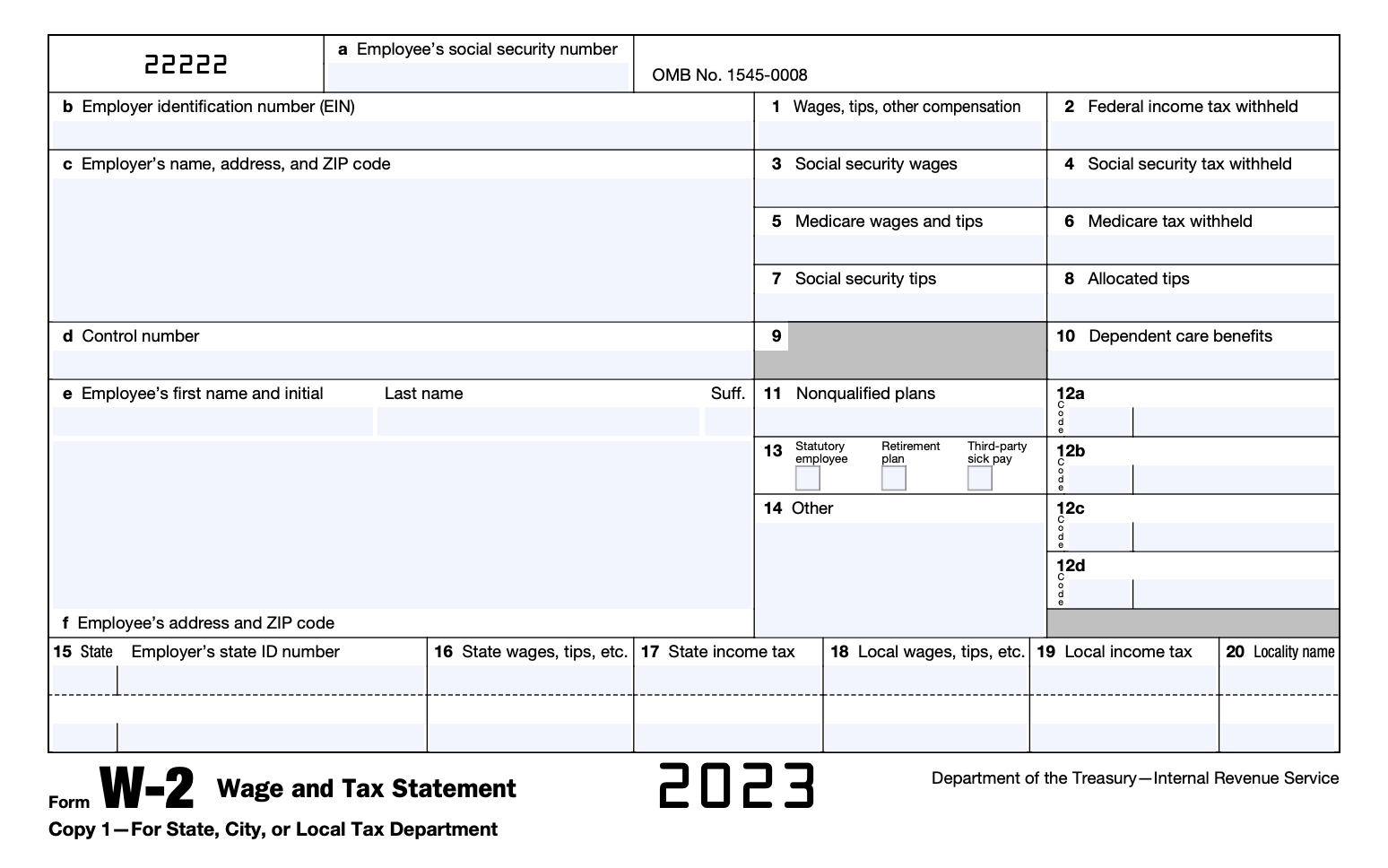

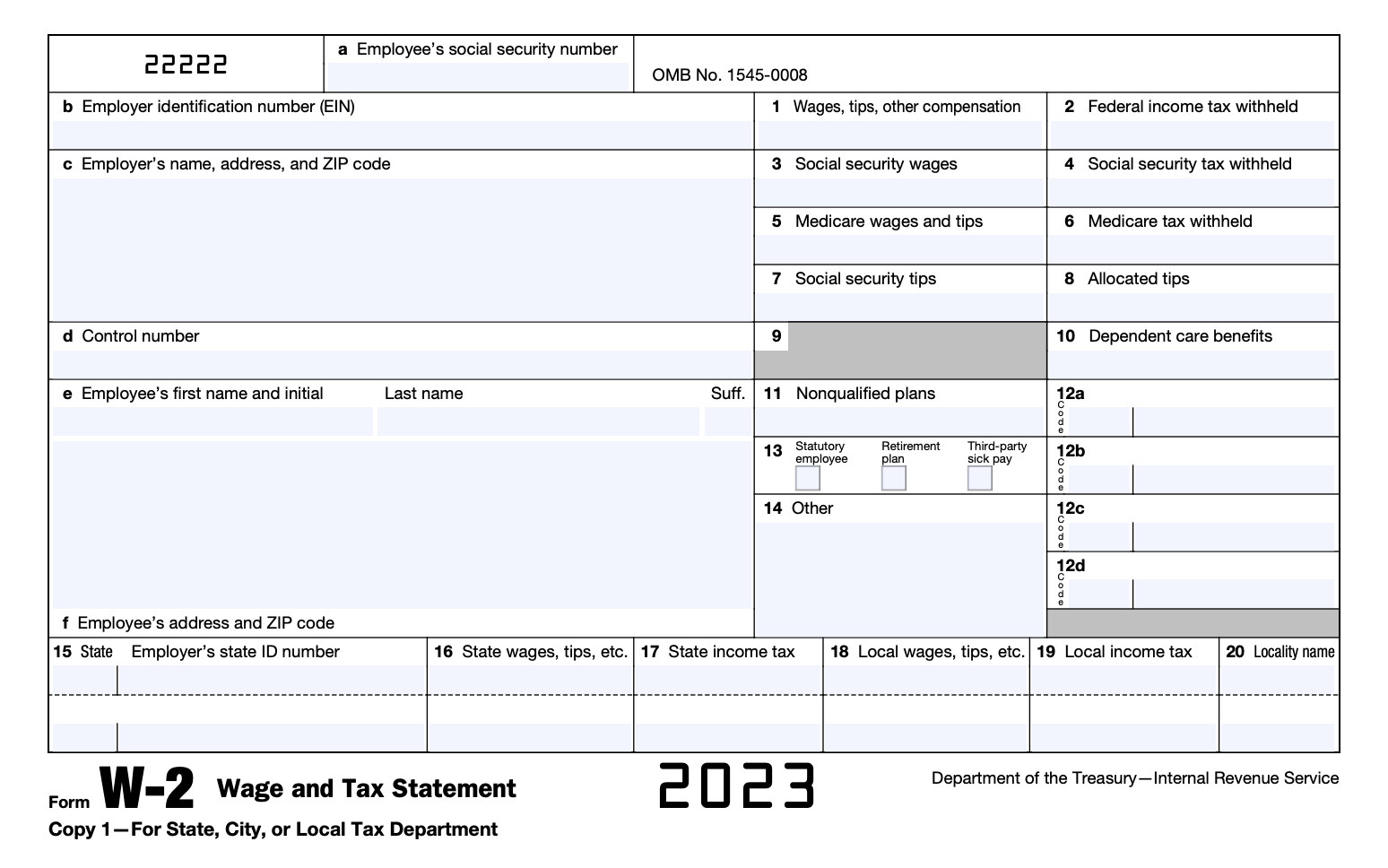

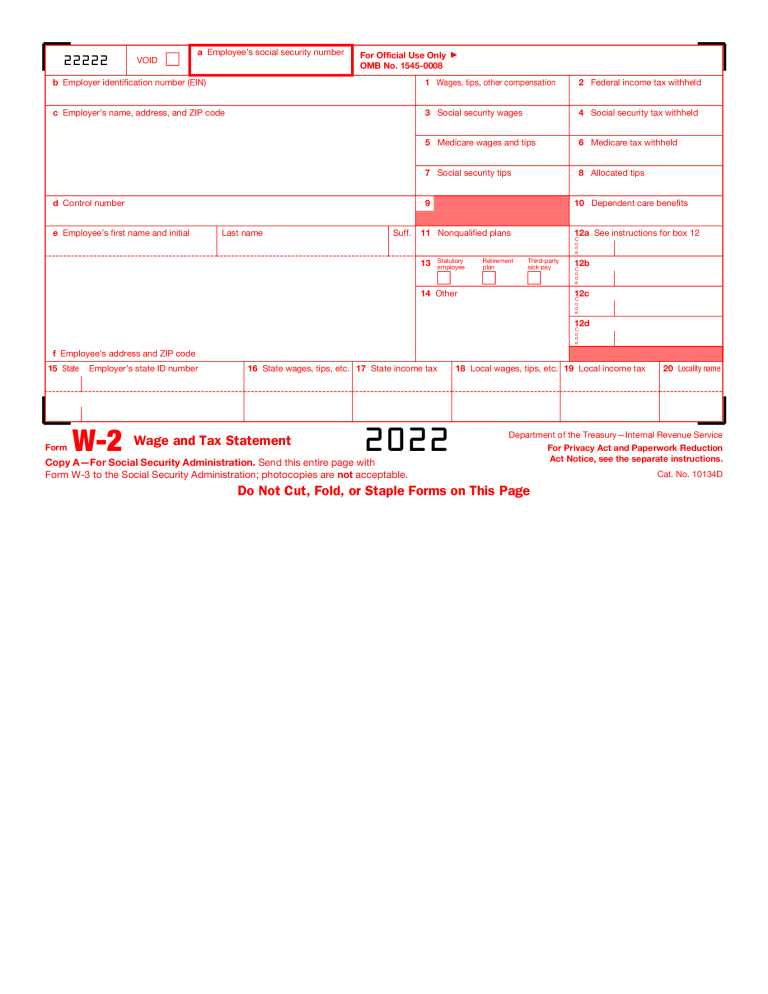

Employer W 2 Form Printable 2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

