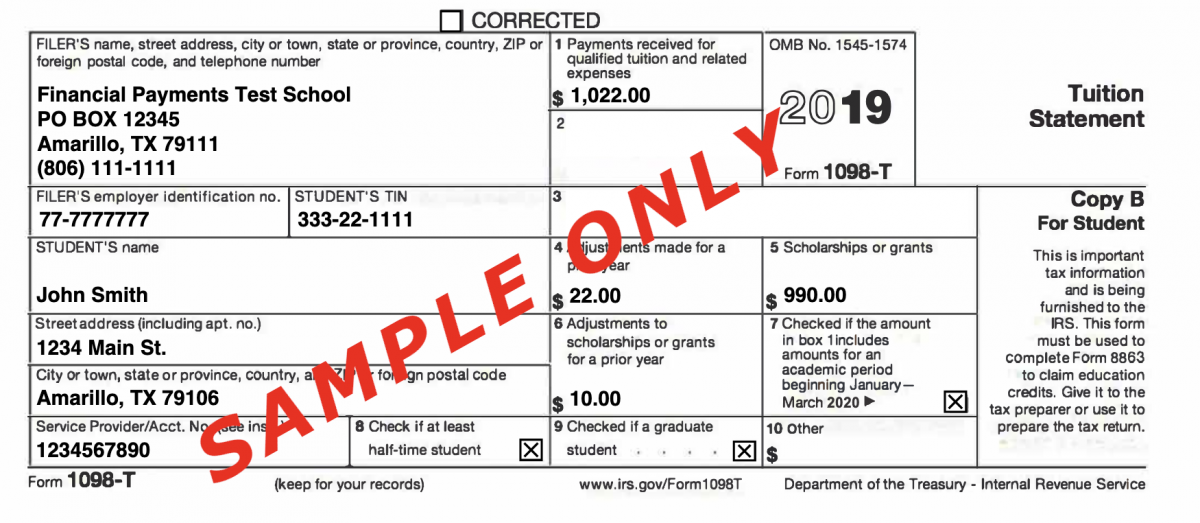

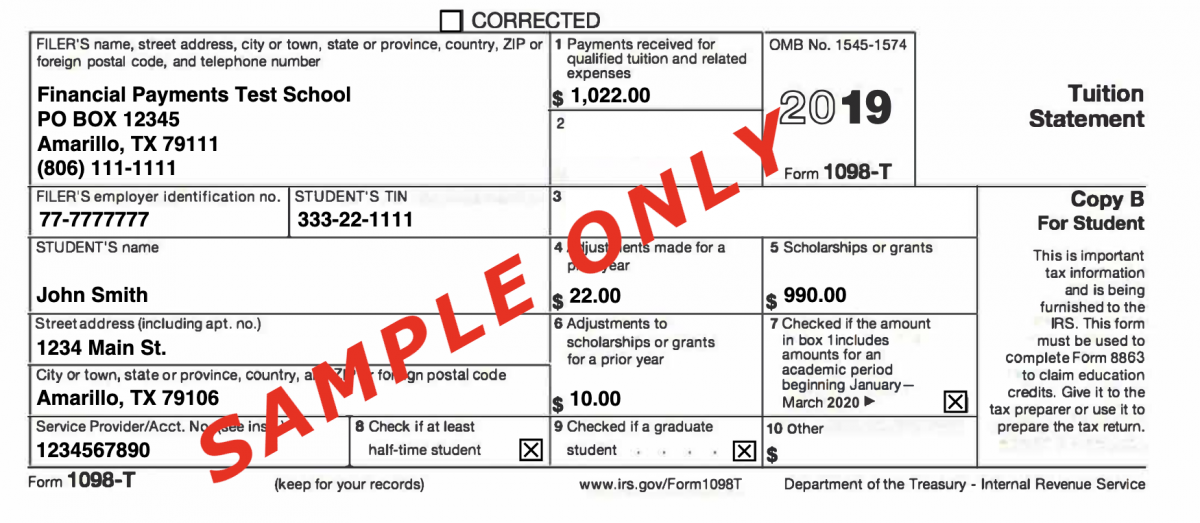

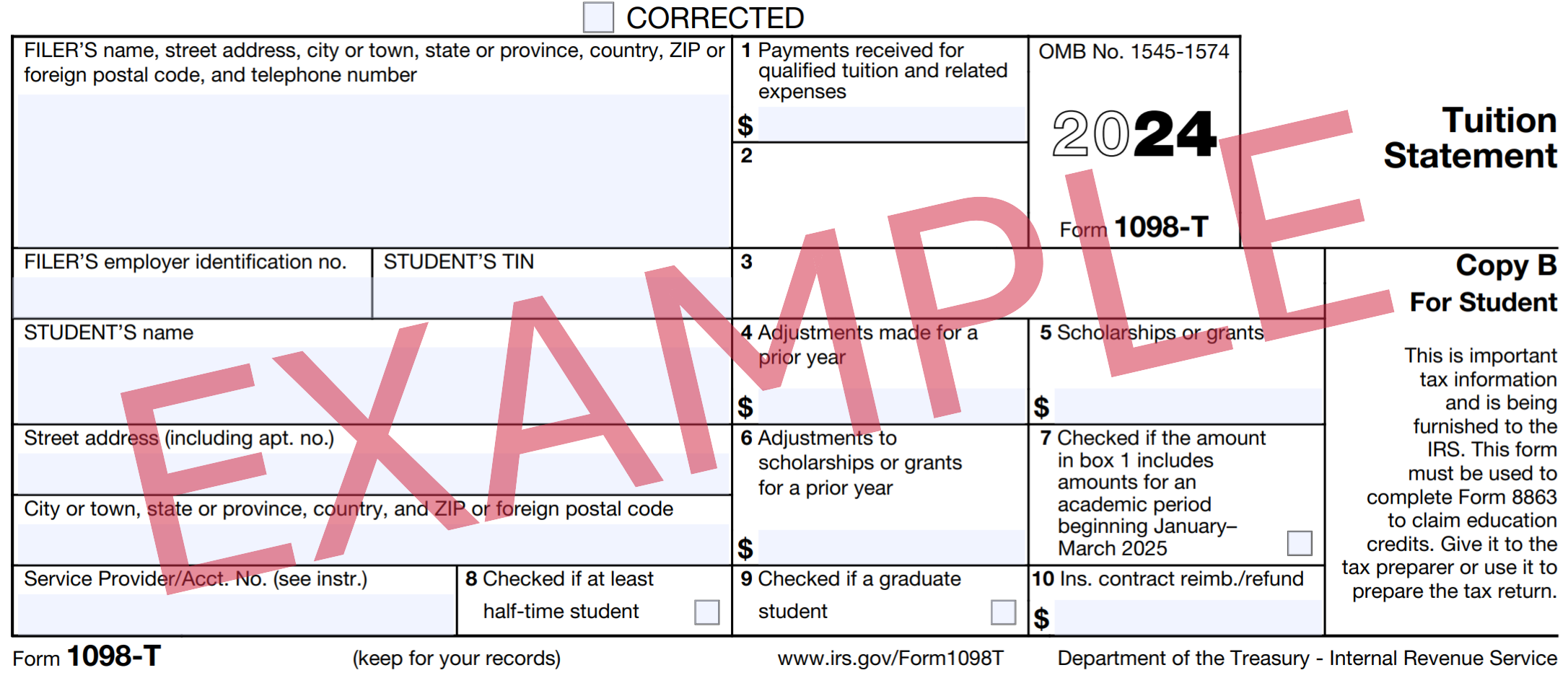

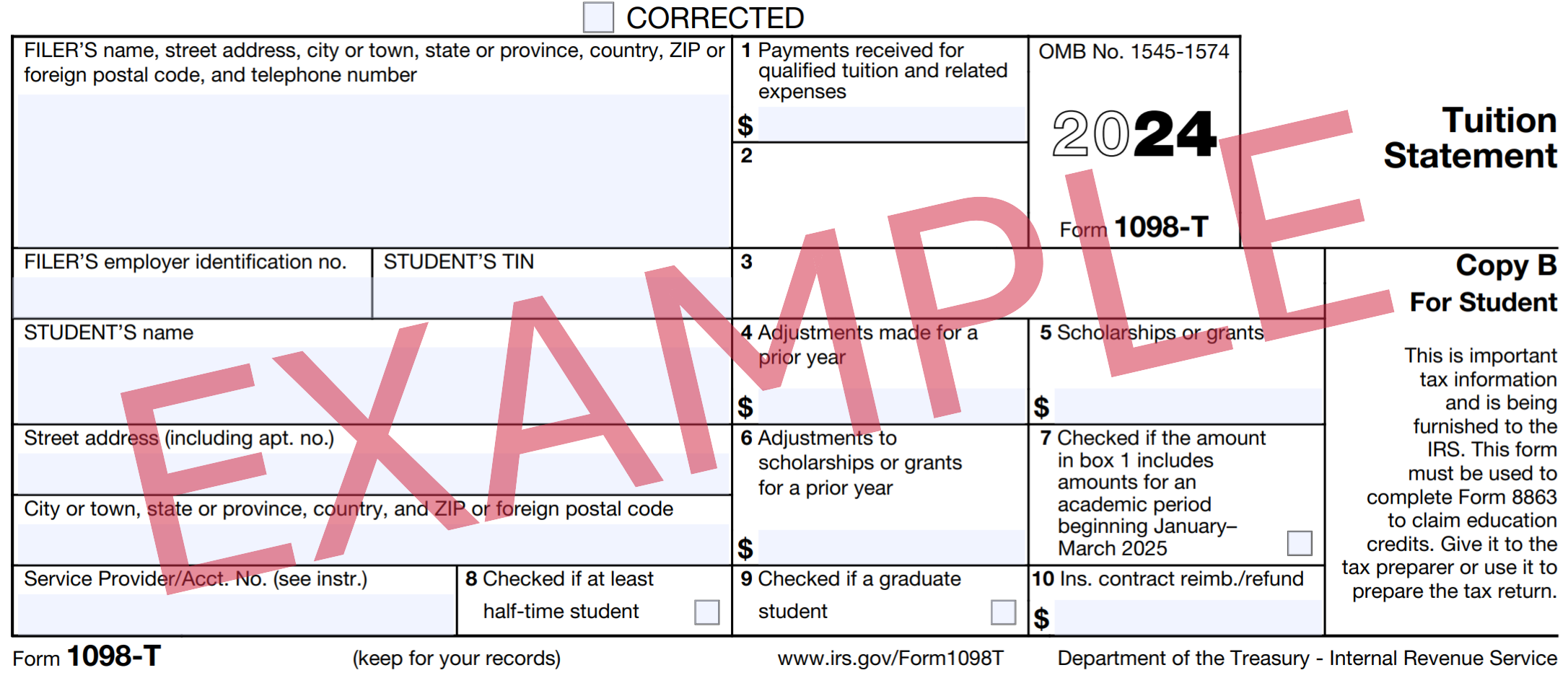

1 Download our mobile app 2 Create an online account it takes just minutes 3 Sign in to your account to set up electronic payments go paperless and activate account alerts Watch a quick overview for setting up your account 2 03 Transcript Was your mortgage transferred to Truist You might find this helpful OVERVIEW Eligible colleges or other post secondary institutions send Form 1098 T to students who paid qualified educational expenses in the preceding tax year Qualified expenses include tuition any fees that are required for enrollment and course materials required for a student to be enrolled at or attend an eligible educational institution

