Free Printable 1099 Nec Form A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

Forms and Instructions About Form 1099 NEC Nonemployee Compensation About Form 1099 NEC Nonemployee Compensation Use Form 1099 NEC to report nonemployee compensation Current Revision Form 1099 NEC PDF Instructions for Form 1099 MISC and Form 1099 NEC Print Version PDF Recent Developments None at this time Other Items You May Find Useful Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding

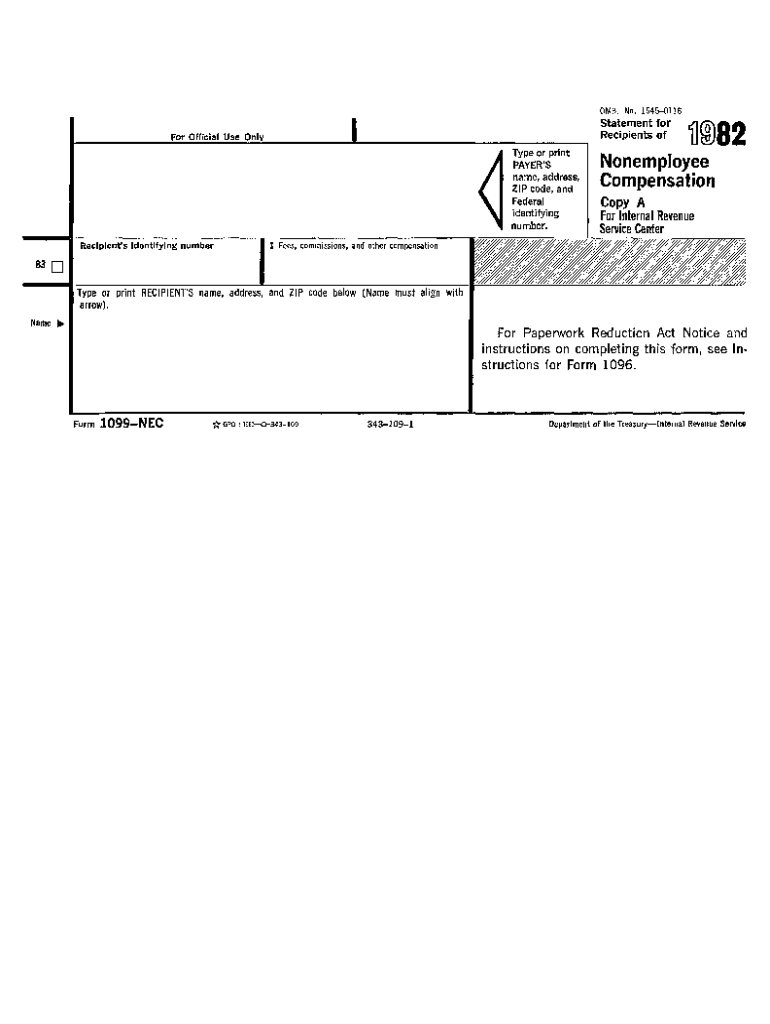

Free Printable 1099 Nec Form

Free Printable 1099 Nec Form

https://forst.tax/wp-content/uploads/2020/01/1099-nec.jpg

Blank 1099 Nec Form 2020 Printable Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/103/100103817/large.png

Fill Out A 1099 NEC

https://assets.website-files.com/5fbc22d336f673712db66095/5fbc25f076bd933980bbf983_progress-1099nec-img-2x-p-1080.png

