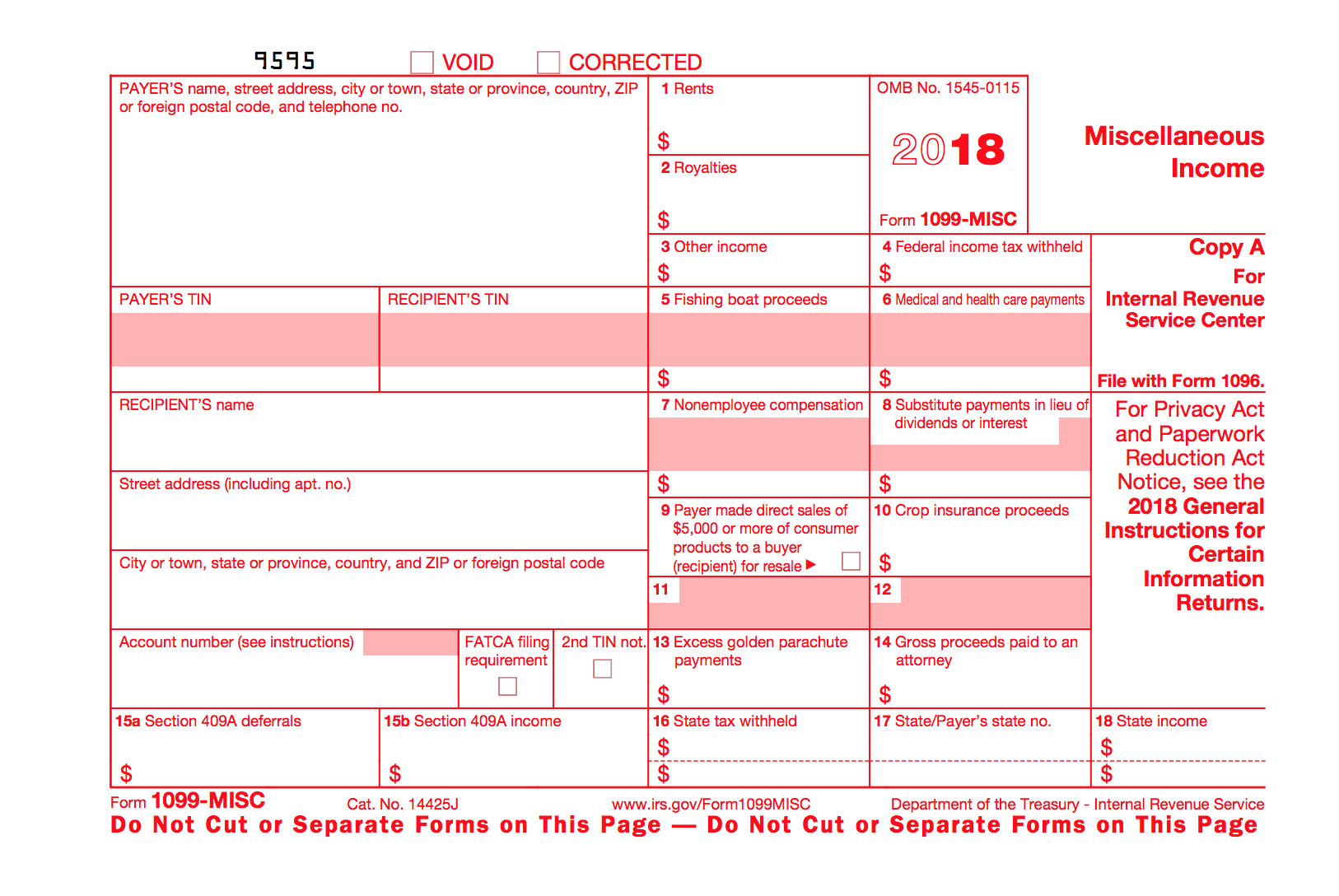

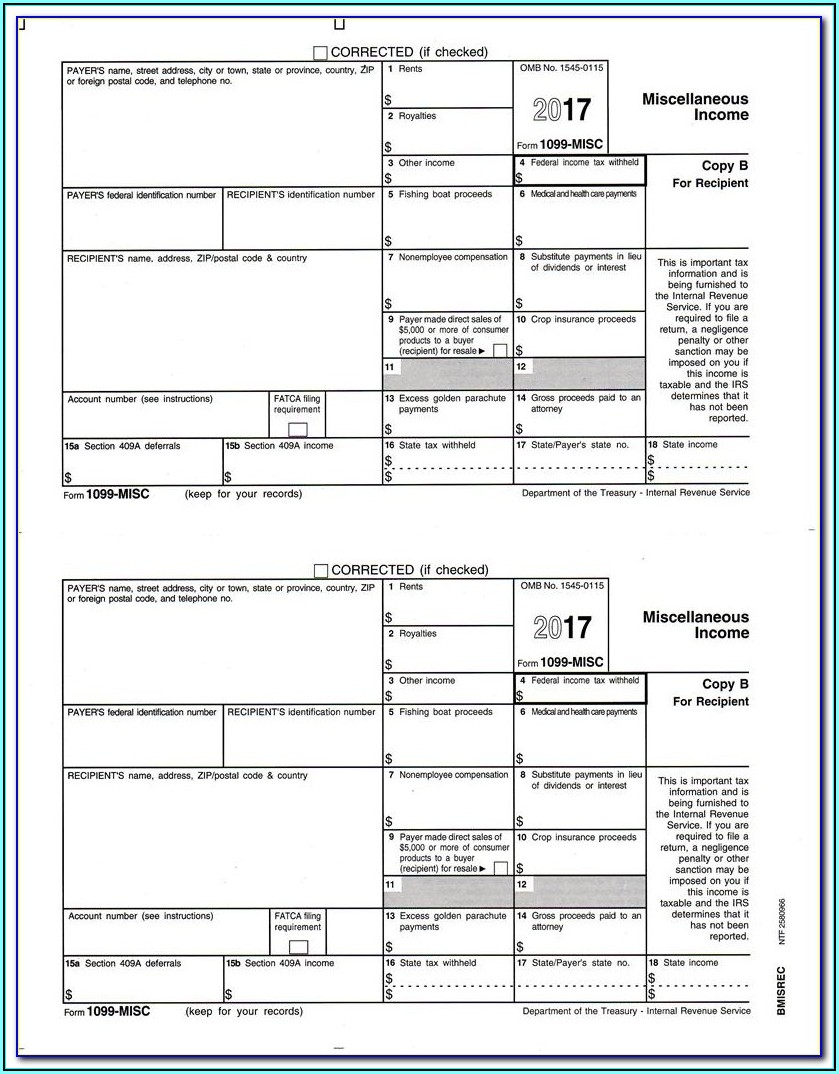

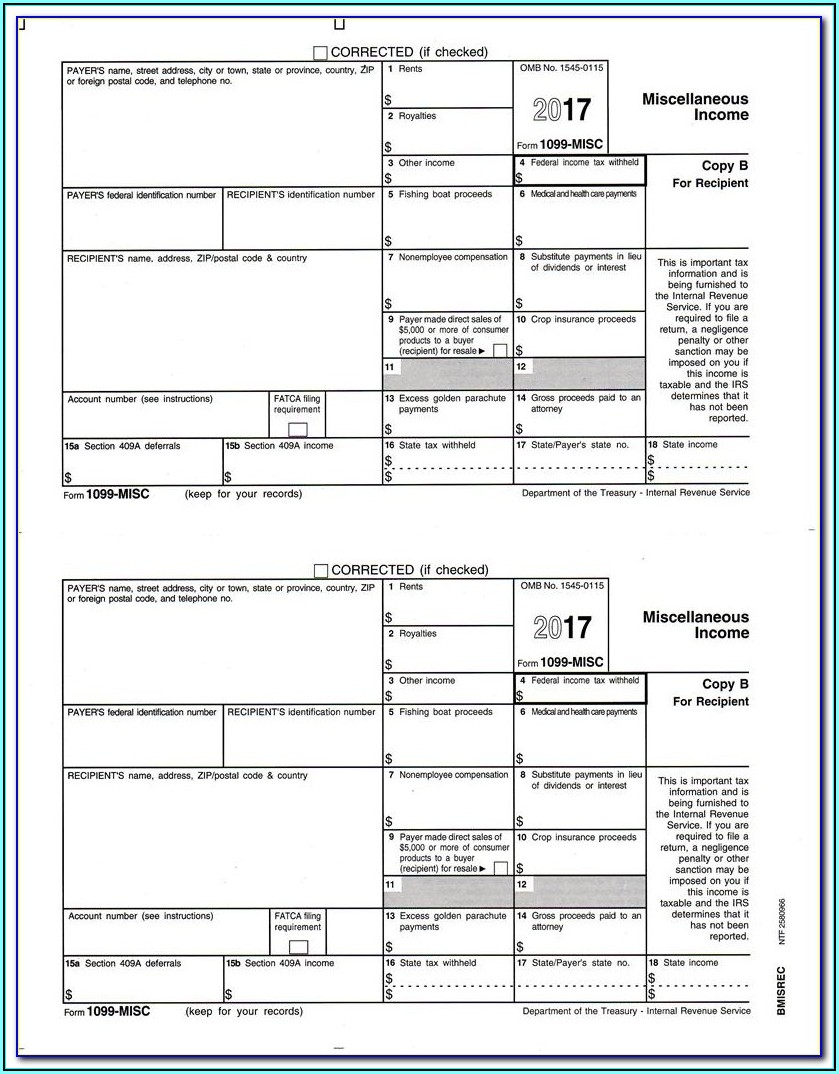

Free Printable 1099 Misc Form Copy 2 What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information

