Free Printable Tax Extension Form Generally no However there are a few cases in which you can Do I need to file a tax extension if I m getting a refund If you re getting a federal refund the short answer is no However it s still a good idea to file an extension to protect yourself and it s free to do so Learn more Do I need to file a tax extension for my state taxes

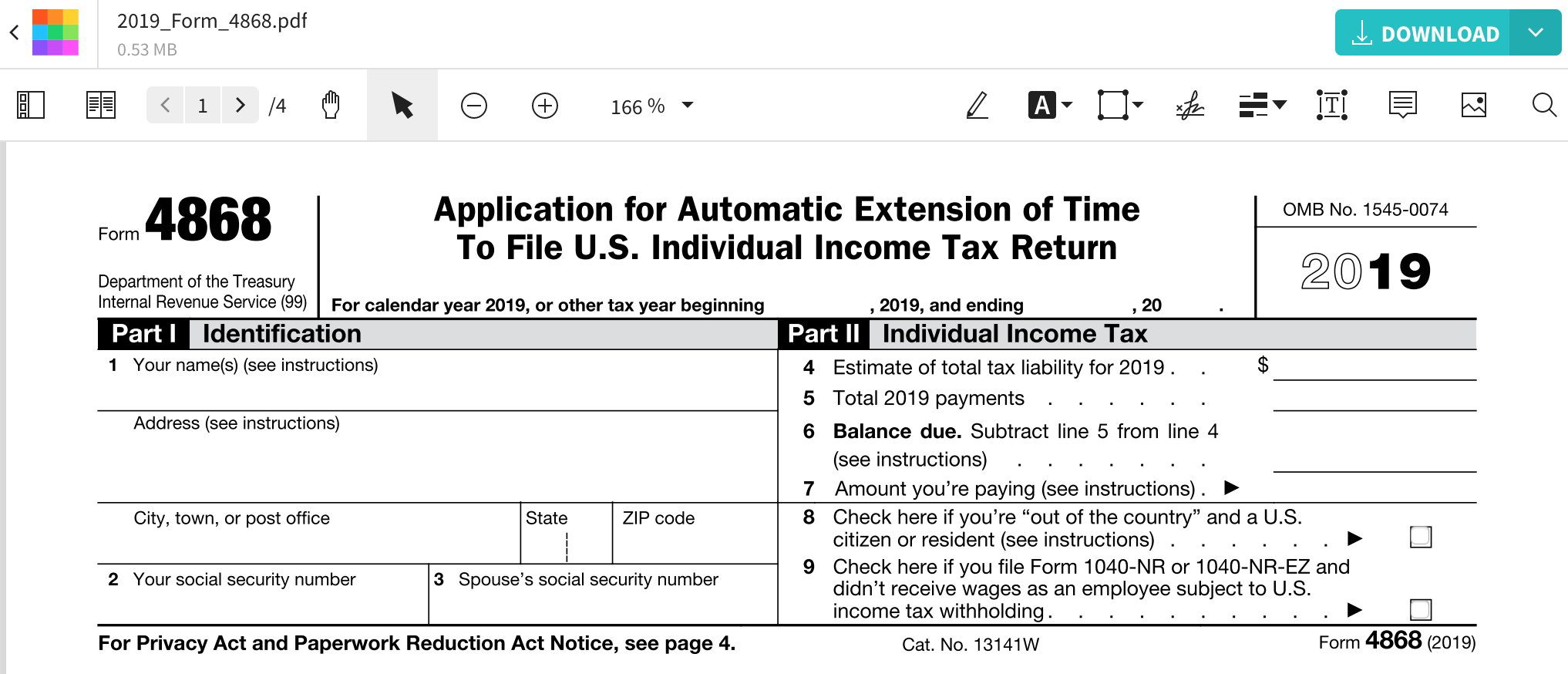

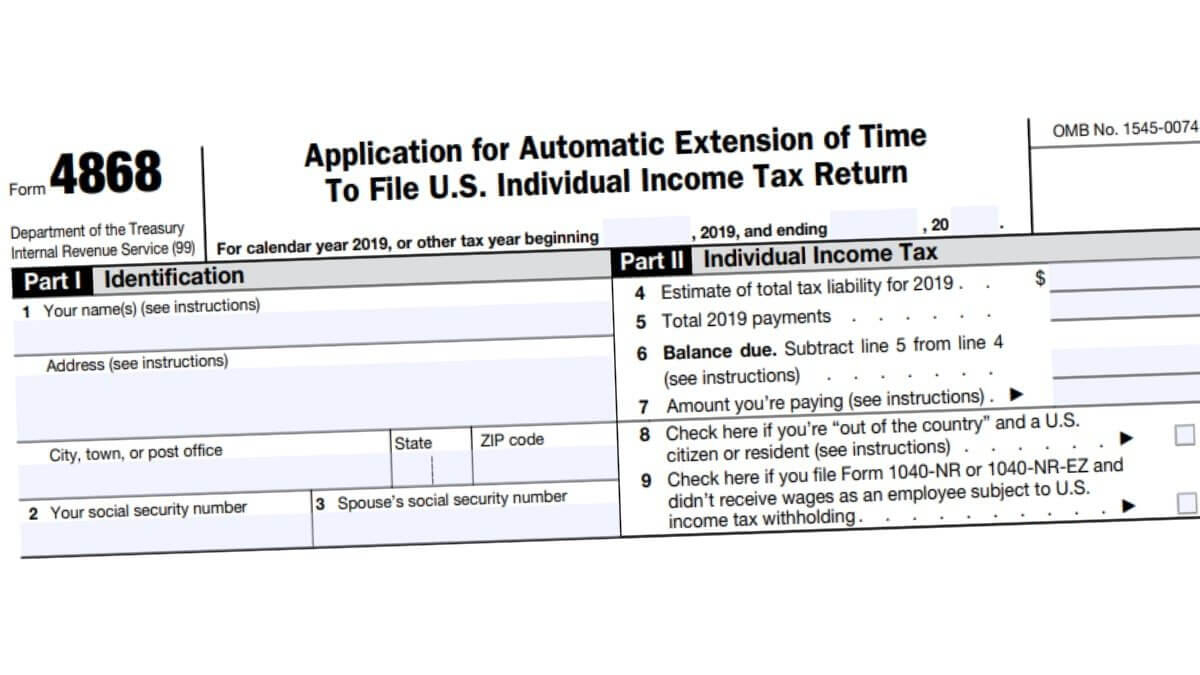

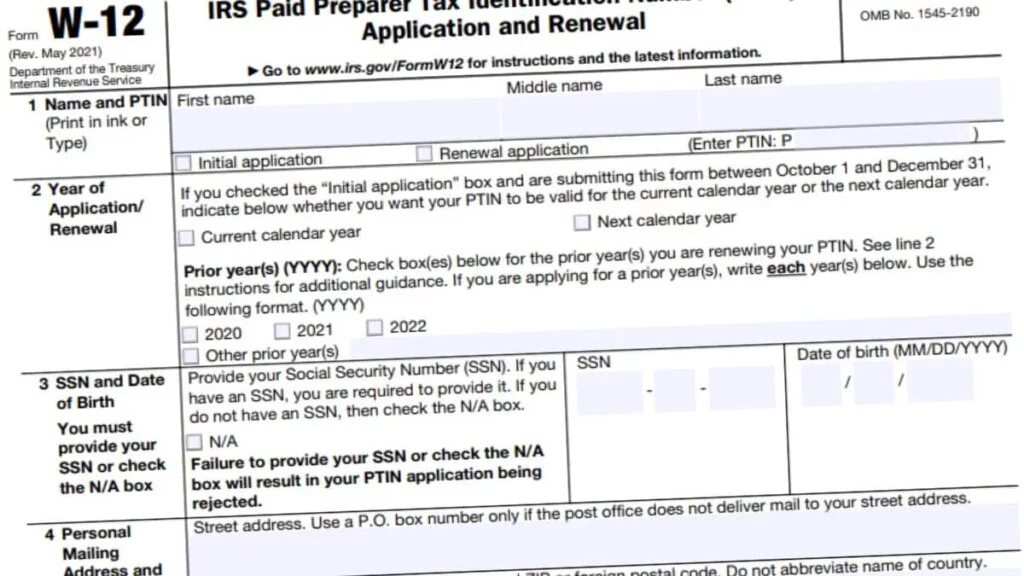

A tax return extension gives you six more months to file but you must still pay your taxes on time You can request an extension Online using IRS Free File program When you pay your estimated tax bill Using IRS Form 4868 If you feel that you may not be able to pay your tax bill in full by the due date you may be eligible to pay in What is Form 4868 IRS Form 4868 also known as an Application for Automatic Extension of Time to File is a form that taxpayers can submit to the IRS if they need more time to file their

