Form 02 01 Refund Of Accumulated Contributions Printable SECTION 1 INSTRUCTIONS Yes No A copy of your Social Security card is required to be attached in order to process your refund You may be contacted by LASERS to verify information provided on this form Please read the Special Tax Notice Regarding Plan Payments which explains important tax information options and effects of this transaction

A To apply for a refund you must submit the following to LASERS Form 02 01 Refund of Accumulated Contributions A copy of your Social Security card Q When will I receive my refund A Most refunds are paid within 60 90 days It is not necessary to contact LASERS regarding the status of your refund I hereby make application for a refund of my accumulated contributions I certify that I have left all state employment and that I am no longer eligible to be a member of LASERS I also certify that I am not transferring from one state agency to another or from one division to another within the same agency

Form 02 01 Refund Of Accumulated Contributions Printable

Form 02 01 Refund Of Accumulated Contributions Printable

https://data.formsbank.com/pdf_docs_html/44/448/44896/page_1_thumb_big.png

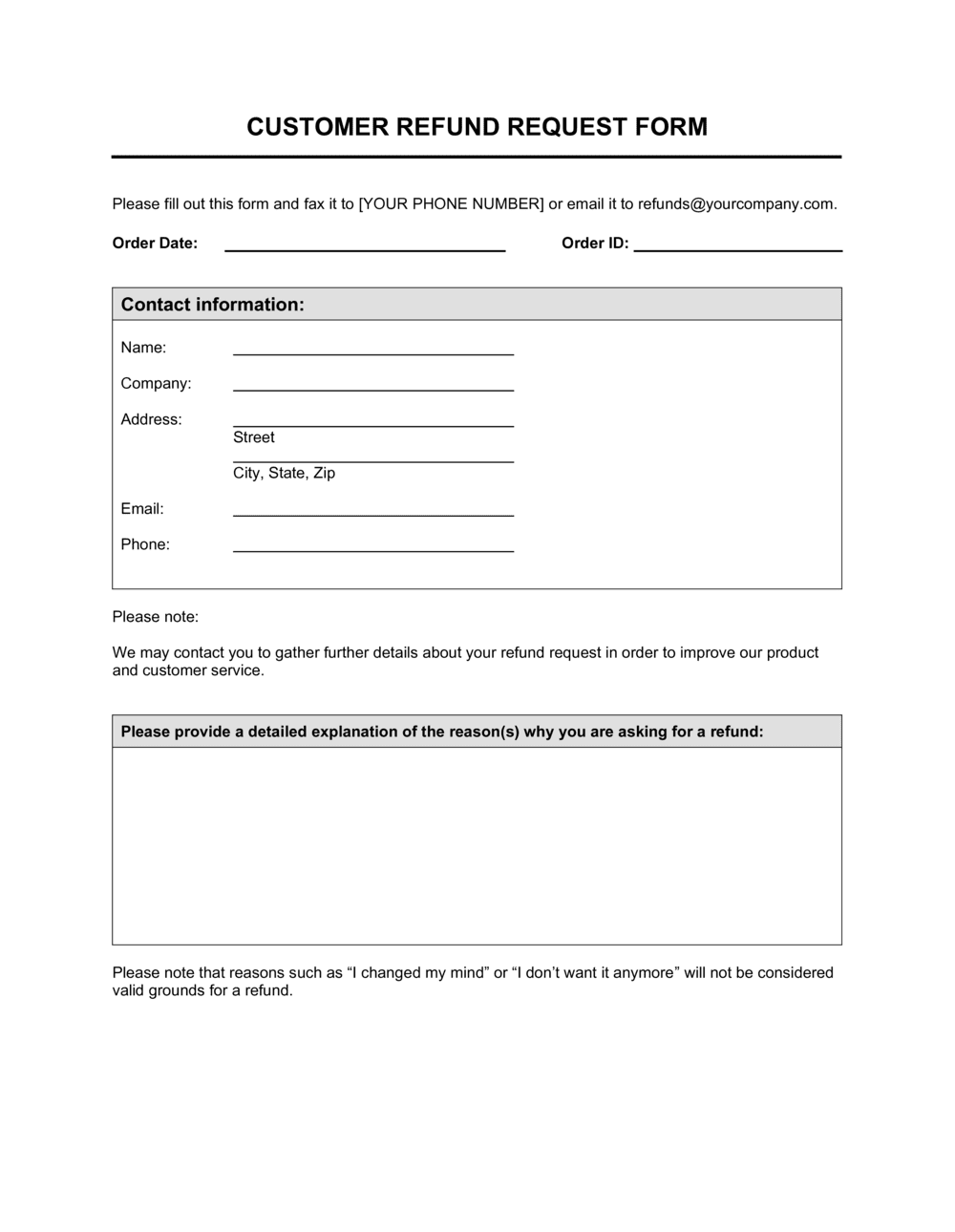

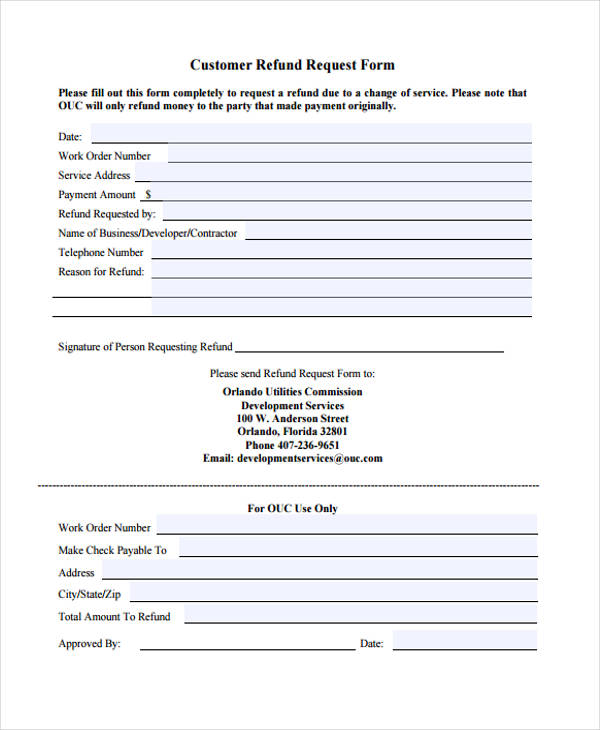

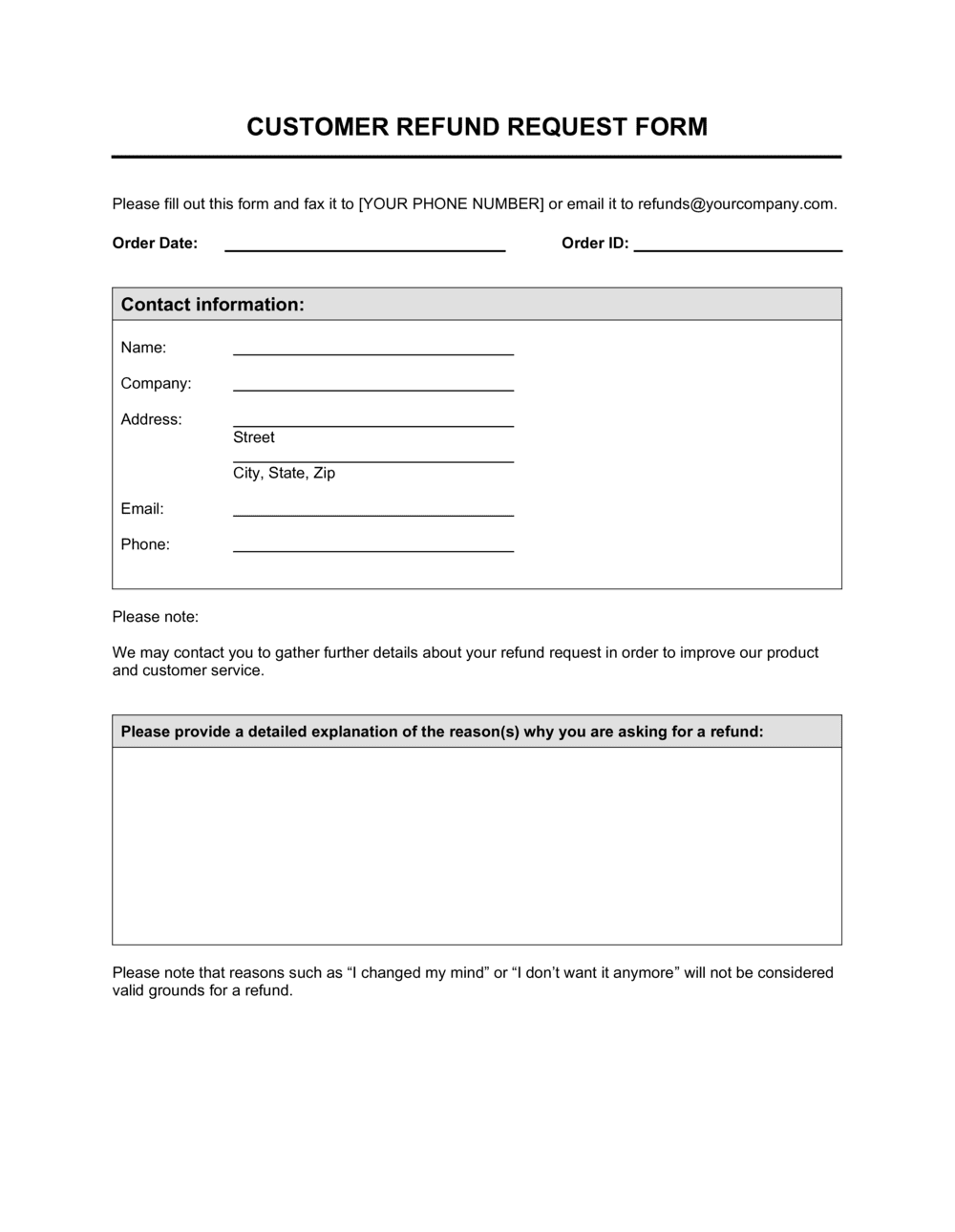

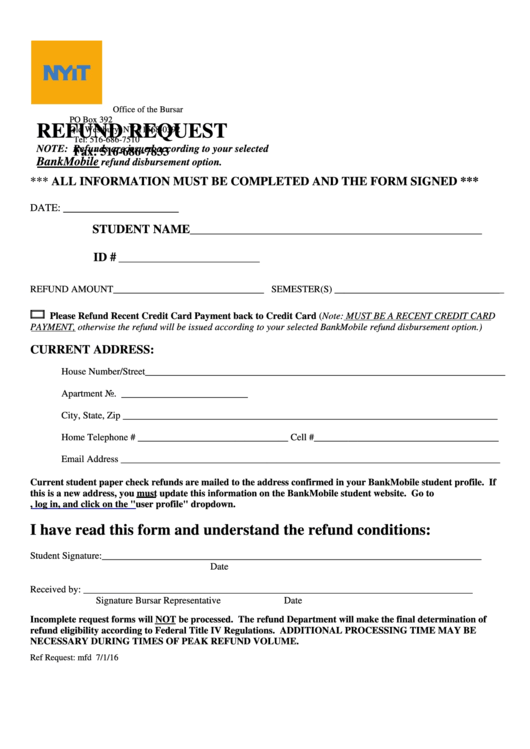

Refund Request Form Template By Business in a Box

https://templates.business-in-a-box.com/imgs/1000px/refund-request-form-D1278.png

