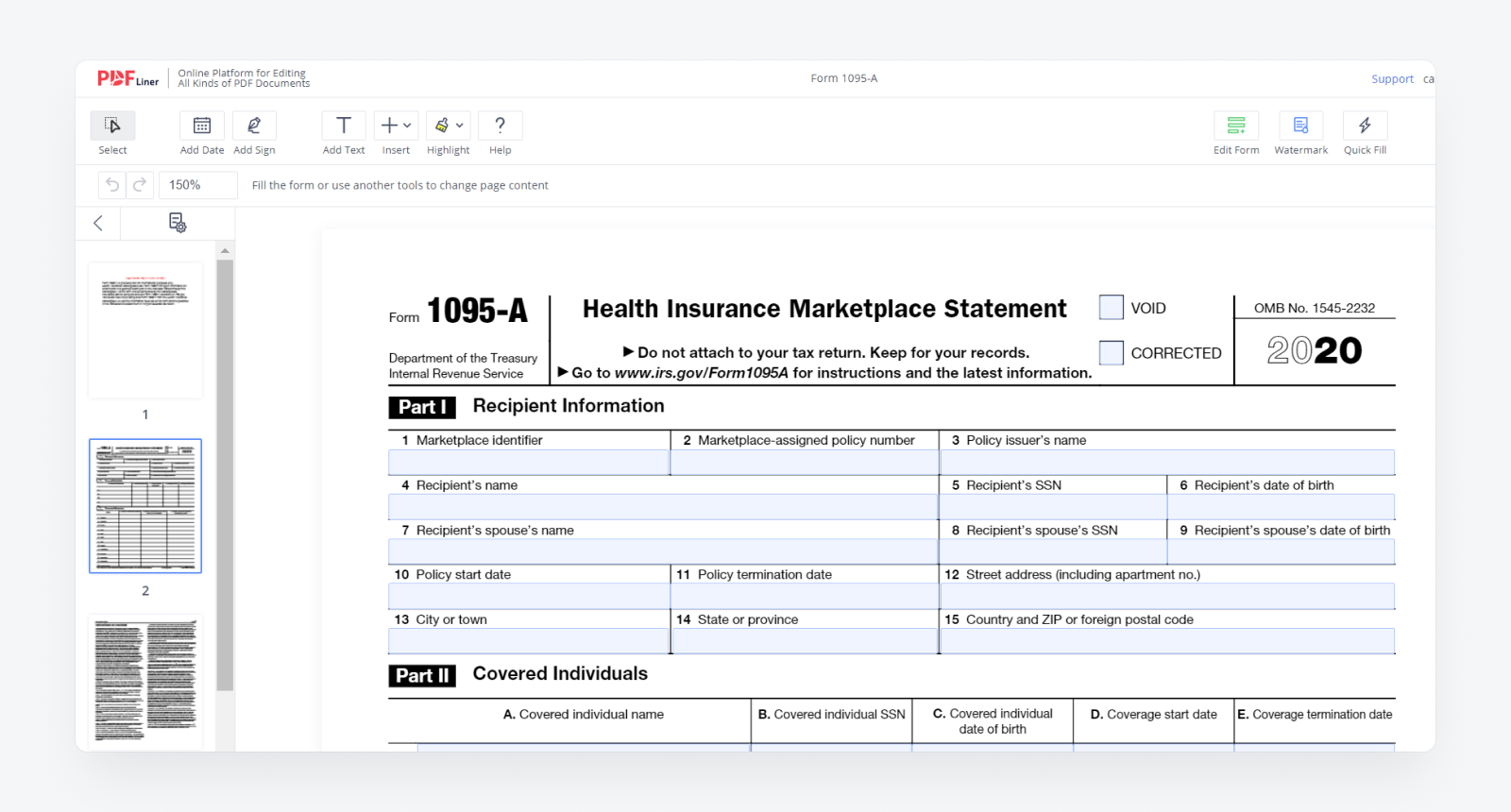

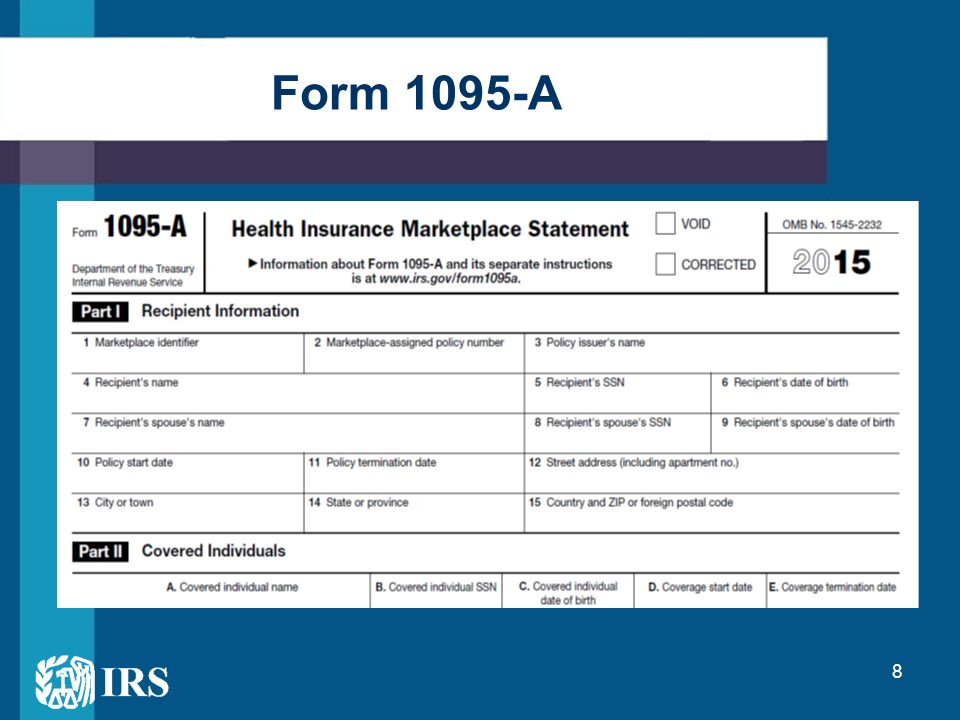

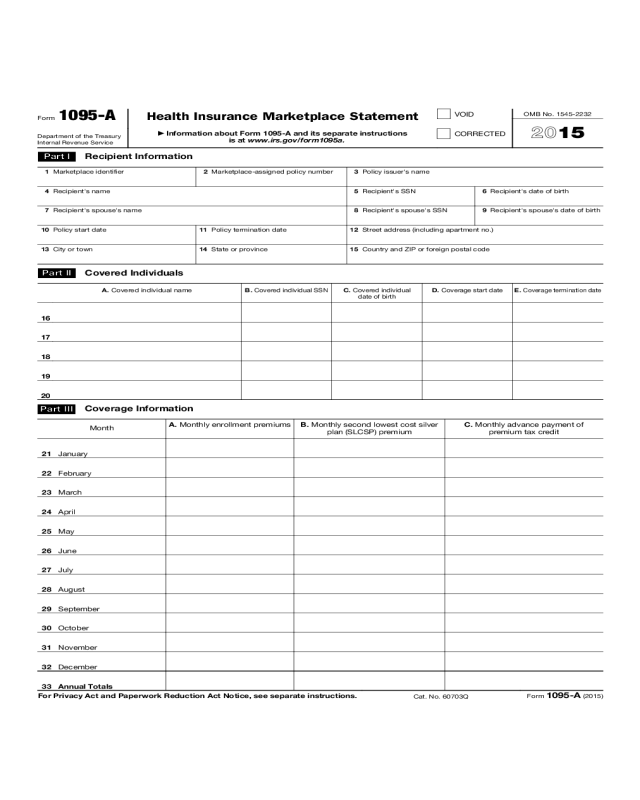