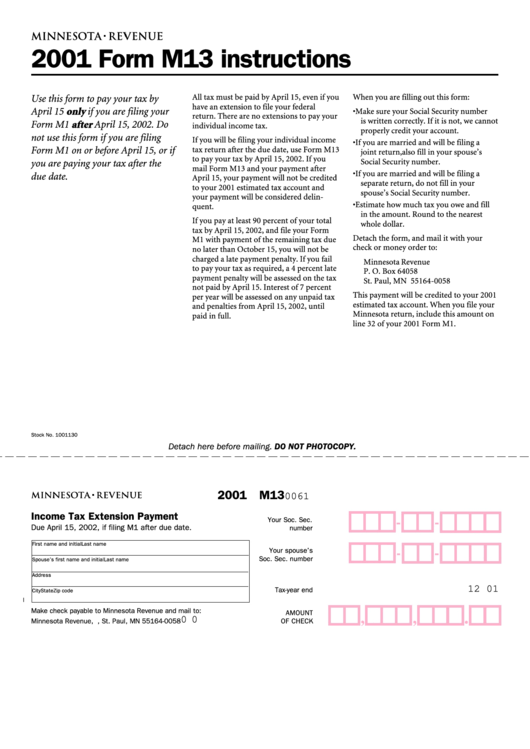

Free Printable Tax Extension Form

Free Printable Tax Extension Form

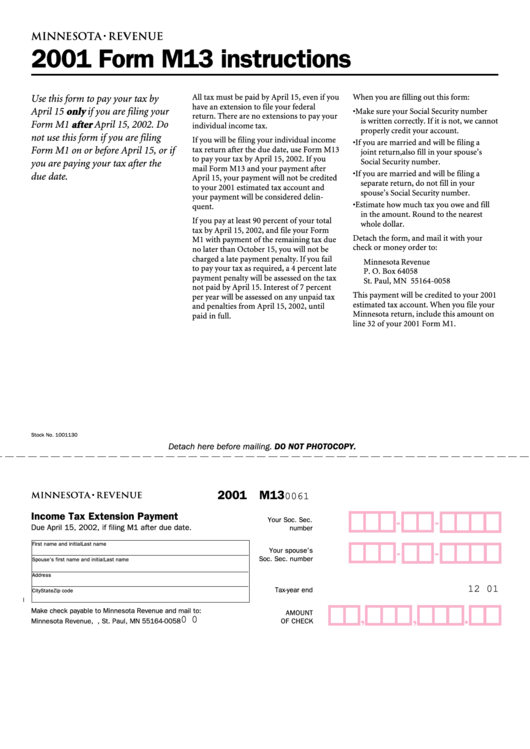

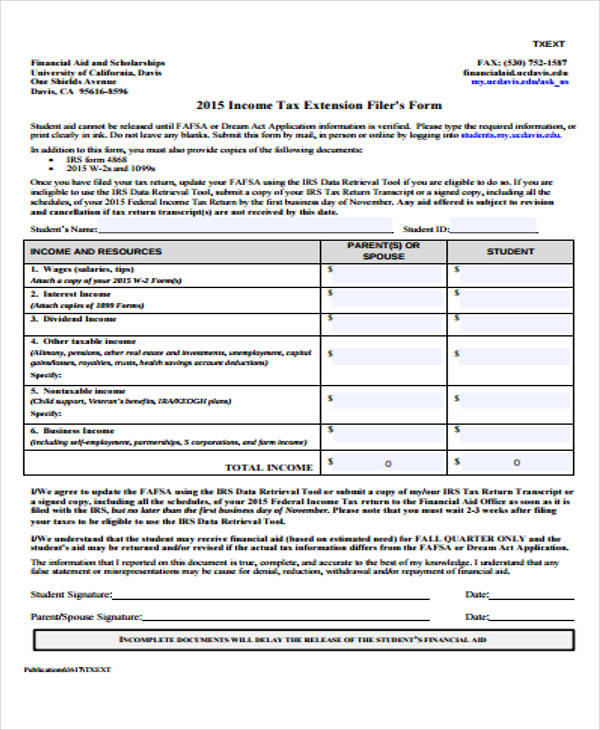

https://data.formsbank.com/pdf_docs_html/227/2270/227019/page_1_thumb_big.png

