Free Printable Schedule C Tax Form Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self employment tax Schedule F Form 1040 to report profit or loss from farming Schedule J Form 1040 to figure your tax by averaging your farming or fishing income over the previous 3 years Doing so may reduce your tax

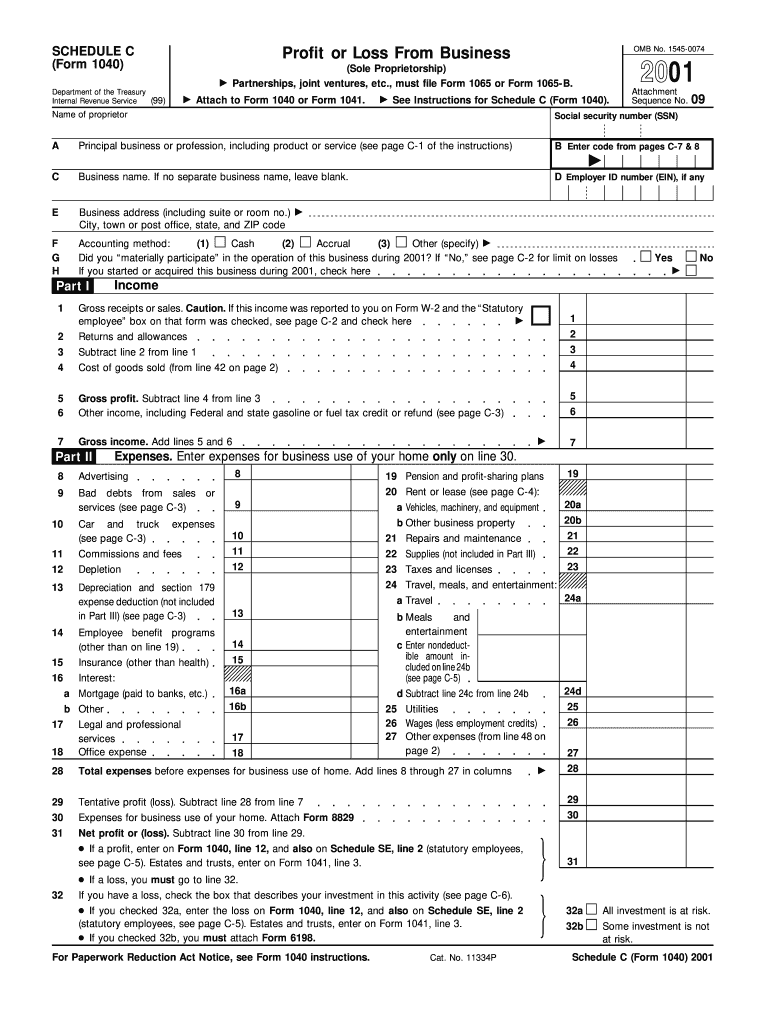

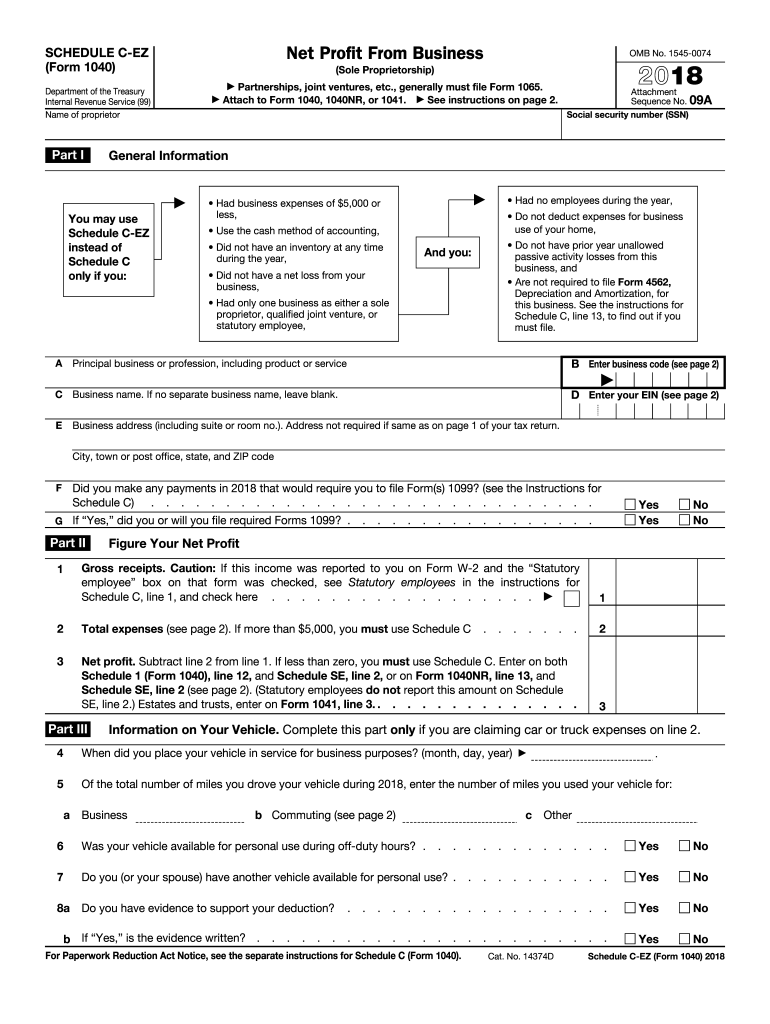