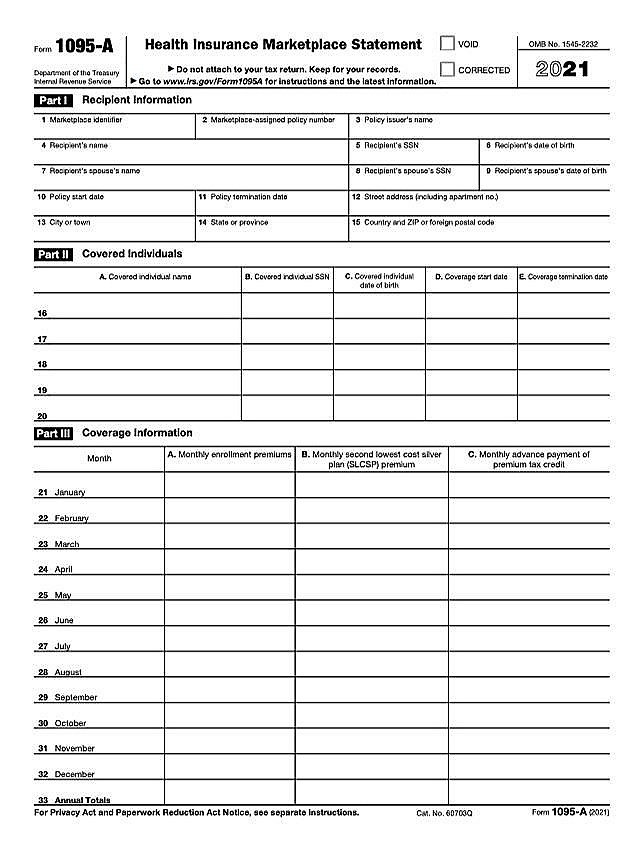

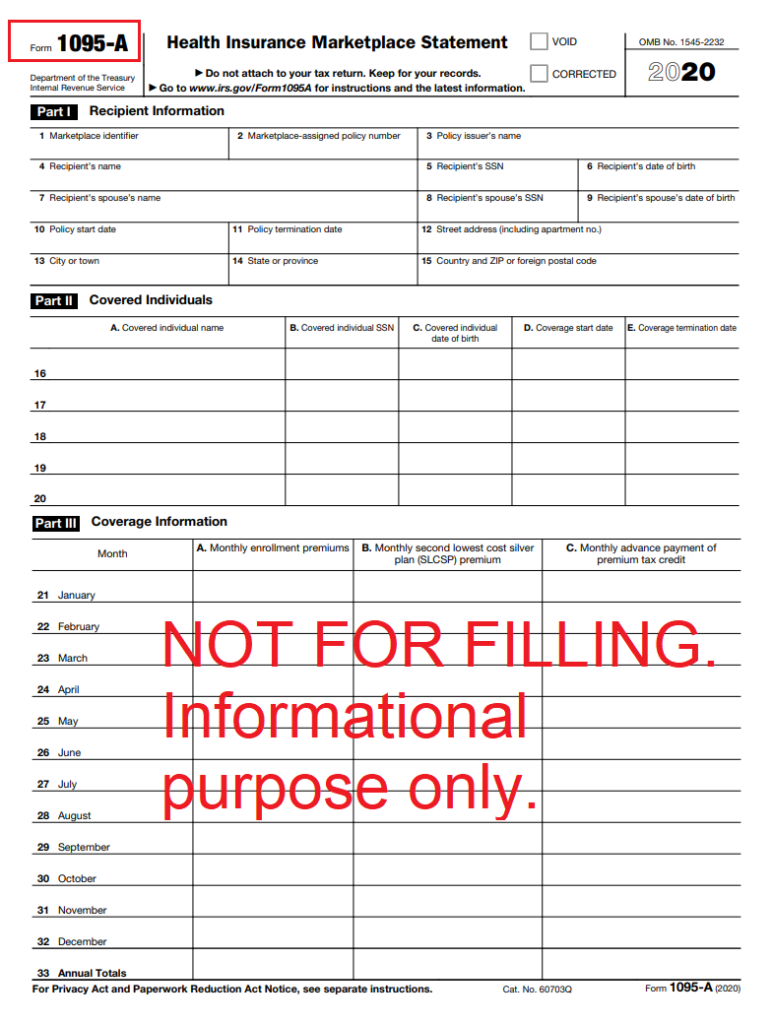

