Free Printable Transfer On Death Deed Form Illinois Page 2 of 2 Transfer on Death Instrument cookcountyclerkil gov Rev 02 08 22 TRANSFER ON DEATH INSTRUMENT PAGE 2 THIS INSTRUMENT IS EXEMPT PURSUANT TO 35 ILCS 200 31 45 PARA PROPERTY TAX CODE As referenced on the foregoing page the aforementioned OWNER S does now hereby CONVEY and TRANSFER effective upon the death of

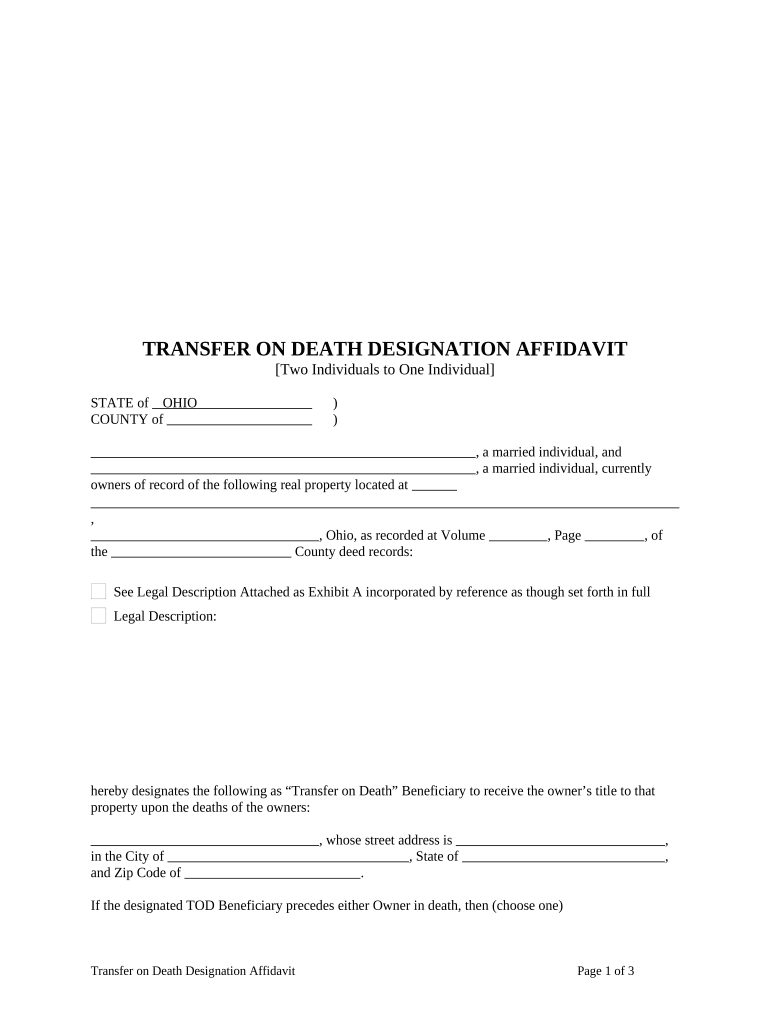

THis Transfer On deaTH insTrUmenT made this day of 20 by name of owner s of the city of county of Owner Owners being the sole Owner s of the following legally described residential real estate located in county illinois legal description Property identification number Property address state of illinois herein Help ILAO open opportunities for justice Fill out and sign the transfer on death instrument TODI form and have it notarized TODI program to help you fill out the Transfer on Death Instrument Form You can also pay a lawyer to help you draft the form if you need help

