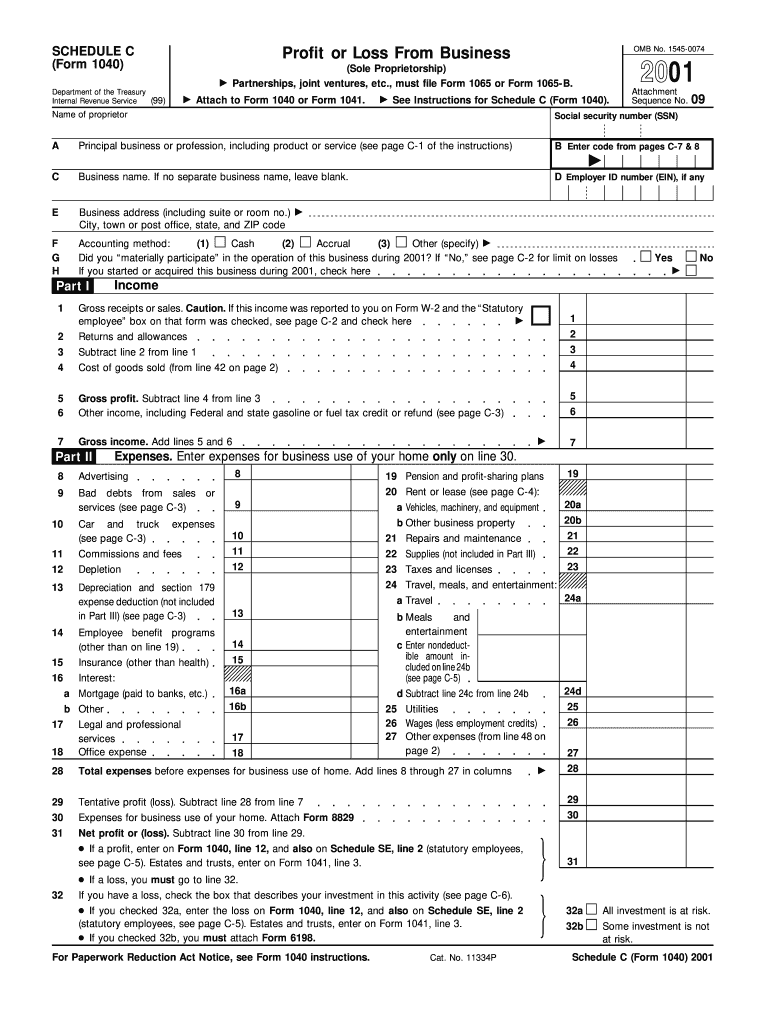

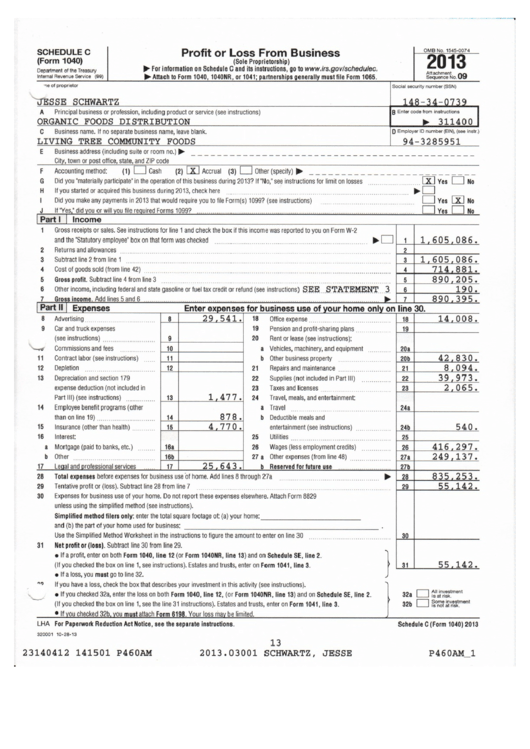

