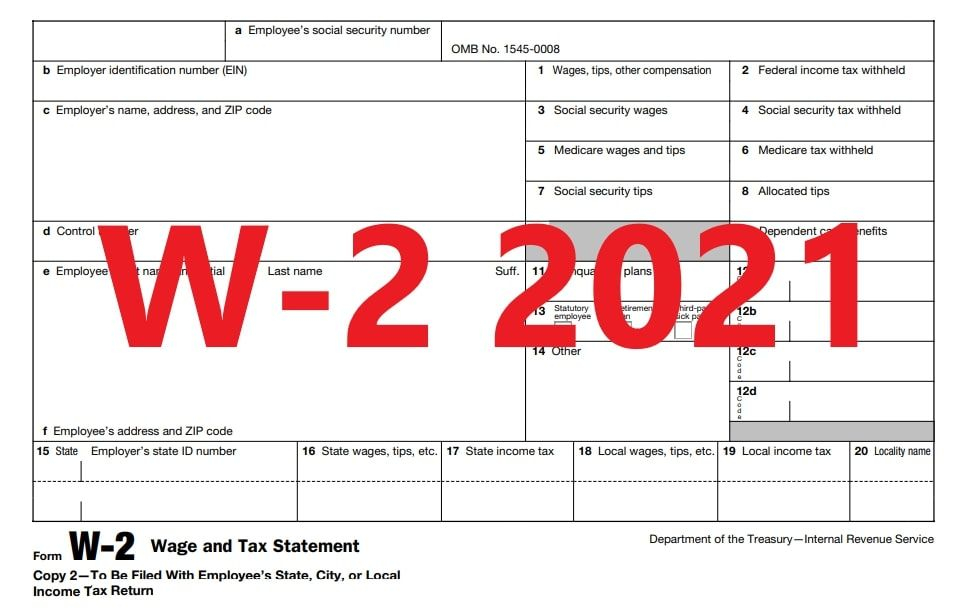

Hand Fill Out W 2 Form Printable 2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

