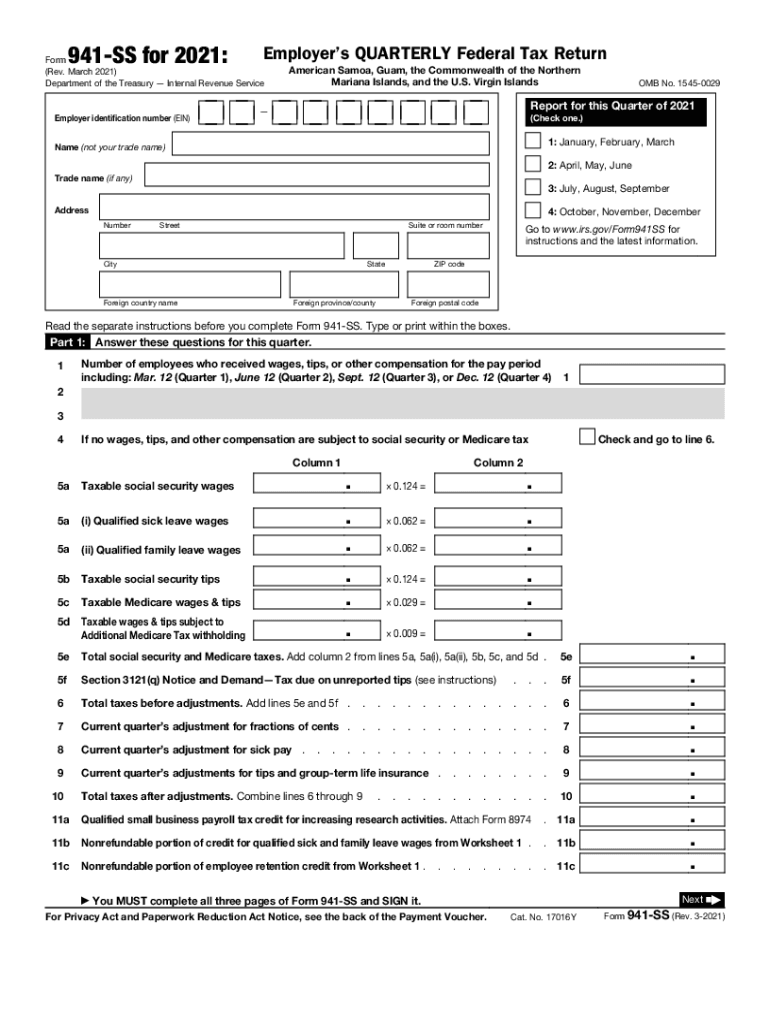

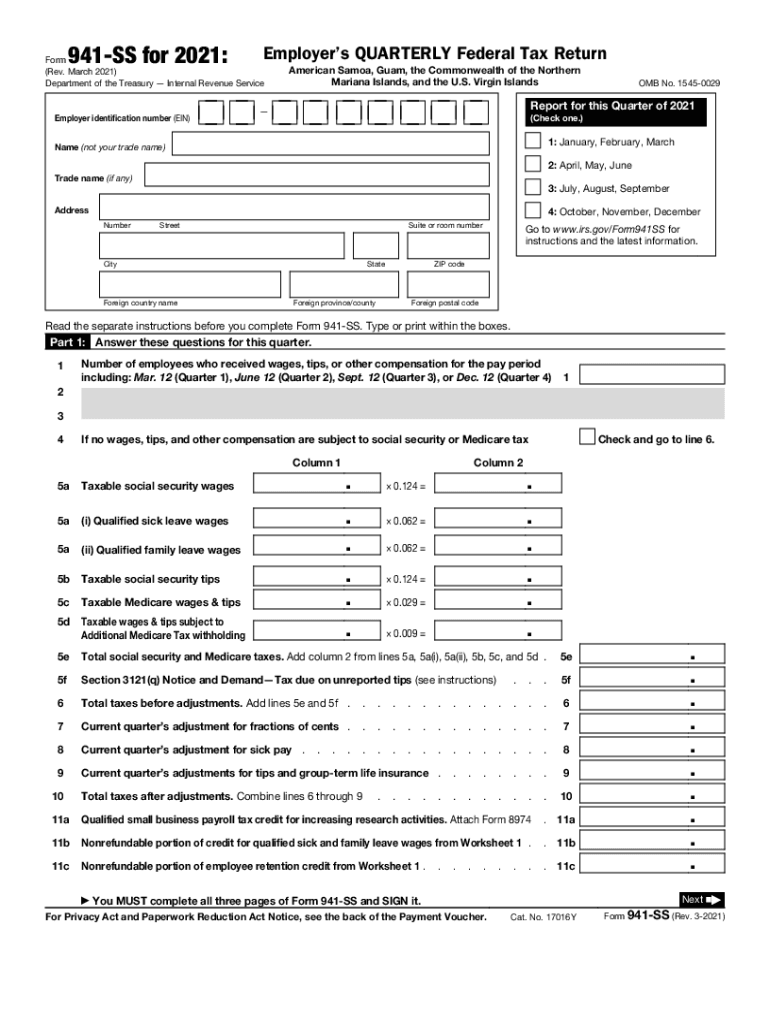

Fed Tax Form 941 Fillable And Printable Instructions for Form 941 Print Version PDF Recent Developments Early Termination of the Employee Retention Credit for Most Employers 23 NOV 2021 Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021

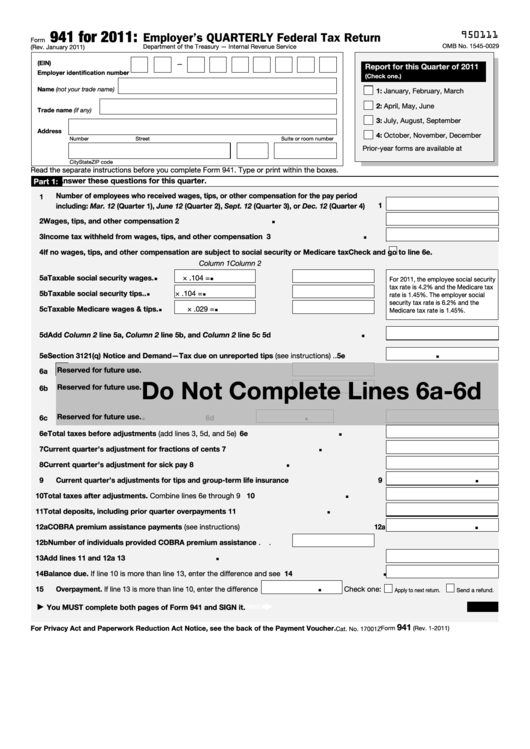

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF Tax year 2023 guide to the employer s quarterly federal tax Form 941 Learn filing essentials get instructions deadlines mailing info and more