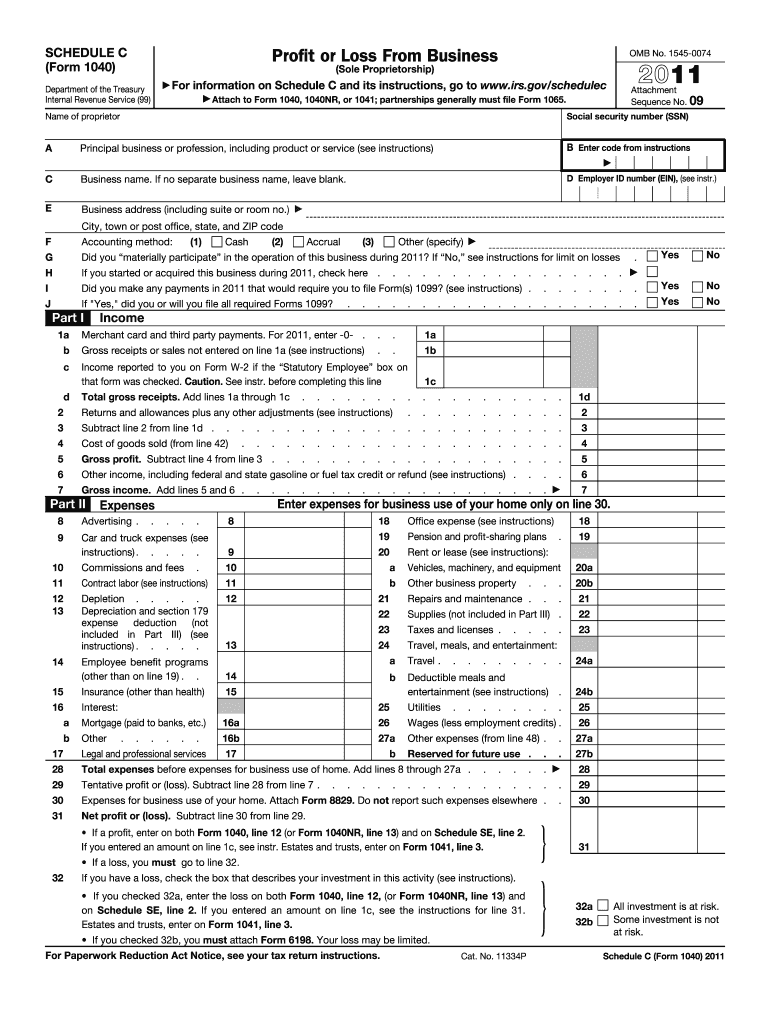

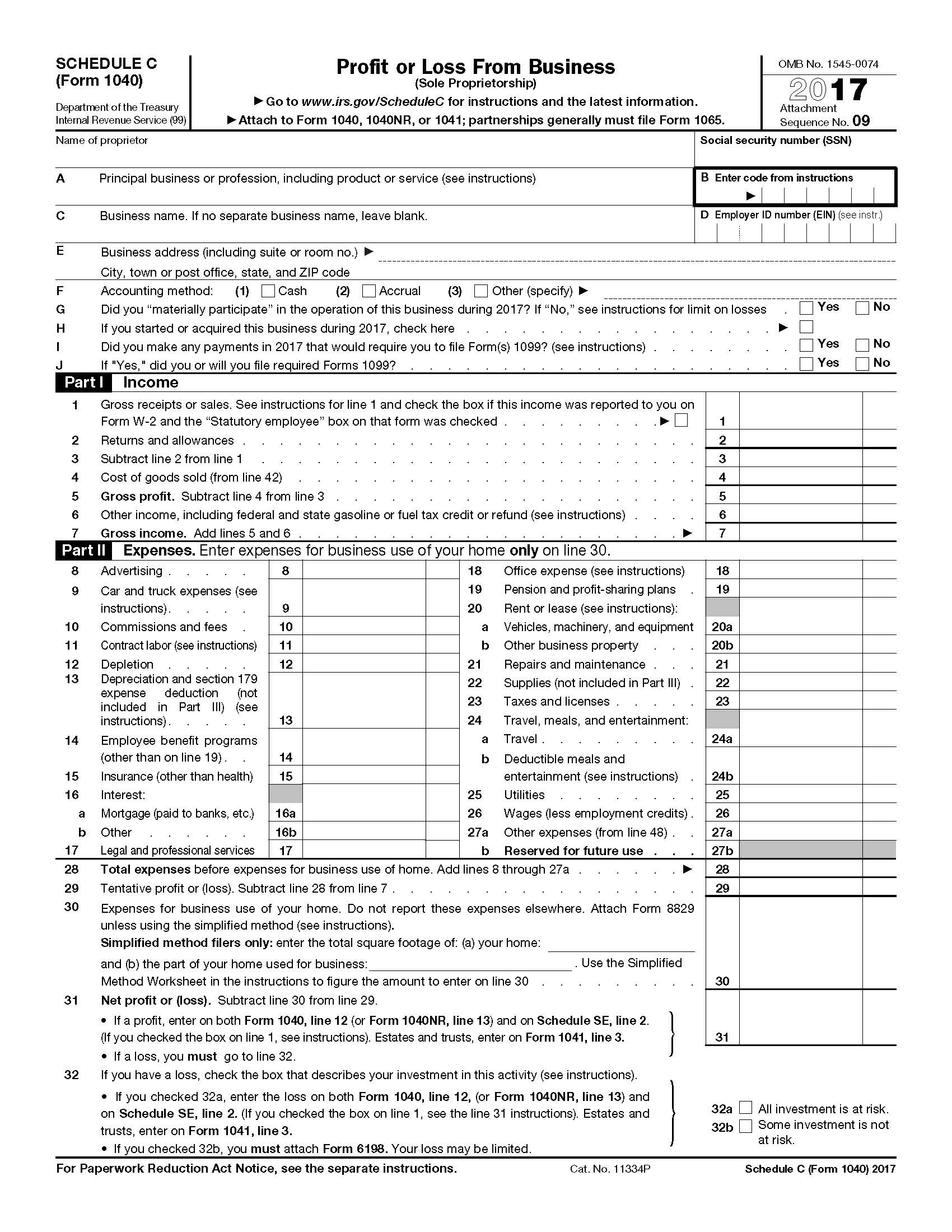

Form 1040 Schedule C Printable Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

