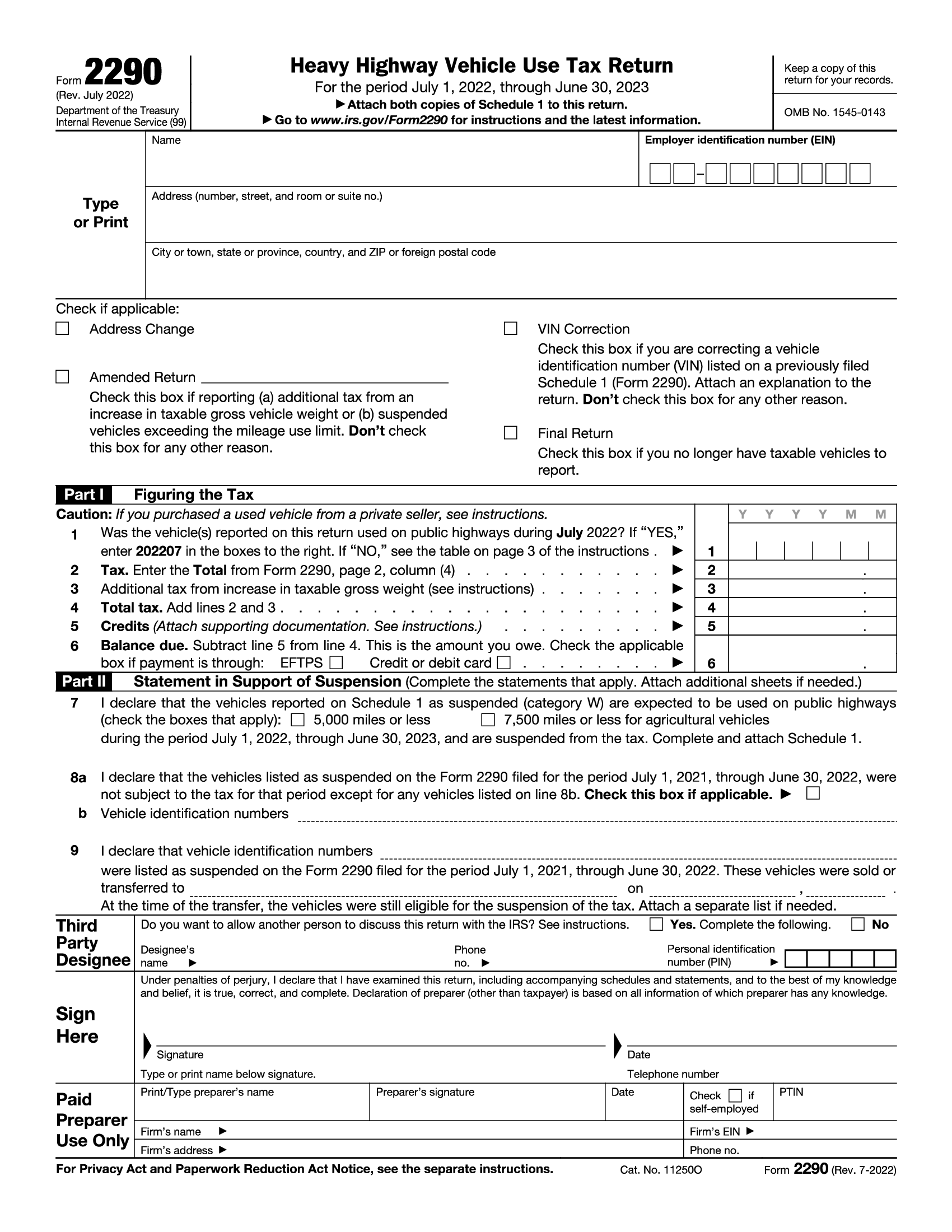

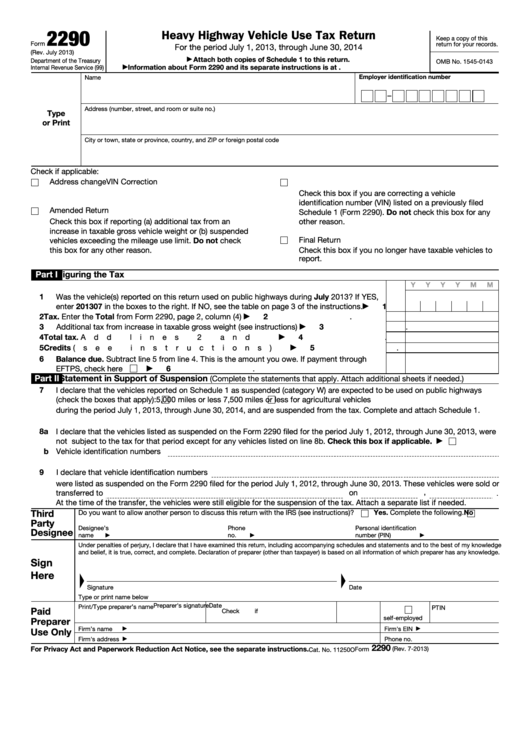

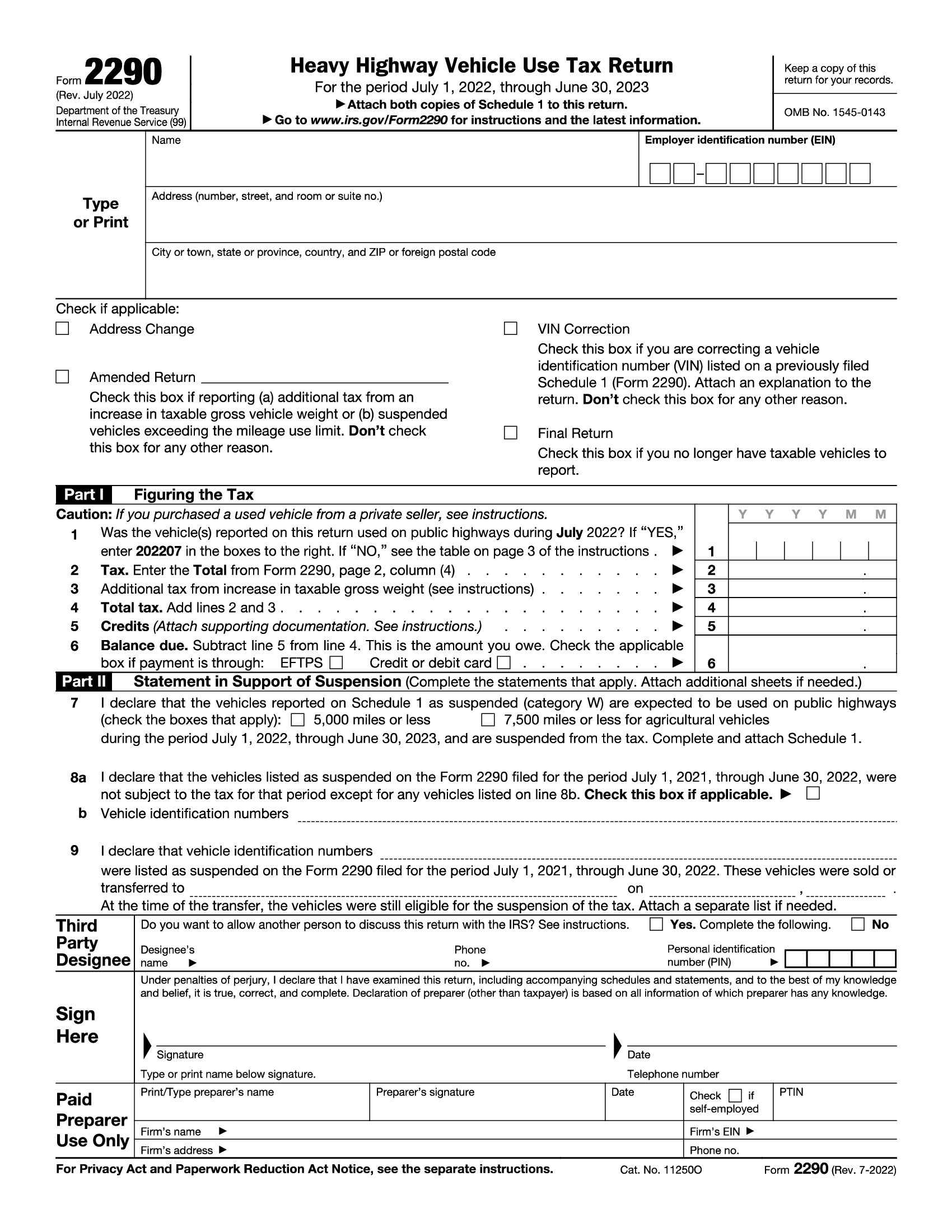

Heavy Weight Truck Income Tax Ca Form 2290 Printable Heavy Highway Vehicle Use Tax Return For the period July 1 2023 through June 30 2024 Attach both copies of Schedule 1 to this return Go to www irs gov Form2290 for instructions and the latest information Keep a copy of this return for your records OMB No 1545 0143 Type or Print Name Employer identification number EIN

Anyone who registers a heavy highway motor vehicle in their name with a taxable gross weight of 55 000 pounds or more must file Form 2290 and pay the tax Vehicles that are used for 5 000 miles or less 7 500 for farm vehicles are required to file a return but are excluded from paying the tax Slides PDF Yvette Brooks Williams Welcome to today s webinar Understanding Form 2290 Heavy Highway Vehicle Use Tax We re glad you re joining us today My name is Yvette Brooks Williams and I am a Senior Stakeholder Liaison with the Internal Revenue Service And I will be your moderator for today s webinar which is slated for 120 minutes