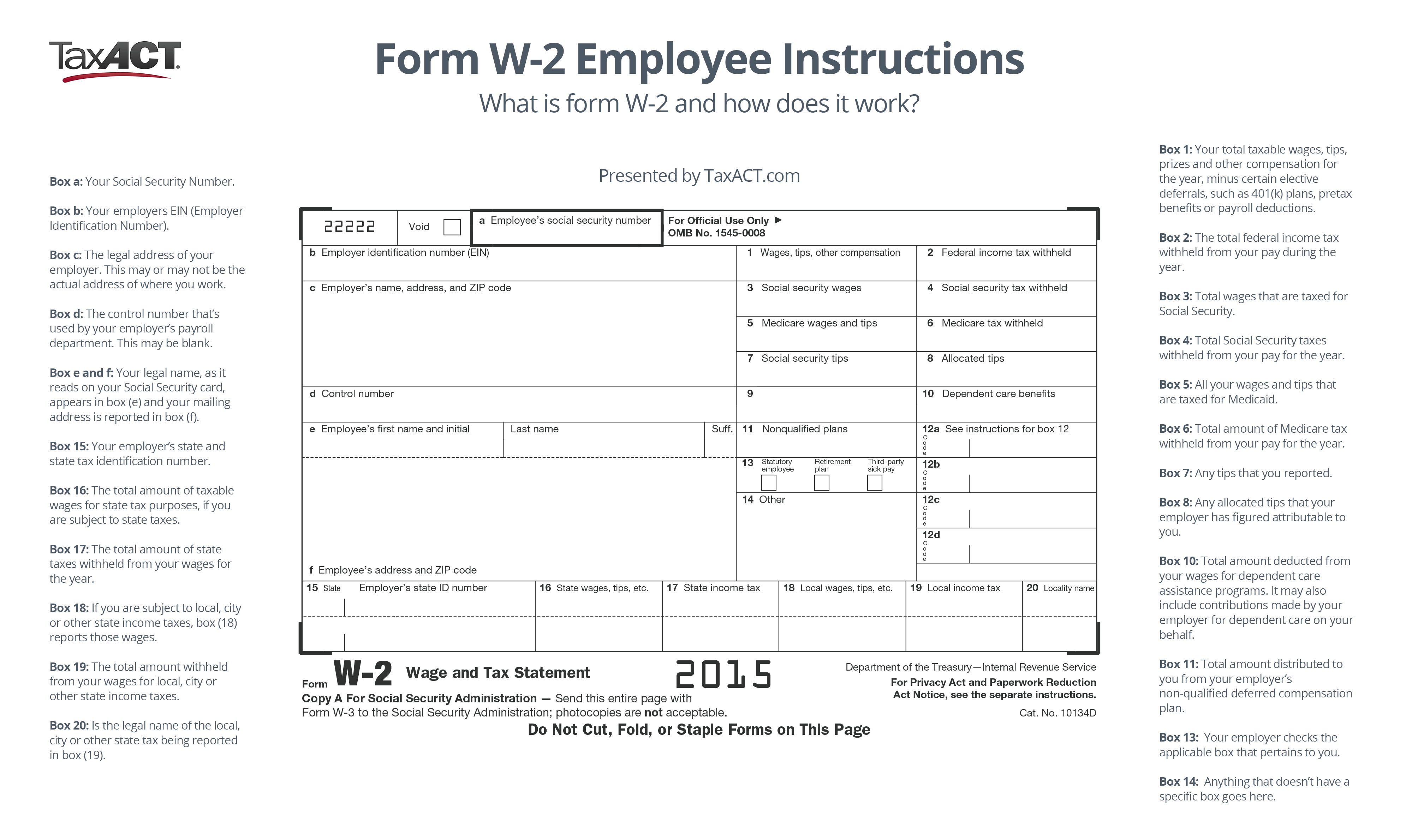

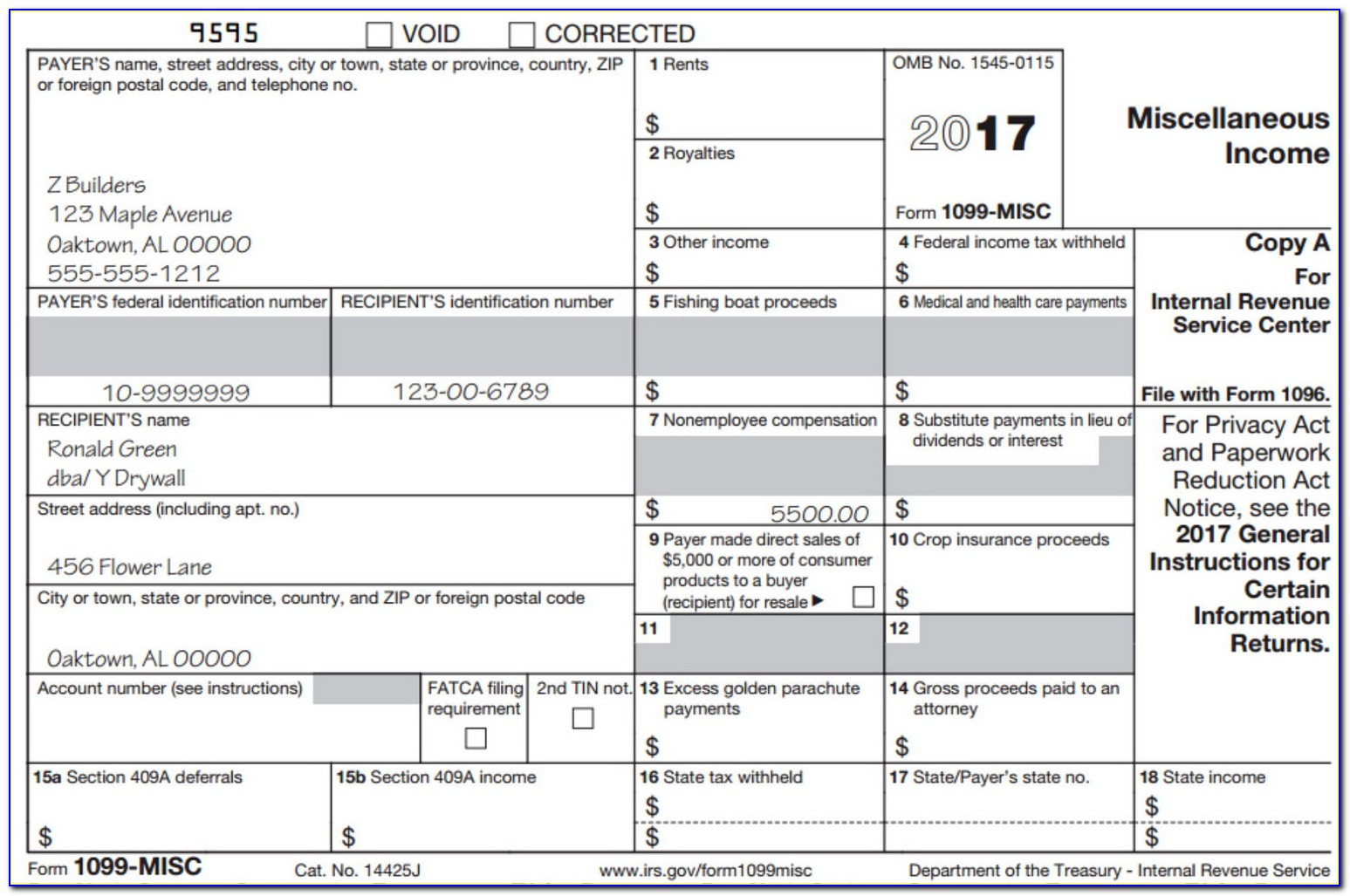

Instructions General Instructions for Forms W 2 and W 3 Introductory Material Future Developments What s New Electronic filing of returns Requirements for Forms W 2 Requirements for Forms W 2c New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 Form and publication changes for 2024 A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck Forms are submitted to the SSA Social Security Administration and the information is shared with the IRS