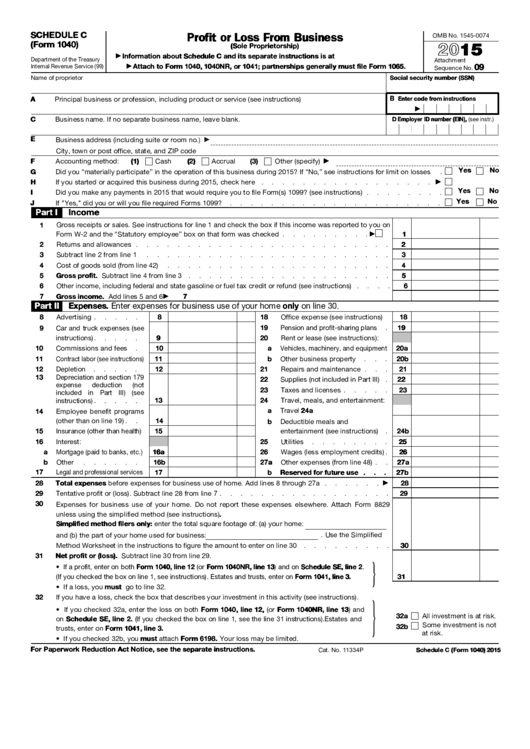

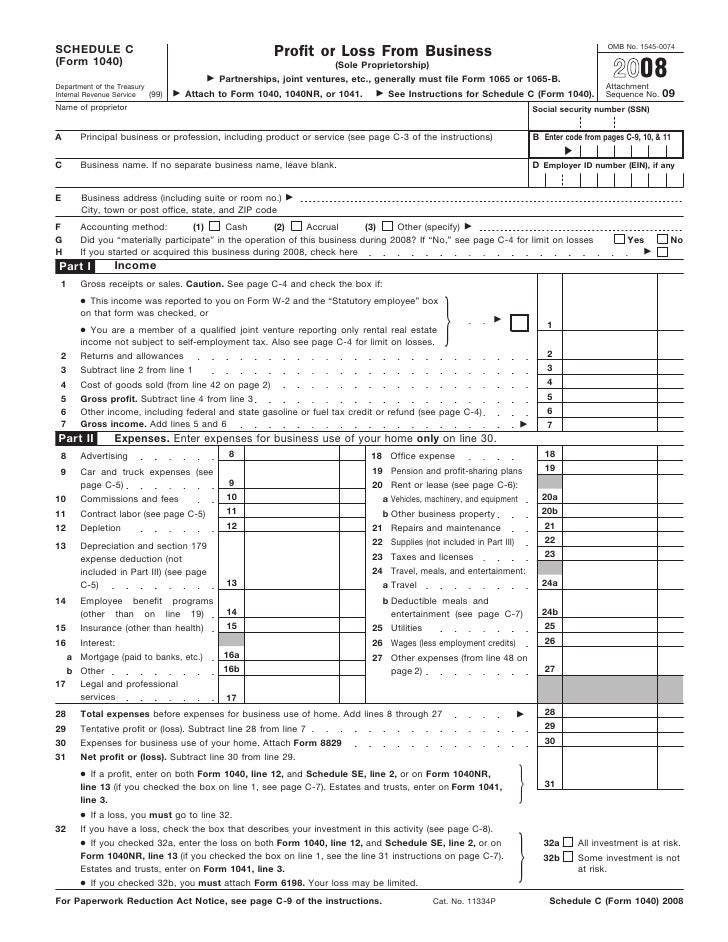

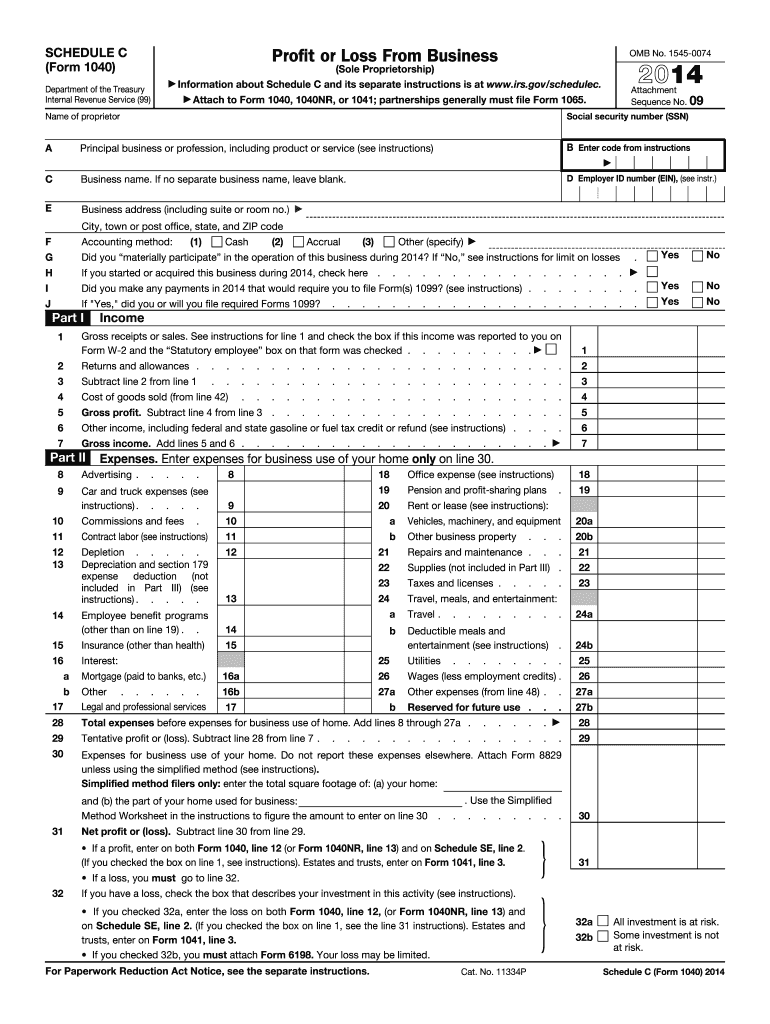

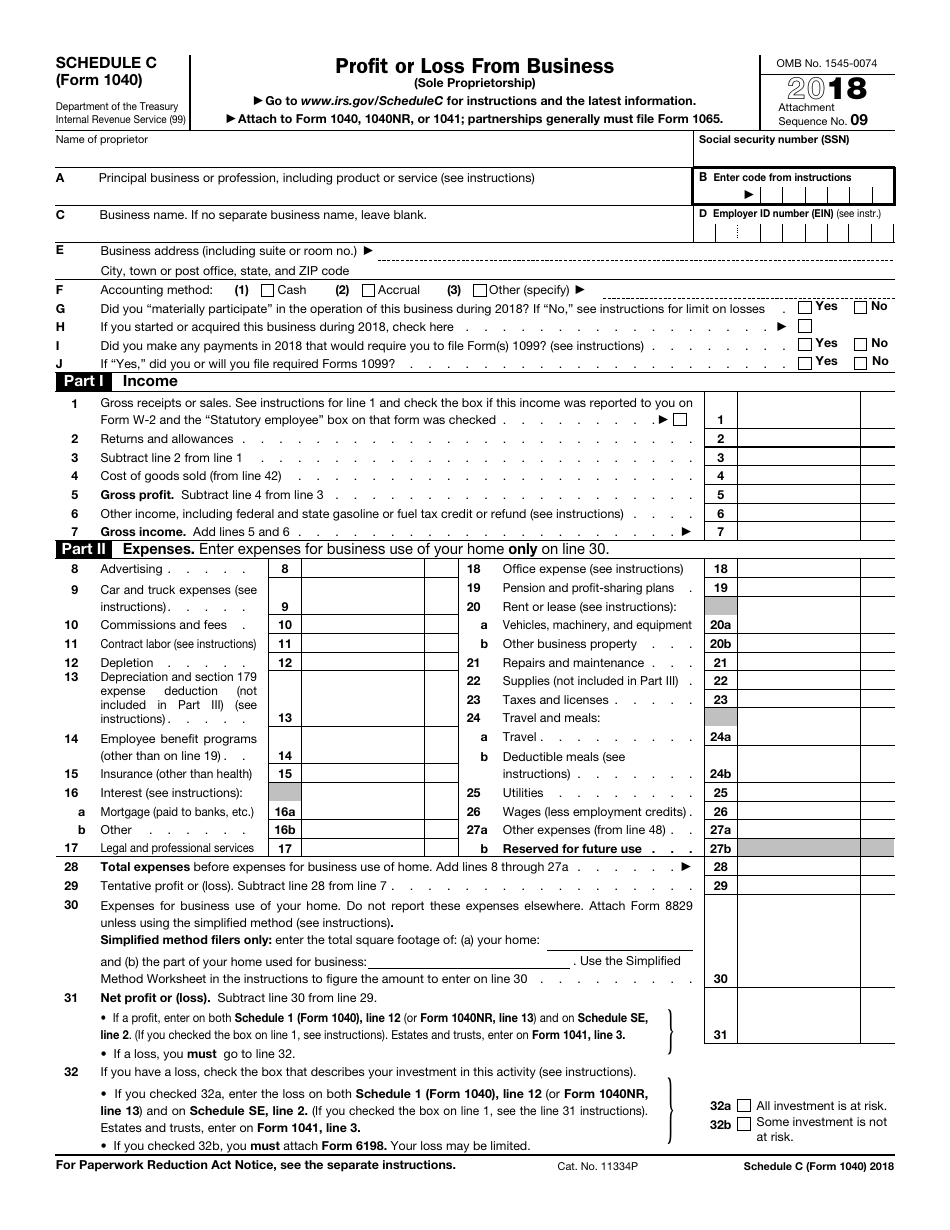

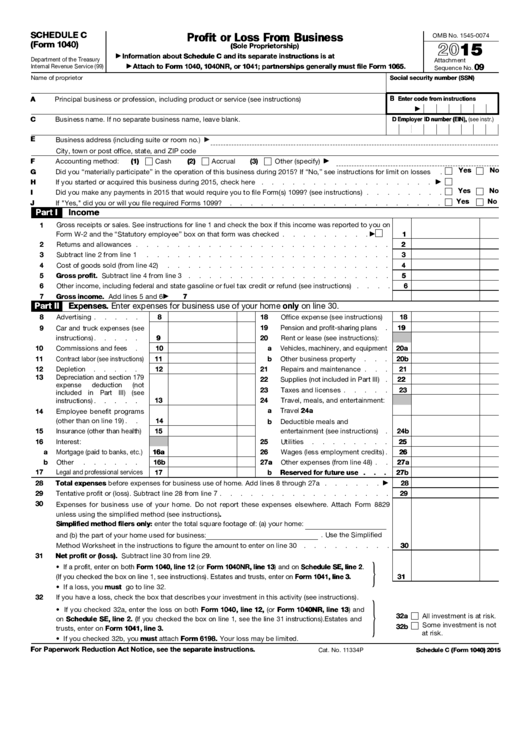

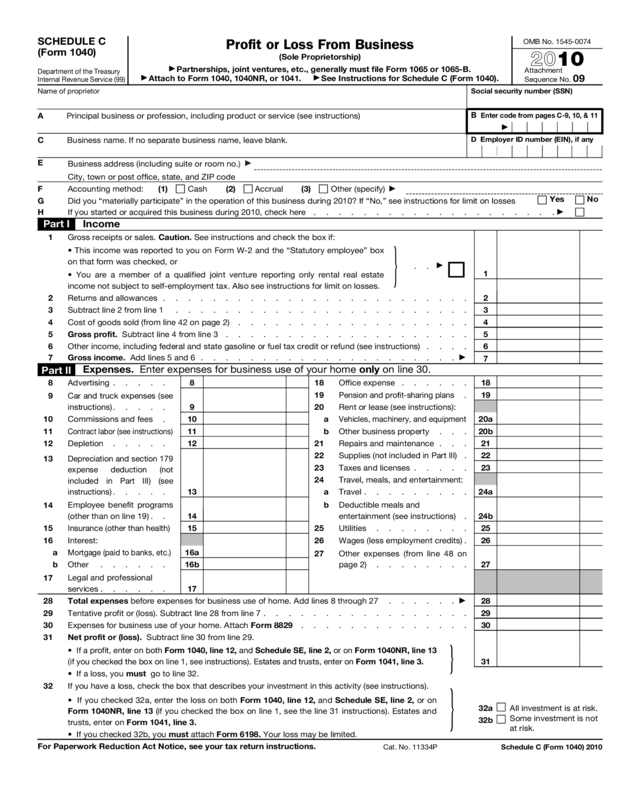

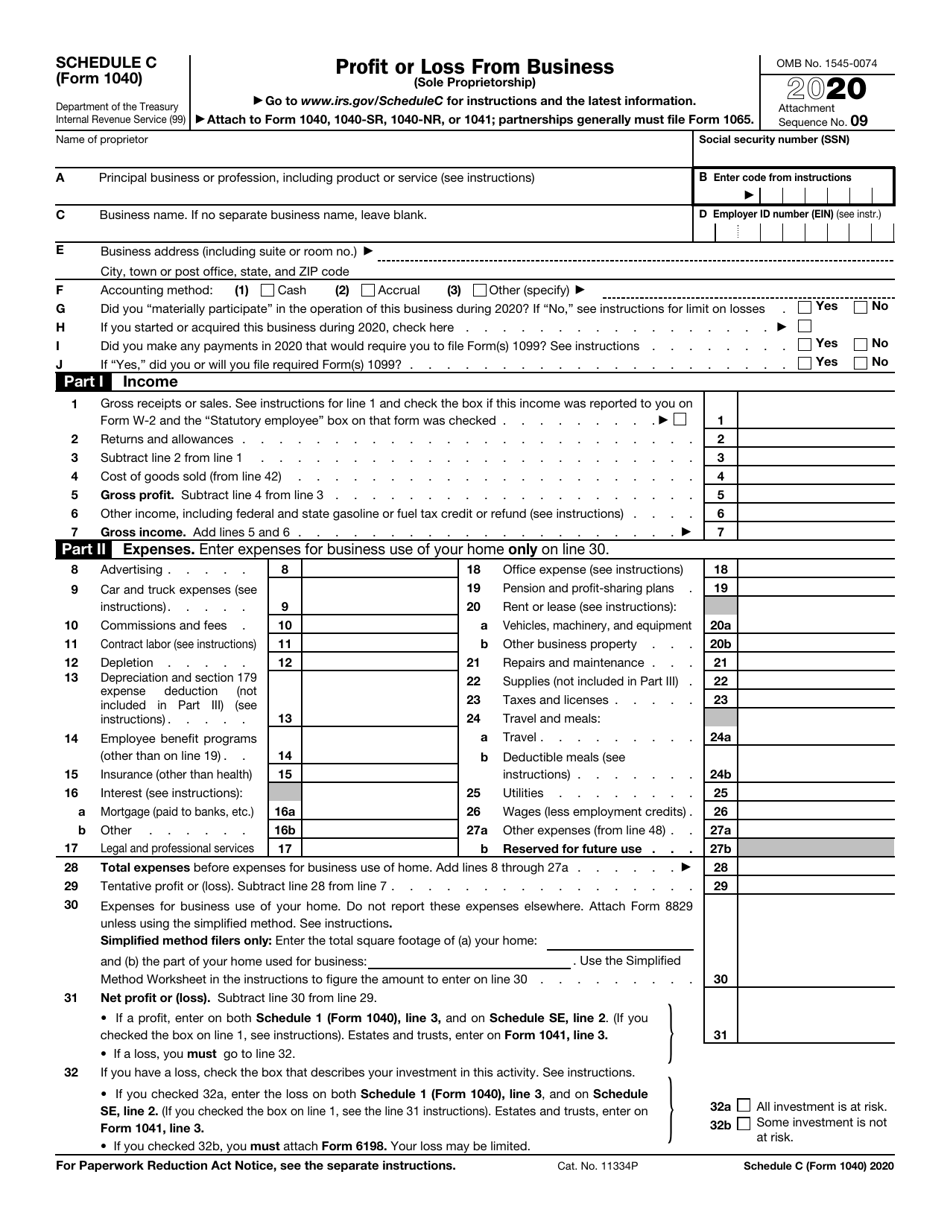

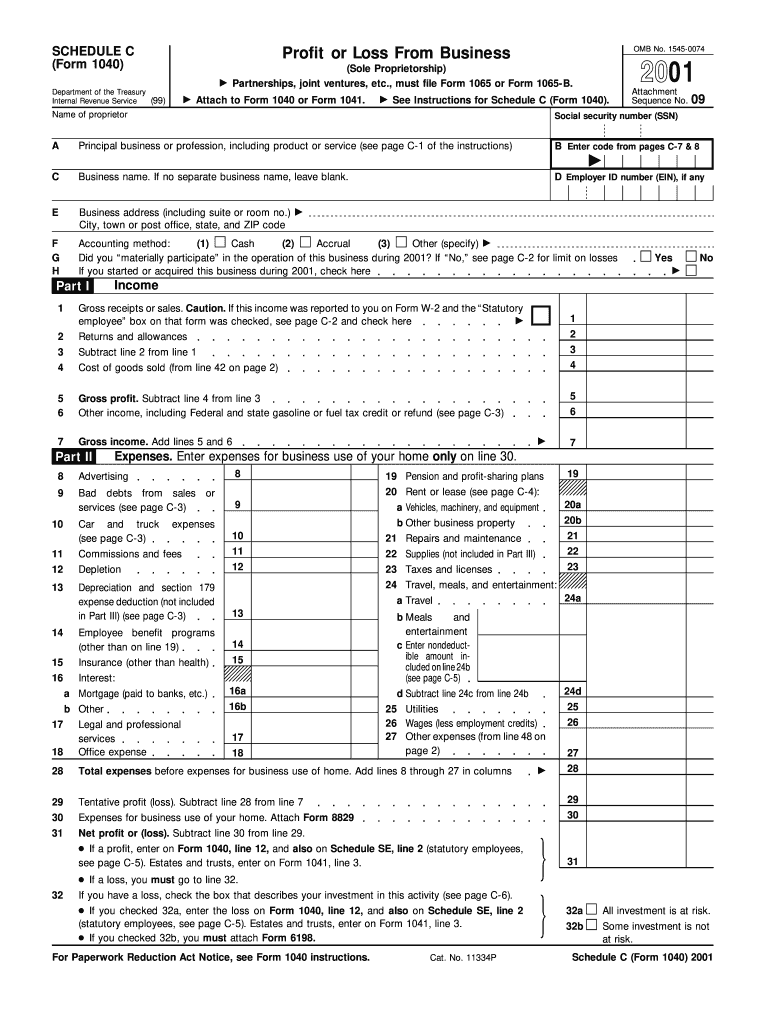

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity 2020 Form 1040 Schedule C Document pdf Download PDF pdf SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information

Form 1040 Schedule C Printable

Form 1040 Schedule C Printable

https://1044form.com/wp-content/uploads/2020/08/fillable-schedule-c-irs-form-1040-printable-pdf-download-1.png

Form 1040 Schedule C Profit Or Loss From Business

https://image.slidesharecdn.com/1273106/95/form-1040-schedule-cprofit-or-loss-from-business-1-728.jpg?cb=1239367643

