Free Fillable And Printable 1099 Forms IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

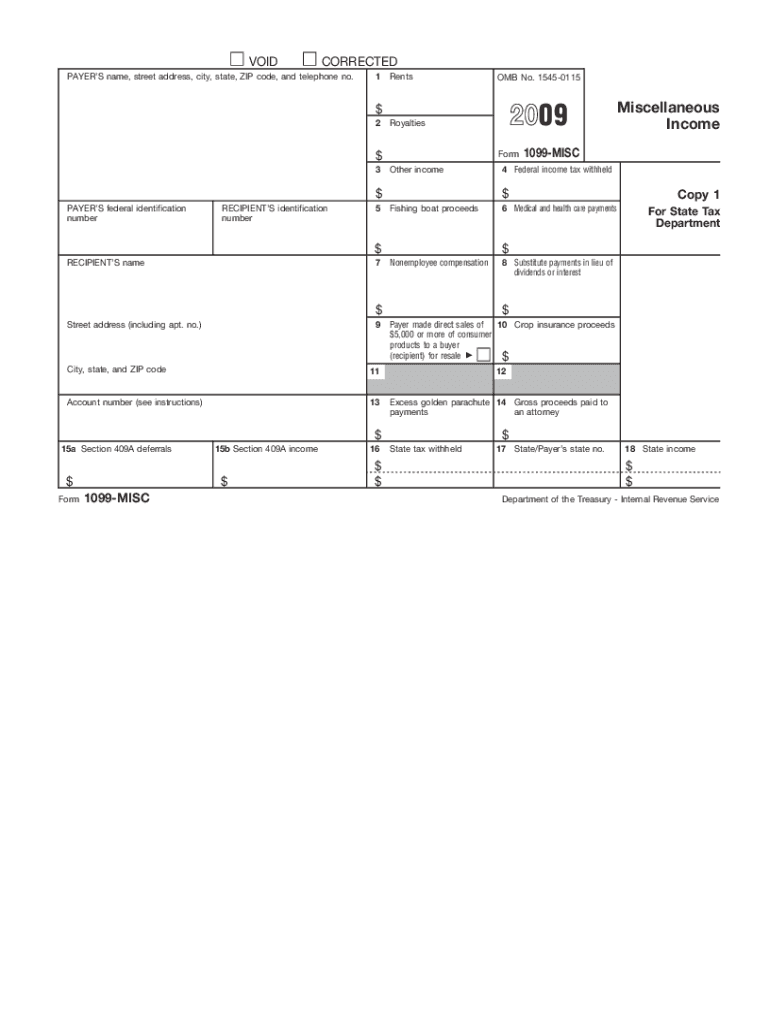

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free enabling you to Choose the income tax form you need Enter your tax information online Electronically sign and file your return Print your return for recordkeeping Limitations with Free File Fillable Forms include A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Free Fillable And Printable 1099 Forms

Free Fillable And Printable 1099 Forms

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

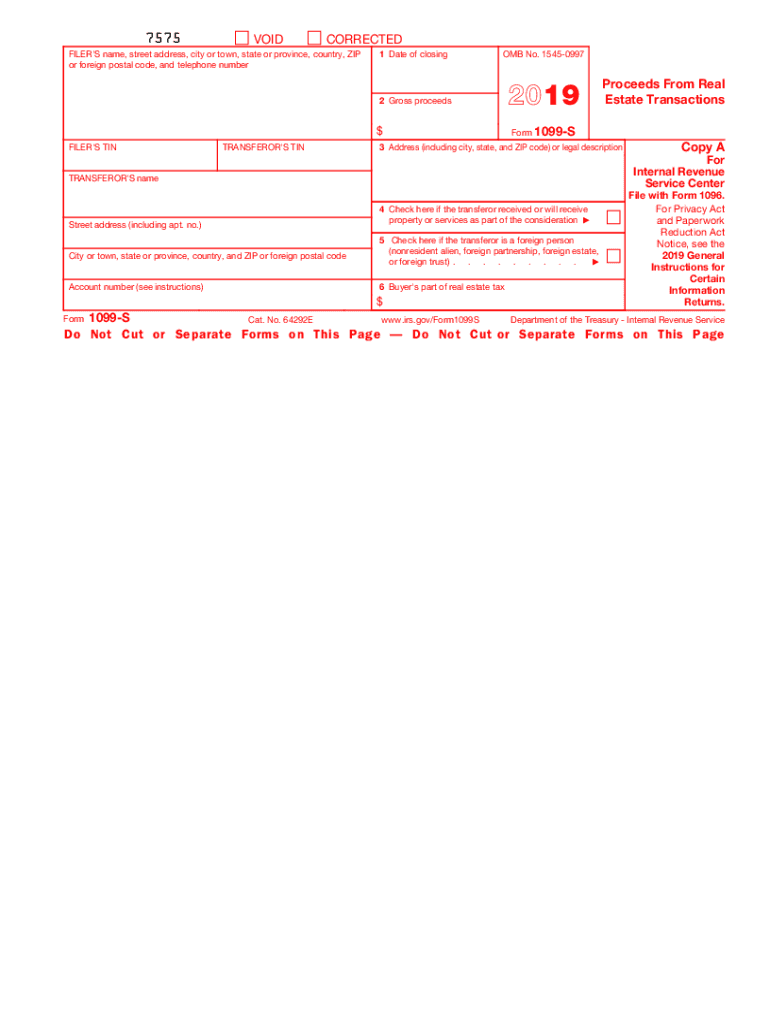

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

1099 0df Printable Form Printable Forms Free Online

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below To order official IRS information returns which include a scannable Copy A for filing with the IRS and all other applicable copies of the form visit www IRS gov orderforms Click on Employer and Information Returns and we ll mail you the forms you request and their instructions as well as any publications you may order

