Business Tax Deductions Printable Tax Form Forms and instructions 1 Deducting Business Expenses Publication 334 Tax Guide for Small Business Publication 463 Travel Gift and Car Expenses Publication 525 Taxable and Nontaxable Income Publication 529 Miscellaneous Deductions Publication 536 Net Operating Losses NOLs for Individuals Estates and Trusts

Download small business and self employed forms and publications or call 800 829 3676 to order forms and publications through the mail According to Fundera on average the effective small business tax rate is 19 8 adding that sole proprietorships pay a 13 3 tax rate and small partnerships pay a 23 6 tax rate

Business Tax Deductions Printable Tax Form

Business Tax Deductions Printable Tax Form

https://www.pdffiller.com/preview/589/482/589482155/big.png

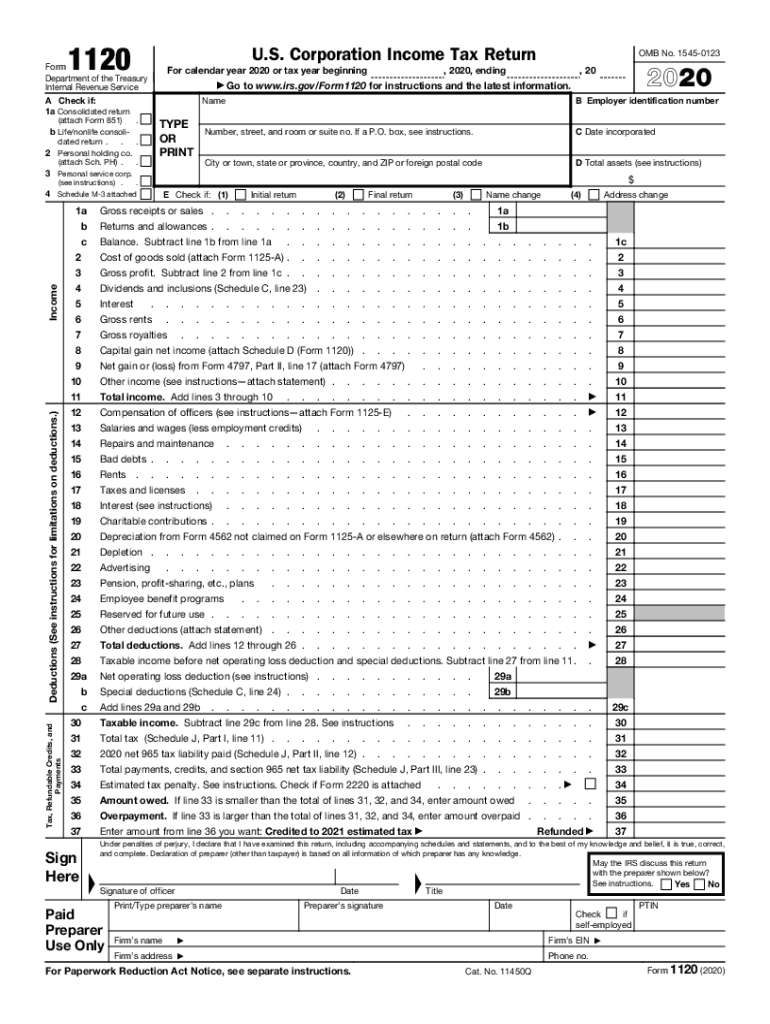

2020 Form IRS 1120 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/539/36/539036263/large.png

Printable Tax Deduction Worksheet Db excel

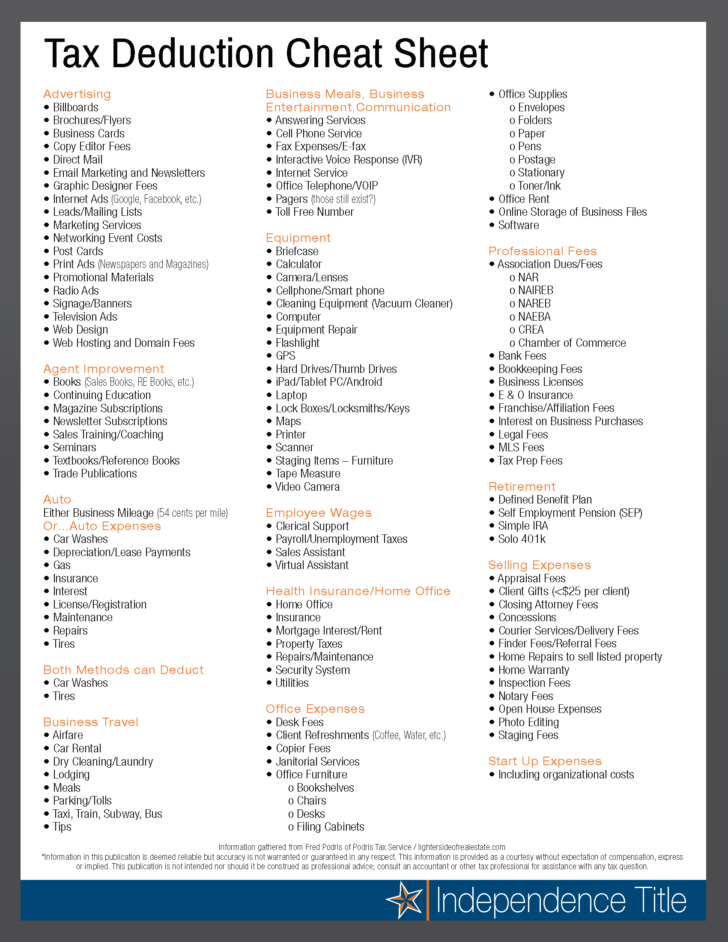

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-728x942.png

1 Startup and organizational costs Our first small business tax deduction comes with a caveat it s not actually a tax deduction Business startup costs are seen as a capital expense by the Overview Features ACCOUNTING Complete guide to small business tax deductions in 2023 By QuickBooks May 30 2023 When you re a small business owner tax time can feel overwhelming Which of your expenses including rent inventory payroll or utilities from the past year qualify as tax deductible

January 27 2022 Taxes are a top financial challenge for small businesses surveyed in NFIB s annual Problems and Priorities report taking up four spots among the top 10 challenges Federal taxes on business income and state taxes on business income both rank high Businesses can take advantage of bonus depreciation to deduct 100 of the cost of machinery equipment computers appliances and furniture If you purchased a new vehicle during the tax year the IRS limits write offs for passenger vehicles In the first year if you don t claim bonus depreciation the maximum depreciation deduction is

