City Of Austin Hotel Occupancy Tax Report Form Printable You must provide a copy of each quarterly report to the Austin Code Department in order to renew your annual operating license Print the Hotel Occupancy Tax Report Check the box next to the statement above the signature line to declare that the information presented on the form is true and correct

The City of Austin s Hotel Occupancy Tax rate is 9 percent The City Council imposed a 7 percent tax rate under Ordinance No 900830 L approved on Aug 30 1990 An additional tax of 2 percent for venue projects was imposed on Aug 1 1998 under Ordinance No 980709 G These ordinances have been codified in Austin City Code Title 11 The Report of Hotel Occupancy Tax is available on this website The City of Austin does not accept alternate report forms All reports must be completed in full signed and dated in order to be accepted If you are unable to print this form please contact us at 512 974 2590 to request a report by mail or fax

City Of Austin Hotel Occupancy Tax Report Form Printable

City Of Austin Hotel Occupancy Tax Report Form Printable

https://www.exemptform.com/wp-content/uploads/2022/08/form-12-302-download-fillable-pdf-or-fill-online-hotel-occupancy-tax.png

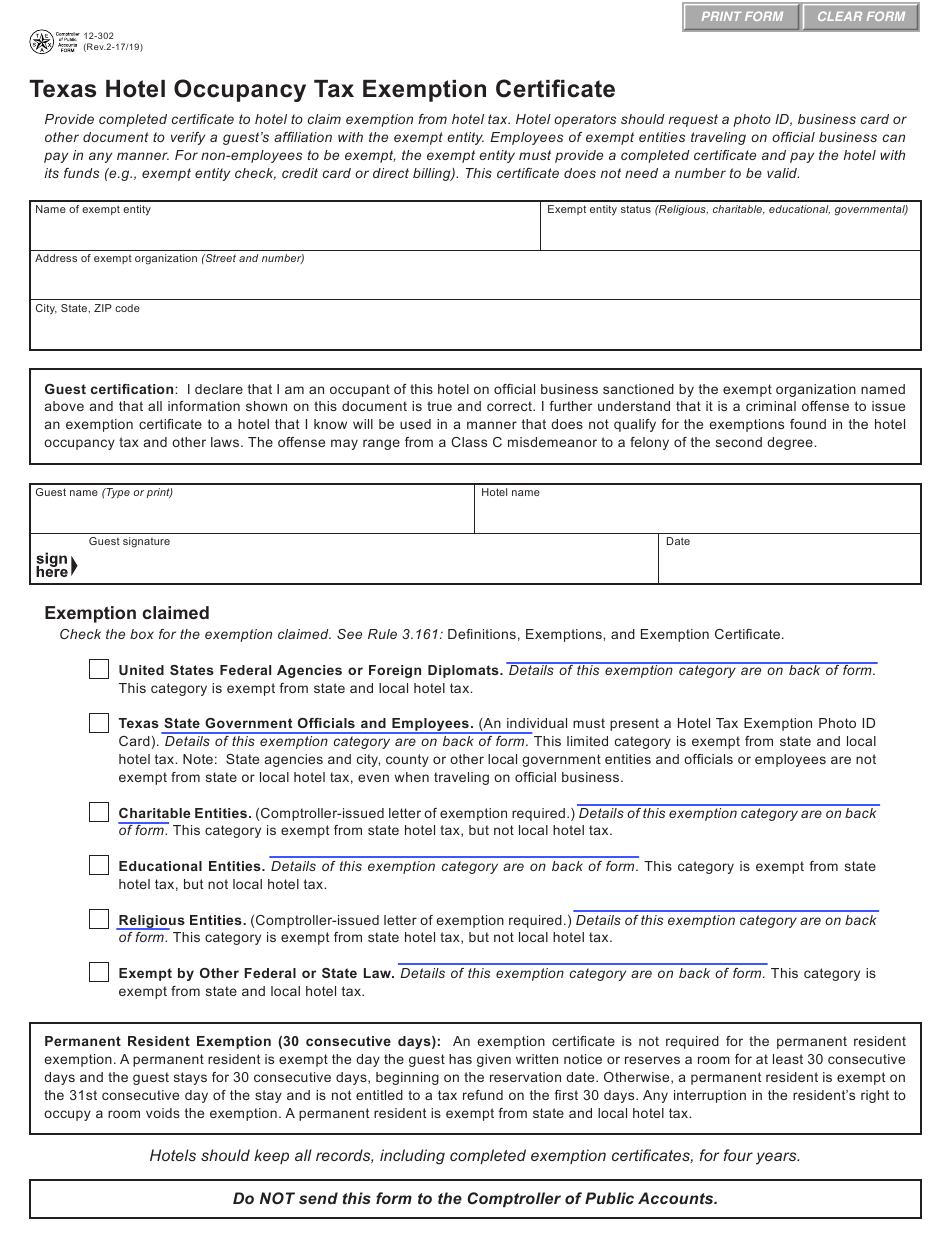

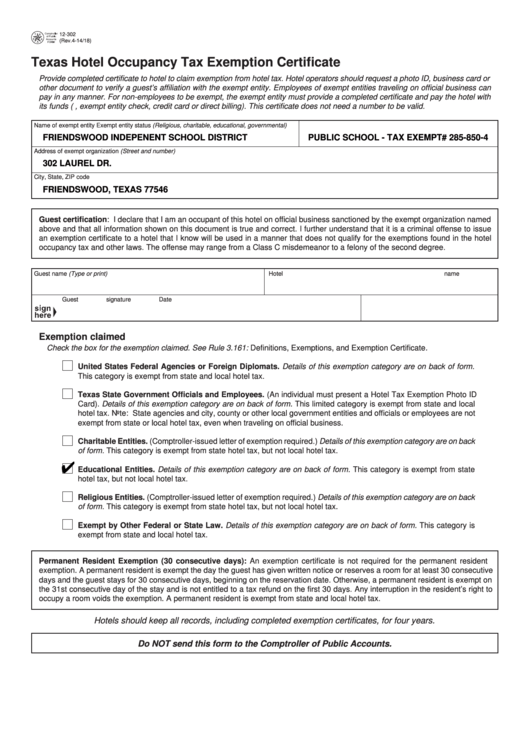

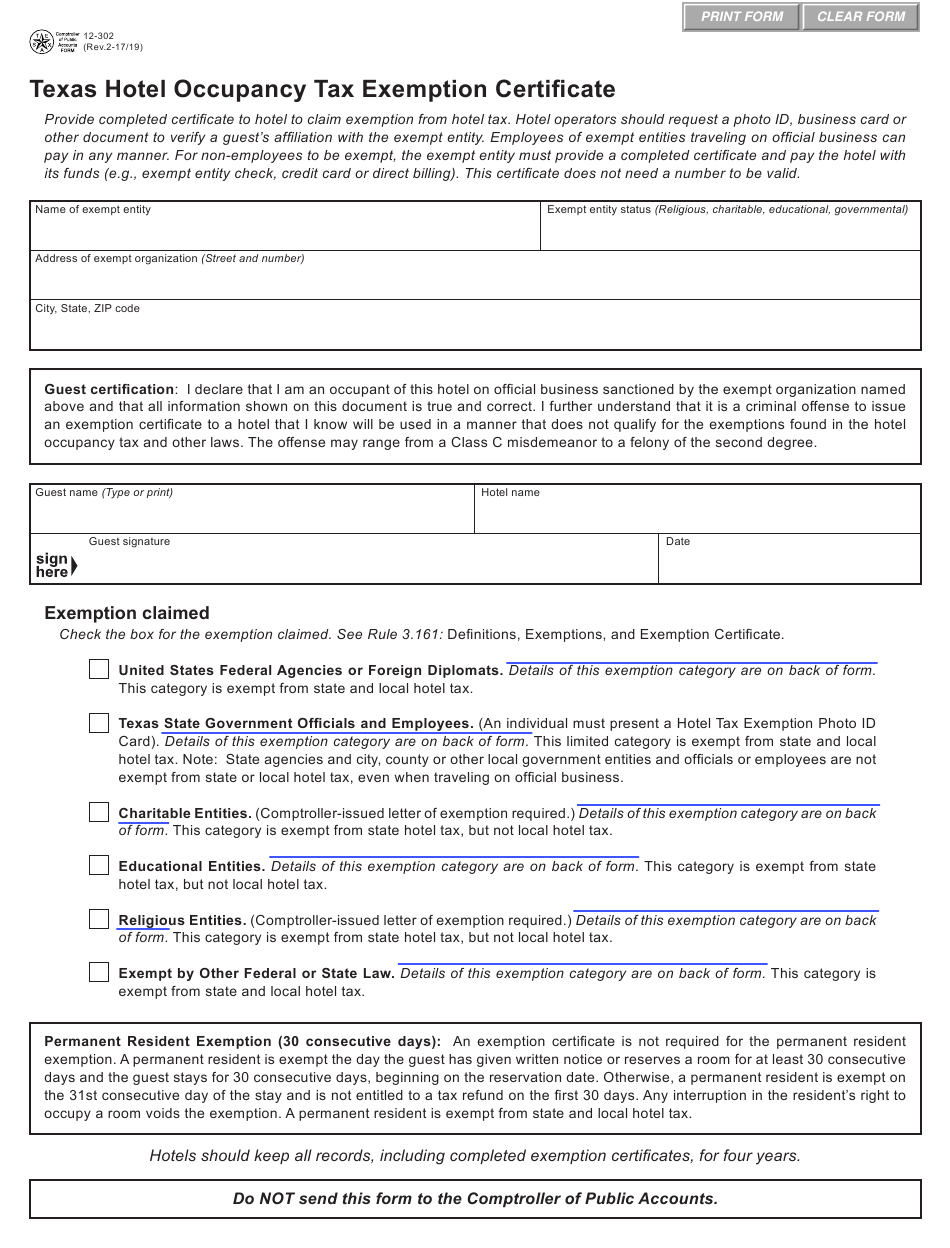

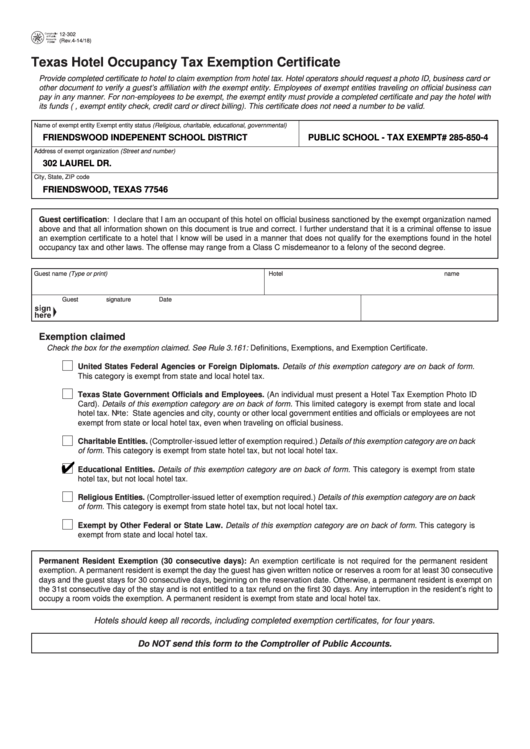

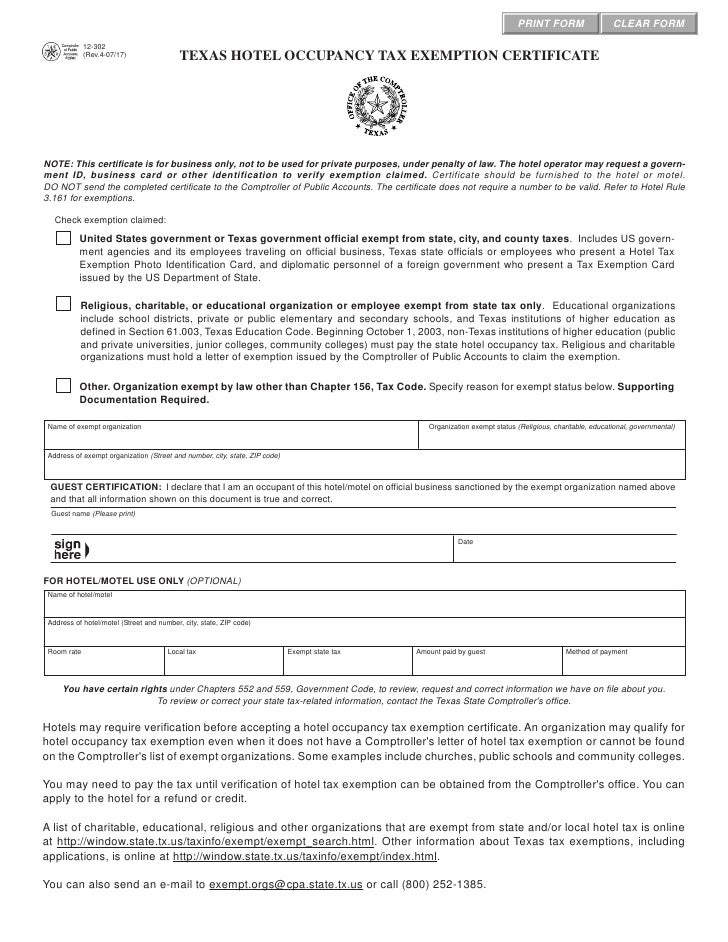

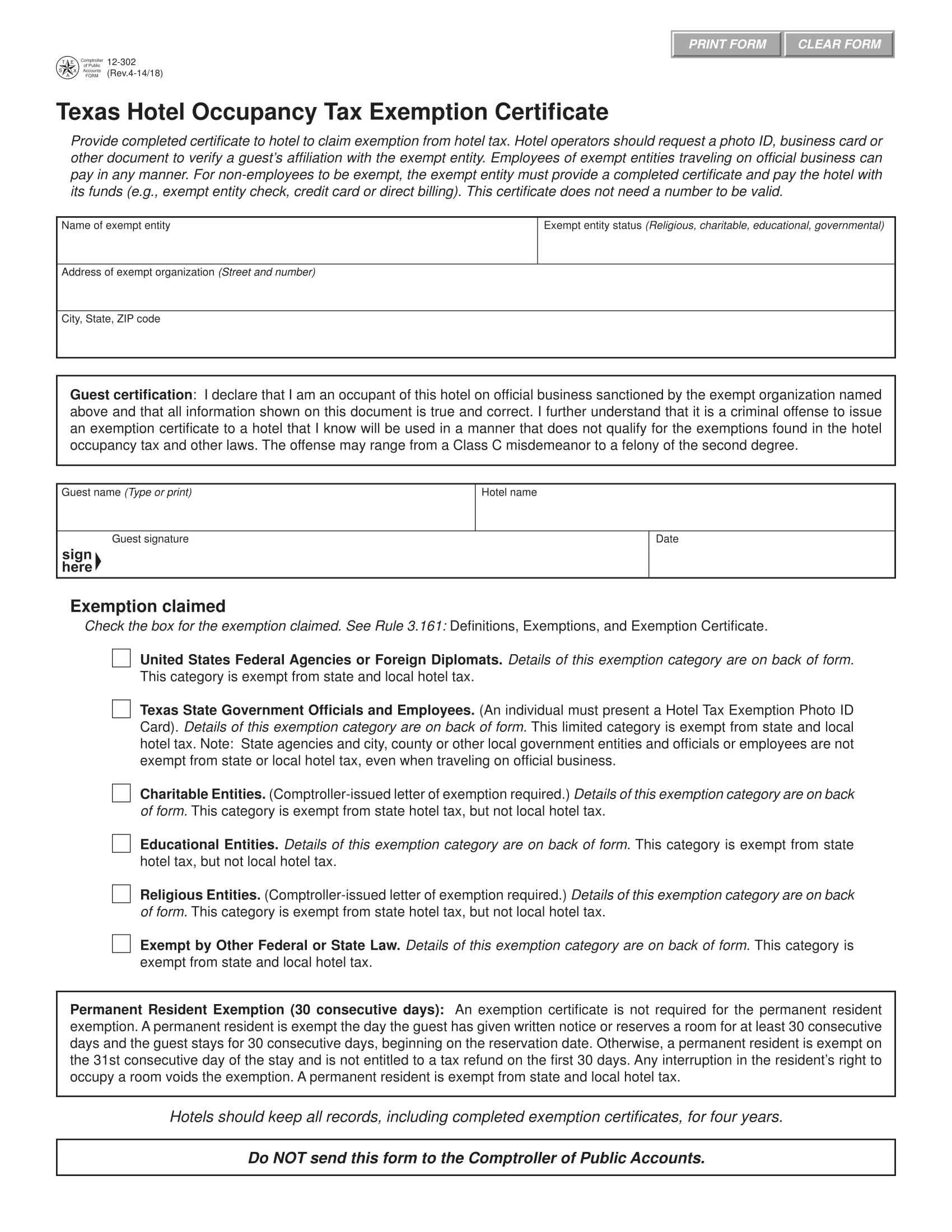

Fillable Form 12 302 Hotel Occupancy Tax Exemption Certificate Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/145/1459/145949/page_1_thumb_big.png

City Of Austin Hotel Occupancy Tax Report Form Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/145/1459/145951/page_1_thumb_big.png

The City of Austin Municipal Hotel Occupancy Tax rate is 11 percent The City Council authorized an increase to the Municipal Hotel Occupancy Tax from 7 to 9 effective on Aug 8 2019 under Ordinance No 20190808 148 The 7 percent tax rate was authorized under Ordinance No 900830 L approved on Aug 30 1990 Tax Line Hotel Occupancy Taxes 512 974 2590 Phone Send Email Contact Information 512 974 2600 Phone Mailing Address City of Austin FSD Hotel PO Box 2920 Austin TX 78768 2920 Physical Location 124 W 8th St Ste 125 2 Austin TX 78701 Open Hours