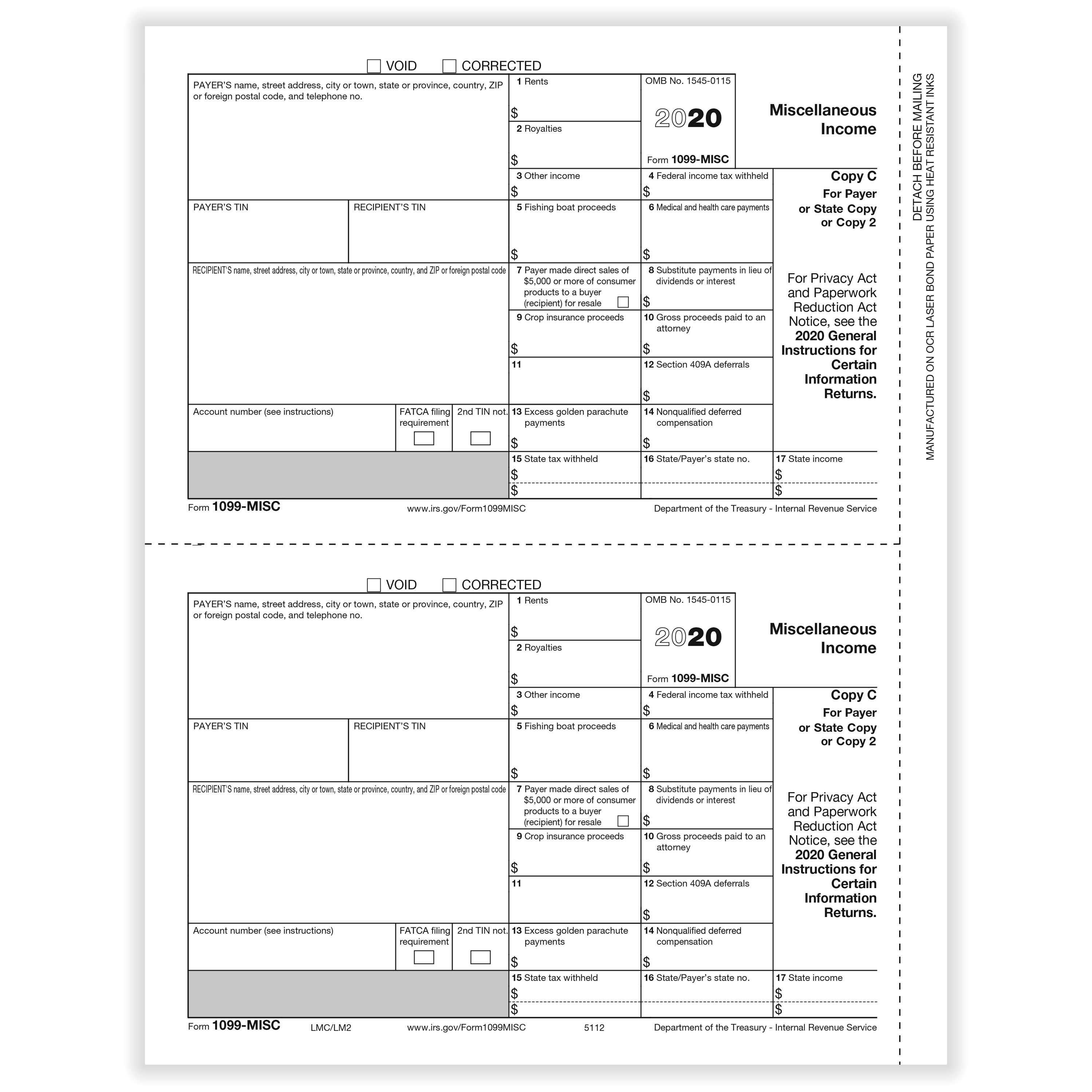

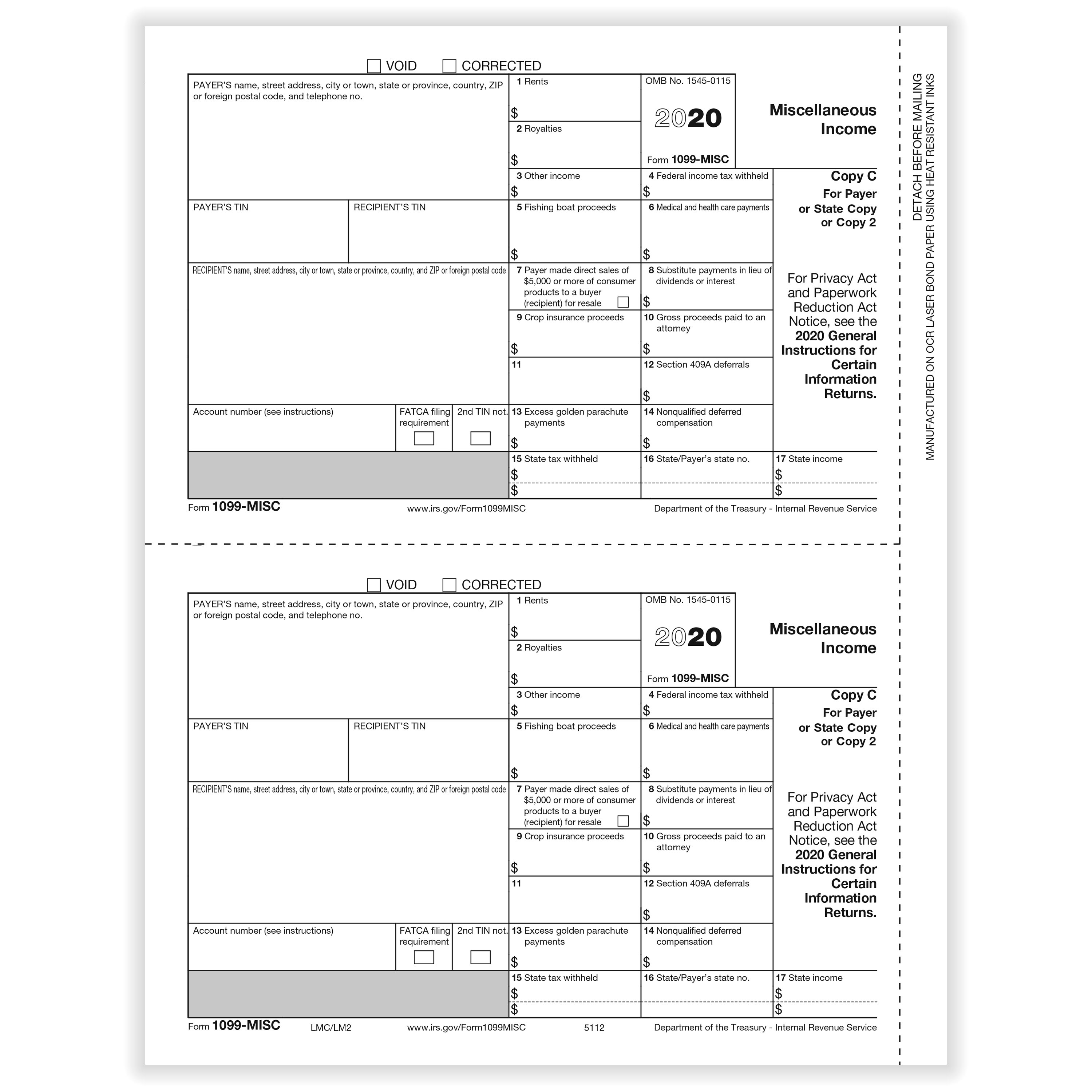

