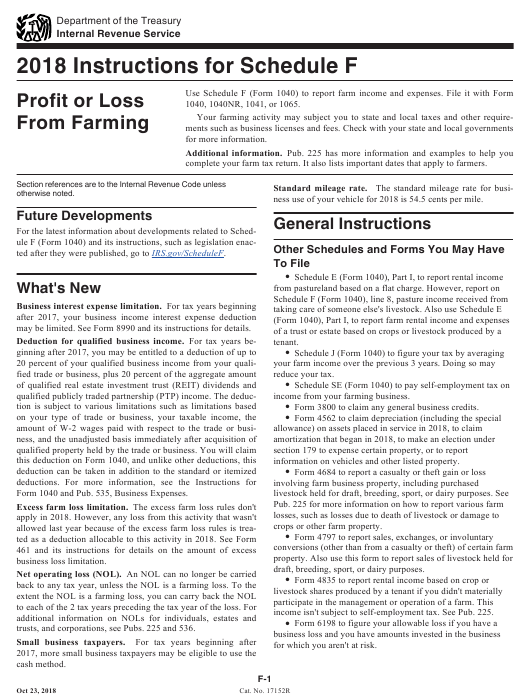

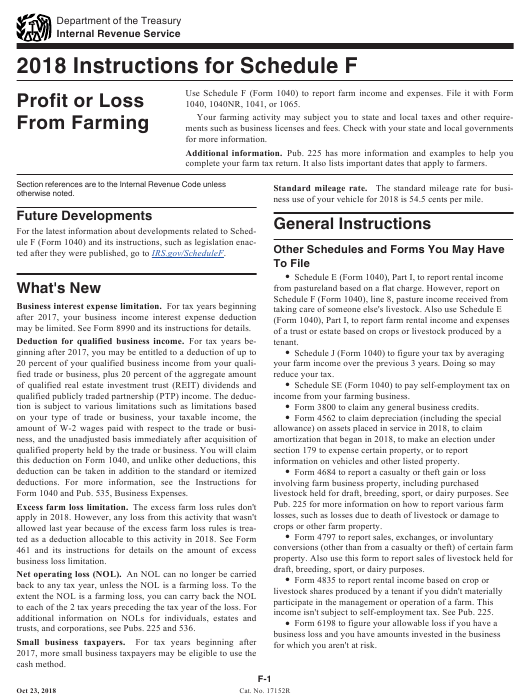

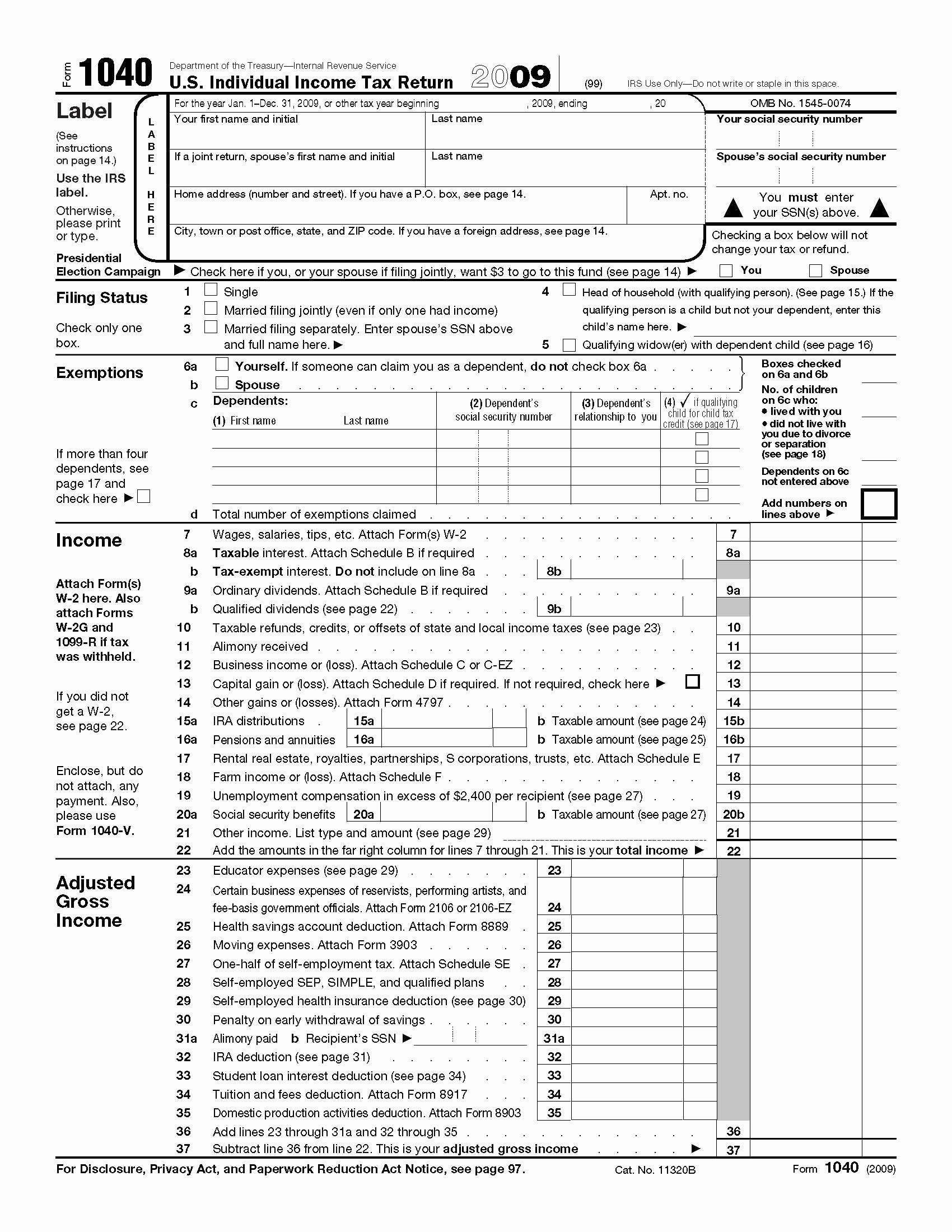

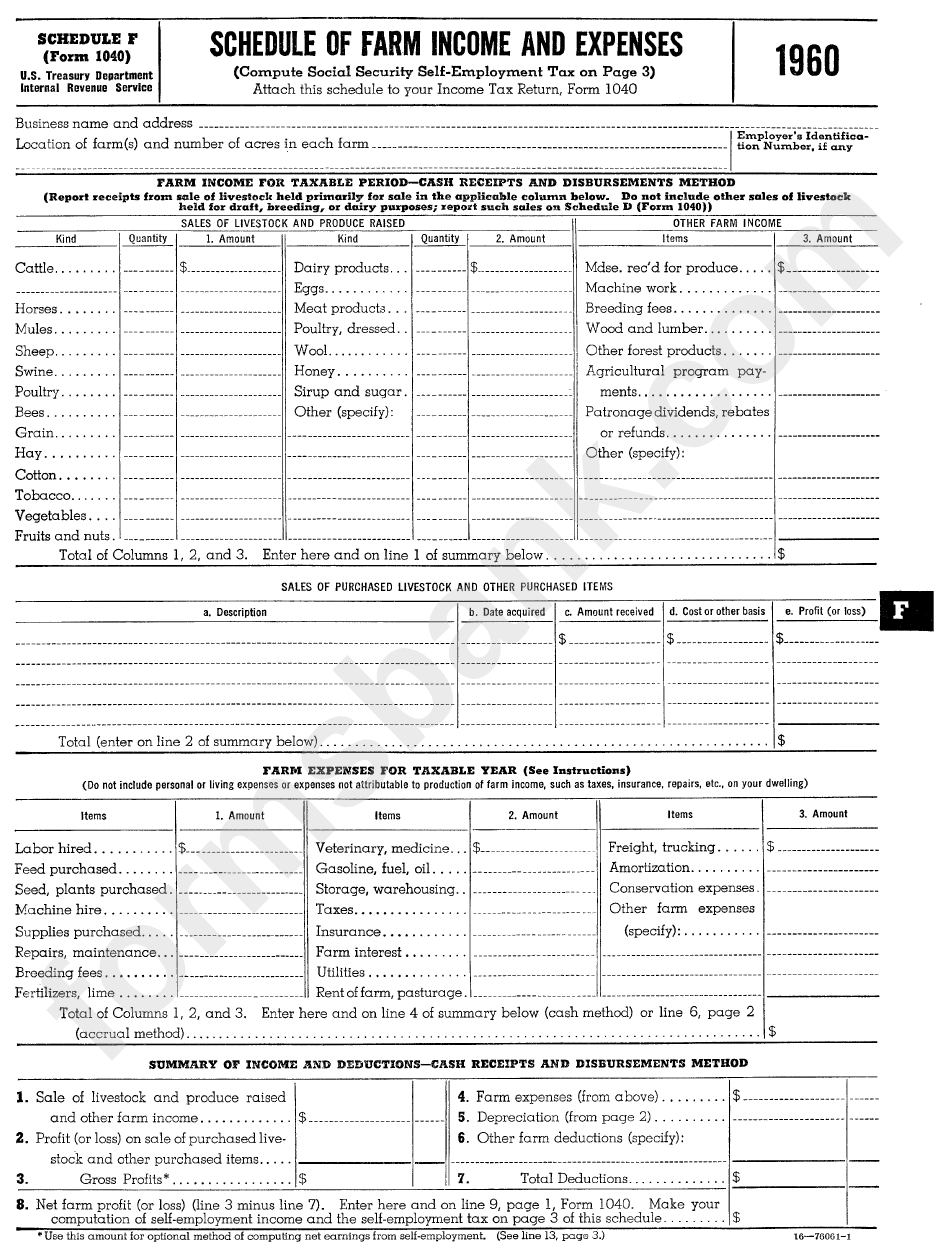

Federal 1040 Schedule F Printable Form Use Schedule F Form 1040 to report farm income and expenses Current Revision Schedule F Form 1040 PDF Form 941 Employer s Quarterly Federal Tax Return Form W 2 Employers engaged in a trade or business who pay compensation Instructions for Schedule F Form 1040 Print Version PDF eBook epub EPUB