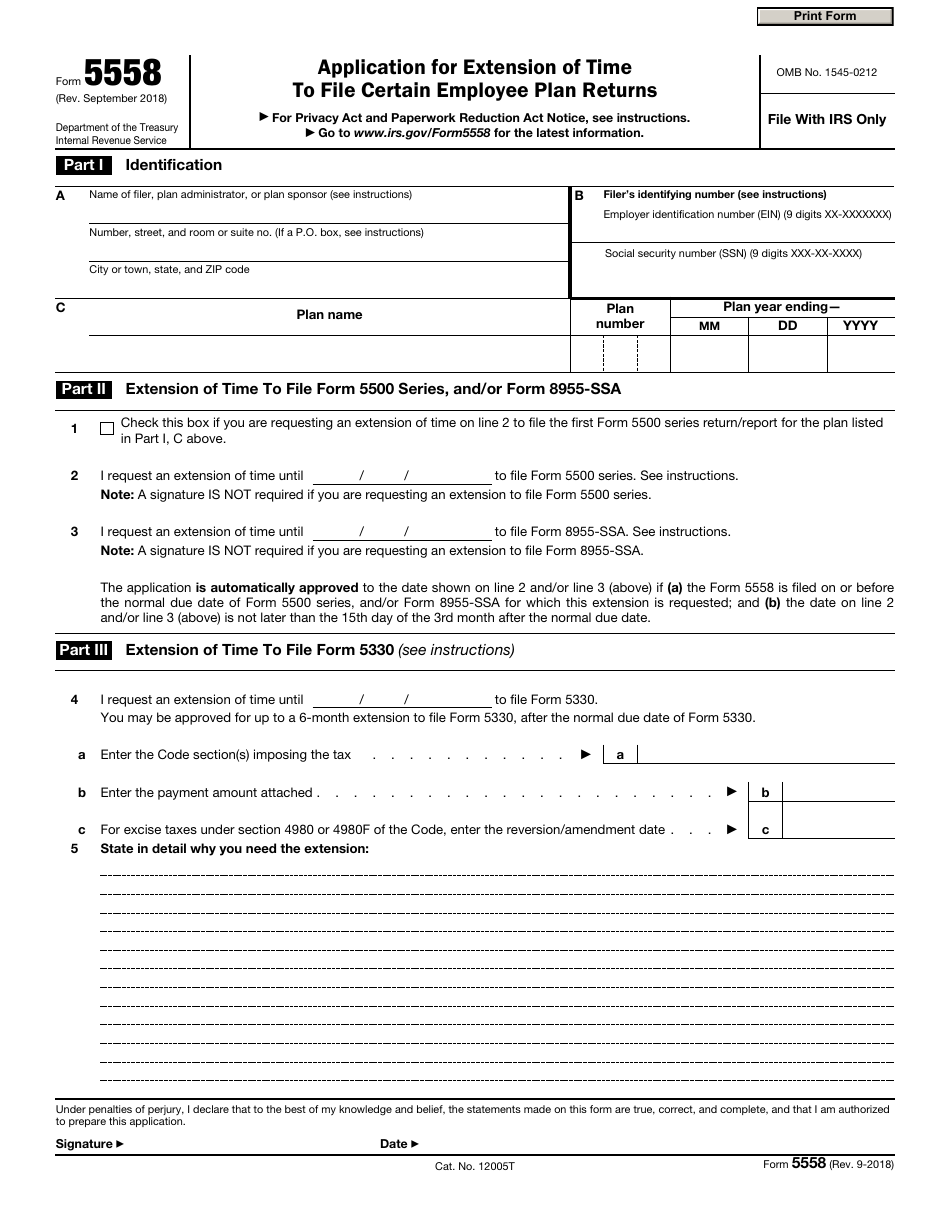

Tax Extension Form Printable

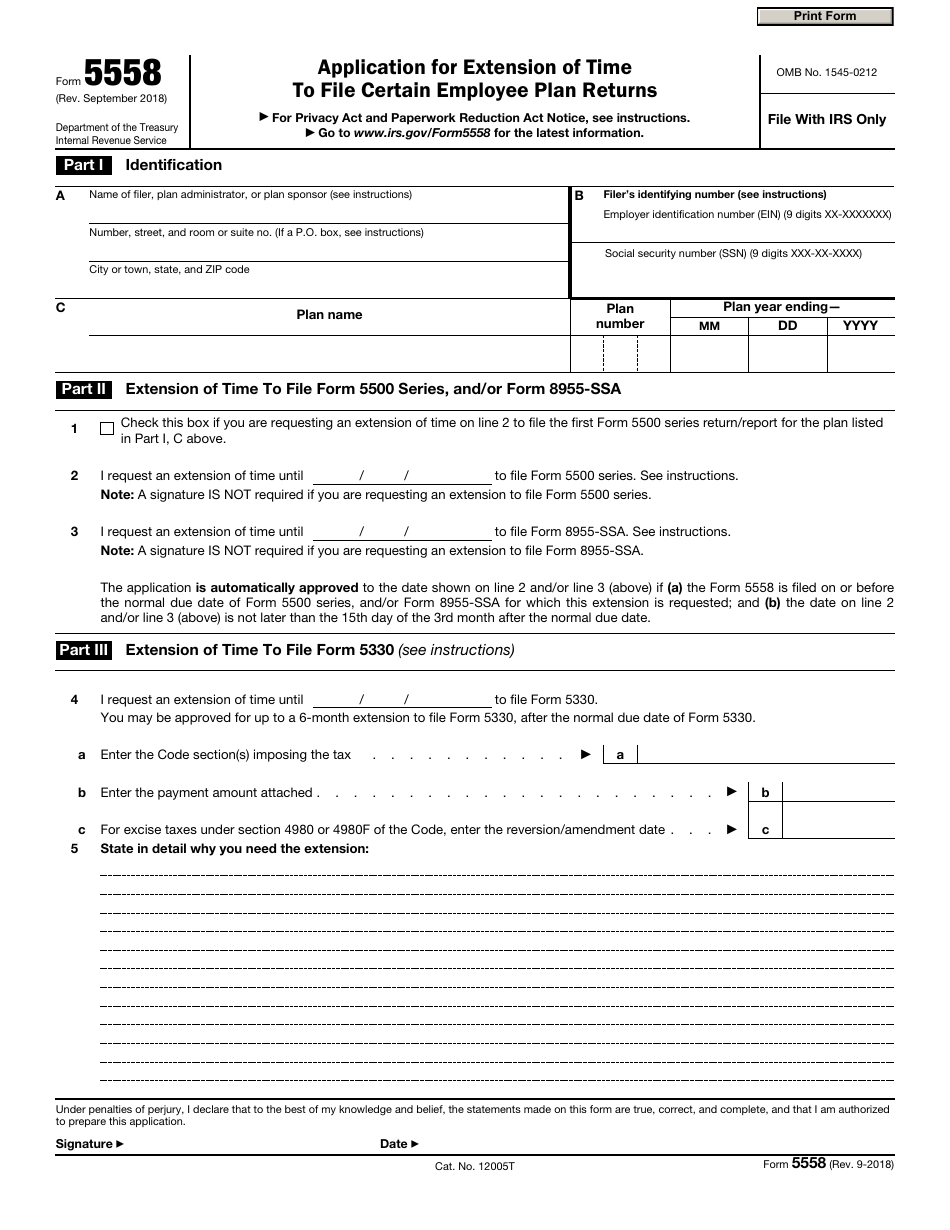

https://data.templateroller.com/pdf_docs_html/1862/18623/1862354/irs-form-5558-application-extension-time-to-file-certain-employee-plan-returns_print_big.png