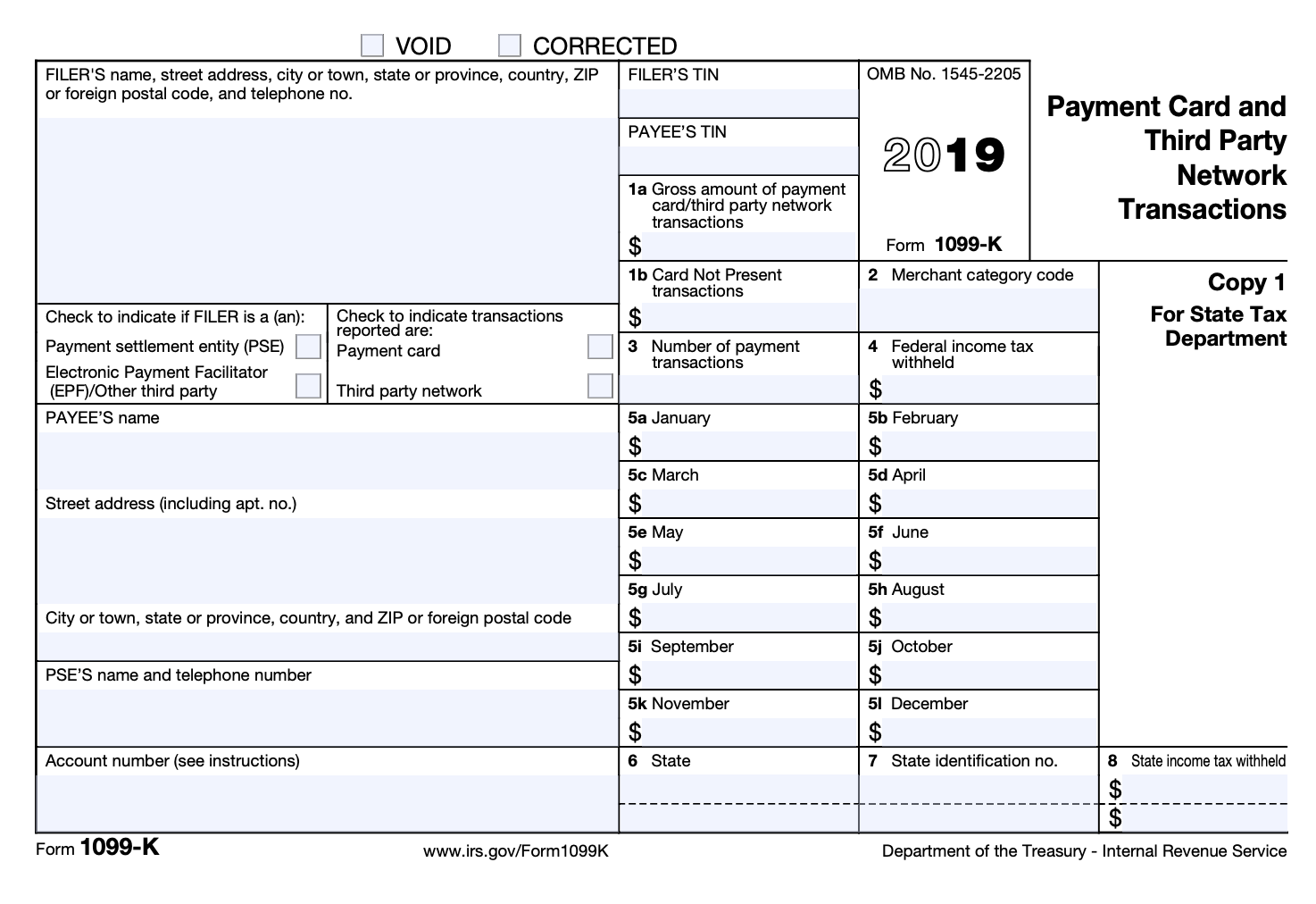

Free Printable 1099 Misc Form Copy 2

Free Printable 1099 Misc Form Copy 2

