Dave Ramsey Debt Snowball Form Printable Dave Ramsey highly recommends the debt snowball method to eliminate your debt in the Baby Steps but let s dig into what template can help you get out of Baby Step 2 fast Let s go through great printables excel and PDF resources to help you eliminate your debt

The Debt Snowball made famous for being part of Dave Ramsey s Baby Steps helped me and my wife pay off over 52 000 in debt in 18 months This is the exact debt snowball form that we used to get out debt in that short period of time There are tons of ways to pay off debt but I would argue that this method is the most successful Dave Ramsey s 7 Baby Steps Ramsey Find Out Which Step You re On Step 1 Save 1 000 for your starter emergency fund Step 2 Pay off all debt except the house using the debt snowball Learn More Step 3 Save 3 6 months of expenses in a fully funded emergency fund Learn More Step 4 Invest 15 of your household income in retirement Learn More

Dave Ramsey Debt Snowball Form Printable

Dave Ramsey Debt Snowball Form Printable

https://i.pinimg.com/originals/ef/49/76/ef4976add31f8925e4fdfc0d05b7b4cf.jpg

![]()

10 Free Debt Snowball Worksheet Printables To Help You Get Out Of Debt

https://www.moneymindedmom.com/wp-content/uploads/2019/12/Debt-Snowball-Tracker-1.jpg

Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

https://i.etsystatic.com/22559710/r/il/ba1bf5/2308132247/il_1140xN.2308132247_s7cu.jpg