Irs 2016 Extension Form 4868 Tutorpaas

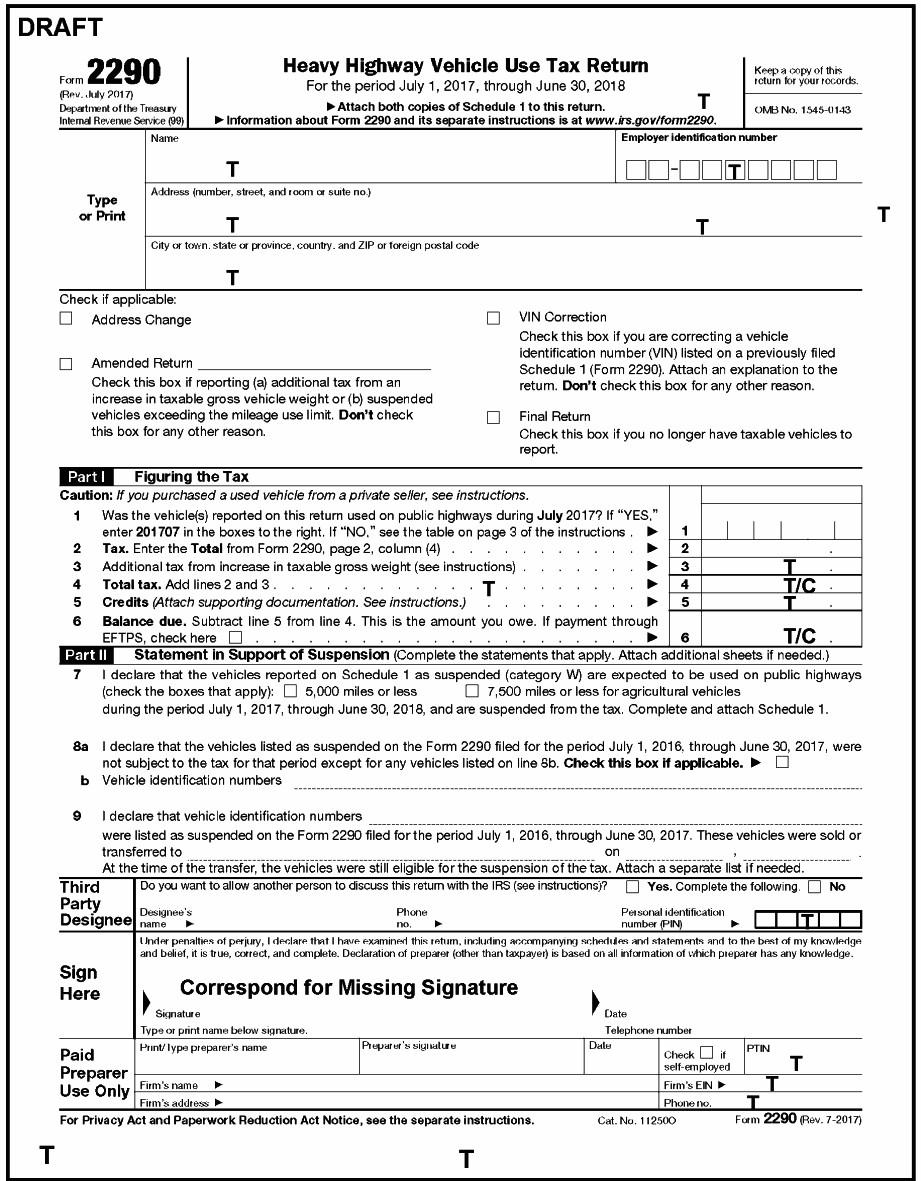

https://hadayak.com/images/971586.jpg

A tax extension is a request for additional time to file your federal income tax return with the IRS Tax extensions can help you avoid incurring a late filing penalty You can submit For online tax extension requests you can get started by using the IRS s Free File tools Regardless of income you can use guided tax software through the IRS s free file partners to submit your request and avoid filling out any forms directly If you prefer to fill out the request yourself you can use the IRS s Free Fillable Forms

All other Form 1040 NR 1040 PR and 1040 SS filers P O Box 1302 Charlotte NC 28201 1302 USA Austin TX 73301 0045 USA Title 2022 Tax Federal Extension Form Create Document Updated October 24 2023 IRS Form 4868 also called the Application for Automatic Extension of Time to File U S Individual Income Tax Return is used by those that need more time to file their federal income tax return Submission of the form allows for an automatic six month extension to file taxes