Free Printable Transfer On Death Deed Form Illinois

Free Printable Transfer On Death Deed Form Illinois

https://esign.com/wp-content/uploads/Transfer-on-Death-Deed.png

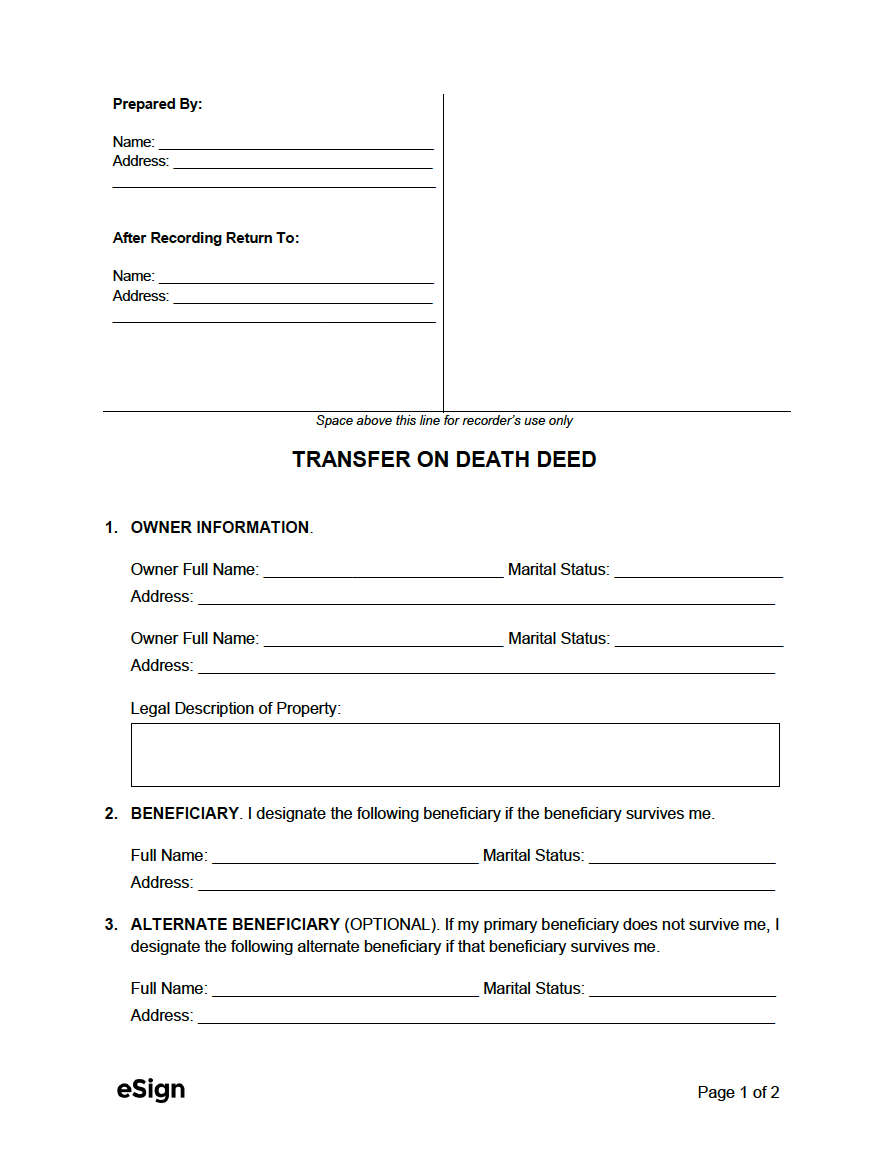

Transfer Death Tod Doc Template PdfFiller

https://www.pdffiller.com/preview/497/322/497322201/large.png

Free Printable Transfer On Death Deed Form Illinois Printable Forms Free Online

https://www.pdffiller.com/preview/495/574/495574104/large.png

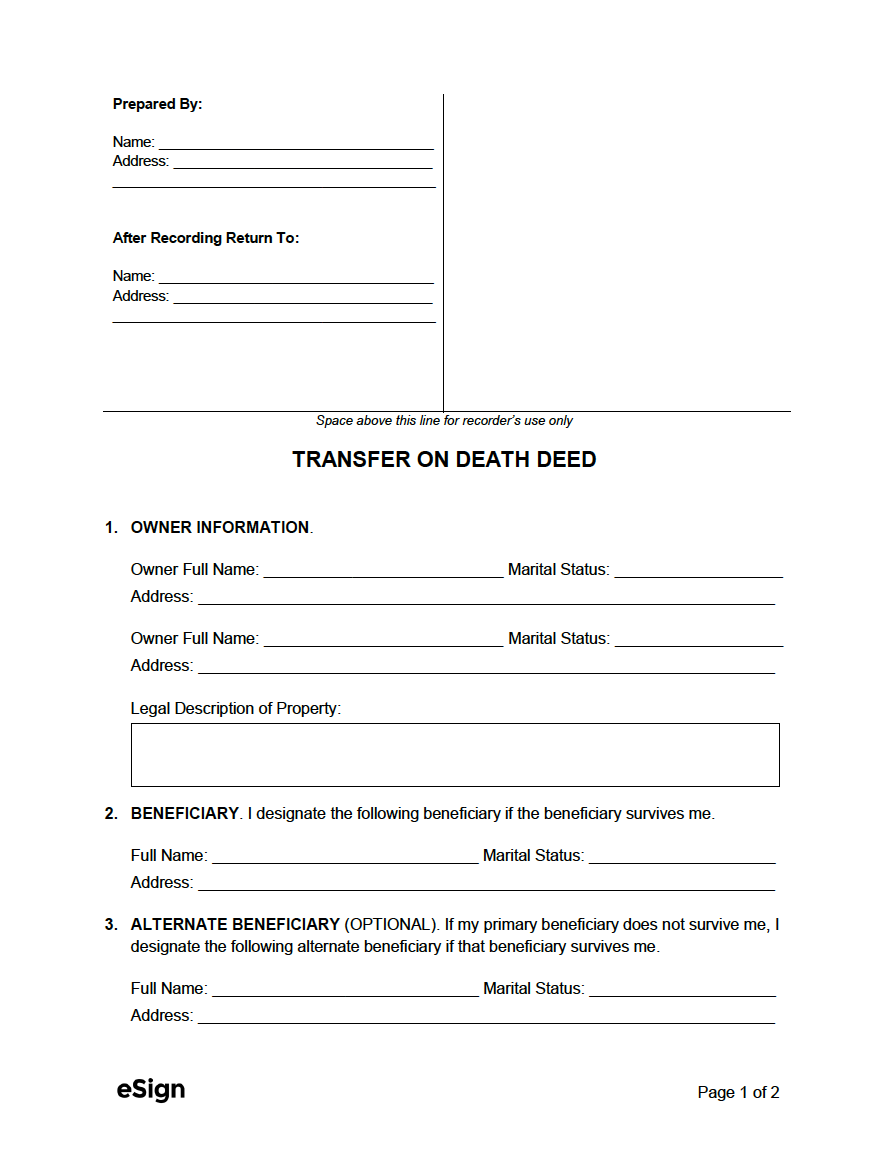

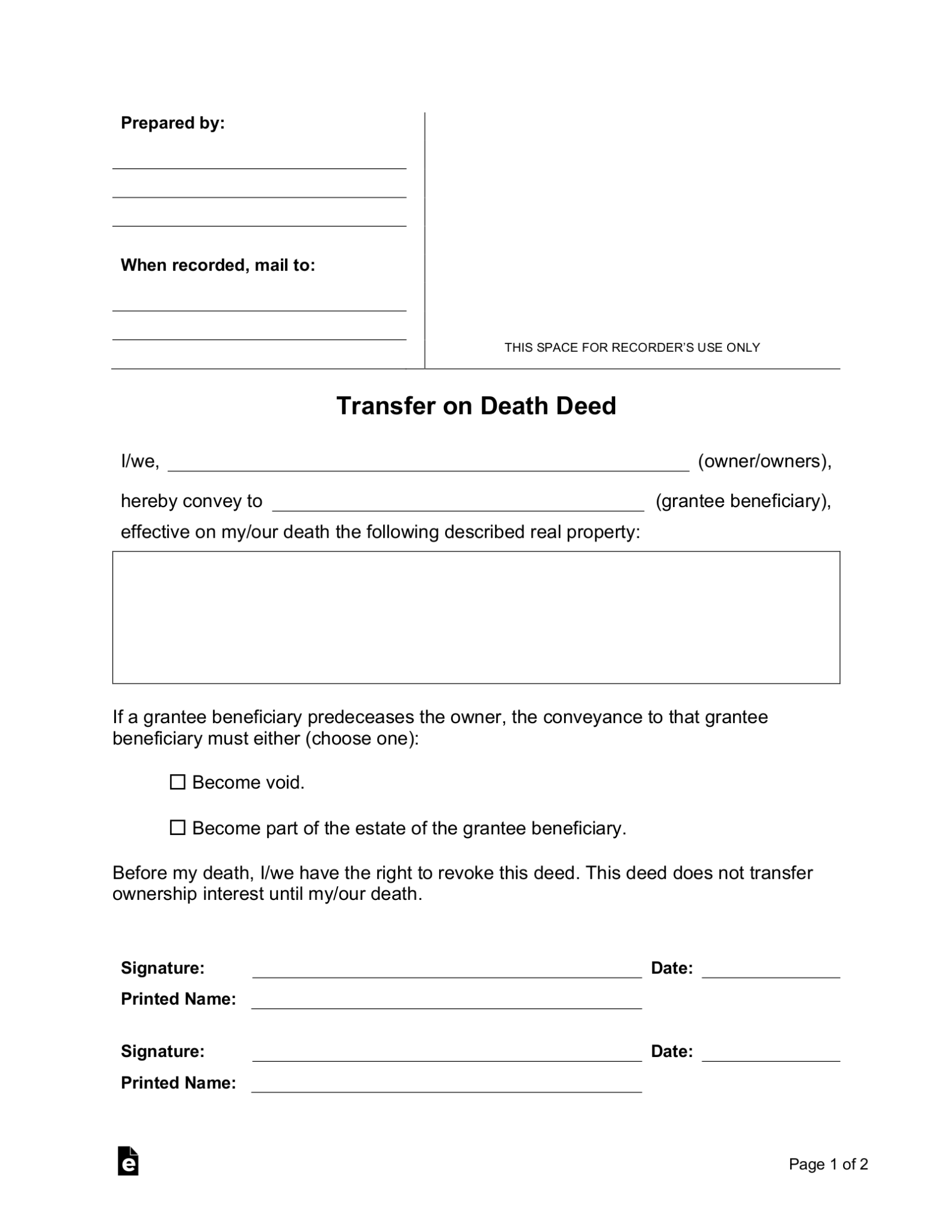

Last updated July 18th 2022 Downloads 4 781 Deeds Illinois Transfer on Death An Illinois transfer on death deed allows property owners to name a beneficiary to transfer the title to in the event of their death An Illinois Transfer on Death Deed is a legally binding document you can complete if you know who to name the heir of your property and think you should avoid the probate process to allow the beneficiary to take control of your property immediately after your passing

Help ILAO open opportunities for justice This program will help you prepare your documents It will ask you questions and you will enter your answers At the end of the program you will get a completed set of documents with instructions that you can save and print Form completion time 10 minutes to 20 minutes Tax benefits TOD instruments do not transfer the property until death so the current owner is treated as still owning the property until death This treatment allows the beneficiaries to take advantage of a step up in basis which permanently erases any taxable capital gain that accrued in the property before the owner s death Lower legal fees

More picture related to Free Printable Transfer On Death Deed Form Illinois

Transfer On Death Deed Georgia PDF Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/42/89/42089684/large.png

Free Printable Transfer On Death Deed Form Illinois Printable Forms Free Online

https://www.pdffiller.com/preview/100/689/100689729/large.png

Sample Transfer On Death Deed Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/131/1310/131070/page_1_bg.png