More picture related to Business Tax Deductions Printable Tax Form

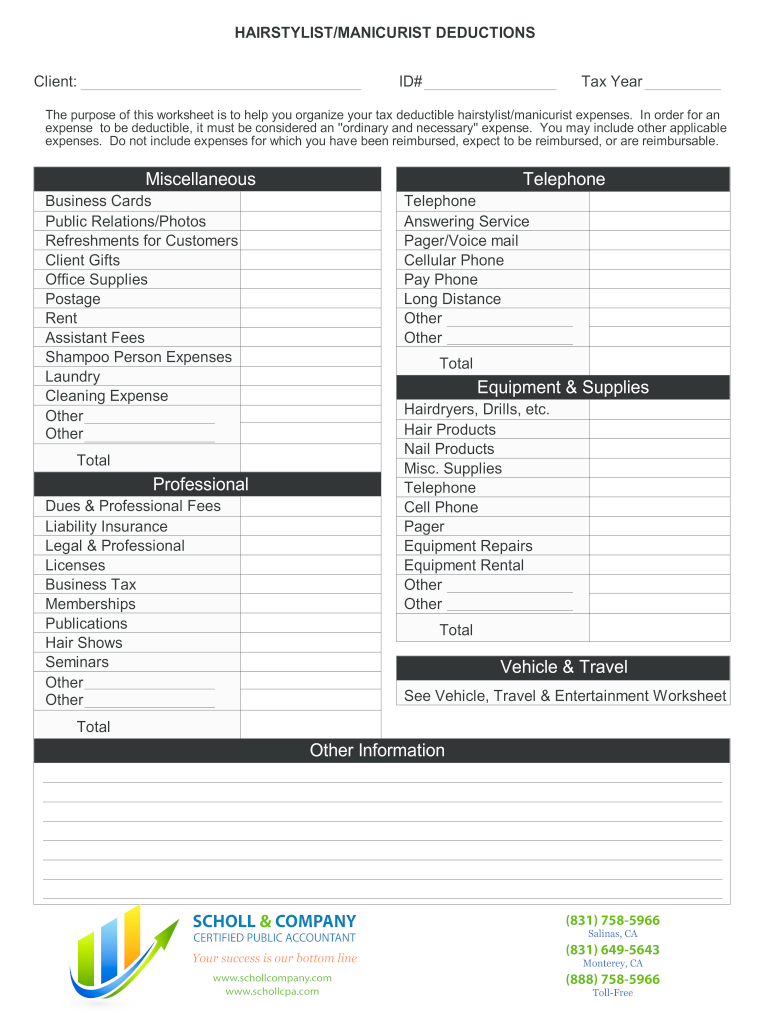

Self Employment Printable Small Business Tax Deductions Worksheet Find Deductions As A 1099

