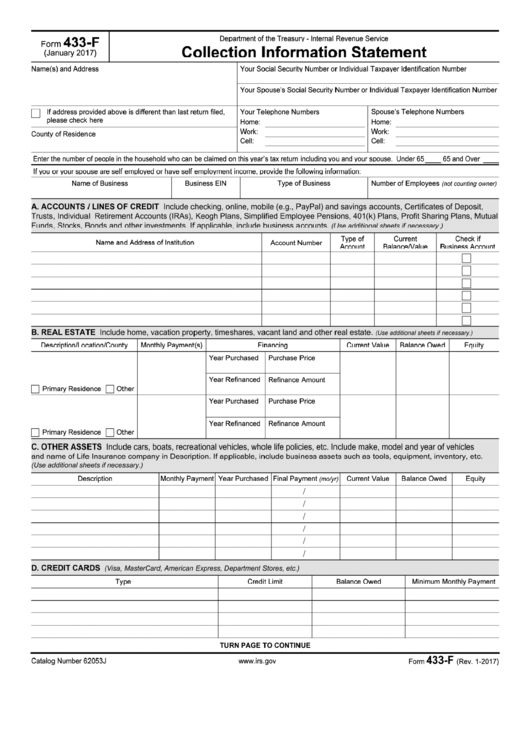

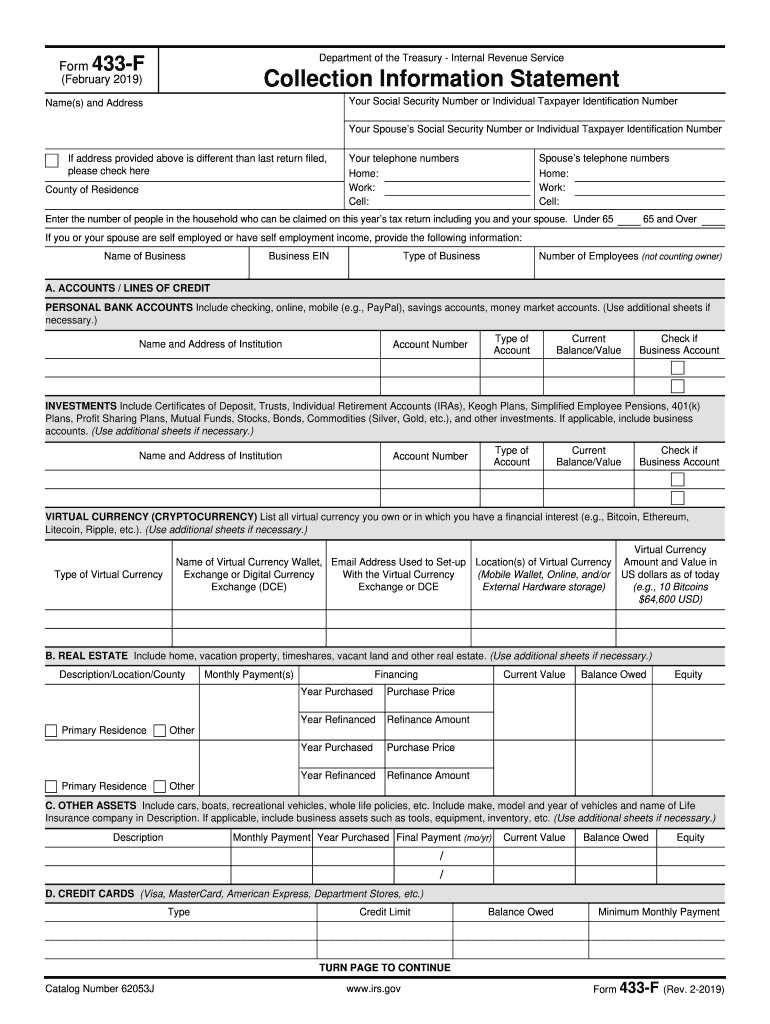

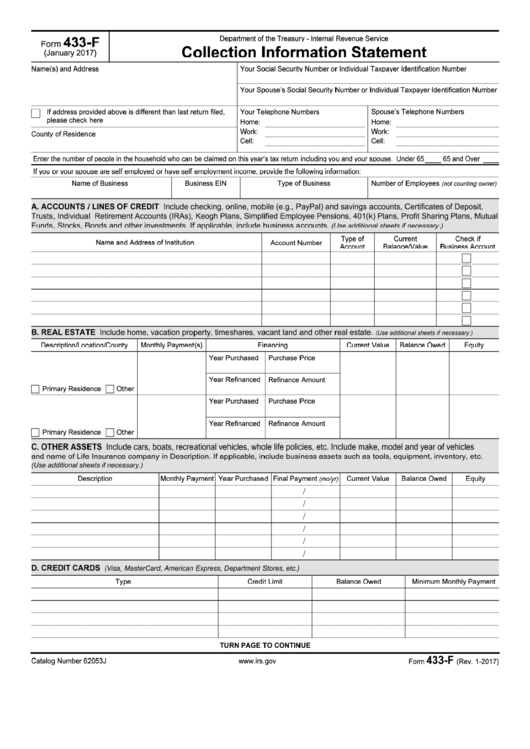

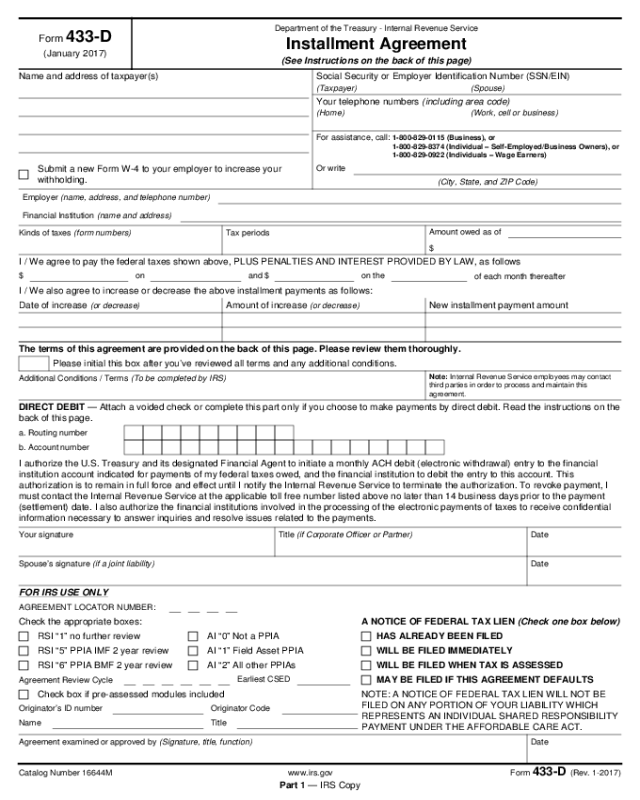