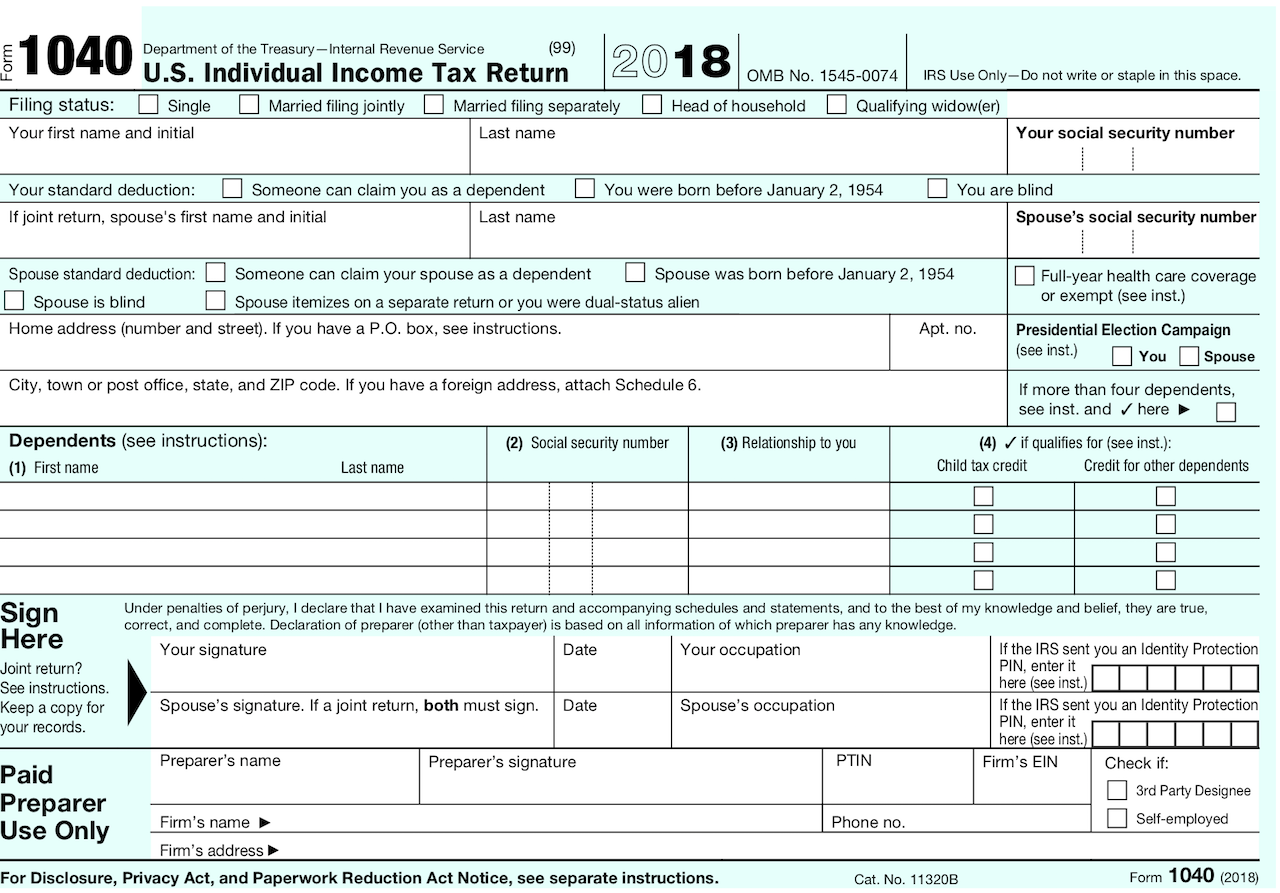

What Is Form 1040 Schedule F Page one of IRS Form 1040 and Form 1040NR requires that you attach Schedule F to report a farm income or loss You can not file Schedule F with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule F is a two page tax form which lists the major sources of farm income and farm expense Order by phone at 1 800 TAX FORM 1 800 829 3676 You can also find printed versions of many forms instructions and publications in your community for free at Libraries IRS Taxpayer Assistance Centers If you are searching for federal tax forms from previous years look them up by form number or year New 1040 form for older adults

Federal 1040 Schedule F Printable Form

Federal 1040 Schedule F Printable Form

https://1044form.com/wp-content/uploads/2020/08/download-instructions-for-irs-form-1040-schedule-f-profit.png

Irs Printable Form 1040

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

Irs Fillable Form 1040 Irs 1040 Schedule F 2019 2021 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/100/24/100024174/large.png

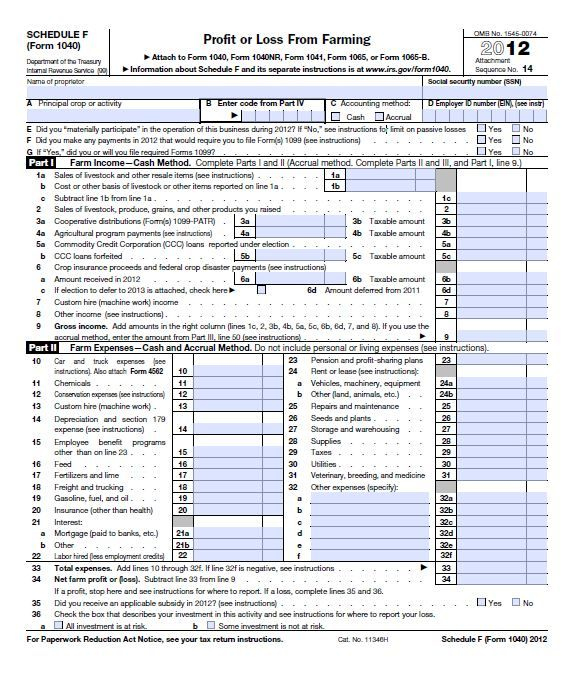

Schedule F is used to report taxable income earned from farming or agricultural activities This schedule must be included on a Form 1040 tax return regardless of the type of farm income You can download or print current or past year PDFs of 1040 Schedule F directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