Employer W 2 Filing Instructions Information Alert If you were unable to file Forms W 2 electronically or by paper with the SSA by January 31 st you may request only one 30 day extension with the IRS by completing Form 8809 You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

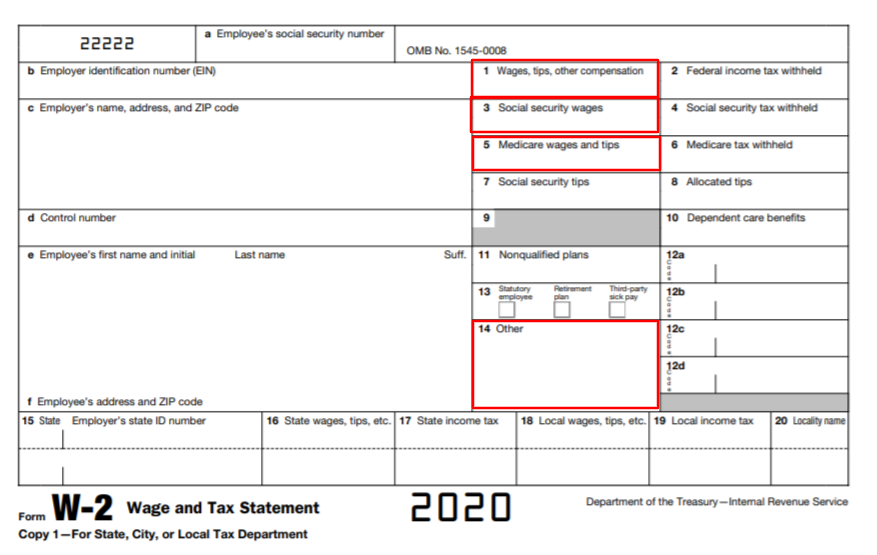

Employer W 2 Form Printable

Employer W 2 Form Printable

https://fitsmallbusiness.com/wp-content/uploads/2022/07/Screenshot_of_W2_Form_2022.jpg