Irs 1040 Form Schedule C Schedule C Form 1040 How To Complete It The Usual Stuff Mary

https://www.pdffiller.com/preview/6/962/6962127/large.png

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 What is Schedule C IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically with

What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form A Schedule C is a supplemental form that will be used with a Form 1040 This form is known as a Profit or Loss from Business form It is used by the United States Internal Revenue Service for tax filing and reporting purposes This form must be completed by a sole proprietor who operated a business during the tax year

More picture related to Form 1040 Schedule C Printable

Irs 1040 Form Schedule C Schedule C Form 1040 How To Complete It The Usual Stuff Mary

https://data.templateroller.com/pdf_docs_html/1862/18621/1862177/irs-form-1040-2018-schedule-c-profit-or-loss-from-business-sole-proprietorship_print_big.png

Printable Irs Form 1040 Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/07/how-to-fill-out-irs-form-1040-with-form-wikihow-free-1.jpg

FREE 9 Sample Schedule C Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/11/SCHEDULE-C-1040-Form.jpg

New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 You include Schedule C with your Form 1040 tax return at tax time to report your business income and expenses as a sole proprietor for that tax year It s for businesses that are either unincorporated sole proprietorships or single member limited liability companies LLCs that haven t elected to be taxed as corporations What is a Schedule C

Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees with business expenses of 5 000 or less may be able to file Schedule C EZ instead of Schedule C

2018 2023 Form IRS 1040 Schedule C EZ Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/454/878/454878824/large.png

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)

What Is Schedule C Of Form 1040

https://www.thebalancemoney.com/thmb/Ck-DUlTknMMfhD3IjwG9_Kz-oU0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

https://www.irs.gov/instructions/i1040sc

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

2010 Form 1040 Schedule C Edit Fill Sign Online Handypdf

2018 2023 Form IRS 1040 Schedule C EZ Fill Online Printable Fillable Blank PdfFiller

Pin On IRS 1040 Form Schedule C 2016

USA 1040 Schedule C Form Template ALL PSD TEMPLATES Getting Things Done Templates Schedule

IRS Form 1040 Schedule C Download Fillable PDF Or Fill Online Profit Or Loss From Business Sole

Schedule C Fill Online Printable Fillable Blank 2021 Tax Forms 1040 Printable

Schedule C Fill Online Printable Fillable Blank 2021 Tax Forms 1040 Printable

Form 1040 Schedule C Sample Profit Or Loss From Business Printable Pdf Download

IRS 1040 Schedule C 2011 Fill And Sign Printable Template Online US Legal Forms

2017 Irs Tax Forms 1040 Schedule C profit Or Loss From Business U S Government Bookstore

Form 1040 Schedule C Printable - A Schedule C is a supplemental form that will be used with a Form 1040 This form is known as a Profit or Loss from Business form It is used by the United States Internal Revenue Service for tax filing and reporting purposes This form must be completed by a sole proprietor who operated a business during the tax year