Hand Fill Out W 2 Form Printable

Hand Fill Out W 2 Form Printable

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

How To Print W2 Forms On White Paper

http://www.halfpricesoft.com/images/edit_w2_m.jpg

What Is Form W 2 An Employer s Guide To The W 2 Tax Form Gusto

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

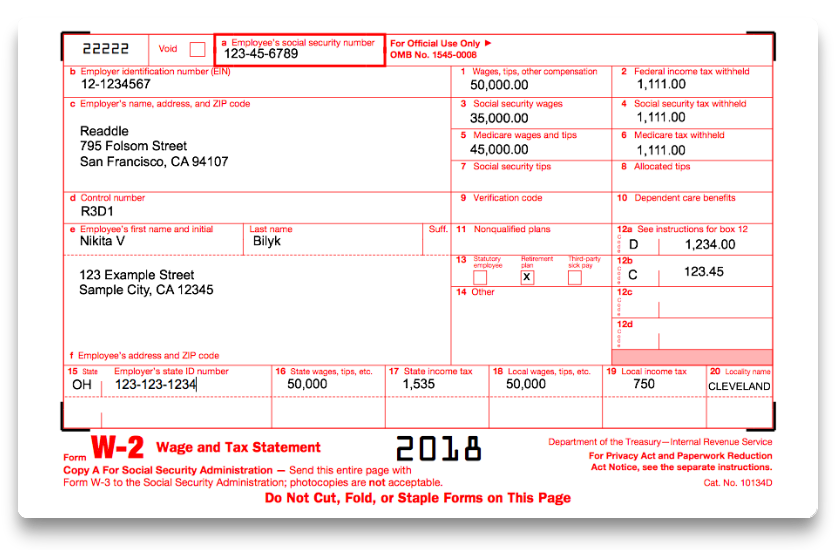

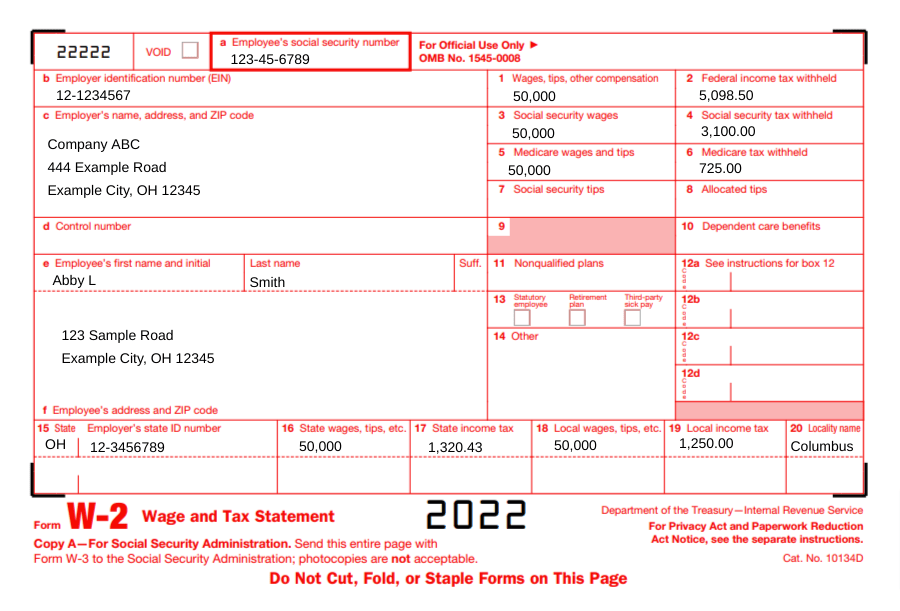

A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return Form W 2 must contain certain information including wages earned and state federal and other taxes withheld from an employee s earnings The Form W 2 must be provided to employees by January 31 What Is a W 2 Form There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form

