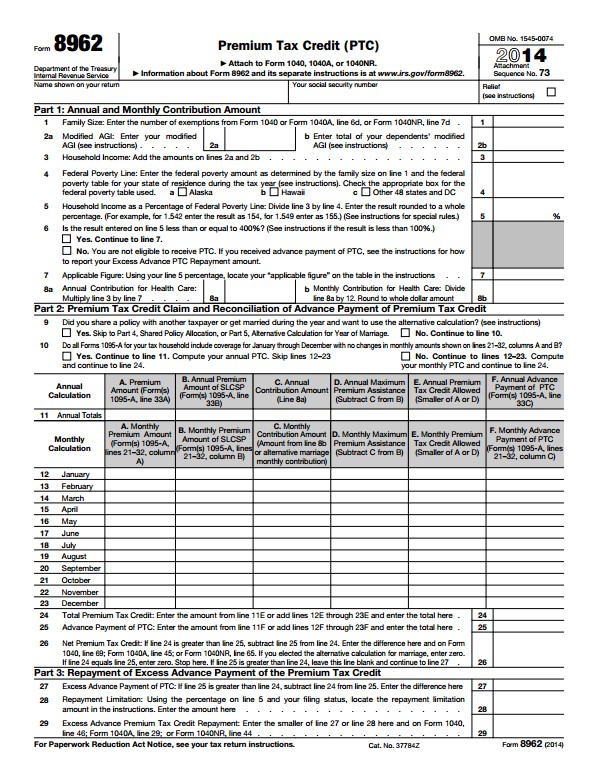

Free Printable Irs Form 8962 Form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you re eligible to receive and determines