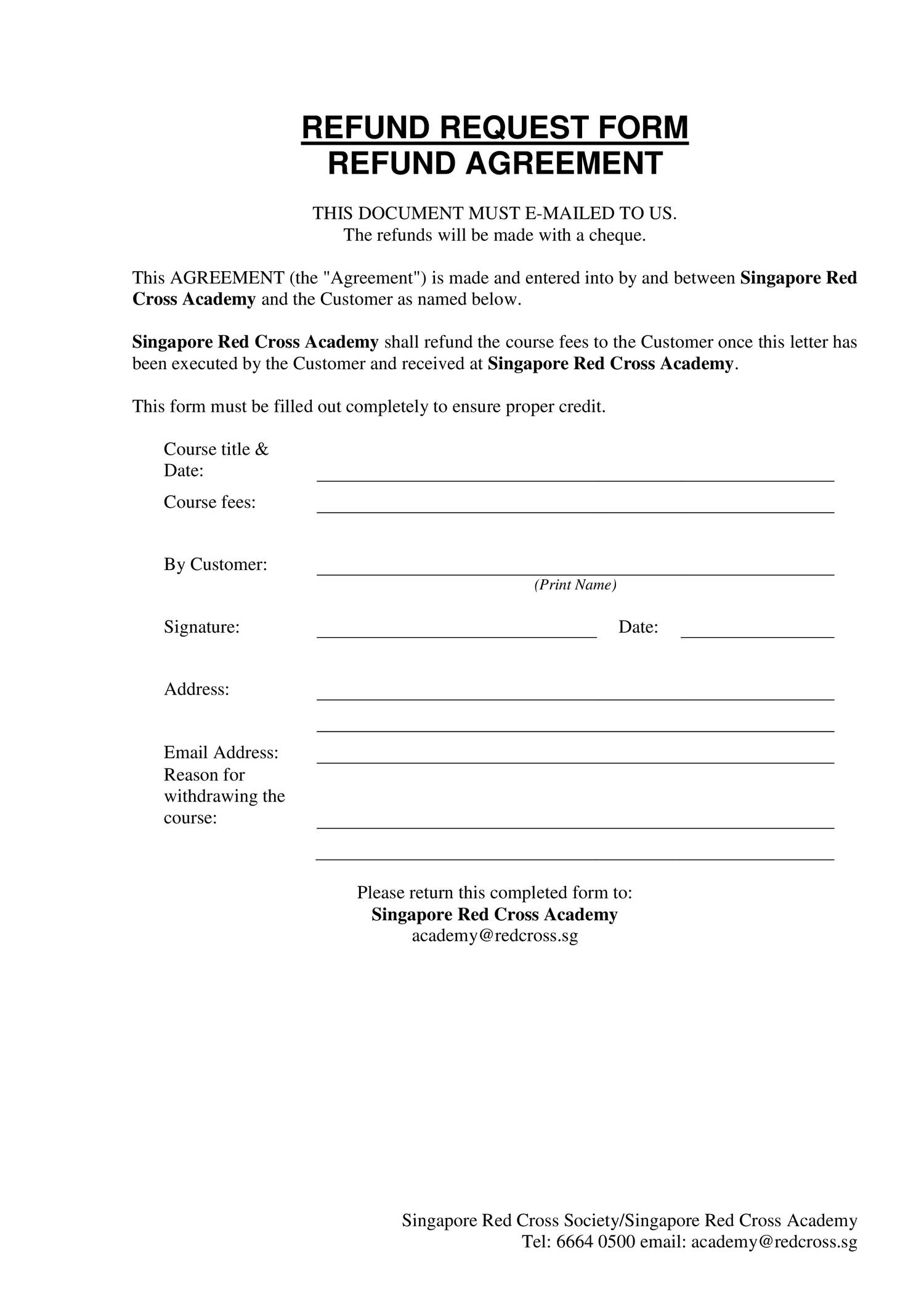

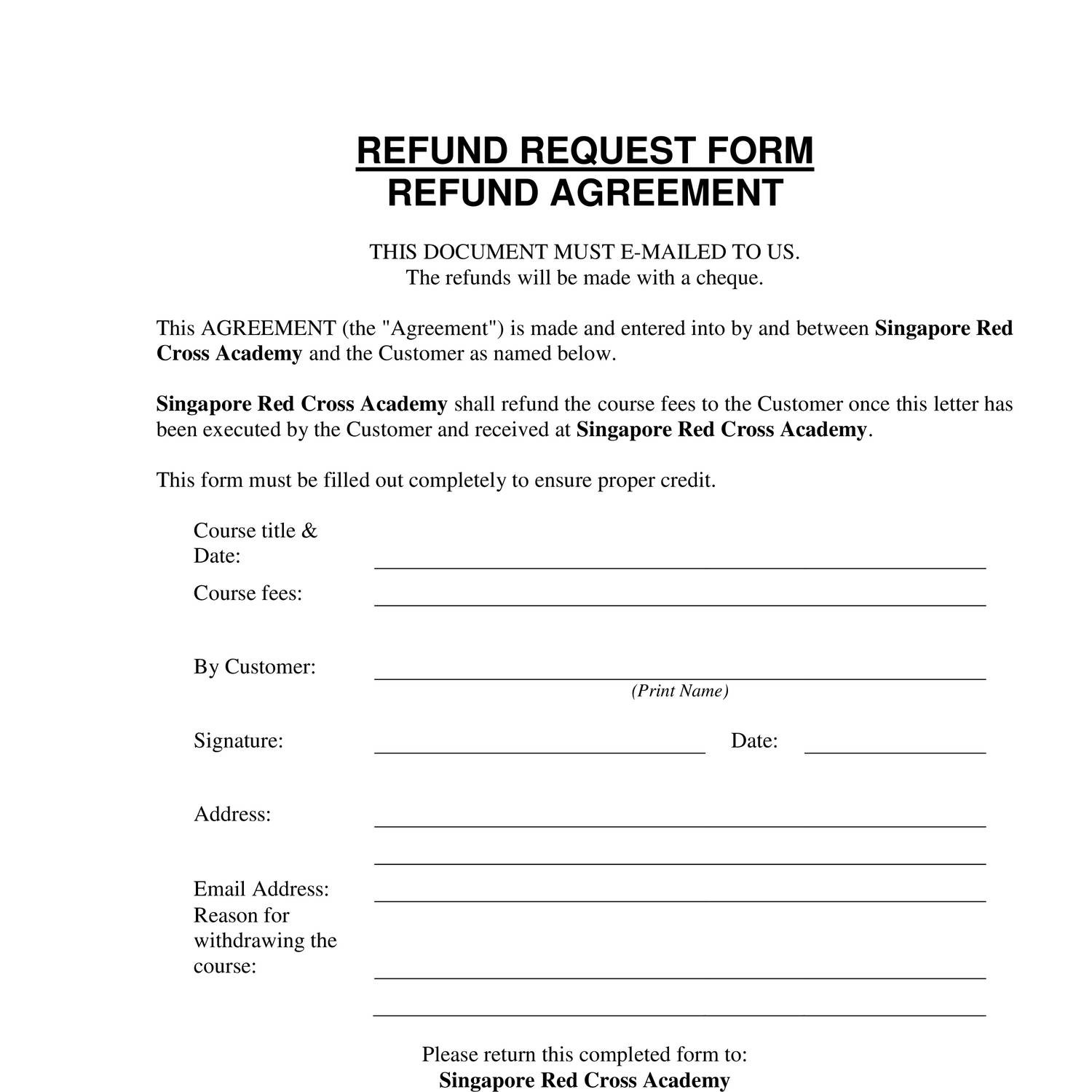

Refund Form Template

https://www.docdroid.net/file/view/mNEIwuX/refund-requestform.jpg

Are you a member of the Louisiana State Employees Retirement System LASERS who wants to withdraw your accumulated contributions If so you need to fill out this form and submit it to LASERS Learn more about the eligibility tax implications and payment options for refunding your retirement account Form 02 01 Refund of Accumulated Contributions A copy of your Social Security card 11 Repayment of Refunds La R S 11 537 D In order to repay a refund you must have 18 months of non refunded service credit on record with LASERS

To apply the member must submit Form 02 01 Refund of Accumulated Contributions to LASERS This form does not need to be certified by the agency Along with Form 02 01 the member must provide a copy of his or her Social Security card to LASERS The name on the Social Security card must match the name on the refund application Application for Refund of Accumulated Contributions Tennessee Consolidated Retirement System 502 Deaderick Street Nashville Tennessee 37243 0201 1 800 770 8277 http tcrs tn gov

