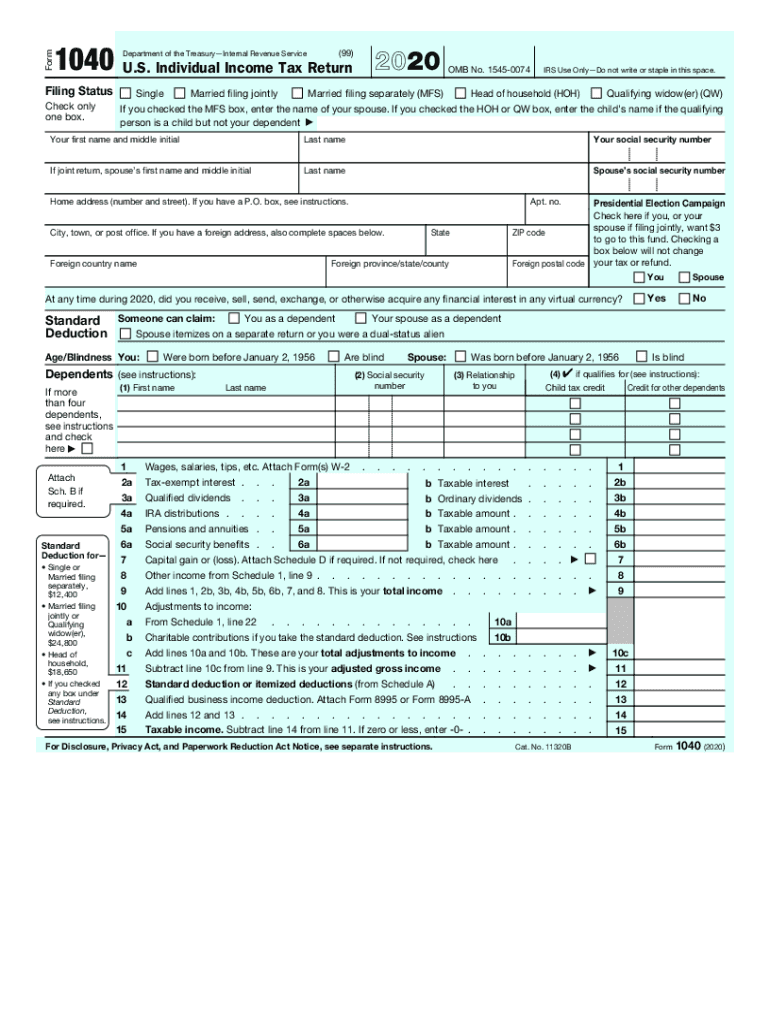

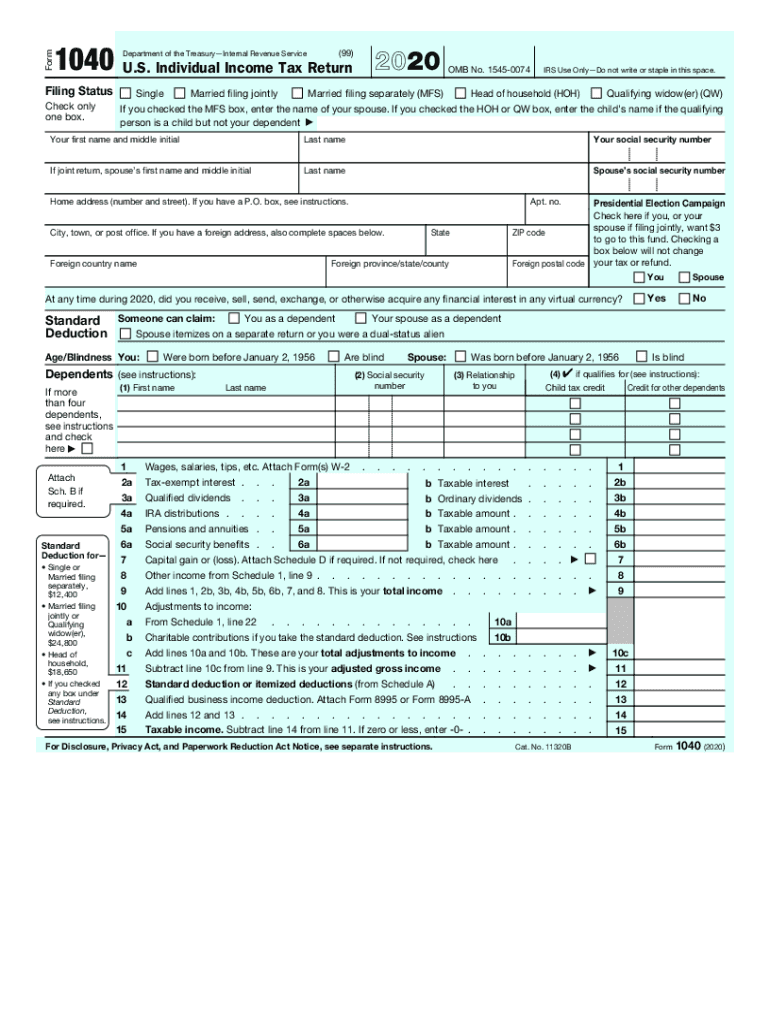

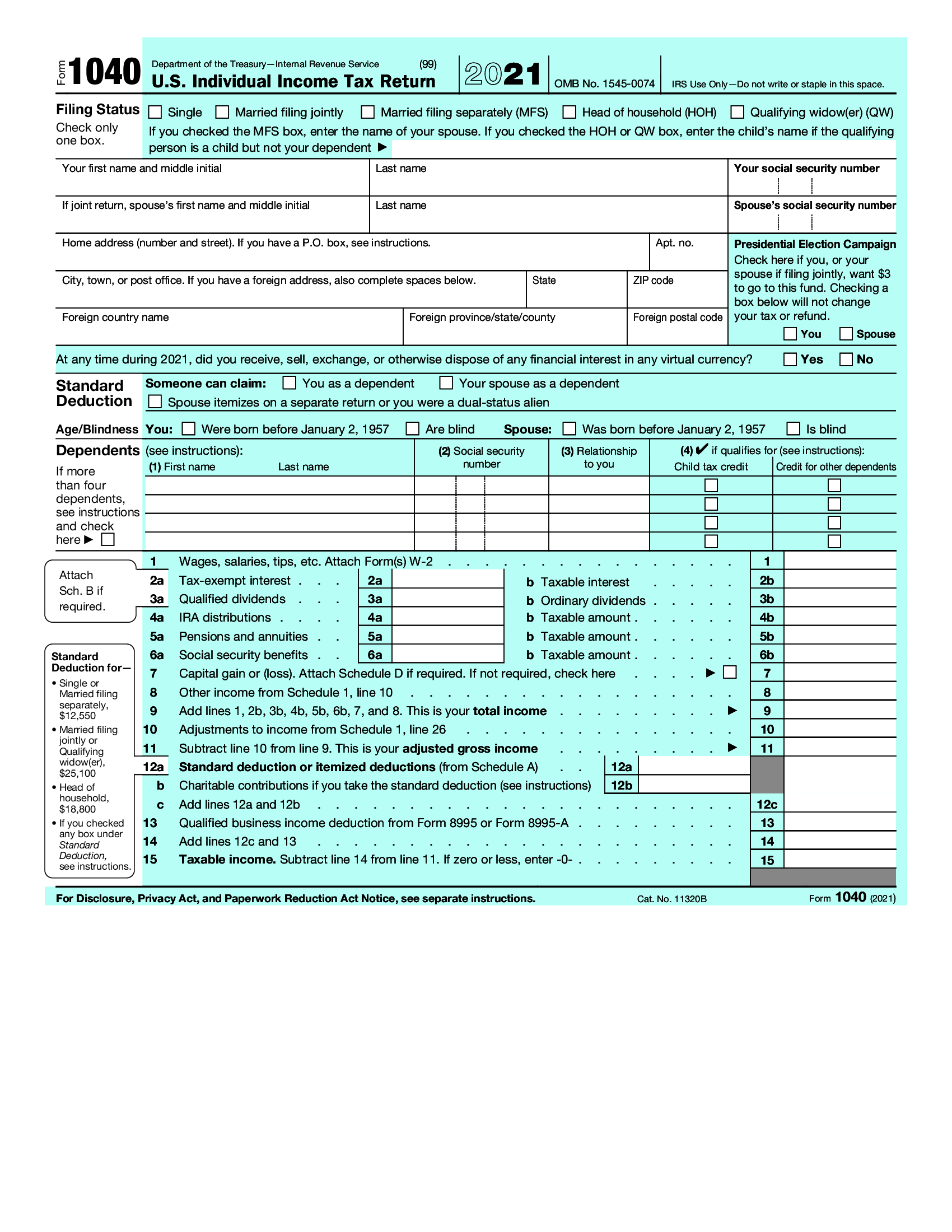

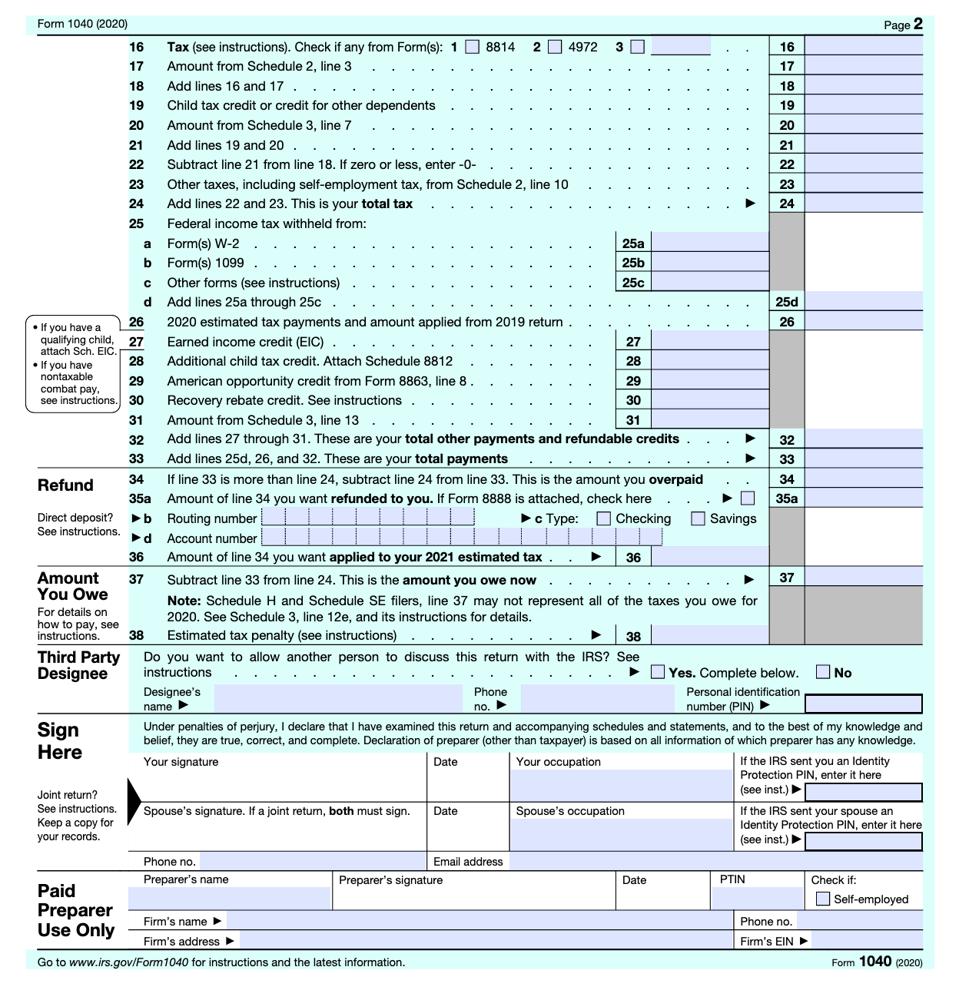

Free Printable Of Form 1040 Allocation Of Refund Form 1040 U S Individual Income Tax Return 2022 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS

Download This Form Print This Form More about the Federal Form 8888 Other TY 2023 We last updated the Allocation of Refund Including Savings Bond Purchases in February 2024 so this is the latest version of Form 8888 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8888 directly from TaxFormFinder Internal Revenue Service IRS Form 8888 lets you split your tax refund among up to three financial accounts as well as allowing you to use it to purchase up to 5 000 in paper series I

Free Printable Of Form 1040 Allocation Of Refund

Free Printable Of Form 1040 Allocation Of Refund

https://www.printableform.net/wp-content/uploads/2021/07/how-to-fill-out-irs-form-1040-with-form-wikihow-free-1.jpg

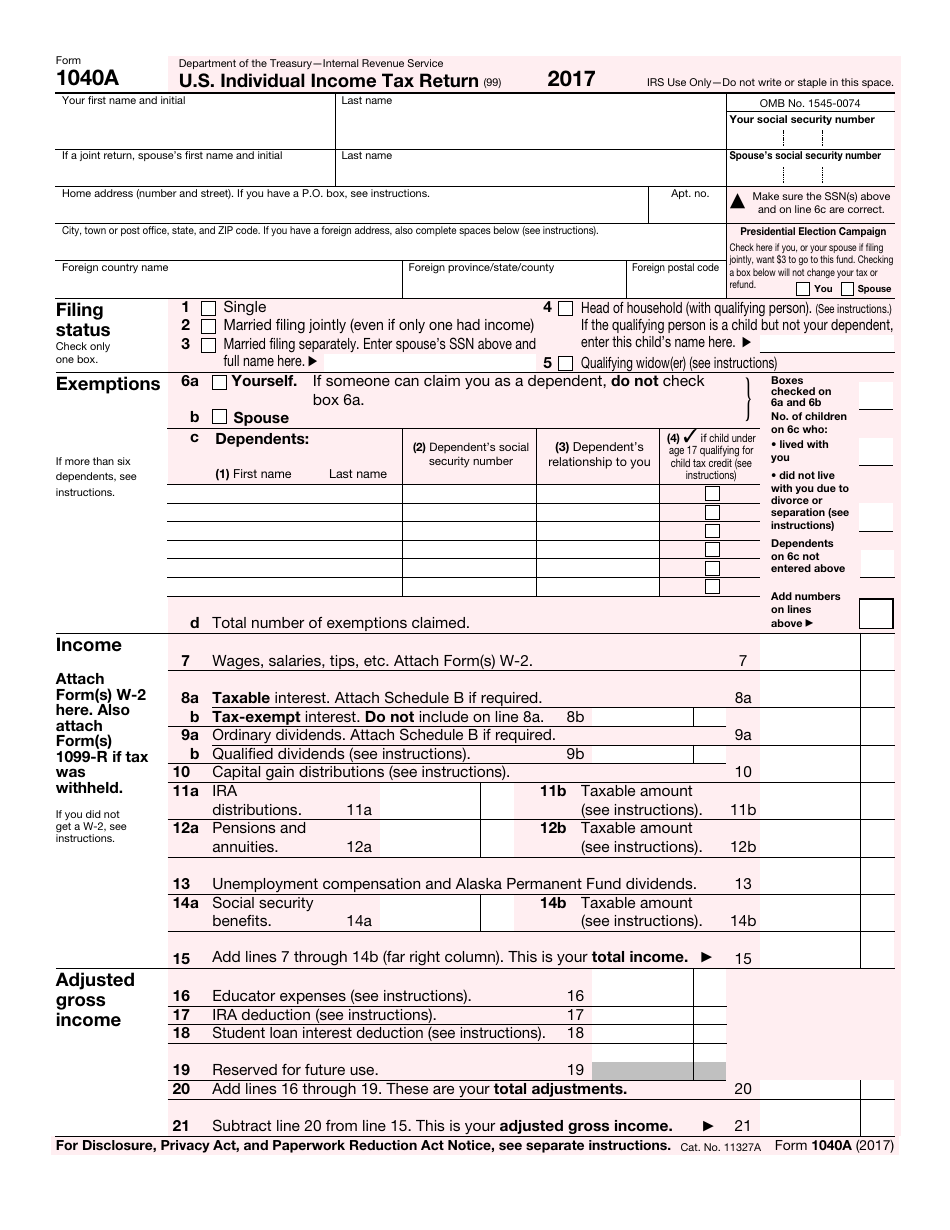

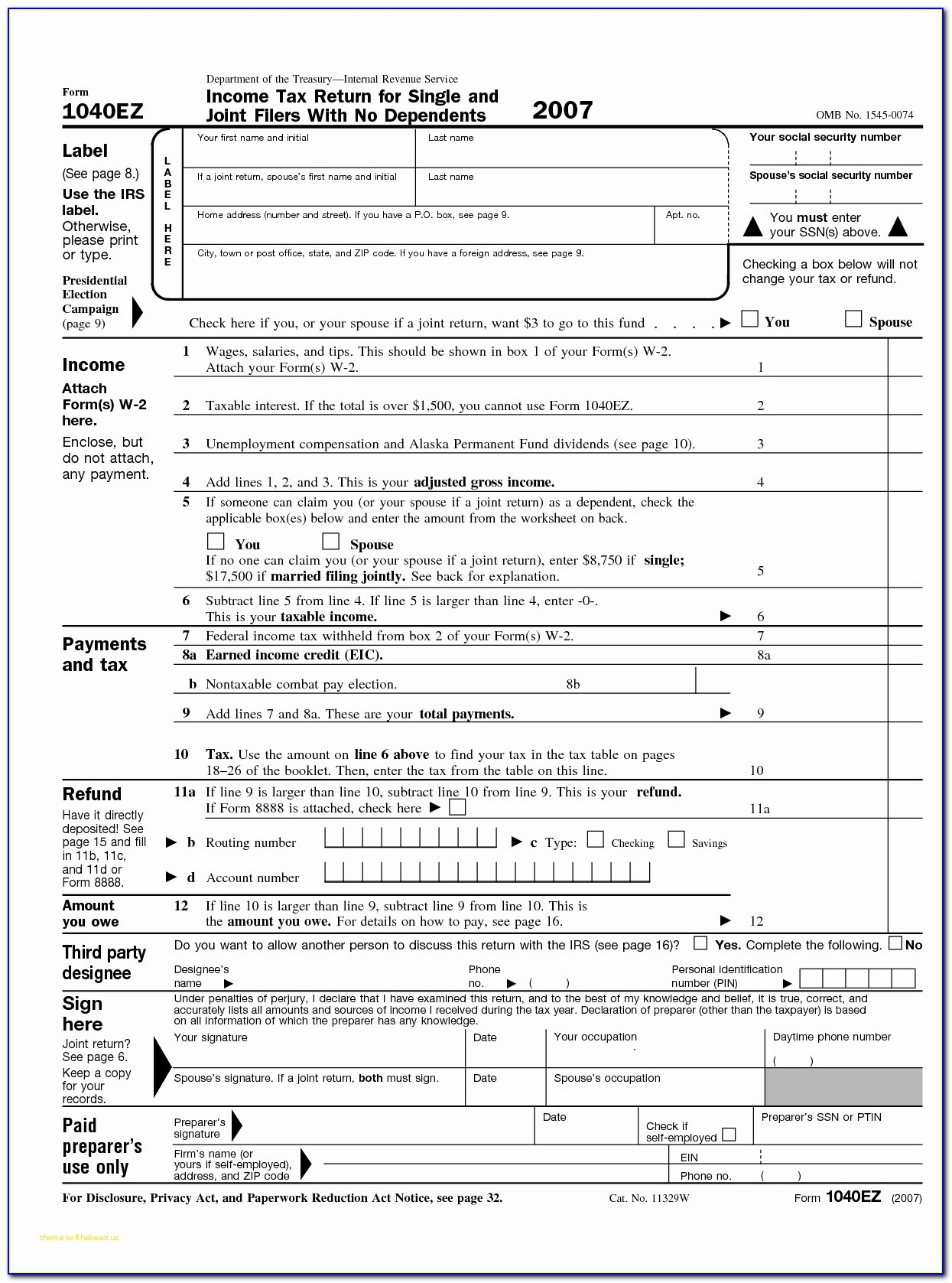

Irs Printable Form 1040

https://data.templateroller.com/pdf_docs_html/1352/13527/1352746/irs-form-1040a-2017-u-s-individual-income-tax-return_print_big.png

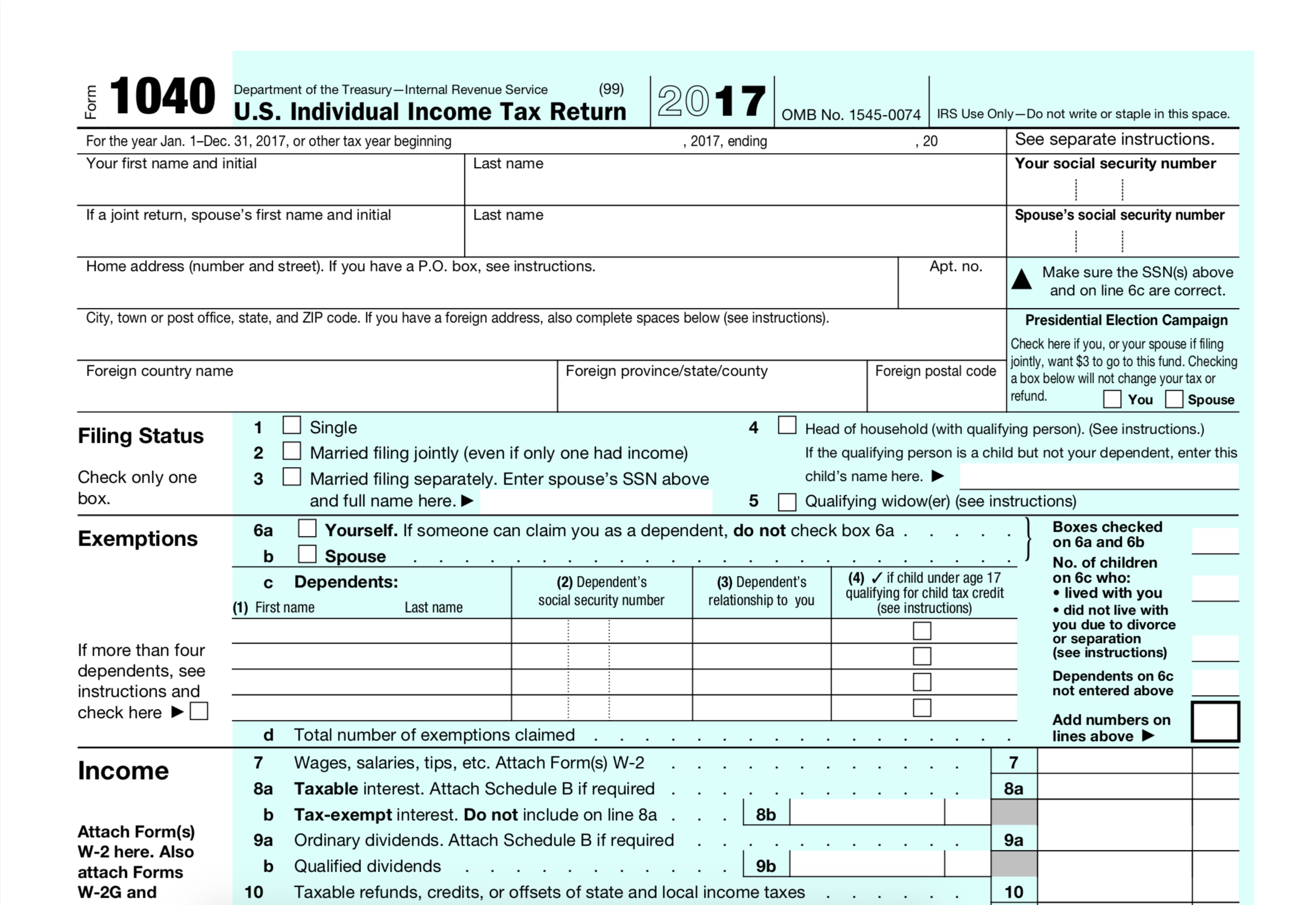

1040 U S Individual Income Tax Return Filing Status 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040-u-s-individual-income-tax-return-filing-status-728x942.png