Fed Tax Form 941 Fillable And Printable

Fed Tax Form 941 Fillable And Printable

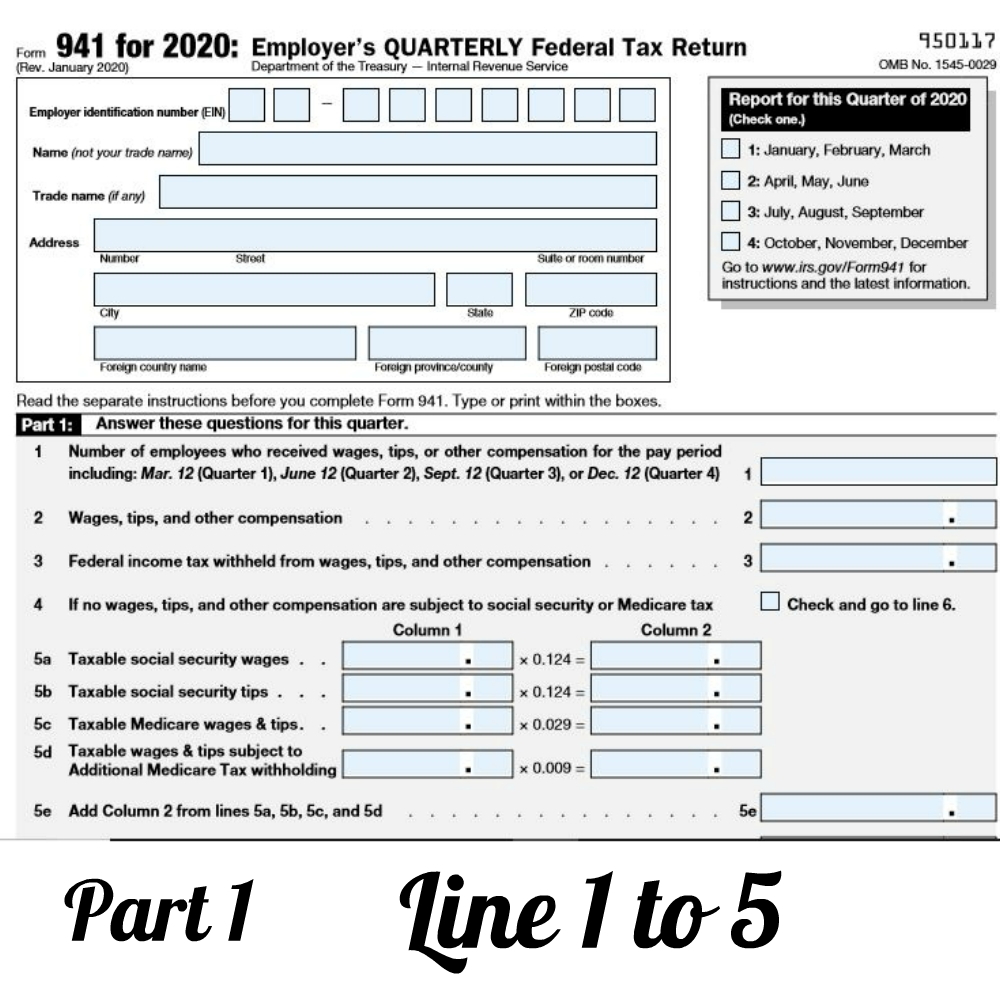

https://ninasoap.com/wp-content/uploads/2020/04/2020-Form-941-Emplyers-Quarterly-Tax-Return-Part-1-Line-to-5-Step5.jpg