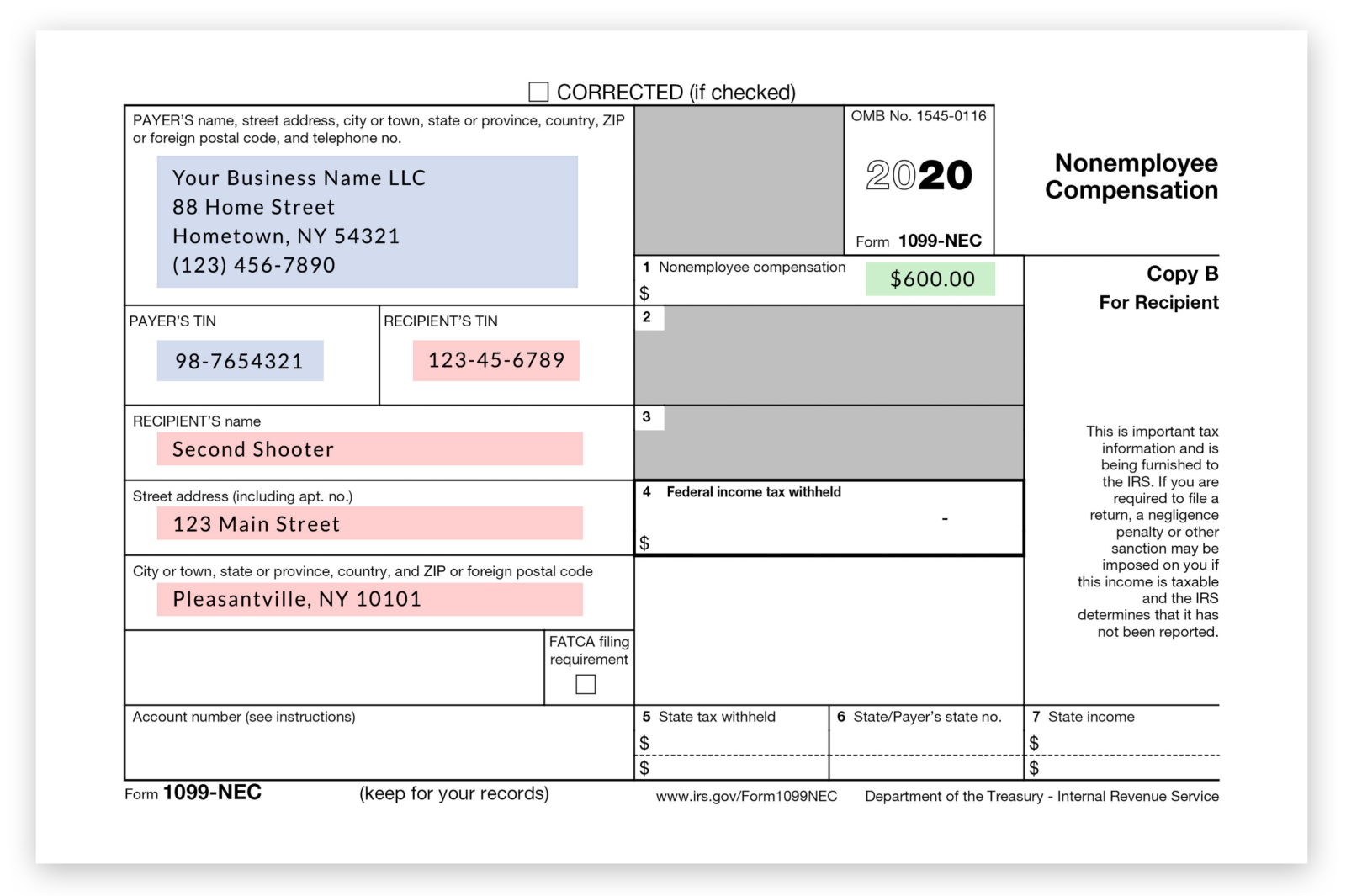

The 1099 NEC is the new form to report nonemployee compensation that is pay from independent contractor jobs also sometimes referred to as self employment income Examples of this include freelance work or driving for DoorDash or Uber Previously companies reported this income information on Form 1099 MISC Box 7 Form 1099 NEC reports non employee compensation to businesses or individuals that are paid 600 or more for that tax year Examples of people who might receive a 1099 NEC form includes Freelancers Self employed individuals Consultants Vendors Independent contractors

Step 1 Answer a few simple questions to create your document Step 2 Preview how your document looks and make edits Step 3 Download your document instantly Then print or share Create Your Version of This Document What is Form 1099 NEC Many businesses often hire independent contractors like freelancers or attorneys for short term jobs Form 1099 NEC nonemployee compensation is for businesses to report payments of at least 600 they ve issued to self employed individuals within a specific tax season Some self employed individuals that companies create 1099 NECs for include service providers consultants freelancers attorneys and independent contractors

