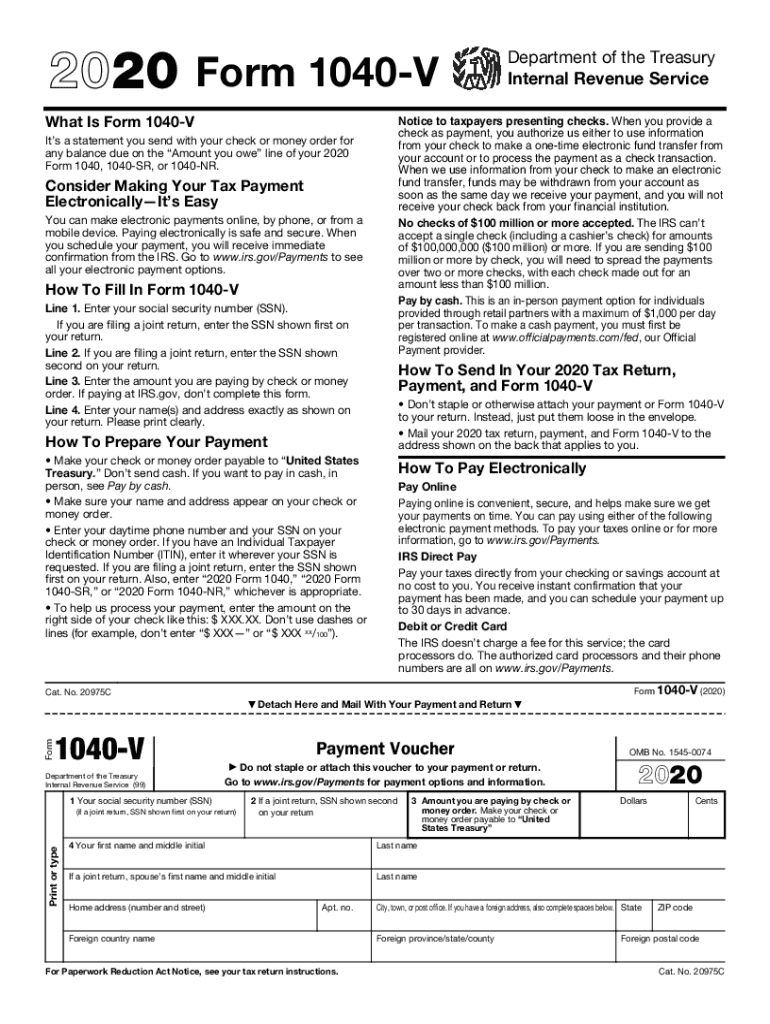

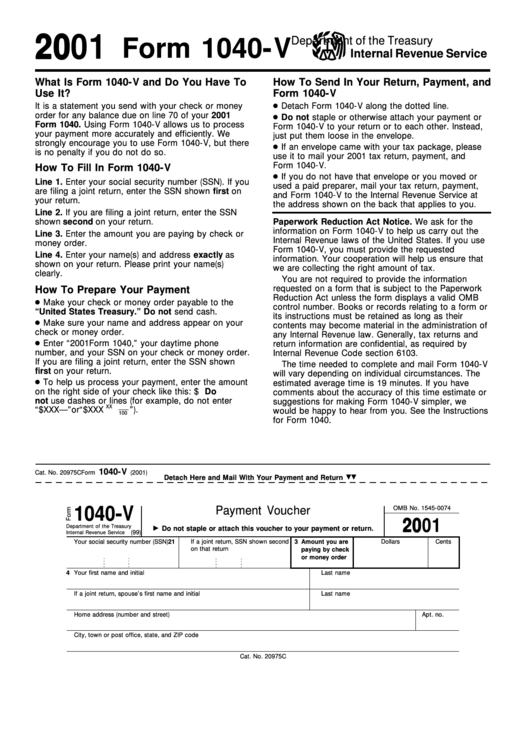

Federal Tax Payment Voucher Printable Form Form 1040 V is a statement you send with your check or money order for any balance due on the Amount you owe line of your Form 1040 or 1040 NR Current Revision Form 1040 V PDF Recent Developments None at this time Other Items You May Find Useful All Form 1040 V Revisions Paying Your Taxes Other Current Products