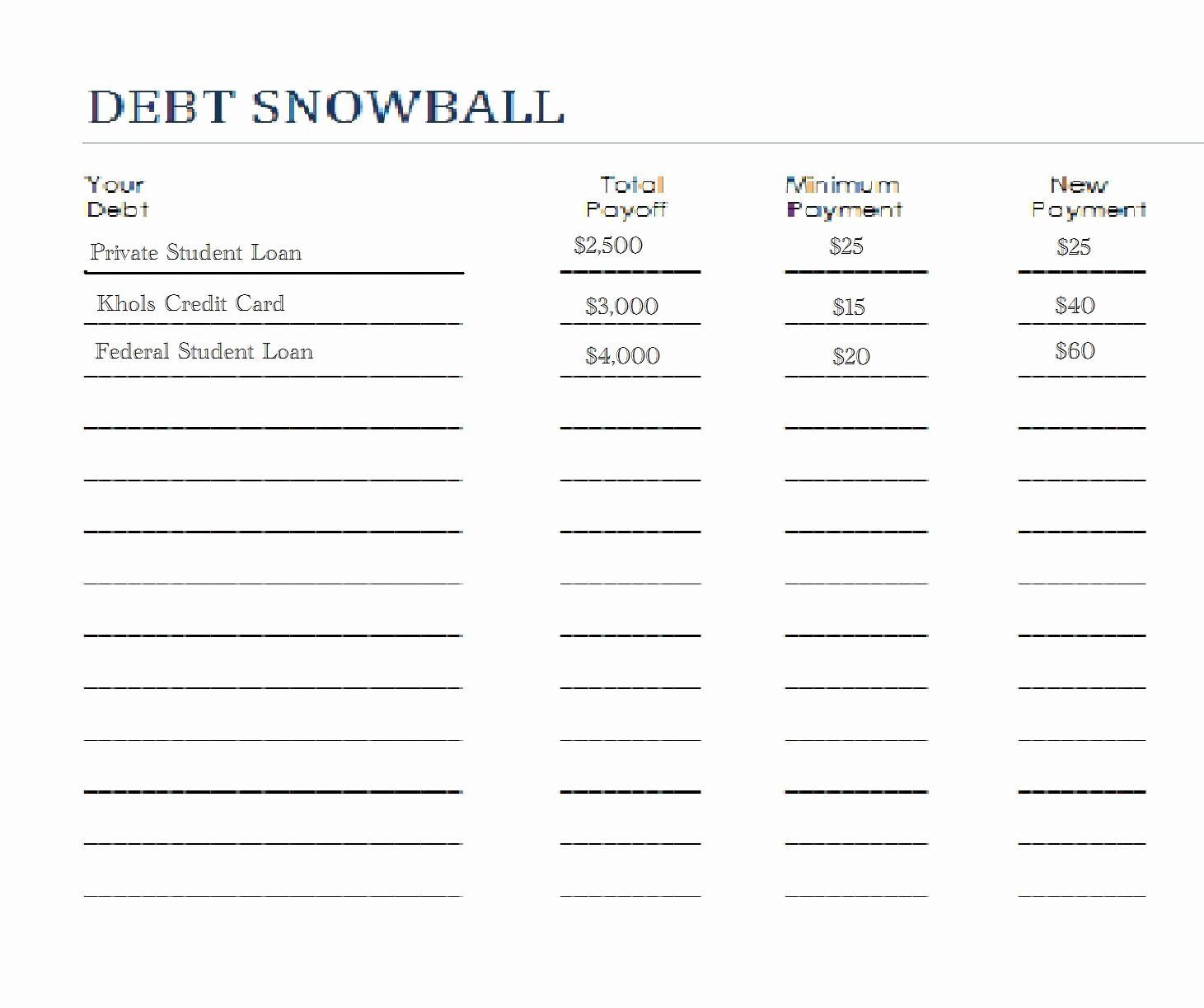

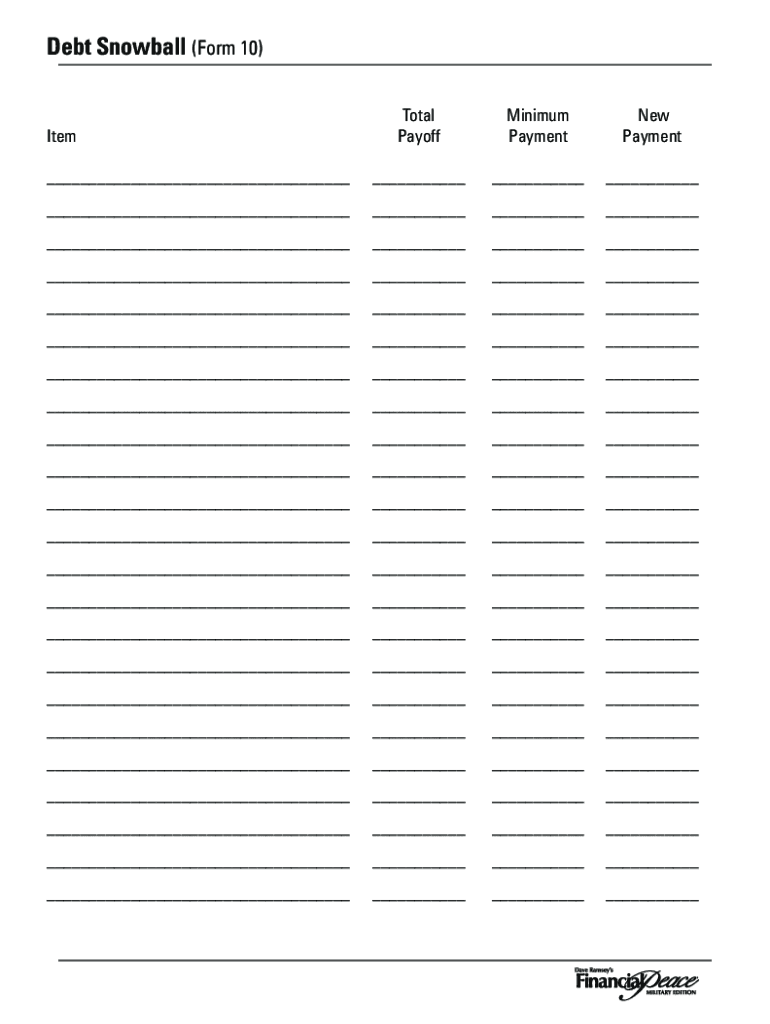

1 List all your debts below starting from the smallest to the largest balance 2 Pay the minimum amount into 3 Do the same 4 Keep using DEBT J F M A M J J A S O N D Monthly payment New balance Monthly payment New balance Monthly payment New balance The Debt Snowball Spreadsheet is a tool used in Dave Ramsey s Financial Peace University to help individuals track and pay off their debts in a systematic way It helps prioritize debts by focusing on paying off the smallest debt first while making minimum payments on other debts

The free printable budget planner includes A monthly budget worksheet so you can give every dollar an assignment in your budget A debt snowball tracker to keep you motivated on your debt pay off journey A payment due date calendar and bill checklist to make sure you never pay another late fee A spending log to keep track of your payments Whichever one you prefer there s going to be one here that works for you 1 Free printable debt snowball worksheet We can t help but recommend our own debt snowball worksheet you can download it for free here as a great option if you re looking to track your debt payoff journey

