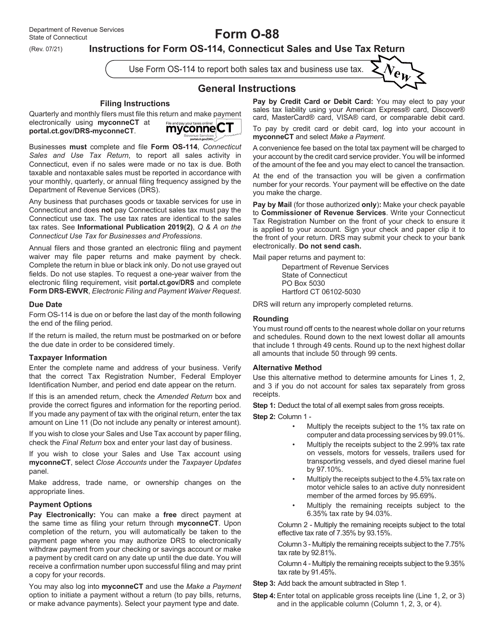

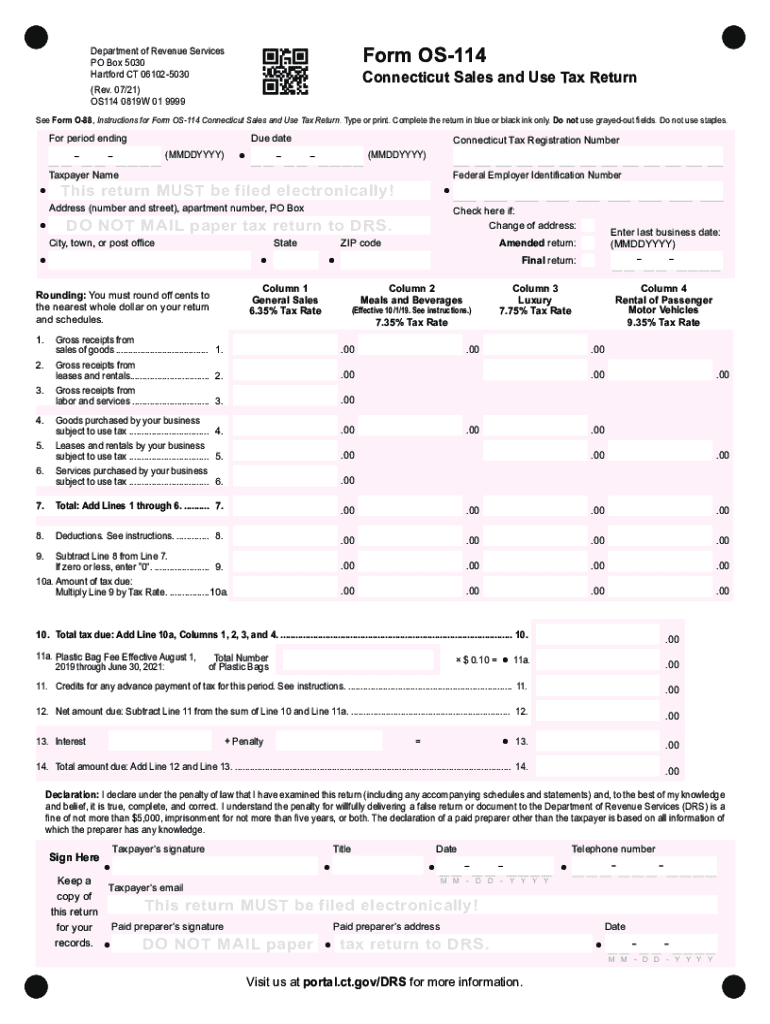

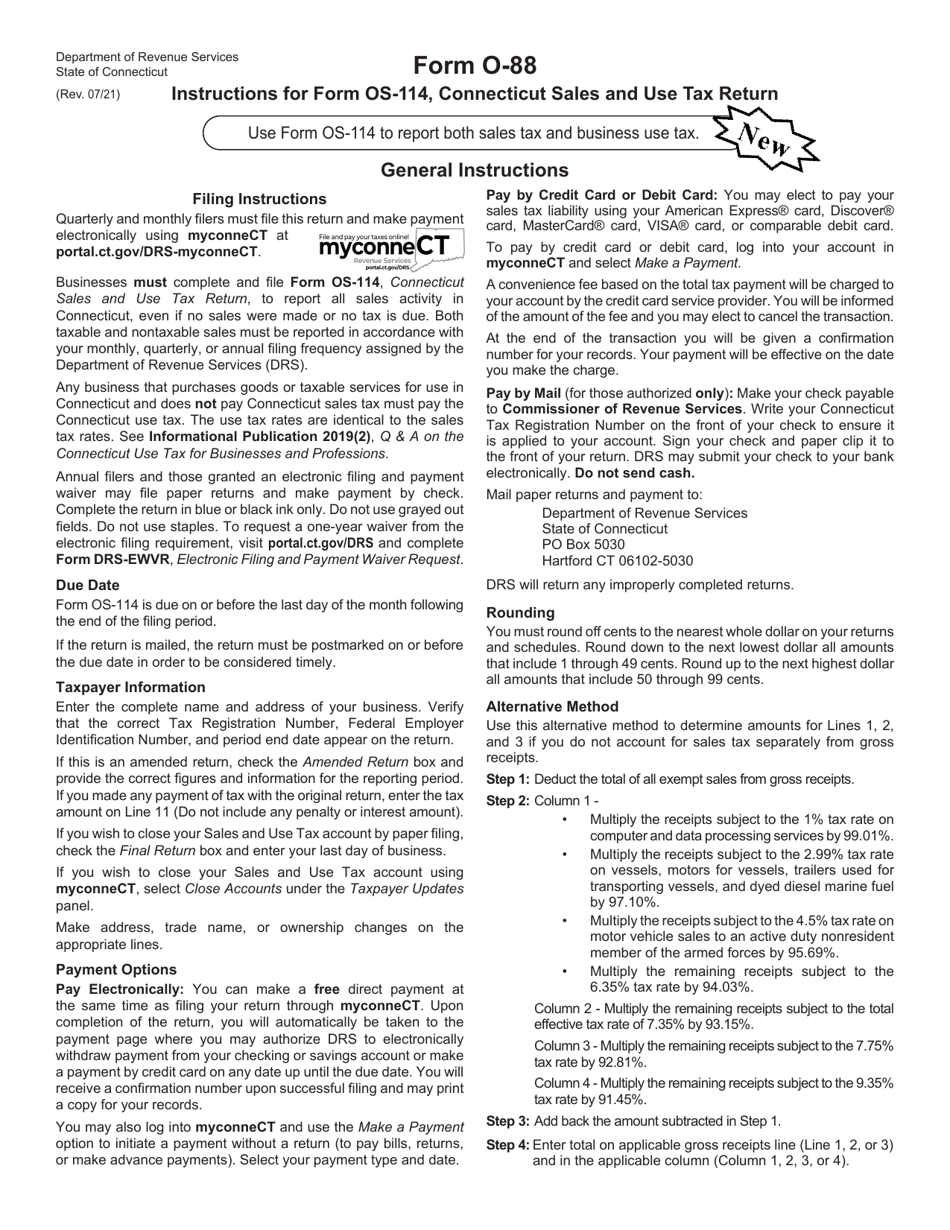

Ct Form Os 114 Printable General Instructions Filing Instructions File and pay Form OS 114 Connecticut Sales and Use Tax Return electronically using myconneCT at portal ct gov DRS myconneCT Annual filers are required to electronically file and pay for periods beginning on or after January 1 2022