1 You expect to owe at least 1 000 in tax for 2023 after subtracting your withholding and refundable credits 2 You expect your withholding and refundable credits to be less than the smaller of a 90 of the tax to be shown on your 2023 tax return or b 100 of the tax shown on your 2022 tax return Form 1040 V is a Federal Individual Income Tax form Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSN EIN of the taxpayer who sent it

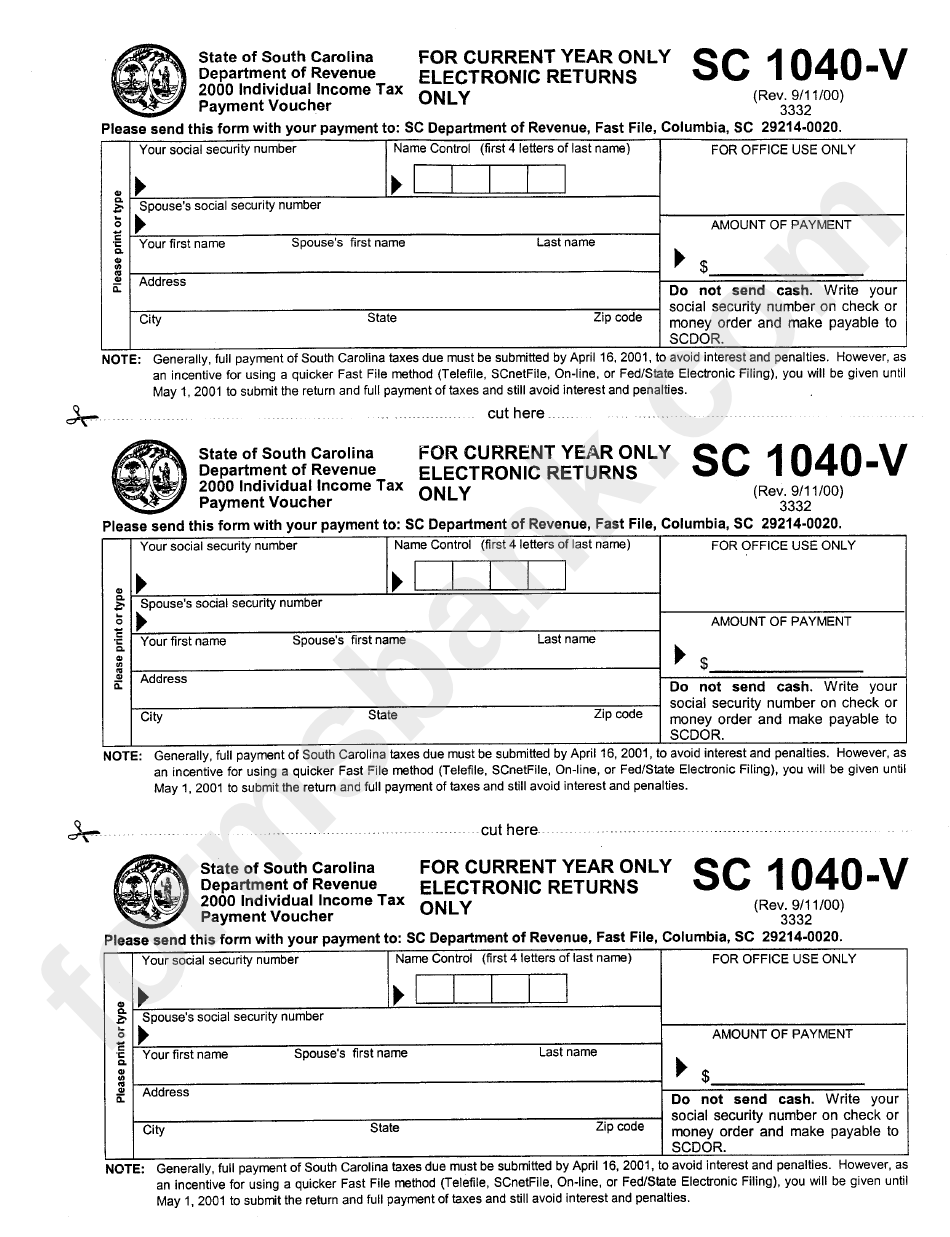

Federal Tax Payment Voucher Printable Form