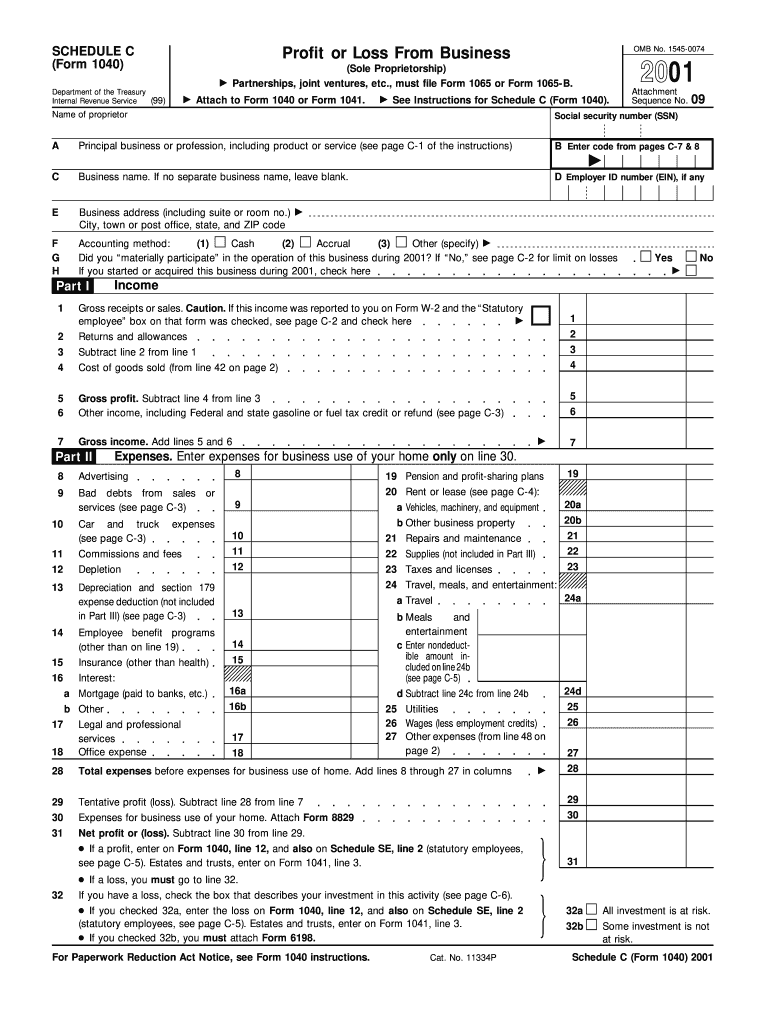

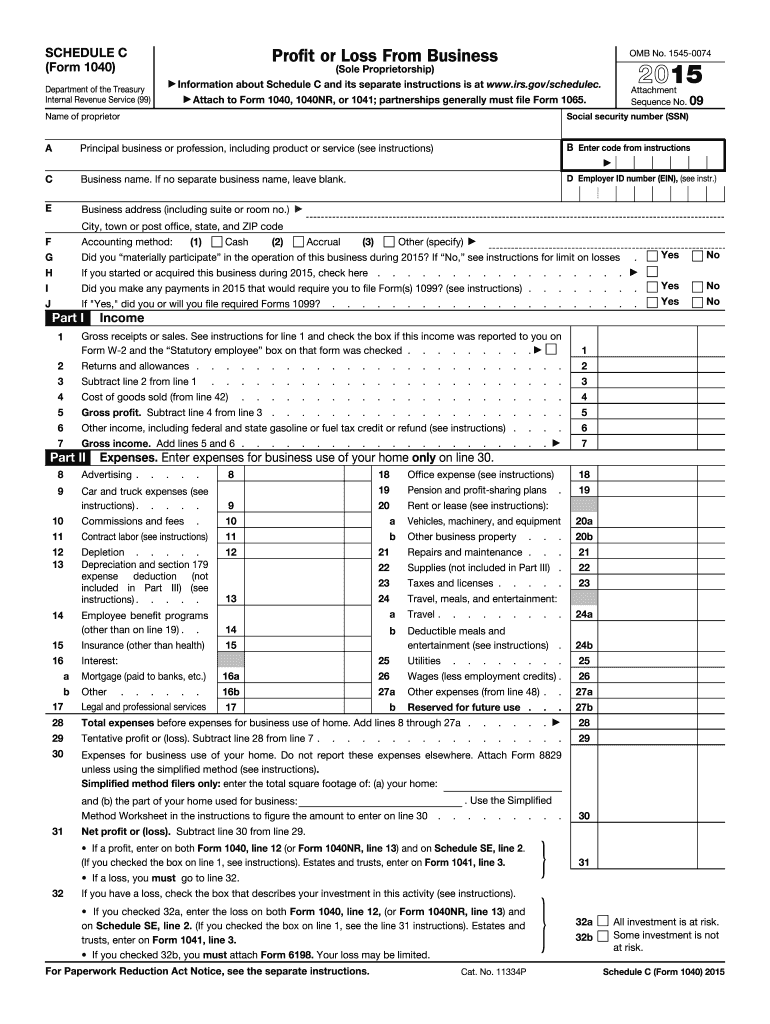

What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file About Schedule C EZ Form 1040 Net Profit from Business Sole Proprietorship

Free Printable Schedule C Tax Form

Free Printable Schedule C Tax Form

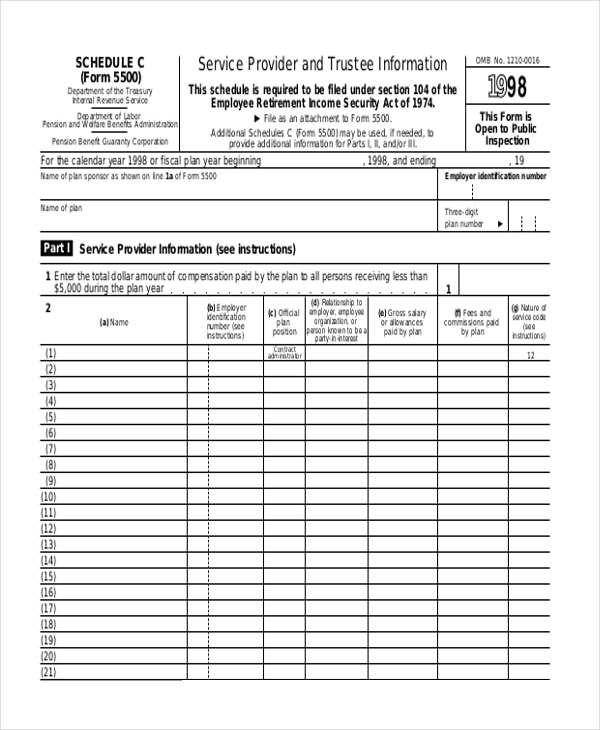

https://images.sampletemplates.com/wp-content/uploads/2016/11/21170803/Schedule-C-Form-Corporation-Income-Tax-Return.jpg

2018 2023 Form IRS 1040 Schedule C EZ Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/454/878/454878824/large.png

Schedule C Tax Form Schedule Form Blank Pdf Sample Nd Ward Forms Anacollege

https://images.sampleforms.com/wp-content/uploads/2016/11/Form-5500-Schedule-C1.jpg

Schedule C Form 1040 Create My Document A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form it is used to provide information about both the profit and the loss sustained in business by the sole proprietor Please use the link below to download 2023 federal 1040 schedule c pdf and you can print it directly from your computer More about the Federal 1040 Schedule C eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

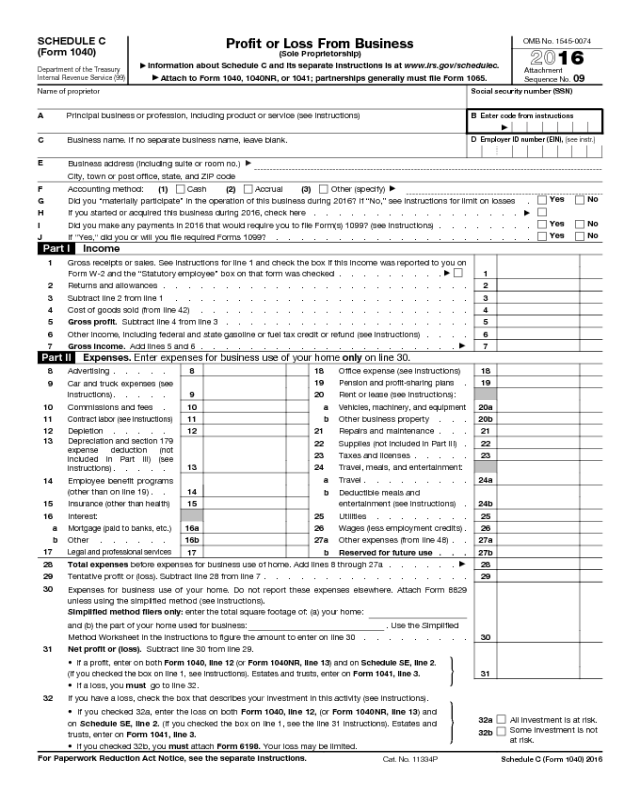

IRS Form 1040 Schedule C Profit or Loss From Business Reporting form sequence number 09 for attachment to IRS Form 1040 Profit or Loss from a Sole Proprietorship business OMB 1545 0074 OMB report IRS OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf Profit or Loss from Business Sole Proprietorship 2023 Schedule C Form 1040 SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065

More picture related to Free Printable Schedule C Tax Form

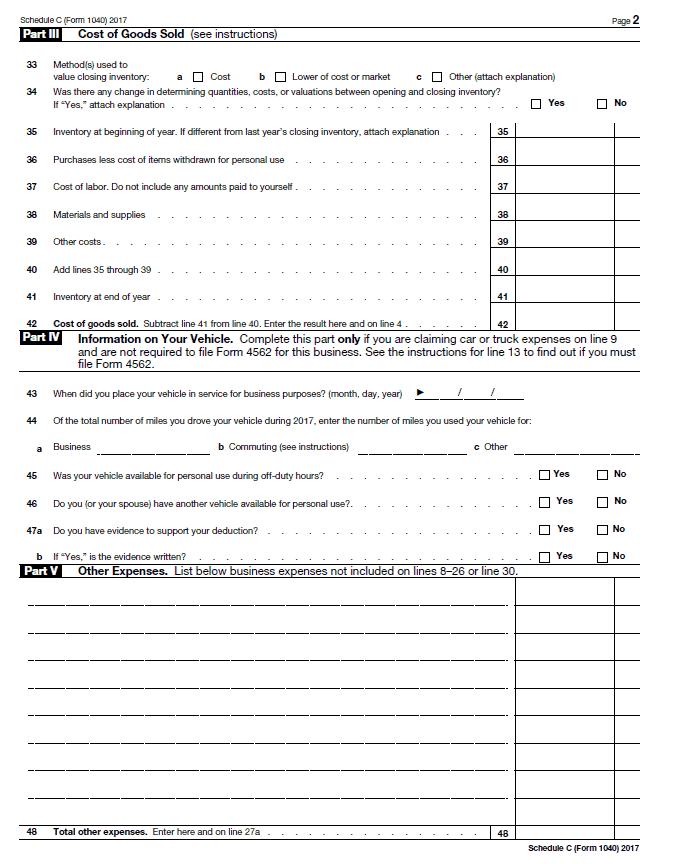

Schedule C Form 1040 Expense Cost Of Goods Sold

https://imgv2-2-f.scribdassets.com/img/document/21529586/original/30d5dde74c/1624602768?v=1

Free Printable Schedule C Tax Form

https://i2.wp.com/1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word-1.jpg

Schedule C Form 1040 How To Complete It The Usual Stuff

http://theusualstuff.com/wp-content/uploads/2018/04/Schedule-C-Page-2.png

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF Printable Federal Income Tax Schedule C Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees with business expenses of 5 000 or less may be able to file Schedule C EZ instead of Schedule C

Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file your own information to support all Schedule C s Business Name if any Address if any Is this your first year in business Yes SCHEDULE C Profit or Loss From Business 2019 SCHEDULE C Form 1040 or 1040 SR Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and the latest information Sequence No

Schedule C Fill Online Printable Fillable Blank 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/schedule-c-fill-online-printable-fillable-blank-1.png

Schedule C Form 1040 How To Complete It The Usual Stuff

https://theusualstuff.com/wp-content/uploads/2018/04/Schedule-C-Page-1.png

https://www.irs.gov/pub/irs-prior/i1040sc--2021.pdf

Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self employment tax Schedule F Form 1040 to report profit or loss from farming Schedule J Form 1040 to figure your tax by averaging your farming or fishing income over the previous 3 years Doing so may reduce your tax