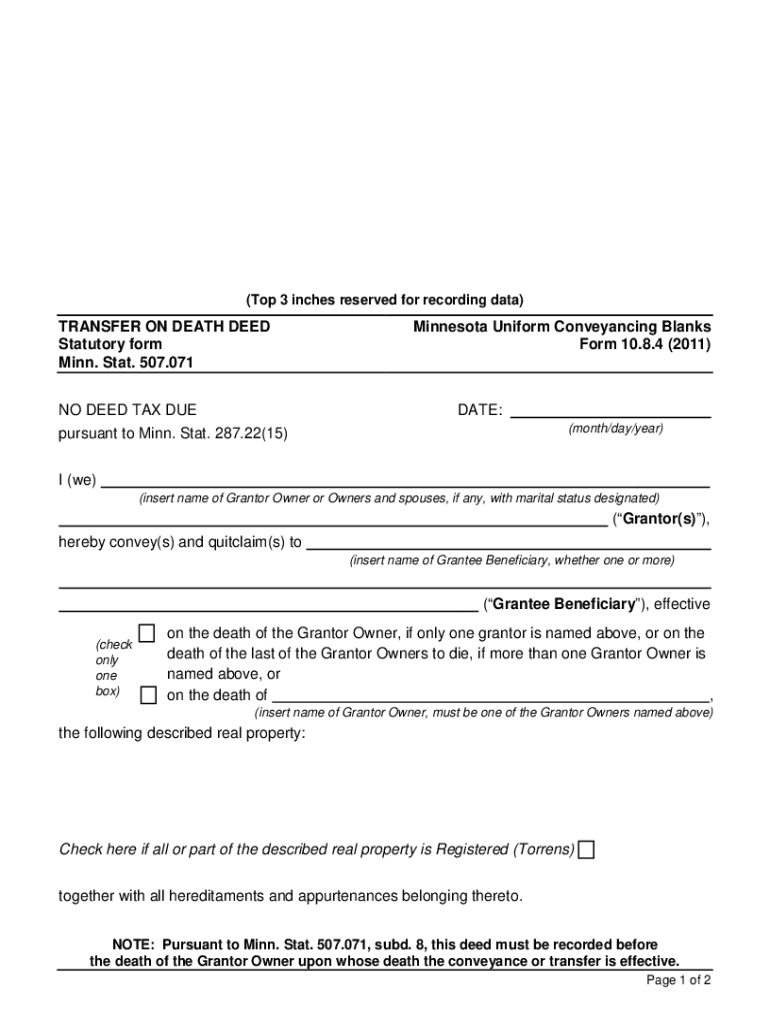

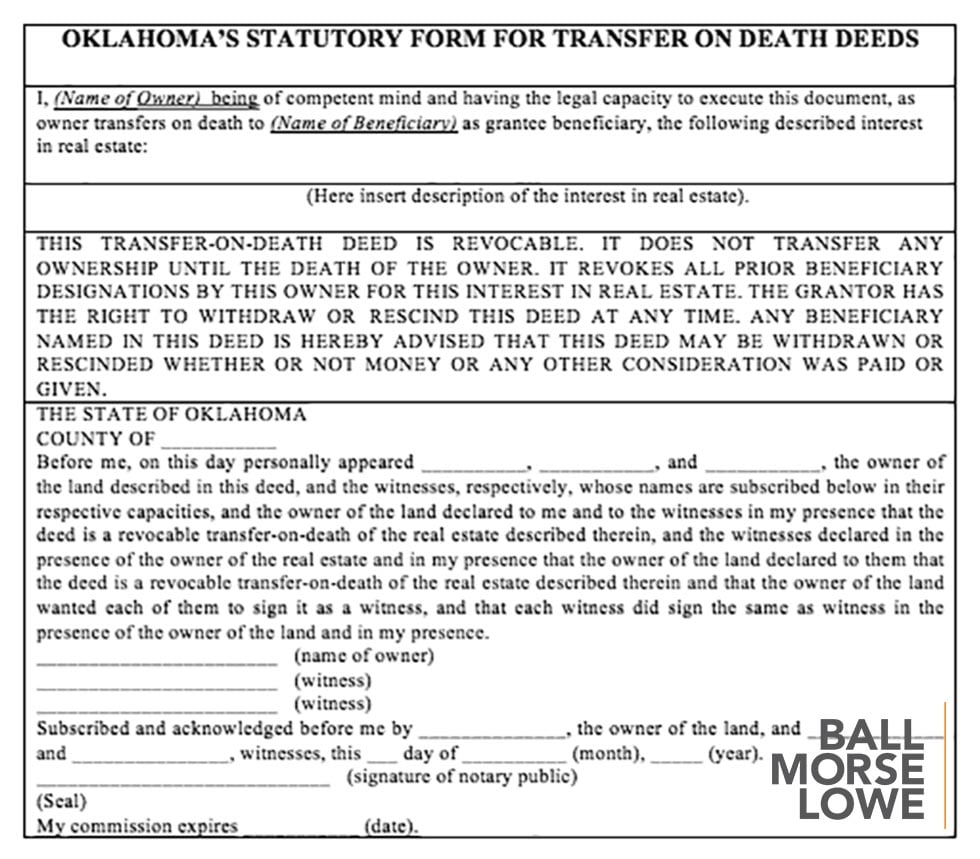

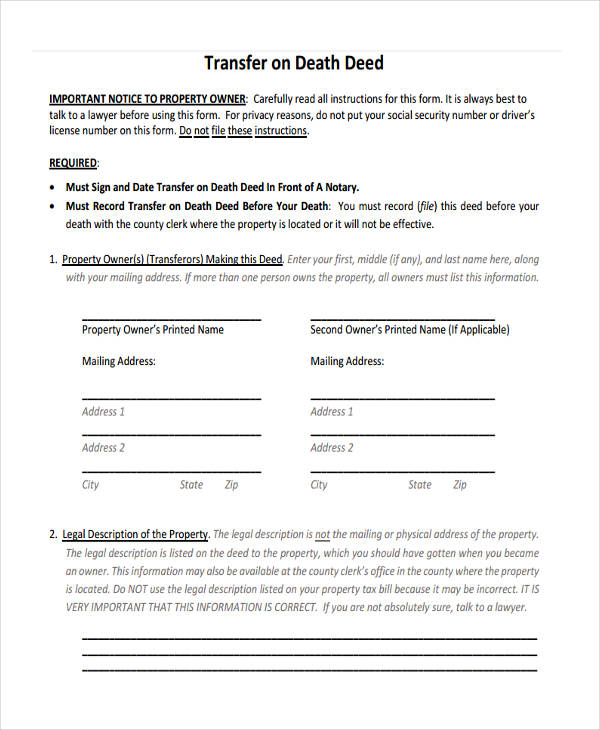

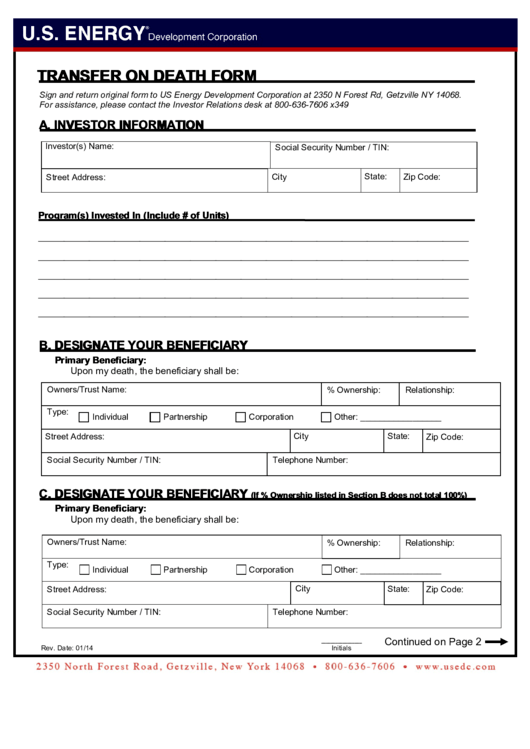

Free Transfer on Death Deed Make Download Rocket Lawyer Legal documents Real estate Home ownership Property title transfers MAKE YOUR FREE Transfer on Death Deed Make document Other Names Beneficiary Deed TOD Ladybird Deed Transfer on Death Form Transfer on Death Instrument What we ll cover About Transfer on Death Deeds How Does a TOD Work A property owner creates a TOD deed by describing the real estate they want to transfer when they pass away and designating a beneficiary An owner can designate one or more beneficiaries and decide if the real estate will be evenly distributed or distributed by certain percentages