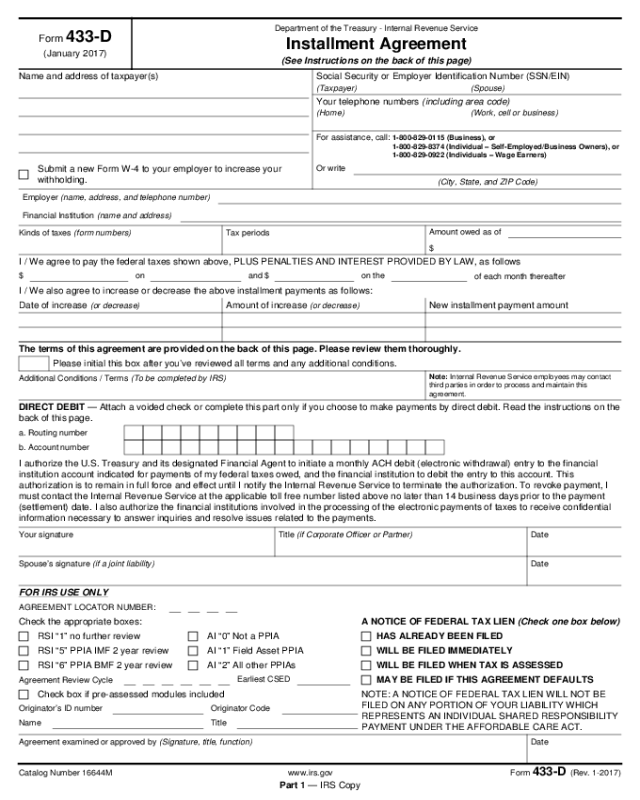

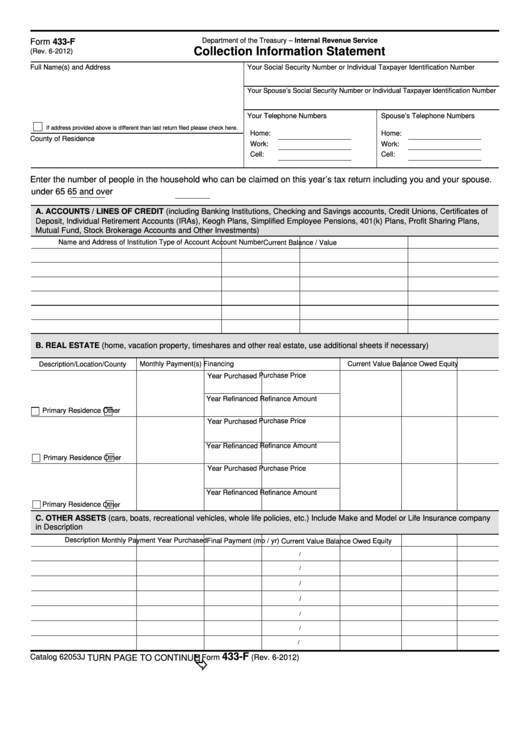

Form 433 F Pdf Printable Catalog 62053J TURN PAGE TO CONTINUE Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