More picture related to Form 02 01 Refund Of Accumulated Contributions Printable

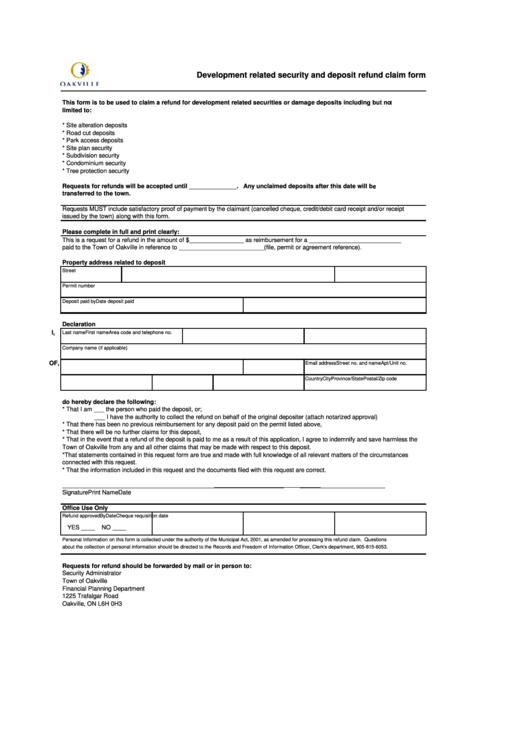

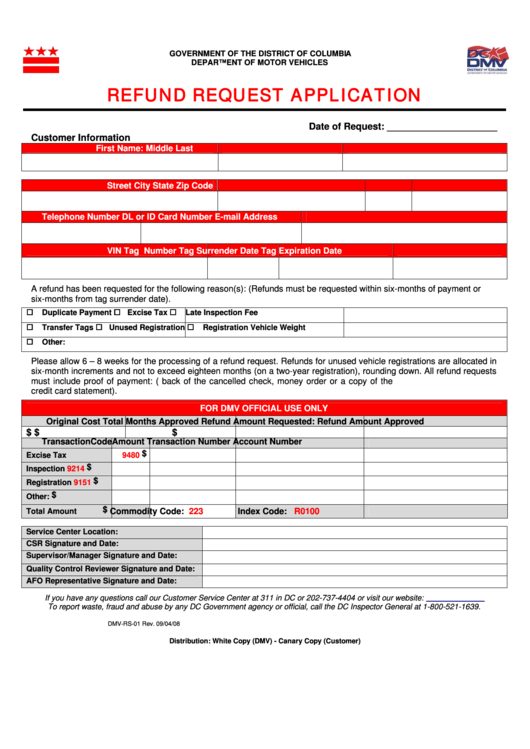

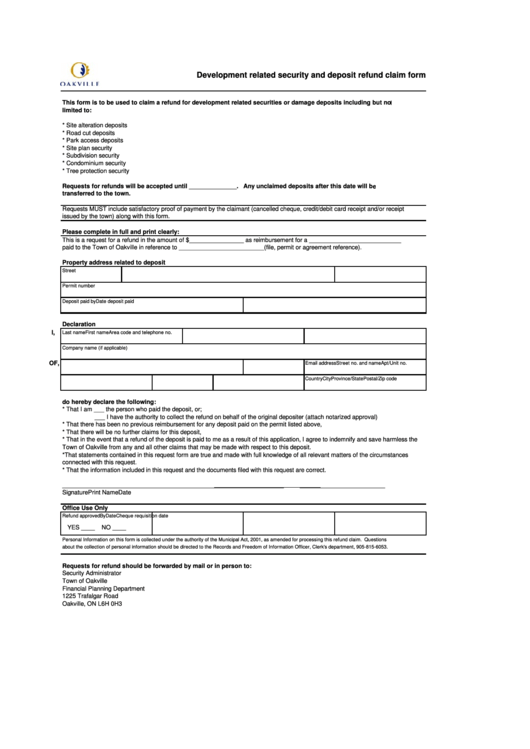

Form Dmv Rs 01 Refund Request Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/149/1494/149420/page_1_thumb_big.png