https://www.incometaxpro.net/tax-form/schedule-c.htm

What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form

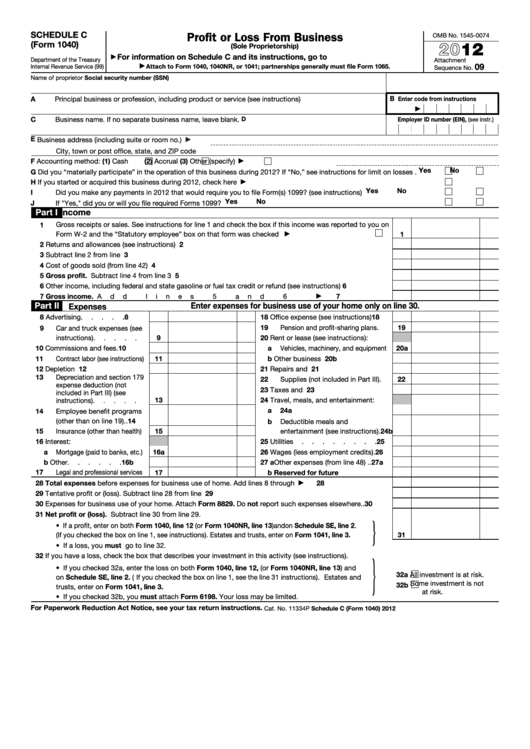

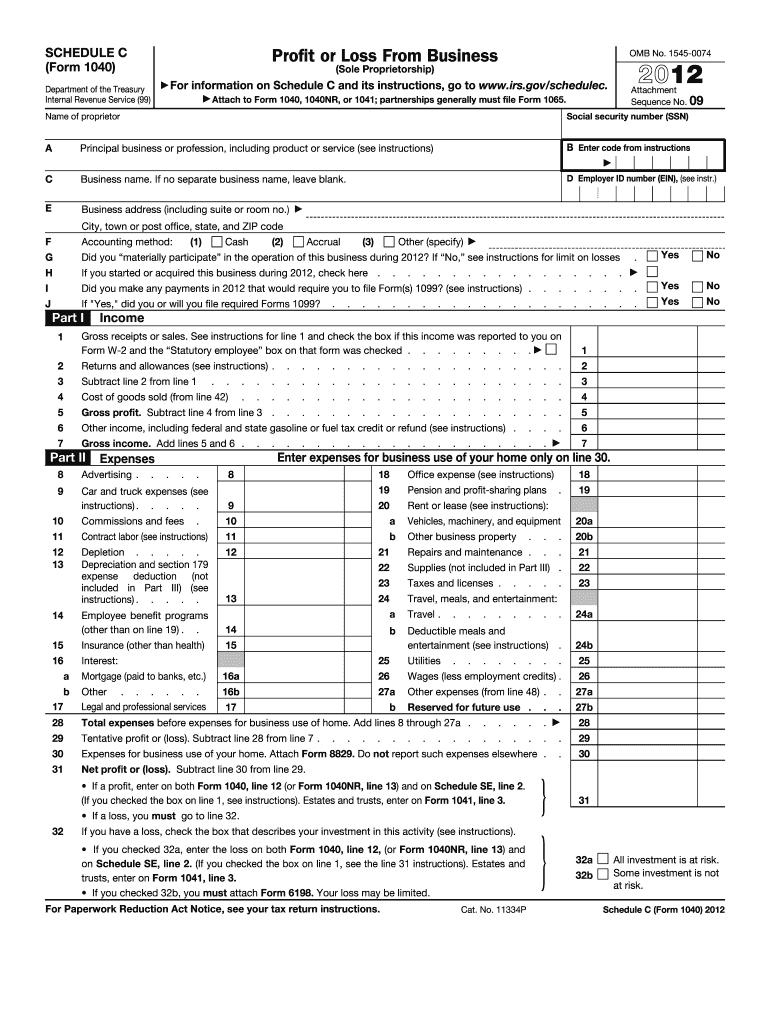

Fillable Schedule C Form 1040 Profit Or Loss From Business 2012 Printable Pdf Download

