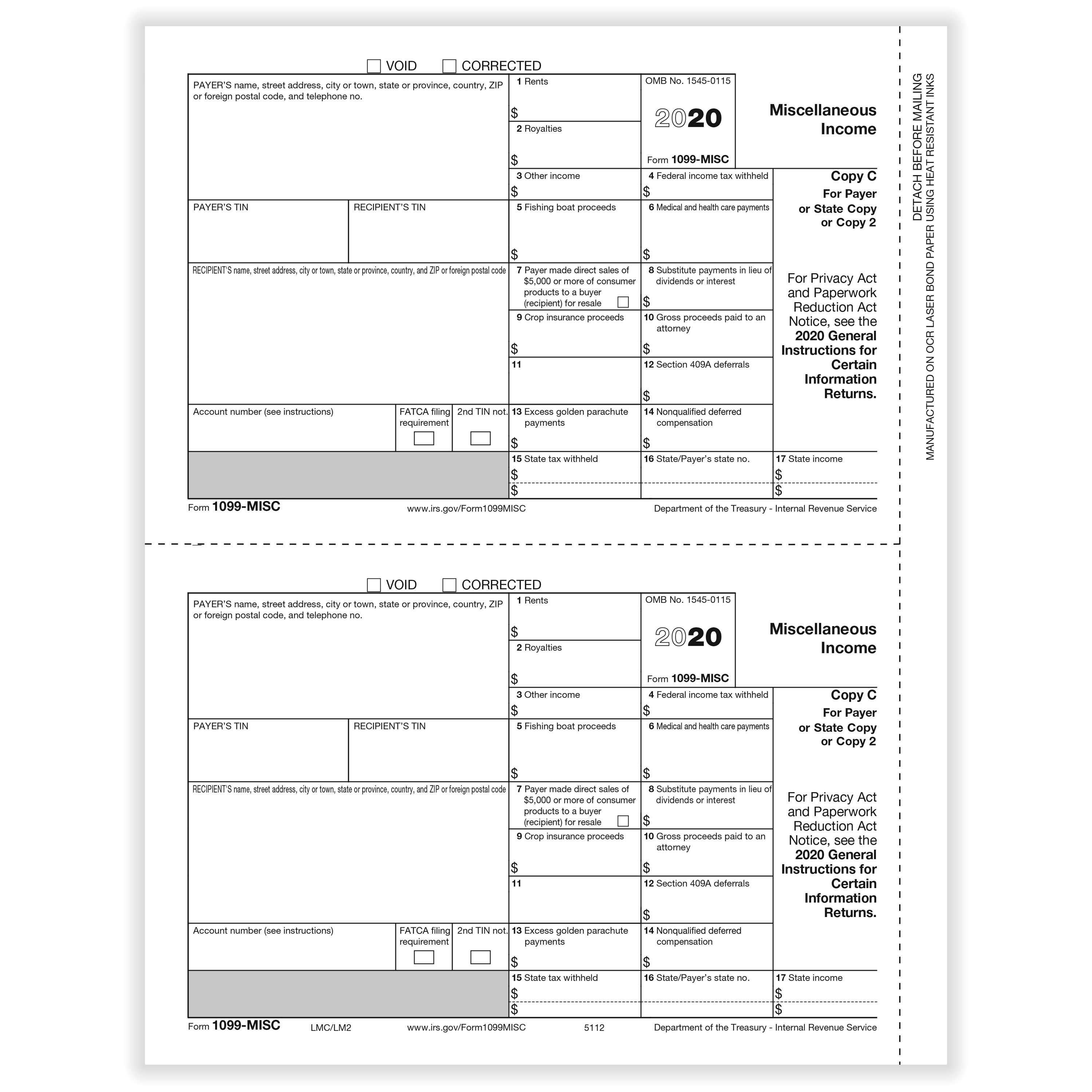

Free Printable 1099 Misc Tax Form Template What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