More picture related to Dave Ramsey Debt Snowball Form Printable

Free Dave Ramsey Debt Snowball Printable Pdf Worksheet Video Debt Snowball Debt Snowball

https://i.pinimg.com/736x/31/54/de/3154de4c0fca1a5685788a6a9ca990d1.jpg

Ramsey Snowball Spreadsheet For Dave Ramsey Debt Snowball Spreadsheet Lovely Dave Ramsey

https://db-excel.com/wp-content/uploads/2019/01/ramsey-snowball-spreadsheet-for-dave-ramsey-debt-snowball-spreadsheet-lovely-dave-ramsey-snowball-750x970.jpg

Payoff Debt Snowball Method Dave Ramsey Debt Sheet Printable Snowball Method Worksheet

https://i.pinimg.com/originals/aa/54/57/aa54578a8e988eff4cfb31e83b8b7d2e.jpg

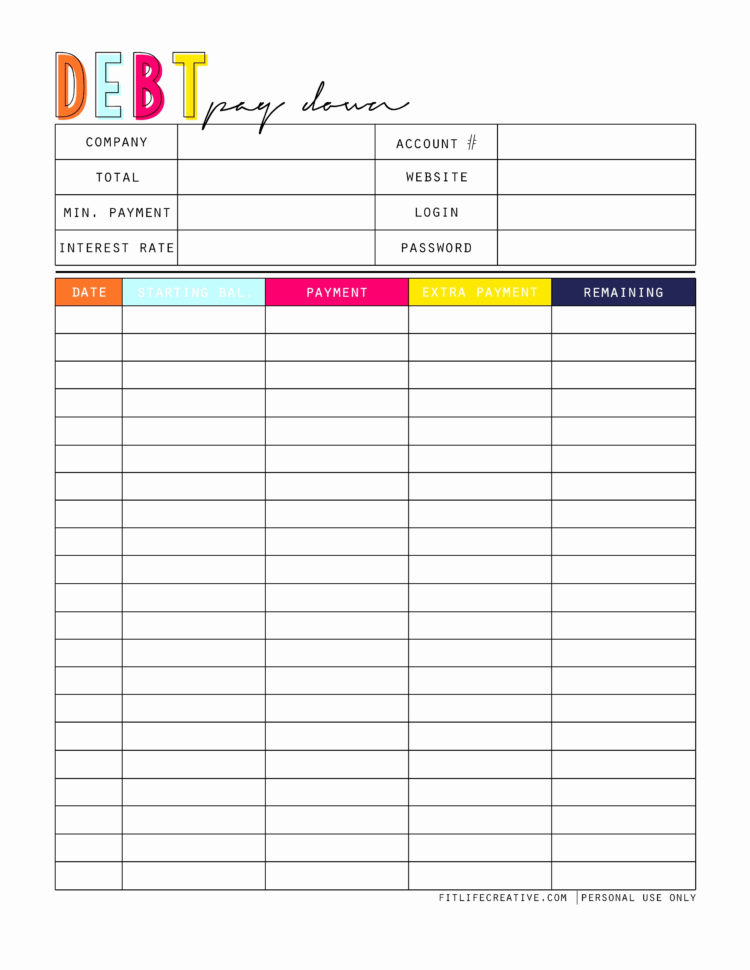

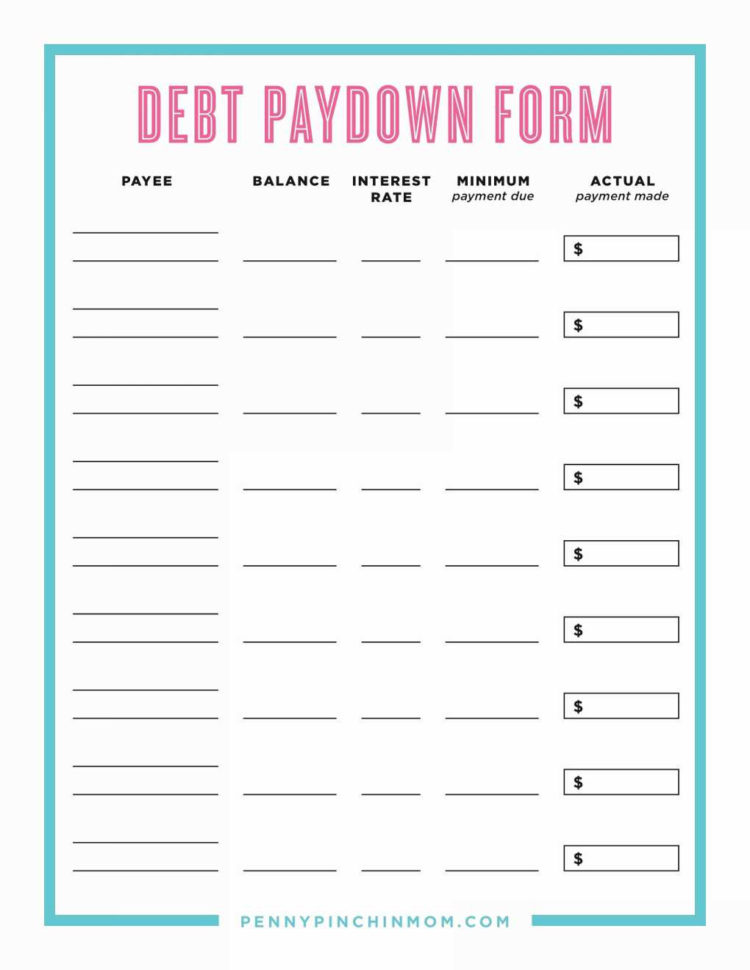

The first new download is a debt payoff worksheet that is available as a printable PDF You can use one worksheet per debt and you can use this regardless of what debt payoff approach you choose debt snowball vs debt avalanche You ll list the creditor at the top and then there are columns to record your starting balance interest rate This free printable debt snowball worksheet is pretty easy to use On the left you write in the names of all your different debt sources like Credit CardX Car Loan Student Loan 1 Student Loan 2 etc This debtbuster worksheet works best if you put the smallest debt at the top of the list and the biggest debt at the

This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand The debt snowball is one of the best ways to make a big dent in your outstanding debts WHAT IS A DEBT SNOWBALL I first learned about the debt snowball method from reading a Dave Ramsey book and from his Financial Peace University course Here is an example of Step 1 Debt Priority 1 Credit card debt balance 3 537 Debt Priority 2 Student loan 1 balance 9 058 Debt Priority 3 Car loan balance 19 102 Debt Priority 4 Student loan 2 balance 23 433 Side note I have the perfect worksheet to help you with this step Keep reading and at the end of the post you ll

![]()

