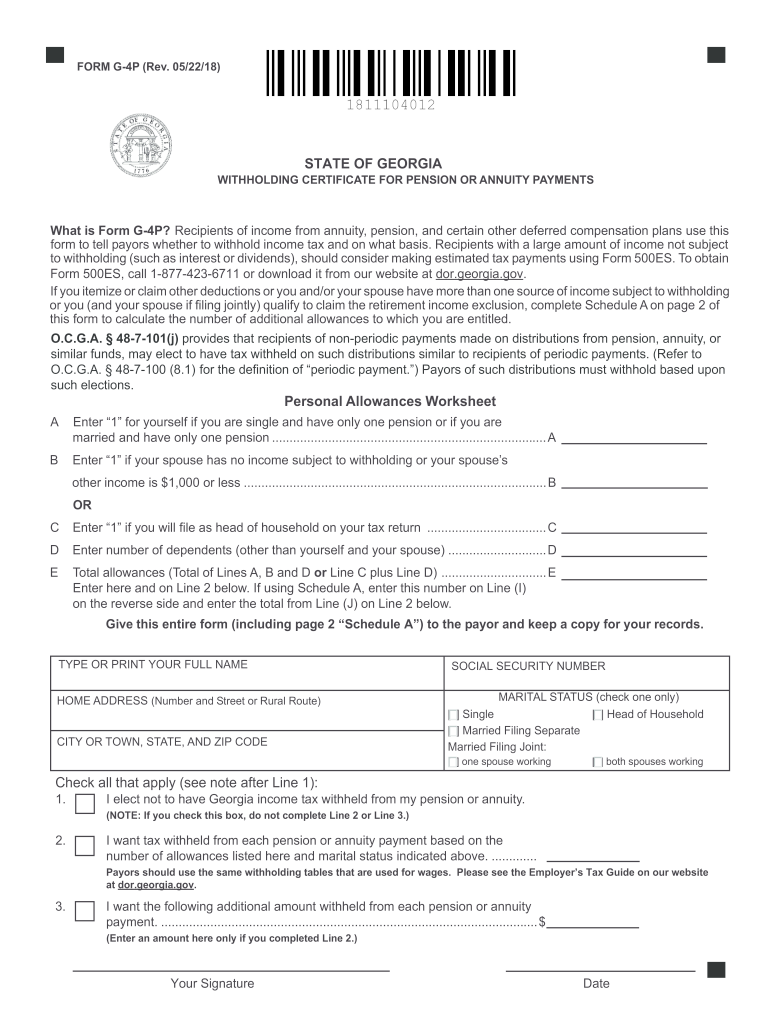

Ga Employer Quarterly With Holding Printable Tax Forms G 1003 Withholding Income Statement Return Withholding Income Statement Transmittal Form G 1003 For recipients of income from annuities pensions and certain other deferred compensation plans Use this form to tell payers whether to withhold income tax and on what basis G7 Withholding Quarterly Return For Monthly Payer

