Free Printable 8962 Irs Form Go to the health coverage tax tool Get help filing your 2023 federal tax return Get free volunteer help filing your return through IRS programs Check if you re eligible for free tax filing software through the IRS See how to complete 2022 tax return Overview of tax form 1095 A health coverage tool penalties for not having coverage more

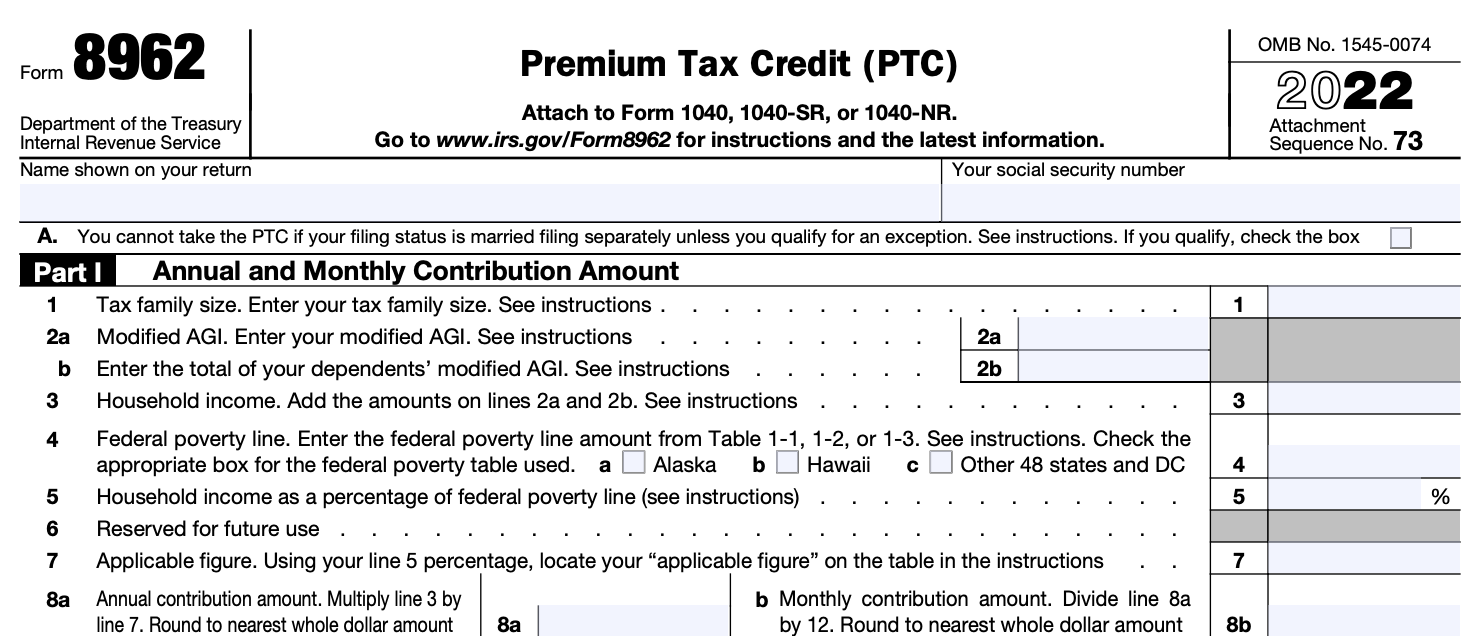

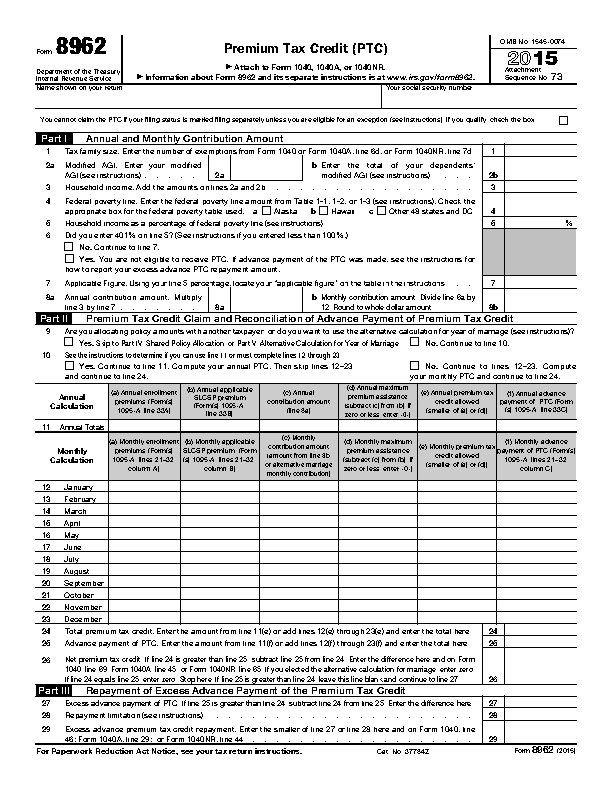

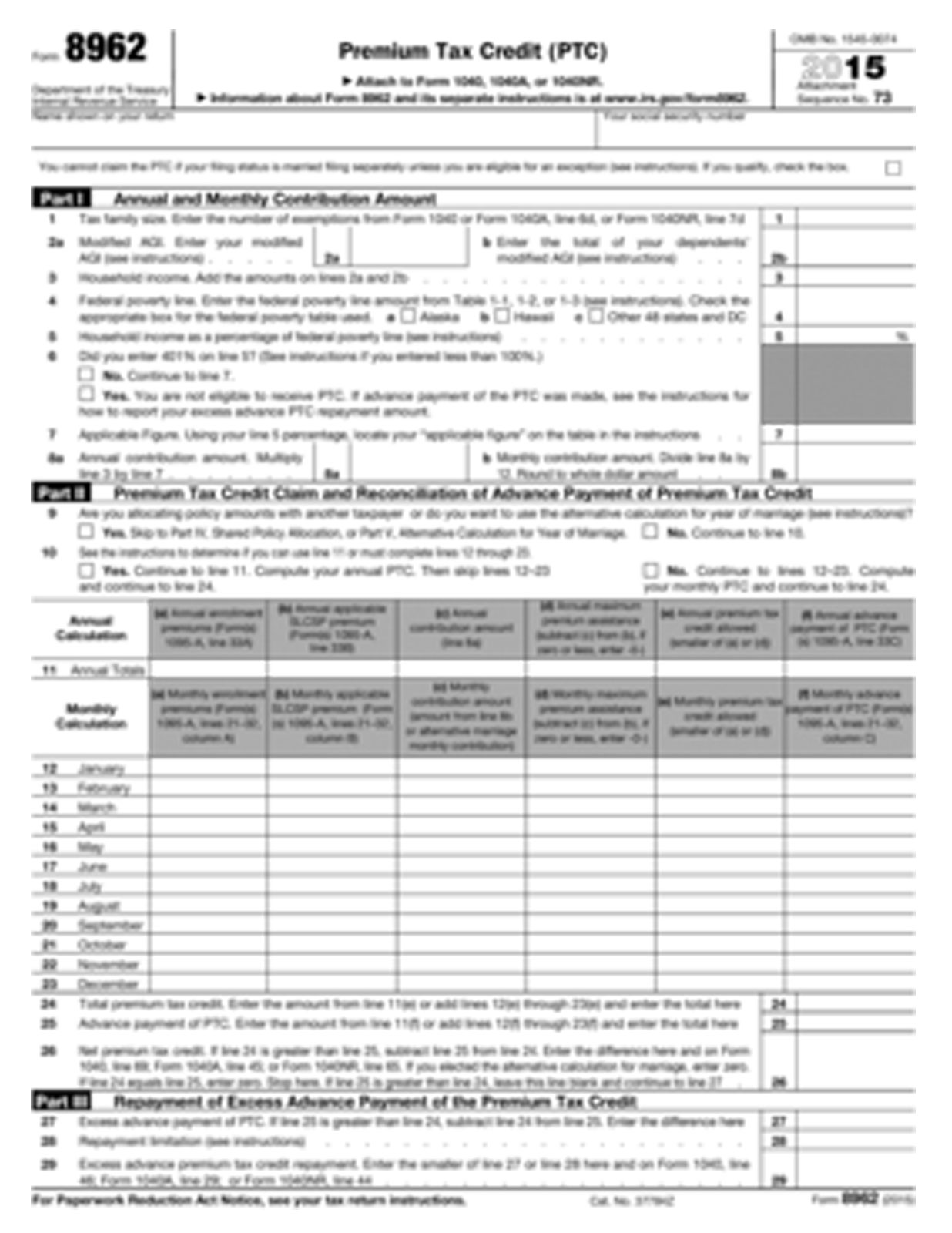

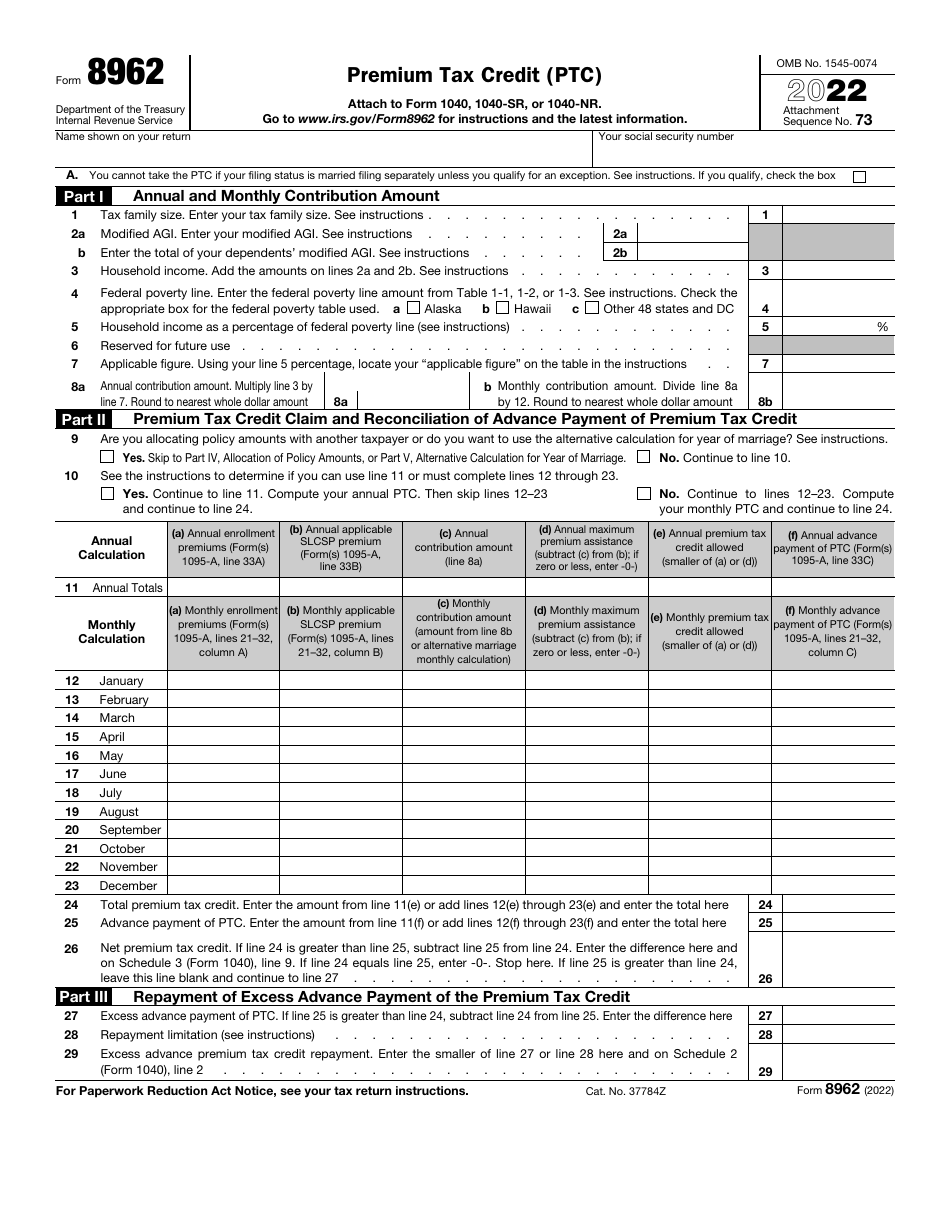

Form 8962 is used to calculate the amount of premium tax credit you re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace Claiming Get your Form 1095 A Print Form 8962 How to move advance payment of premium tax credit info to Form 8962 Complete all sections of Form 8962 On Line 26 you ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income This will affect the amount of your refund or tax due