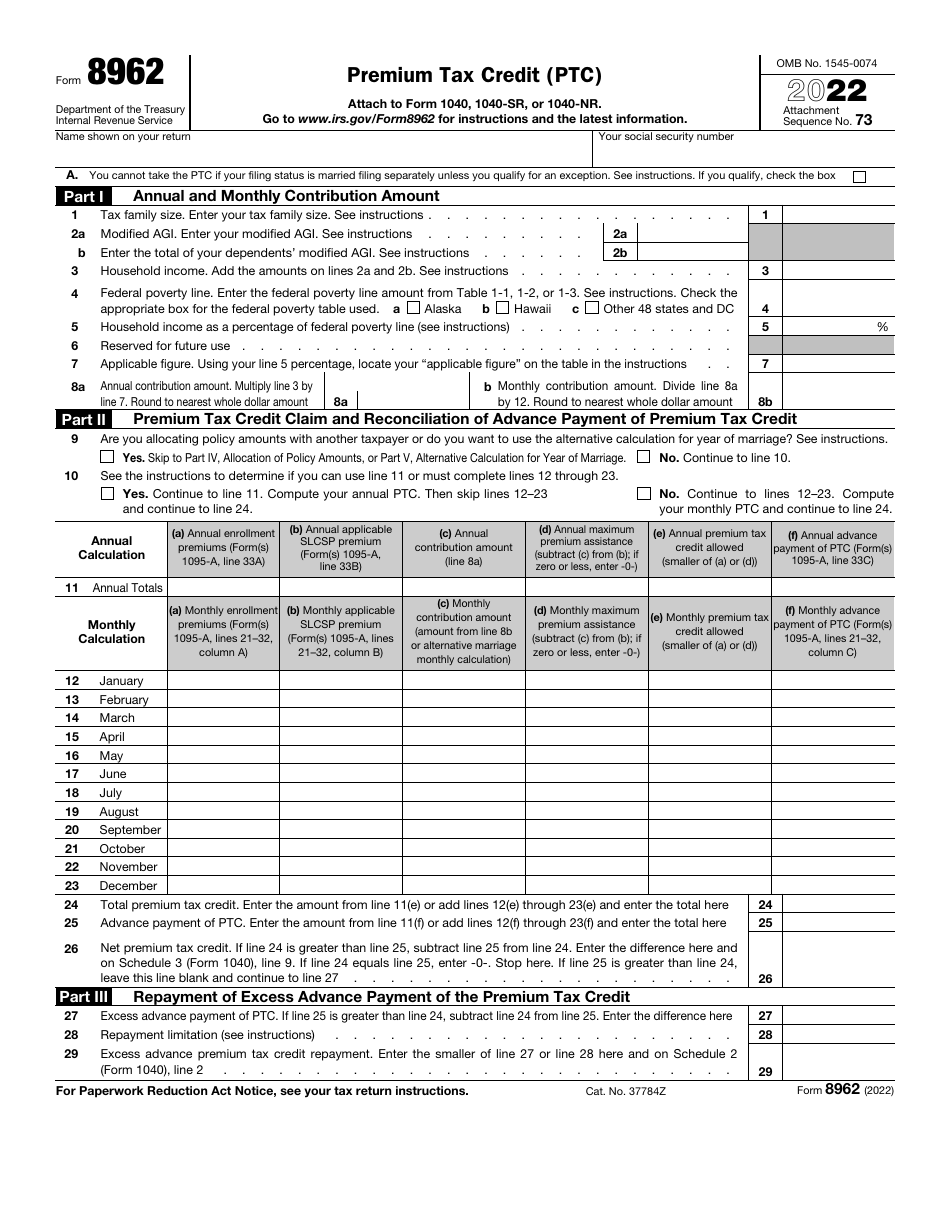

This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB Get your Form 1095 A Print Form 8962 How to move advance payment of premium tax credit info to Form 8962 Complete all sections of Form 8962 On Line 26 you ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income This will affect the amount of your refund or tax due

Free Printable Irs Form 8962

Free Printable Irs Form 8962

https://www.universalnetworkcable.com/wp-content/uploads/2018/12/printable-tax-forms-8962.jpg

IRS Instructions 8962 2019 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/489/187/489187822/large.png