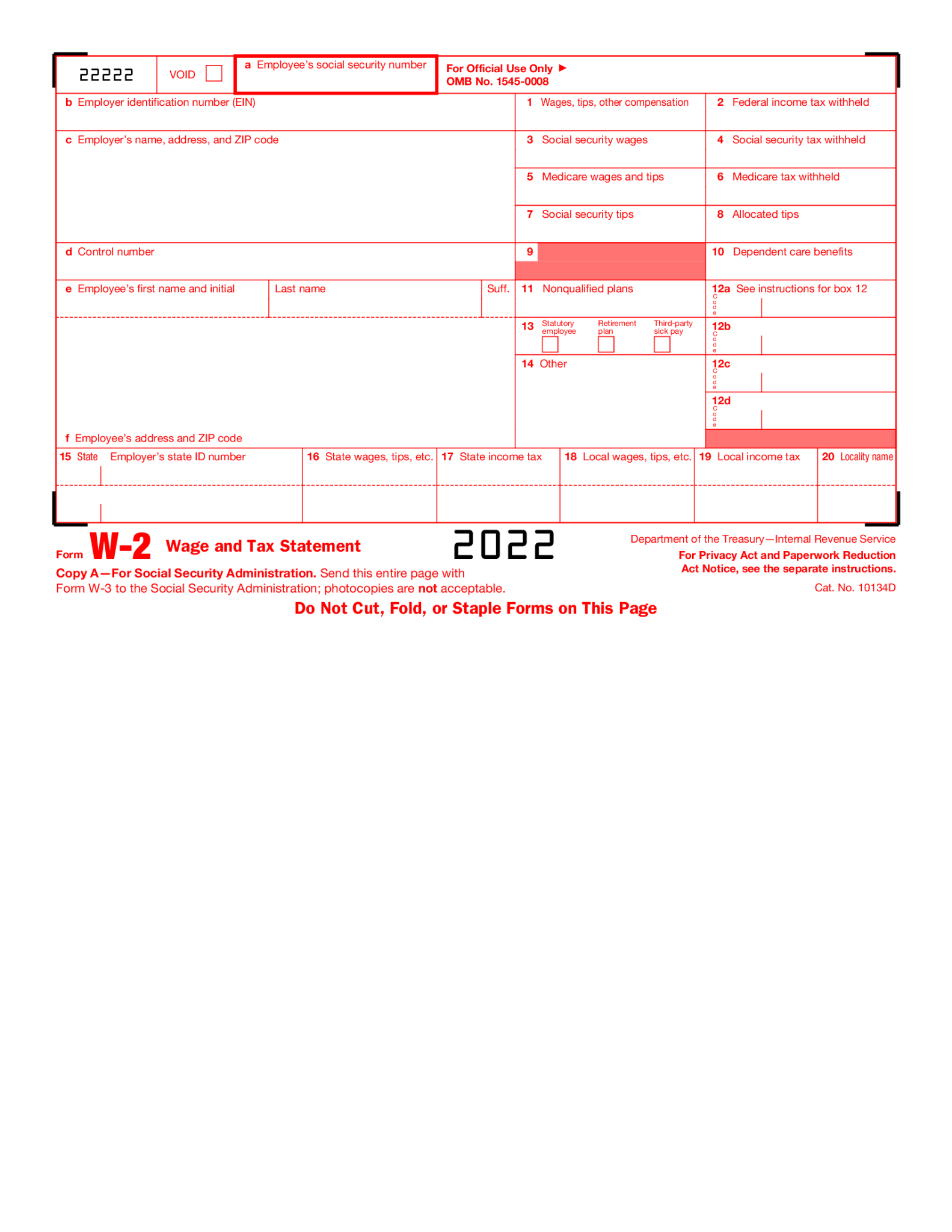

A W 2 Form known officially as a Wage and Tax Statement is an important tax document providing valuable information for employees and the Internal Revenue Service IRS This document shows the total earnings of an employee for the year as well as the amount of taxes withheld from their paychecks It also includes other deductions such as contributions to retirement plans health 4 Print the forms Inspect the printed forms one more time for any errors If the forms are accurate place them in company envelopes and mail them to your employees Business owners small and

More picture related to Hand Fill Out W 2 Form Printable

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

https://giftcpas.com/wp-content/uploads/2017/12/2017_Form_W-2.png

How To Fill Out And Print W2 Forms

https://www.halfpricesoft.com/w2-software/images/w2_form_ssa_substitute_m.jpg

How To Fill Out IRS Form W 2 2017 2018 PDF Expert

https://pdfexpert.com/img/howto/fill-w2-form/how-to-fill-w2-filledform.png

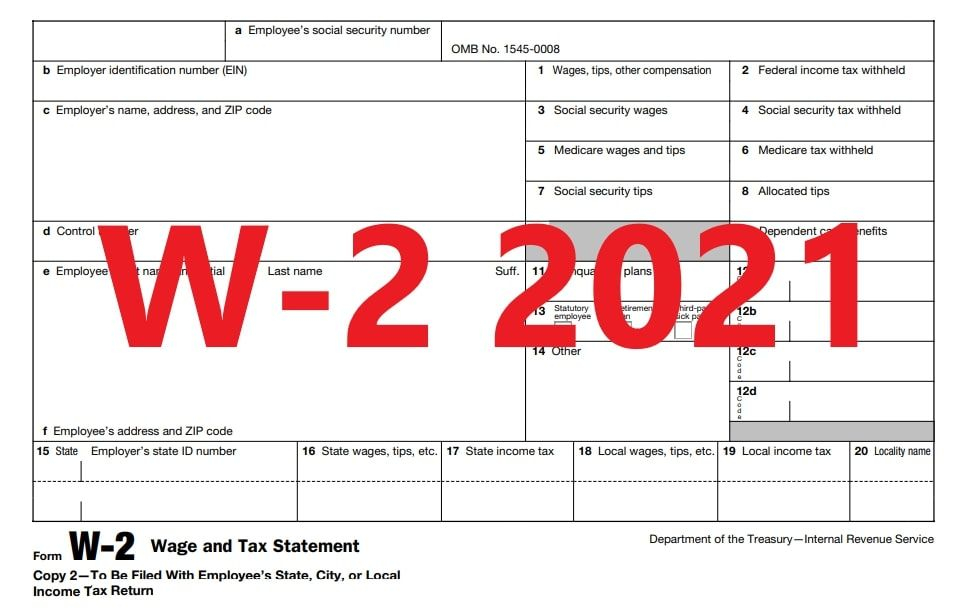

Form W 2 reports an employee s annual wages as well as the amount of taxes withheld from their pay by their employer Employees use the information on the W 2 to complete their personal income tax return Employers must file a copy of each employee s W 2 with the Social Security Administration SSA and the Internal Revenue Service IRS Employers must fill out IRS Form W 2 and supply them to employees the IRS and some state tax agencies no later than January 31st of the year following the previous tax year Employees use it to report payroll taxes paid and the IRS uses it to determine how much is owed in taxes if any or if employees are due a refund