Free Debt Snowball Tracker Printable Simply Unscripted Db excel

https://db-excel.com/wp-content/uploads/2019/09/free-debt-snowball-tracker-printable-simply-unscripted.jpg

Dave Ramsey Debt Snowball Worksheets Db excel

https://db-excel.com/wp-content/uploads/2019/09/dave-ramsey-debt-snowball-spreadsheet.jpg

https://savedbythecents.com/dave-ramsey-snowball-debt-templates-in-printable-excel-and-pdf/

Dave Ramsey highly recommends the debt snowball method to eliminate your debt in the Baby Steps but let s dig into what template can help you get out of Baby Step 2 fast Let s go through great printables excel and PDF resources to help you eliminate your debt

https://wellkeptwallet.com/debt-snowball-worksheet/

The Debt Snowball made famous for being part of Dave Ramsey s Baby Steps helped me and my wife pay off over 52 000 in debt in 18 months This is the exact debt snowball form that we used to get out debt in that short period of time There are tons of ways to pay off debt but I would argue that this method is the most successful

Debt Snowball Form Fill Out And Sign Printable PDF Template SignNow

Free Debt Snowball Tracker Printable Simply Unscripted Db excel

Dave Ramsey Snowball Debt Templates In Printable Excel And PDF

The Debt Snowball Method A Complete Guide With Free Printables

Dave Ramsey Budget Spreadsheet Example Of Snowball Best Debt Sheet Db excel

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

Pay Off Debt Dave Ramsey Debt Snowball Concept Hassle Free Savings

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff Progress Log Debt Free Goal

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Etsy Debt Snowball Printable

Dave Ramsey Debt Snowball Form Printable - In most cases if someone dies with credit card debt the remaining balance is paid for out of their estate A person s estate is all the assets they own such as bank accounts houses cars and other possessions But if there s a joint card holder the credit card debt would automatically become their responsibility