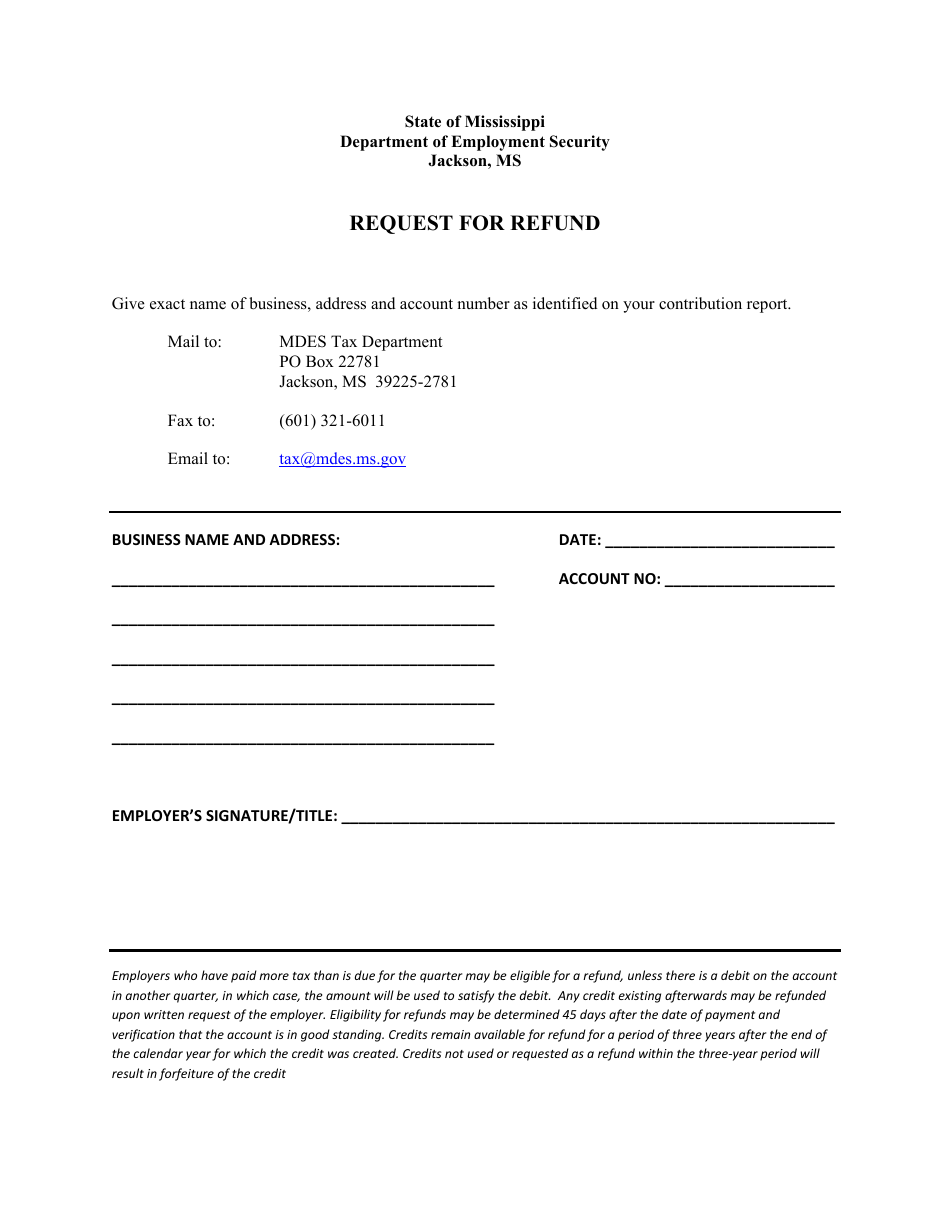

Bond Refund Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/39/392/39392850/large.png

Refund Form Template

https://images.sampleforms.com/wp-content/uploads/2017/03/Customer-Refund-Request-Form.jpg

Refunds of Accumulated Contributions A copy of the member s social security card and driver s license or other government issued ID must be submitted with the completed MERS form titled Application for Refund of Member Contributions The processing of the member s refund will be delayed if the identification documents are not FOR REFUND OF ACCUMULATED CONTRIBUTIONS Member s Name Member s Mailing Address SECTION I CERTIFICATION OF TERMINATION Date To the Board of Trustees I Print Name whose Social Security Number Last 4 is hereby make application for the return of the amount of contributions made by me to the New Hampshire Retirement

TCRS CustomerSupport tn gov TCRS Andrew Jackson Building 15th Floor 502 Deaderick Street Nashville TN 37243 0201 Deferred Compensation Program Empower Retirement PO Box 173764 Denver CO 80217 3764 Discover the full suite of online and printable forms guides and publications to help you learn more about and manage your RetireReadyTN and PLEASE PRINT NAME Cincinnati Retirement System 801 Plum St Suite 328 Cincinnati Ohio 45202 APPLICATION FOR RETURN OF ACCUMULATED CONTRIBUTIONS CASH REFUND State of Ohio DRAFT Hamilton County SS Created Date 8 23 2021 3 01 12 PM

Application Refund Accumulated Contributions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/281/1281122/large.png

Printable Refund Form Template

https://www.docdroid.net/thumbnail/mNEIwuX/1500,1500/refund-requestform.jpg

https://crt.la.gov/channelz/e-forms/hr/retirement/lasers-forms/2-01_Refund_of_Accumulated_Contributions_12-2021.pdf

SECTION 1 INSTRUCTIONS Yes No A copy of your Social Security card is required to be attached in order to process your refund You may be contacted by LASERS to verify information provided on this form Please read the Special Tax Notice Regarding Plan Payments which explains important tax information options and effects of this transaction

https://lasersonlinesupport.zendesk.com/hc/en-us/articles/9889331003796-Refund-of-Contributions