8962

https://i.pinimg.com/originals/5a/ea/00/5aea00410784f7ab692813315d42f42f.jpg

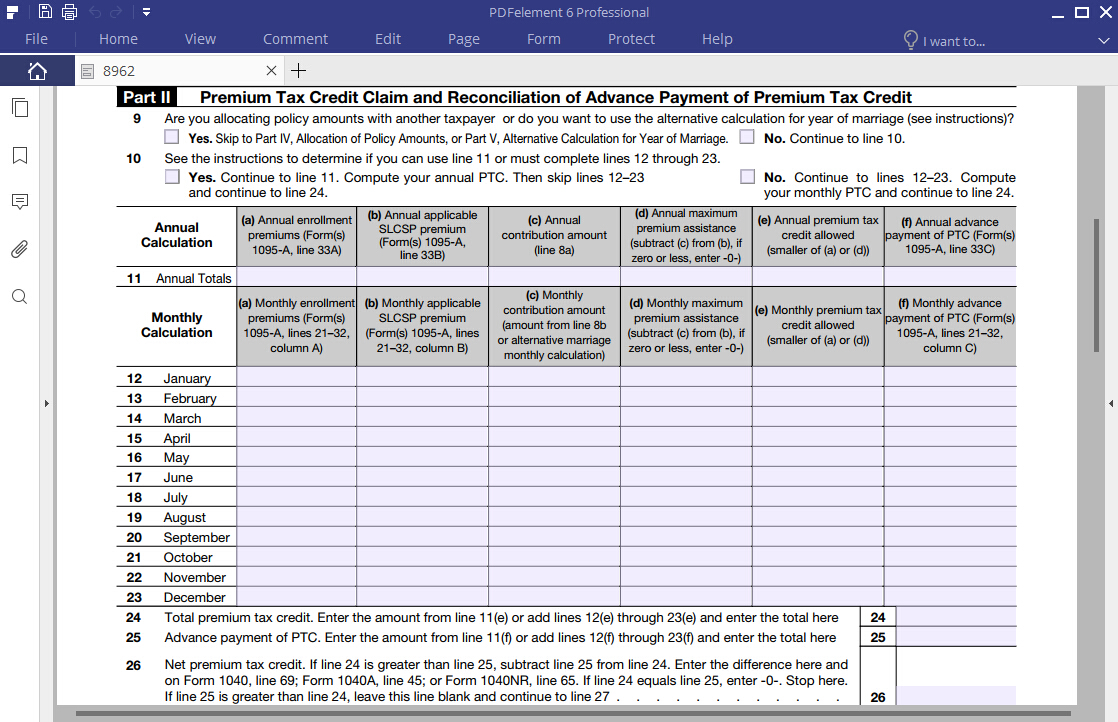

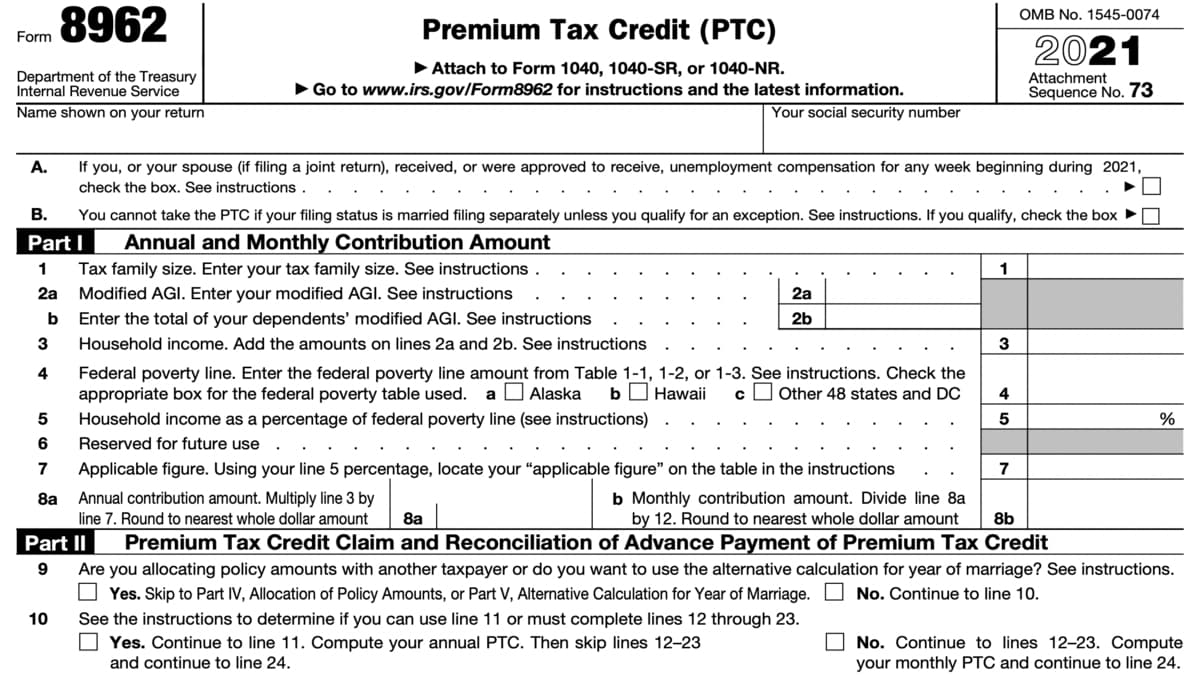

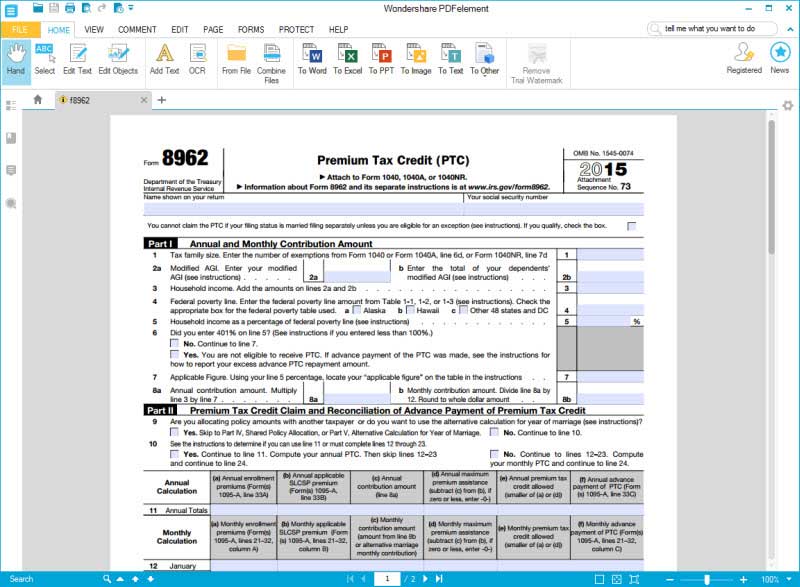

EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax Other Federal Other Forms The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit amount with their federal return With that amount they re then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit APTC that have been made for the filer throughout the year

