Free Irs 1099 Misc Income Form Printable You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

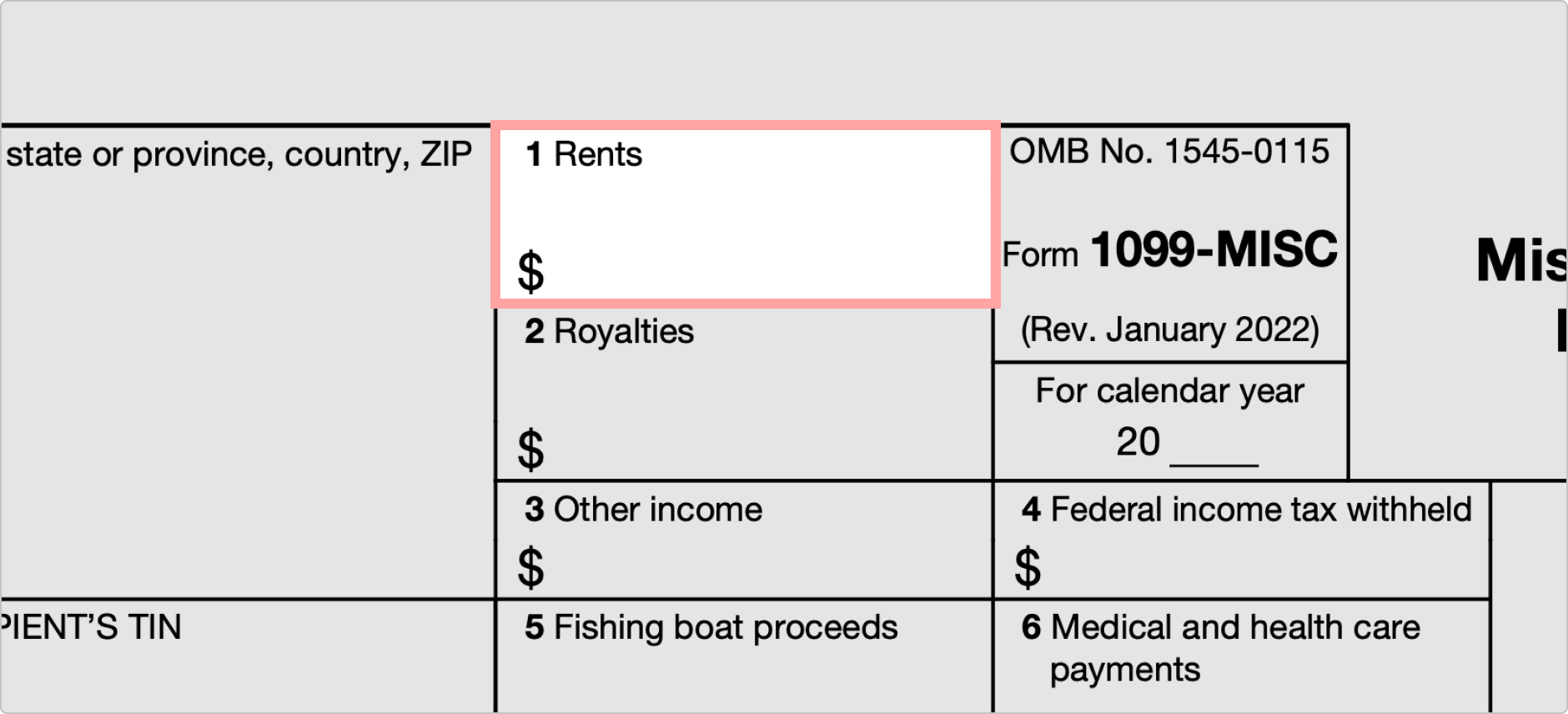

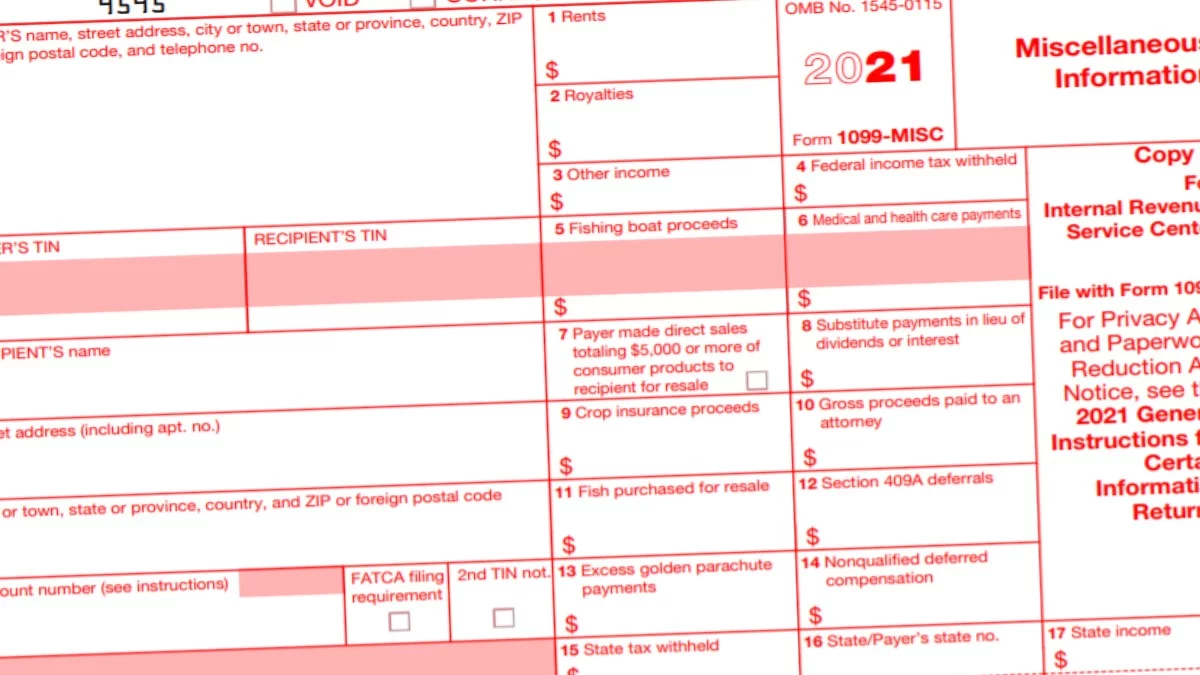

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Free Irs 1099 Misc Income Form Printable

Free Irs 1099 Misc Income Form Printable

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Steps to use IRIS A2A To start using IRIS A2A with software or a third party service follow these steps Apply for an IRIS A2A Transmitter Control Code TCC Get an API Client ID Get a schema package Submit IRIS Assurance Testing System ATS transmissions Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or The due date for filing Form 1099 MISC with the IRS is February 28 2024 if you file on paper or March 31 2024 if you file electronically Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099 NEC income Year Round Tax Estimator Available in TurboTax Premium formerly Self Employed

More picture related to Free Irs 1099 Misc Income Form Printable

Form 1099 Misc Fillable Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-1099-misc-fillable.jpg