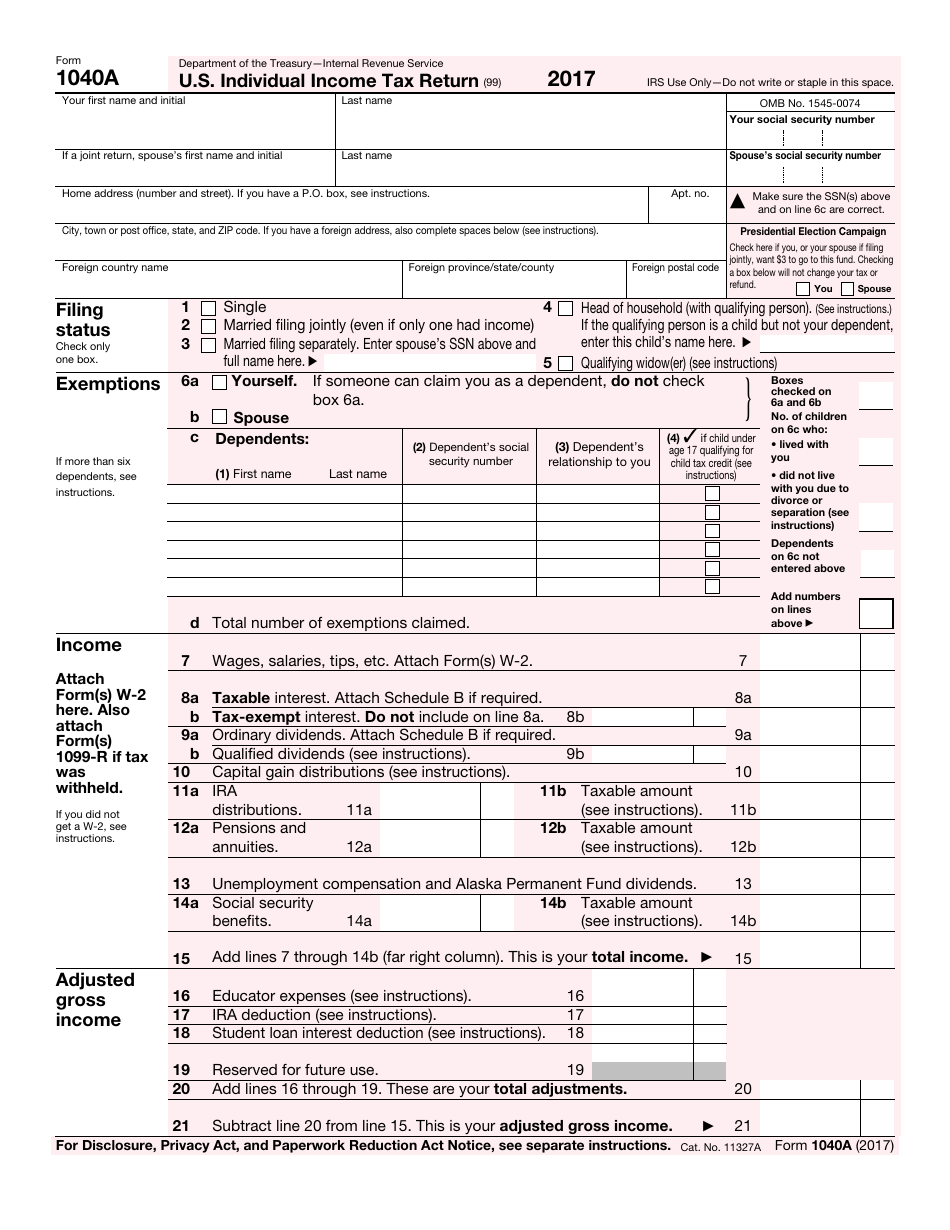

Answer the following questions for that year Yes Go to line 3 No Stop here Do not file this form You are not an injured spouse 3 Did or will the IRS use the joint overpayment to pay any of the following legally enforceable past due debt s owed only by your spouse See instructions What is the purpose of Schedule NR Schedule NR Nonresident and Part Year Resident Computation of Illinois Tax allows part year or nonresidents of Illinois to determine the income that is taxed by Illinois during the tax year and to figure Illinois Income Tax Attach Schedule NR to Form IL 1040 Individual Income Tax Return

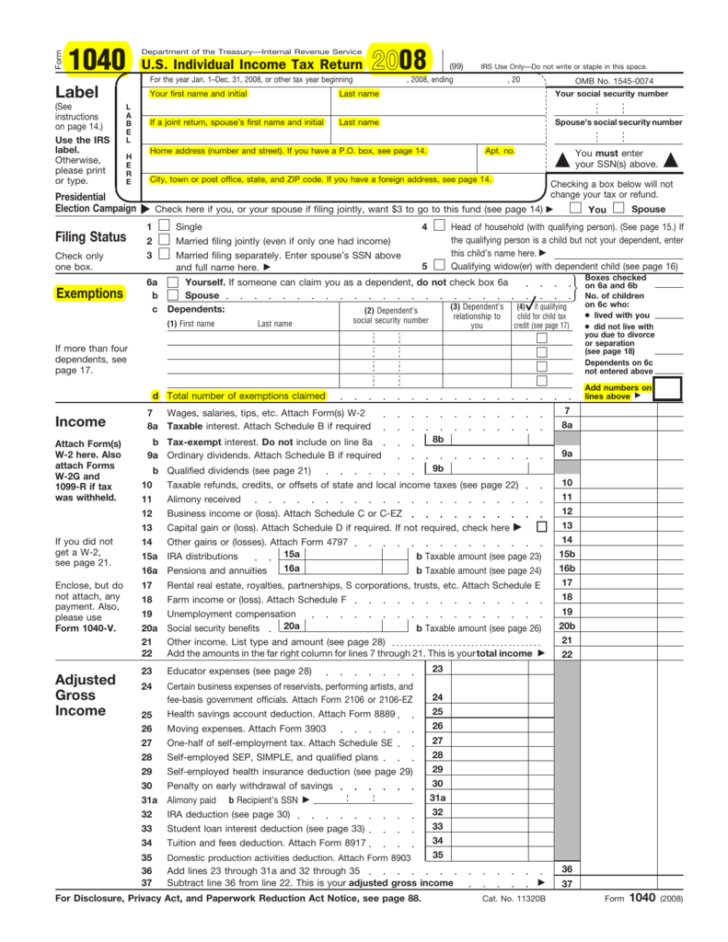

Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services Lines 1 through 7 are all about your income If you have a W 2 you will need to enter the earnings information from that form here You also need to attach any and all W 2 forms Then you can enter information on any interest dividends pensions annuities individual retirement account distributions or Social Security benefits