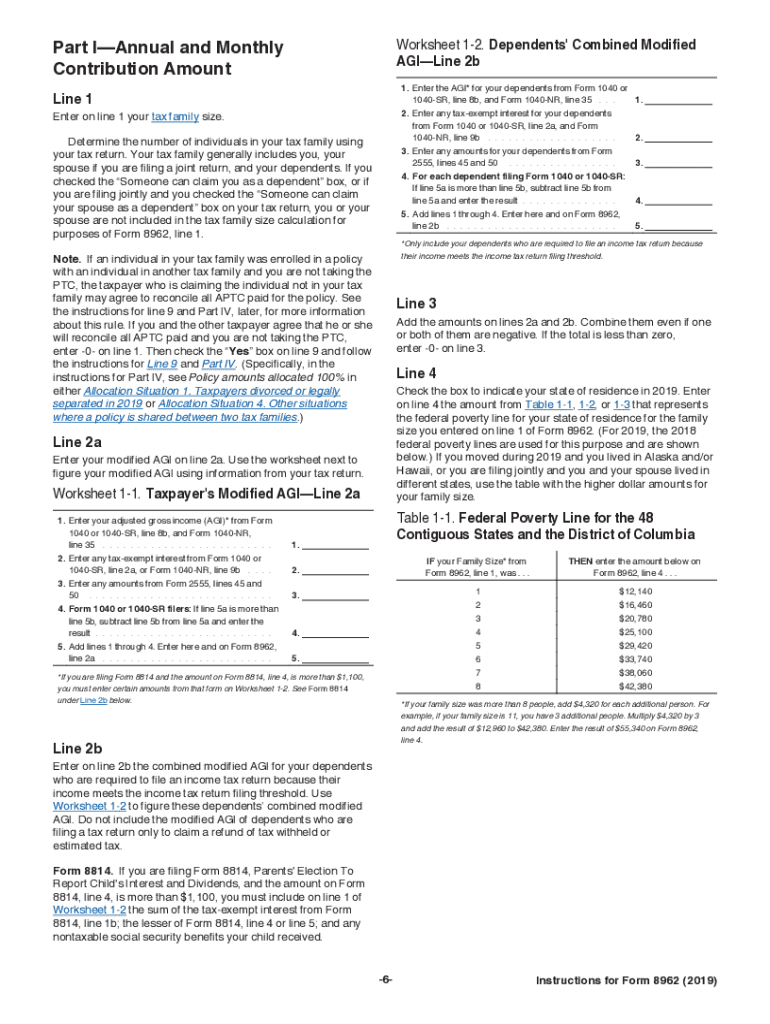

At the top of Form 8962 enter your name and Social Security number Step 3 Calculate the Annual and Monthly Contribution Amounts in Part I of Form 8962 Line 1 Use your tax return to enter the size of your tax family on line 1 This number generally includes you your spouse if filing jointly and your dependents Multiply the difference by 100 then drop any numbers after the decimal point For example if the difference was 1 8545565 you would enter 185 on line 5 of Form 8962 Tip There are 3 different federal poverty lines used 1 for the 48 contiguous states and the District of Columbia 1 for Hawaii and 1 for Alaska

More picture related to Free Printable Irs Form 8962

2016 Form IRS Instructions 8962 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/422/467/422467372/large.png

IRS Form 8962 Instruction For How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/8962-part 2.jpg

Form 8962 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/images/10000/form-8962-page1.png

TurboTax will automatically fill out Form 8962 once you enter your Form 1095 A You have to include Form 8962 with your tax return if You qualified for the Premium Tax Credit in 2023 You or someone on your tax return received advance payments of the Premium Tax Credit A member of your family received advance payments of the Premium Tax With the free printable 8962 form available it removes the hustle of looking for this crucial document Perhaps more importantly we provide 2022 Form 8962 instructions in PDF and online Our user friendly guide makes filling out the blank template easy clearing your path toward getting that valuable tax return Why wait then

Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC Our website offers beneficial resources including a free IRS Form 8962 printable version and comprehensive samples Also to render illustrative help relevant instructions for Form 8962 for 2023 are keenly interspersed throughout the examples

How To Fill Out IRS Form 8962 Correctly

https://images.wondershare.com/pdfelement/forms-templates/article/fill-f8962.png

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/459/416/459416023/big.png

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you re eligible to receive and determines

https://www.healthcare.gov/tax-forms-and-tools/

This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

How To Fill Out IRS Form 8962 Correctly

Free Free Irs 8962 Printable Forms Printable Forms Free Online

8962 Form Instructions Get IRS Form 8962 Printable How To Fill Out 8962 Tax Form Example

Tax Form 8962 Printable

Fill Free Fillable Form 8962 Premium Tax Credit PTC IRS PDF Form

Fill Free Fillable Form 8962 Premium Tax Credit PTC IRS PDF Form

IRS Form 8962 Download Fillable PDF Or Fill Online Premium Tax Credit Ptc 2022 Templateroller

8962 Form Fill Out And Sign Printable PDF Template SignNow

IRS Form 8962 Instruction For How To Fill It Right

Free Printable Irs Form 8962 - Benefits We Offer For those seeking assistance with this form 8962taxform provides a valuable resource Our site offers a free printable tax form 8962 allowing individuals to access and prepare their documents without any cost