https://www.signnow.com/preview/420/57/420057167/large.png

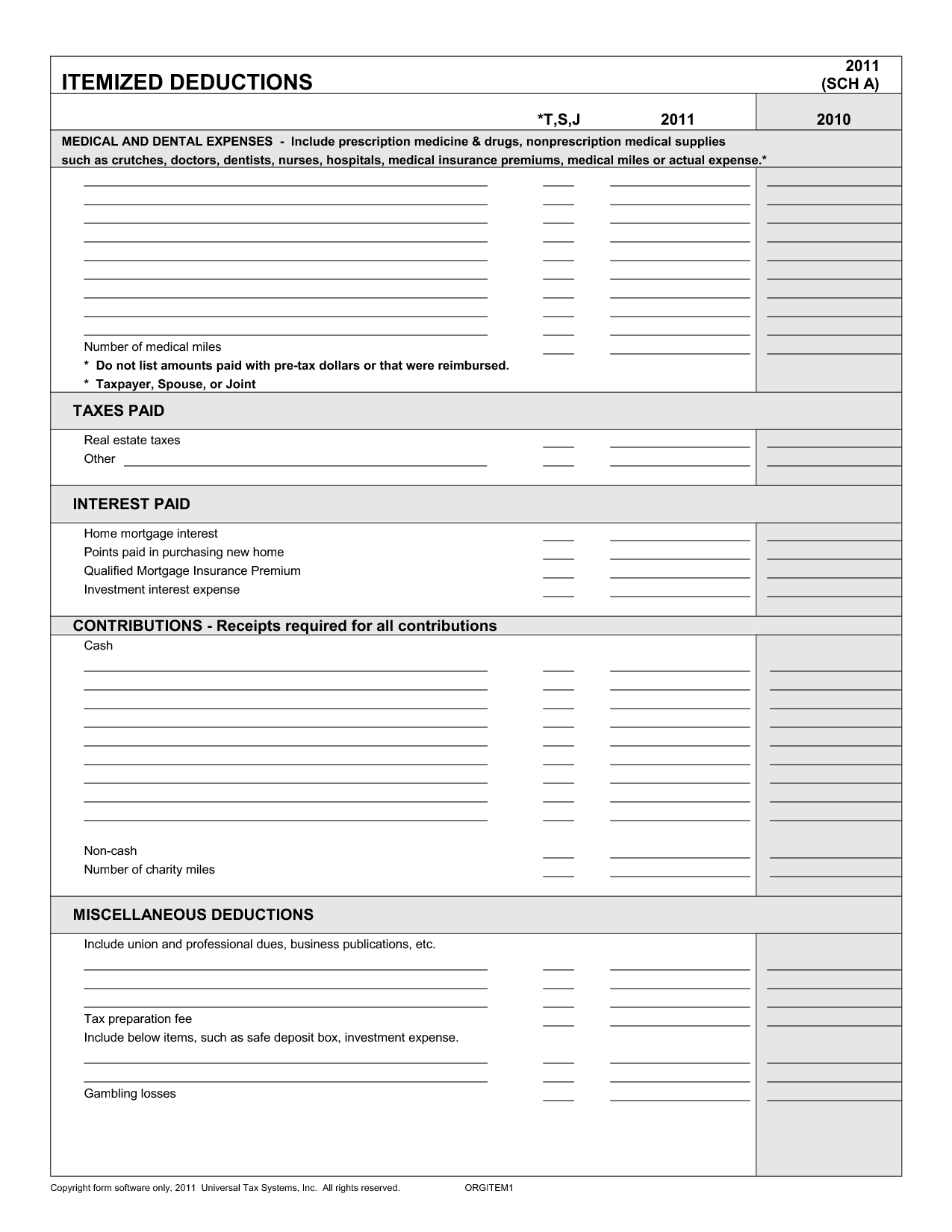

16 Best Images Of Schedule C Deductions Worksheet Itemized Deduction List Template Itemized

http://www.worksheeto.com/postpic/2009/09/itemized-deduction-list-template_449451.png

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

https://i.etsystatic.com/23545555/r/il/f49ff7/3754474129/il_fullxfull.3754474129_gsw3.jpg

The top 25 tax deductions for a small business in the 2023 2024 tax year as outlined in this comprehensive tax deductions cheat sheet can help business owners lower their income tax bills by claiming all the deductions relevant to their work These top tax write offs will help speed up the income tax filing process and reduce the amount you owe to the government in taxes Engaged in a trade or business The IRS will otherwise presume you are not in business and Must be supported by a Form 1099 you have issued where any individual is paid over 600 per year 7 If you are a service business gift certificates for your services are not a deduction 8 This includes EMPLOYEE health insurance employee food