A To apply for a refund you must submit the following to LASERS Form 02 01 Refund of Accumulated Contributions A copy of your Social Security card Q When will I receive my refund A Most refunds are paid within 60 90 days It is not necessary to contact LASERS regarding the status of your refund

Printable Refund Form Template

Application Refund Accumulated Contributions Fill Online Printable Fillable Blank PdfFiller

Form 02 01 Refund Of Accumulated Contributions Printable Printable Forms Free Online

Printable Refund Form Template

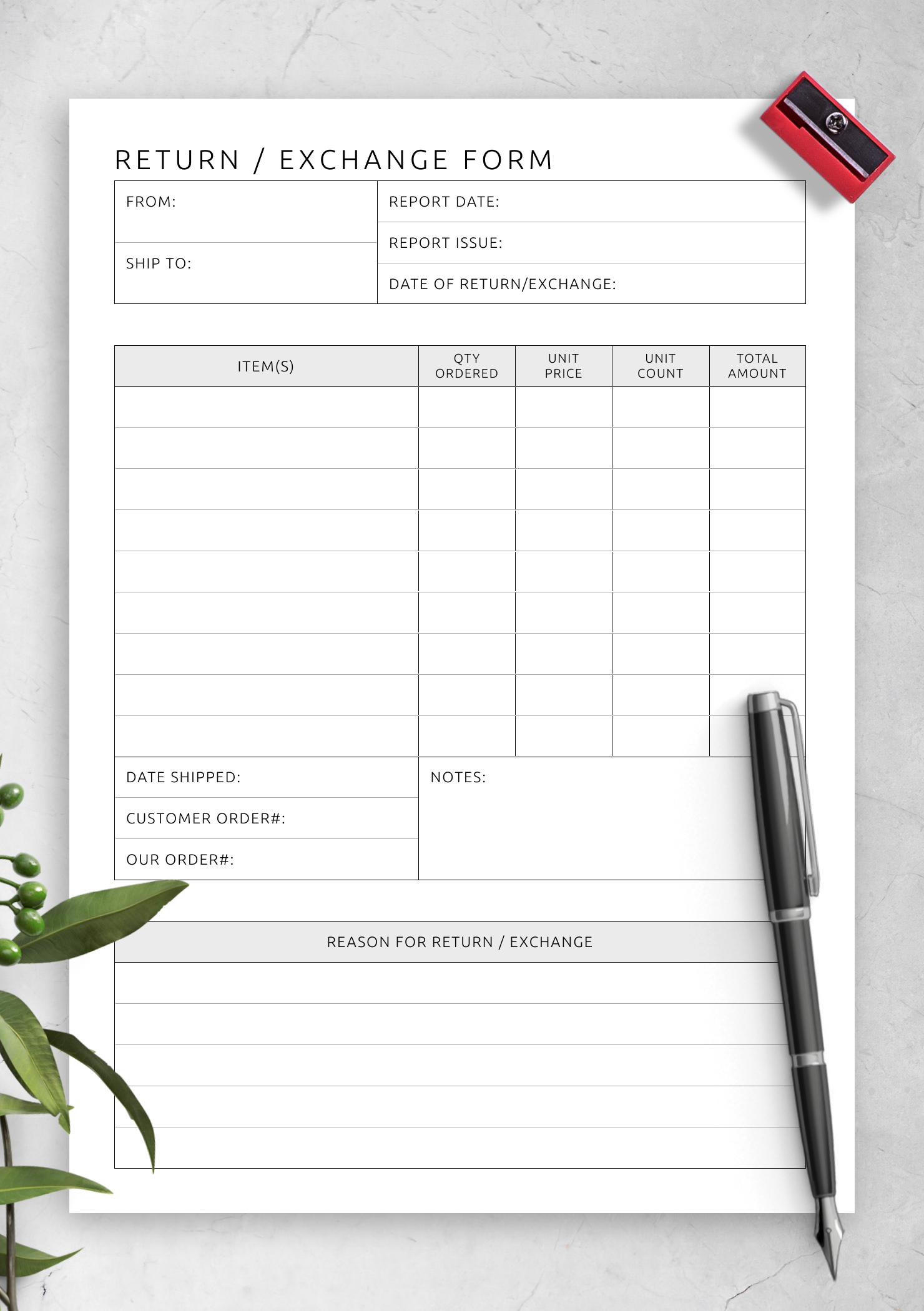

Download Printable Return Exchange Form Template PDF

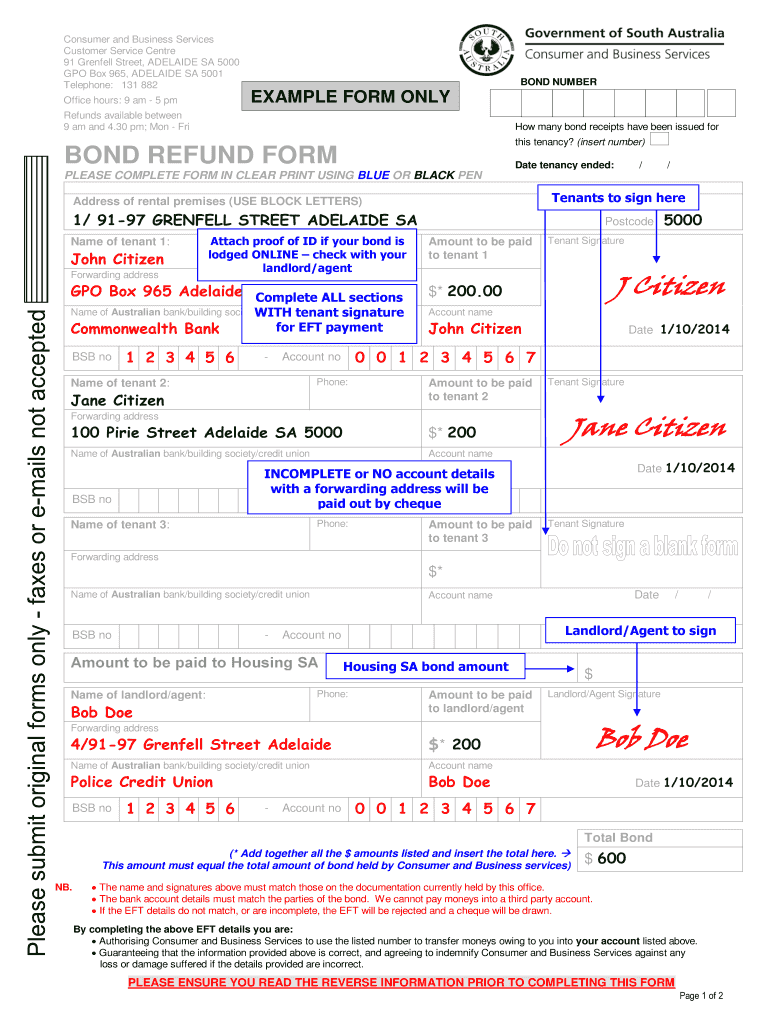

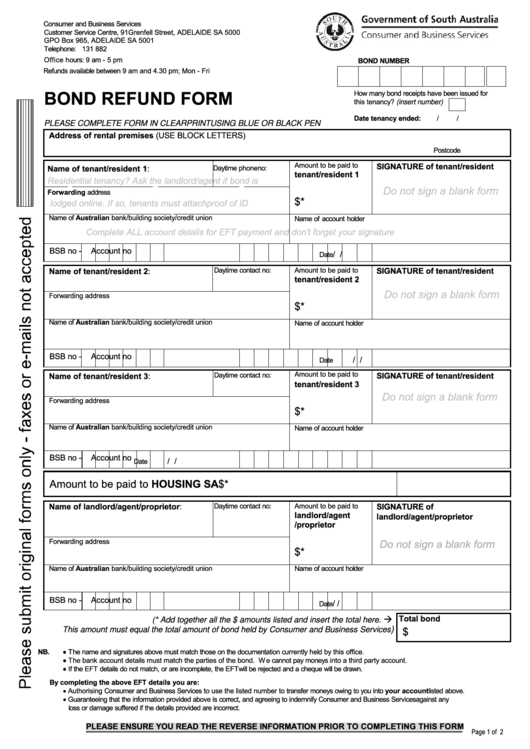