Federal Tax Payment Voucher Printable Form

https://data.formsbank.com/pdf_docs_html/350/3503/350372/page_1_bg.png

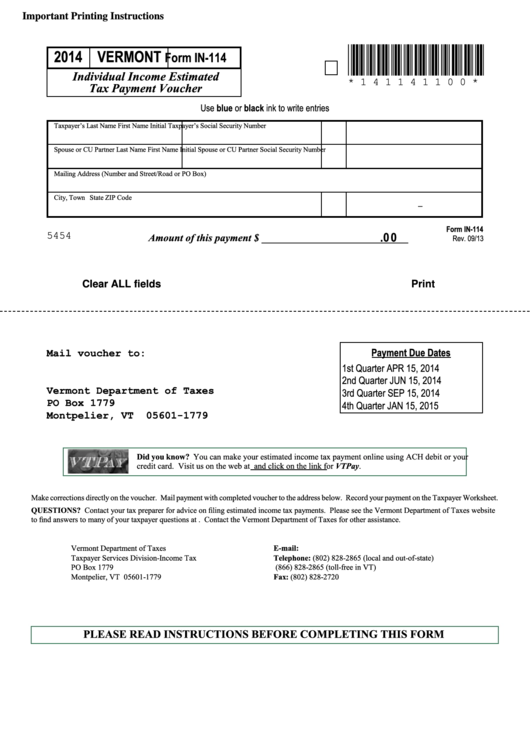

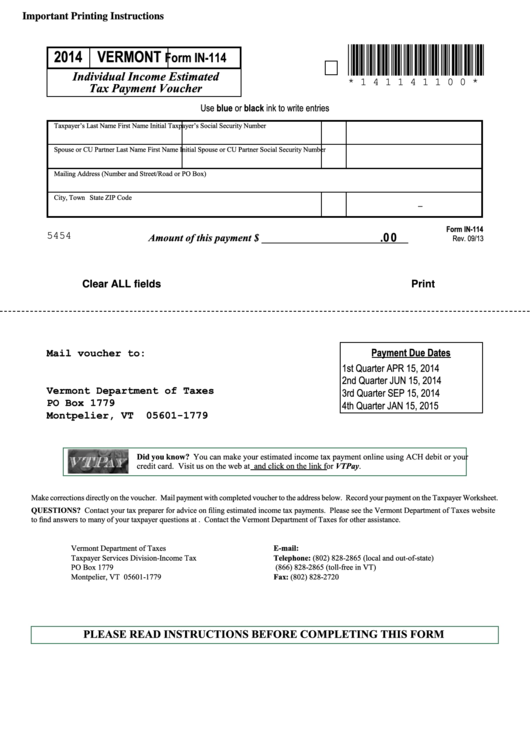

Fillable Form In 114 Individual Income Estimated Tax Payment Voucher 2014 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/282/2822/282295/page_1_thumb_big.png

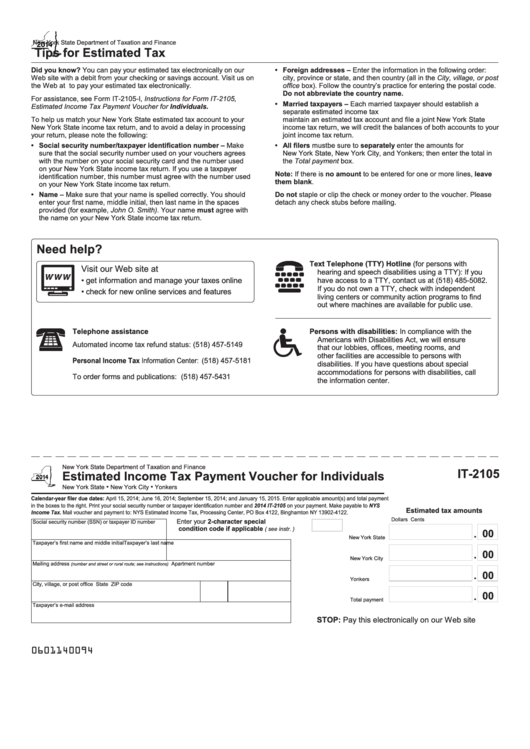

Fillable Form It 2105 2014 Estimated Income Tax Payment Voucher Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/131/1318/131859/page_1_thumb_big.png