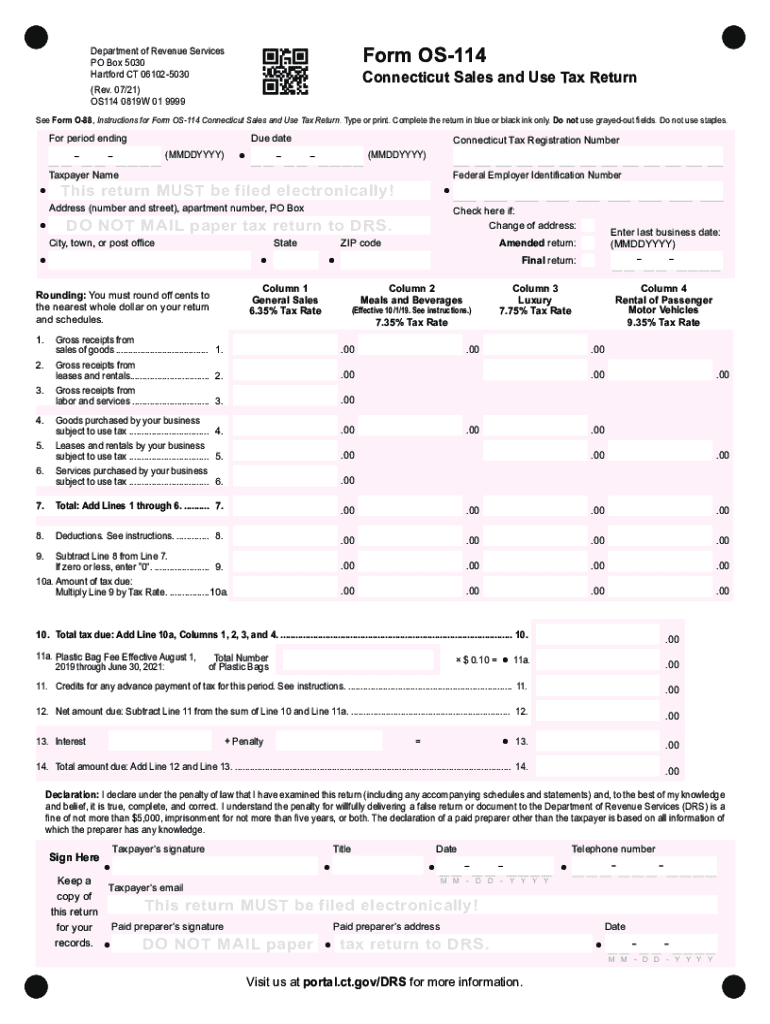

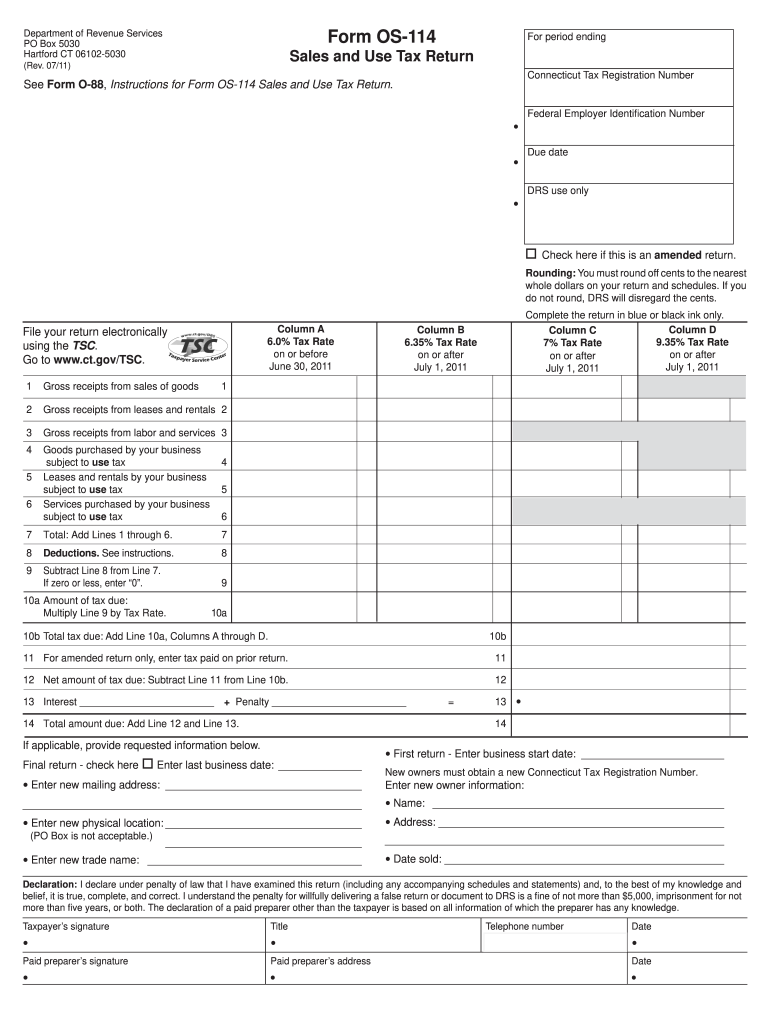

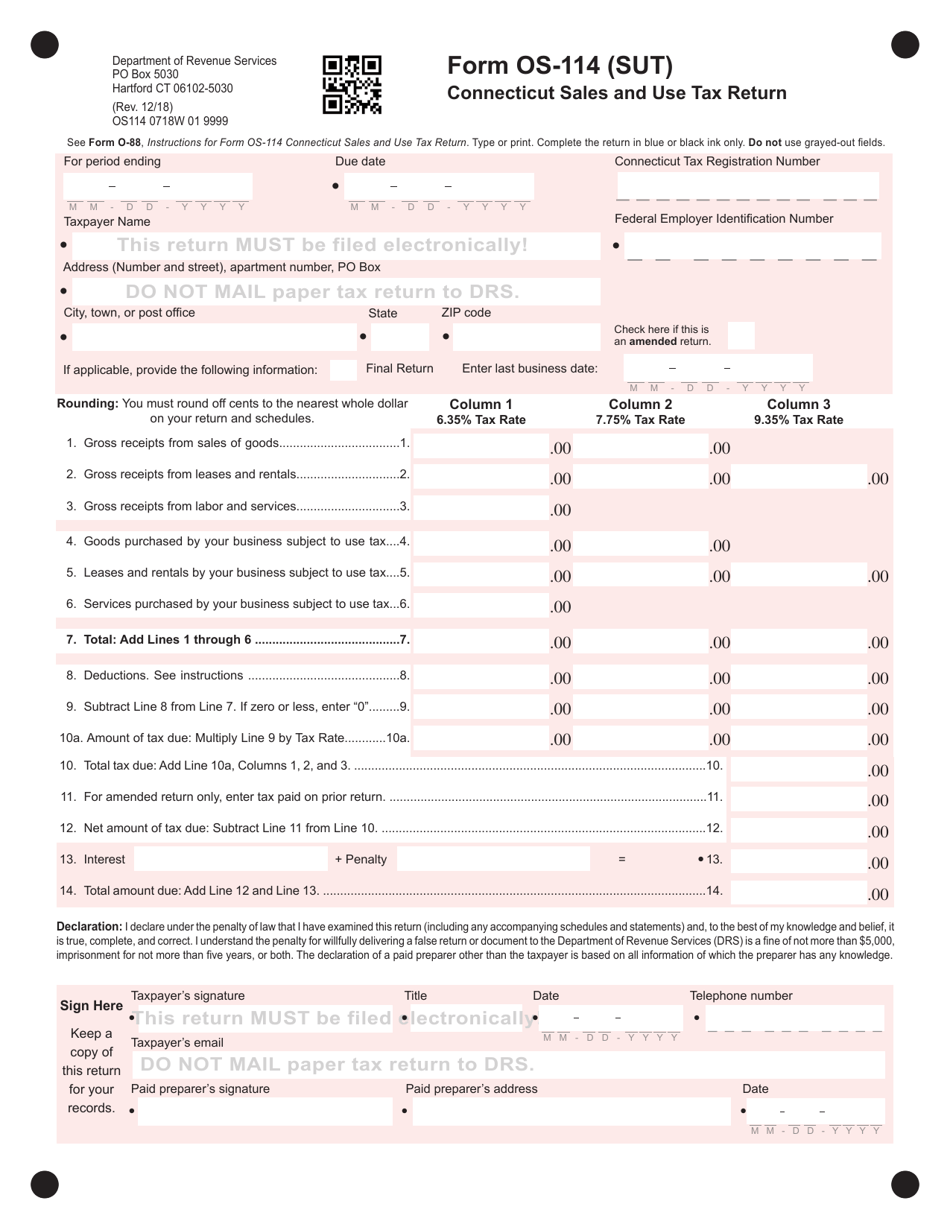

See Form O 88 Instructions for Form OS 114 Connecticut Sales and Use Tax Return Type or print Complete the return in blue or black ink only For period ending Due date M M D D Y Y Y Y M M D D Y Y Y Y Taxpayer Name This return MUST be filed electronically Address Number and street apartment number PO Box Search Bar for CT gov Search Language Settings Top Connecticut State Department of Revenue Filers of Form OS 114BUT must now use Form OS 114 File electronically on myconneCT Name Description Revised Date Due Date OS 114 Sales and Use Tax Return 02 2022 Varies O 88 Instructions for OS 114

Ct Form Os 114 Printable

Ct Form Os 114 Printable

https://data.templateroller.com/pdf_docs_html/2220/22209/2220989/instructions-for-form-os-114-connecticut-sales-and-use-tax-return-connecticut_big.png

Download Instructions For Form OS 114 Connecticut Sales And Use Tax Return PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2220/22209/2220989/page_1_thumb_950.png

Download Instructions For Form OS 114 Connecticut Sales And Use Tax Return PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2220/22209/2220989/page_3_thumb_950.png

