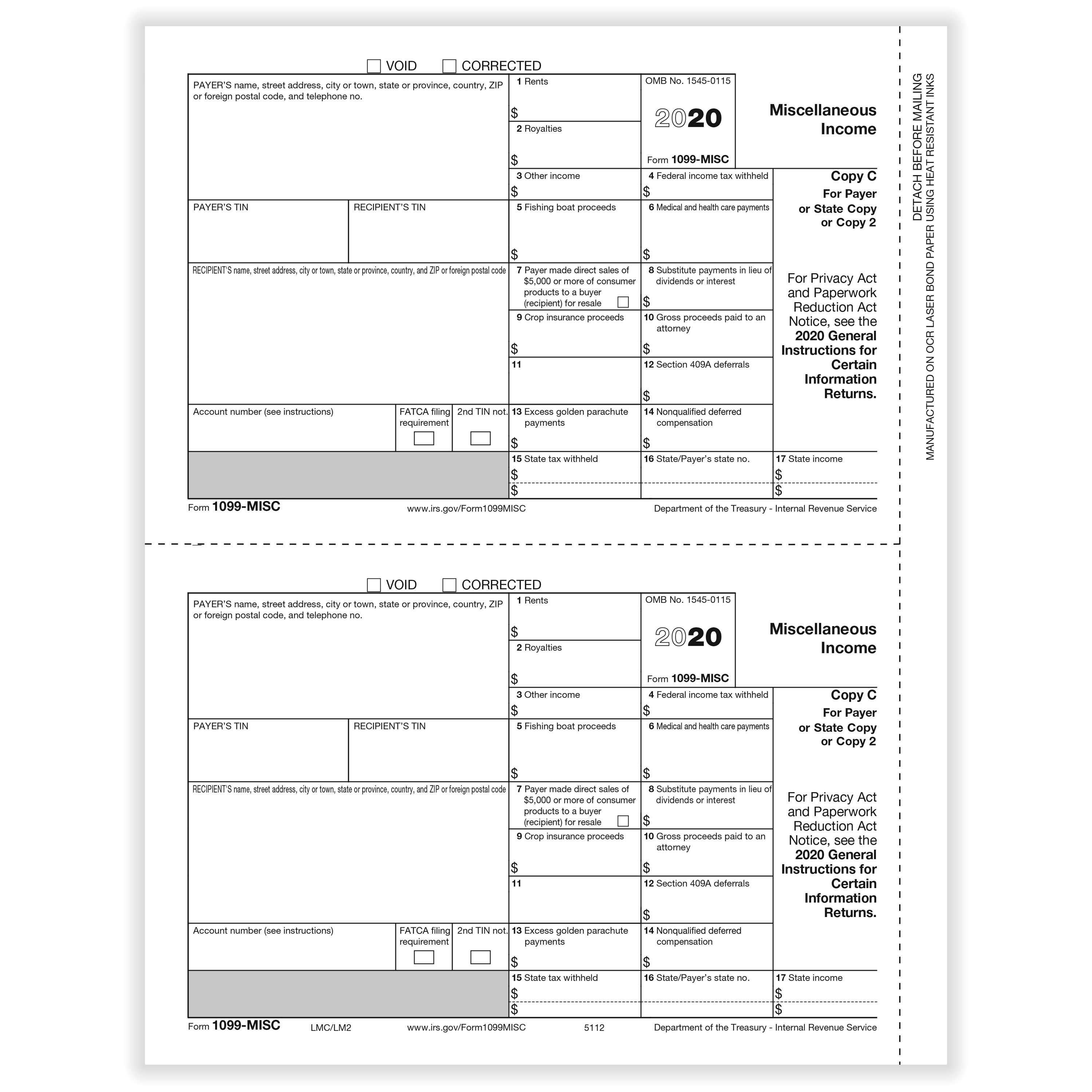

Free Printable 1099 Tax Forms IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