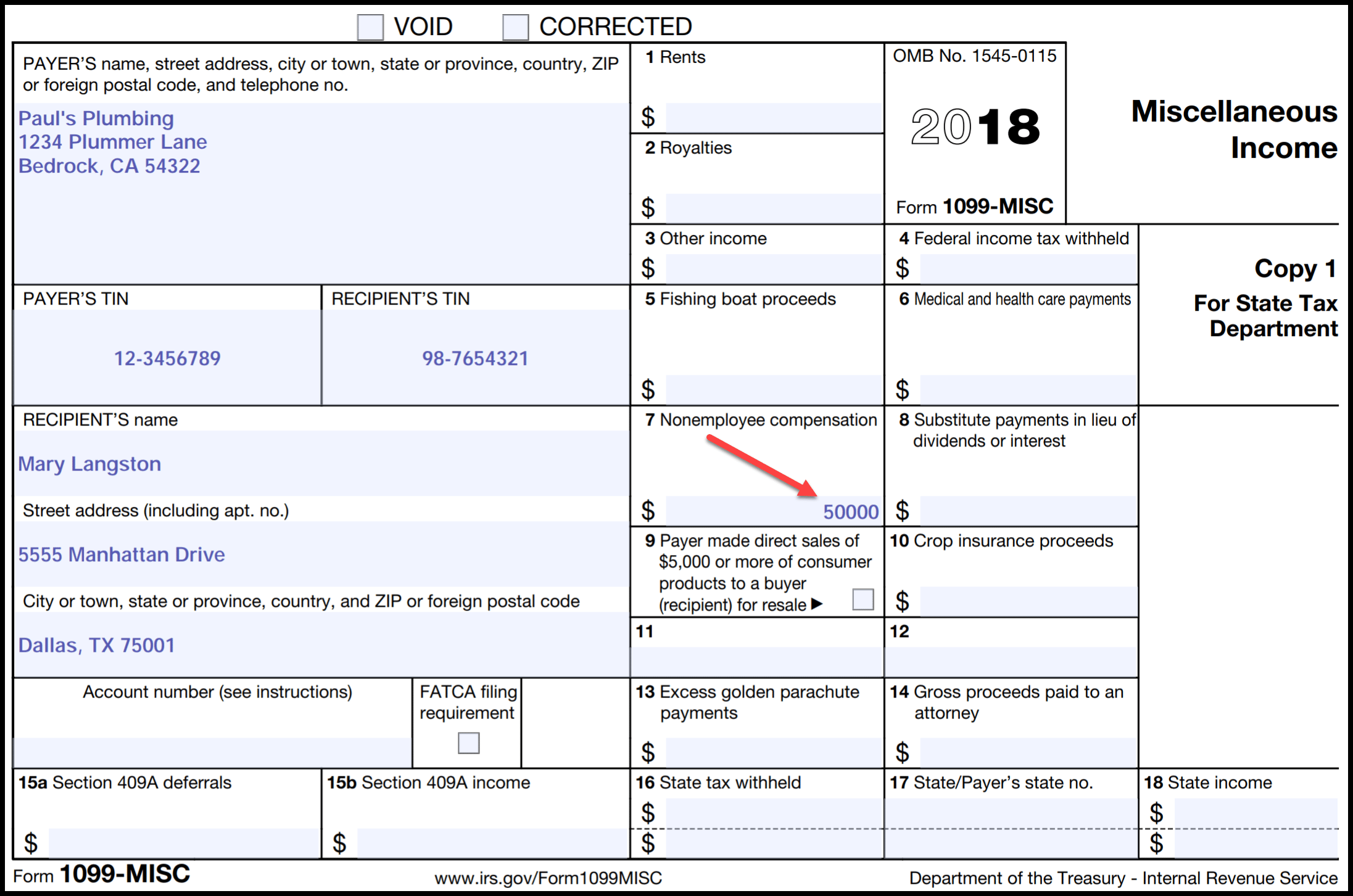

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

https://cdn.formstax.com/Images/Products/L0759-5112-2020-1099MISC-Laser-Copy-C_xl.jpg