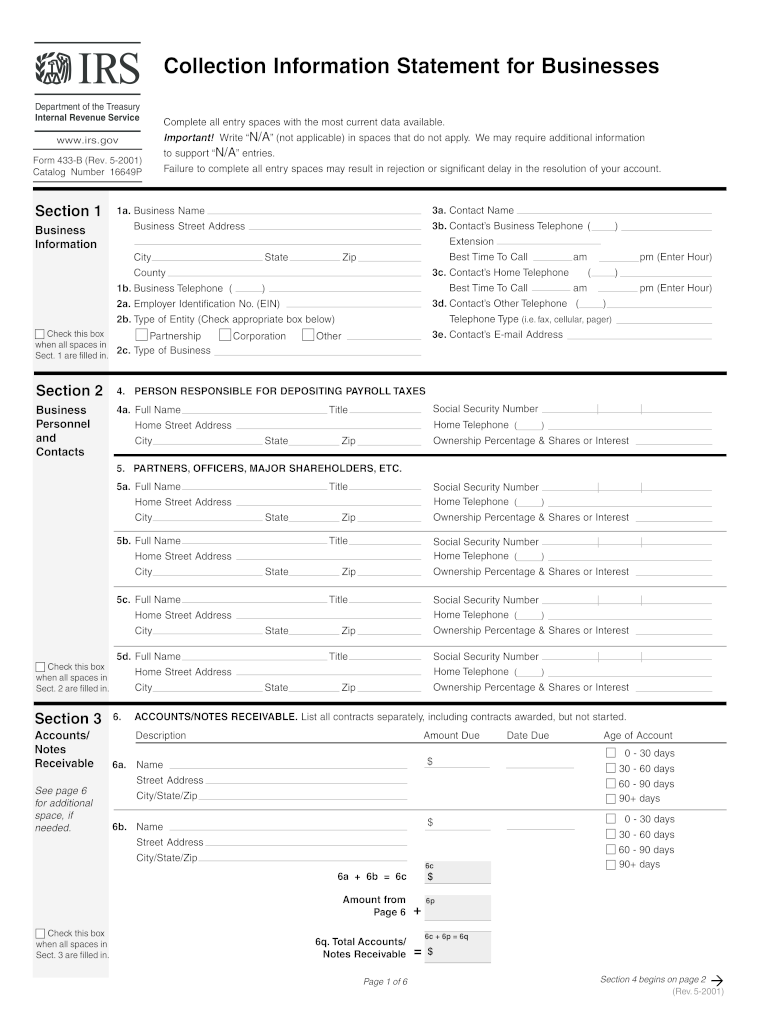

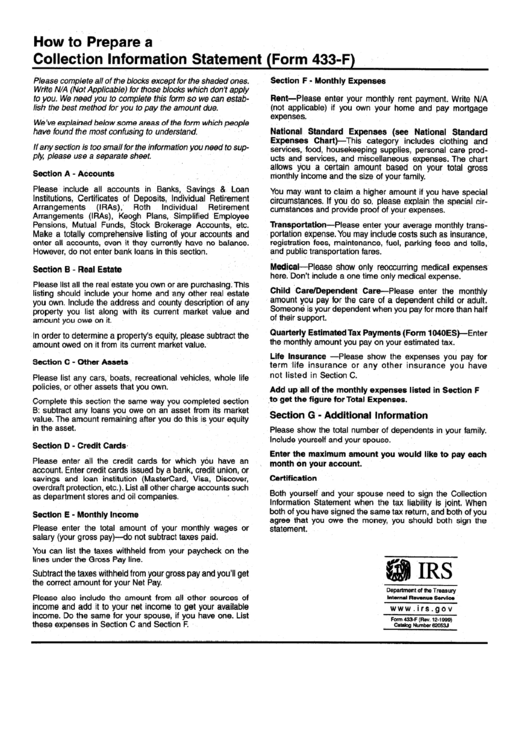

You can use Form 433 F Collection Information Statement to provide your financial information to the IRS Your Collection Information Statement is needed to determine your eligibility for certain installment agreements currently not collectible status and other tax resolution options that the IRS has available based on your ability to pay For any court ordered payments be prepared to submit a copy of the court order portion showing the amount you are ordered to pay the signatures and proof you are making the payments Acceptable forms of proof are copies of cancelled checks or copies of bank or pay statements Form 433 F Rev 6 2012

Form 433 F Pdf Printable

Form 433 F Pdf Printable

https://data.formsbank.com/pdf_docs_html/291/2917/291734/page_1_thumb_big.png

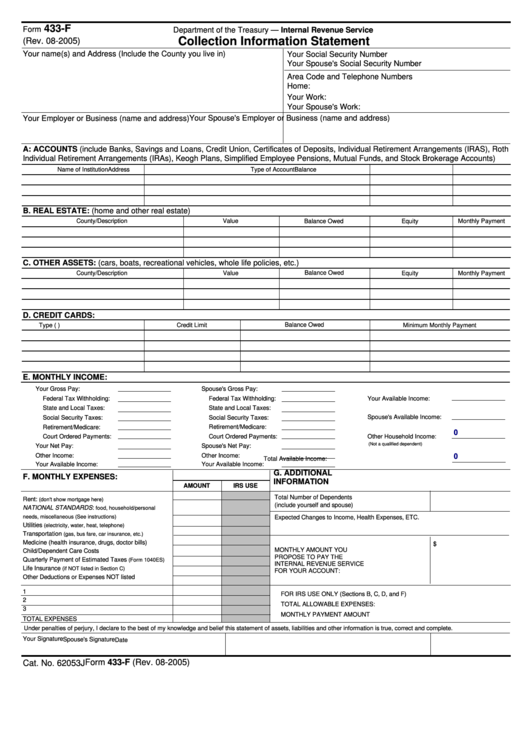

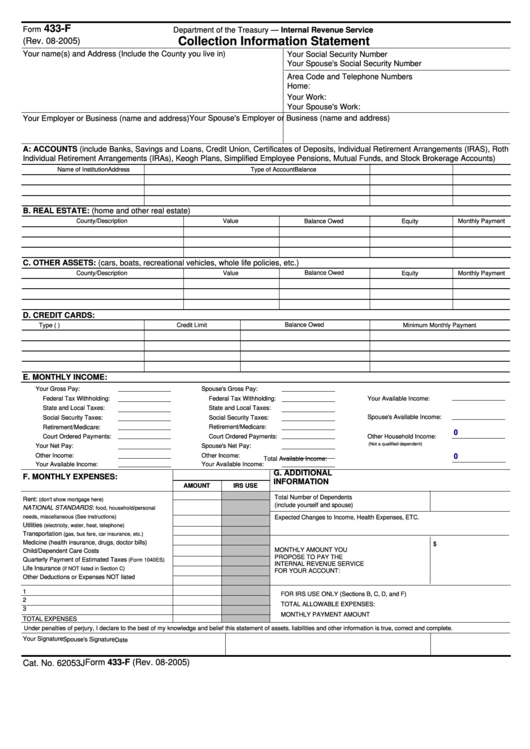

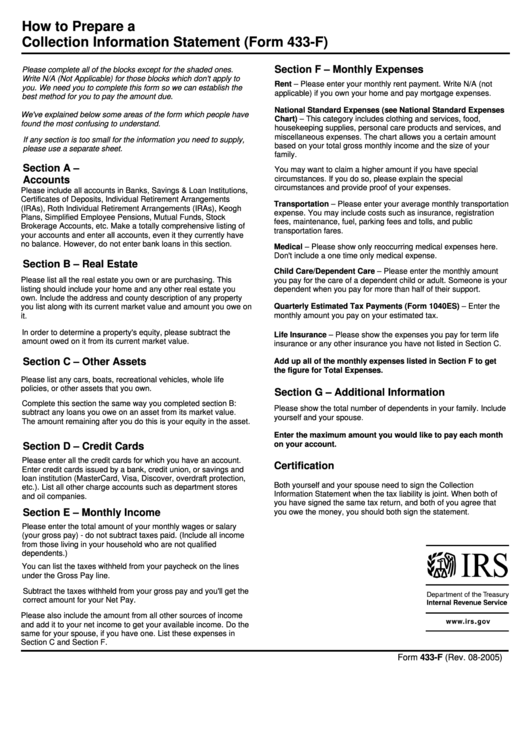

Fillable Form 433 F Collection Information Statement 2005 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/249/2499/249903/page_1_thumb_big.png

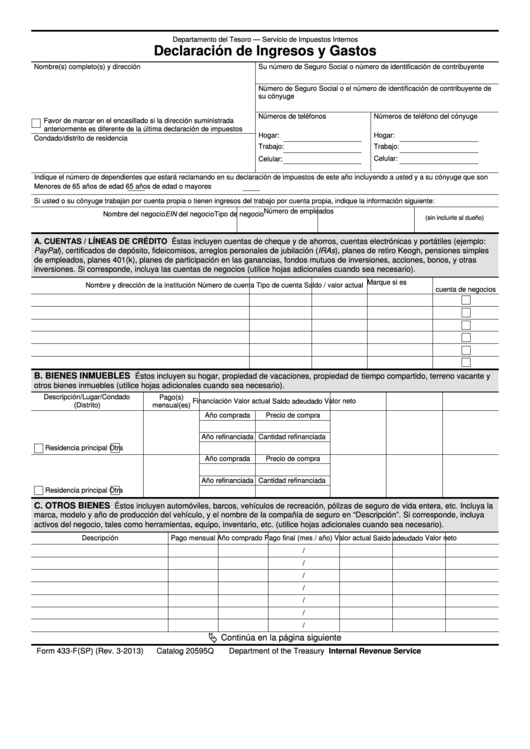

Fillable Form 433 F Sp Declaracion De Ingresos Y Gastos Spanish Version Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/296/2967/296787/page_1_thumb_big.png

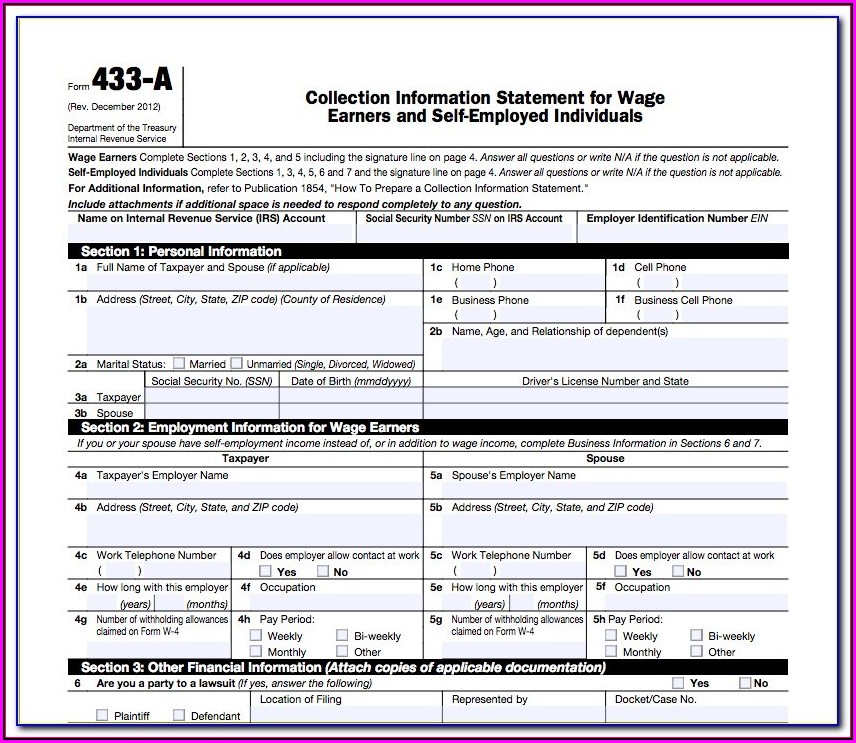

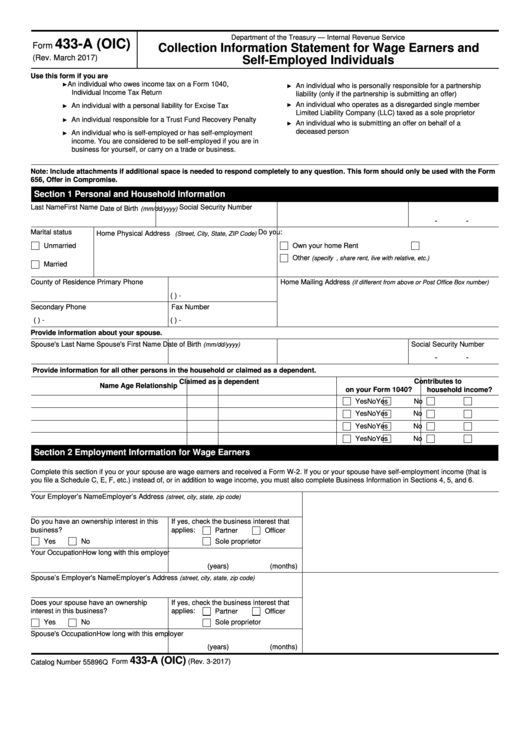

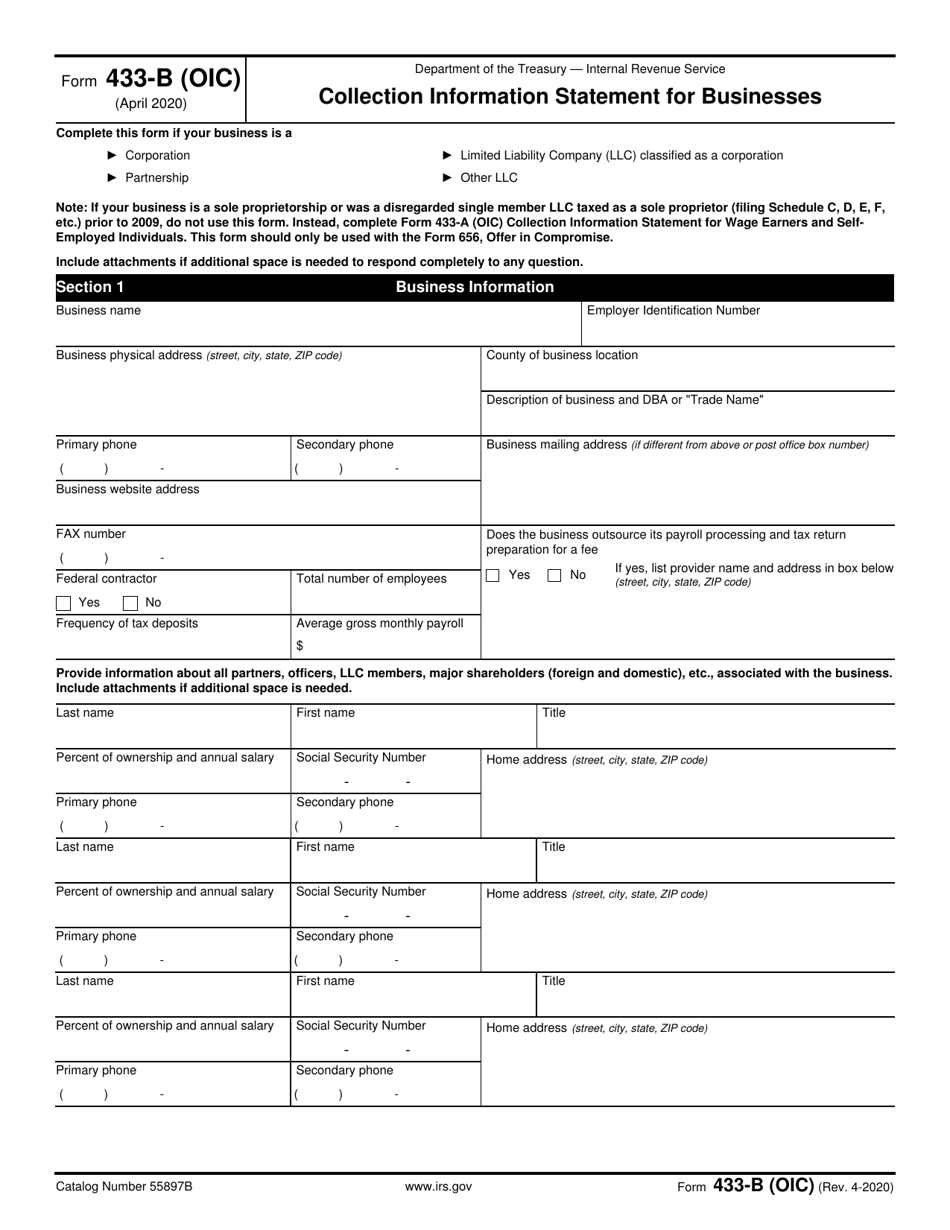

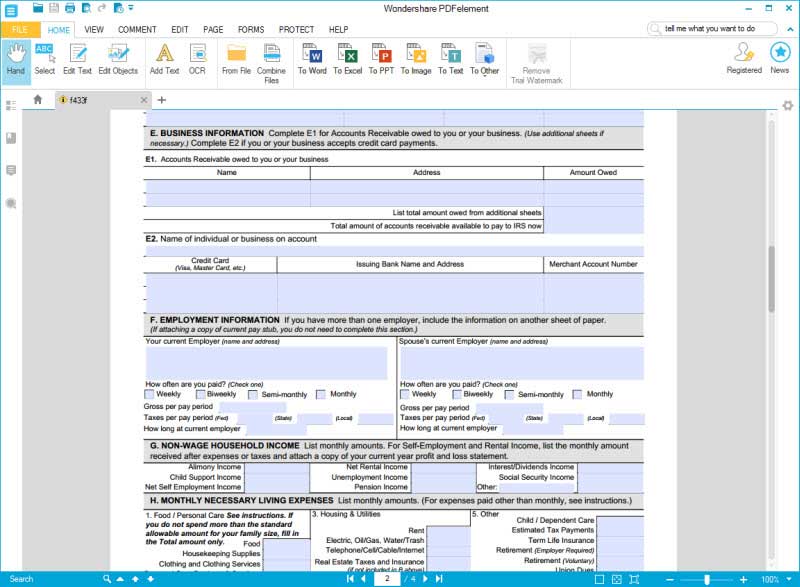

A 4 page form available for download in PDF Actual and valid for filing 2023 taxes Additional instructions and information can be found on page 3 of the document Editable printable and free Fill out the form in our online filing application Download a fillable version of IRS Form 433 F through the link below or browse more documents in Collection Information Statement for Wage July 2022 Department of the Treasury Earners and Self Employed Individuals Internal Revenue Service Wage Earners Complete Sections 1 2 3 4 and 5 including the signature line on page 4 Answer all questions or write N A if the question is not applicable

