Free Irs Form 1099 Printable IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more This free web based filing system lets you E file up to 100 returns at a time Enter manually or by csv upload Download payee copies to distribute Keep a record of completed filed and distributed forms Save and manage issuer information Get started To use the IRIS Taxpayer Portal you need an IRIS Transmitter Control Code TCC

Free Irs Form 1099 Printable

Free Irs Form 1099 Printable

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Free Irs Form 1099 Printable Printable Templates

https://www.pdffiller.com/preview/445/723/445723799/big.png

Free Form 1099 MISC PDF Word

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Form 1099 NEC Rev January 2024 Nonemployee Compensation Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No 1545 0116 For calendar year VOID CORRECTEDPAYER S name street address city or town state or province country ZIP or foreign postal code and telephone no PAYER S TIN RECIPIENT If you have questions about reporting on Form 1099 MISC call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free Persons with a hearing or speech disability with access to TTY TDD equipment can call 304 579 4827 not toll free

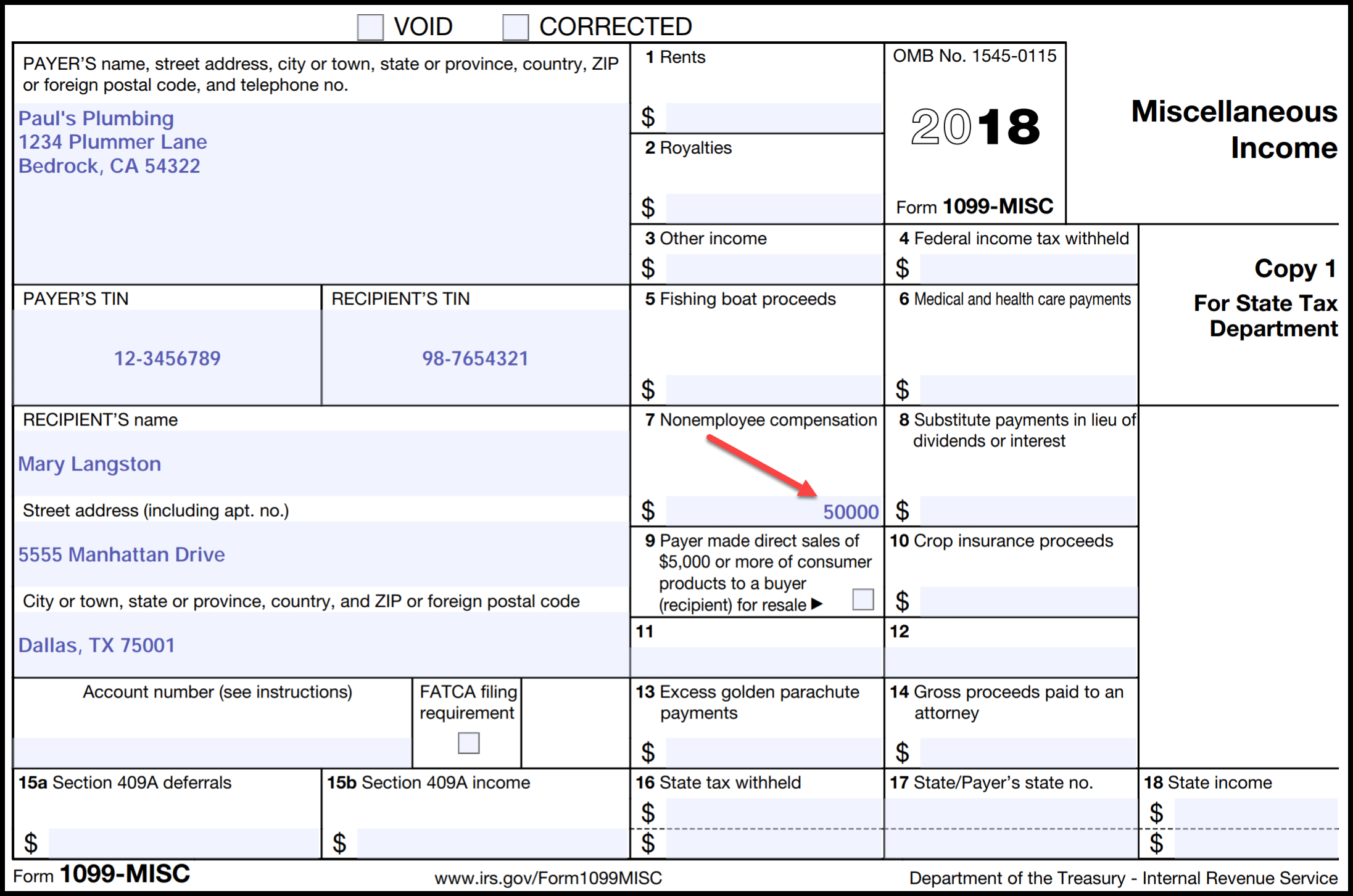

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below 1099 NEC You ll receive a 1099 NEC nonemployee compensation for income you receive for contract labor or self employment of more than 600 Note Prior to tax year 2020 this information was reported on Form 1099 MISC If you work for more than one company you ll receive a 1099 NEC tax form from each company