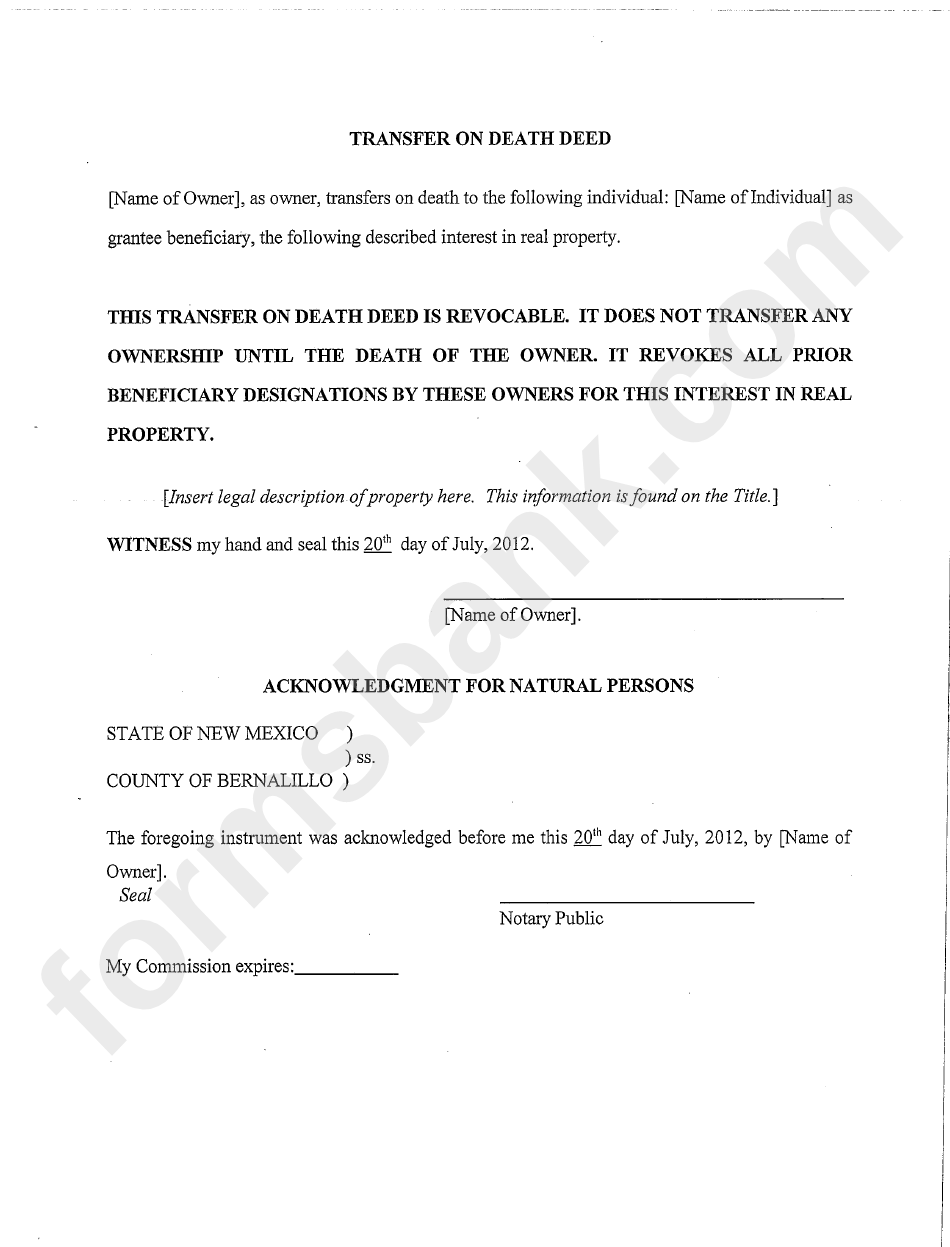

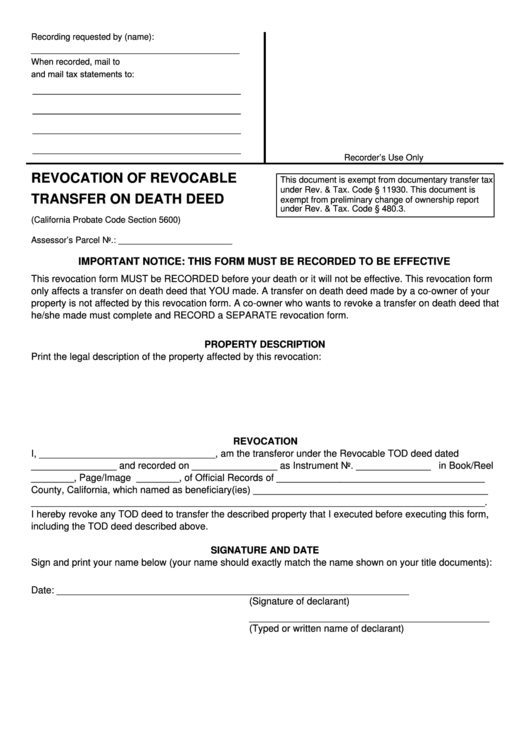

Select County Where the Property is Located Comparable to Ladybird beneficiary and enhanced life estate deeds these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner s death while retaining absolute possession of and control over the property while alive A transfer on death deed is a document that is used for transferring real estate to a person beneficiary upon the owner s death The deed has no effect over the owner s property until death occurs Should the owner grantor wish to lease renovate or even sell the property they retain the right to do so Also known as a Beneficiary deed

Notice Of Death Affidavit Illinois Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/6/641/6641148/large.png

Free Transfer On Death Deed Form PDF Word EForms

https://eforms.com/images/2023/06/Transfer-on-Death-Deed-1583x2048.png

https://www.cookcountyclerkil.gov/sites/default/files/pdfs/Transfer%20on%20Death%20Instrument%20-%20TODI%20-%202022.pdf

Page 2 of 2 Transfer on Death Instrument cookcountyclerkil gov Rev 02 08 22 TRANSFER ON DEATH INSTRUMENT PAGE 2 THIS INSTRUMENT IS EXEMPT PURSUANT TO 35 ILCS 200 31 45 PARA PROPERTY TAX CODE As referenced on the foregoing page the aforementioned OWNER S does now hereby CONVEY and TRANSFER effective upon the death of

https://www.isba.org/sites/default/files/sections/generalpracticesoloandsmallfirm/TODI%20forms.pdf

THis Transfer On deaTH insTrUmenT made this day of 20 by name of owner s of the city of county of Owner Owners being the sole Owner s of the following legally described residential real estate located in county illinois legal description Property identification number Property address state of illinois herein

Free Printable Transfer On Death Deed Form Illinois Printable Forms Free Online

Notice Of Death Affidavit Illinois Fill Online Printable Fillable Blank PdfFiller

Fillable Revocation Of Revocable Transfer On Death Deed Form Printable Pdf Download