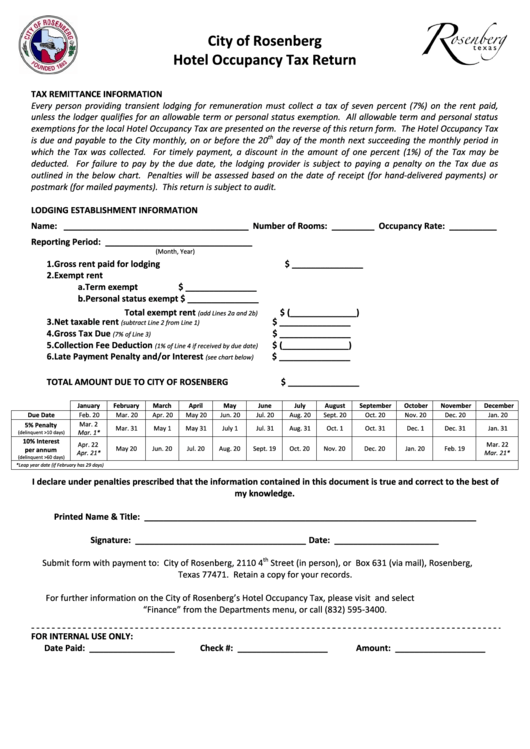

How much do I charge in hotel occupancy taxes Properties within the Austin Full Purpose Jurisdiction Charge customers a 15 hotel occupancy tax in addition to the room rate 9 of the hotel occupancy tax is collected and paid to the City of Austin and 6 of the hotel occupancy tax is collected and paid to the State of Texas Every person required to collect the Hotel Occupancy Tax must file a Report of Hotel Occupancy Tax quarterly with the City of Austin Controllers office showing the consideration paid for all room occupancies in the preceding quarter the amount of permanent 30 day and other exemptions granted and the amount of the tax collected on such occupancies

More picture related to City Of Austin Hotel Occupancy Tax Report Form Printable

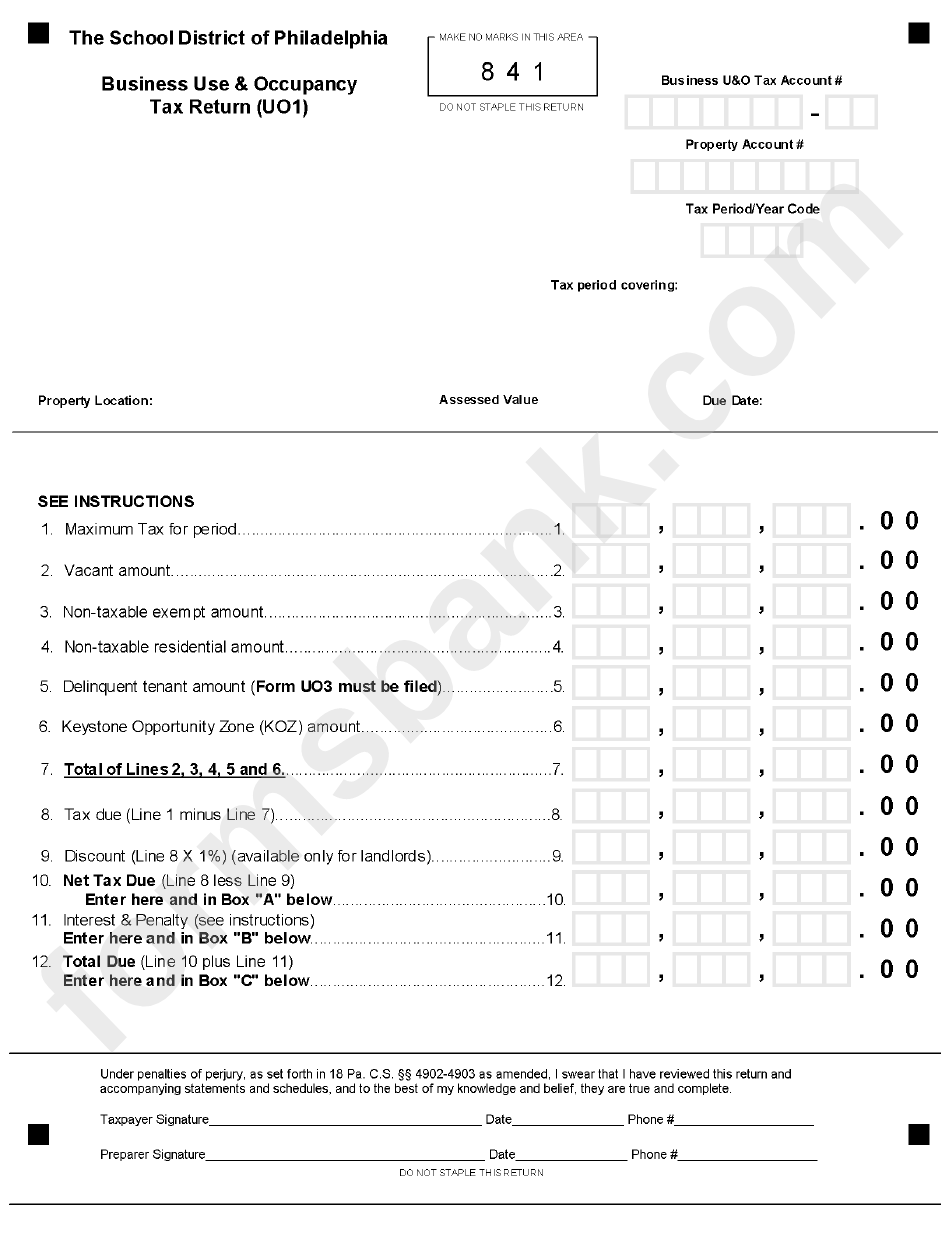

Form Uo1 Business Use Occupancy Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/269/2692/269202/page_1_bg.png

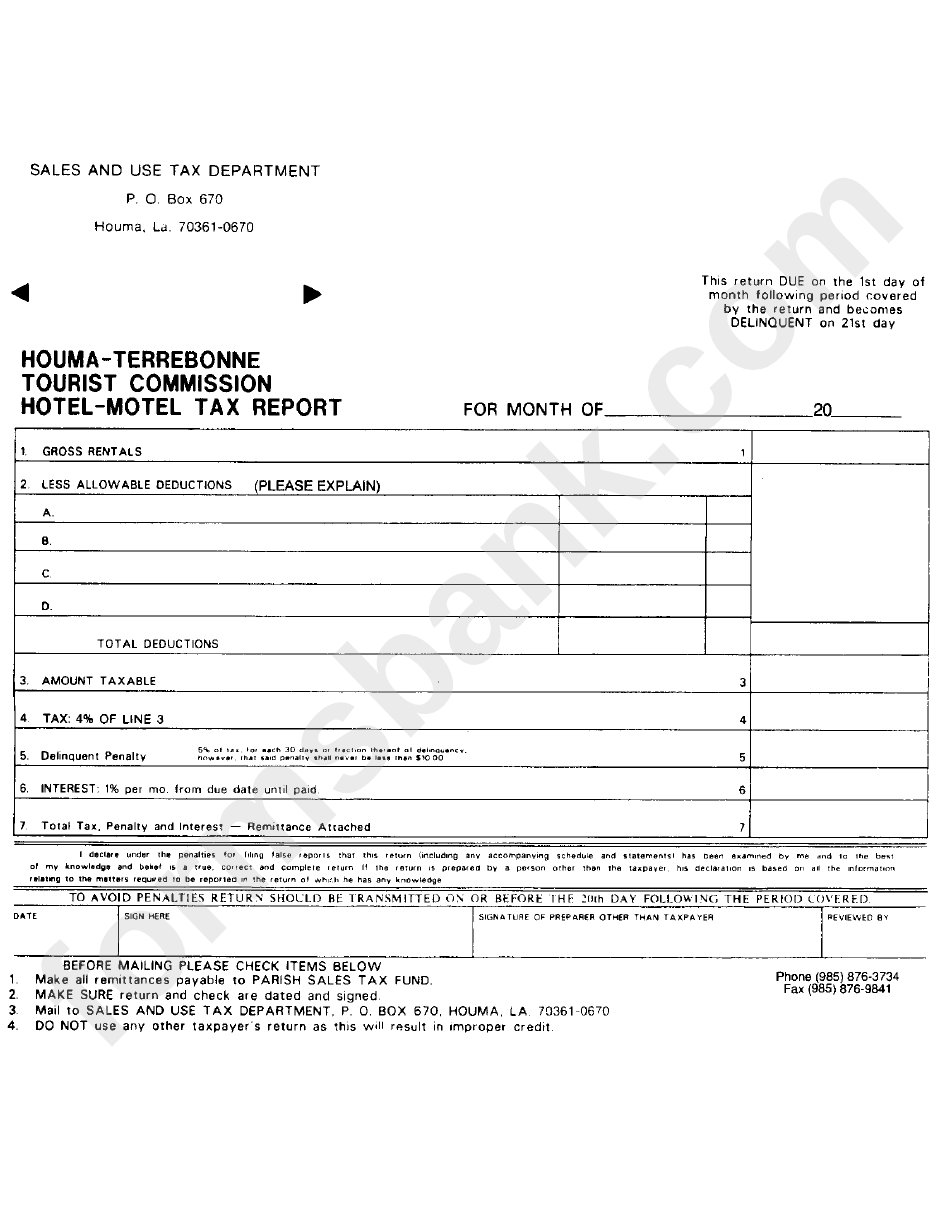

Hotel Motel Tax Report Form Houma Terrebonne Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/244/2447/244763/page_1_bg.png

City Of Austin Hotel Occupancy Tax Report Form Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/60/601/60188/page_1_thumb_big.png

CITY OF AUSTIN ECONOMIC DEVELOPMENT 1 HOTEL OCCUPANCY TAX UPDATE JANUARY 29 2024 o 22 4 towards FY24 Approved Budget of 152 172 894 o Cultural Arts Fund November 2023 604 297 Hotel Occupancy Tax Report Out past Plan present Collect future FY24 Grantees City Hotel Occupancy Tax is 11 The State of Texas imposes an additional Hotel Occupancy Tax City Hotel Occupancy Tax is due when the full room rate is paid and cancellation is within 30 days of the scheduled stay Fees paid that are less than the room rate are not taxable such as a percentage or sliding scale

The City s local hotel occupancy tax is in addition to the 6 percent rate imposed by the State of Texas which must be remitted separately to the State For information on the State Hotel Occupancy Tax please visit their website or call 1 800 252 1385 Currently AirBnB is collecting and remitting the 6 State Hotel Occupancy Tax to the State City of Austin Performance Report 2014 15 A Hotel Occupancy Tax of 15 0 cents per dollar is assessed to hotel guests staying in Austin hotels which is collected and remitted by the hotels The tax applies to traditional lodging such as hotels motels and bed and breakfasts but also applies to condominiums apartments and houses rented