When Do You Need to File Form 433 F The IRS often requires Form 433 F if you request a payment plan on your tax liability Here are the situations where you need to complete Form 433 F when applying for a payment plan Form 433 F Collection Information Statement is one of the forms the IRS uses to collect financial information from people with taxes owed It shows the IRS the taxpayer s ability to pay monthly cash flow The IRS uses the information on this form to determine eligibility for payment plans and uncollectible status among other resolutions

More picture related to Form 433 F Pdf Printable

Fillable 433 Irs Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2020/02/irs-form-433-f-fillable.jpg

Form 433 a Collection Information Statement For Wage Earners And Self 733

https://data.formsbank.com/pdf_docs_html/286/2862/286295/page_1_thumb_big.png

Fillable 433 Irs Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2059/20595/2059580/irs-form-433-b-oic-collection-information-statement-for-businesses_print_big.png

We ll file the IRS Form 433 F on your behalf so you can sit back and rest easy knowing you re on your way to clearing your name from the IRS radar and making progress towards settling your tax debt Give us a call today at 844 328 5857 to schedule a free tax consultation and start improving your financial well being Get Form 433 F for IRS Automated Collection Service 2019 2024 Get Form form 433f is not affiliated with IRS PDF editing your way Complete or edit your irs form 433 f anytime and from any device using our web desktop and mobile apps Create custom documents by adding smart fillable fields Native cloud integration