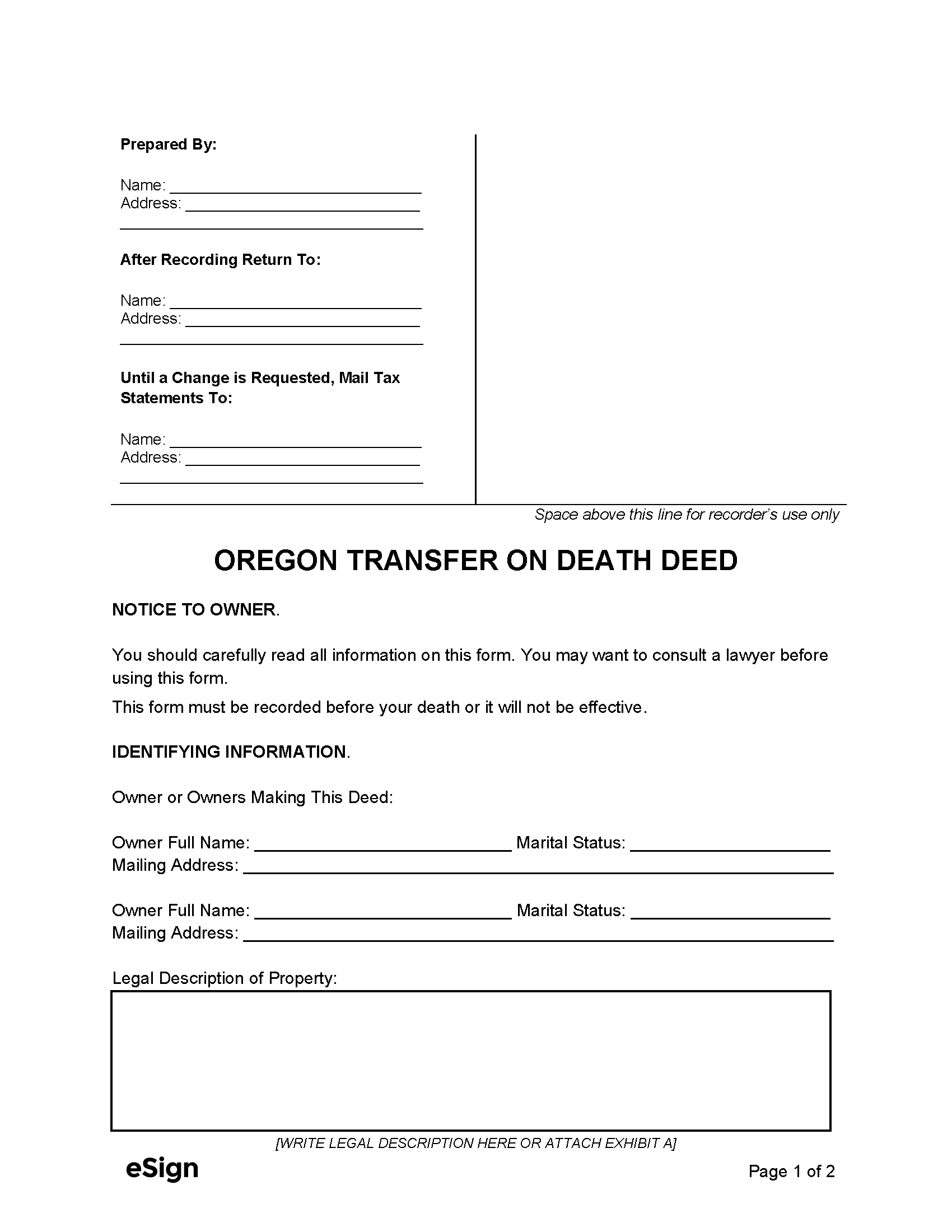

Free Oregon Transfer On Death Deed PDF Word

Transfer On Death Deed Ohio 2020 Fill And Sign Printable Template Online US Legal Forms

Free Illinois Transfer On Death Deed PDF Word EForms

Free Illinois Transfer On Death Deed PDF Word EForms

Transfer On Death Deed Template

Top 11 Transfer On Death Deed Form Templates Free To Download In PDF Format

Transfer Death Form Fill Out And Sign Printable PDF Template SignNow

Free Printable Transfer On Death Deed Form Illinois - An Illinois Transfer on Death Deed is a legally binding document you can complete if you know who to name the heir of your property and think you should avoid the probate process to allow the beneficiary to take control of your property immediately after your passing