Free Printable Form 1099 From Irs IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

Form 1099 NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040 1040 SR or 1040 NR See the Instructions for Forms 1040 and 1040 SR or the Instructions for Form 1040 NR Boxes 15 17 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Free Printable Form 1099 From Irs

Free Printable Form 1099 From Irs

https://images.ctfassets.net/ifu905unnj2g/7njQnBtOe3zLbzG3V4rWHE/de7ada497a46a667e012a996afc8b7d1/1099_Sample_IRS.gif

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/509/836/509836879/big.png

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

If you don t want to file your 1099s electronically through the IRS s Information Returns Intake System IRIS you ll need to print them out and mail them the old fashioned way But you can t just download the PDF form and hit Print to get a paper copy The IRS has very specific requirements about how to print 1099s Contents Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form IRS Tax Tip 2024 07 Feb 14 2024 If taxpayers are filing a tax return for the first time IRS Free File can help This program provides free tax preparation free electronic filing and free direct deposit for eligible taxpayers The IRS Free File adjusted gross income AGI limit for tax year 2023 is 79 000 for families and individuals

More picture related to Free Printable Form 1099 From Irs

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Free Printable Form 1099 From Irs Printable Forms Free Online

https://www.thebalancesmb.com/thmb/WGZEpZIhNTI8RWMw-kEuhR-bSNQ=/785x536/filters:no_upscale():max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png