More picture related to Free Printable Of Form 1040 Allocation Of Refund

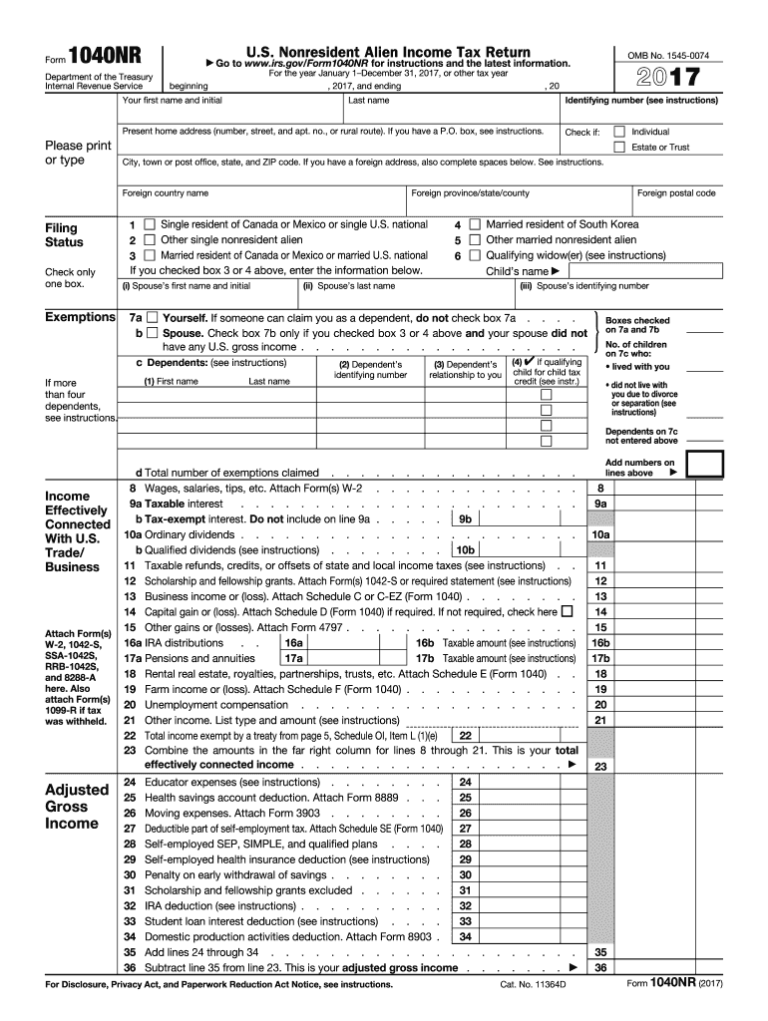

1040nr Fill Out And Sign Printable PDF Template SignNow 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040nr-fill-out-and-sign-printable-pdf-template-signnow-1-768x1021.png