Schedule F ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040 If you have a profit or a loss it gets combined with the other non farming income reported on your return and increases or reduces your taxable income When you suffer a net operating loss meaning you paid more in expenses Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule f pdf and you can print it directly from your computer More about the Federal 1040 Schedule F eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms

More picture related to Federal 1040 Schedule F Printable Form

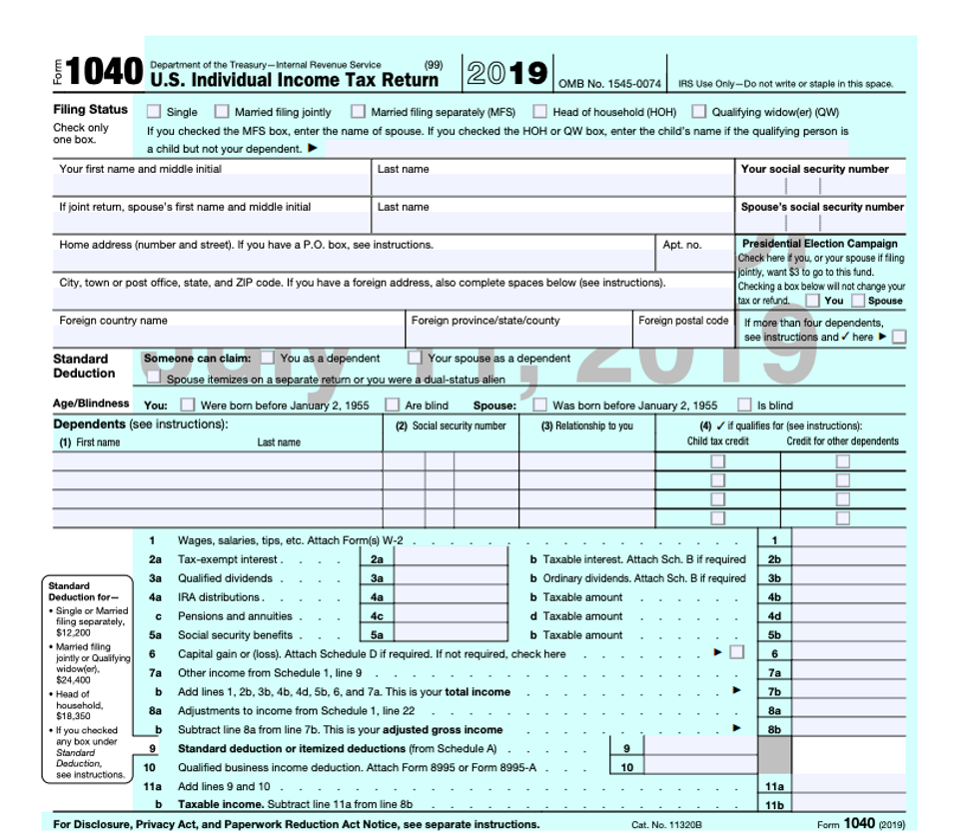

2019 1040 Schedule F Tax Forms Organizer 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/2015-federal-income-tax-forms-1040-with-images-tax.jpg

Irs Fillable Form 1040 Irs Tax Forms Wikipedia Are There Any Requirements Or Guidelines For

https://www.signnow.com/preview/464/235/464235462/large.png

2023 1040 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/549/394/549394086/large.png