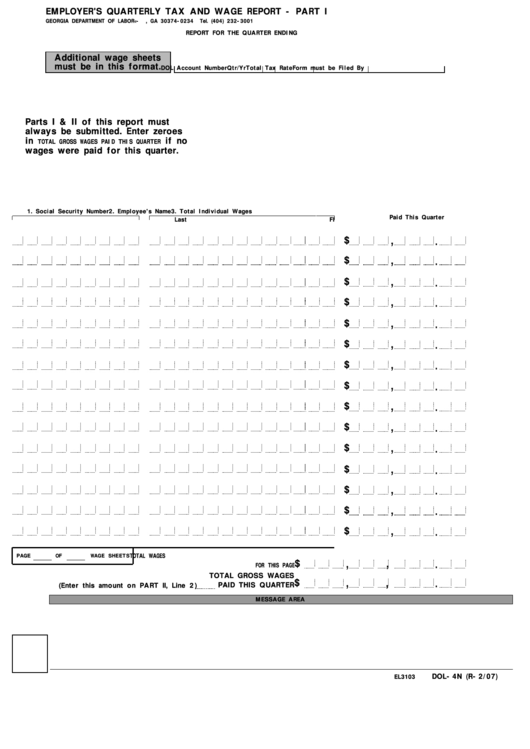

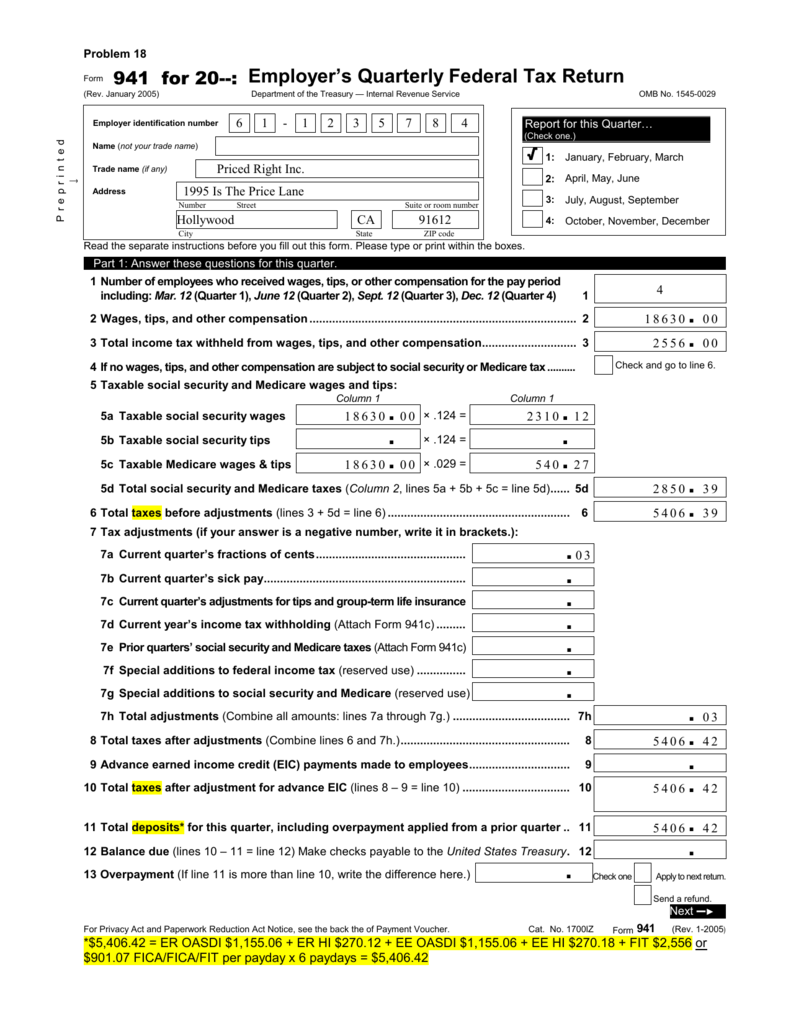

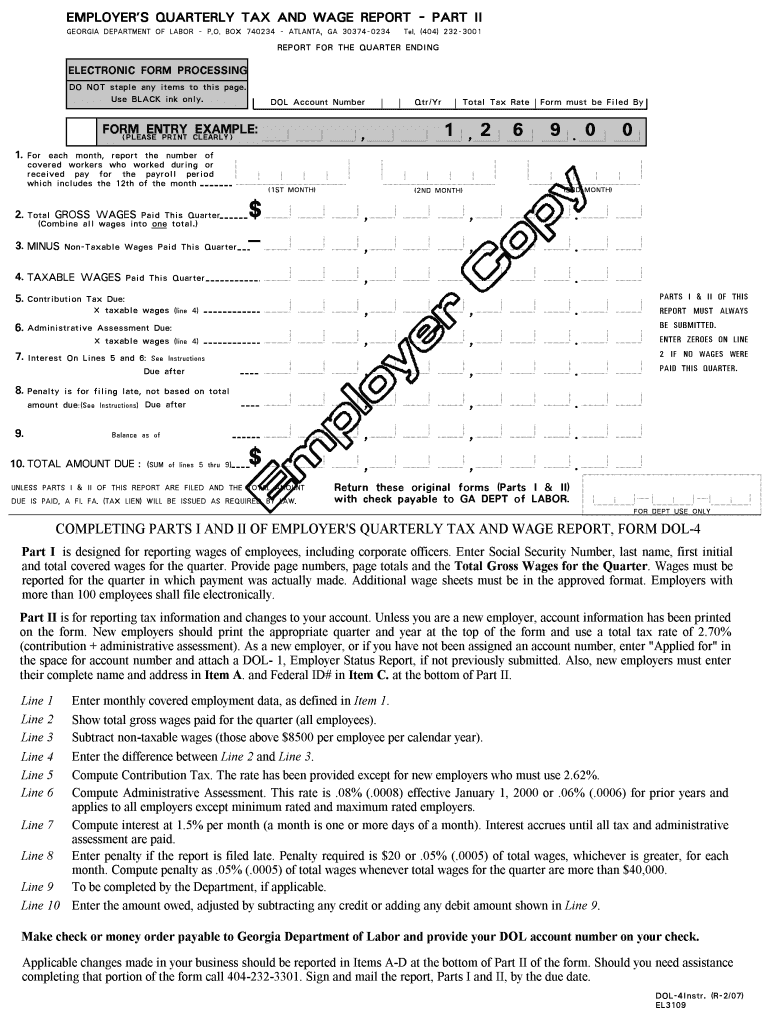

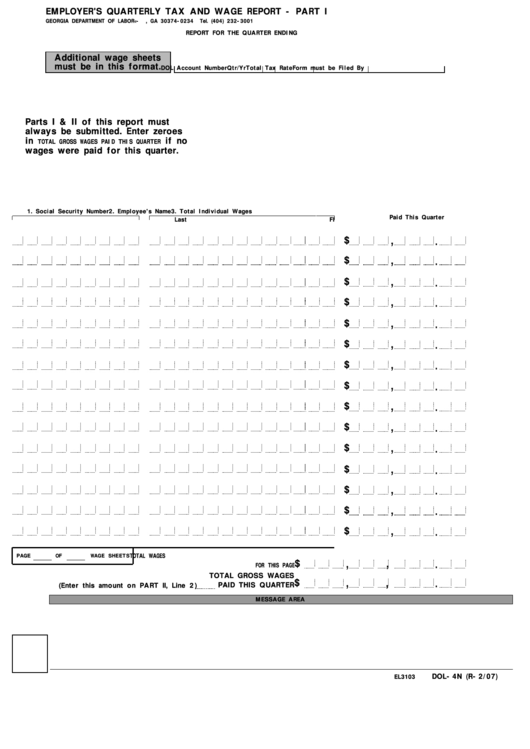

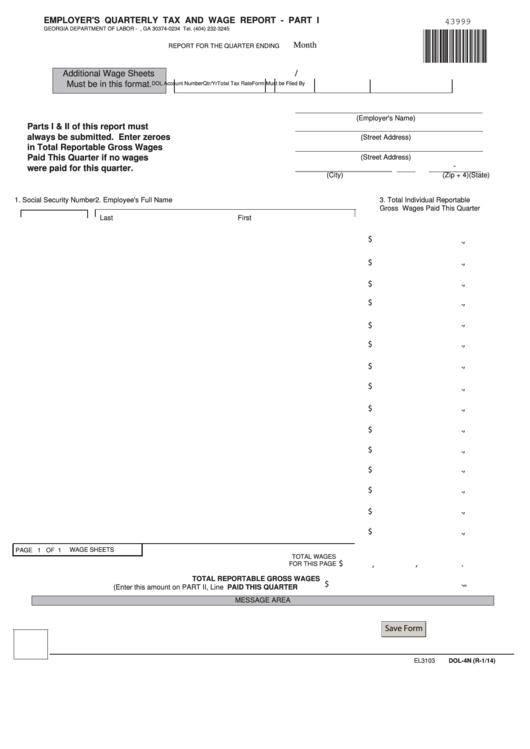

Most businesses must report and file tax returns quarterly using the IRS Form 941 This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations EMPLOYER S QUARTERLY TAX AND