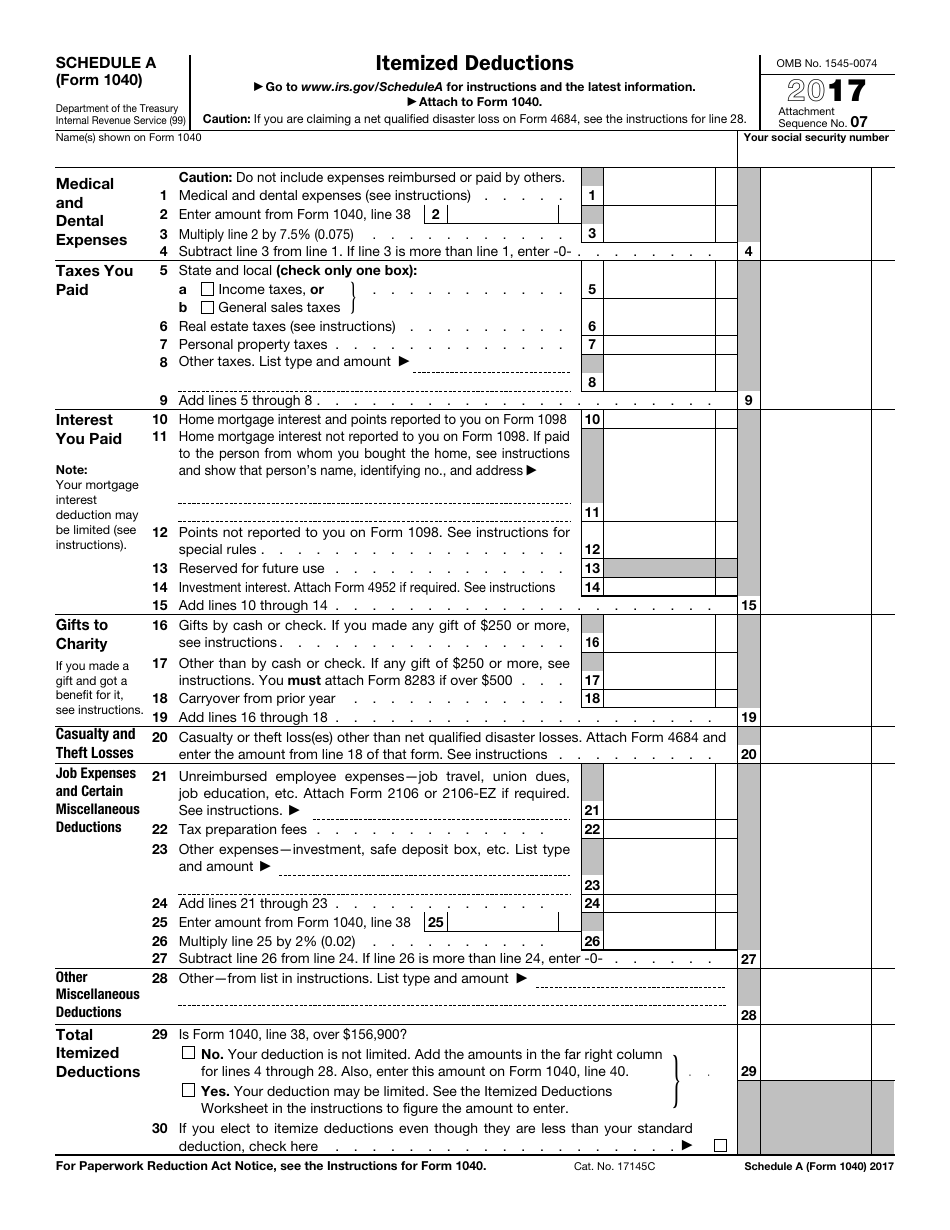

1040 Schedule A Printable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1352/13527/1352750/irs-form-1040-2017-schedule-a-itemized-deductions_print_big.png

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/Form_1040_2021.61dc944778e68.png

What s New for 2022 IL 1040 Instructions R 12 22 Printed by authority of the state of Illinois Electronic only one copy Mailing your income tax return If no paymentis enclosed mail your return to If a payment is enclosed mail your return to U S Individual Income Tax Return 2023 Form 1040 Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service For the year Jan 1 Dec 31 2023 or other tax year beginning OMB No 1545 0074 IRS Use Only Do not write or staple in this space 2023 ending 20 See separate instructions

New for 2021 Homestead Property Tax Credit Updates Themaximum taxable value increases to 136 600 The limit on total household resources increases to 60 600 The homestead property tax credit phase out begins whenyour total household resources exceed 51 600 TurboTax Free Edition TurboTax Free Edition 0 Federal 0 State 0 To File is available for those filing Form 1040 and limited credits only as detailed in the TurboTax Free Edition disclosures Roughly 37 of taxpayers qualify Offer may change or end at any time without notice

2020 Form IRS 1040 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/781/535781055/large.png

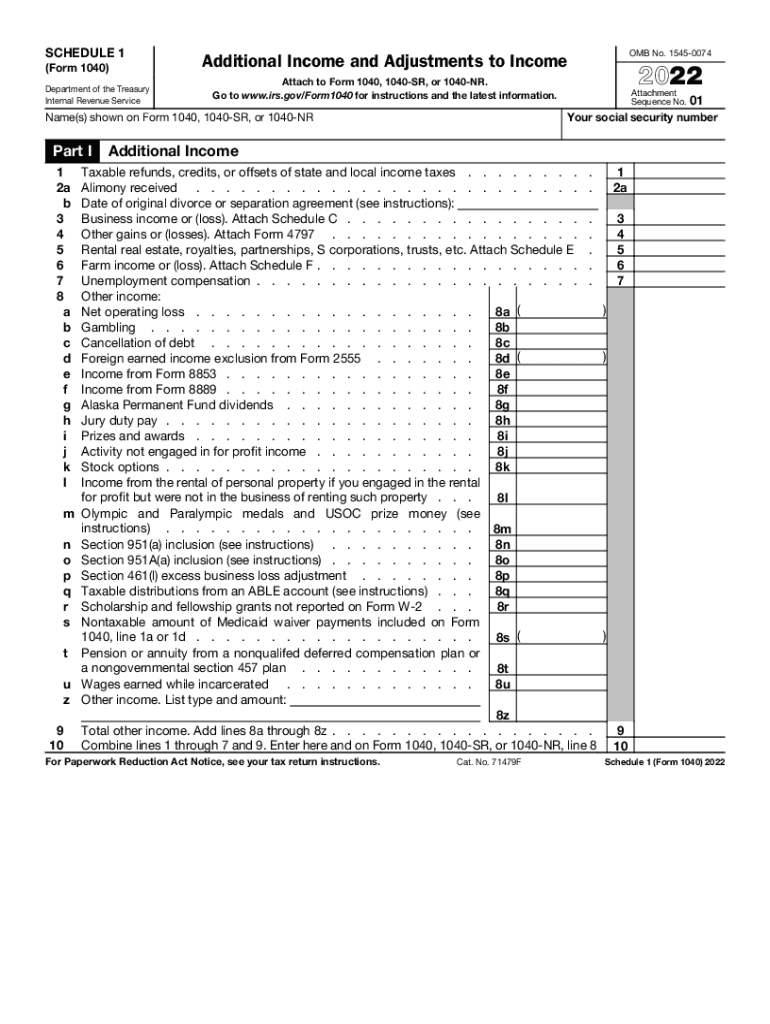

2022 Form IRS 1040 Schedule 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/654/624654308/large.png

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Form 1040 U S Individual Income Tax Return 2022 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS

https://www.taxformfinder.org/federal/form-8888

Download This Form Print This Form More about the Federal Form 8888 Other TY 2023 We last updated the Allocation of Refund Including Savings Bond Purchases in February 2024 so this is the latest version of Form 8888 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8888 directly from TaxFormFinder