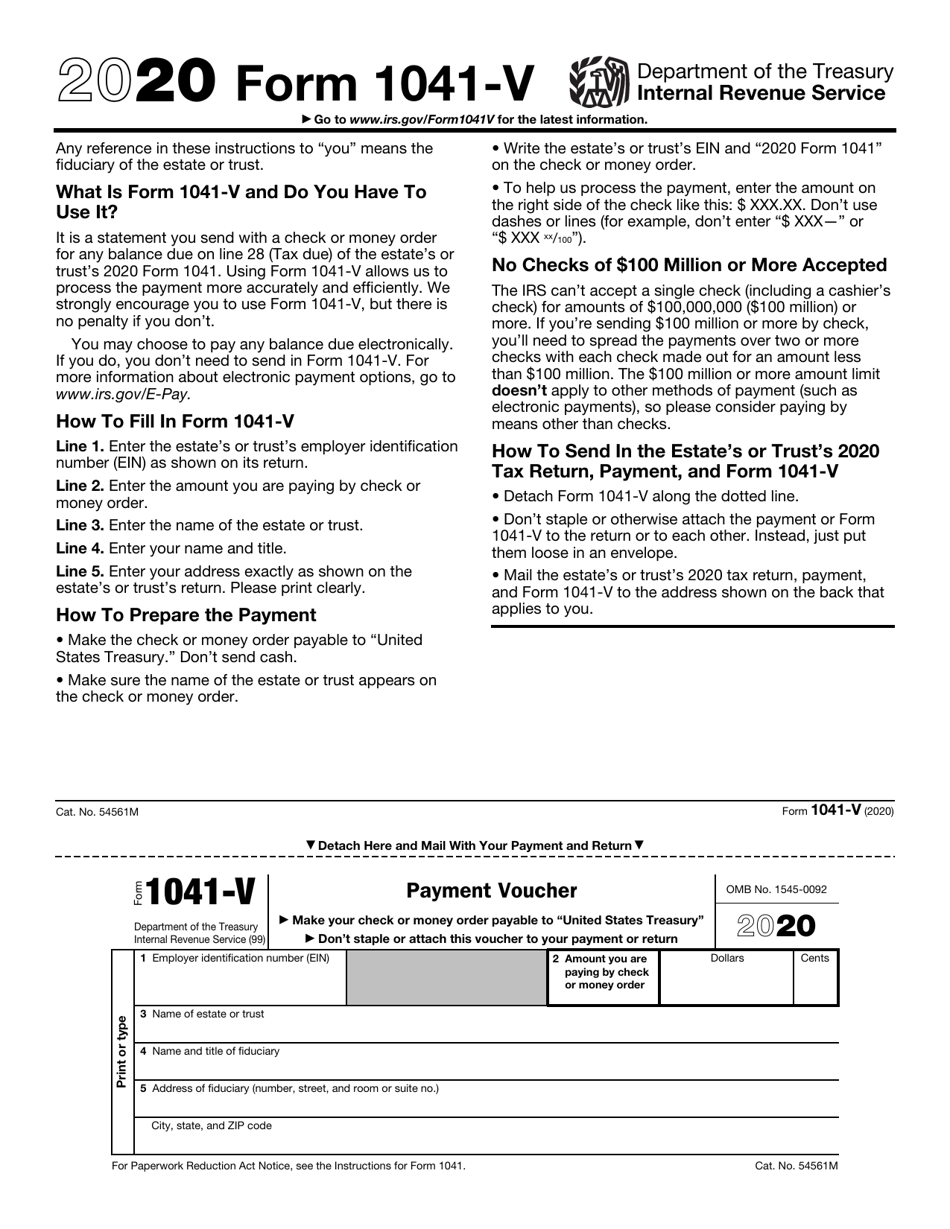

Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2017 2nd Quarter 2017 3rd Quarter 2017 or 4th Quarter 2017 on your check or money Form 1040 V Payment Voucher is an optional form that you can mail the IRS if you re paying your taxes by check If you re paper filing and paying via check we ll include your 1040 V with your tax return printout along with mailing instructions If you re e filing and paying via check we ll prepare your 1040 V right after you e file so you