WAGE REPORT PART I GEORGIA DEPARTMENT OF LABOR P O BOX 740234 ATLANTA GA 30374 0234 Tel 404 232 3245 REPORT FOR THE QUARTER ENDING

Ga Employer Quarterly With Holding Printable Tax Forms

Ga Employer Quarterly With Holding Printable Tax Forms

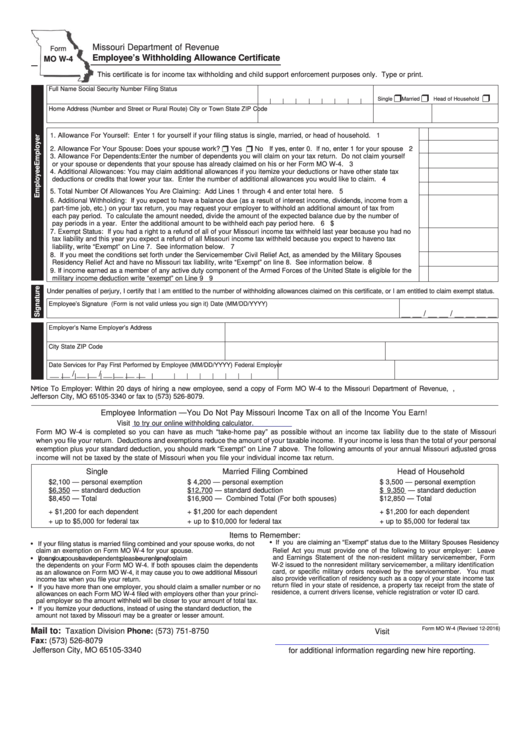

https://www.withholdingform.com/wp-content/uploads/2022/08/fillable-form-mo-w-4-employee-s-withholding-allowance-certificate-17.png