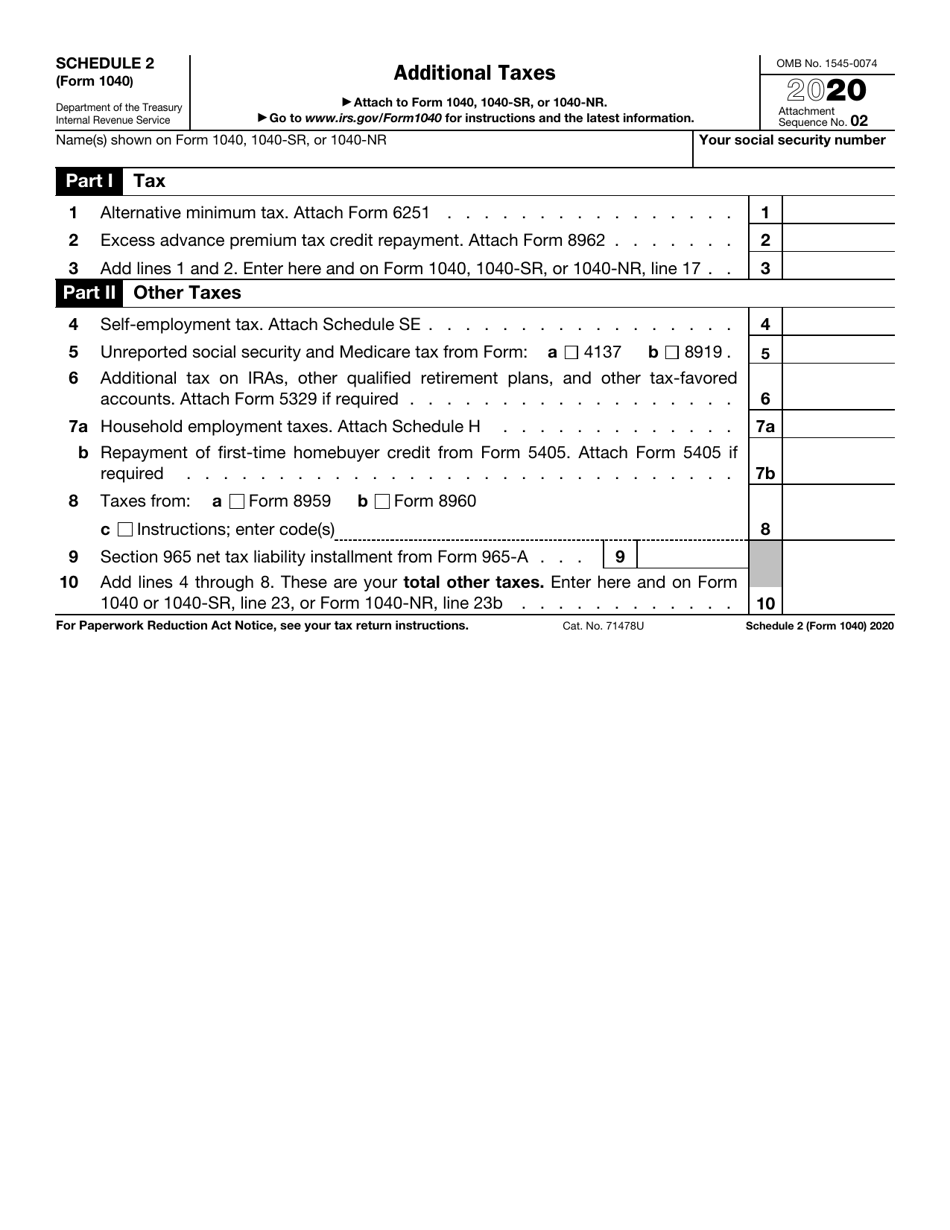

IRS Form 1040 Schedule 2 Download Fillable PDF Or Fill Online Additional Taxes 2020

2020 Form IRS 1040 Fill Online Printable Fillable Blank PdfFiller

What Does A 1040 Form Look Like Seven Questions To Ask At 1040 Form Printable

2019 Form IRS 1040 SR Fill Online Printable Fillable Blank PdfFiller

Irs Printable Form 1040

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 U S Individual Tax Return Definition

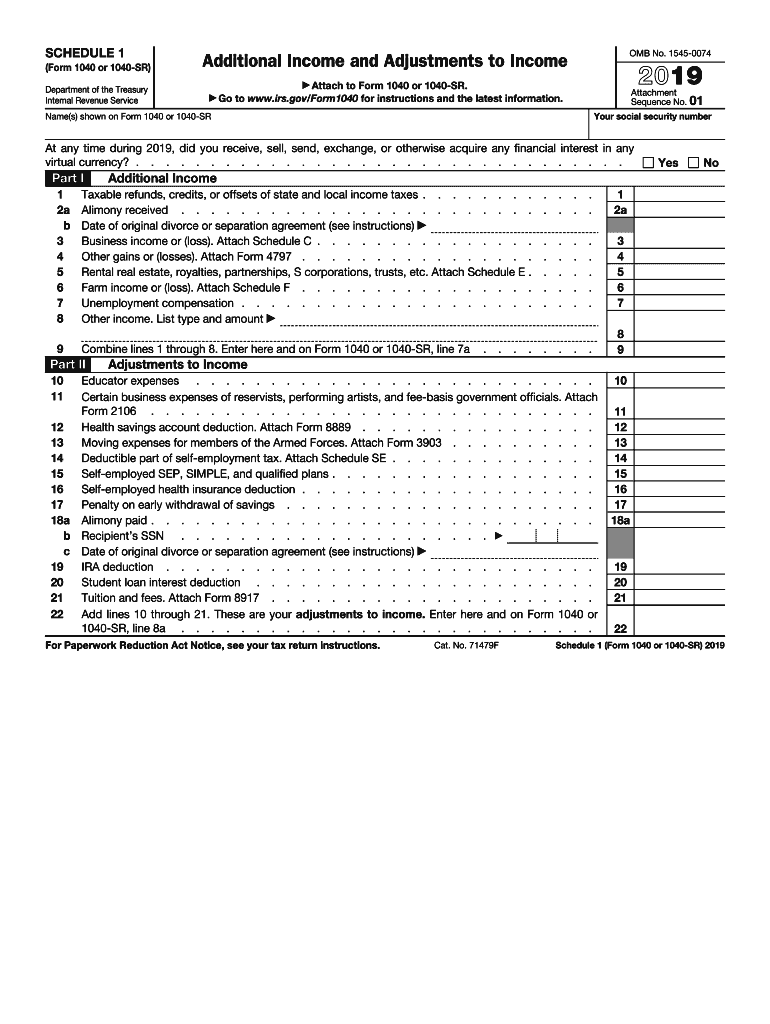

2019 Form IRS 1040 Schedule 1 Fill Online Printable Fillable Blank PdfFiller

2022 Tax Forms 1040 Printable Fillable Fillable Form 2023

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill And Sign Printable Template Online

Free Printable Of Form 1040 Allocation Of Refund - Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services