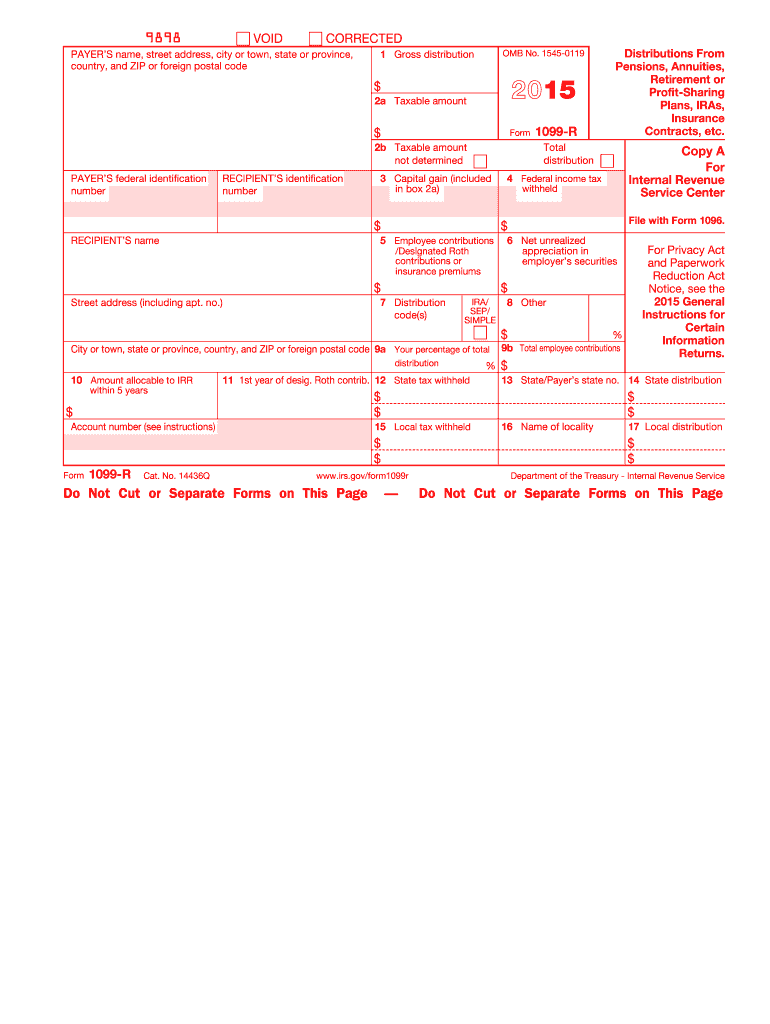

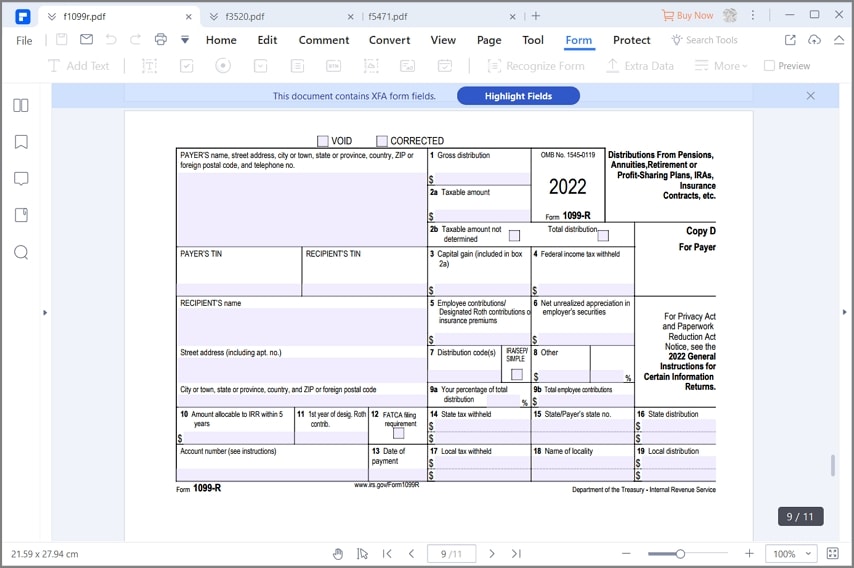

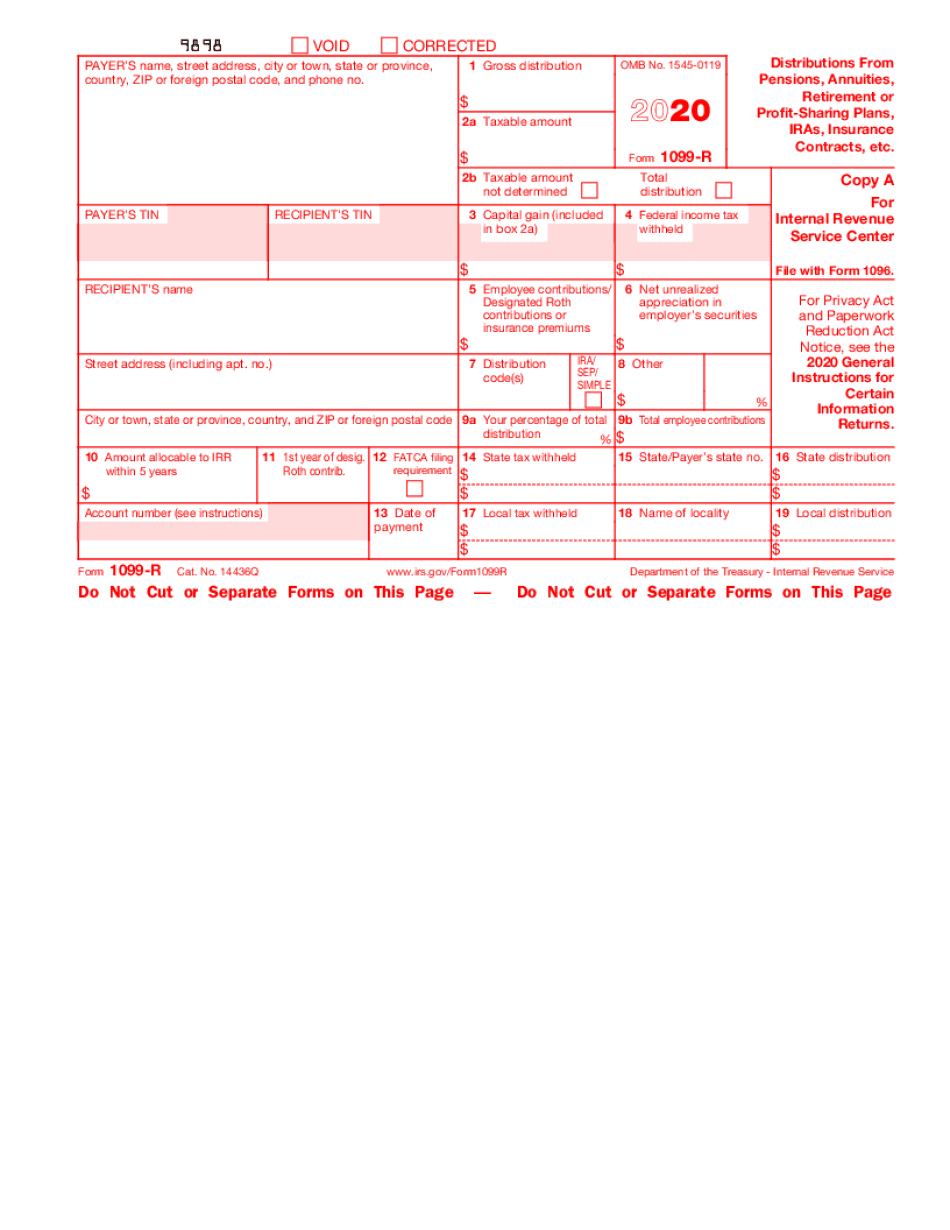

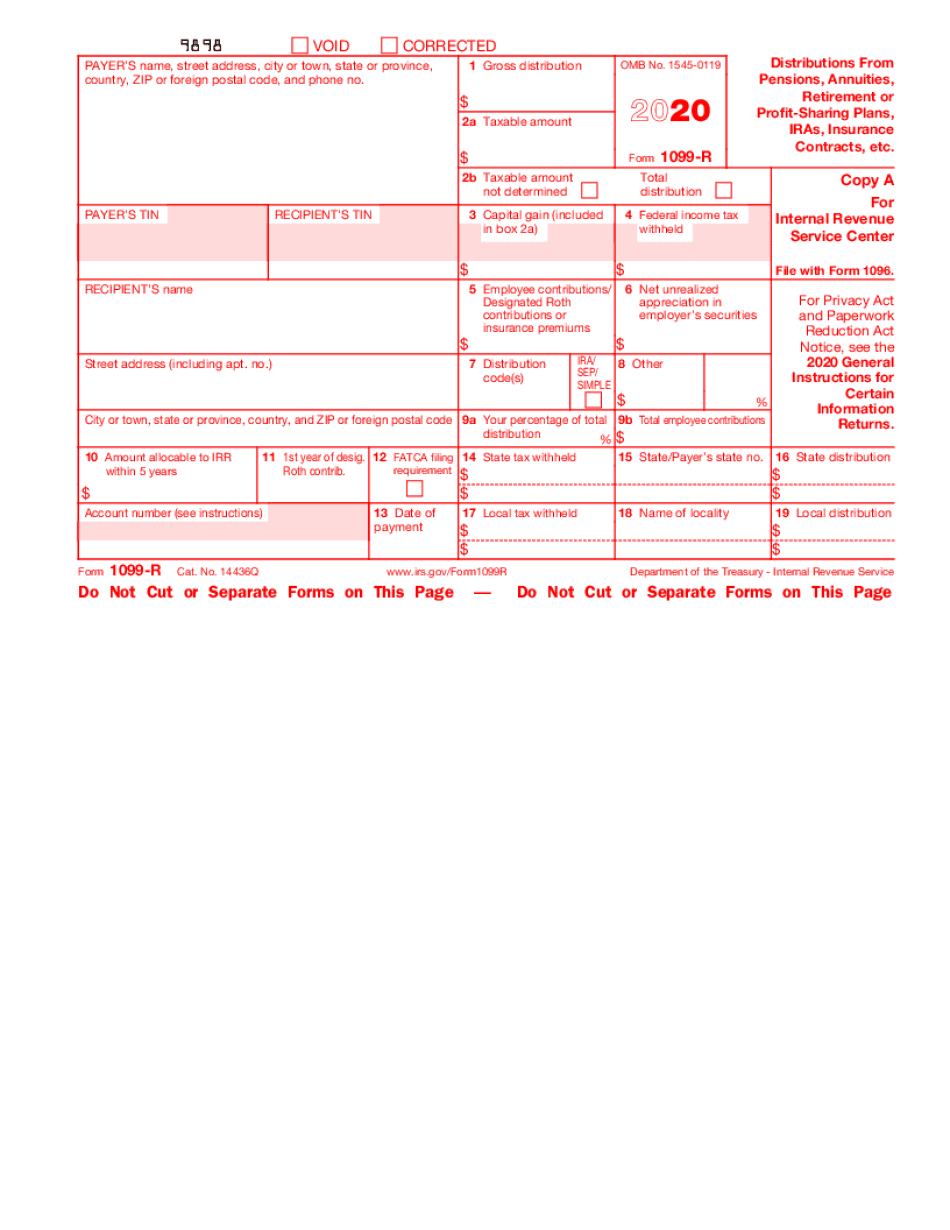

2015 Form IRS 1099 R Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/6/963/6963909/large.png

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below For State Tax Department www irs gov Form1099INT if checked Copy B For Recipient Federal income tax withheld This is important tax information and is being furnished to the 7 Foreign country or U S territory

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/488/370/488370241/large.png

https://www.irs.gov/newsroom/irs-opens-free-portal-to-file-information-returns-new-electronic-option-can-reduce-millions-of-paper-forms-1099-estimated-to-be-filed-by-businesses-in-2023

IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Form 1099 NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040 1040 SR or 1040 NR See the Instructions for Forms 1040 and 1040 SR or the Instructions for Form 1040 NR Boxes 15 17