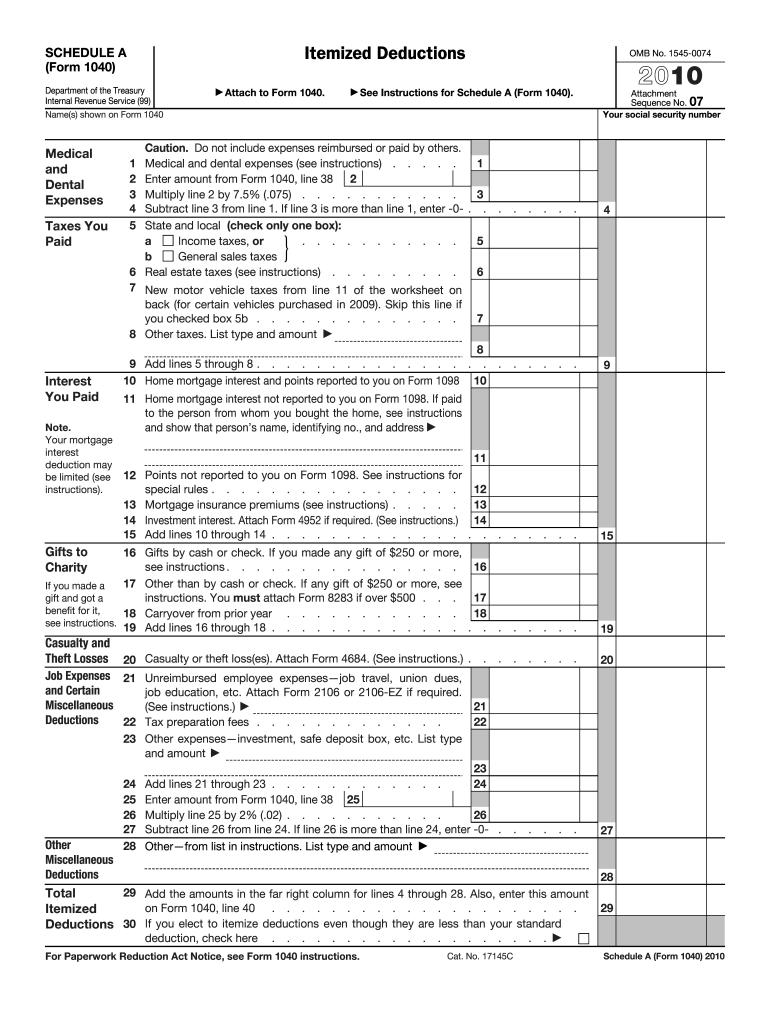

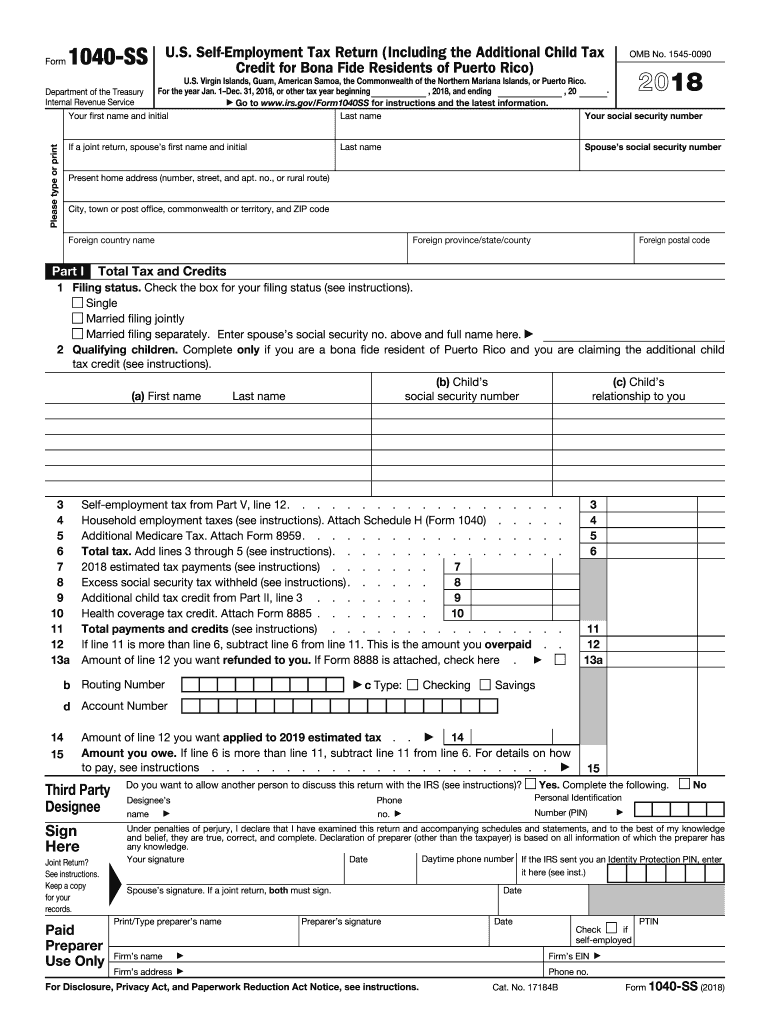

Form 1040 formally known as the U S Individual Income Tax Return is the form people use to report income to the IRS claim tax deductions and credits and calculate their tax refund or Print E file Schedule A Form 1040 Itemized Deductions available available Schedule D Form 1040 Capital Gains and Losses available available Form 4136 Credit for Federal Tax Paid on Fuels available available Form 5329 Add l Taxes on Qualified Plans Incl IRAs Spouse available Schedule F Form 1040 Profit or Loss