How To Complete Form 941 In 5 Simple Steps

https://www.surepayroll.com/globalassets/images/blog/2019/form-941.png

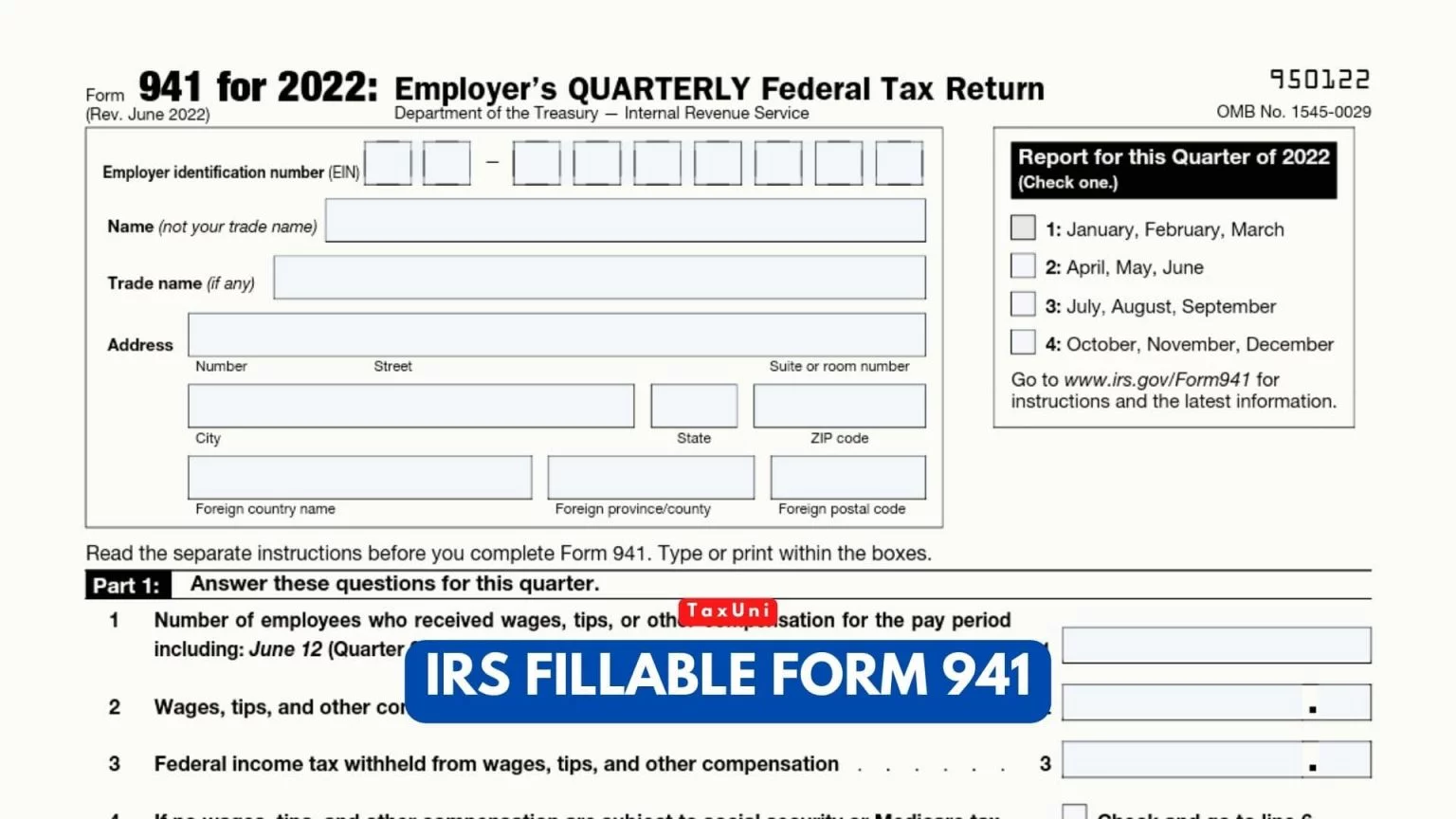

941 Form 2022 Printable PDF Template

https://www.taxuni.com/wp-content/uploads/2022/12/IRS-Fillable-Form-941-TaxUni-Cover-1-1536x864.jpg