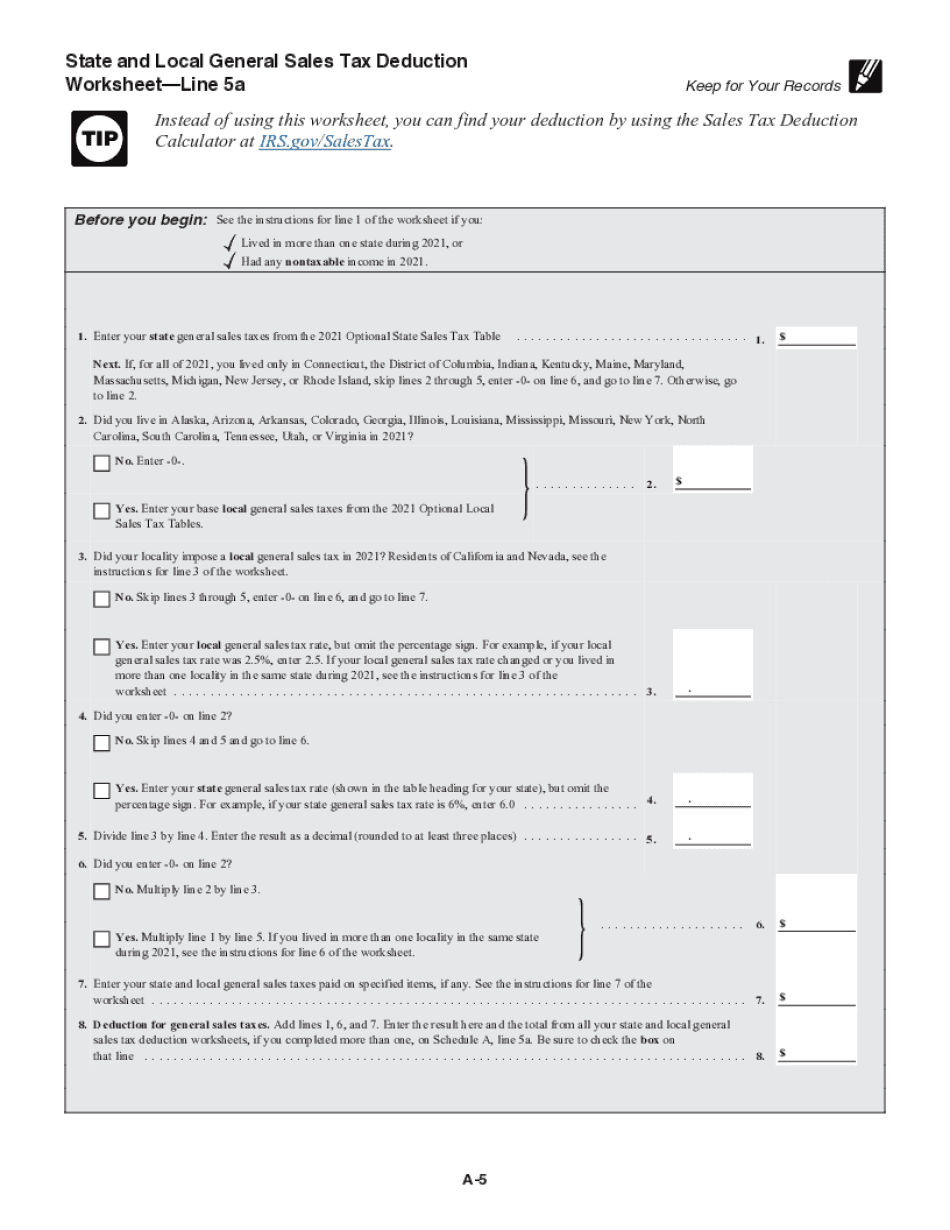

Under the tax law most small businesses sole proprietorships LLCs S corporations and partnerships can deduct 20 of their income on their taxes Woo hoo Here s what this means Say your small business generates 100 000 in profit You can deduct 20 000 before ordinary income tax rates are applied SMALL BUSINESS WORKSHEET Client ID TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses In order for an Books Magazines expense to be deductible it must be considered an Business Cards ordinary and necessary expense You may include

List Of Tax Deductions Examples And Forms

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

Self Employed Business Tax Deduction Sheet A Success Of Your Business The Best Insurance Company

https://s-media-cache-ak0.pinimg.com/originals/0f/39/4f/0f394febb07050a111c4d2e0f3298c24.jpg

https://www.irs.gov/forms-pubs/guide-to-business-expense-resources

Forms and instructions 1 Deducting Business Expenses Publication 334 Tax Guide for Small Business Publication 463 Travel Gift and Car Expenses Publication 525 Taxable and Nontaxable Income Publication 529 Miscellaneous Deductions Publication 536 Net Operating Losses NOLs for Individuals Estates and Trusts

https://www.irs.gov/businesses/small-businesses-self-employed/small-business-forms-and-publications

Download small business and self employed forms and publications or call 800 829 3676 to order forms and publications through the mail