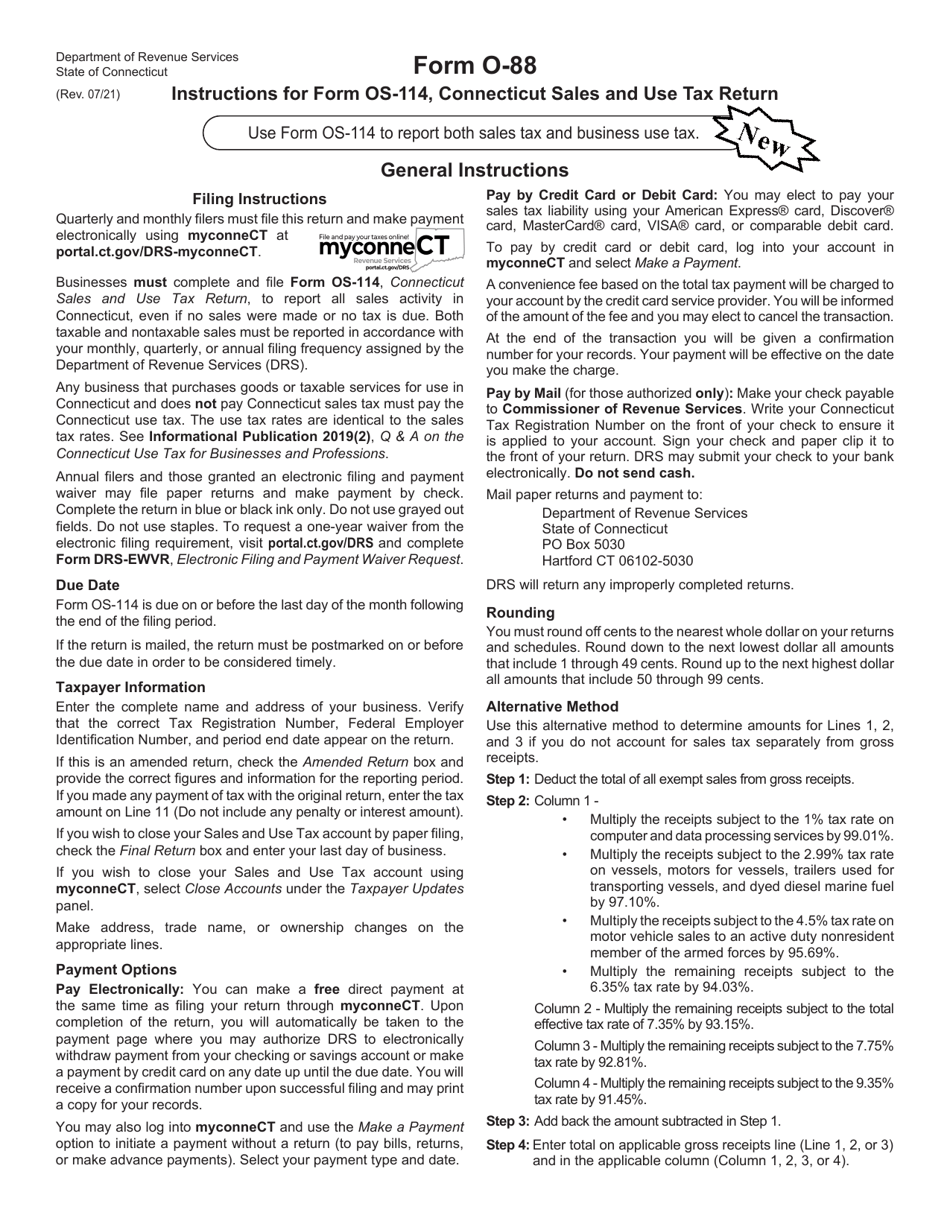

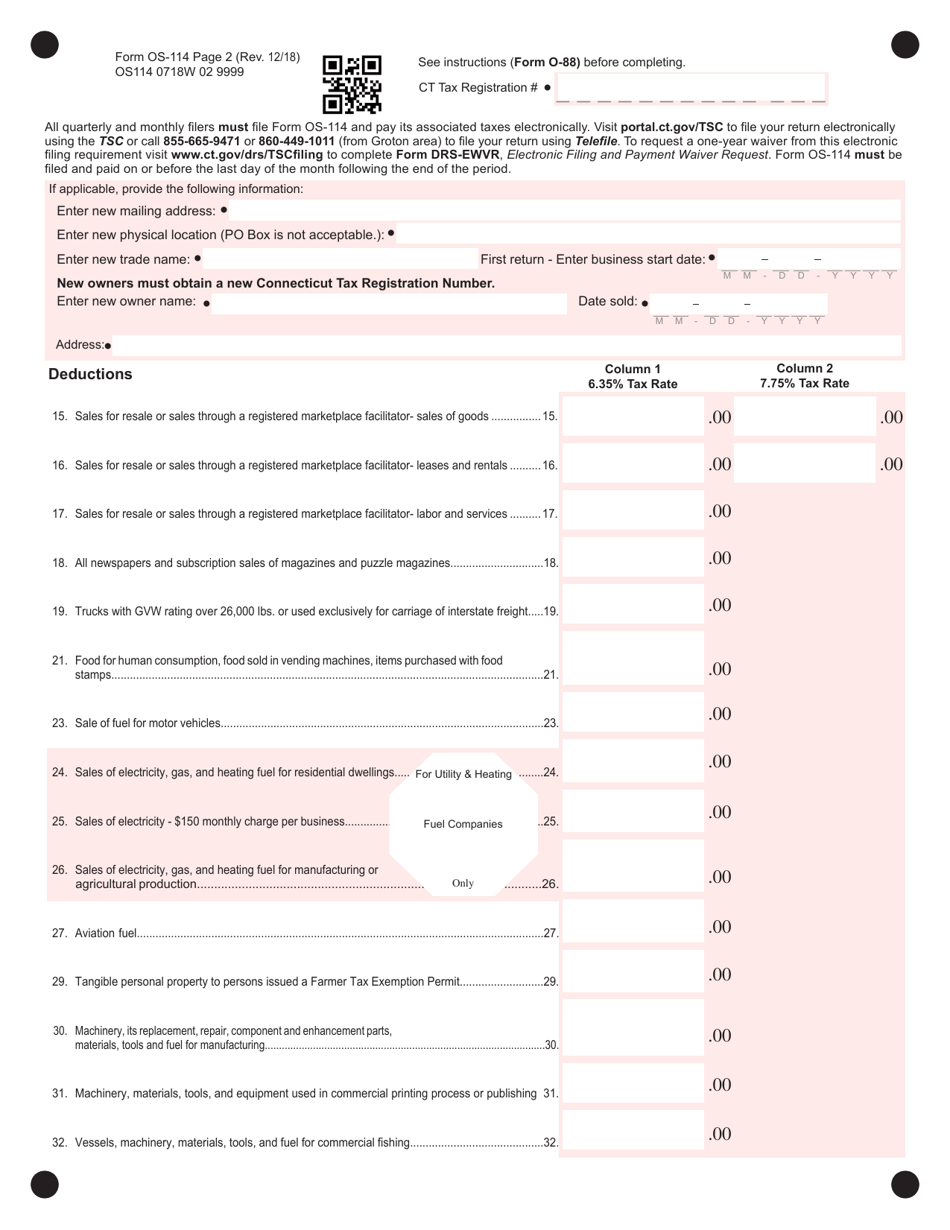

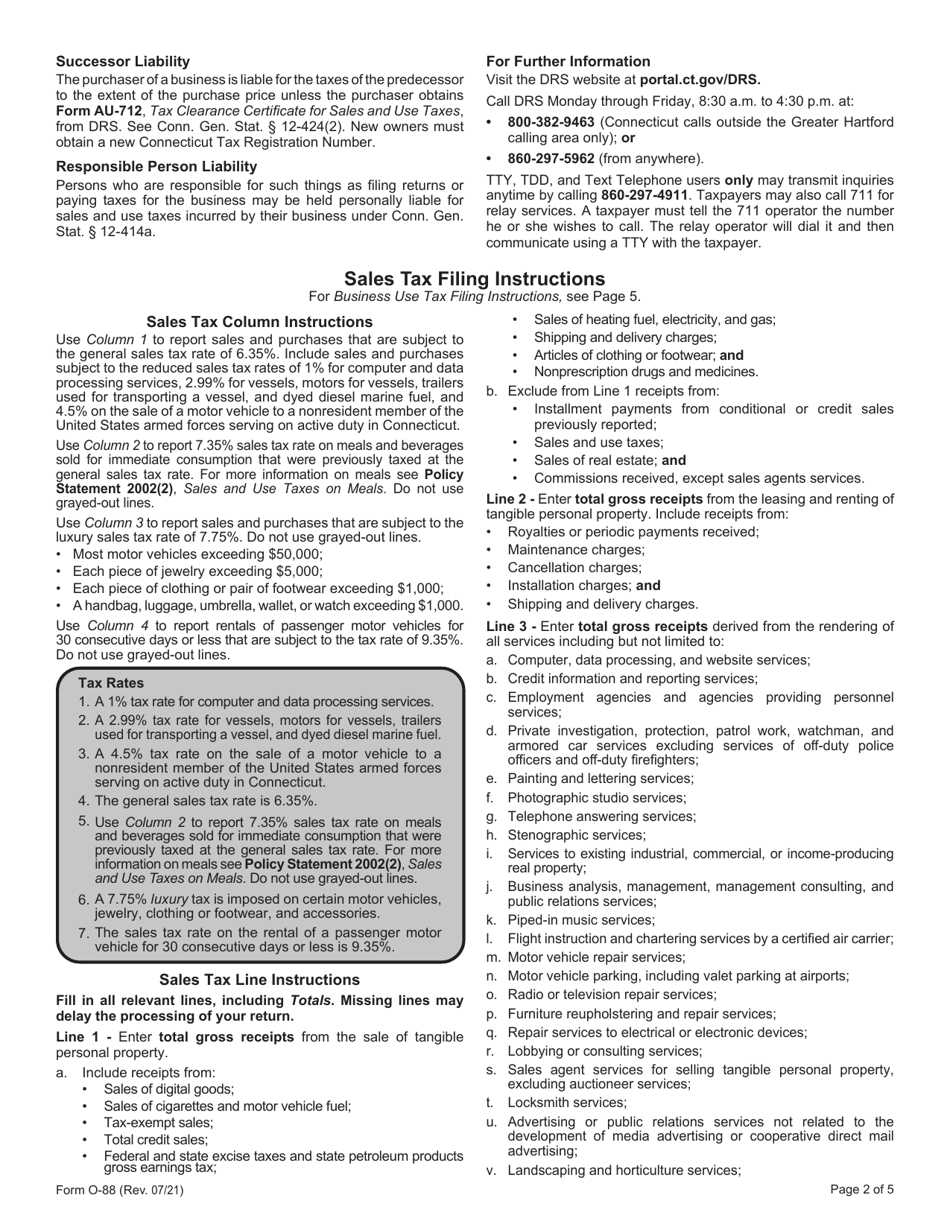

Instructions for Form OS 114 Sales and Use Tax Return Check here if this is an amended return Rounding You must round off cents to the nearest whole dollars on your return and schedules If you do not round DRS will disregard the cents Complete the return in blue or black ink only If applicable provide requested information below Businesses must complete and file Form OS 114 Connecticut Sales and Use Tax Return to report all sales activity in Connecticut even if no sales were made or no tax is due Both taxable and nontaxable sales must be reported in accordance with your monthly quarterly or annual filing frequency assigned by the Department of Revenue Services DRS

What Is Form OS 114 Form OS 114 SUT Connecticut Sales and Use Tax Return is a document that all individuals businesses and organizations registered for sales and use taxes in the State of Connecticut must file to report their sales activity in the state They have to do reports based on this form monthly quarterly and annually Form OS 114 SUT Connecticut Sales and Use Tax Return Department of Revenue Services PO Box 5030 Hartford CT 06102 5030 Rev 02 16 OS114 00 16W 01 9999 MMDDYYYY Sign Here Keep a copy of this return for your records Taxpayer s signature Title Date MMDDYYYY Telephone number Taxpayer s email