This form is a payment voucher you send along with your check or money order when you have a balance due to the IRS on any of the following forms Form 1040 Form 1040 SR Form 1040 NR You ll know you have a balance due by looking at the Amount you owe section of the 1040 form you completed Form 1040 V Payment Voucher is a statement that taxpayers send to the Internal Revenue Service IRS along with their tax return if they pay with a check or money order to their IRS filing

More picture related to Federal Tax Payment Voucher Printable Form

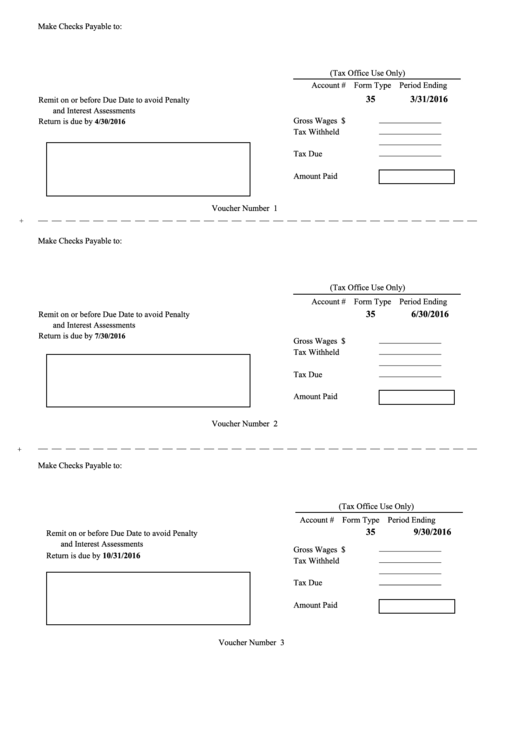

Fillable Form 35 Tax Quarterly Payment Voucher Form 2016 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/293/2939/293991/page_1_thumb_big.png

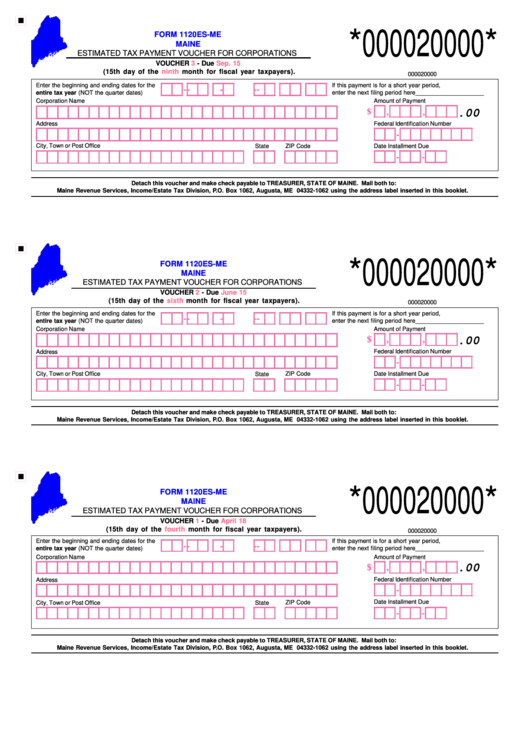

Form 1120es Me Estimated Tax Payment Voucher For Corporations With Instructions Printable Pdf

https://data.formsbank.com/pdf_docs_html/274/2742/274263/page_1_thumb_big.png

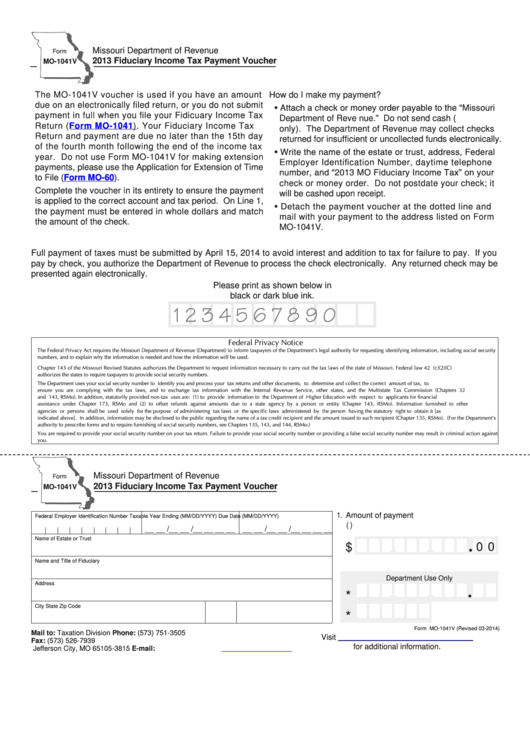

Fillable Form Mo 1041v Fiduciary Income Tax Payment Voucher 2013 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/263/2635/263527/page_1_thumb_big.png