The IRS Form 433 F also known as the Collection Information Statement plays a pivotal role in IRS collections If you re swimming in tax debt or have been contacted by IRS revenue officers this form is your lifeline This form collects financial information from individuals with taxes owed kind of like a detective collecting clues to It appears you don t have a PDF plugin for this browser Please use the link below to download 2022 federal form 433 f pdf and you can print it directly from your computer Download This Form Print This Form More about the Federal Form 433 F Corporate Income Tax TY 2022

Form 433 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/490/118/490118323/large.png

Form 433 F Pdf Printable Printable Forms Free Online

https://www.signnow.com/preview/474/234/474234730/large.png

https://www.irs.gov/pub/irs-utl/f433f.pdf

Catalog 62053J TURN PAGE TO CONTINUE Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

https://www.backtaxeshelp.com/resources/tax-relief-forms/form-433-f/

You can use Form 433 F Collection Information Statement to provide your financial information to the IRS Your Collection Information Statement is needed to determine your eligibility for certain installment agreements currently not collectible status and other tax resolution options that the IRS has available based on your ability to pay

IRS Form 433 F Fill It Out In Style

Form 433 Fill Out And Sign Printable PDF Template SignNow

Form 433 F Pdf Printable Printable Forms Free Online

Irs Form 433 F Fill Out Sign Online DocHub

2010 Form IRS 433 F Fill Online Printable Fillable Blank PdfFiller

Irs Form 433 D Printable Printable Templates

Irs Form 433 D Printable Printable Templates

Irs Installment Agreement Form 433 f Leah Beachum s Template

Form 433 F Collection Information Statement Instructions Printable Pdf Download

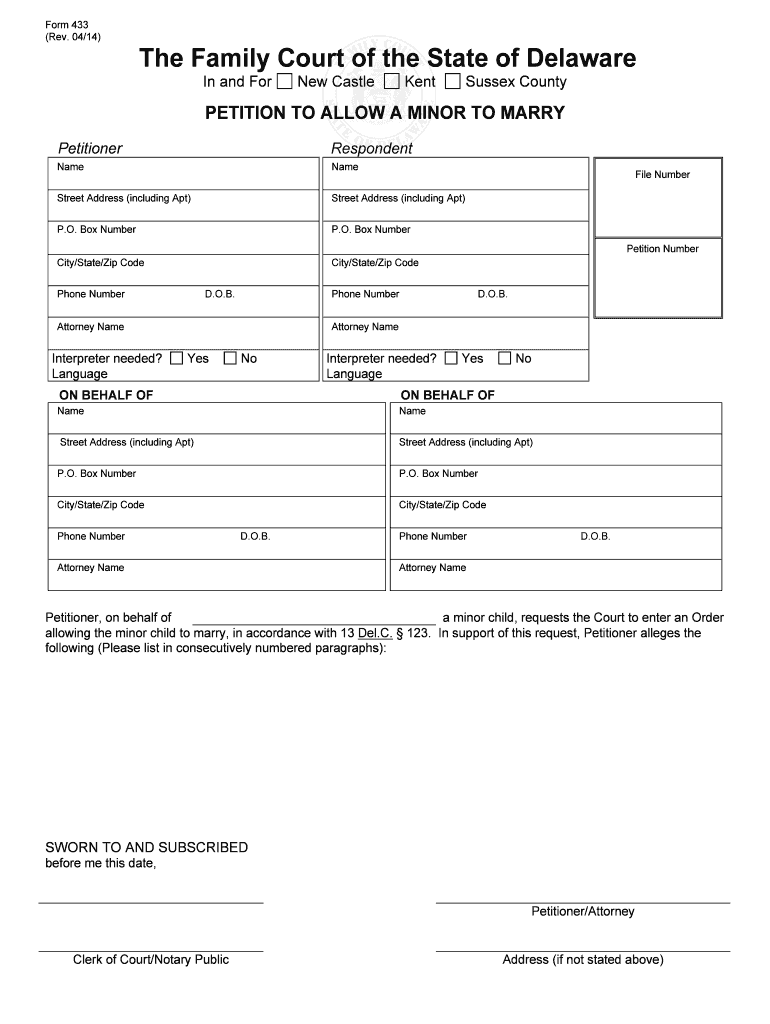

32 433 Forms And Templates Free To Download In PDF

Form 433 F Pdf Printable - Collection Information Statement for Wage July 2022 Department of the Treasury Earners and Self Employed Individuals Internal Revenue Service Wage Earners Complete Sections 1 2 3 4 and 5 including the signature line on page 4 Answer all questions or write N A if the question is not applicable