Free Printable 8962 Irs Form

Free Printable 8962 Irs Form

https://www.signnow.com/preview/536/160/536160325/large.png

Tax Form 8962 Printable

https://i.pinimg.com/originals/5a/ea/00/5aea00410784f7ab692813315d42f42f.jpg

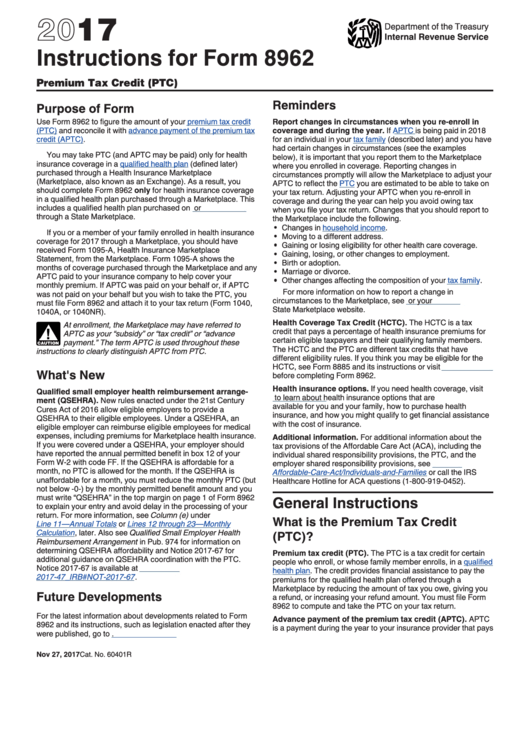

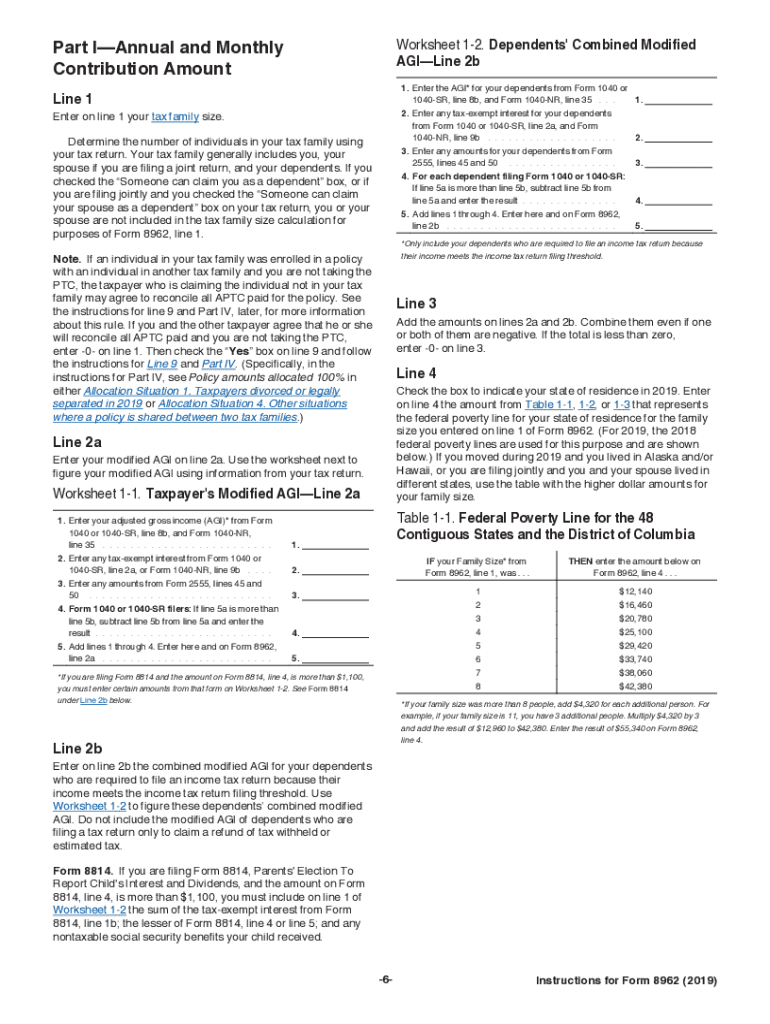

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/459/416/459416023/big.png

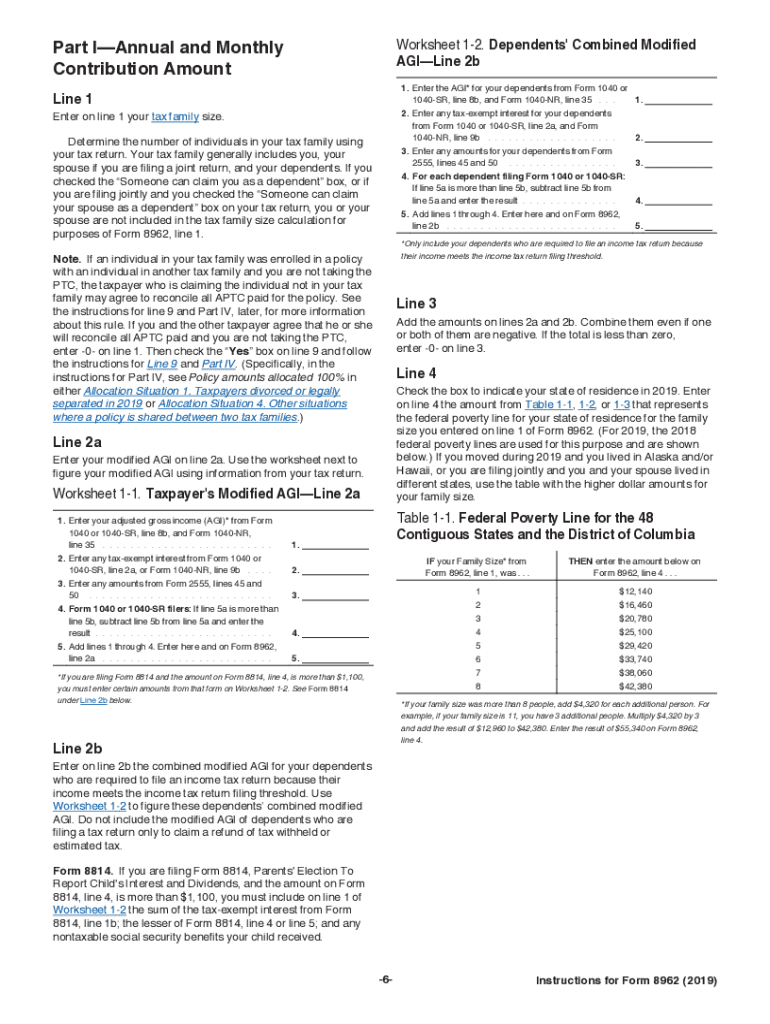

Print This Form More about the Federal Form 8962 Other TY 2023 We last updated the Premium Tax Credit in January 2024 so this is the latest version of Form 8962 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8962 directly from TaxFormFinder You can print other Federal tax forms here Follow the form instructions to enter the repayment limitation on line 28 Enter your excess advance premium tax credit repayment on line 29 Write the smaller of either line 27 or line 28 on line 29 and on your Form 1040 or 1040NR That s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC

Step 1 Gather Required Documents Before you start filling out Form 8962 make sure you have the following documents and information on hand Form 1095 A Health Insurance Marketplace Statement Form 1095 B or 1095 C Health Coverage Statement if applicable Form 1040 or Form 1040 SR Individual Income Tax Return For tax years 2023 through 2025 taxpayers with household income that exceeds 400 of the federal poverty line for their family size may be allowed a Premium Tax Credit Repayment The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC

More picture related to Free Printable 8962 Irs Form

Instructions For Form 8962 Premium Tax Credit Ptc 2017 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/296/2969/296984/page_1_thumb_big.png

Irs Form 8962 Instructions 2023 Printable Forms Free Online

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a02a4c9c6/2016/03/Screen-Shot-2022-12-30-at-12.49.54-PM.png