Tax year 2023 guide to the employer s quarterly federal tax Form 941 Learn filing essentials get instructions deadlines mailing info and more The signer must also print their name and title e g president and include the date and phone number Form 941 V Payment Voucher You can only make a payment with Form 941 if you check How to Print Form 1040 V Payment Voucher To print IRS Form 1040 V Payment Voucher From within your TaxAct return Online or Desktop click Print Center down the left to expand Click Custom Print check Federal Form 1040 V Your Name then click Print Click the link for Your Name 2020 Custom Forms pdf Note

Form 1040 V is the payment voucher you detach and mail with your annual Form 1040EZ Form 1040A Form 1040 SR or Form 1040 income tax return Use IRS Form 1040 V when you are paying by check or money order and make your check or money order payable to United States Treasury What Is Form 1040 V It s a statement you send with your check or money order for any balance due on the Amount you owe line of your 2021 Form 1040 1040 SR or 1040 NR Consider Making Your Tax Payment Electronically It s Easy You can make electronic payments online by phone or from a mobile device Paying electronically is safe and secure

Form 1040 V Payment Voucher Meru Accounting

https://us.meruaccounting.com/wp-content/uploads/2020/05/Form-1040V.gif

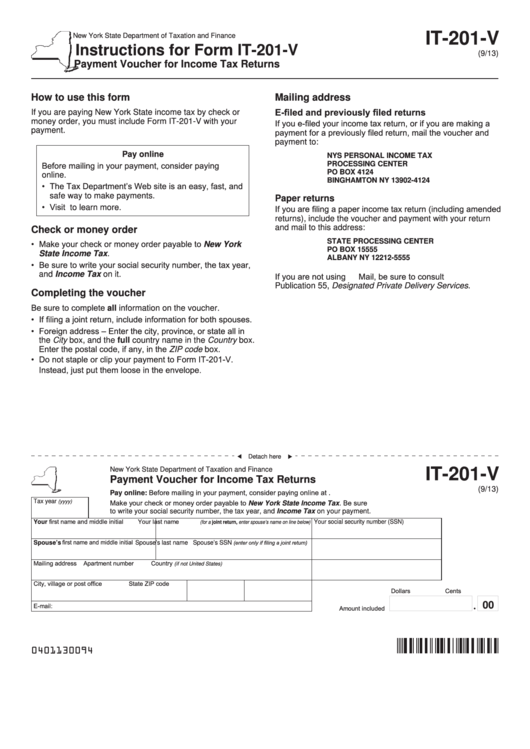

Fillable Form It 201 V Payment Voucher For Income Tax Returns Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/337/3374/337416/page_1_thumb_big.png

https://www.irs.gov/forms-pubs/about-form-1040-v

Form 1040 V is a statement you send with your check or money order for any balance due on the Amount you owe line of your Form 1040 or 1040 NR Current Revision Form 1040 V PDF Recent Developments None at this time Other Items You May Find Useful All Form 1040 V Revisions Paying Your Taxes Other Current Products

https://www.irs.gov/pub/irs-pdf/f1040es.pdf

1 You expect to owe at least 1 000 in tax for 2023 after subtracting your withholding and refundable credits 2 You expect your withholding and refundable credits to be less than the smaller of a 90 of the tax to be shown on your 2023 tax return or b 100 of the tax shown on your 2022 tax return

Irs Payment Voucher Fill Out And Sign Printable Pdf Template Signnow My XXX Hot Girl