More picture related to Free Printable 1099 Nec Form

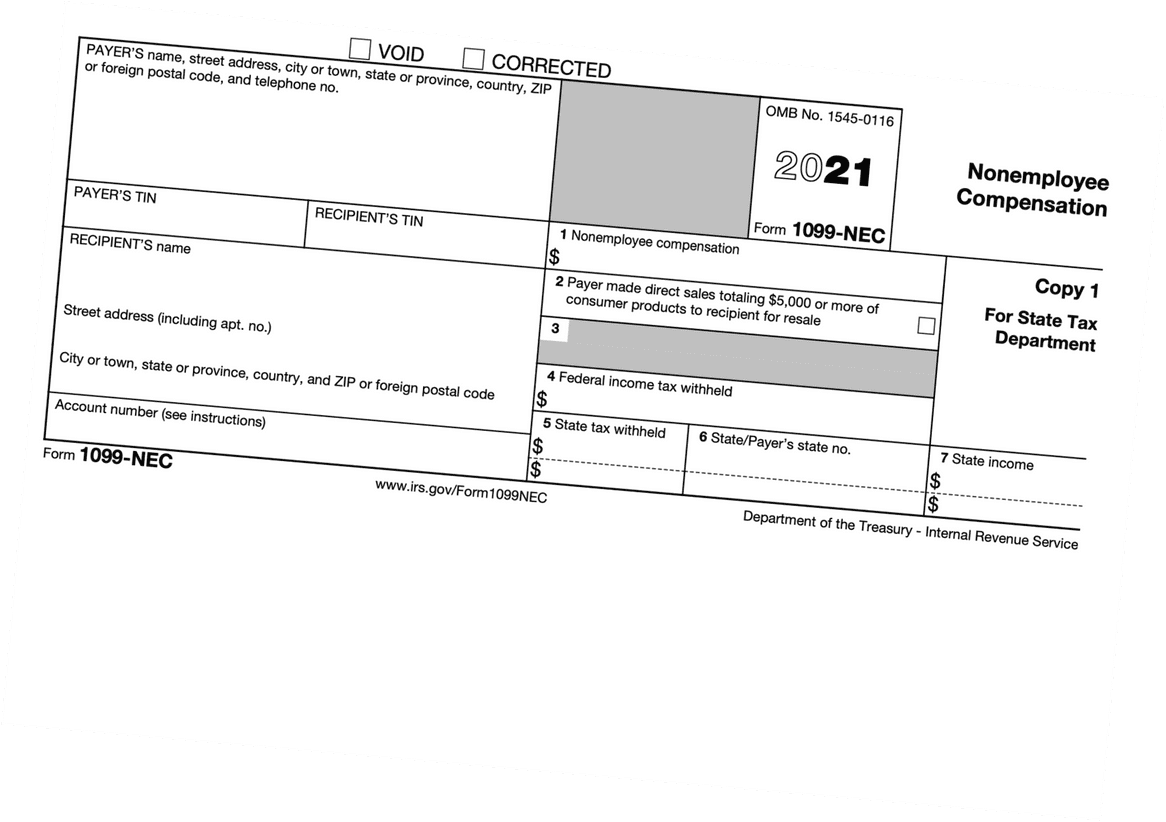

2021 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/533/156/533156765/large.png

1099 NEC Editable PDF Fillable Template 2022 With Print And Clear Buttons Courier Font Etsy

https://i.etsystatic.com/25616924/r/il/53e8da/4486482592/il_1080xN.4486482592_n0gk.jpg

Free Printable 1099 NEC File Online 1099FormTemplate

https://d9hhrg4mnvzow.cloudfront.net/www.1099formtemplate.com/1099-nec-printable/ecff6d62-1099-nec-long-5_10we0mu000000000000028.png

The nonemployee compensation reported in Box 1 of Form 1099 NEC is generally reported as self employment income and is usually subject to self employment tax Payments from your trade or business to individuals that aren t reportable on the 1099 NEC form would typically be reported on Form 1099 MISC The IRS provides a more comprehensive list The information you will need to fill out the 1099 NEC includes Your business Employer Identification Number EIN or if you are a sole proprietor your Social Security Number SSN If you don t have an EIN you can get one here It s free and prevents you having to use your SSN on forms like these