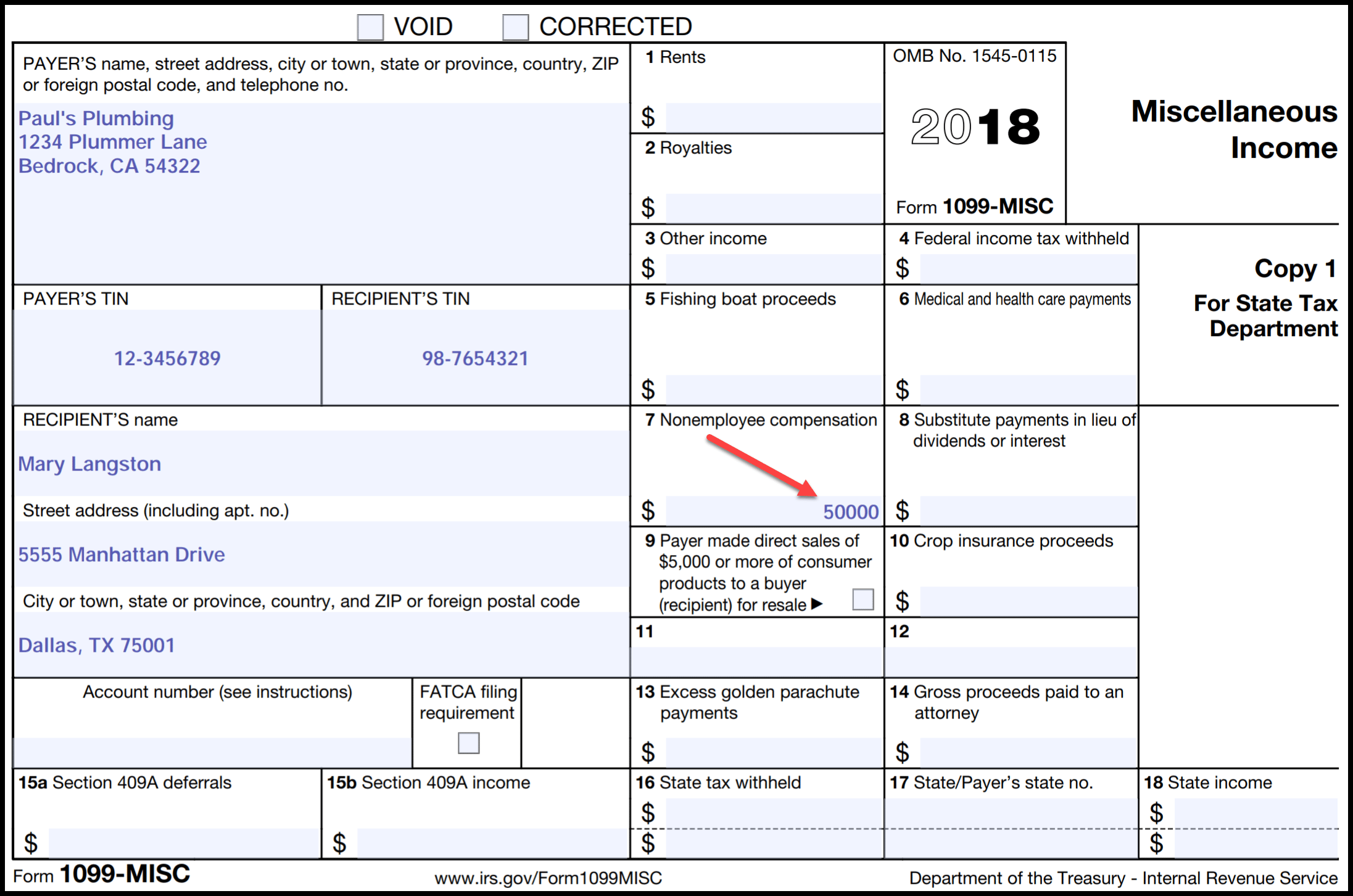

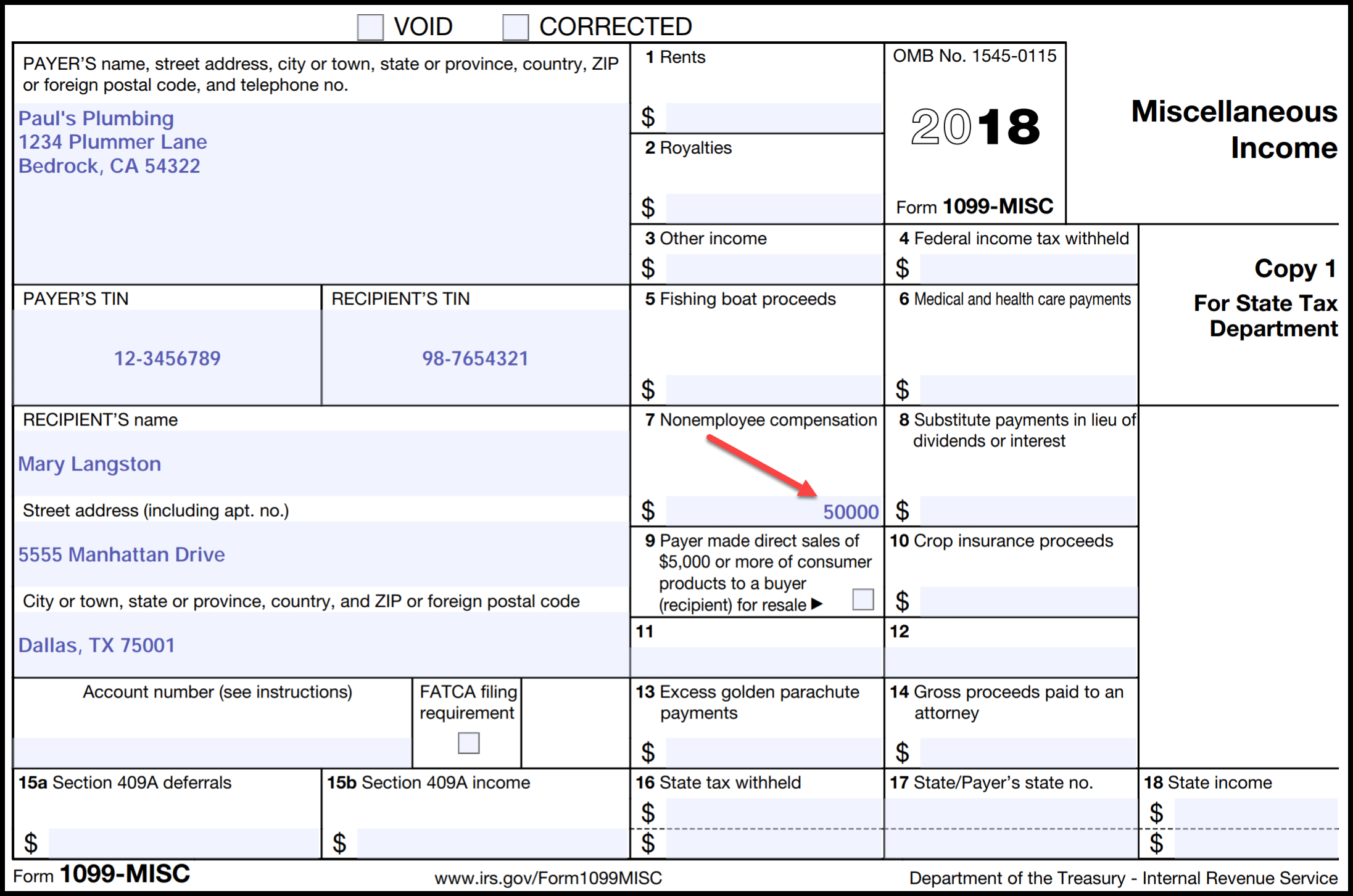

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

Free Printable 1099 Tax Forms

Free Printable 1099 Tax Forms

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