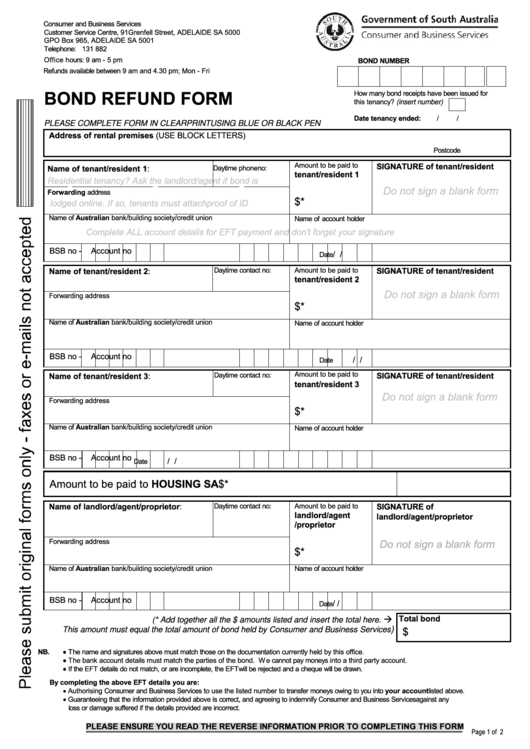

Fillable Bond Refund Form Consumer And Business Services Government Of South Australia

Fillable Bond Refund Form Consumer And Business Services Government Of South Australia

Form 02 01 Refund Of Accumulated Contributions Printable Printable Forms Free Online

Printable Refund Form Template

Refund Form Template

Form 02 01 Refund Of Accumulated Contributions Printable - Application for Withdrawal of Accumulated Contributions Form 5 Please review the following information in regard to applying to withdraw your accumulated contributions For retirement counseling call 410 625 5555 or 1 800 492 5909 Answer Only complete and return Form W 4R if you are not rolling over all of your payment to another