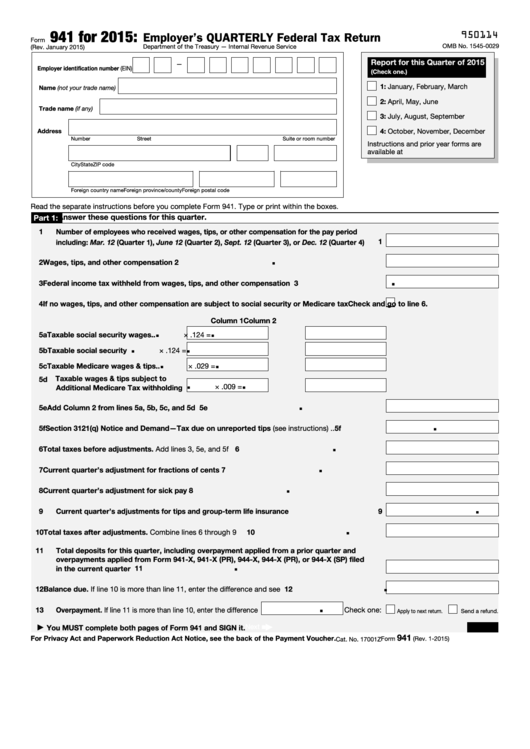

Printable 941 Form For 2020 Printable World Holiday

https://s3.studylib.net/store/data/008209946_1-9ecf812cafff096c9fead454d9cc809a.png

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

https://www.printableform.net/wp-content/uploads/2021/07/fillable-form-941-employer-s-quarterly-federal-tax-1.png