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-7-box2-2x.png

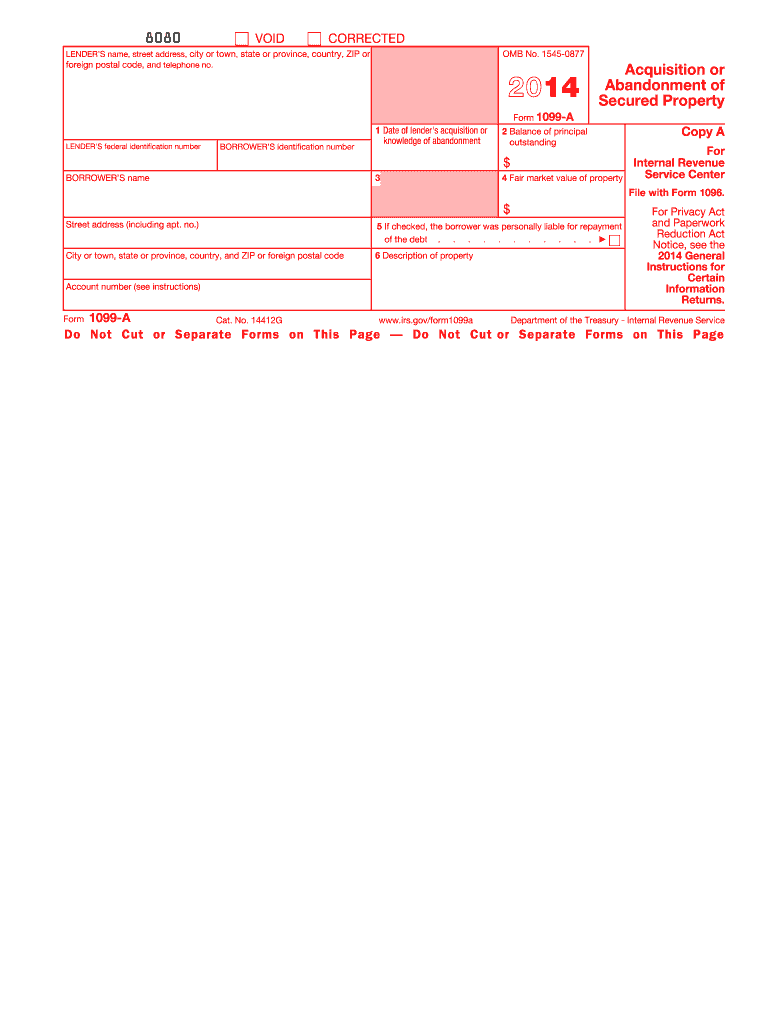

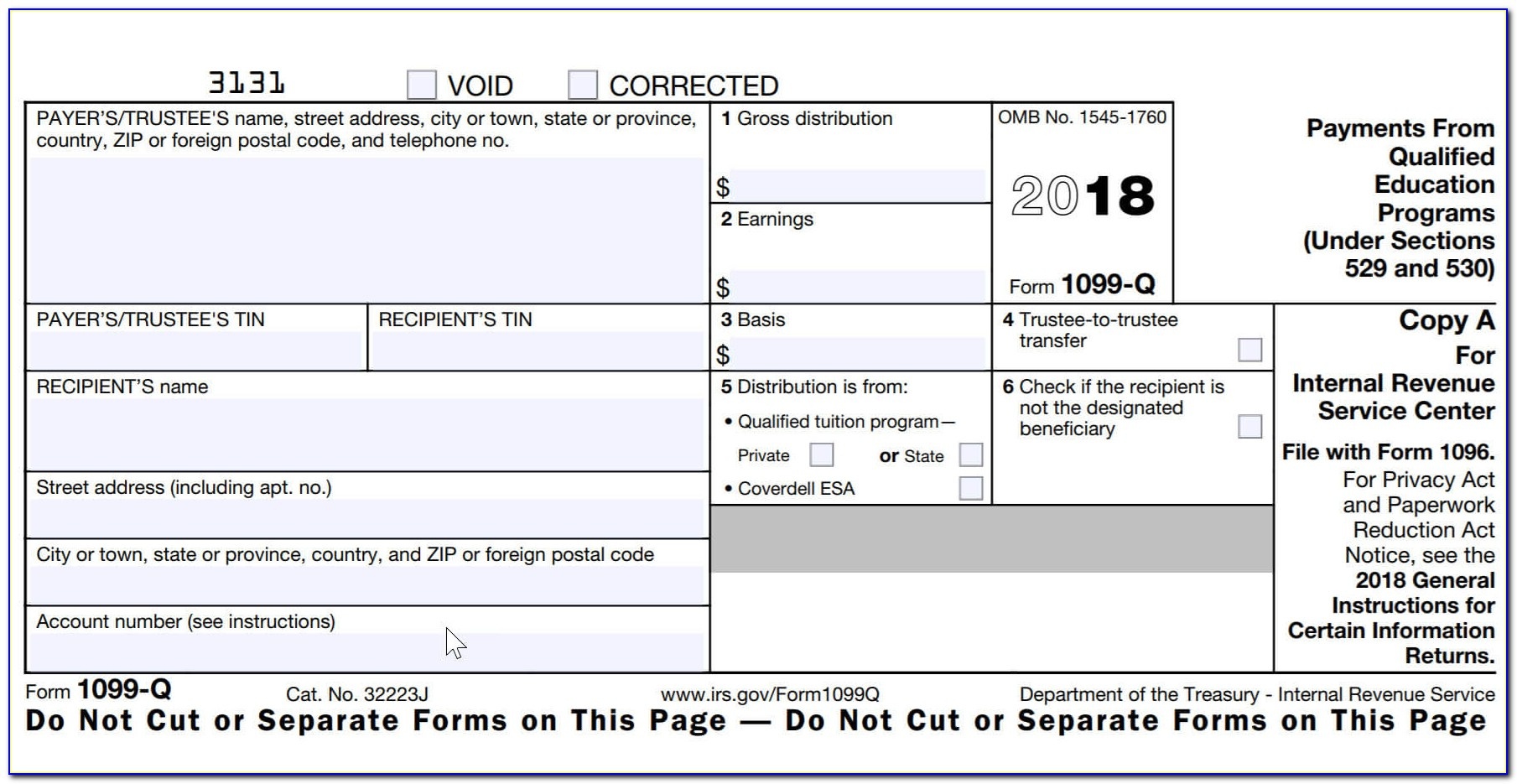

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more In tax year 2020 the IRS reintroduced Form 1099 NEC for reporting independent contractor income otherwise known as nonemployee compensation If you re self employed income you receive during the year might be reported on the 1099 NEC but Form 1099 MISC is still used to report certain payments of 600 or more you made to other businesses and people This article covers the 1099 MISC

Form 1099 NEC Form 1099 MISC You are required to furnish Form 1099 NEC to the payee and file with the IRS by January 31 2024 for payments made to contractors in the 2023 tax year For 2023 you are required to send Form 1099 MISC to the payee the contractor by January 31 2024 and file with the IRS by February 28 if filing by paper or by Your 2021 tax return to access your adjusted gross income Once you have your documentation follow these steps 1 Go to the IRS Free File website 2 Click the Use Free Guided Tax Preparation

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

1099 MISC Form Fillable Printable Download 2023 Instructions

https://formswift.com/seo-pages-assets/uploads/1099-misc-2022-assets/box-1-2x.png

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

How To Fill Out And Print 1099 MISC Forms

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

1099 MISC Form 2023 2024

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Printable Blank 1099 Form

1099 Misc Printable Template Free Printable Templates

1099 Misc Form Printable Instructions

Free Irs 1099 Misc Income Form Printable - A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or