More picture related to Ct Form Os 114 Printable

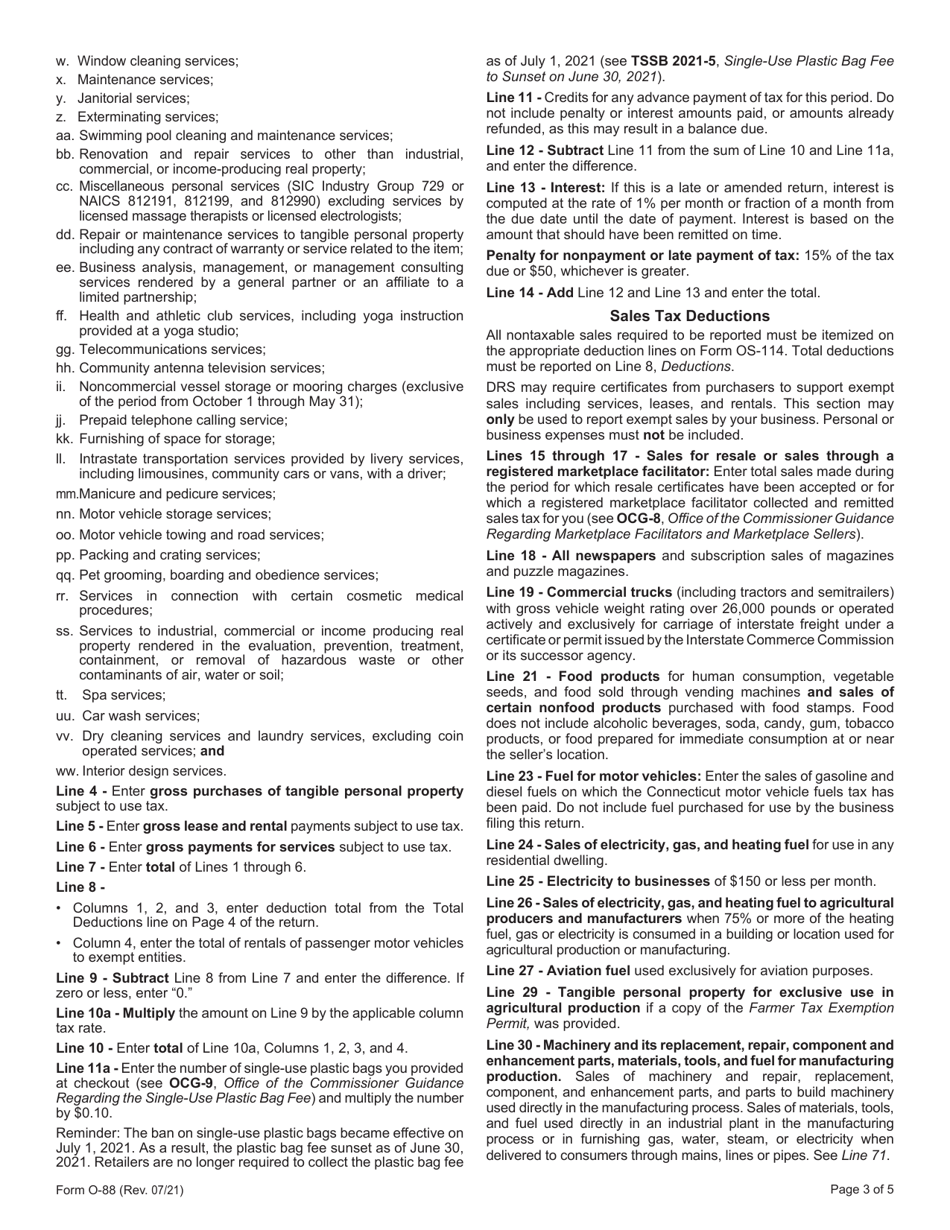

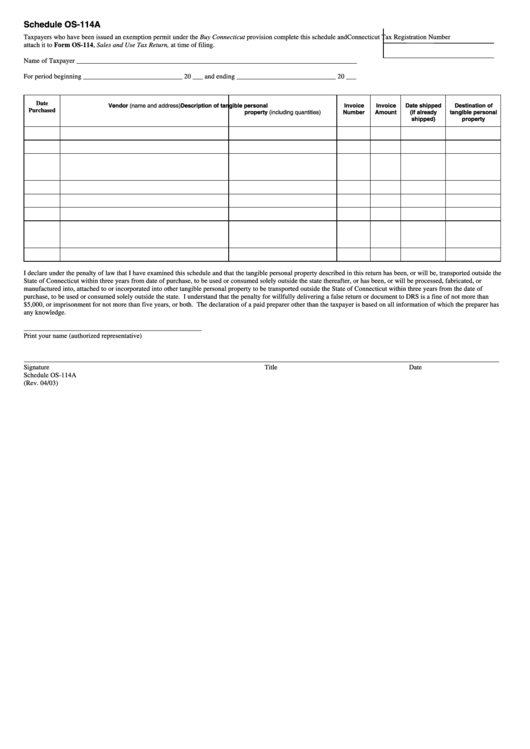

Fillable Schedule Form Os 114a Connecticut Tax Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/271/2710/271030/page_1_thumb_big.png

Schedule Os 114a Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/318/3182/318240/page_1_thumb_big.png

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples Mj1vWllKwy

https://i2.wp.com/childforallseasons.com/wp-content/uploads/2019/12/irs-form-433-b-instructions.jpg

You must complete and fi le Form OS 114 Sales and Use Tax Return even if no sales were made or no tax is due If you are fi ling an amended return check the box on the return Complete the return in blue or black ink only Due Date Form OS 114 is due on or before the last day of the month following the end of the fi ling period Download Printable Form Os 114 In Pdf The Latest Version Applicable For 2023 Fill Out The Connecticut Sales And Use Tax Return Connecticut Online And Print It Out For Free Form Os 114 Is Often Used In Connecticut Department Of Revenue Services Connecticut Legal Forms Legal And United States Legal Forms

CT OS 114 Information Businesses must complete and file Form OS 114 Sales and Use Tax Return even if no sales were made or no tax is due Form OS 114 is due on or before the last day of the month following the end of the filing period Link to official form info Connecticut OS 114 Upcoming Due Dates in the Next Year This blog gives instructions on how to file and pay sales tax in Connecticut using form OS 114 Read on for more detailed information If you do not have a CT REG username and password then your first step is setting that up If you forgot to print or save a copy of your sales tax return don t sweat it You can easily go back into

2021 Form CT DRS OS 114 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/572/558/572558501/large.png

Form OS 114 SUT Fill Out Sign Online And Download Printable PDF Connecticut Templateroller

https://data.templateroller.com/pdf_docs_html/1999/19995/1999523/page_2_thumb_950.png

https://portal.ct.gov/-/media/DRS/Forms/2022/SUT/O-88_0222.pdf

General Instructions Filing Instructions File and pay Form OS 114 Connecticut Sales and Use Tax Return electronically using myconneCT at portal ct gov DRS myconneCT Annual filers are required to electronically file and pay for periods beginning on or after January 1 2022

https://portal.ct.gov/-/media/DRS/Forms/1-2018/SUT/OS-114_1218.pdf?la=en

See Form O 88 Instructions for Form OS 114 Connecticut Sales and Use Tax Return Type or print Complete the return in blue or black ink only For period ending Due date M M D D Y Y Y Y M M D D Y Y Y Y Taxpayer Name This return MUST be filed electronically Address Number and street apartment number PO Box

Download Instructions For Form OS 114 Connecticut Sales And Use Tax Return PDF Templateroller

2021 Form CT DRS OS 114 Fill Online Printable Fillable Blank PdfFiller

Fillable Online Tax Ny Instructions For Form OS 114 Connecticut Sales And Use Tax Fax Email

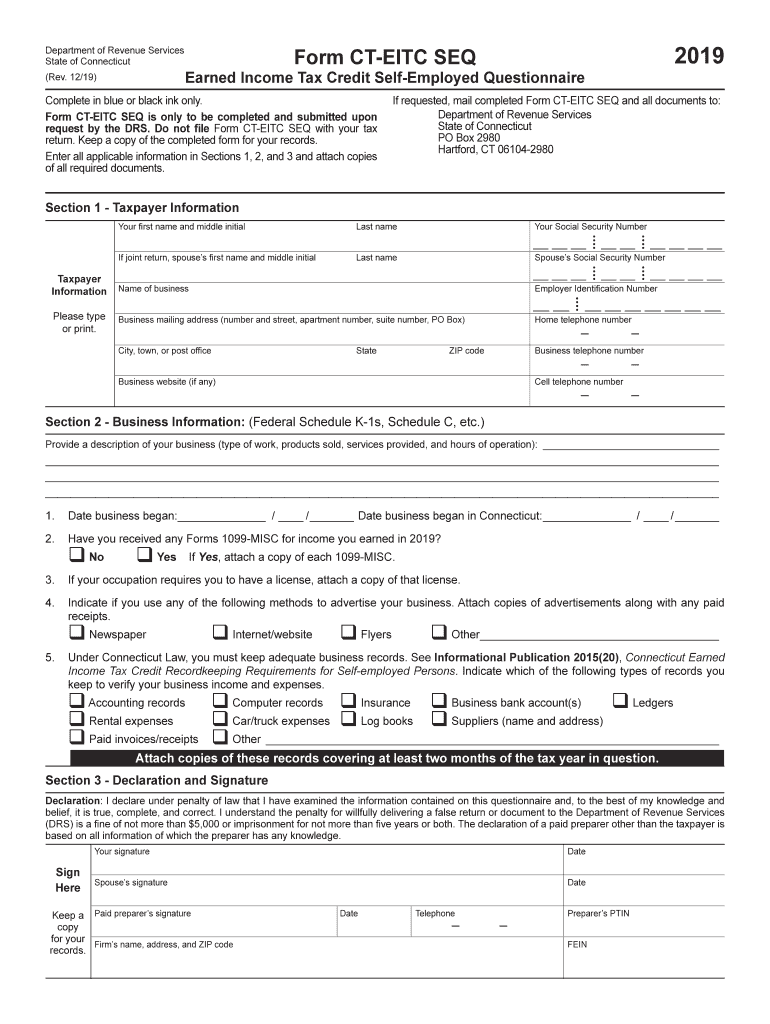

2018 Ct Eitc Fill Out And Sign Printable PDF Template SignNow

Ct Form Os 114 Fill Out Printable PDF Forms Online

Divorce In Ct Fill Online Printable Fillable Blank Pdffiller Printable Online Connecticut

Divorce In Ct Fill Online Printable Fillable Blank Pdffiller Printable Online Connecticut

Ct Form Os 114 Fill Out Printable PDF Forms Online

Ct Form Os 114 File Online Fill Out And Sign Printable PDF Template SignNow

Form OS 114 SUT Fill Out Sign Online And Download Printable PDF Connecticut Templateroller

Ct Form Os 114 Printable - Instructions for Form OS 114 Sales and Use Tax Return Check here if this is an amended return Rounding You must round off cents to the nearest whole dollars on your return and schedules If you do not round DRS will disregard the cents Complete the return in blue or black ink only If applicable provide requested information below