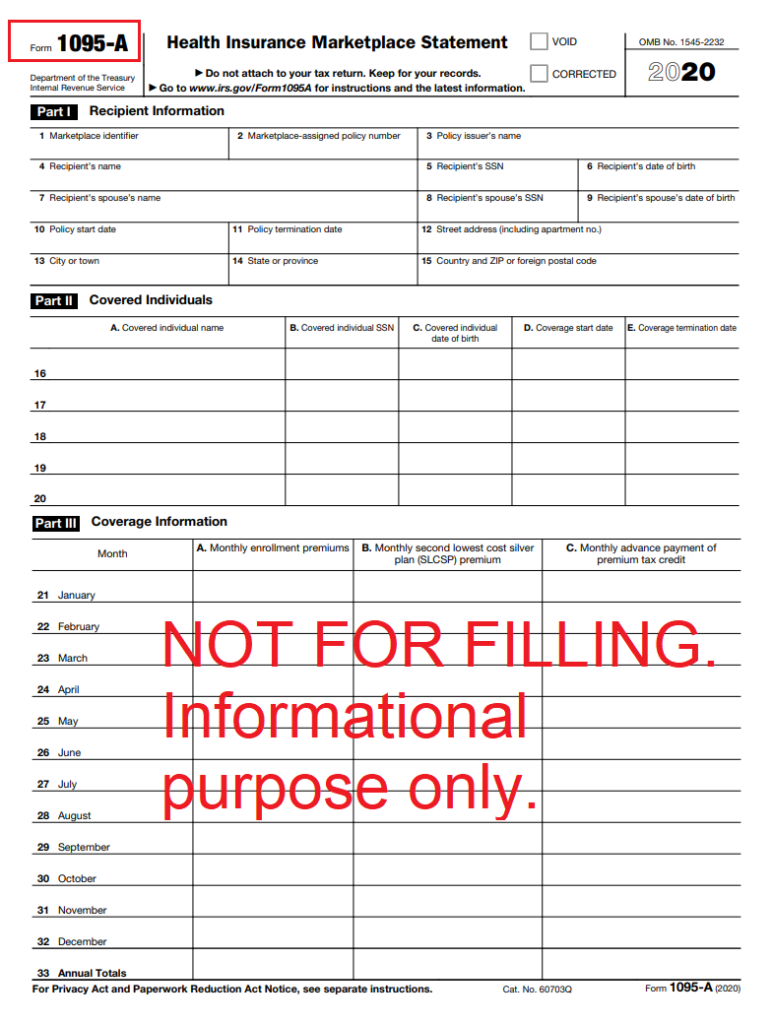

Free Printable 1095 A Form You received this Form 1095 A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095 A provides information you need to complete Form 8962 Premium Tax Credit PTC