Bb T 1098 Tax Forms Printable

Bb T 1098 Tax Forms Printable

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-1200x523.png

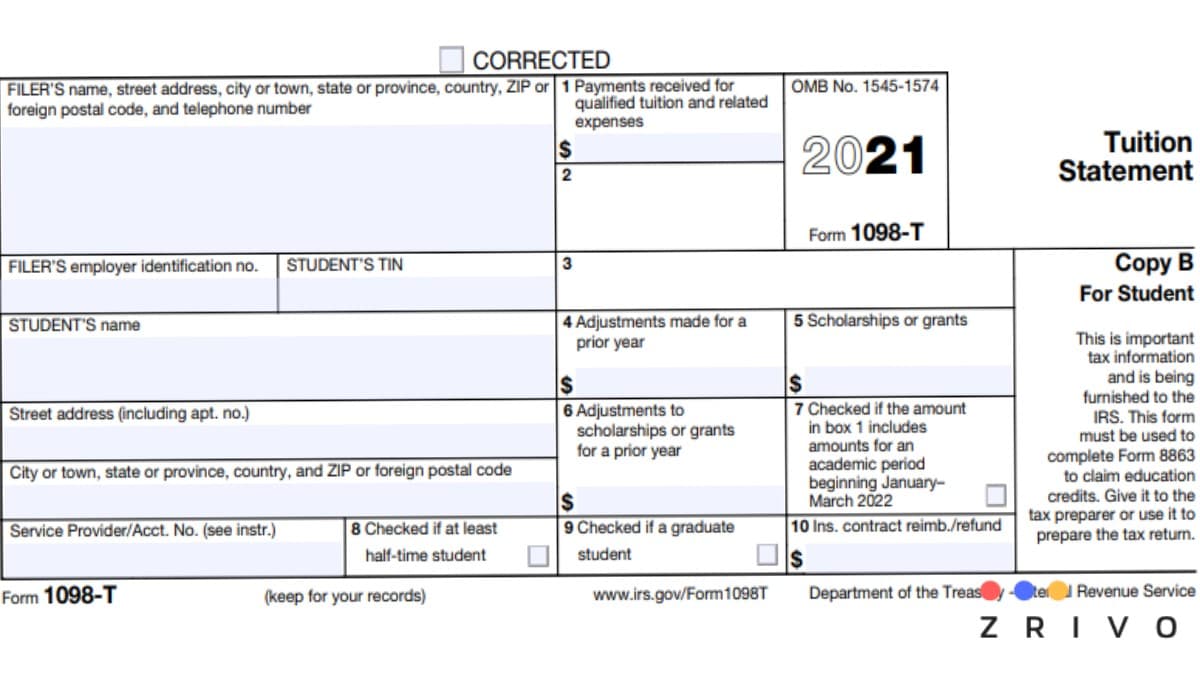

Printable 1098 T Tax Form IRS 1098 T Form For 2022 Tuition Statement Instructions PDF

https://1098t-form-printable.us/images/uploads/blog/Temza-March23/1098t-fur-main4.jpg?1678366923145

Understanding Your IRS Form 1098 T Student Billing

https://studentbilling.berkeley.edu/sites/default/files/styles/openberkeley_image_full/public/1098t_sample_2020.jpg?itok=9ehuNdu-×tamp=1610405644