Form 8962 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/images/10000/form-8962-page1.png

Multiply the difference by 100 then drop any numbers after the decimal point For example if the difference was 1 8545565 you would enter 185 on line 5 of Form 8962 Tip There are 3 different federal poverty lines used 1 for the 48 contiguous states and the District of Columbia 1 for Hawaii and 1 for Alaska Our website offers beneficial resources including a free IRS Form 8962 printable version and comprehensive samples Also to render illustrative help relevant instructions for Form 8962 for 2023 are keenly interspersed throughout the examples

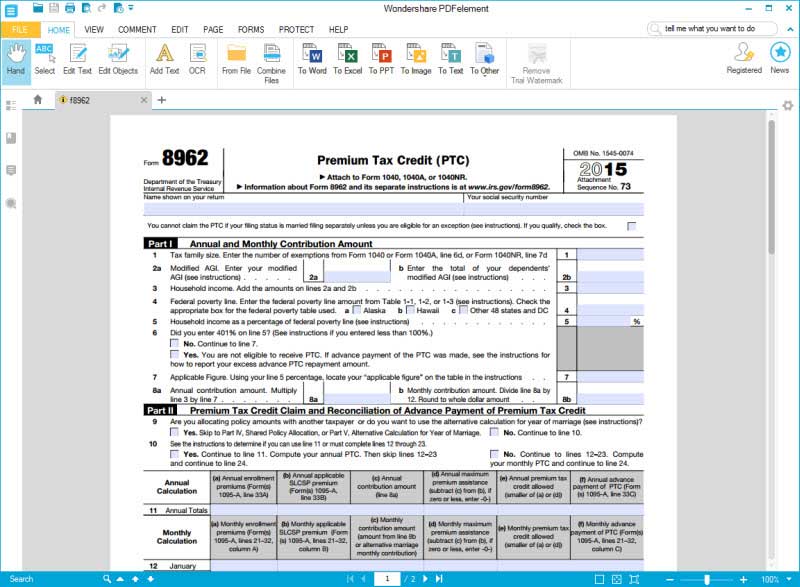

How do I complete IRS Form 8962 There are five parts to this two page tax form Part I Annual and Monthly Contribution Amount Part II Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit Part III Repayment of Excess Advance Payment of the Premium Tax Credit Part IV Allocation of Policy Amounts Part V Alternative Calculation for Year of Marriage Select the checkbox for Form 8962 Premium Tax Credit and print it If your refund or balance due has changed print Form 1040 Our TurboTax Audit Support Guarantee gives you free audit guidance from a trained tax professional to help you understand your IRS notice and answer all your audit related questions

8962 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/489/187/489187822/large.png

IRS Form 8962 Instruction For How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-8962.jpg

https://www.healthcare.gov/tax-forms-and-tools/

Go to the health coverage tax tool Get help filing your 2023 federal tax return Get free volunteer help filing your return through IRS programs Check if you re eligible for free tax filing software through the IRS See how to complete 2022 tax return Overview of tax form 1095 A health coverage tool penalties for not having coverage more

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to calculate the amount of premium tax credit you re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace Claiming

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

How To Calculate Form 8962 Printable Form Templates And Letter

8962 Form Fill Out And Sign Printable PDF Template SignNow

Free Free Irs 8962 Printable Forms Printable Forms Free Online

IRS Form 8962 Printable

8962 2015 Edit Forms Online PDFFormPro

Form 8962 2015 Irs Forms Form Tax Credits

Form 8962 2015 Irs Forms Form Tax Credits

IRS Form 8962 Download Fillable PDF Or Fill Online Premium Tax Credit Ptc 2022 Templateroller

Free Free Irs 8962 Printable Forms Printable Forms Free Online

Form 8962 2020 2021 Pdf Fill Online Printable Fillable Blank Form 8962 instructions

Free Printable 8962 Irs Form - By using the printable IRS tax form 8962 individuals accurately report their household income and adjust any discrepancies preventing potential issues or audits Refund Maximization Correctly filling out Form 8962 can lead to a maximized refund or reduced fiscal liability as it clarifies the amount of tax credit the taxpayer is entitled to