List Of Tax Deductions Examples And Forms

List Of Tax Deductions Examples And Forms

Small Business Tax Worksheet

Small Business Tax Deductions Worksheets

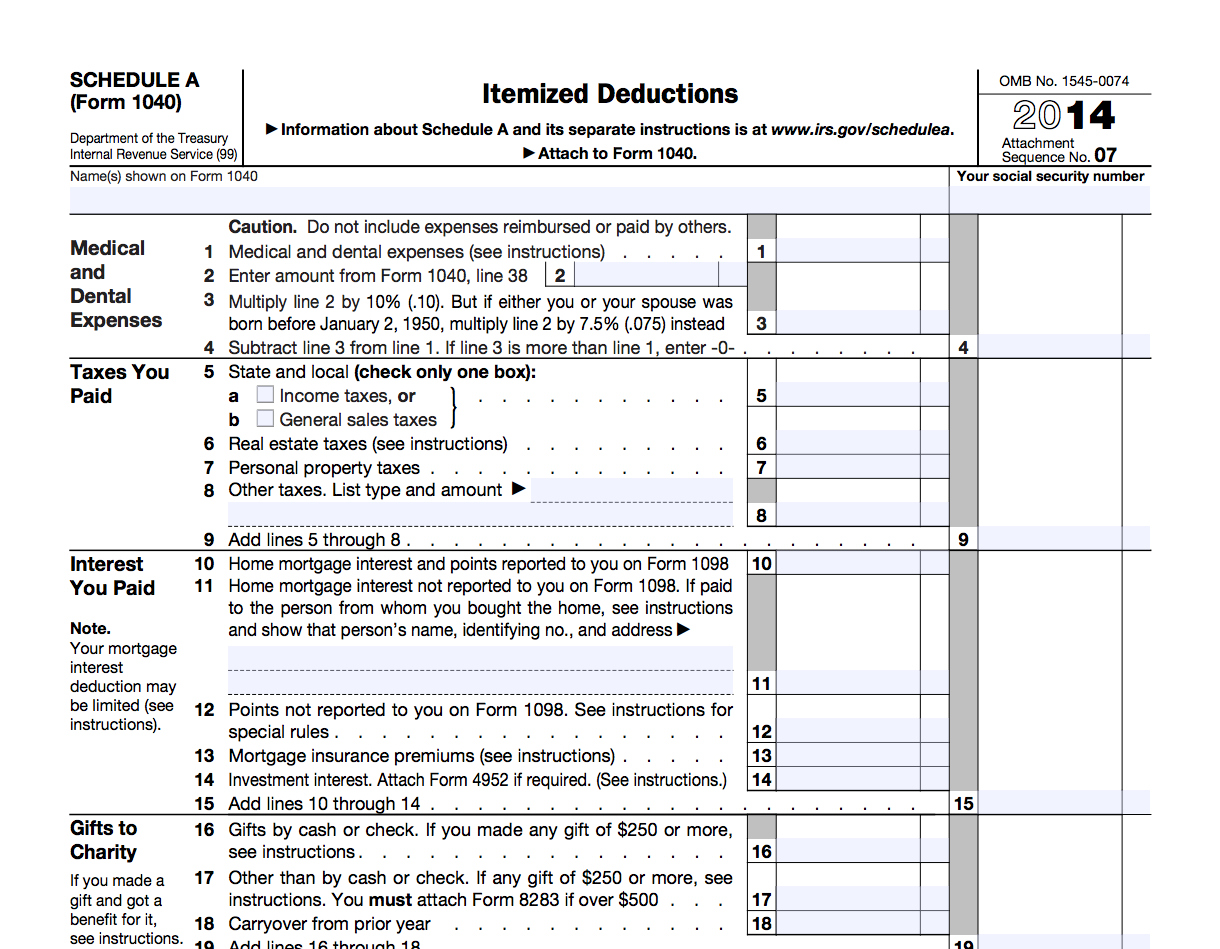

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

9 Best Images Of Tax Deduction Worksheet Business Tax Deductions Worksheet 2015 Itemized Tax

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Business Tax List Of Business Tax Deductions

Business Tax Deductions Printable Tax Form - January 27 2022 Taxes are a top financial challenge for small businesses surveyed in NFIB s annual Problems and Priorities report taking up four spots among the top 10 challenges Federal taxes on business income and state taxes on business income both rank high