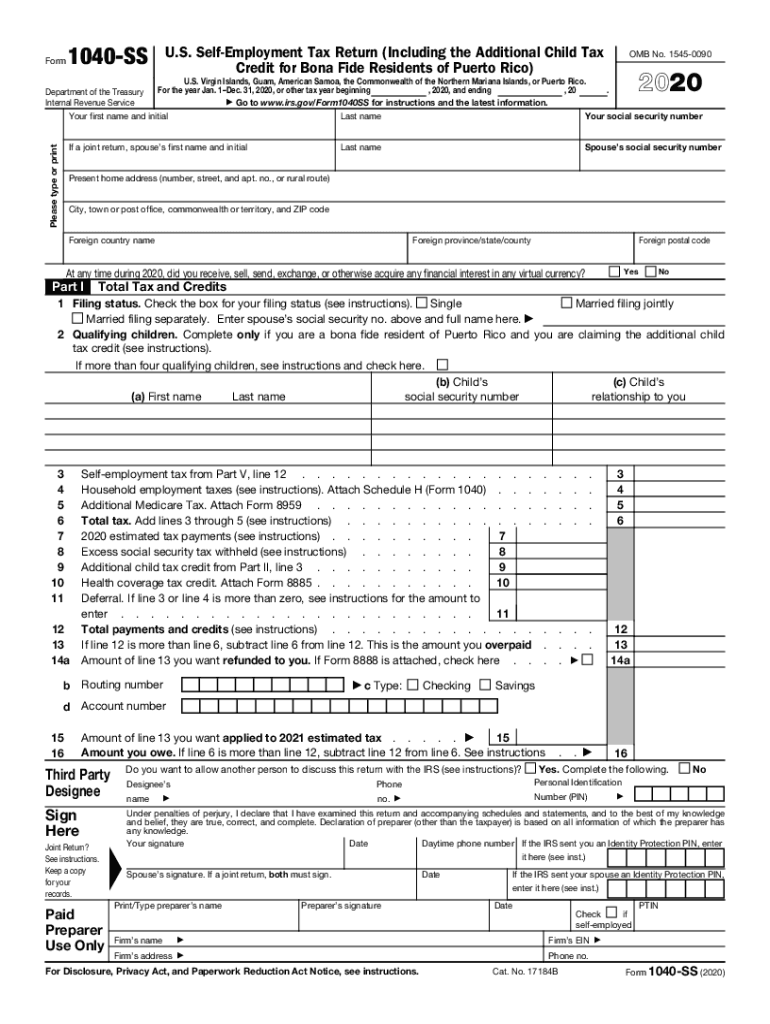

Attach to Form 1040 Form 1040 SR Form 1040 NR Form 1041 or Form 1065 Go to www irs gov ScheduleF for instructions and the latest information OMB No 1545 0074 2020 Attachment Sequence No 14 Name of proprietor Social security number SSN A Principal crop or activity B Enter code from Part IV Cash Accrual C Form 1040 US Individual Income Tax Schedule 8812 Child Tax Credit Schedule A Itemized Deductions Schedule B Interest and Dividends Schedule C Profit or Loss from Business Schedule C EZ Net Profit from Business Schedule D Capital Gains and Losses Schedule E Rents Royalties Partnerships Etc Schedule EIC Earned Income Credit