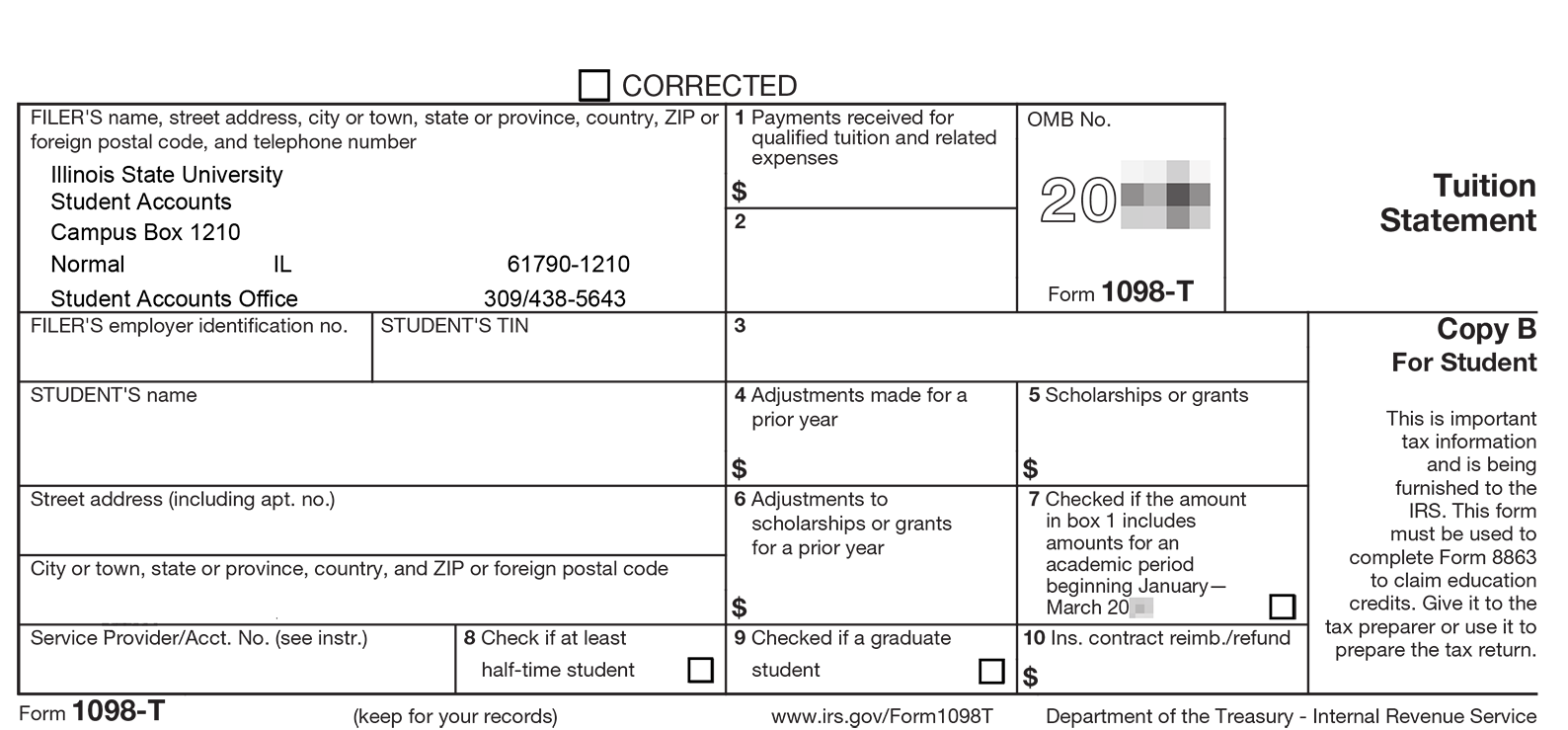

If your 1098 T form doesn t show up in Self Service by the end of January or if you have any questions about the form contact the Business Office at businessoffice abtech edu or 828 398 7152 Key Words 1098 T form 1098T 1098 tax return taxes receipt receipts payments bookstore purchases purchase A Veteran s benefits Illinois Veterans Grant Post 9 11 GI Bill etc received are reported as grants on the 1098 T form in Box 5 City Colleges of Chicago does not issue a 1098 T form if veteran s benefits equal or exceeds your total charges qualified tuition and related expenses Q I made a payment during the current tax reporting year

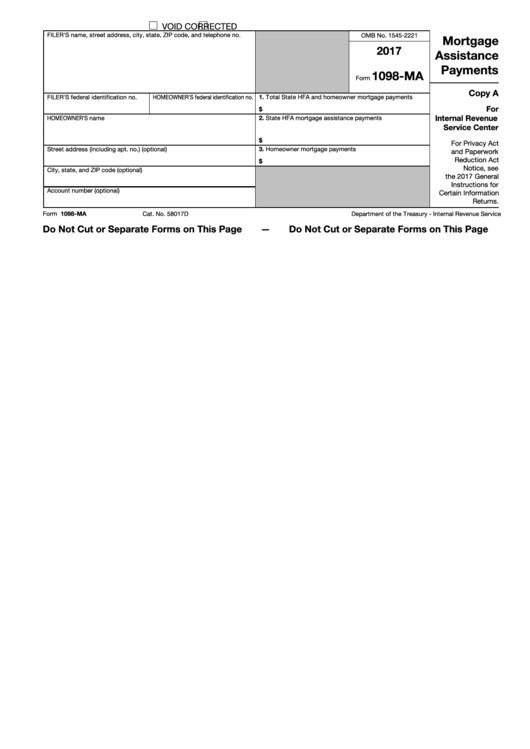

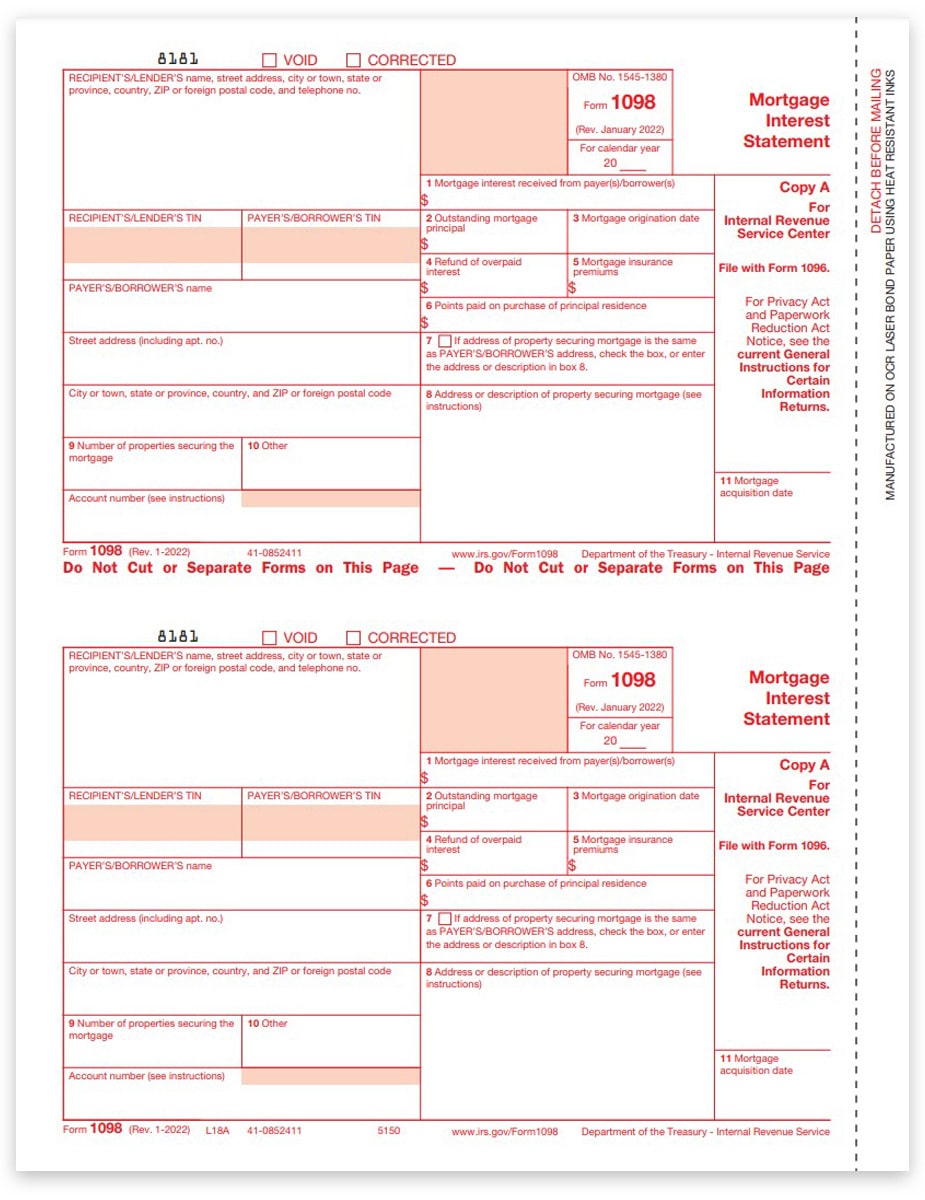

1098 T Information Baker College delivers form 1098 T electronically Students wishing to receive a paper copy of the 1098 T form can opt out of electronic delivery on the MyStFrancisSchoolofLaw 1098 T Delivery Method page St Francis students can view years 2022 through the most recent reporting year of tax form 1098T on the student portal WHAT IS A MORTGAGE INTEREST STATEMENT 1098 A year end statement also known as IRS tax form 1098 is essentially a status update on a mortgage It s a document that is sent out and shows how much mortgage interest mortgage points and property taxes have been paid by the borrower that year