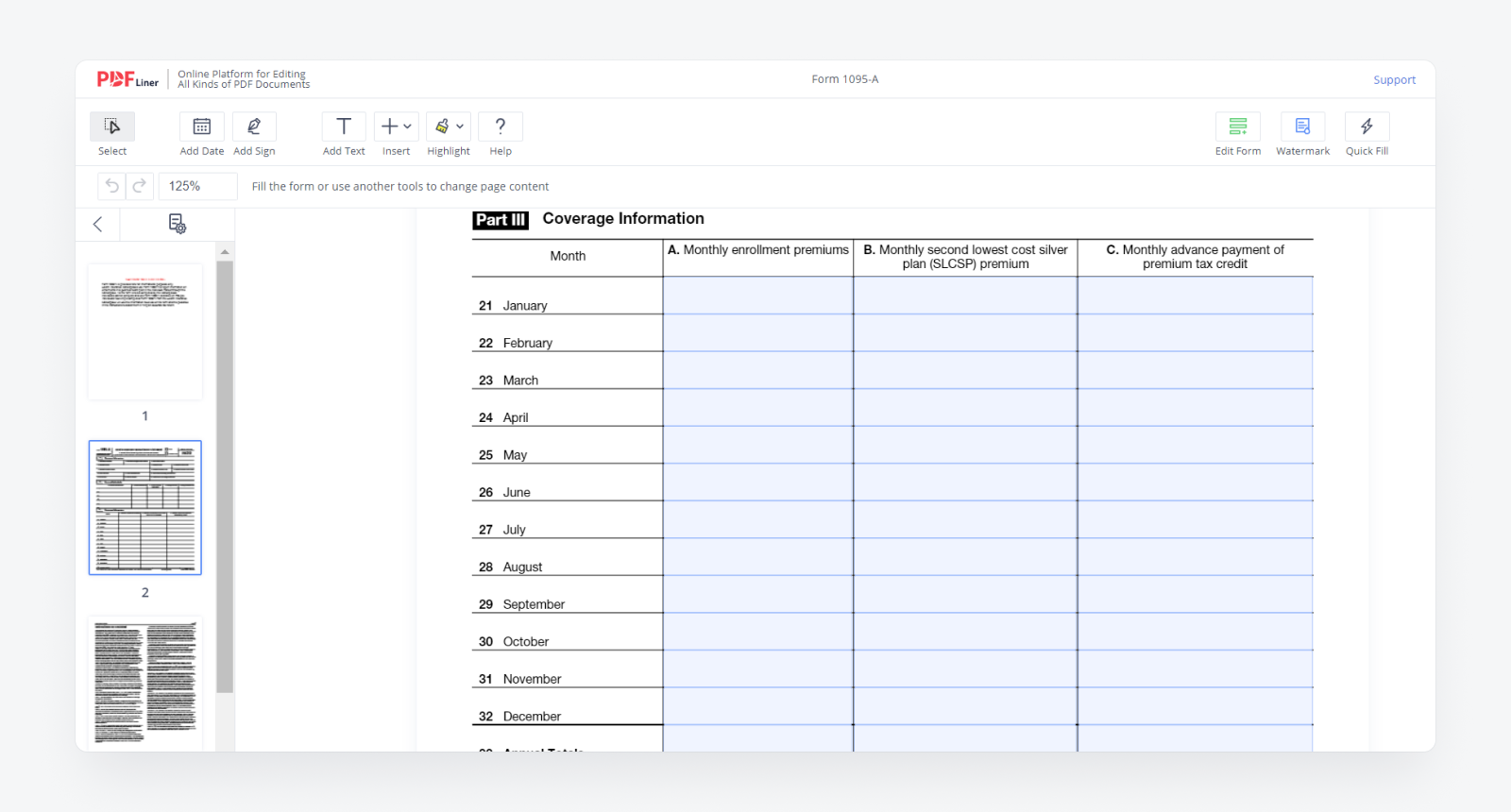

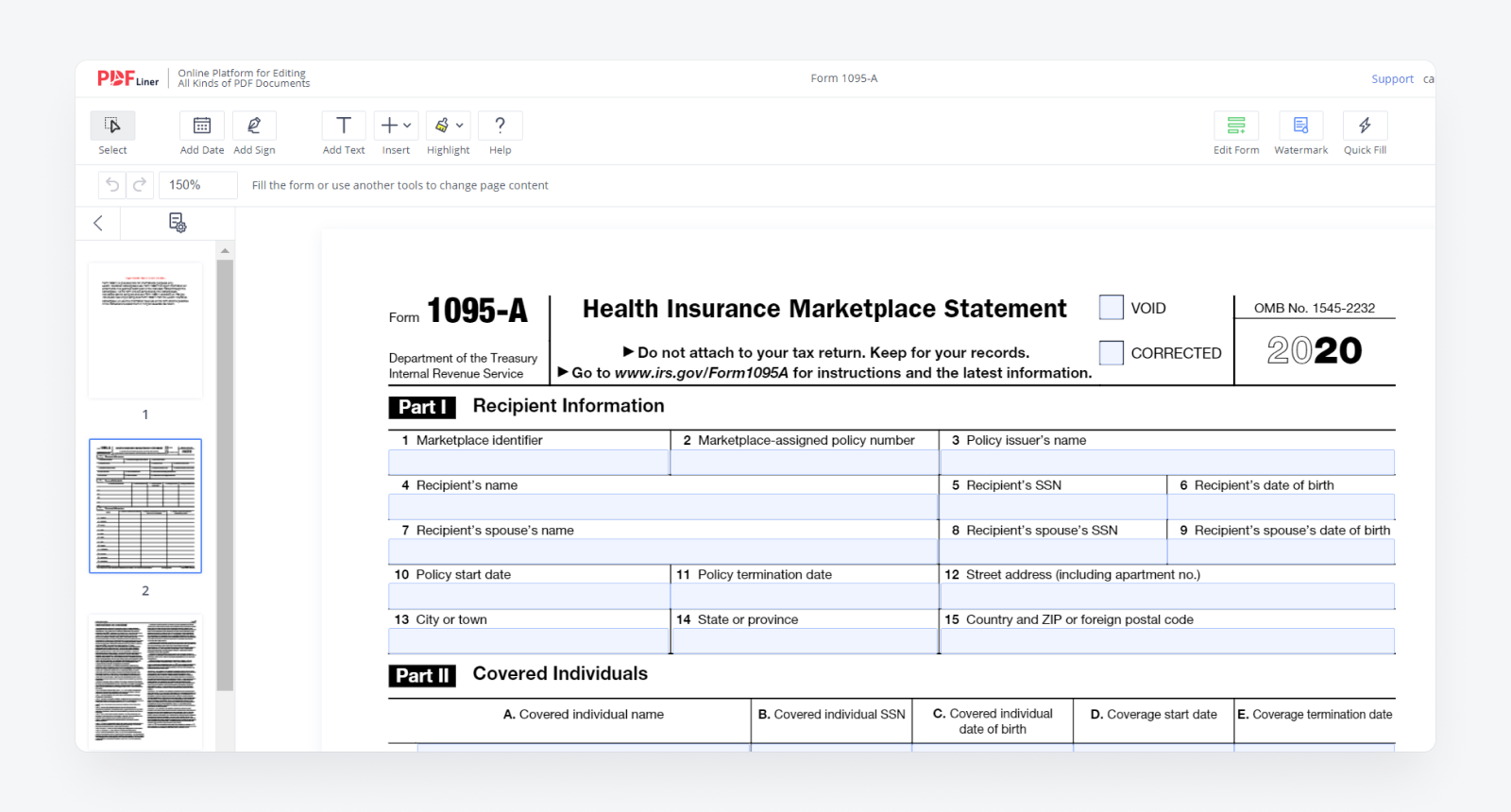

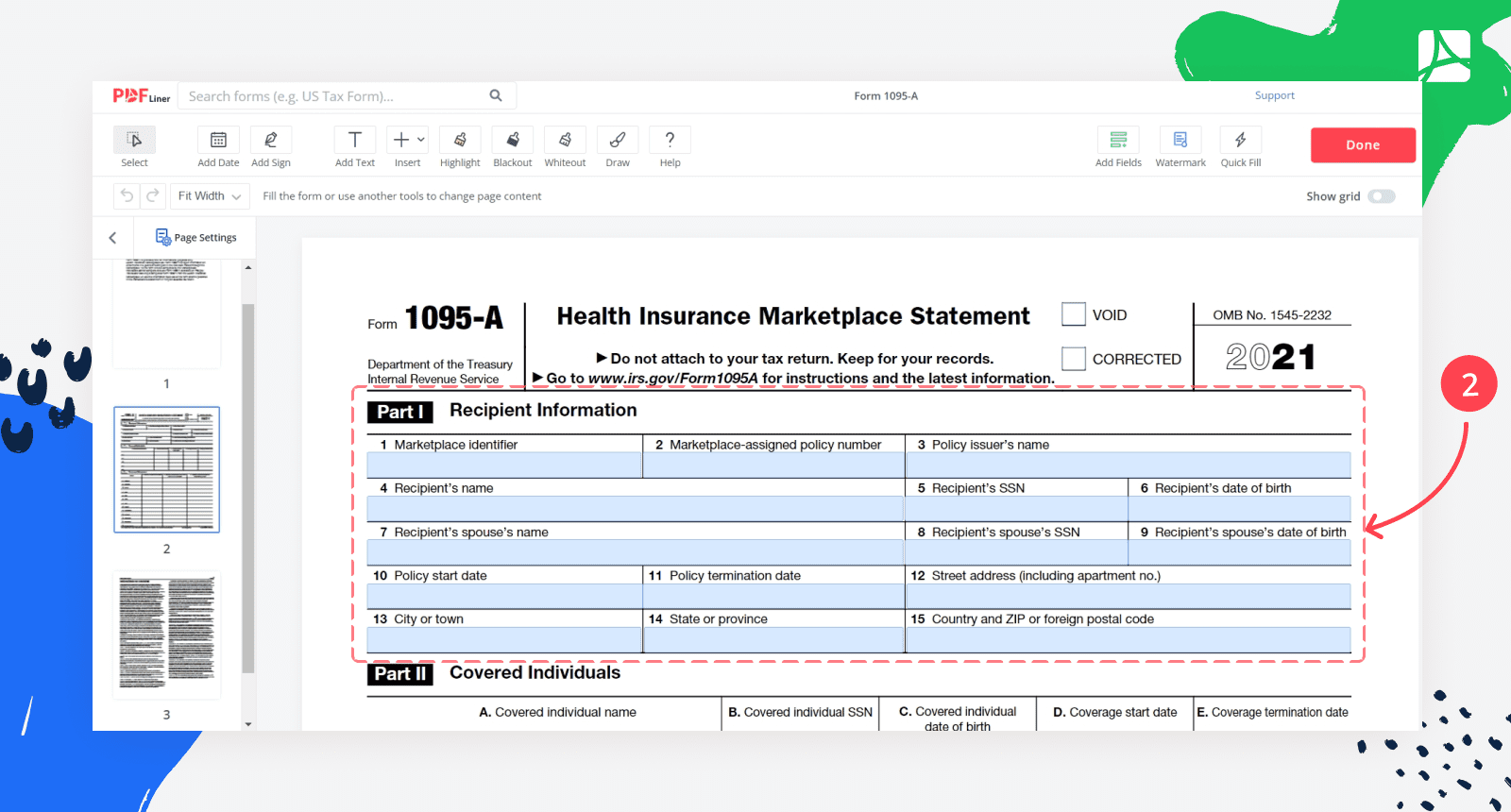

The Form 1095 A will tell you the dates of coverage total amount of the monthly premiums for your insurance plan the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit and amounts of advance payments of the premium tax credit STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2023 application not your 2024 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095 A online 2 STEP 4 Under Your Forms 1095 A for Tax Filing select Download PDF and follow these steps based on your browser

Free Printable 1095 A Form

Free Printable 1095 A Form

https://blog.pdfliner.com/howTo/img/tild6536-3761-4039-a239-346663353333__how-to-fill-out-form.png

1095 A Printable Form Download All Latest Free Printable Form For 2023

https://www.pdffiller.com/preview/527/848/527848229/big.png

1095 A Tax Form To Print Get IRS Form 1095A For 2022 Printable Blank PDF To Download For Free

https://1095a-form-print.com/images/uploads/2023-03-16/1095a-rain1-main-scrn-4ppds.jpg

File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A Get a sample 1095 A PDF 132 KB This is just a preview don t fill it out Health coverage tax tool You ll need to use this tool when filing your 2023 taxes only if the information on your tax Form 1095 A about your second lowest cost Silver plan SLCSP is missing or incorrect Find out if this applies to you