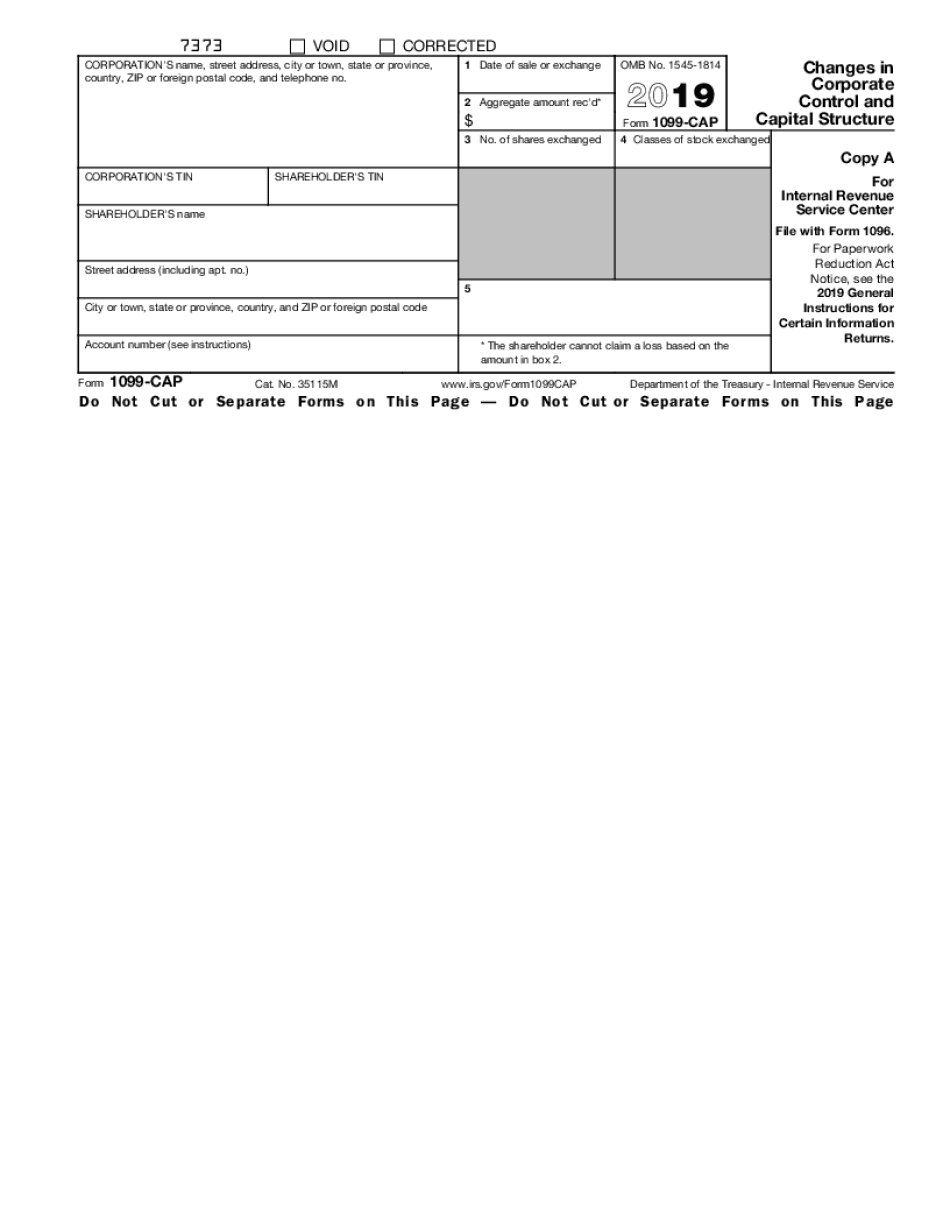

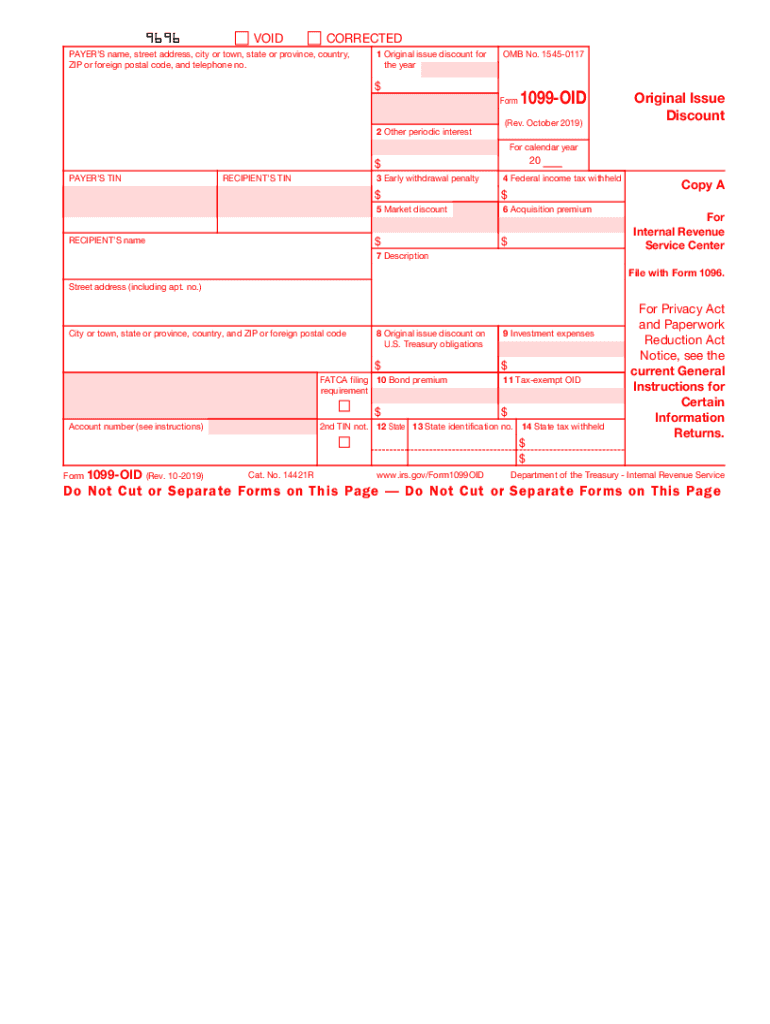

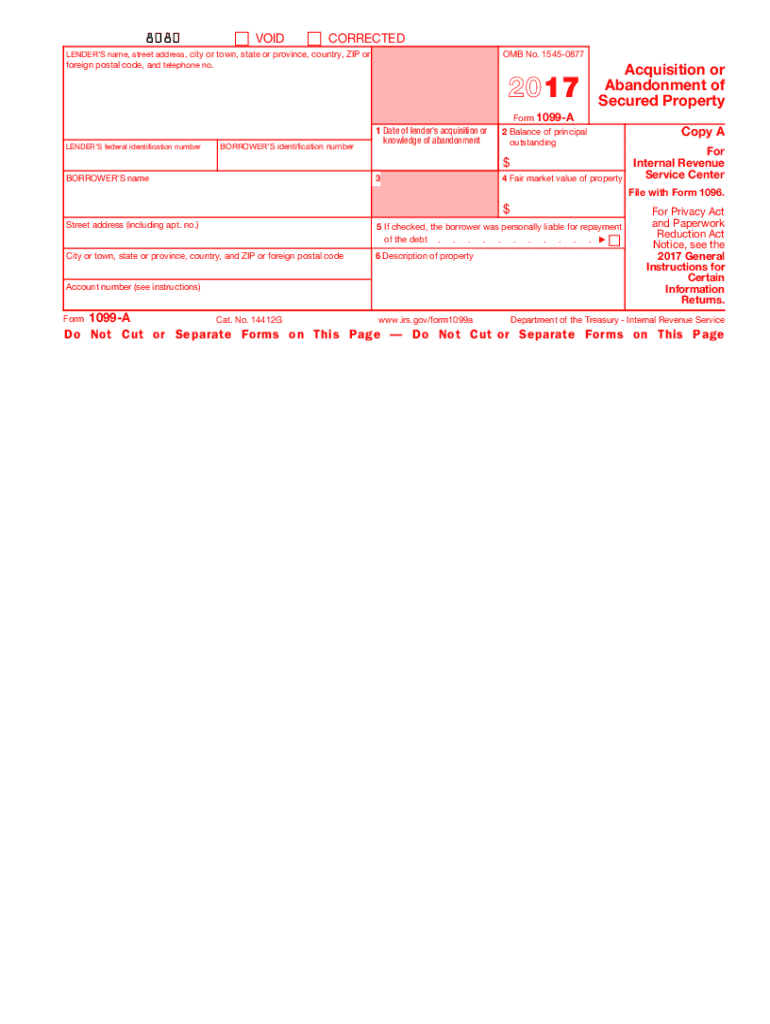

2019 2024 Form IRS 1099 OID Fill Online Printable Fillable Blank PdfFiller

IRS Form 1099 Reporting For Small Business Owners

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Types Of 1099 Form 2023 Printable Forms Free Online

Free Printable 1099 R Form Printable Templates

IRS Form 1099 R 2023 Forms Docs 2023

IRS 1099R Form Best Templates To Fill Out And Sign Online In PDF

IRS 1099R Form Best Templates To Fill Out And Sign Online In PDF

Free Irs Form 1099 Printable Printable Templates

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

A 1099 Form Fill Out And Sign Printable PDF Template SignNow

Free Printable Form 1099 From Irs - IRS Tax Tip 2024 07 Feb 14 2024 If taxpayers are filing a tax return for the first time IRS Free File can help This program provides free tax preparation free electronic filing and free direct deposit for eligible taxpayers The IRS Free File adjusted gross income AGI limit for tax year 2023 is 79 000 for families and individuals