More picture related to Bb T 1098 Tax Forms Printable

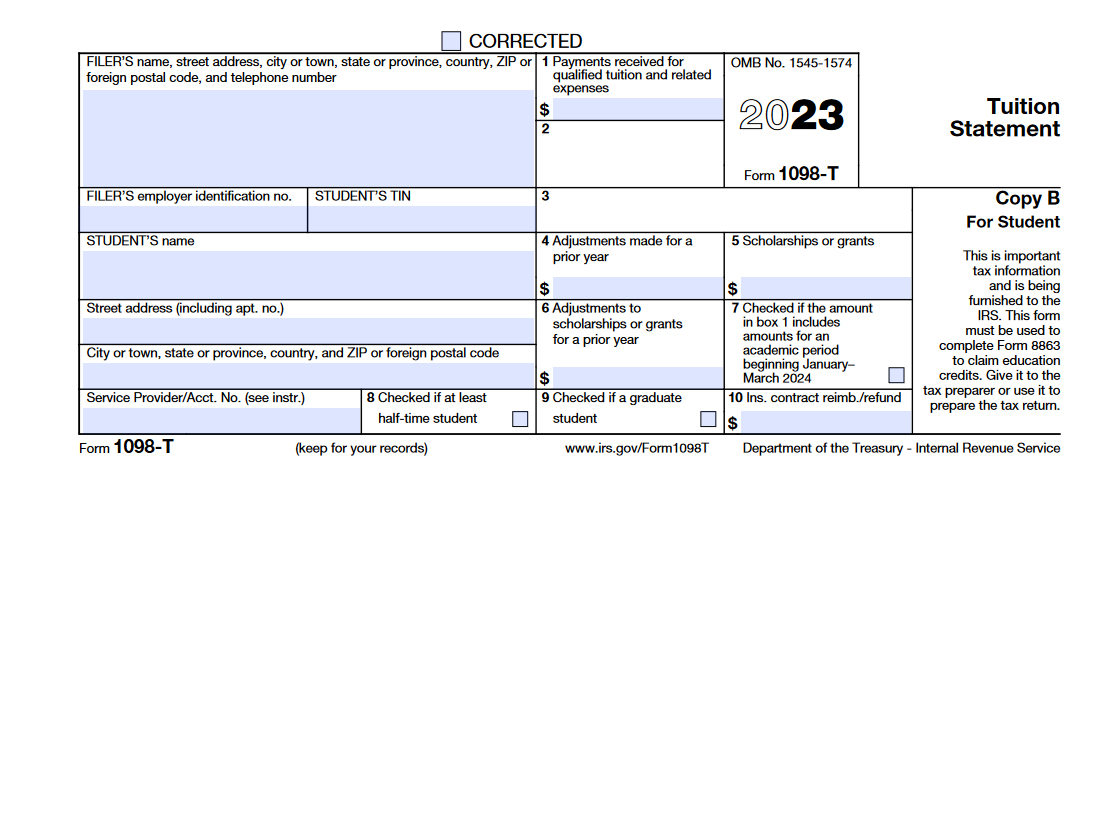

1098 T Form 2024

https://www.zrivo.com/wp-content/uploads/2020/11/1098-T-Form-2021.jpg

1098 T Information Bursar s Office Office Of Finance UTHSC

https://uthsc.edu/finance/images/1098t-image.png

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

Checked if a graduate Checked if the amount in box 1 includes amounts for an academic period beginning January March 2023 10 Ins contract reimb refund This is important tax information and is being furnished to the IRS This form must be used to complete Form 8863 to claim education credits Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage related expenses paid on a mortgage during the tax year These expenses can be