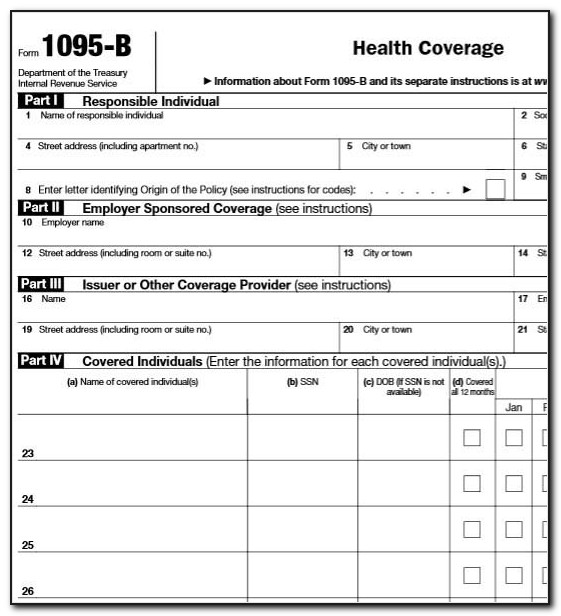

The form provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy Insurance companies in health care exchanges provide you with the 1095 A form This form includes Your name Amount of coverage you have The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers They are forms 1095 A 1095 B and 1095 C These forms help determine if you the required health insurance under the Act For individuals who bought insurance through the health care marketplace this information will help to determine whether you are able to receive

More picture related to Free Printable 1095 A Form

1095 A Printable Form Download All Latest Free Printable Form For 2023

https://www.viralcovert.com/wp-content/uploads/2018/11/print-1095-a-tax-form.jpg

1095 A Tax Form Welk Security Trust

https://robertwelk.com/wp-content/uploads/2018/06/Form1095-A.jpg

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild3031-3330-4561-b633-663361653531__how-to-get-form-1095.png

Form 1095 C Employer Provided Health Insurance Offer and Coverage Form 1095 C is issued by large employers required to offer coverage to employees This form reports both Offer of coverage to an employee Coverage of the employee if the employer is self insured and the employee enrolls in coverage However just like with the 1095 B most If you need a copy of your 1095 B form you may request one by calling Member Services at 1 844 477 0450 About your Form 1095 The form s you get will depend on the type s of health coverage you had See the table below to find out which type of form s to expect

Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace How to reconcile using Form 1095 A You ll use the 1095 A form to reconcile check if there s any difference between the premium tax credit you got and the amount you qualify for on your taxes Before you start check the form to make sure the information is right If you filed your taxes with an incorrect form you may need to

1095 A Tax Form H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2015/01/1095-banner-featured-825x510.jpg

Fill Free Fillable Form 1095 A Health Insurance Marketplace Statement 2019 PDF Form

https://var.fill.io/uploads/pdfs/html/74d04930-1980-4138-8313-4786594790c1/bg2.png

https://www.irs.gov/pub/irs-access/f1095a_accessible.pdf

You received this Form 1095 A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095 A provides information you need to complete Form 8962 Premium Tax Credit PTC

https://www.irs.gov/affordable-care-act/individuals-and-families/health-insurance-marketplace-statements

The Form 1095 A will tell you the dates of coverage total amount of the monthly premiums for your insurance plan the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit and amounts of advance payments of the premium tax credit

How To Use Form 1095 A During Tax Season Legacy Health Insurance

1095 A Tax Form H R Block

Printable 1095 A Form TUTORE ORG Master Of Documents

1095 A Printable Form Download All Latest Free Printable Form For 2023

What Is A Tax Form 1095 A And How Do I Use It Stride Blog

How To Get The 1095 a Form Online Healthy Information Cebtralpainnervecenter

How To Get The 1095 a Form Online Healthy Information Cebtralpainnervecenter

Form 1095 A Sample Amulette

WHAT TO DO WITH FORM 1095 A Insurance Information

Form 1095 A 2023 Printable Form 1095 A Online PDFliner

Free Printable 1095 A Form - IRS Tax Form 1095 A for 2023 Printable 1095A Form Blank PDF Free Fillable Statatement IRS 1095 A Tax Form Get Now Form 1095 A Value for Taxpayers With Health Insurance IRS Form 1095 A is a document you ll receive if you buy medical coverage through the Health Insurance Marketplace