Form 1040 V Payment Voucher Meru Accounting

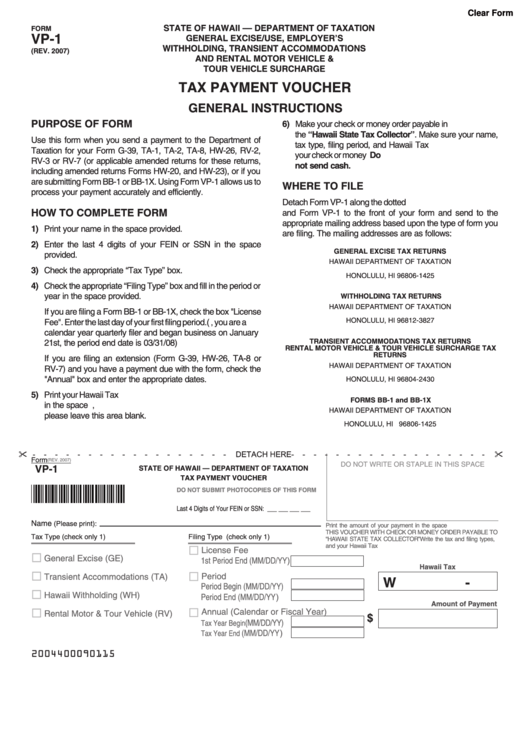

Fillable Form Vp 1 Tax Payment Voucher Printable Pdf Download

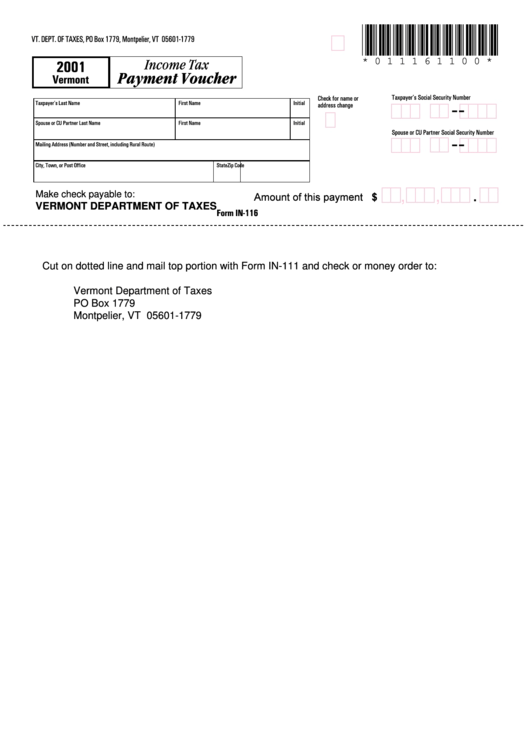

Income Tax Payment Voucher Template 2001 Printable Pdf Download

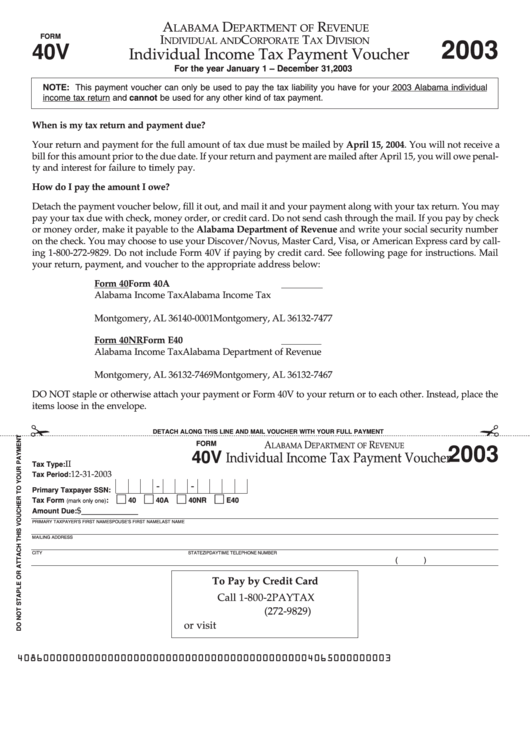

Form 40v Individual Income Tax Payment Voucher 2003 Printable Pdf Download

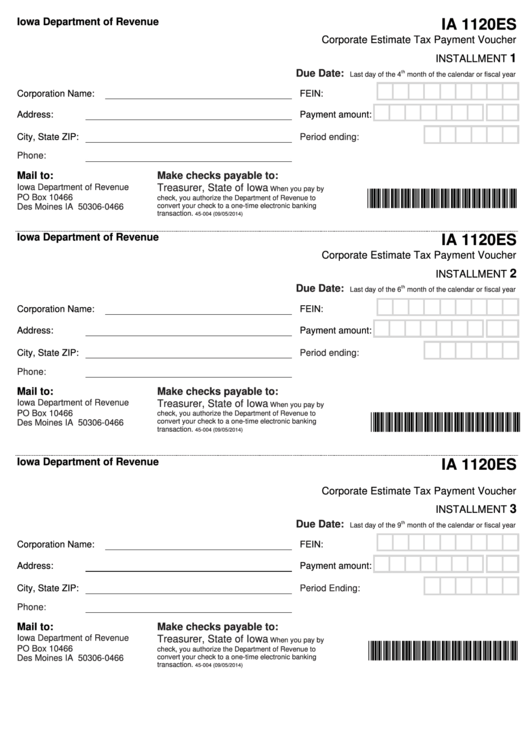

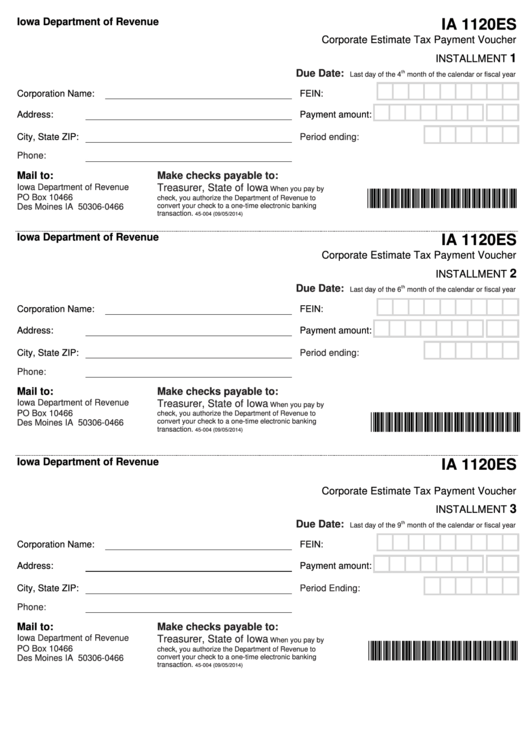

Fillable Form Ia 1120es Corporate Estimate Tax Payment Voucher Printable Pdf Download