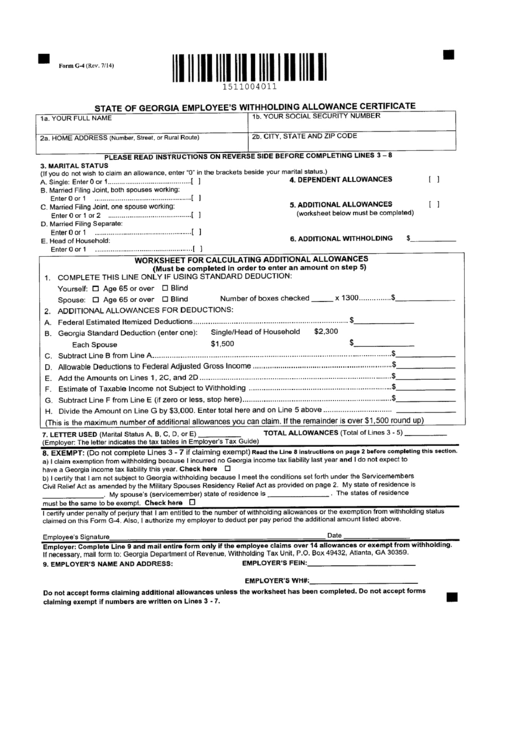

Form G4 is to be completed and submitted to your employer in order to have tax withheld from your wages Employees Withholding Allowance Certificate G 4 PDF 433 85 KB Contact Us About DOR Careers Each employer whose tax withheld or tax required to be withheld is 800 00 or less per year can remit payment with Form G 7 Quarterly Return on or before January 31 of the following year

All new employees should complete and sign the Federal W 4 and State G 4 tax forms The forms will be effective with the first paycheck If you do not provide Human Resources with the completed W 4 and G 4 forms taxes will be withheld at the maximum tax rate Federal W 4 form Georgia G 4 form All employers who are liable for unemployment insurance UI must file tax and wage reports for each quarter they are in business The reports and any payment due must be filed on or before April 30th July 31st October 31st and January 31st if the due date falls on a weekend or a legal holiday reports are due by the next business day Employers must report all wages paid to employees

More picture related to Ga Employer Quarterly With Holding Printable Tax Forms

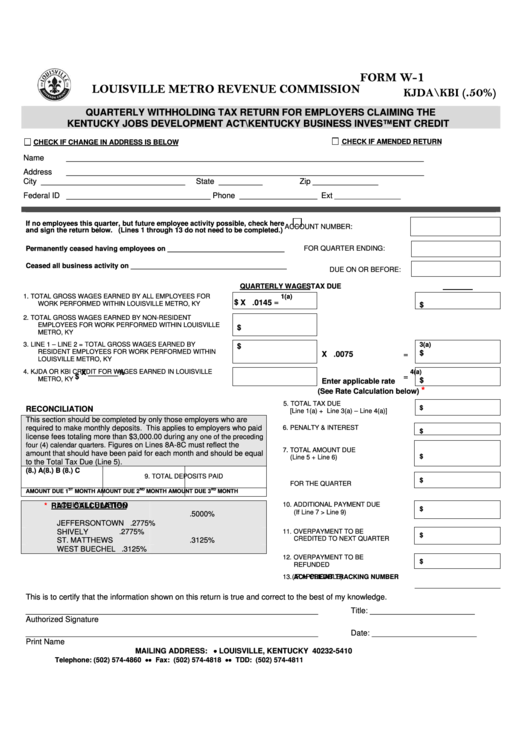

Fillable Form W 1 Kjdakbi Quarterly Withholding Tax Return For Employers Claiming Printable