Any nonemployee who made 600 or more will receive a 1099 NEC You ll receive the 1099 NEC by early February as businesses are required to send them out by Jan 31 Form 1099 NEC is a tax You can print blank 1099 NEC form copies from the web or fully completed forms from your payroll software many offer it for free FILE TO DOWNLOAD OR INTEGRATE IRS Form 1099 NEC Download as PDF What Is a Form 1099 NEC When Is It Due Form 1099 NEC is an information return

How To Fill Out And Print 1099 NEC Forms

https://www.halfpricesoft.com/1099-nec-software/images/1099-nec-3-per-page-big.jpg

Printable Blank 1099 Nec Form Printable World Holiday

https://cdn.hrdirect.com/Images/Products/L0205-1099-NEC-rec-copy-b-sheet_xl.jpg

https://eforms.com/irs/form-1099/nec/

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

https://www.irs.gov/forms-pubs/about-form-1099-nec

Forms and Instructions About Form 1099 NEC Nonemployee Compensation About Form 1099 NEC Nonemployee Compensation Use Form 1099 NEC to report nonemployee compensation Current Revision Form 1099 NEC PDF Instructions for Form 1099 MISC and Form 1099 NEC Print Version PDF Recent Developments None at this time Other Items You May Find Useful

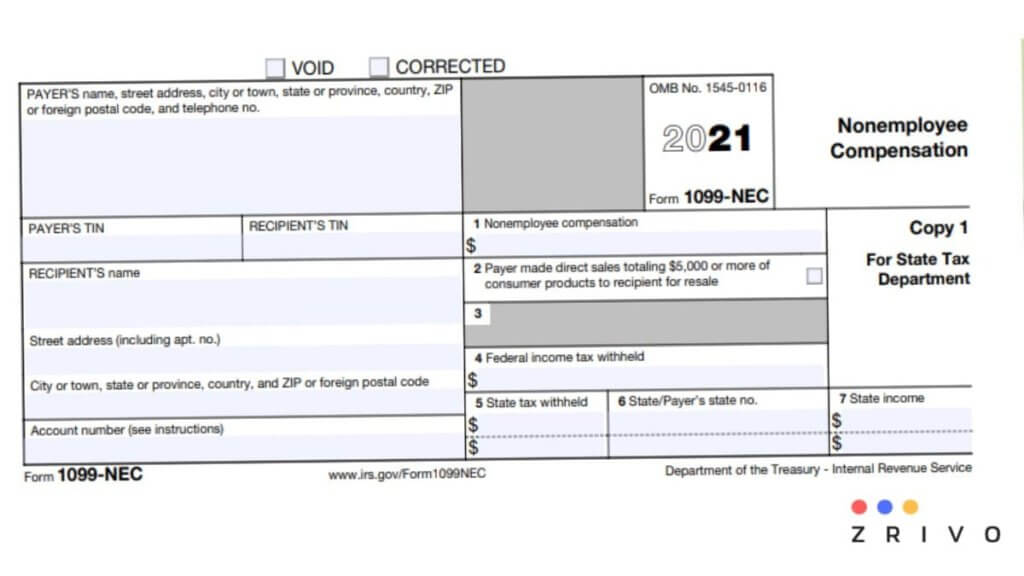

Printable 1099 nec Form 2021 Customize And Print

How To Fill Out And Print 1099 NEC Forms

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

Printable 1099 nec Form 2021 Customize And Print

1099 Nec Word Template

Sample 1099 NEC Forms Printed EzW2 Software

Sample 1099 NEC Forms Printed EzW2 Software

1099 Nec Form 2020 Printable Customize And Print

The New 1099 NEC IRS Form For Second Shooters Independent Contractors formerly 1099 MISC

Line By Line 1099 NEC Instructions How To Fill Out Form 1099 NEC

Free Printable 1099 Nec Form - Use federal 1099 NEC tax forms to report payments of 600 or more to non employees contractors These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you Learn more about the IRS e filing changes Each kit contains 2023 1099 NEC forms three tax forms per page four free 1096 forms