1099 Printable Forms

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to

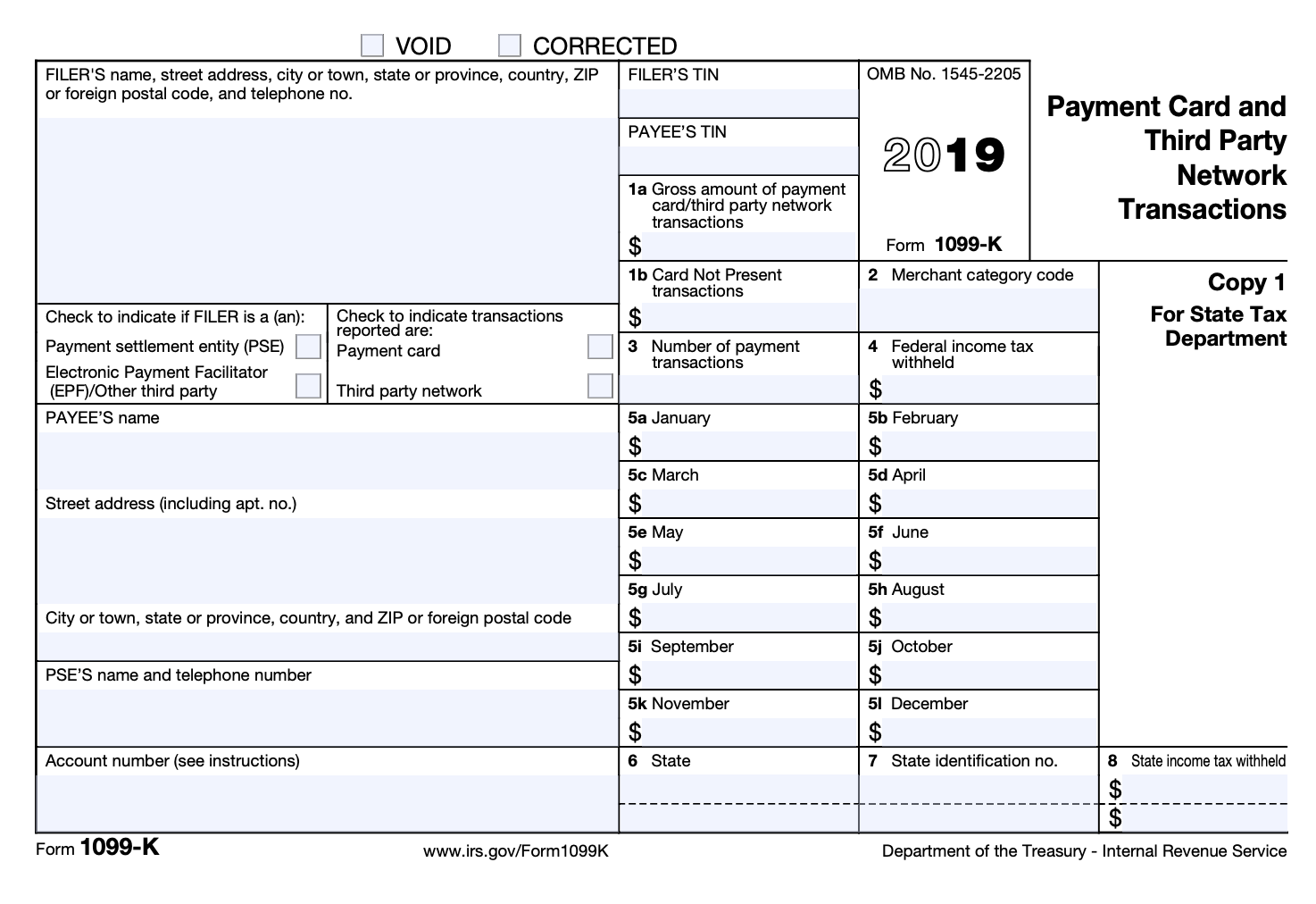

1099 INT reports interest income typically of 10 or more from your bank credit union or other financial institution The form reports the interest income you received any federal income taxes Nerdy takeaways A 1099 form also called an information return is a document sent to you by an entity that paid you certain types of income throughout the tax year Getting a 1099 doesn t mean