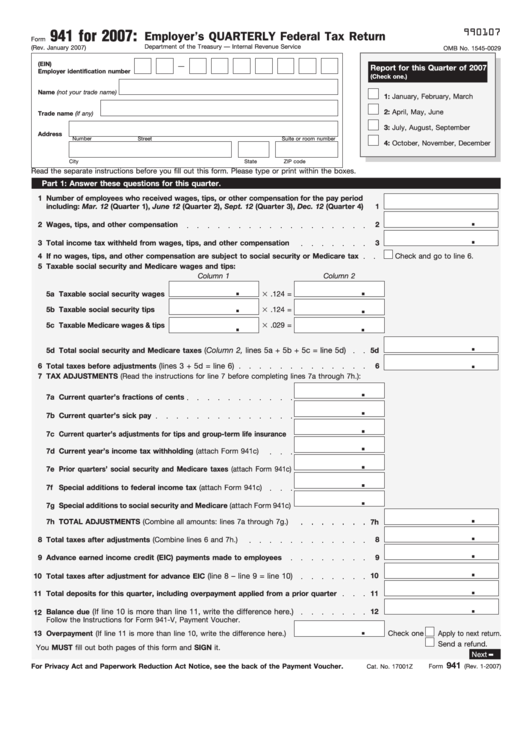

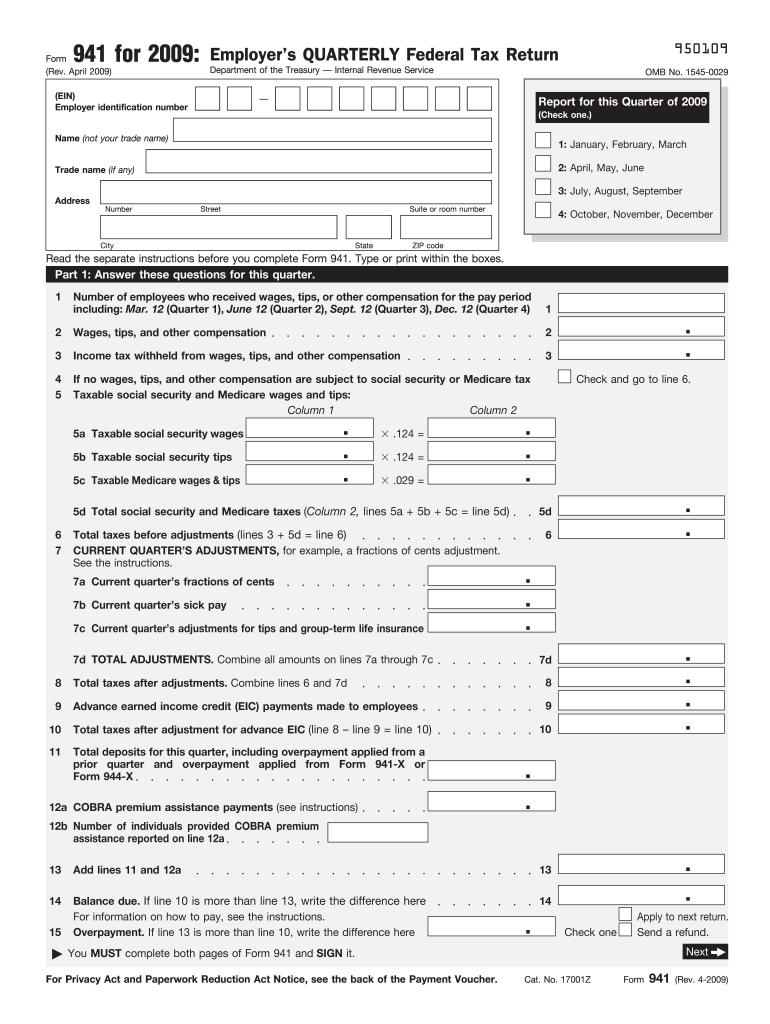

IRS Form 941 also known as the Employer s Quarterly Federal Tax Return is where businesses report the income taxes and payroll taxes that they withheld from their employees wages as IRS Form 941 is a quarterly report that cites Withholding of federal income taxes from employee paychecks based on the information from their W 4 forms Withholding amounts due based on your employees Medicare and Social Security wages Calculation of your employer portion of FICA taxes

Fill out business information At the top portion of Form 941 fill in your EIN business name trade name if applicable and business address Off to the right side mark which quarter the information is for For example if the form is for the first quarter put an X in the box next to January February March Employer s Quarterly Federal Tax Return Form 941 Rev March 2023 941 for 2023 Form Rev March 2023 Employer s QUARTERLY Federal Tax Return 950122 OMB No 1545 0029 Department of the Treasury Internal Revenue Service Report for this Quarter of 2023 Employer identification number EIN Check one