Schedule C Fill Online Printable Fillable Blank 2021 Tax Forms 1040 Printable

IRS 1040 Schedule C 2015 Fill Out Tax Template Online US Legal Forms

Free Printable Schedule C Tax Form

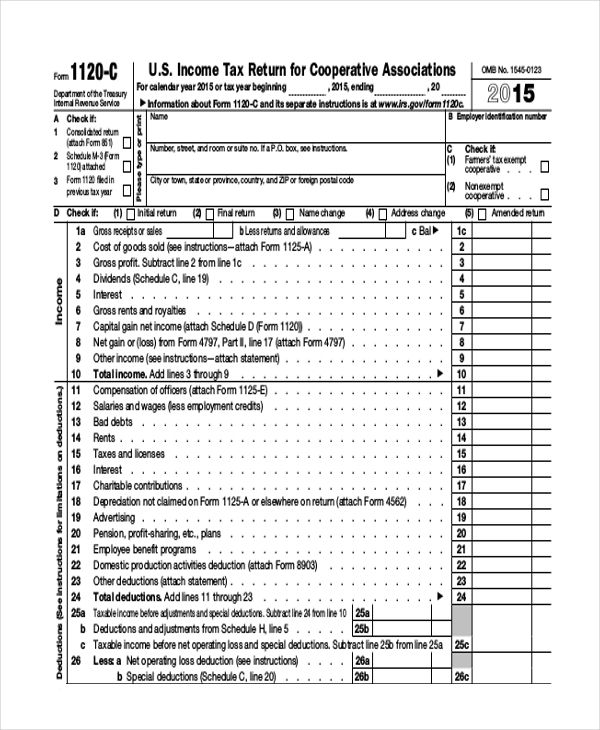

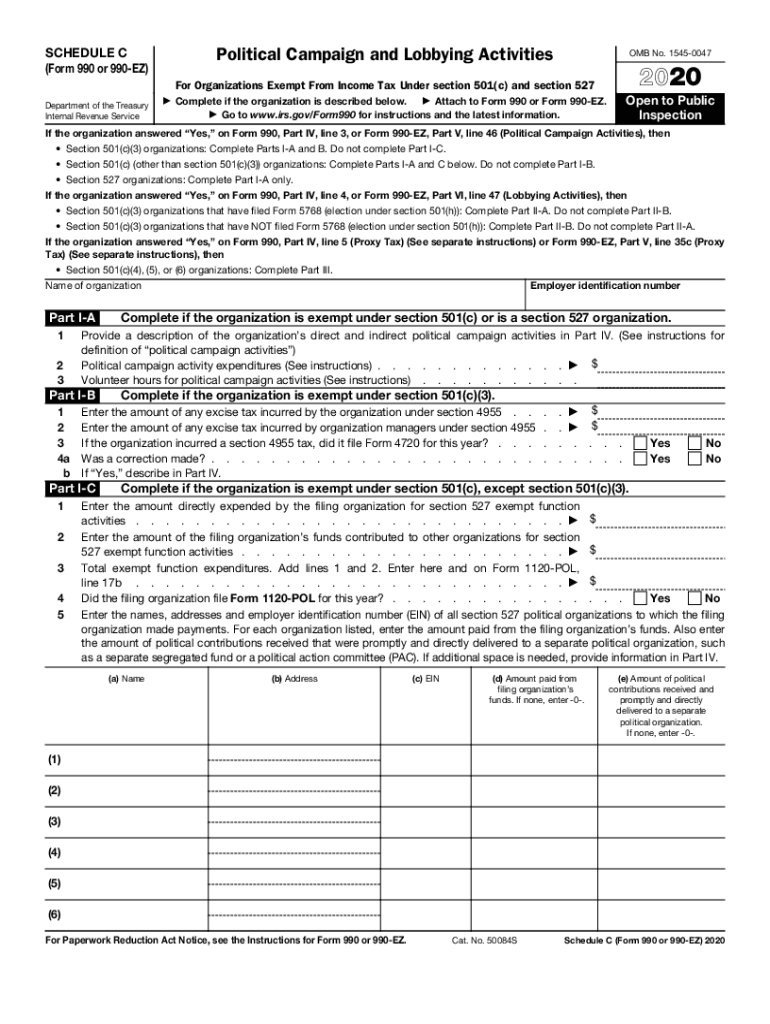

IRS 990 Or 990 EZ Schedule C 2020 Fill Out Tax Template Online US Legal Forms

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

1040 Schedule C 2012 2023 Form Fill Out And Sign Printable PDF Template SignNow

Form 1040 Schedule C Edit Fill Sign Online Handypdf

Printable Schedule C

Free Printable Schedule C Tax Form - What Is a Schedule C Form A form Schedule C Profit or Loss from Business Sole Proprietorship is a two page IRS form for reporting how much money you made or lost working for yourself hence the sole proprietorship In other words it s where you report the money you made and subtract your expenses to figure out your net profit