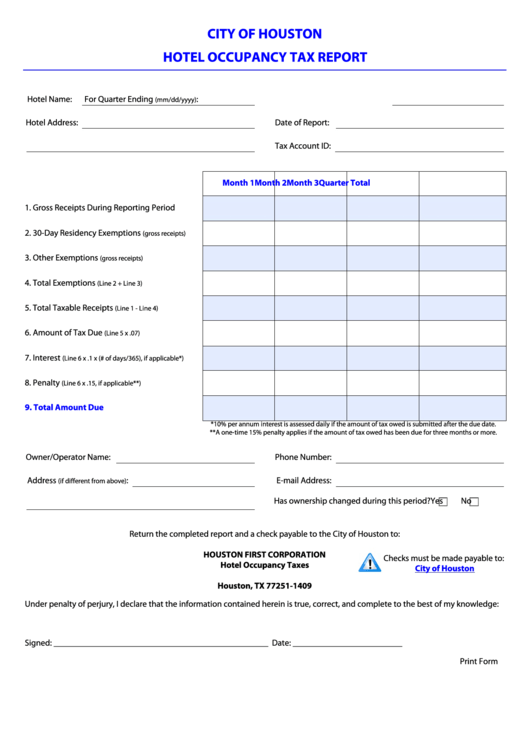

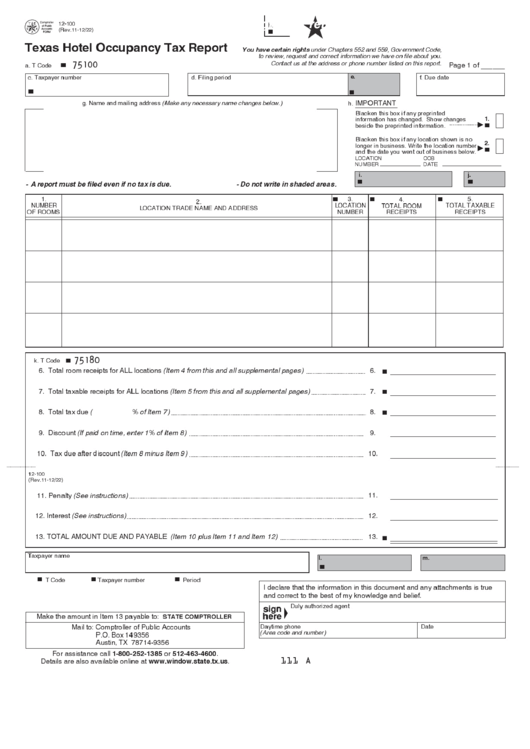

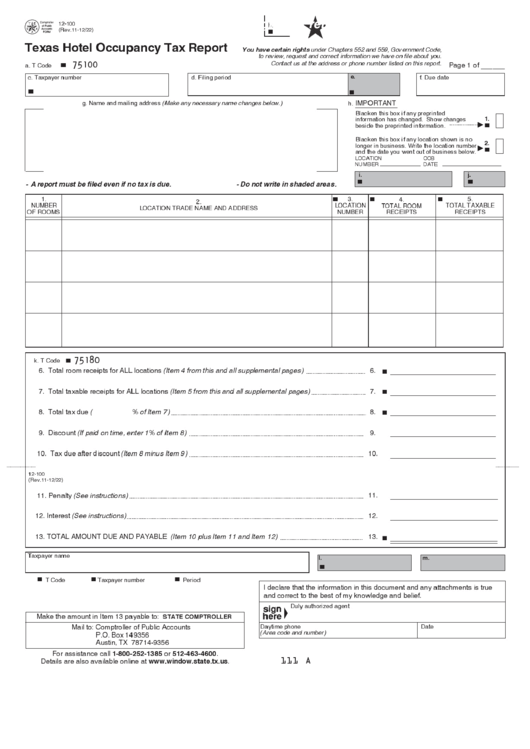

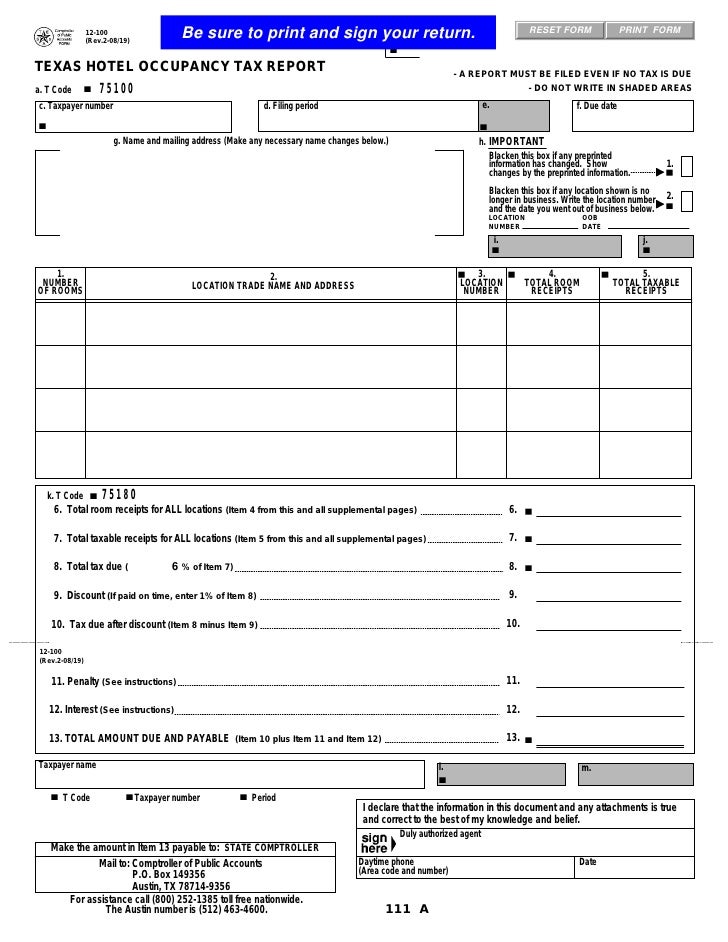

Fillable Form 12 100 Texas Hotel Occupancy Tax Report Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/316/3168/316867/page_1_thumb_big.png