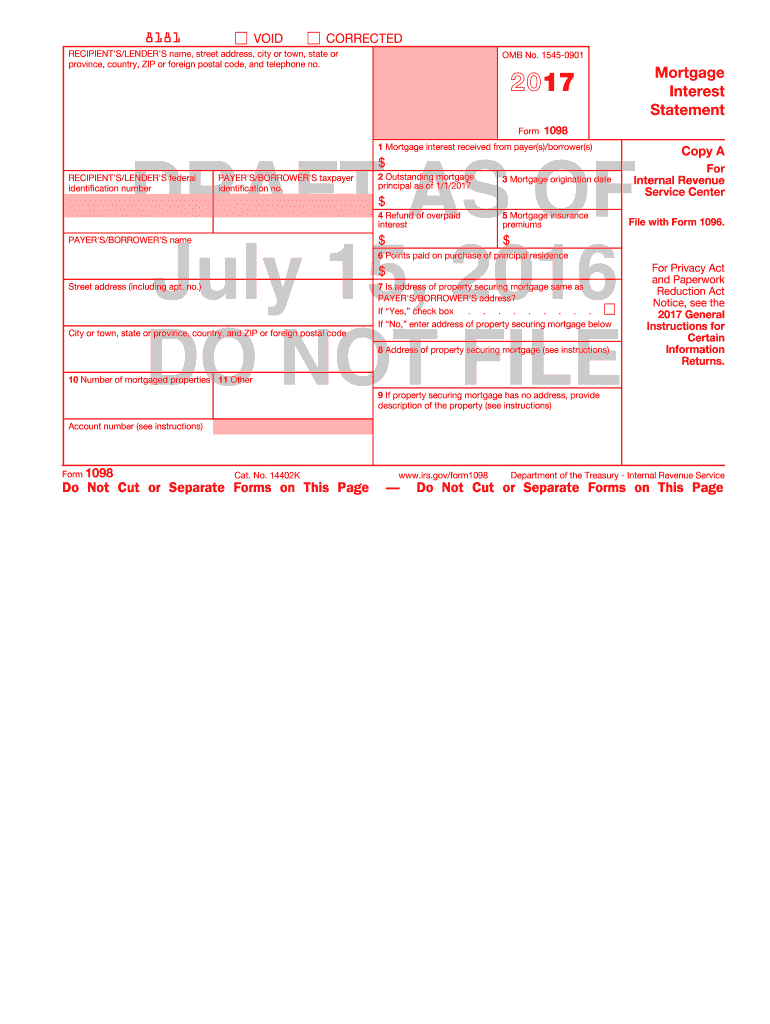

IRS Form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year Lenders file a copy with the IRS and send another copy to the payer of the interest A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid Bb T 1098 Tax Forms Printable Free printable templates are a terrific material for anybody looking to save time and money while producing professional looking documents Whether you need a resume a flyer a business card or even a spending plan organizer there are numerous templates offered online that can be downloaded and printed for

1098 T Form How To Complete And File Your Tuition Statement

https://blog.pdffiller.com/app/uploads/2021/07/Form-1098-T-featured.png

Free Fillable 1098 Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/295/2950/295009/page_1_thumb_big.png

https://webfiles.blackbaud.com/files/support/helpfiles/education/higher-ed/content/bm-tax-forms.html

Tax forms Higher education billing clerks can prepare 1089 T forms for students and the Internal Revenue Service Tax information is dynamically calculated based on transactions that have taken place within Billing management Billing management allows Billing clerks to Automatically assemble a legally valid 1098 T document using data recorded throughout Billing management

https://www.truist.com/mortgage/manage-your-mortgage

1 Download our mobile app 2 Create an online account it takes just minutes 3 Sign in to your account to set up electronic payments go paperless and activate account alerts Watch a quick overview for setting up your account 2 03 Transcript Was your mortgage transferred to Truist You might find this helpful

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

1098 T Form How To Complete And File Your Tuition Statement

How To Print And File Tax Form 1098 Mortgage Interest Statement

Free Fillable Form 1098 Printable Forms Free Online

How To Print And File Tax Form 1098 Mortgage Interest Statement

Form 1098 T Information Student Portal

Form 1098 T Information Student Portal

Accessing And Reading Your 1098 T Form Help Illinois State

How To Print And File Tax Form 1098 Mortgage Interest Statement

Fillable Form 1098 T Tuition Statement Tuition Irs Tax Forms Tax Forms

Bb T 1098 Tax Forms Printable - WHAT IS A MORTGAGE INTEREST STATEMENT 1098 A year end statement also known as IRS tax form 1098 is essentially a status update on a mortgage It s a document that is sent out and shows how much mortgage interest mortgage points and property taxes have been paid by the borrower that year