More picture related to Fed Tax Form 941 Fillable And Printable

Fed Tax Form 941 Fillable And Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/68/684/68433/page_1_thumb_big.png

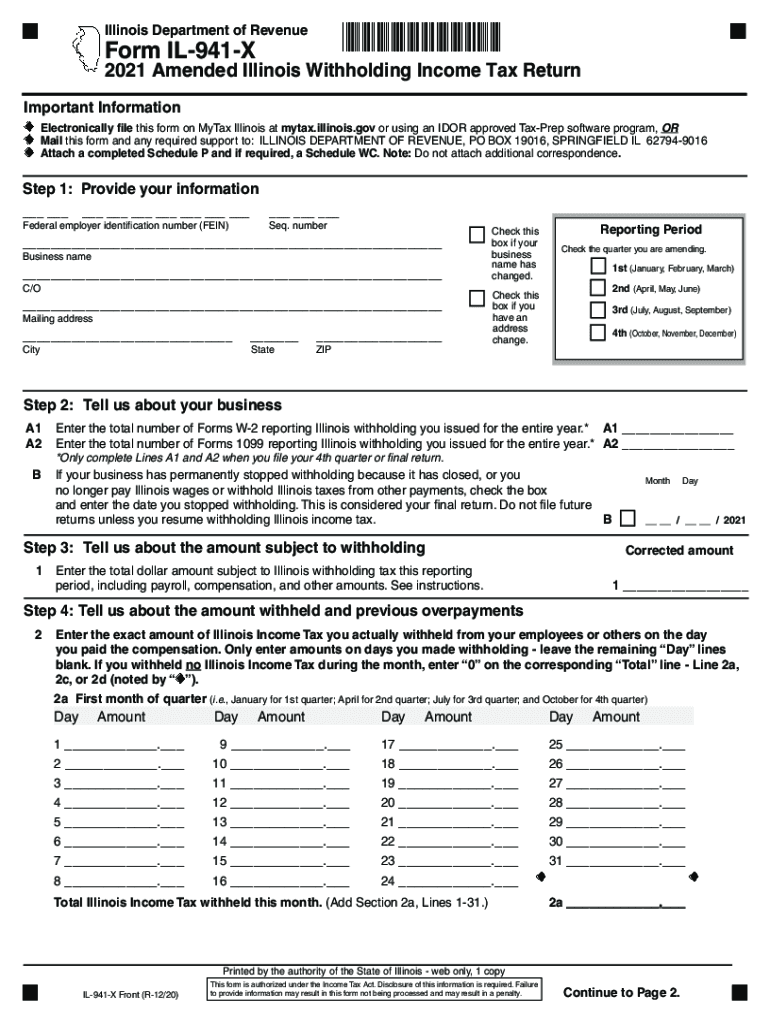

Il 941 X 2021 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/552/420/552420071/large.png

Form 941 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/11/100011680/large.png