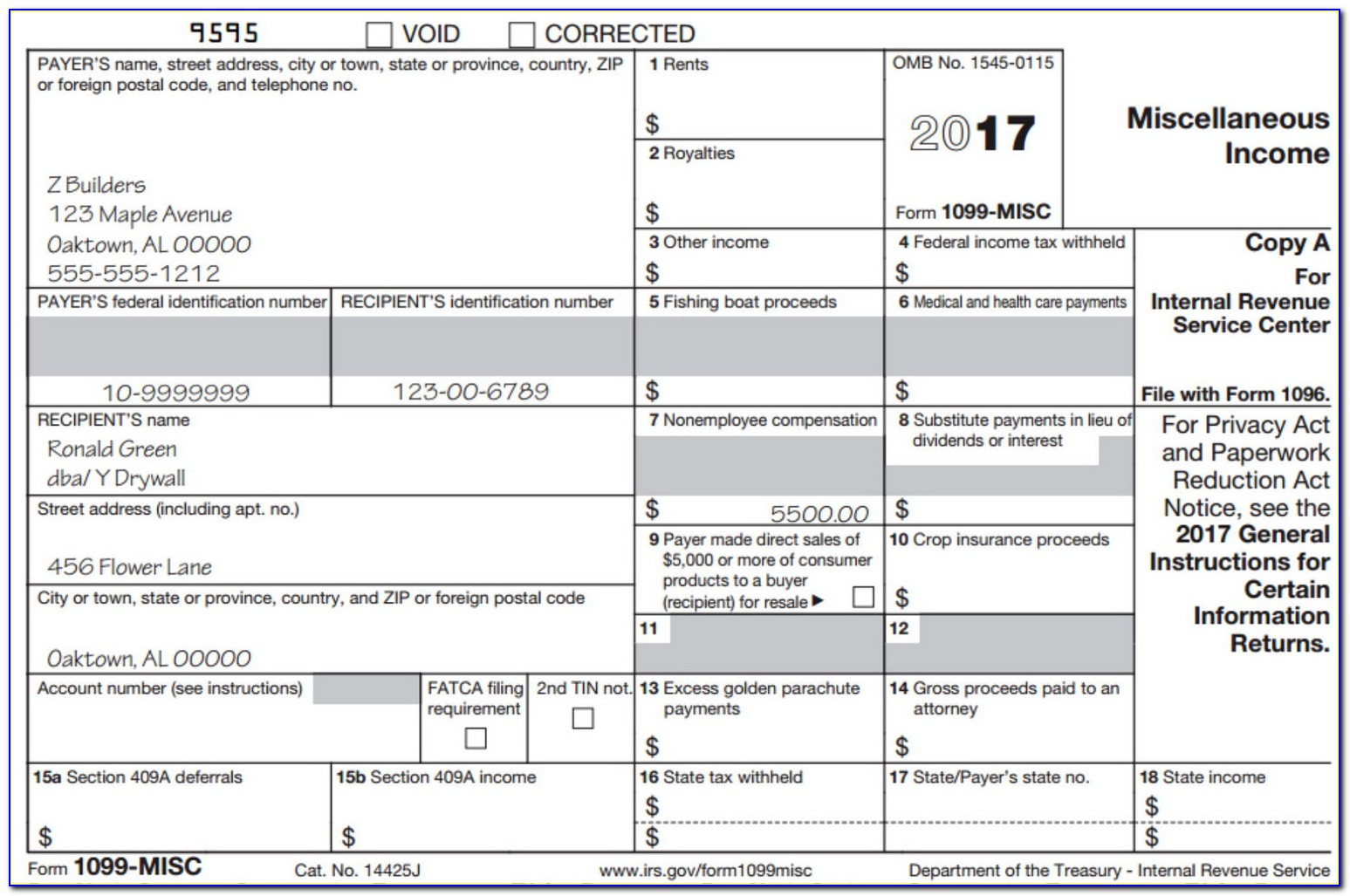

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

https://giftcpas.com/wp-content/uploads/2017/12/2017_Form_W-2.png

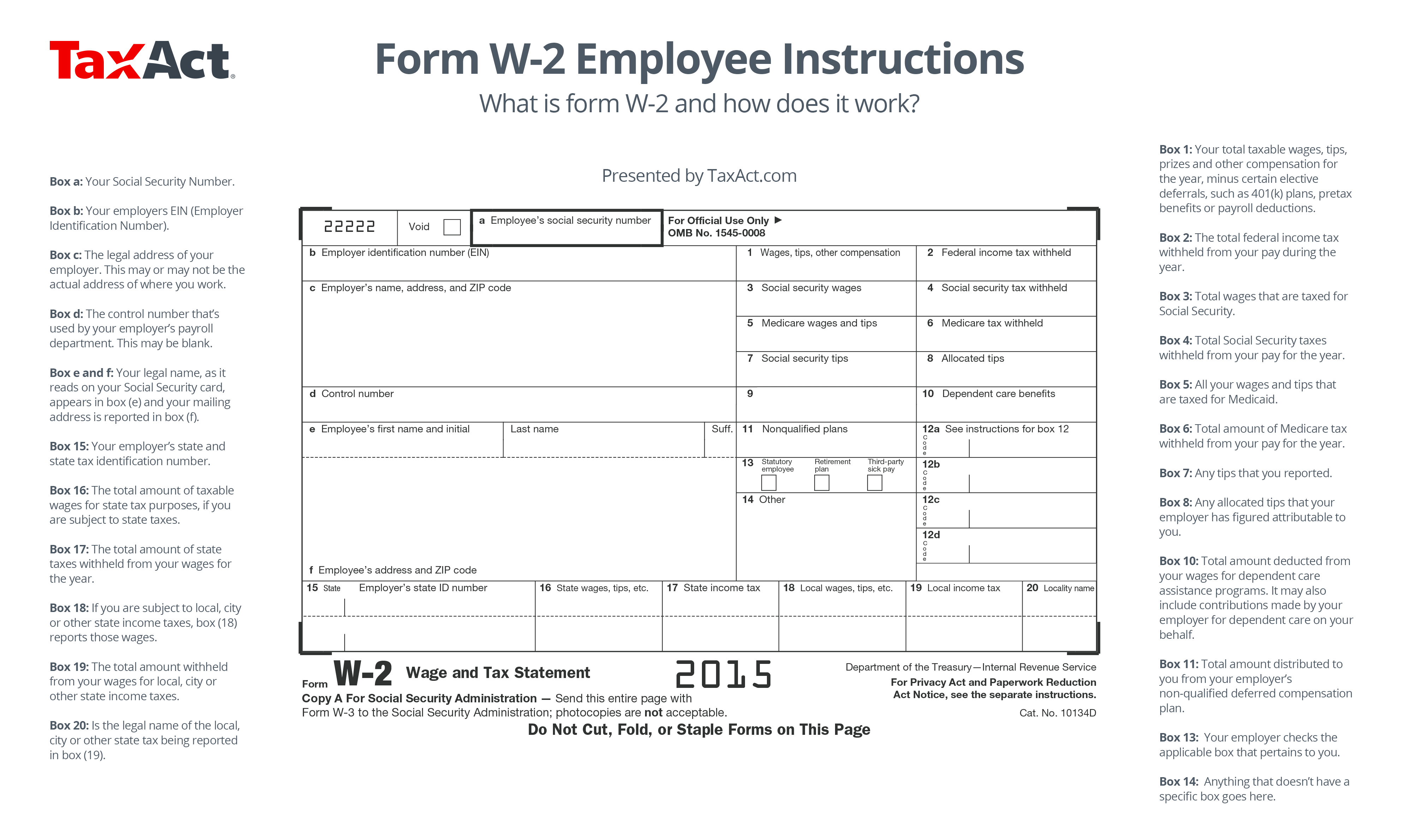

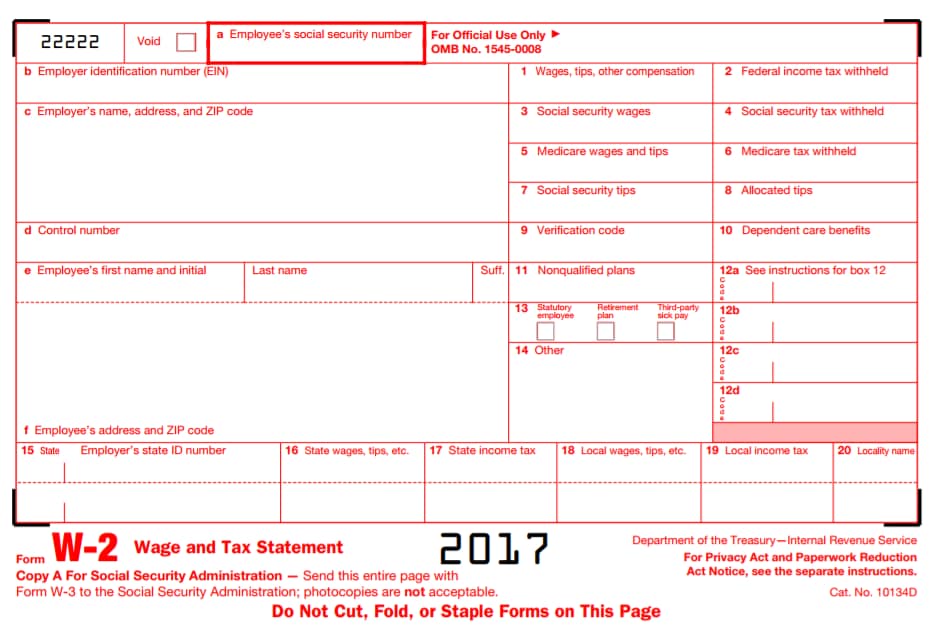

What Is W 2 Form And How Does It Work TaxAct Blog

https://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions-1.png

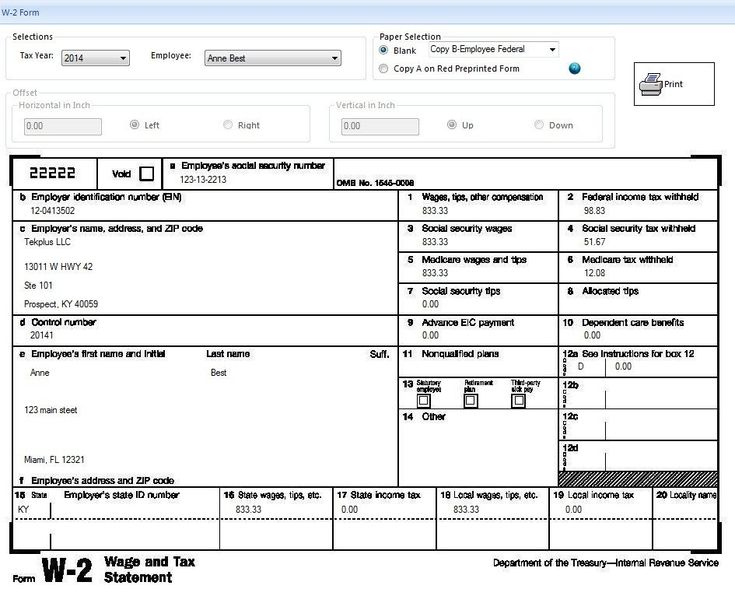

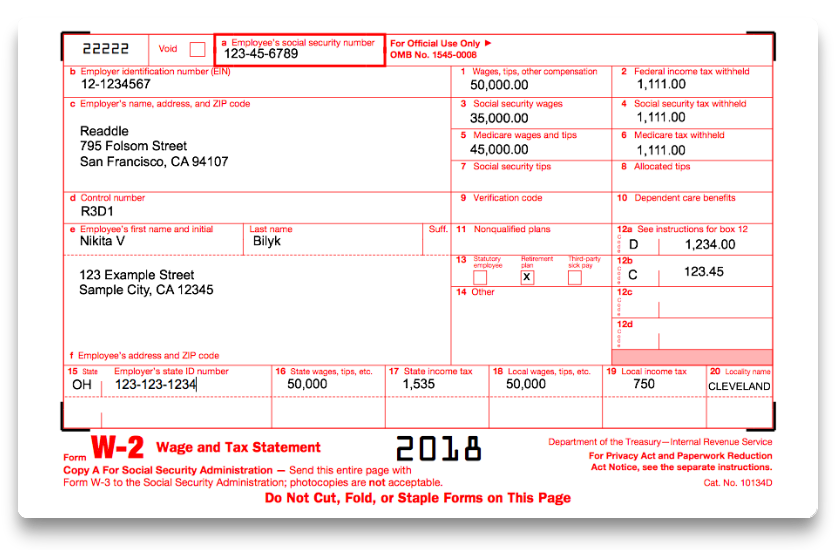

Employers can submit a W 2 online through the SSA or by mail Employers may file by mail only if they have less than ten filings 2 SSA deadline January 31 Employee submission deadline January 31 Employers may request one 30 day extension to file with the SSA by using Form 8809 Form Parts 28 Box 1 Wages Tips and Other Compensation Employers must file a copy of each employee s W 2 with the Social Security Administration SSA and the Internal Revenue Service IRS Employers may face fines and penalties if they fail to provide a correct W 2 to an employee or fail to file it with the federal government on time What is Form W 2

Check the W 2 wage report for accuracy prior to sending it to us AccuWage Online Complete up to 50 W 2s on your computer submit them to us electronically and print copies for your employees Complete up to 25 W 2Cs on your computer submit them to us electronically and print copies for your employees What is a W 2 IRS Form W 2 also known as a Wage and Tax Statement reports an employee s income from the prior year and how much tax the employer withheld Employers send out W 2s to

More picture related to Employer W 2 Form Printable

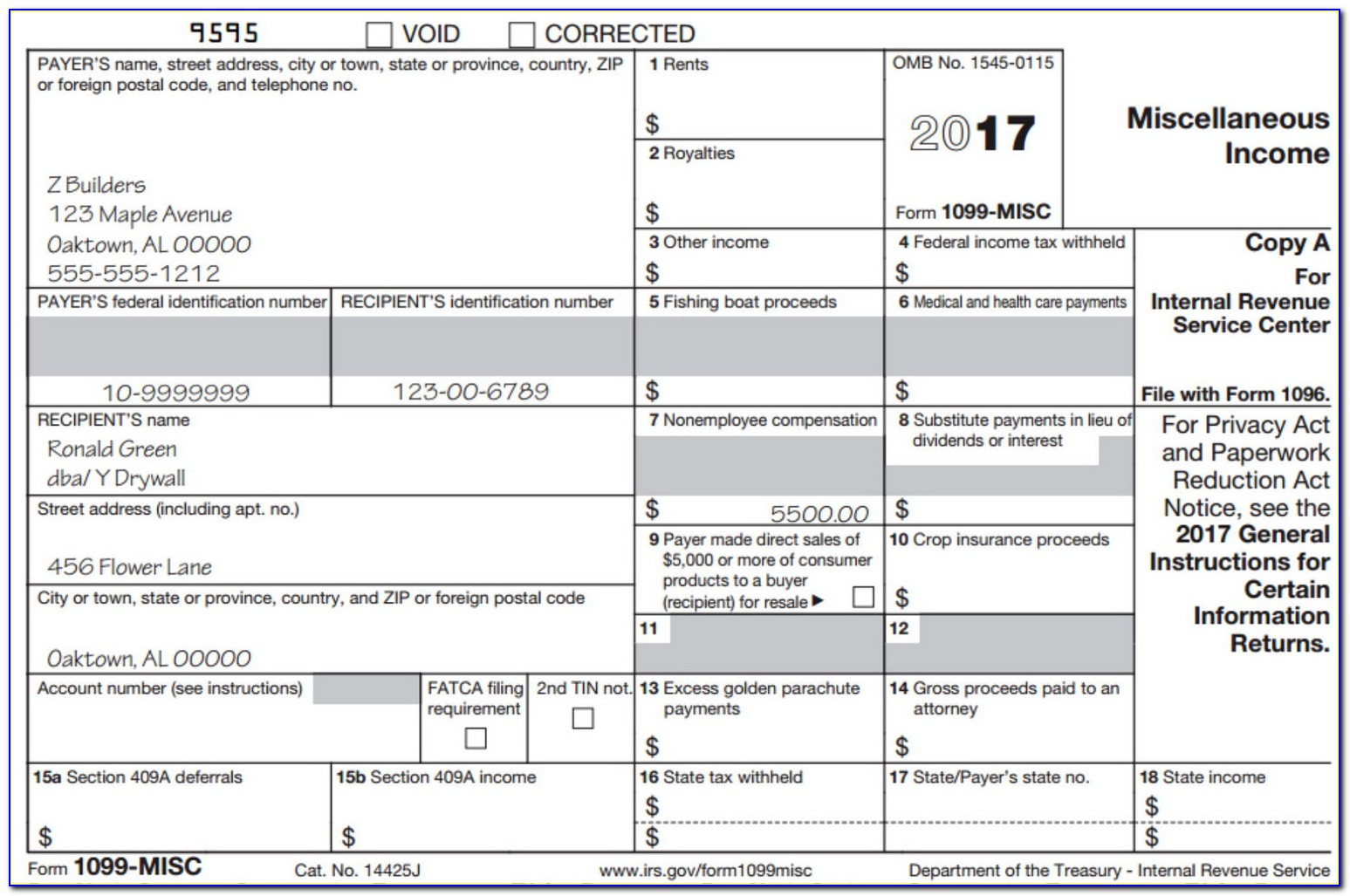

Understanding 2017 W 2 Forms

https://jumbotron-production-f.squarecdn.com/assets/5771c3f67ecf46fe6b42.jpg

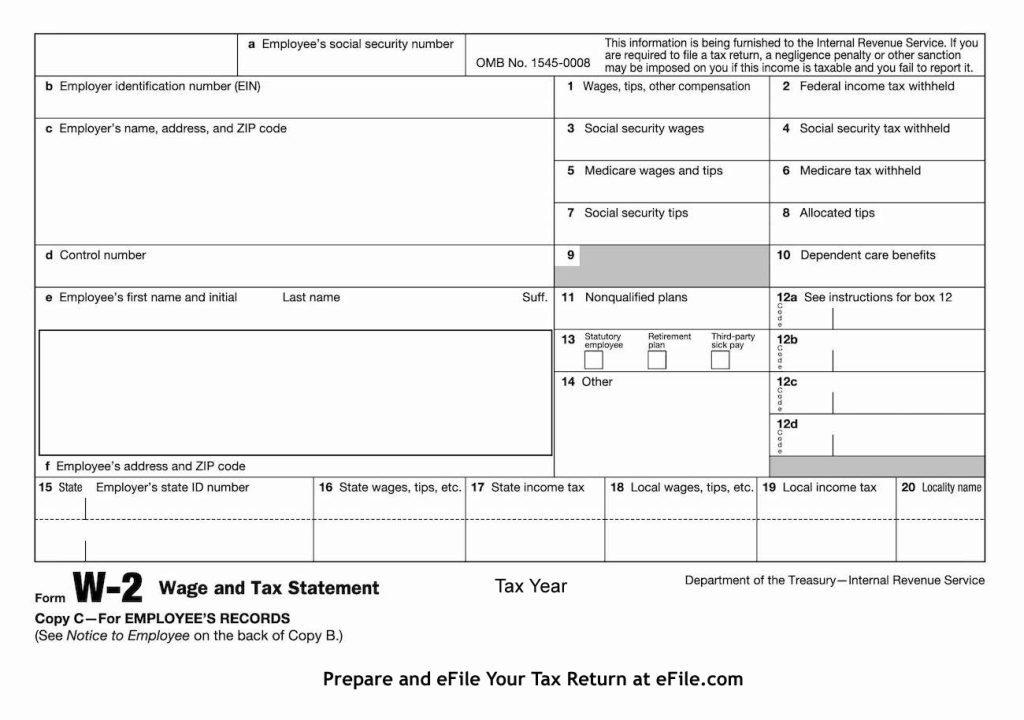

How To Fill Out Form W 2 Detailed Guide For Employers 2023

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

Understanding 2015 W 2 Forms

https://diyfqze5s92fh.cloudfront.net/publish-web/2016/Feb/W2_example-1455840596416.png

Form W 2c W 3c Instructions Social Security accepts laser printed Forms W 2 W 3 as well as the standard red drop out ink forms Both the laser forms and the red drop out ink forms must comply with Internal Revenue Service s Publication 1141 and require pre approval from Social Security Free File Up to 50 W 2s Using W 2 Online A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return Form W 2 must contain certain information including wages earned and state federal and other taxes withheld from an employee s earnings The Form W 2 must be provided to employees by January 31

What is a W 2 Form W 2 forms are an important part of employees tax filings They detail all wages and salary paid along with the amounts withheld for taxes and benefits and other information such as imputed income If your automated taxes and forms setting is Off review your Form W 2 print setting Select Change setting to change the paper type if needed Select View or Manage on the copy you need W 3 Summary Transmittal of Wage and Tax Statements W 2 Copies B C 2 employee W 2 Copies A D employer Select View and print

Printable W2 Form For New Employee Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/03/printable-w2-forms-for-employees-form-resume-examples.jpg

Understanding Your Tax Forms The W 2

https://blogs-images.forbes.com/kellyphillipserb/files/2014/02/W2.png

https://www.irs.gov/pub/irs-access/fw2_accessible.pdf

2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

https://www.ssa.gov/employer/

Employer W 2 Filing Instructions Information Alert If you were unable to file Forms W 2 electronically or by paper with the SSA by January 31 st you may request only one 30 day extension with the IRS by completing Form 8809

2022 W2 Free Fillable Printable W 2 Form Fillable Form 2023

Printable W2 Form For New Employee Printable Form 2023

What Is A W 2 Form TurboTax Tax Tips Videos

Fillable 2023 W 2 Forms Fillable Form 2023

W 2 Reporting Requirements W 2 Changes For 2020 Forms

How To Print W2 Forms On White Paper

How To Print W2 Forms On White Paper

Printable W2 Form For New Employee Printable Form 2023

W 2 IRS Approved W 2 Laser Tax Form Copy C W 2 Forms Formstax

C mo Rellenar Un Formulario IRS W 2 2017 2018 PDF Expert

Employer W 2 Form Printable - A W 2 Form known officially as a Wage and Tax Statement is an important tax document providing valuable information for employees and the Internal Revenue Service IRS This document shows the total earnings of an employee for the year as well as the amount of taxes withheld from their paychecks It also includes other deductions such as contributions to retirement plans health