https://data.formsbank.com/pdf_docs_html/173/1737/173716/page_1_thumb_big.png

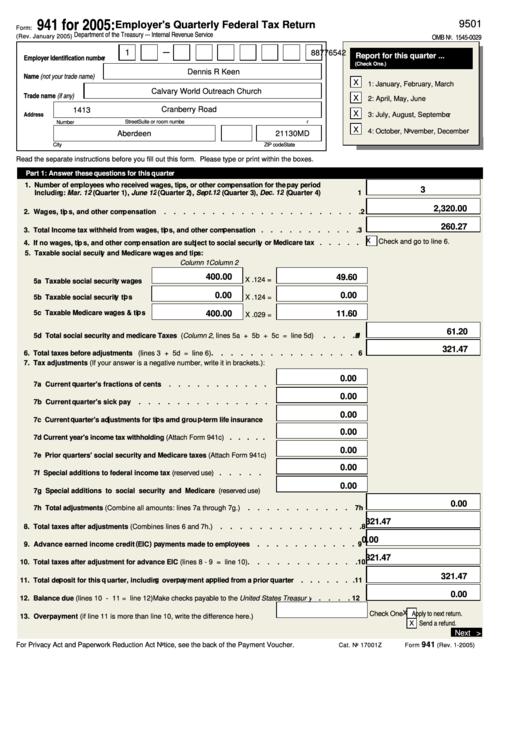

Employer S Quarterly Federal Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/45/451/45186/page_1_thumb_big.png

Form 941 Employer s Quarterly Federal Tax Return 2015 Free Download

https://www.formsbirds.com/formimg/individual-income-tax/2721/form-941-employers-quarterly-federal-tax-return-2015-l1.png

3 INTRODUCTION This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2021 It includes applicable withholding tax tables basic definitions answers to frequently asked An official website of the State of Georgia The gov means it s official Local state and federal government websites often end in gov State of Georgia government websites and email systems use georgia gov or ga gov at the end of the address Before sharing sensitive or personal information make sure you re on an official

Georgia Form G 4 is the state s Employee s Withholding Allowance Certificate This form is available from the Georgia Department of Revenue GA DOR Its purpose is to inform a Georgia based employer of the amount to withhold from an employee s paycheck for Georgia s Individual Income Tax Employees can also use Form G 4 to claim allowances based on dependents marital status and other Please contact the Legal Office at 404 232 3310 should you have any questions Authorization for Medical Treatment PDF 34 45 KB Allows medical treatment of minor in absence of the representative of minor Must be signed by the representative of minor

Form Dol 4n Employer S Quarterly Tax And Wage Report State Of Georgia Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/248/2487/248723/page_1_thumb_big.png