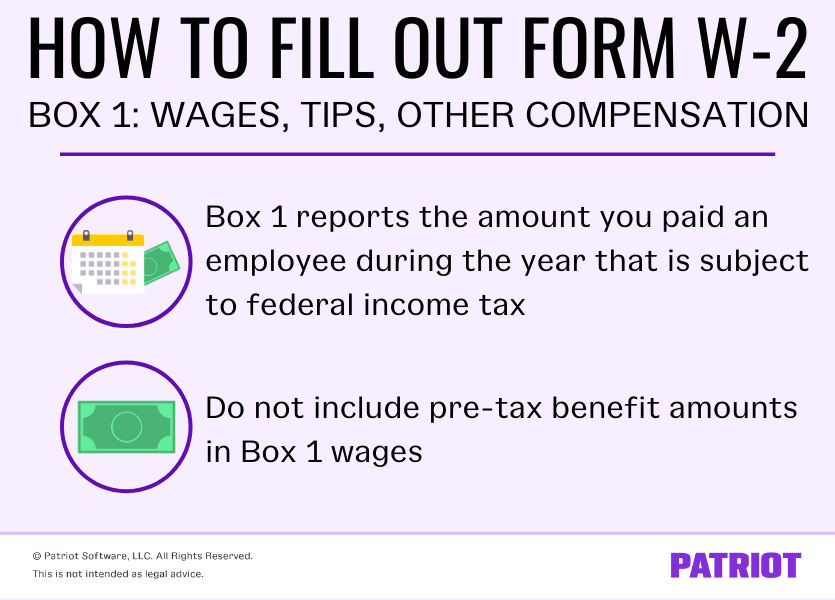

There are several W 2 Box 12 codes you may need to put on an employee s Form W 2 If applicable add the codes and amounts in Box 12 These codes and values may lower the employee s taxable wages Let s say an employee elected to contribute 1 000 to a 401 k retirement plan You would write D 1 000 00 in Box 12 The 4 2 On the W 2 s Available for WFID WFID company name page Select W 2 s for prefilling this year s W 2 s and then select the Continue button The system displays the W 2 List for this Submission company name page Select the Previous button to return to the Employer Information for this Wage Report company name page

How To Fill Out A W 2 Form Everything Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2020/09/FeatureImage_How_to_Fill_Out_a_W2_Form.jpg

How To Fill Out And Print W2 Forms

http://www.halfpricesoft.com/w2-software/images/4-up-w2-form.jpg

https://www.irs.gov/pub/irs-access/fw2_accessible.pdf

2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

https://www.irs.gov/instructions/iw2w3

Instructions General Instructions for Forms W 2 and W 3 Introductory Material Future Developments What s New Electronic filing of returns Requirements for Forms W 2 Requirements for Forms W 2c New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 Form and publication changes for 2024

Understanding Your Tax Forms The W 2

How To Fill Out A W 2 Form Everything Employers Need To Know

W 2 Form Fillable Printable Downloadable 2023 Instructions FormSwift

What Is Form W 2 And How Does It Work TaxAct Blog

2022 W2 Free Fillable Printable W 2 Form Fillable Form 2023

W 2 Form 2021 Printable Form 2021

W 2 Form 2021 Printable Form 2021

W2 Form Printable Fill Out Sign Online DocHub

How To Fill Out Form W 2 Detailed Guide For Employers 2022

Printable W2 Form For New Employee Printable Form 2023

Hand Fill Out W 2 Form Printable - This service offers fast free and secure online W 2 filing options to CPAs accountants enrolled agents and individuals who process W 2s the Wage and Tax Statement and W 2Cs Statement of Corrected Income and Tax Amounts