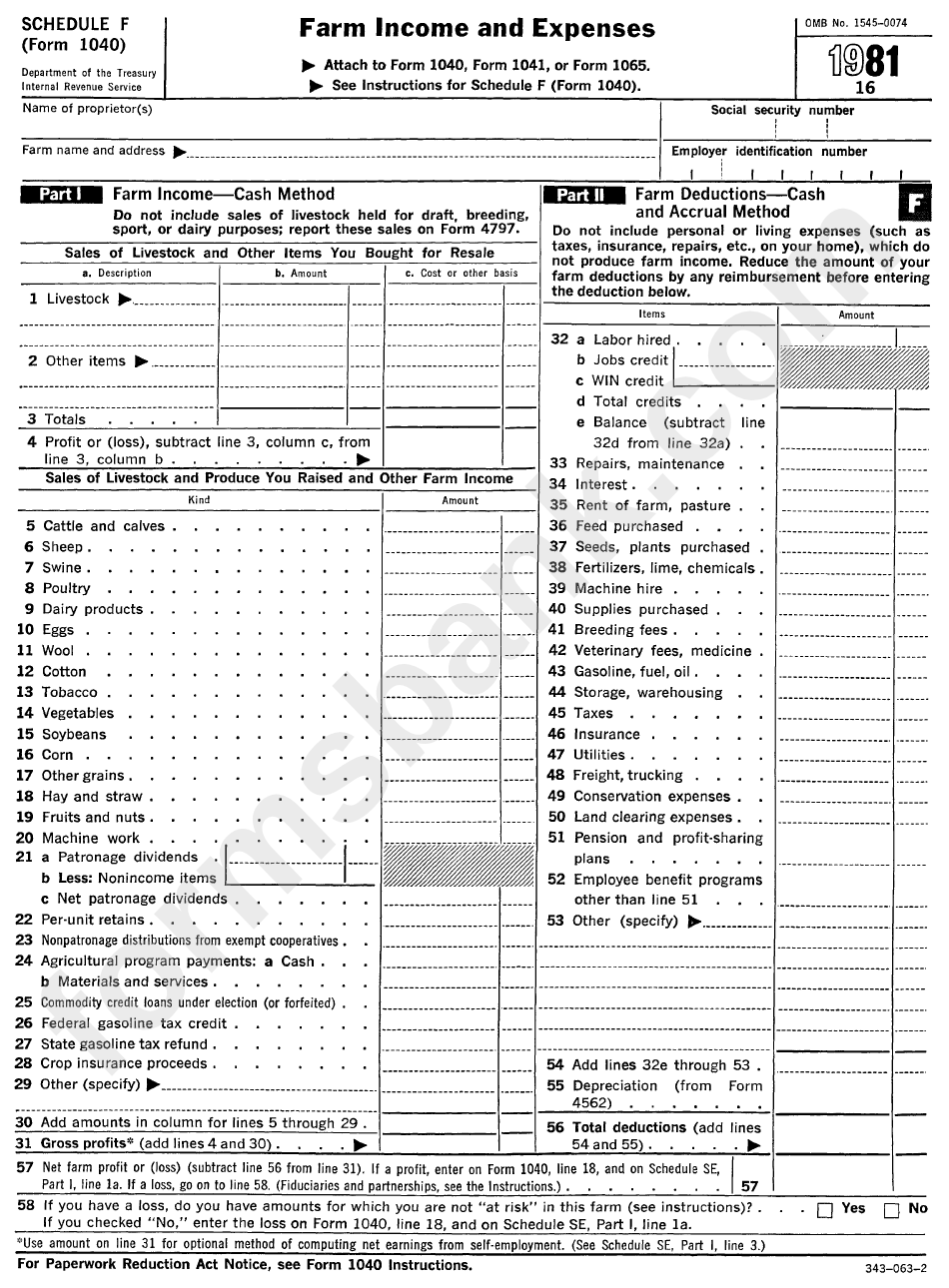

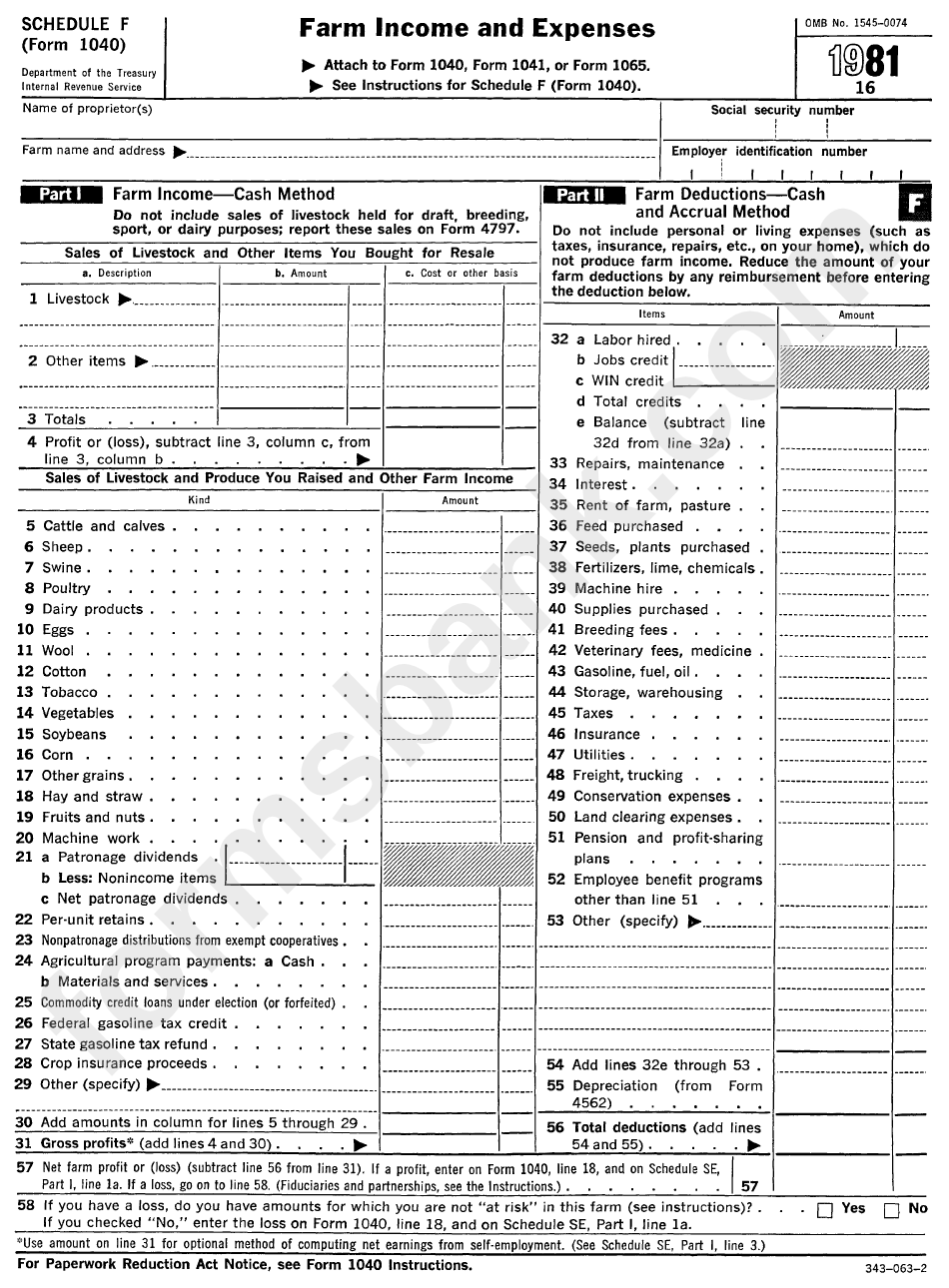

Schedule F Form 1040 Farm Income Tax Expenses 1981 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/280/2805/280536/page_1_bg.png

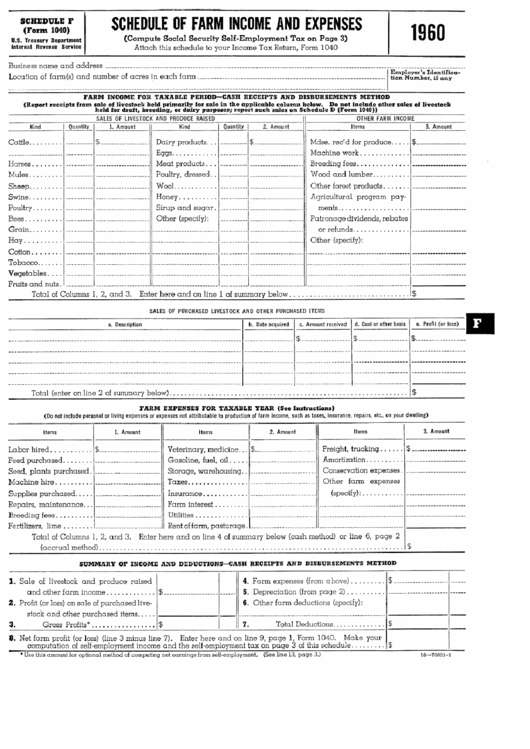

Schedule F Form 1040 Schedule Of Farm Income And Expenses 1960 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/354/3547/354792/page_1_thumb_big.png

https://www.irs.gov/forms-pubs/about-schedule-f-form-1040

Use Schedule F Form 1040 to report farm income and expenses Current Revision Schedule F Form 1040 PDF Form 941 Employer s Quarterly Federal Tax Return Form W 2 Employers engaged in a trade or business who pay compensation Instructions for Schedule F Form 1040 Print Version PDF eBook epub EPUB

https://www.incometaxpro.net/tax-form/schedule-f.htm

What Is Form 1040 Schedule F Page one of IRS Form 1040 and Form 1040NR requires that you attach Schedule F to report a farm income or loss You can not file Schedule F with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule F is a two page tax form which lists the major sources of farm income and farm expense