More picture related to Free Printable 1099 Tax Forms

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 Form

https://www.signnow.com/preview/100/9/100009398/large.png

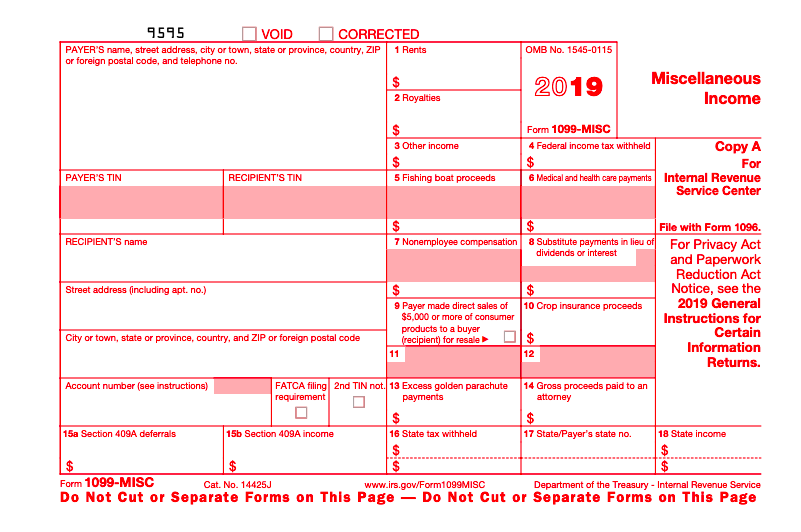

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes Create Document Updated December 21 2023 Written by Sara Hostelley Reviewed by Brooke Davis Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns

You can print blank 1099 NEC form copies from the web or fully completed forms from your payroll software many offer it for free FILE TO DOWNLOAD OR INTEGRATE IRS Form 1099 NEC Download as PDF What Is a Form 1099 NEC When Is It Due Form 1099 NEC is an information return Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/509/836/509836879/big.png

https://eforms.com/irs/form-1099/

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

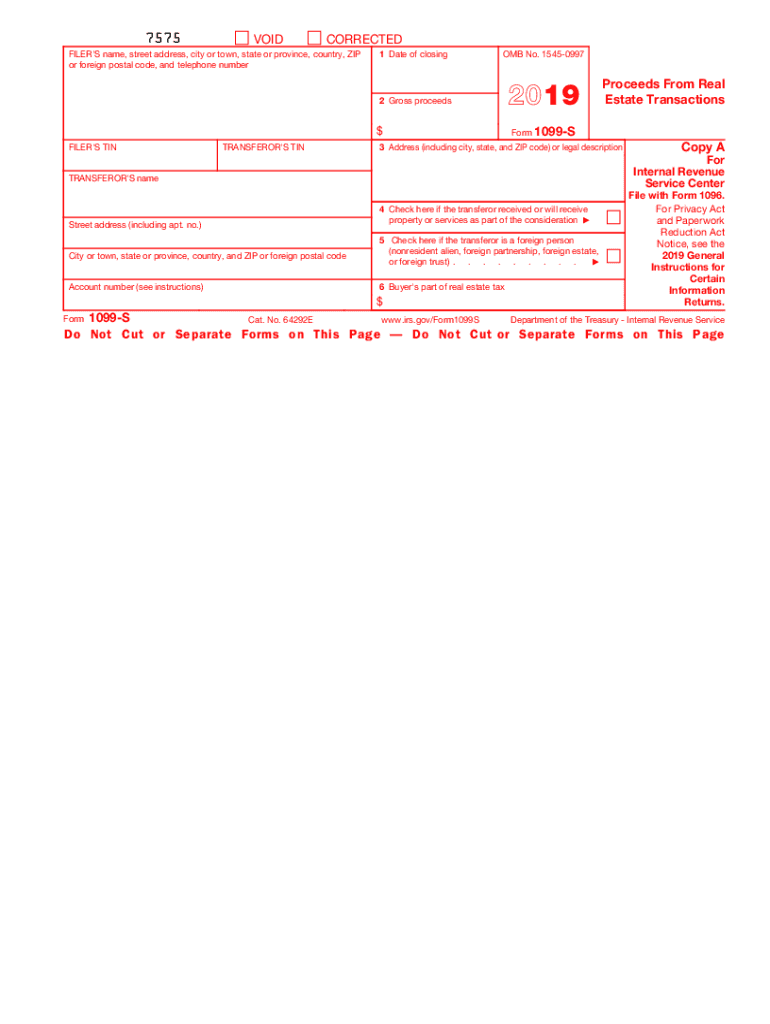

1099 S Fillable Form Printable Forms Free Online

What Is A 1099 Misc Form Financial Strategy Center

1099 S Fillable Form Printable Forms Free Online

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

How To Fill Out And Print 1099 MISC Forms

Printable 1099 Tax Forms

Printable 1099 Tax Forms

Free 1099 Fillable Form Printable Forms Free Online

1099 MISC Form The Ultimate Guide For Business Owners

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

Free Printable 1099 Tax Forms - Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services