City Of Austin Hotel Occupancy Tax Report Form Printable Printable Forms Free Online

https://www.countyforms.com/wp-content/uploads/2022/09/occupancy-tax-report-form-printable-pdf-download.png

https://www.austintexas.gov/page/hotel-occupancy-tax-report

You must provide a copy of each quarterly report to the Austin Code Department in order to renew your annual operating license Print the Hotel Occupancy Tax Report Check the box next to the statement above the signature line to declare that the information presented on the form is true and correct

https://www.austintexas.gov/page/hotel-occupancy-taxes-faq

The City of Austin s Hotel Occupancy Tax rate is 9 percent The City Council imposed a 7 percent tax rate under Ordinance No 900830 L approved on Aug 30 1990 An additional tax of 2 percent for venue projects was imposed on Aug 1 1998 under Ordinance No 980709 G These ordinances have been codified in Austin City Code Title 11

Texas Hotel Occupancy Tax Forms 12 302 Texas Hotel Occupancy Tax Exem

Fillable Form 12 100 Texas Hotel Occupancy Tax Report Printable Pdf Download

Texas Hotel Occupancy Tax Forms AP 102 Hotel Occupancy Tax Questionna

Sales Or Use Tax And Hotel Occupancy Tax Instructions Dc Department Of Finance And Revenue

