Free Fillable Printable 1099 Forms IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

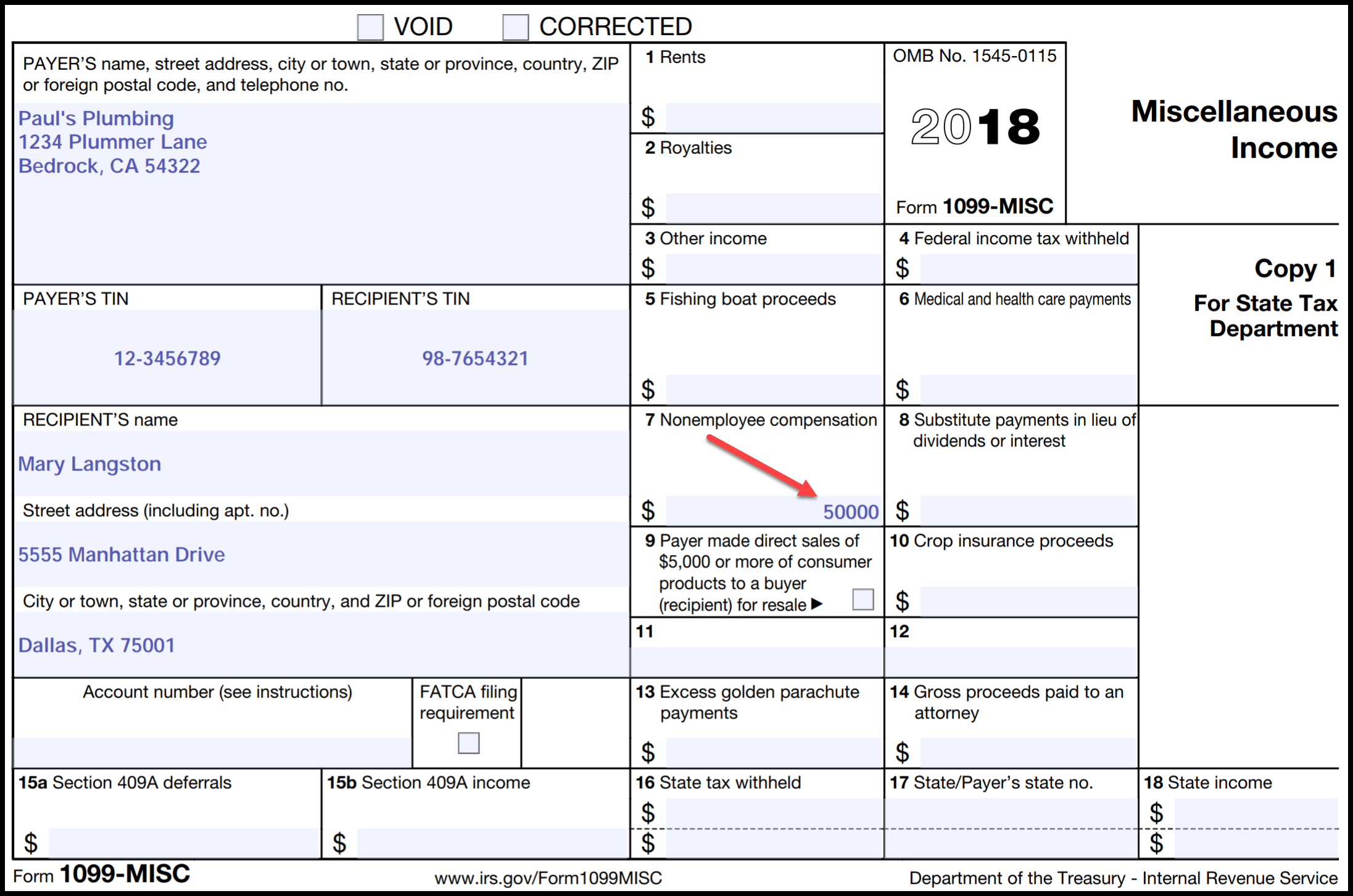

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free enabling you to Choose the income tax form you need Enter your tax information online Electronically sign and file your return Print your return for recordkeeping Limitations with Free File Fillable Forms include

Free Fillable Printable 1099 Forms

Free Fillable Printable 1099 Forms

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099 Form Free Printable

https://freeprintablejadi.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-form.png

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below Lowest Price Pay only 2 75 form the lowest price in the industry to e file 1099 MISC directly with the IRS No hidden charges Form Validation Get your forms scanned and validated for basic errors and ensure that you have transmitted returns error free to the IRS Instant Notifications

Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

More picture related to Free Fillable Printable 1099 Forms

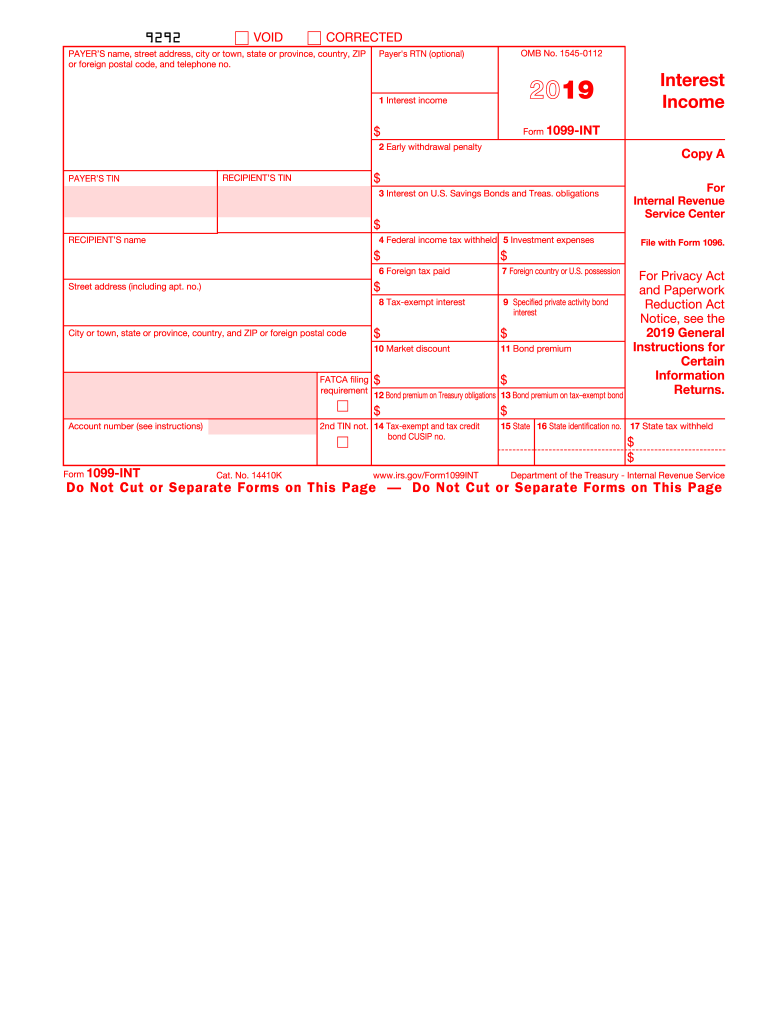

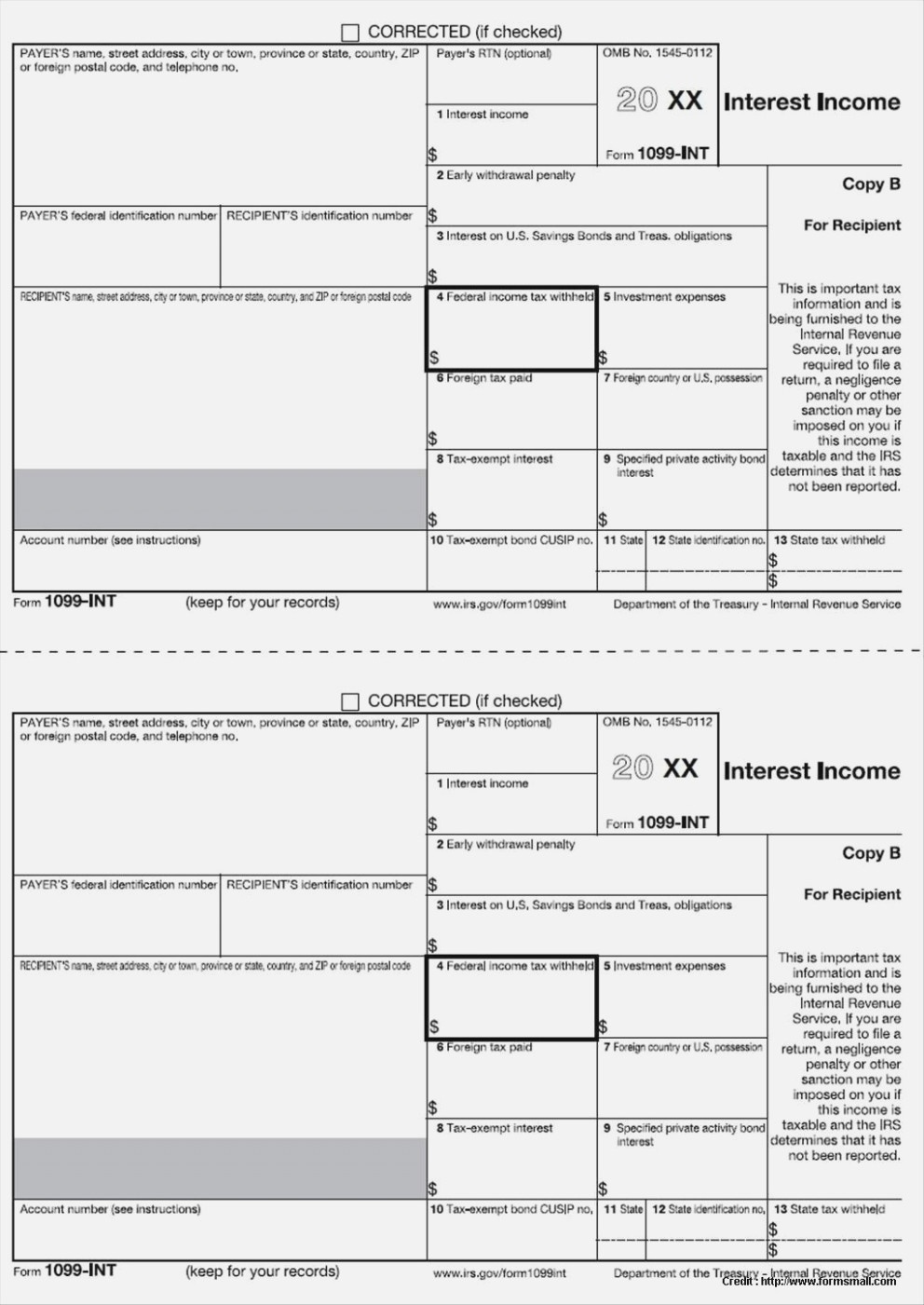

Int 1099 2019 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/447/880/447880866/large.png

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/509/836/509836879/big.png

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-7-box2-2x.png

As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most March 29 2023 Reviewed by Isaiah McCoy CPA If you hired a contractor or freelancer and paid them more than 600 in a year directly you have to send them a 1099 NEC If you don t want to file your 1099s electronically through the IRS s Information Returns Intake System IRIS you ll need to print them out and mail them the old fashioned way

deferred compensation Copy B For Recipient This is important tax information and is being furnished to the IRS If you are required to file a return a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported keep for your records www irs gov Form1099MISC If you re a business owner you may need to create W 2 and 1099 forms including 1099 NEC and 1099 MISC for your employees or contractors Select your product and follow the instructions to create W 2s and 1099s using Quick Employer Forms

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

https://eforms.com/irs/form-1099/

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

1099 0df Printable Form Printable Forms Free Online

1099 S Fillable Form Printable Forms Free Online

1099 Form Template Create A Free 1099 Form Form

Printable 1099 Tax Forms Free Printable Form 2024

1099 S Fillable Form Printable Forms Free Online

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

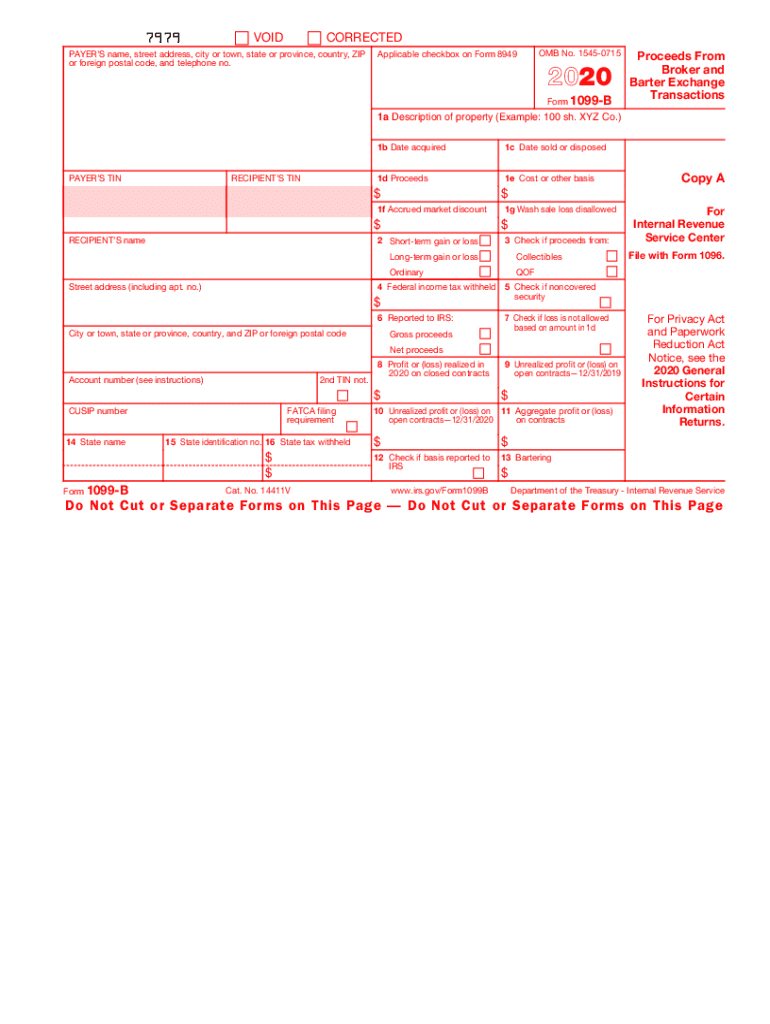

1099 B 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Free Printable 1099 Form Free Printable

Printable 1099 Misc Tax Form Template Printable Templates

Free Fillable Printable 1099 Forms - Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information