Lowest Price Pay only 2 75 form the lowest price in the industry to e file 1099 MISC directly with the IRS No hidden charges Form Validation Get your forms scanned and validated for basic errors and ensure that you have transmitted returns error free to the IRS Instant Notifications A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

More picture related to Free Fillable And Printable 1099 Forms

1099 Form

https://www.signnow.com/preview/100/9/100009398/large.png

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-6-box1-2x.png

Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information If you don t want to file your 1099s electronically through the IRS s Information Returns Intake System IRIS you ll need to print them out and mail them the old fashioned way But you can t just download the PDF form and hit Print to get a paper copy The IRS has very specific requirements about how to print 1099s Contents

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted Tips on Filling the 1099 MISC Template Form 1099 MISC Miscellaneous Income is the form that businesses used to report payments to those who is called non employees by the IRS The form is easy to fill Here are a few tips on filling the 1099 misc 2022 1

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/509/836/509836879/big.png

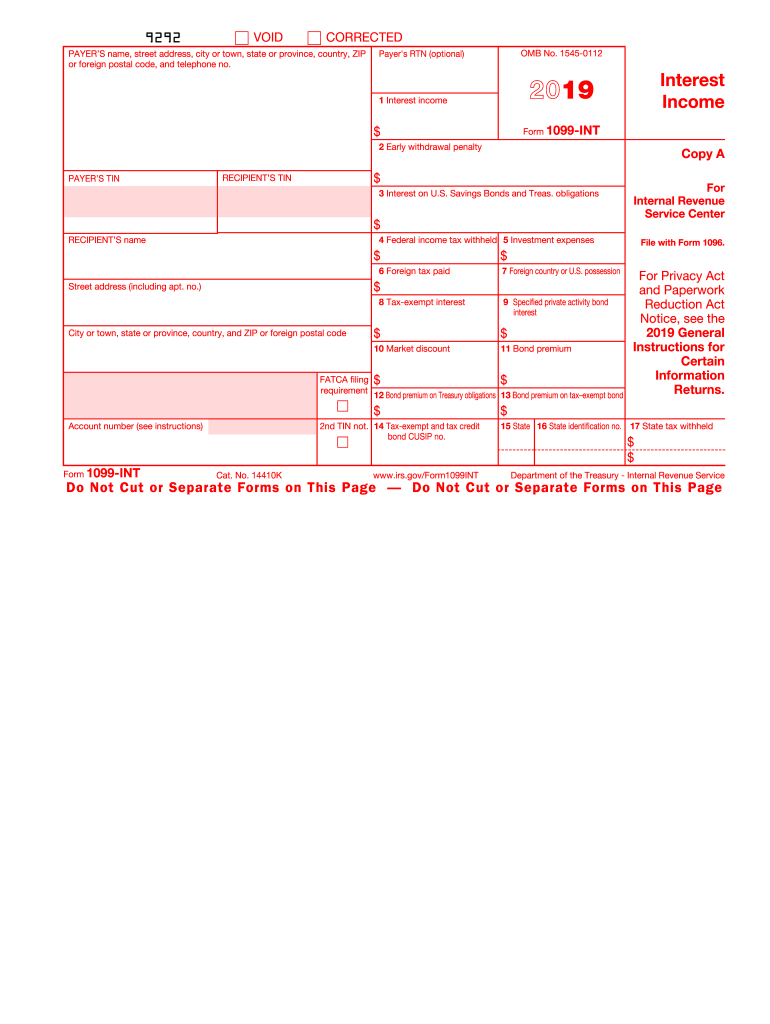

2019 Form IRS 1099 INT Fill Online Printable Fillable Blank PDFfiller

https://www.pdffiller.com/preview/447/880/447880866/large.png

https://eforms.com/irs/form-1099/

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

https://www.irs.gov/e-file-providers/free-file-fillable-forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free enabling you to Choose the income tax form you need Enter your tax information online Electronically sign and file your return Print your return for recordkeeping Limitations with Free File Fillable Forms include

How To Fill Out And Print 1099 MISC Forms

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

Printable 1099 Tax Forms Free Printable Form 2024

1099 S Fillable Form Printable Forms Free Online

1099 Form Template Create A Free 1099 Form Form

Irs Printable 1099 Form Printable Form 2023

Irs Printable 1099 Form Printable Form 2023

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

Form 1099 Misc Fillable Form Printable Forms Free Online

Free Fillable And Printable 1099 Forms - A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes