Free Free Irs 8962 Printable Forms IRS Free File Do your taxes for free IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software It s safe easy and no cost to you Those who don t qualify can still use Free File Fillable Forms

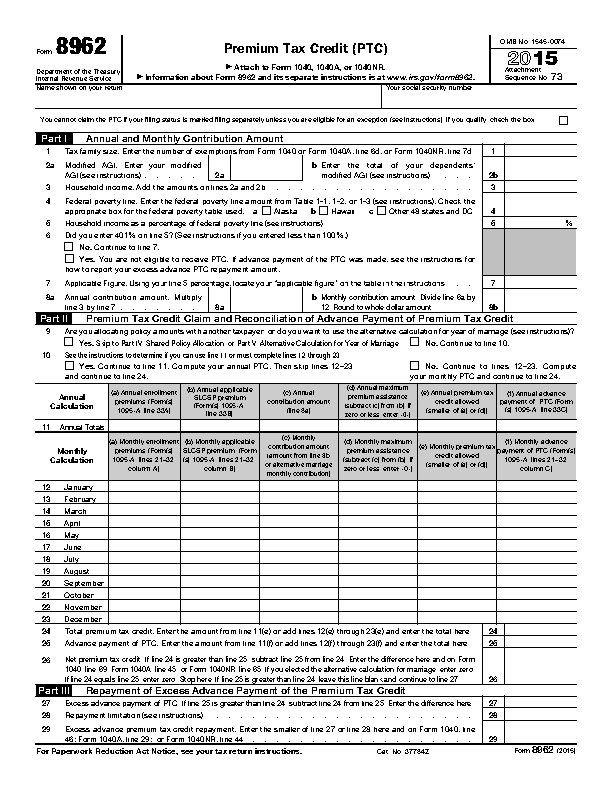

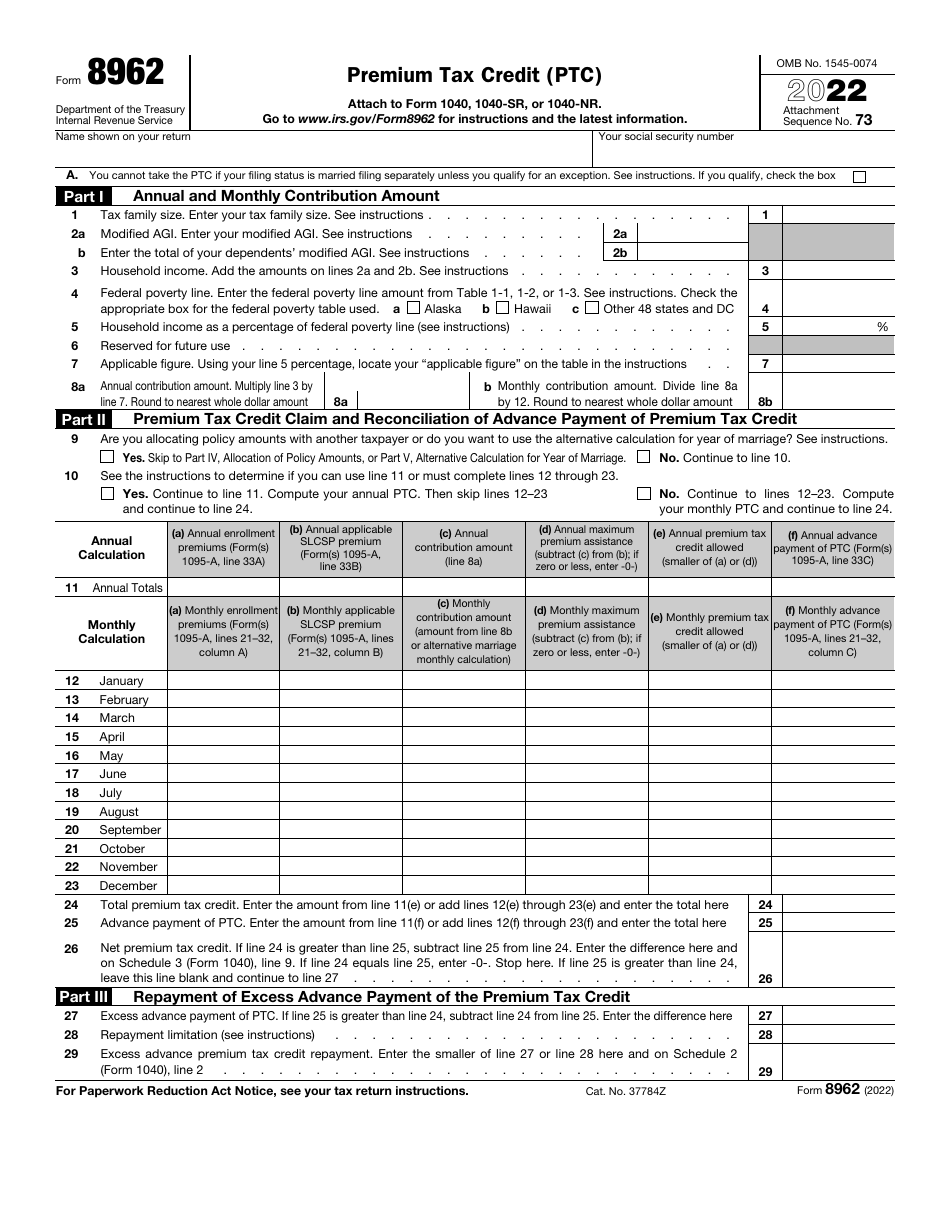

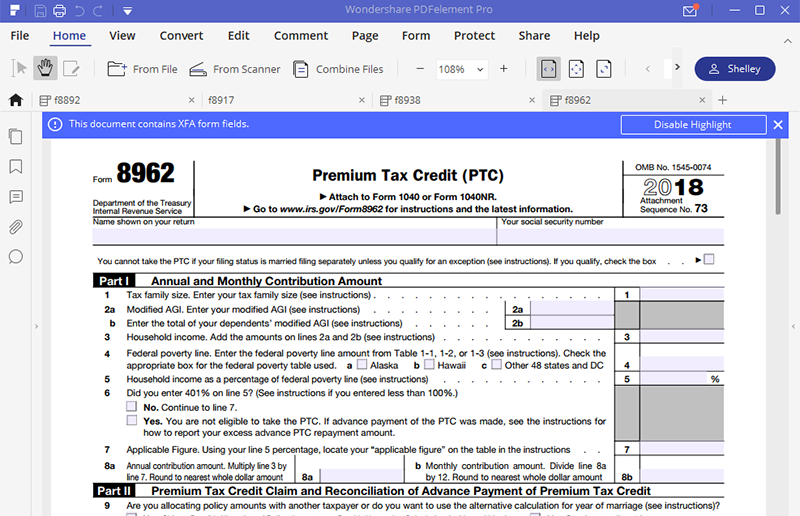

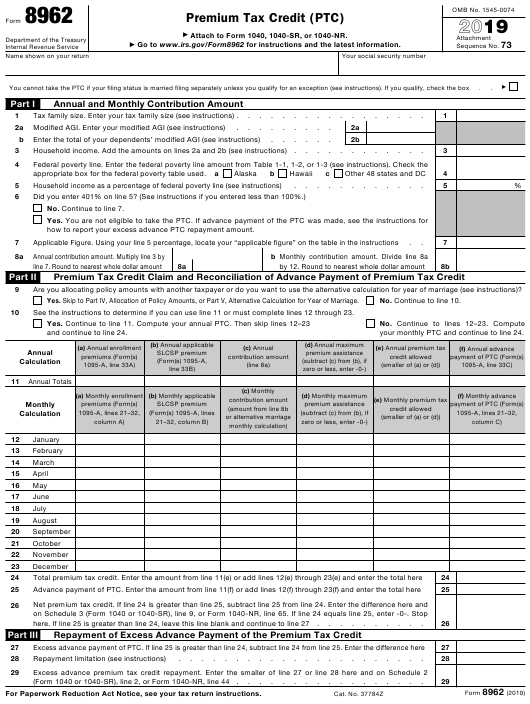

Form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you re eligible to receive and determines Get your Form 1095 A Print Form 8962 How to move advance payment of premium tax credit info to Form 8962 Complete all sections of Form 8962 On Line 26 you ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income This will affect the amount of your refund or tax due

Free Free Irs 8962 Printable Forms

Free Free Irs 8962 Printable Forms

https://www.signnow.com/preview/536/160/536160325/large.png

IRS 8962

https://images.wondershare.com/pdfelement/pdf-forms/tax-form/8962-part2-2.jpg

Free Free Irs 8962 Printable Forms Printable Forms Free Online

https://staticformsprocdn.azureedge.net/irs-form-8962-for-2015/irs-form-8962-for-2015-thumbnail.png

Follow the form instructions to enter the repayment limitation on line 28 Enter your excess advance premium tax credit repayment on line 29 Write the smaller of either line 27 or line 28 on line 29 and on your Form 1040 or 1040NR That s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC Claiming the premium tax credit Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments you ve already received The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size

This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax Other Federal Other Forms TaxFormFinder has an additional 774 Federal income tax forms that you may need plus all federal income tax forms

More picture related to Free Free Irs 8962 Printable Forms

Irs Form 8962 For 2016 Printable TUTORE ORG Master Of Documents

https://www.irs.gov/pub/xml_bc/66452q12.gif

IRS Form 8962 Download Fillable PDF Or Fill Online Premium Tax Credit Ptc 2022 Templateroller

https://data.templateroller.com/pdf_docs_html/2550/25504/2550476/irs-form-8962-premium-tax-credit-ptc_print_big.png

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

IRS Form 8962 Understanding Your Form 8962

https://www.investopedia.com/thmb/4JQL9eZ-deaY9YkGg4Fxx0yPOuQ=/828x640/filters:no_upscale():max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png

IRS 8962 2021 Get IRS 8962 2021 2024 How It Works Open form follow the instructions Easily sign the form with your finger Send filled signed form or save 8962 form 2021 printable rating 4 8 Satisfied 59 votes Tips on how to fill out edit and sign Irs 8962 form 2021 online How to fill and sign Irs form 8962 2021 Multiply the difference by 100 then drop any numbers after the decimal point For example if the difference was 1 8545565 you would enter 185 on line 5 of Form 8962 Tip There are 3 different federal poverty lines used 1 for the 48 contiguous states and the District of Columbia 1 for Hawaii and 1 for Alaska

Select the checkbox for Form 8962 Premium Tax Credit and print it If your refund or balance due has changed print Form 1040 Our TurboTax Audit Support Guarantee gives you free audit guidance from a trained tax professional to help you understand your IRS notice and answer all your audit related questions At the top of Form 8962 enter your name and Social Security number Step 3 Calculate the Annual and Monthly Contribution Amounts in Part I of Form 8962 Line 1 Use your tax return to enter the size of your tax family on line 1 This number generally includes you your spouse if filing jointly and your dependents

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/459/416/459416023/big.png

Form 8962 2014 Diy Menu Cards Menu Card Template Wedding Menu Template Wedding Menu Cards

https://i.pinimg.com/originals/08/8b/29/088b29243aa4f32572db8821e4237591.jpg

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

IRS Free File Do your taxes for free IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software It s safe easy and no cost to you Those who don t qualify can still use Free File Fillable Forms

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you re eligible to receive and determines

8962 Form Instructions Get IRS Form 8962 Printable How To Fill Out 8962 Tax Form Example

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

IRS Form 8962 Instruction For How To Fill It Right

How To File IRS Form 8962 For 2022 Premium Tax Credit YouTube

Free Printable Tax Form 8962 Printable Forms Free Online

IRS 8962 2014 Fill And Sign Printable Template Online US Legal Forms

IRS 8962 2014 Fill And Sign Printable Template Online US Legal Forms

IRS Instructions 8962 2019 Fill And Sign Printable Template Online US Legal Forms

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Printable Pdf Printable Forms Free Online

Irs Form 8962 Printable 2021 Printable Form 2023

Free Free Irs 8962 Printable Forms - Claiming the premium tax credit Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments you ve already received The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size