More picture related to Free Irs Form 1099 Printable

Free Irs Form 1099 Printable Printable Templates

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Business Tax A new online portal where businesses can file Form 1099 series information returns for free is now open the IRS said Wednesday The Information Returns Intake System IRIS is available to businesses of any size but the IRS expects it to be especially useful for small businesses that now file information returns on paper IRIS What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

For Internal Revenue Service Center File with Form 1096 7 Foreign country or U S territory For Privacy Act and Paperwork Reduction Act Notice see the current General Instructions for Certain Information Returns Bond premium on tax exempt bond 2nd TIN not Cat No 14410K www irs gov Form1099INT Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

2018 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/421/116/421116584/large.png

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/7njQnBtOe3zLbzG3V4rWHE/de7ada497a46a667e012a996afc8b7d1/1099_Sample_IRS.gif

https://www.irs.gov/newsroom/irs-opens-free-portal-to-file-information-returns-new-electronic-option-can-reduce-millions-of-paper-forms-1099-estimated-to-be-filed-by-businesses-in-2023

IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

https://eforms.com/irs/form-1099/

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Irs Printable 1099 Form Printable Form 2023

2018 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Irs 1099 Form 2023 Pdf Printable Forms Free Online

1099 MISC Form Fillable Printable Download Free 2021 Instructions

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Ir s Form 1099 Printable Fill Out And Sign Printable PDF Template SignNow

IRS 1099 S 2020 Fill And Sign Printable Template Online US Legal Forms

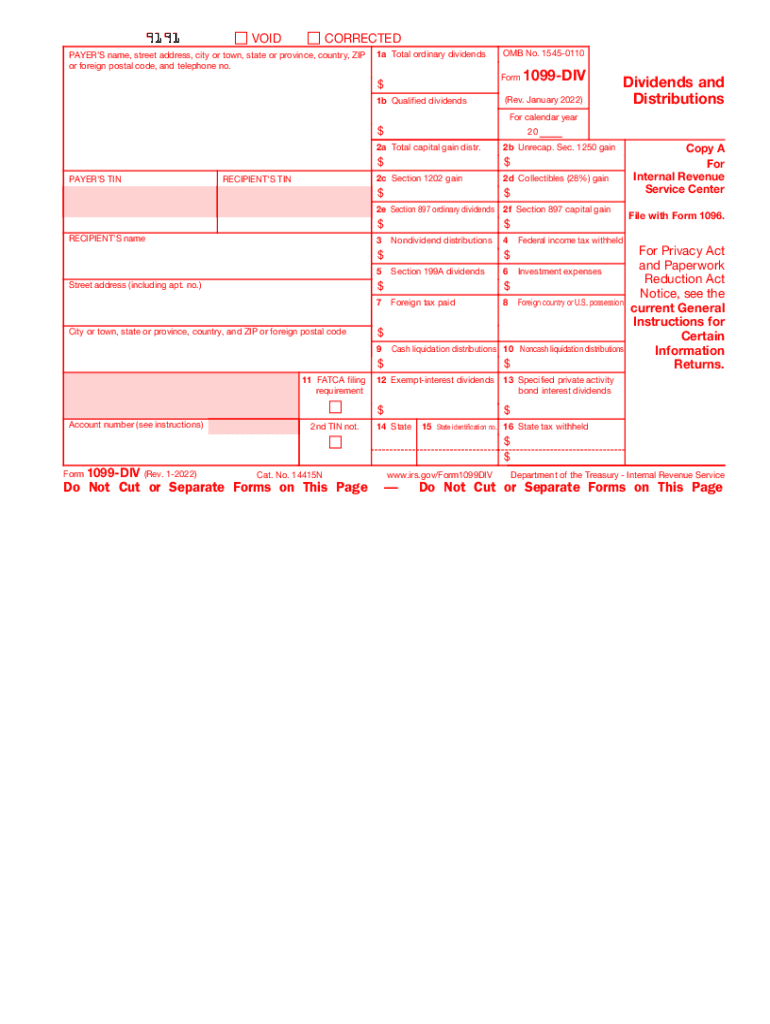

2022 2024 Form IRS 1099 DIV Fill Online Printable Fillable Blank PdfFiller

Free Irs Form 1099 Printable - Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Answer the following questions to find an IRS Free File trusted partner s 1 General 2 Adjusted Gross Income 3 Earned Income Tax Credit 4 Results General Information