Fillable Form Ia 1120es Corporate Estimate Tax Payment Voucher Printable Pdf Download

Payment 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Form 1040 V Payment Voucher 2001 Printable Pdf Download

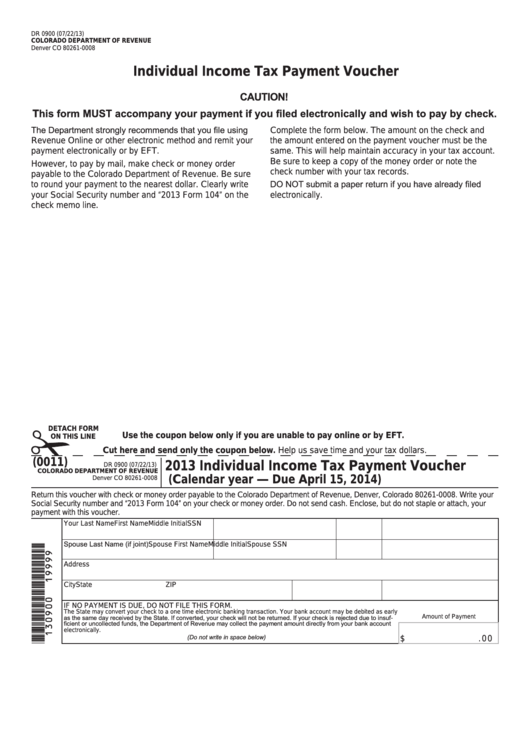

Fillable Form Dr 0900 Individual Income Tax Payment Voucher Printable Pdf Download

Federal Tax Payment Voucher Printable Form - Form 1040 V Payment Voucher is a statement that taxpayers send to the Internal Revenue Service IRS along with their tax return if they pay with a check or money order to their IRS filing