More picture related to Free Printable Tax Extension Form

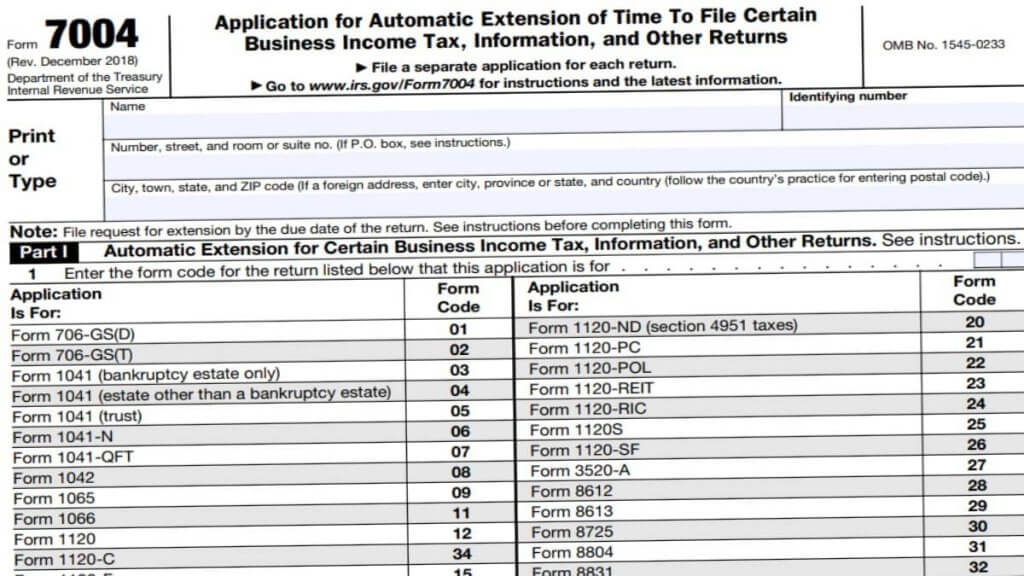

Business Tax Extension 7004 Form 2021

https://www.taxuni.com/wp-content/uploads/2020/09/Business-Tax-Extension-7004-Form-2021-1024x576.jpg

Printable Tax Extension Form Printable Form 2022

https://www.printableform.net/wp-content/uploads/2021/11/free-20-service-form-formats-in-pdf-ms-word.jpg

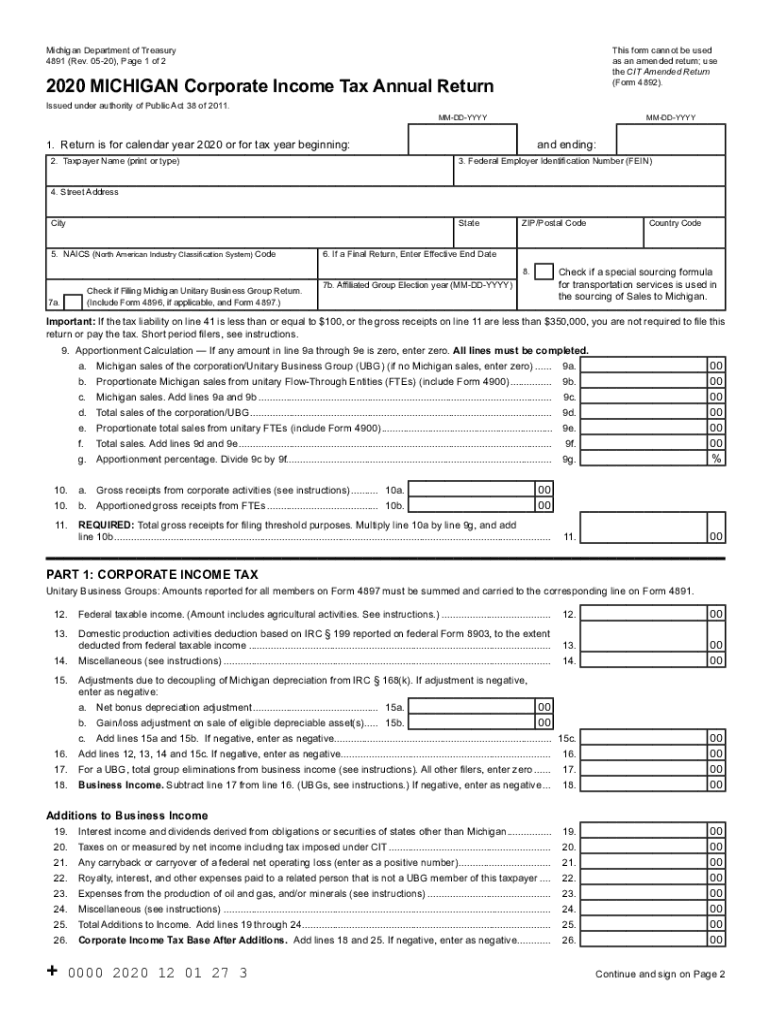

2020 2022 Form MI DoT 4891 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/552/439/552439875/large.png

There are two methods for printing Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return One method is to return to the extension steps review your entries and then print a copy of the form Note Although the current date is requested in this process the date is not printed on Form 4868 The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms

Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services To e file Form 4868 the IRS federal tax extension form for individuals just select the extension button above and eFileIT for free For more details follow these points See simple instructions on how to eFile an IRS Tax Extension for free and or pay IRS taxes File your return or extension by April 15 or Tax Day

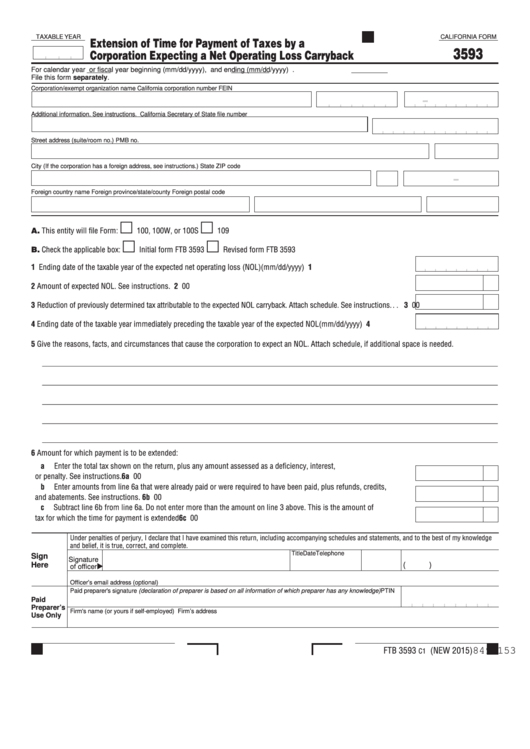

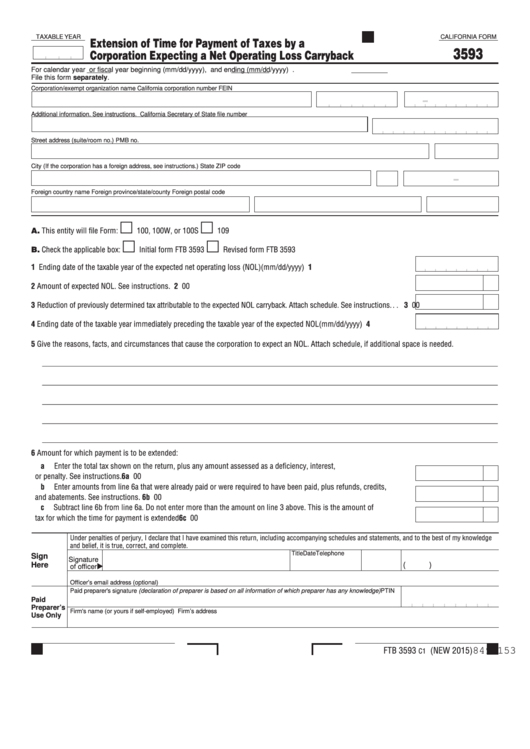

Fillable Form 3593 California Extension Of Time For Payment Of Taxes By A Corporation

https://data.formsbank.com/pdf_docs_html/333/3331/333131/page_1_thumb_big.png

Free Printable Tax Extension Form Printable Forms Free Online

https://calendargraphicdesign.com/wp-content/uploads/2021/01/form-4868-fill-irs-extension-form-online-for-free-smallpdf.png

https://turbotax.intuit.com/irs-tax-extensions/

Generally no However there are a few cases in which you can Do I need to file a tax extension if I m getting a refund If you re getting a federal refund the short answer is no However it s still a good idea to file an extension to protect yourself and it s free to do so Learn more Do I need to file a tax extension for my state taxes

https://www.usa.gov/federal-tax-extensions

A tax return extension gives you six more months to file but you must still pay your taxes on time You can request an extension Online using IRS Free File program When you pay your estimated tax bill Using IRS Form 4868 If you feel that you may not be able to pay your tax bill in full by the due date you may be eligible to pay in

FREE 7 Sample Federal Tax Forms In PDF

Fillable Form 3593 California Extension Of Time For Payment Of Taxes By A Corporation