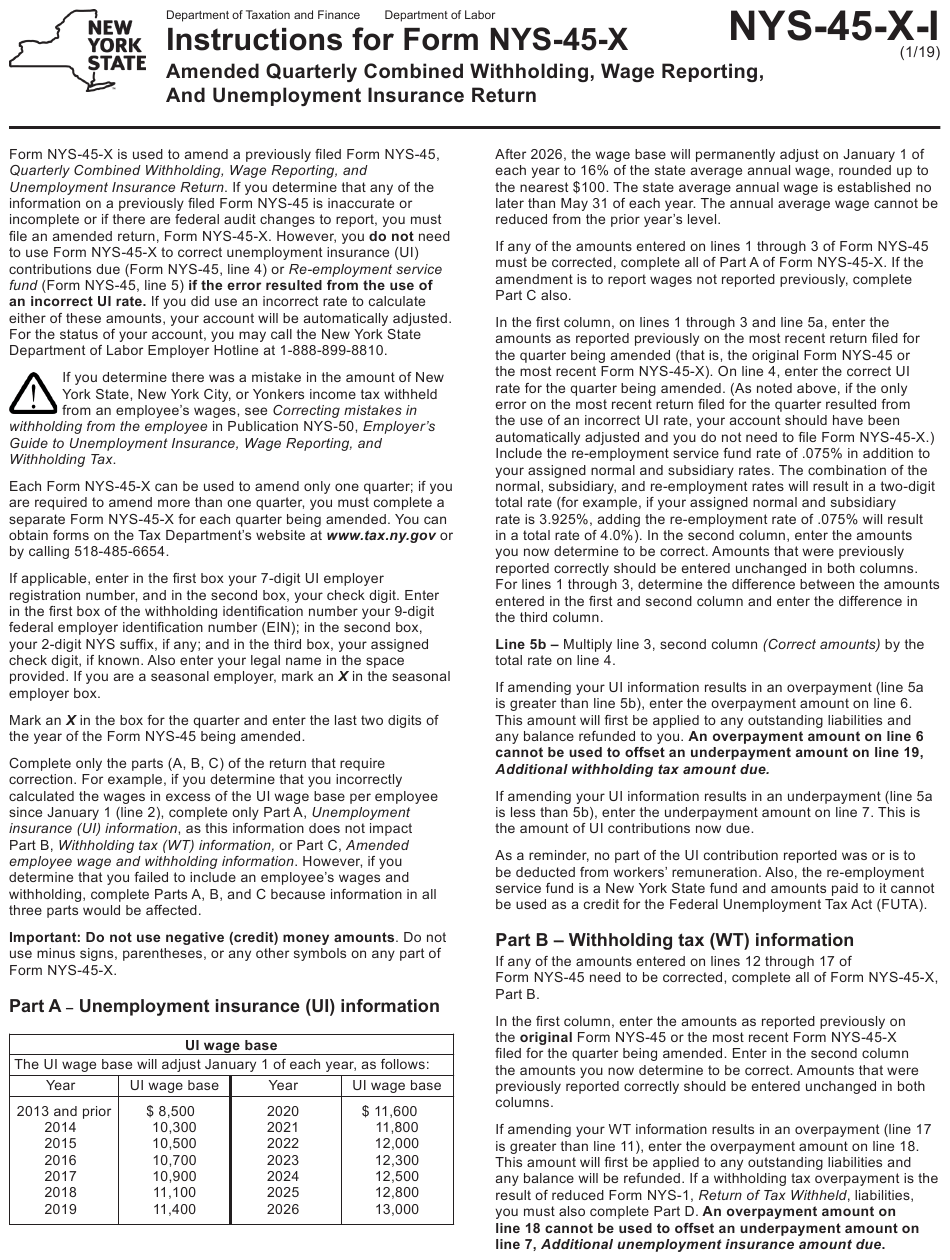

State Of Ga Forms For Reporting Quarterly Withholding WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/download-instructions-for-form-nys-45-x-amended-quarterly-combined.png

https://dor.georgia.gov/documents/forms/type/withholding

G 1003 Withholding Income Statement Return Withholding Income Statement Transmittal Form G 1003 For recipients of income from annuities pensions and certain other deferred compensation plans Use this form to tell payers whether to withhold income tax and on what basis G7 Withholding Quarterly Return For Monthly Payer

https://www.paychex.com/articles/payroll-taxes/form-941-information-and-guide

Most businesses must report and file tax returns quarterly using the IRS Form 941 This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations

Wg15 Form Fill Out Sign Online DocHub

Form Dol 4n Employer S Quarterly Tax And Wage Report State Of Georgia Printable Pdf Download