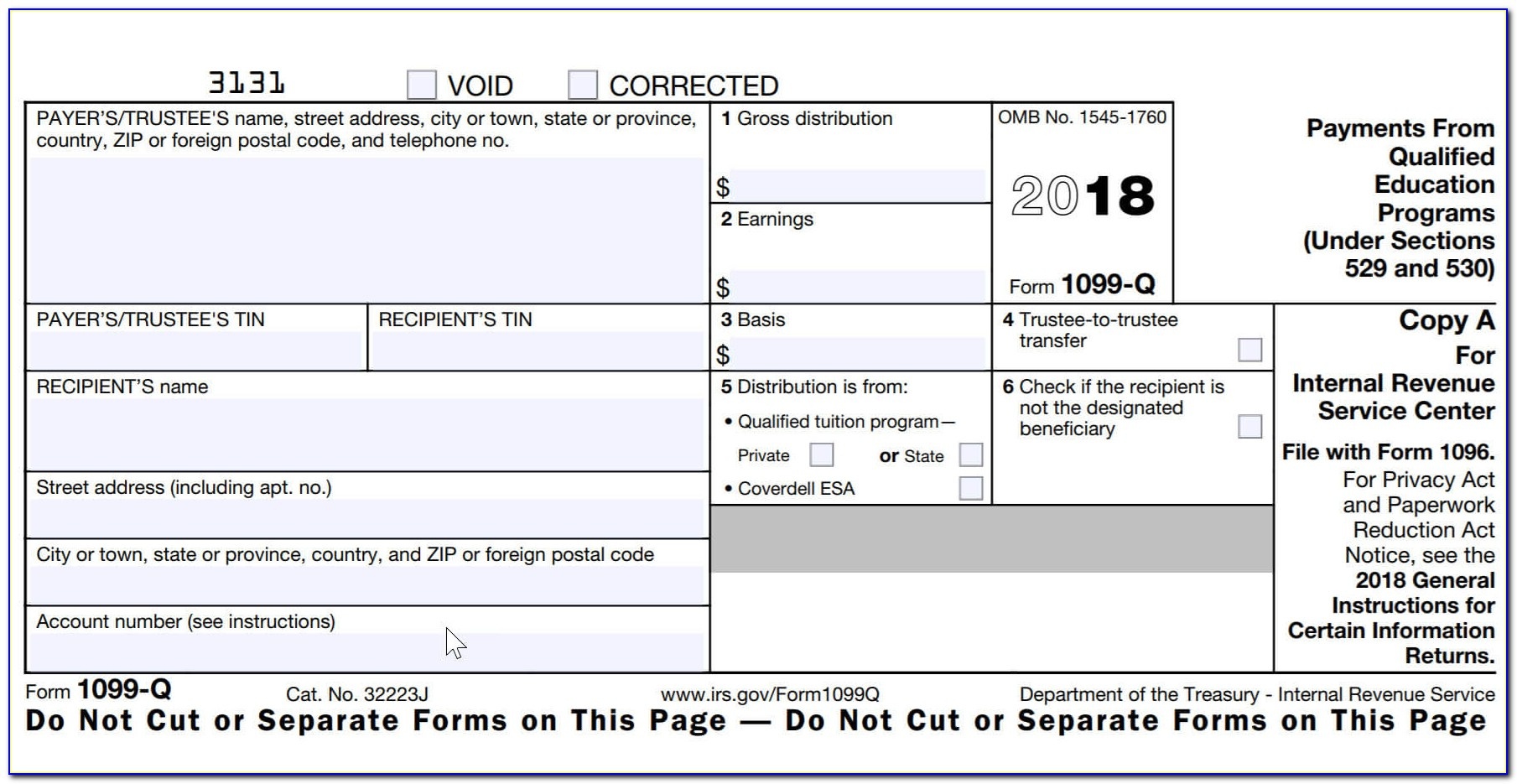

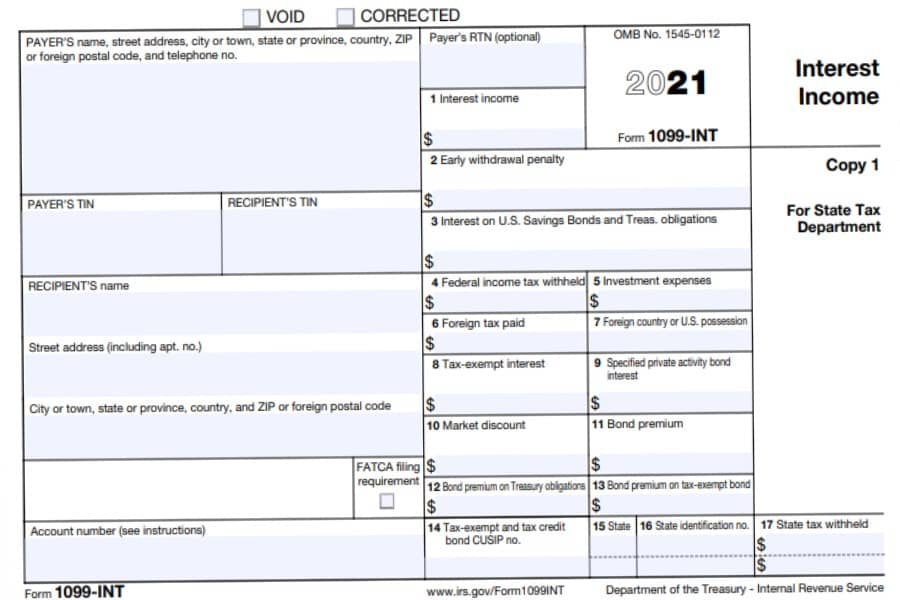

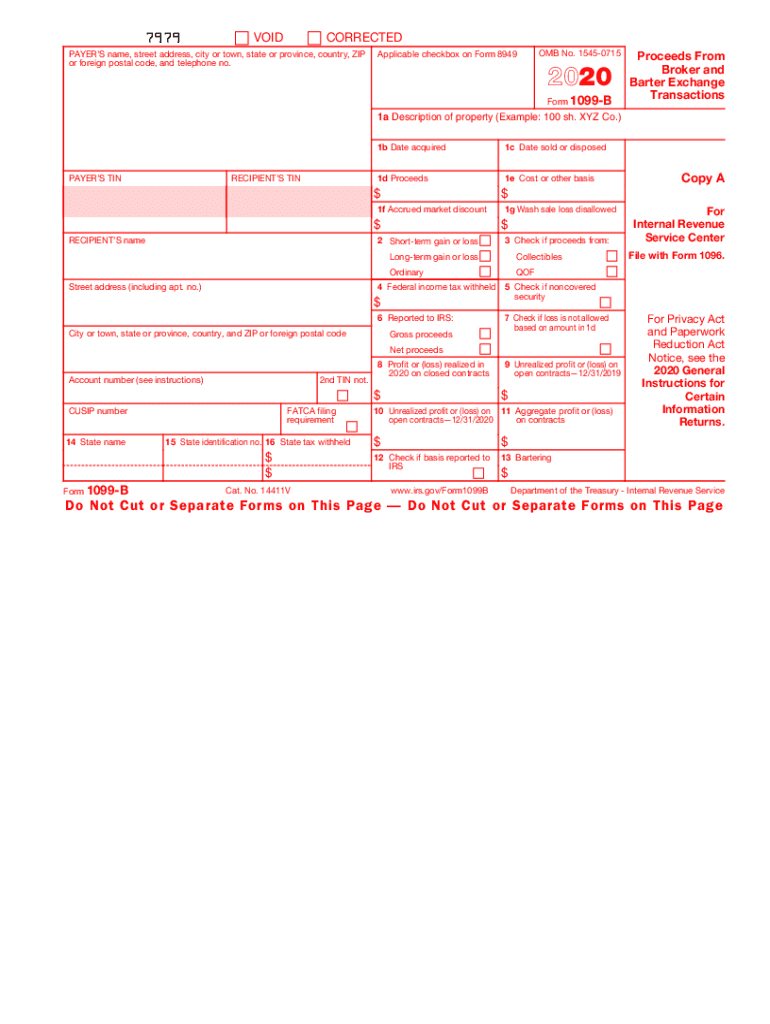

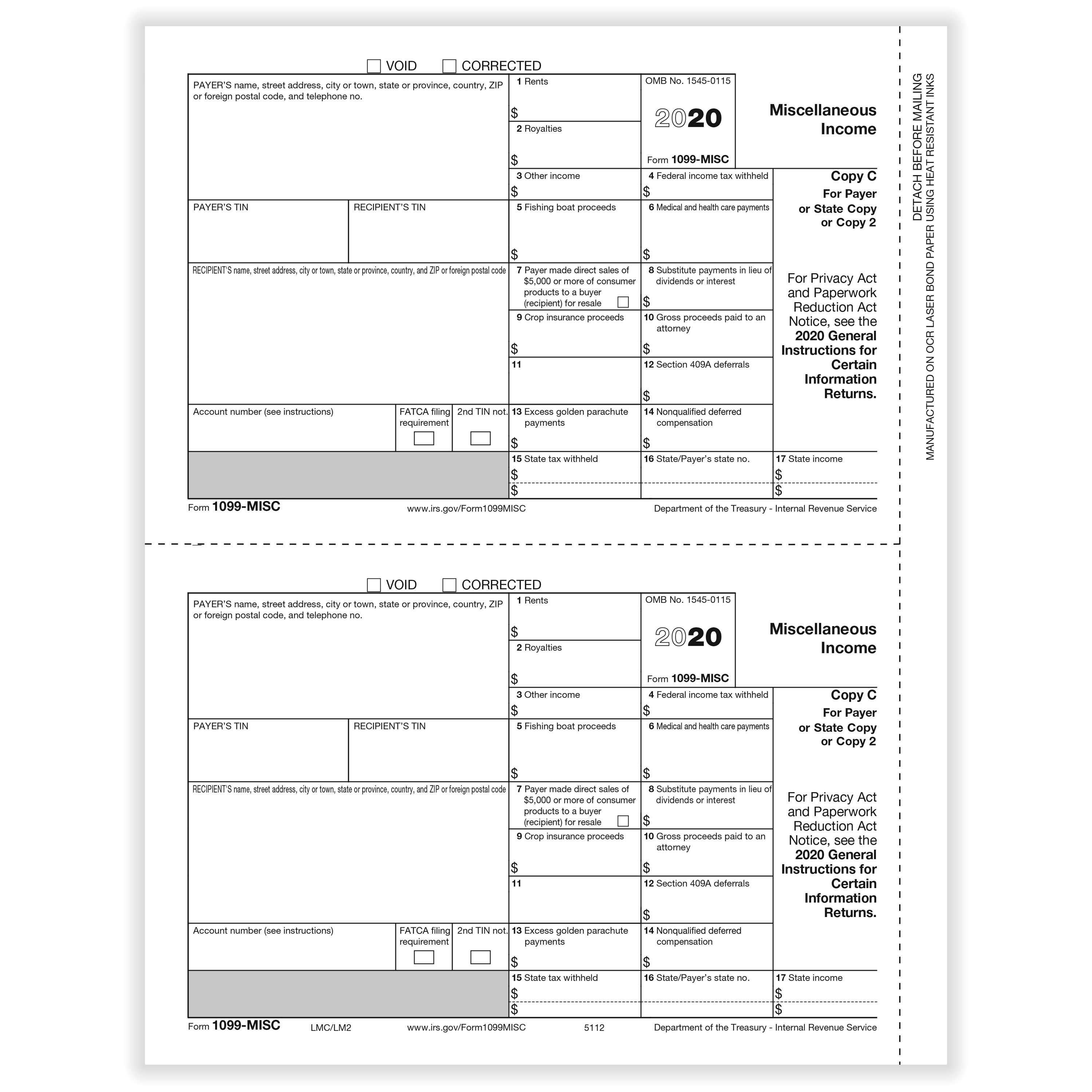

Free Printable 1099 Misc Tax Form Template

Free Printable 1099 Misc Tax Form Template

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

1099 MISC Form Template Create And Fill Online

https://www.pandadoc.com/app/uploads/form-1099-misc.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information Resources Form 1099 MISC An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS Download Frequently asked questions

Many 1099 MISC Forms found online use the IRS informational copy with the second page printed in red Do not use this copy for your filings or you ll be subjected to penalties by the IRS You ll need to complete and file a 1099 MISC if You paid royalties or broker payments instead of dividends or tax exempt interest in an amount What is Form 1099 MISC IRS Form 1099 MISC is filed by payers to report miscellaneous payments of 600 or more made to independent contractors during the tax year

More picture related to Free Printable 1099 Misc Tax Form Template

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Get Started A 1099 Misc form is a tax form used to report miscellaneous payments that a company made for the reporting tax year Examples of income reported on a 1099 Misc include payments to an attorney health care payments royalty payments and substitute payments a person receives instead of dividends IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

1099 Misc Printable Template Free Printable Templates

https://freeprintablejadi.com/wp-content/uploads/2019/06/printable-1099-misc-form-2017-irs-form-resume-examples-p1lr0vvm4l-free-printable-1099-misc-forms.jpg

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

https://formswift.com/1099-misc

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

Printable 1099 Tax Forms Free Printable Form 2024

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Printable Form 1099 Misc For 2021 Printable Form 2023

1099 B 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

How To PDF Printing 1099 misc Forms

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

IRS 1099 MISC 2009 Fill Out Tax Template Online US Legal Forms

Fillable 1099 Misc Fill Out Sign Online DocHub

1099 Fillable Form Free Printable Form Templates And Letter

Free Printable 1099 Misc Tax Form Template - Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information