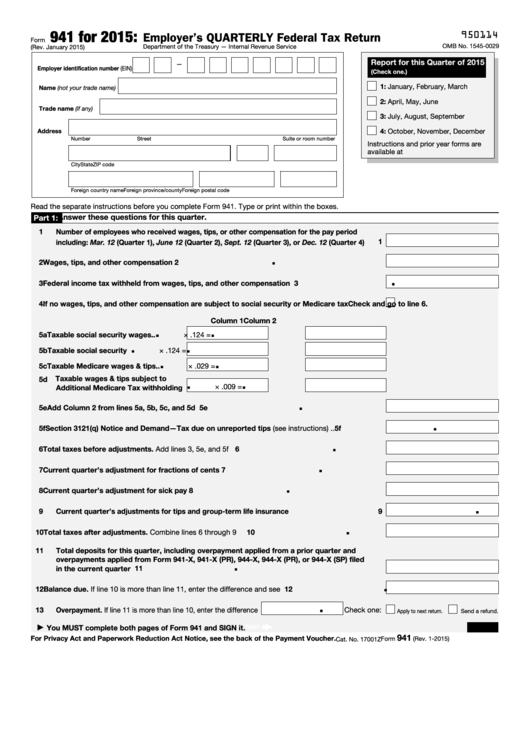

The IRS released the final instructions for the updated Form 941 in June of 2022 ahead of the second quarter s end There are five parts that need to be completed on Revised Form 941 Part 1 This quarter taxes and wages Part 2 Your deposit schedule and tax liability for this quarter Part 3 Your business Employers transfer withheld taxes to the IRS monthly or semiweekly reporting quarterly on Form 941 with details on staff compensation and taxes owed or overpaid Form 941 has five parts

What is Form 941 Form 941 is a required IRS document that businesses must file every three months to report and calculate the federal income tax withheld from employees paychecks It also includes the amount of Social Security and Medicare taxes owed to the IRS by both the employer and the employees Libraries IRS Taxpayer Assistance Centers If you are searching for federal tax forms from previous years look them up by form number or year New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form

2021 941 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/557/838/557838144/large.png

941 Form 2020 Pdf Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/386/860/386860264/large.png

https://www.irs.gov/forms-pubs/about-form-941

Instructions for Form 941 Print Version PDF Recent Developments Early Termination of the Employee Retention Credit for Most Employers 23 NOV 2021 Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021

https://www.irs.gov/forms-instructions

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

Fillable Form 941 Employer S Quarterly Federal Tax Return 2015 Printable Pdf Download

2021 941 Form Fill Out And Sign Printable PDF Template SignNow

IRS Form 941 X Complete Print 941X For 2022

IRS Form 941 Employer s QUARTERLY Federal Tax Return Forms Docs 2023

Fillable Form 941 Employer S Quarterly Federal Tax Return 2011 Printable Pdf Download