Complete List Of Ga Employer Tax Forms Printable Printable Forms Free Online

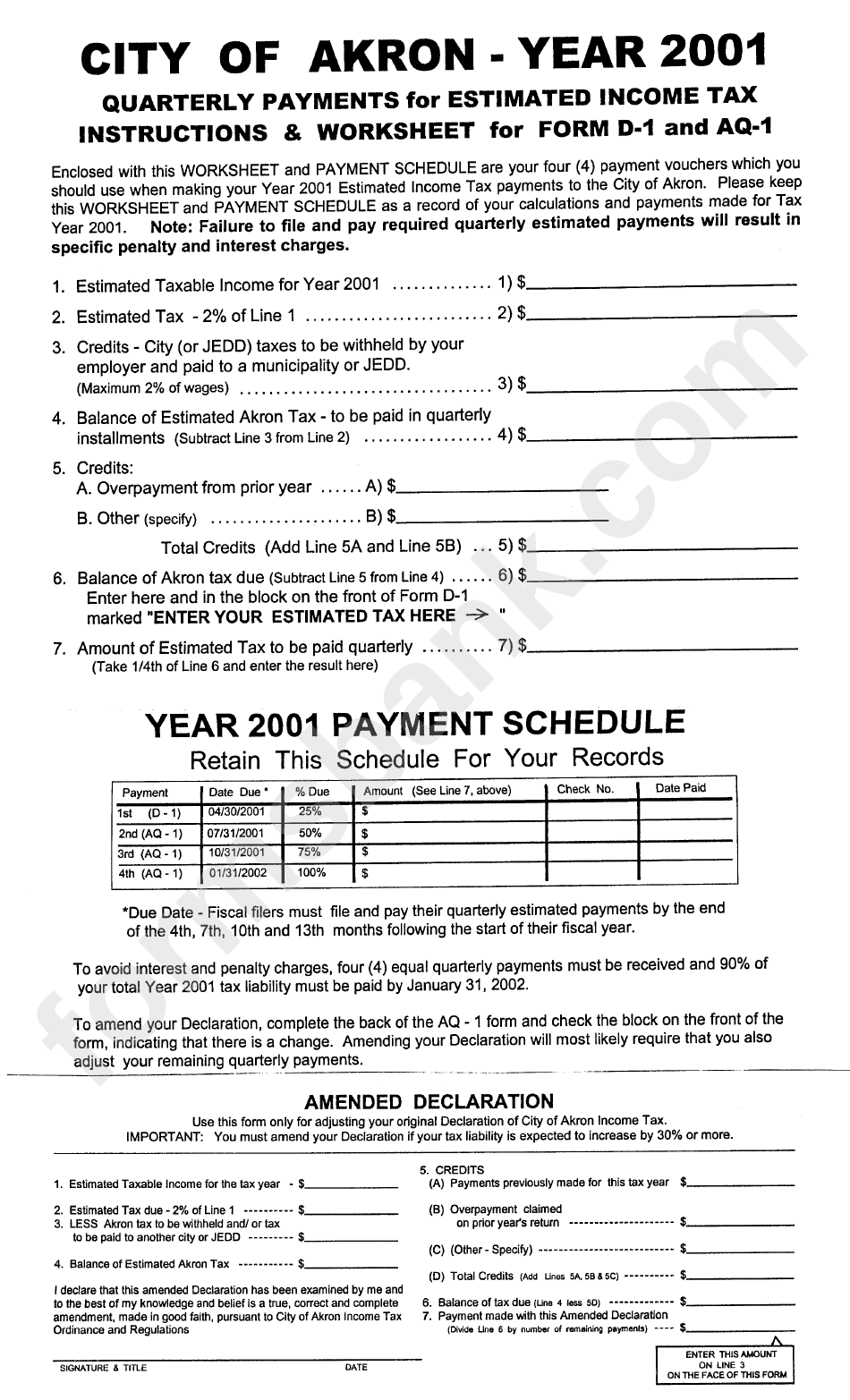

Quarterly Payments For Estimated Income Tax Form Printable Pdf Download

Ms State Tax Forms Withholding Fill Out Sign Online DocHub

Printable State Tax Forms

Printable State Tax Forms

Form Dol 4n Employer S Quarterly Tax And Wage Report Georgia Department Of Labor Printable

Form G 4 State Of Georgia Employee S Withholding Allowance Certificate Printable Pdf Download

2023 Ga Withholding Form Printable Forms Free Online

Ga Employer Quarterly With Holding Printable Tax Forms - Quarterly Withholding G 7 Return Excel Template After completing the template save the file as an Excel 97 2003 Workbook xls Log into GTC click on the withholding payroll number select the return period and Import the template For additional information about this return please visit the Department of Revenue Withholding Tax Forms