Free Printable Irs 1099 Misc Form You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

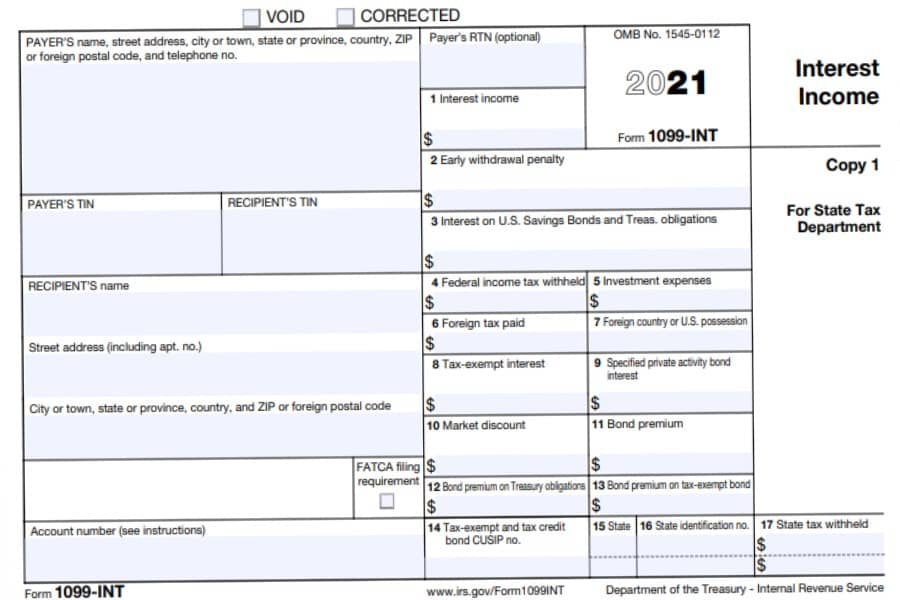

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form For State Tax Department www irs gov Form1099MISC Federal income tax withheld deferred compensation Copy B For Recipient This is important tax information and is being furnished to the IRS

Free Printable Irs 1099 Misc Form

Free Printable Irs 1099 Misc Form

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

6 Must know Basics Form 1099 MISC For Independent Contractors Bonsai

https://uploads-ssl.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

This free web based filing system lets you E file up to 100 returns at a time Enter manually or by csv upload Download payee copies to distribute Keep a record of completed filed and distributed forms Save and manage issuer information Get started To use the IRIS Taxpayer Portal you need an IRIS Transmitter Control Code TCC Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

If you have questions about reporting on Form 1099 MISC call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free Persons with a hearing or speech disability with access to TTY TDD equipment can call 304 579 4827 not toll free The due date for filing Form 1099 MISC with the IRS is February 28 2024 if you file on paper or March 31 2024 if you file electronically check out our free self employment expense calculator Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare

More picture related to Free Printable Irs 1099 Misc Form

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-6-box1-2x.png

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

Create Free Fillable Printable 1099 MISC Online for 2021 Create Fillable and Printable Form 1099 MISC Online for 2021 Fill E file Download or Print Forms Quick Secure Online Filing Instant Filing Status Postal Mail Recipient Copies Create 1099 MISC Now Pricing starts as low as 2 75 form What Is Form 1099 MISC Used For Businesses file form 1099 MISC for each person to whom they ve paid 1 At least 10 in broker payments or royalties in lieu of tax exempt interest or dividends At least 600 in The fishing boat proceeds The cash paid from a notional principal contract to an estate partnership or individual in most cases

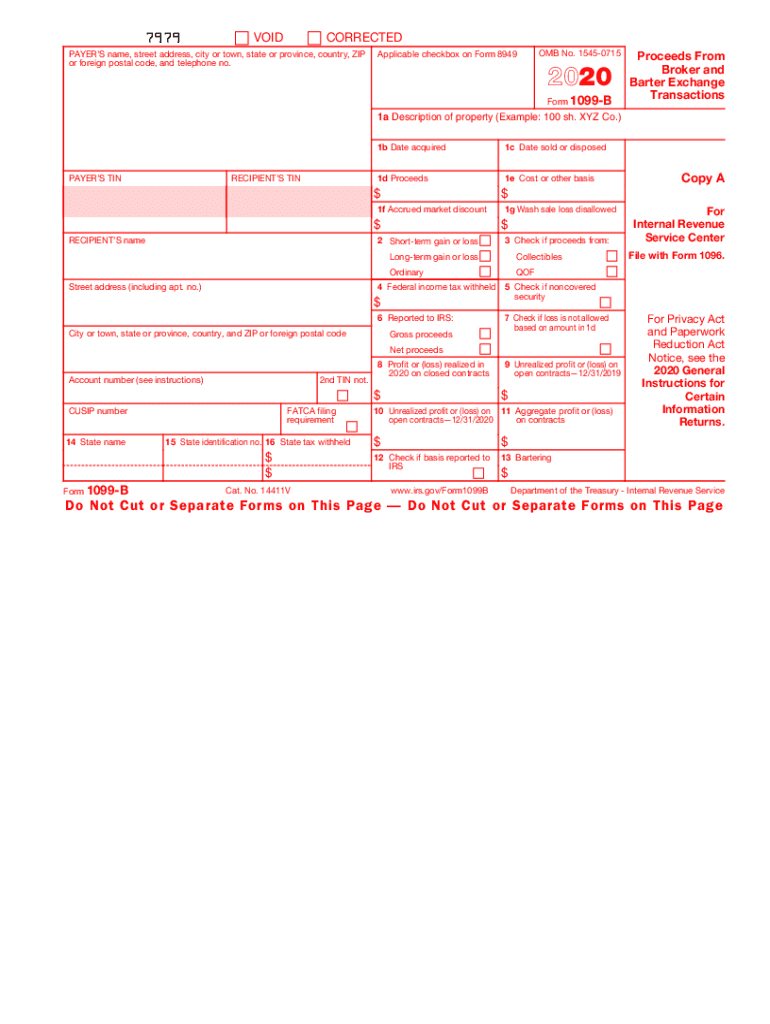

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest 1 How to File 5 Steps Gather Info Obtain Correct Form Complete Form Submit Retain Sources By Type 18 1099 A 1099 B 1099 C 1099 CAP 1099 DIV 1099 G 1099 INT 1099 K 1099 LTC 1099 MISC 1099 NEC 1099 OID 1099 PATR 1099 Q 1099 QA 1099 R 1099 S 1099 SA

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Form 1099 Misc Fillable Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-1099-misc-fillable.jpg

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

https://eforms.com/irs/form-1099/misc/

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Printable 1099 Misc Tax Form Template Printable Templates

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

How To Fill Out And Print 1099 MISC Forms

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

2009 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

2009 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

Printable Form 1099 Misc For 2021 Printable Form 2023

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season

1099 B 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Free Printable Irs 1099 Misc Form - Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below