Free Printable Tax Extension Form Printable Forms Free Online

Free Printable Tax Extension Form Printable Forms Free Online

IRS Extension 2022 Form 4868 IRS Forms TaxUni

Tax Extension Form 2023 Online Printable Forms Free Online

Tax Extension Form 2023 Online Printable Forms Free Online

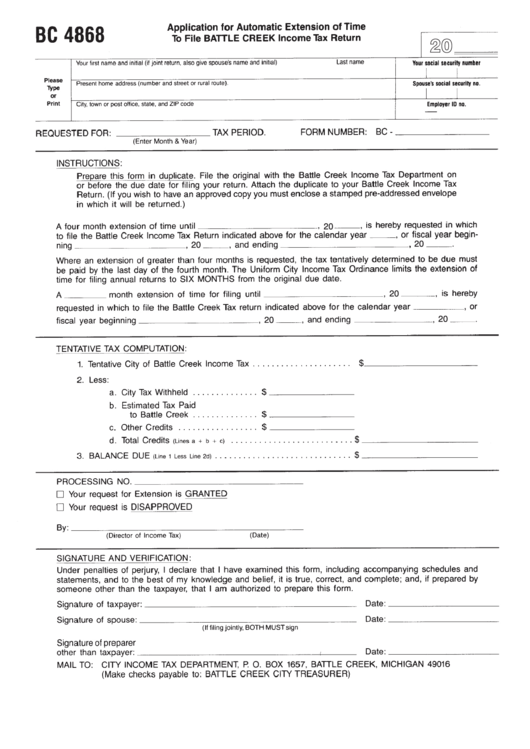

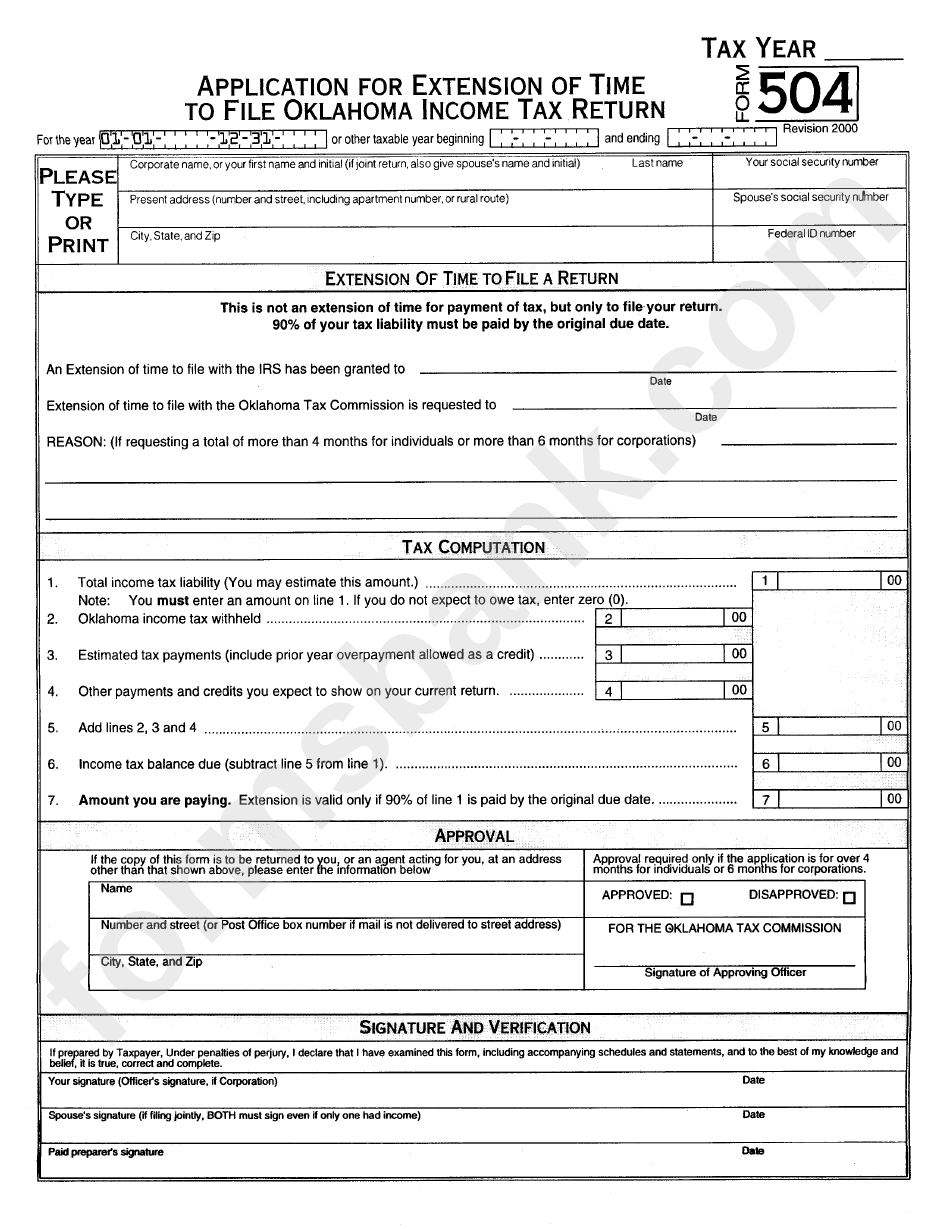

Form 504 Application For Extension Of Time To File Oklahoma Income Tax Return 2003 Printable

File Personal Tax Extension 2021 IRS Form 4868 Online

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

Income Tax Extension 2023 Form Printable Forms Free Online

Free Printable Tax Extension Form - Free File Fillable Forms are electronic federal tax forms equivalent to a paper 1040 form You should know how to prepare your own tax return using form instructions and IRS publications if needed It provides a free option to taxpayers whose income AGI is greater than 79 000