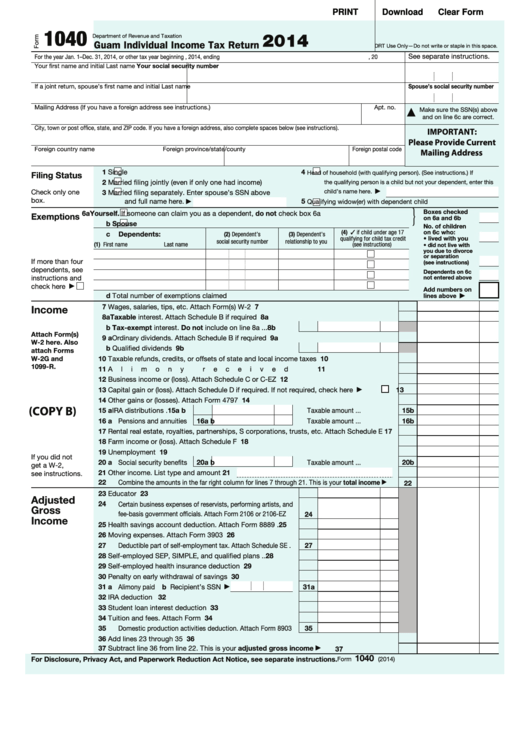

Printable Irs Form 1040 Printable Form 2023

Schedule F Form 1040 Farm Income Tax Expenses 1981 Printable Pdf Download

2019 IRS Tax Forms 1040 Printable 2021 Tax Forms 1040 Printable

Irs Fillable Form 1040 Irs 1040 Schedule F 2019 2021 Fill And Sign Printable Template Online

Describes New Form 1040 Schedules Tax Tables

IRS 1040 Form Fillable Printable In PDF

IRS 1040 Form Fillable Printable In PDF

2010 Form IRS 1040 Schedule F Fill Online Printable Fillable Blank PdfFiller

Schedule F Form 1040 Schedule Of Farm Income And Expenses 1960 Printable Pdf Download

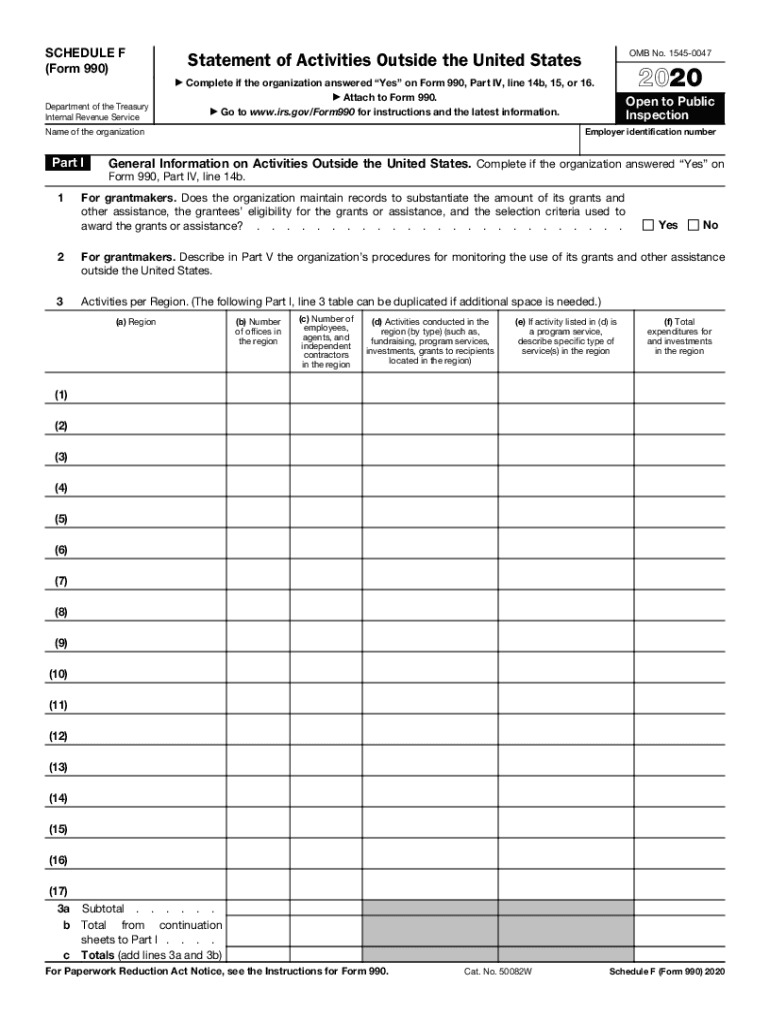

2020 Form IRS 990 Schedule F Fill Online Printable Fillable Blank PdfFiller

Federal 1040 Schedule F Printable Form - Abstract Schedule F Form 1040 is used by individuals estate or trust to report their farm income or loss and expenses The data is used to verify that the items reported on the form are correct and also for general statistical use Current Actions There is no change in the paperwork burden previously approved by OMB