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below Download and Print Copies Mail recipient copies What is Form 1099 MISC IRS Form 1099 MISC is filed by payers to report miscellaneous payments of 600 or more made to independent contractors during the tax year

Landlords are typically required to file 1099 MISC forms for payments made to property managers contractors attorneys repair professionals and anyone else who performs services for your property and does not qualify as your employee You report instances where these payments equal 600 or more during the year A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest 1

More picture related to Free Printable 1099 Misc Form Copy 2

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pandadoc.com/app/uploads/form-1099-misc.png

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-6-box1-2x.png

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Copy 2 The payer gives Copy 2 of Form 1099 MISC to the recipient for the recipient to file with his or her state income tax return when required Once you have this information you can use a free online service to print the form Currently the only way to e file a 1099 MISC is through the IRS FIRE system You must have a valid If you don t want to file your 1099s electronically through the IRS s Information Returns Intake System IRIS you ll need to print them out and mail them the old fashioned way But you can t just download the PDF form and hit Print to get a paper copy The IRS has very specific requirements about how to print 1099s Contents

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop

1099 MISC Instructions And How To File Square

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/1099-misc-software/images/1099-copyA.jpg

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

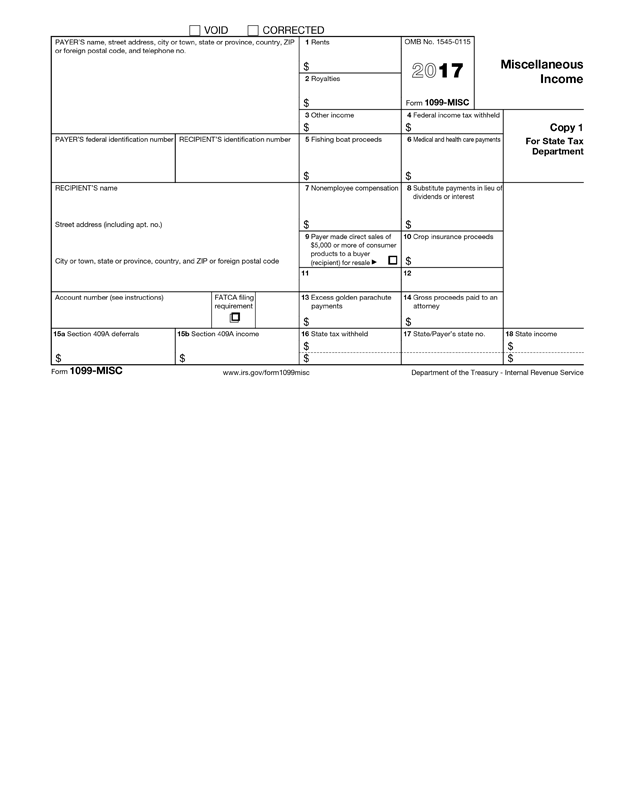

https://www.irs.gov/instructions/i1099mec

Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments

IRS Form 1099 Reporting For Small Business Owners

1099 MISC Instructions And How To File Square

Year End 1099 MISC State Copy 2 Forms P

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Copy 2 1099 Misc Form Form Resume Examples 4x2va6pV5l

Copy 2 1099 Misc Form Form Resume Examples 4x2va6pV5l

Your Ultimate Guide To 1099 MISC

Printable Blank 1099 Form

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Free Printable 1099 Misc Form Copy 2 - Turbo Tax doesn t give copy 2 The person really doesn t need to send the state a copy They don t even attach copy B for the IRS if mailing their return If they need another copy for state or someone they can just make a copy of B Turbo Tax doesn t provide copy A either That is only sent with the efile to the IRS