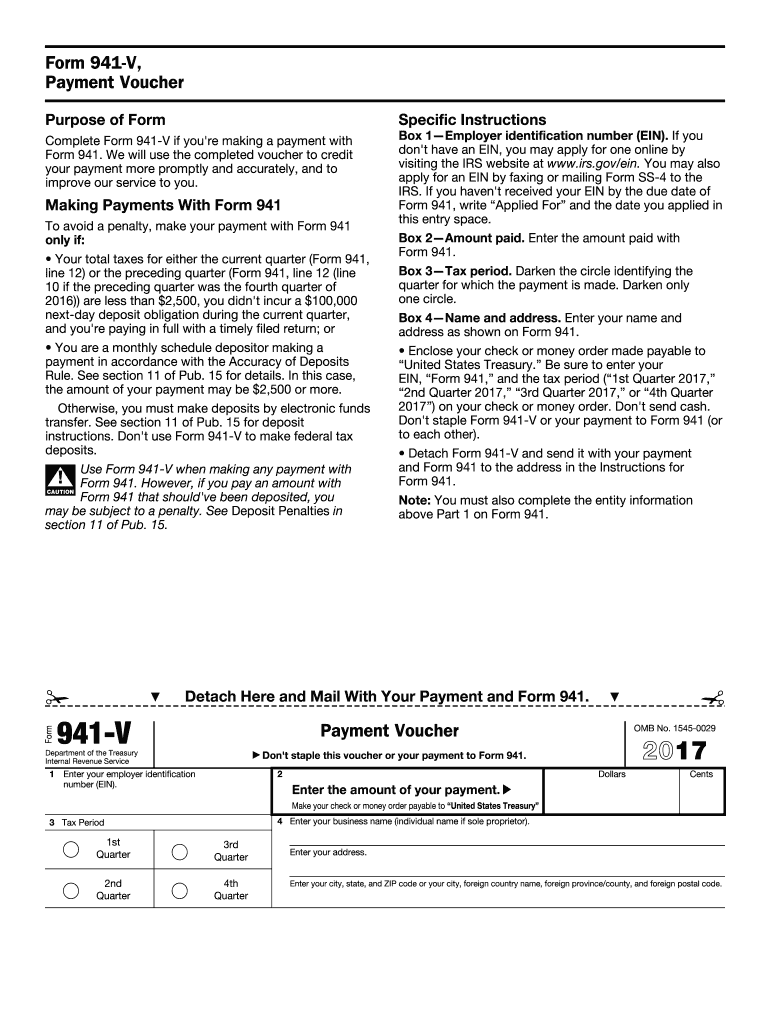

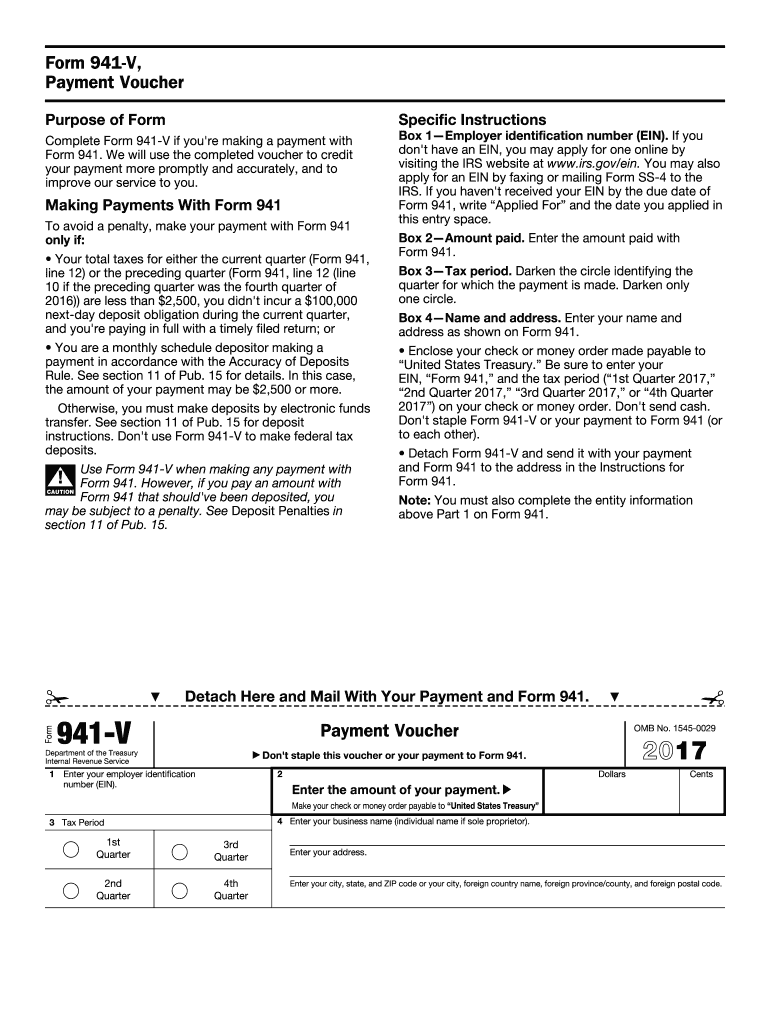

2017 Form IRS 941 V Fill Online Printable Fillable Blank PdfFiller

2017 Form IRS 941 V Fill Online Printable Fillable Blank PdfFiller

941 Form 2020 Pdf Fill Out Sign Online DocHub

IRS 941 Schedule B 2017 2022 Fill And Sign Printable Template Online US Legal Forms

Printable 941 Form For 2020 Printable World Holiday

Fed Tax Form 941 Fillable And Printable - Fill out business information At the top portion of Form 941 fill in your EIN business name trade name if applicable and business address Off to the right side mark which quarter the information is for For example if the form is for the first quarter put an X in the box next to January February March