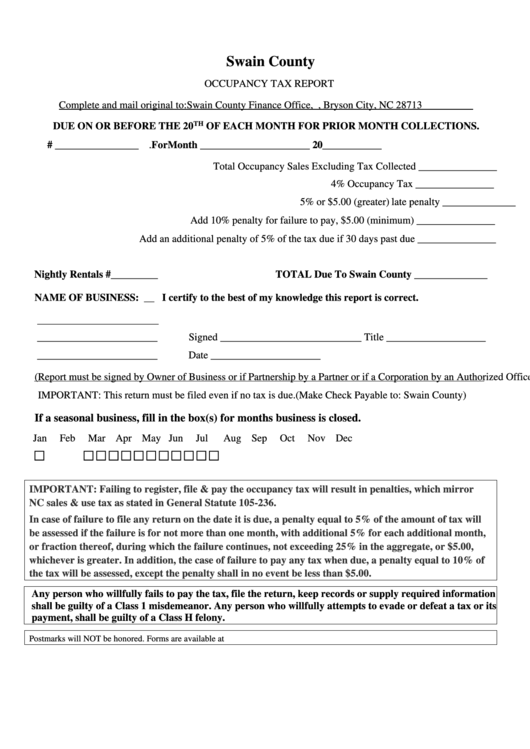

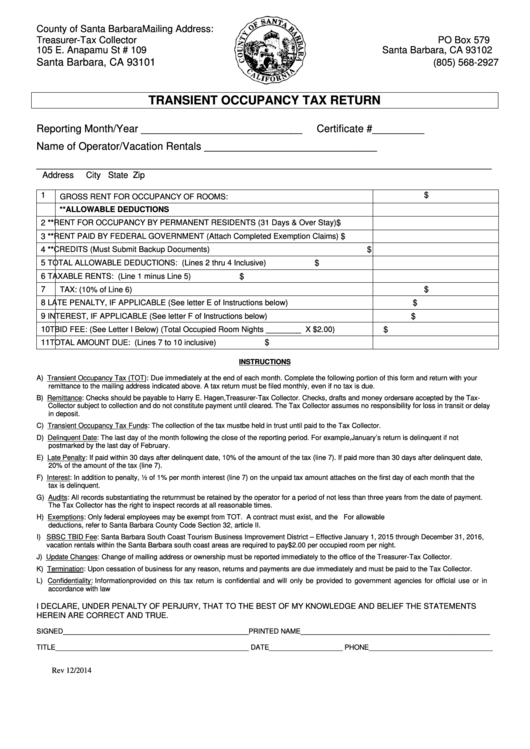

Fillable Transient Occupancy Tax Return Printable Pdf Download CountyForms

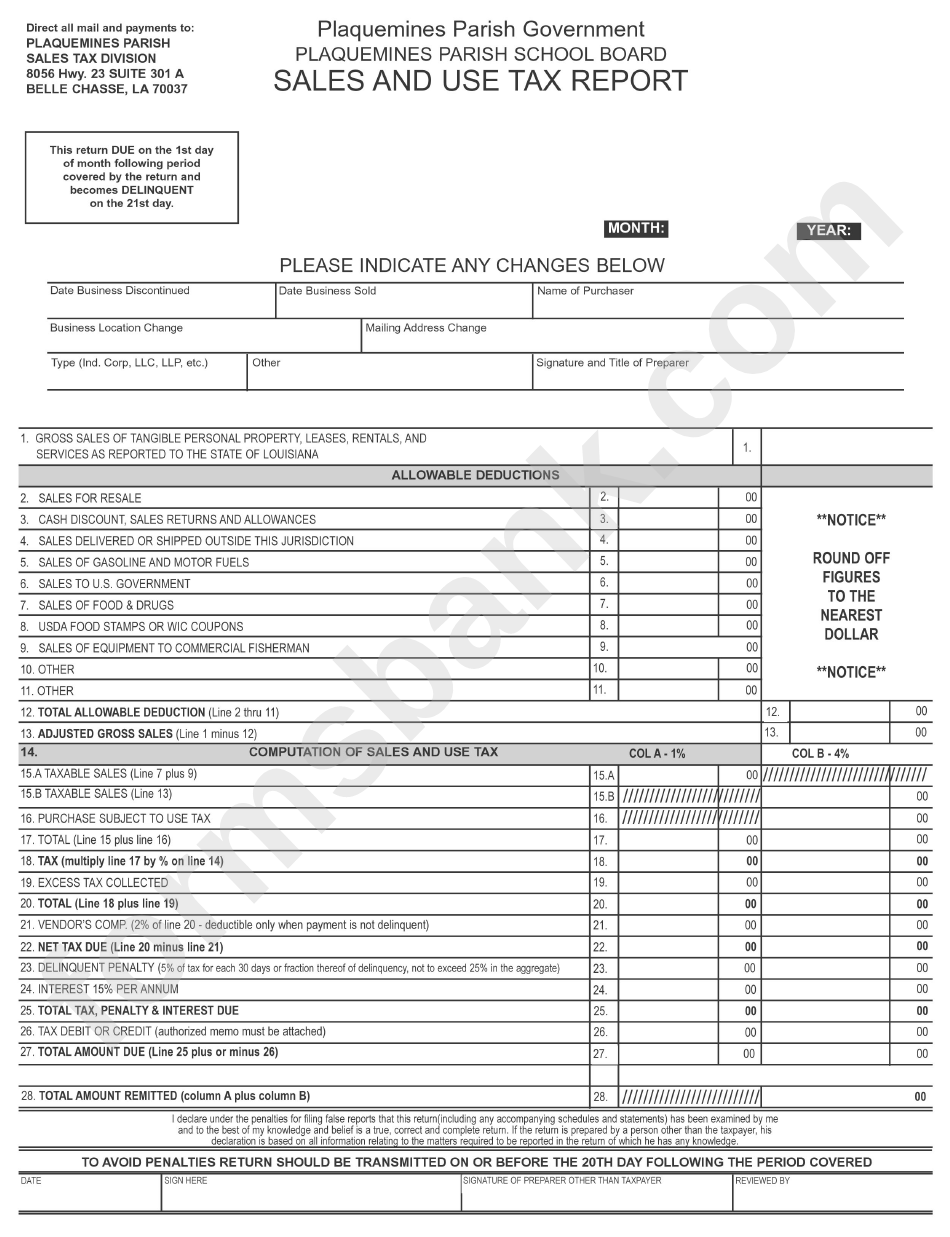

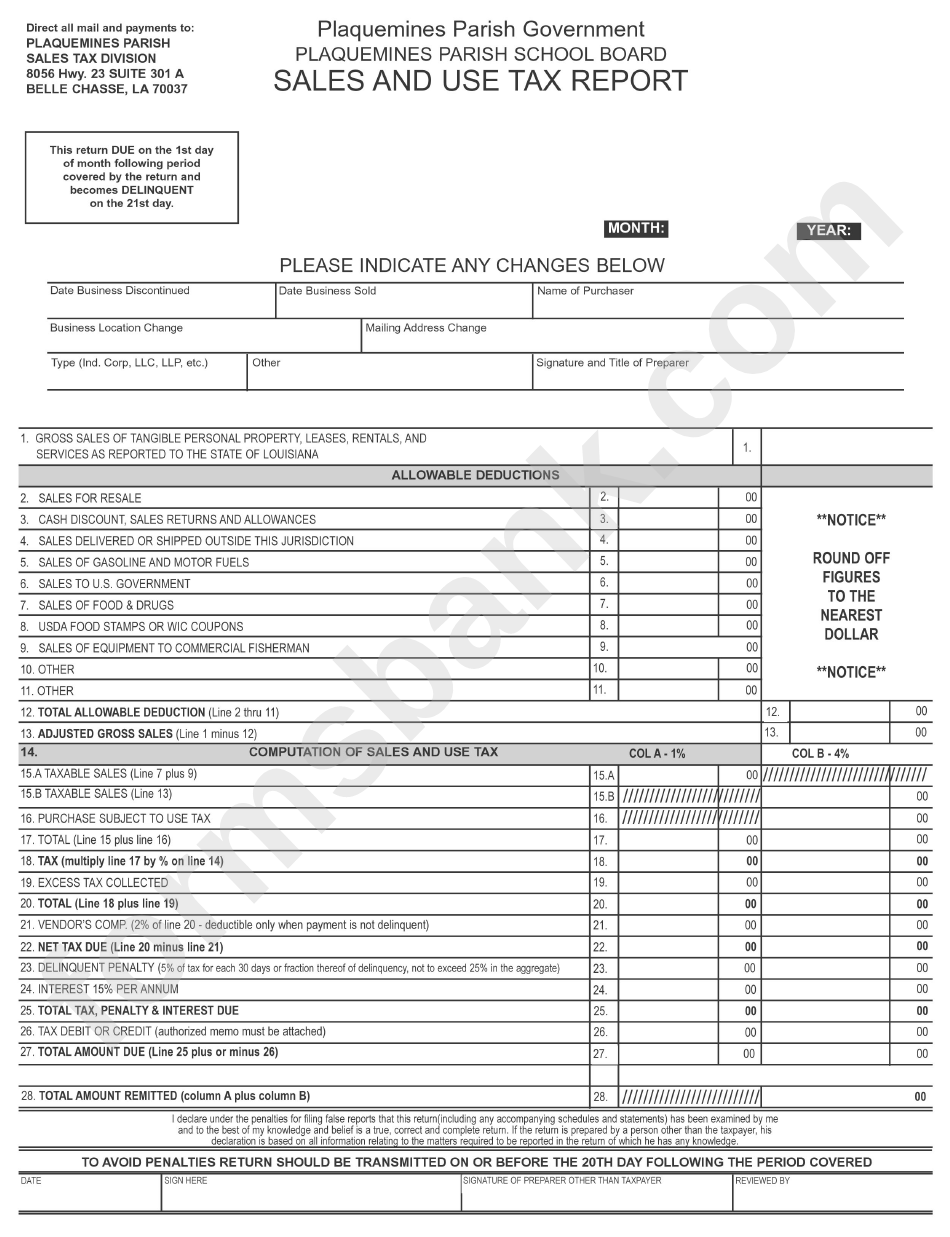

Sales And Use Tax Report Form Union Parish Printable Pdf Download Bank2home

Sales And Use Tax Report Form Union Parish Printable Pdf Download Bank2home

Texas Hotel Occupancy Tax Forms 12 100 Hotel Occupancy Tax Report

Texas Hotel Occupancy Tax Report Fill Online Printable Fillable Blank PdfFiller

Hotel Tax Exempt Form

City Of Austin Hotel Occupancy Tax Report Form Printable - To obtain your Certificate of Occupancy please email DSDCertificateofOccupancy austintexas gov Mail to City of Austin DSD Code Compliance Attn Finance STR PO Box 1088 Austin TX 78767 OR you may visit our office at 6310 Wilhelmina Delco Dr Austin TX 78752 between 8 00 a m to 3 00 p m