Heavy Weight Truck Income Tax Ca Form 2290 Printable

Heavy Weight Truck Income Tax Ca Form 2290 Printable

https://www.expresstrucktax.com/Content/Images/step5_transmit.png

IRS Form 2290 Heavy Highway Vehicle Use Tax Return Forms Docs 2023

https://blanker.org/files/images/f2290.png

Form 2290 2023 Printable Forms Free Online

https://www.heavyvehicletax.com/static/img/resources/form-2290-intro.png

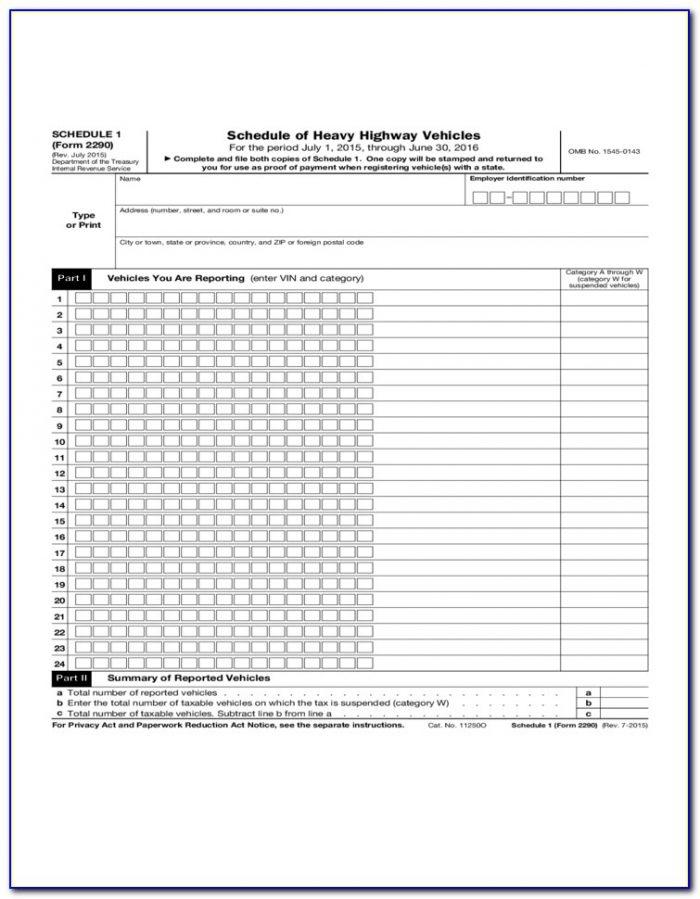

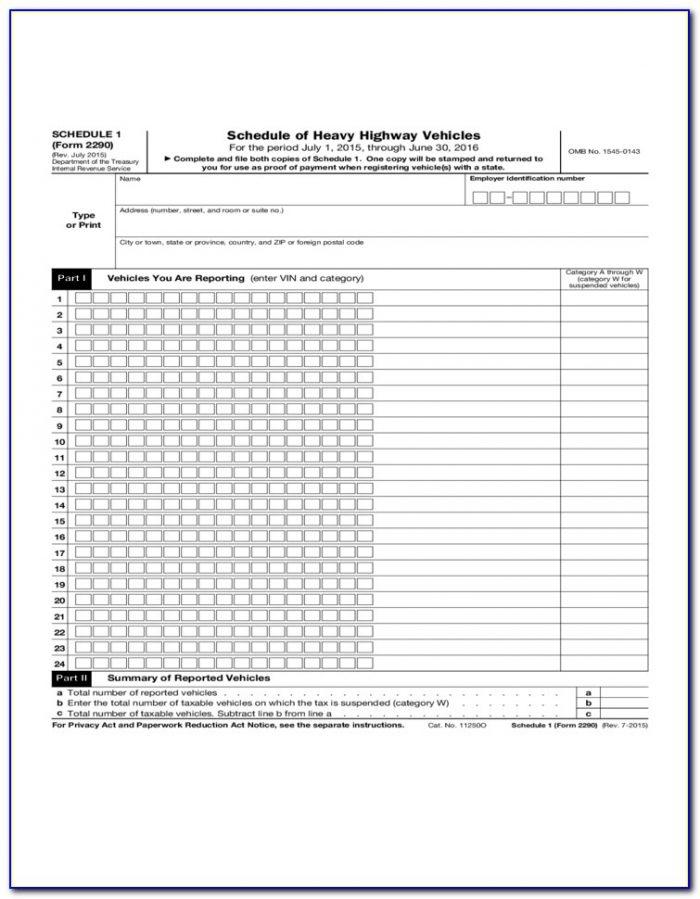

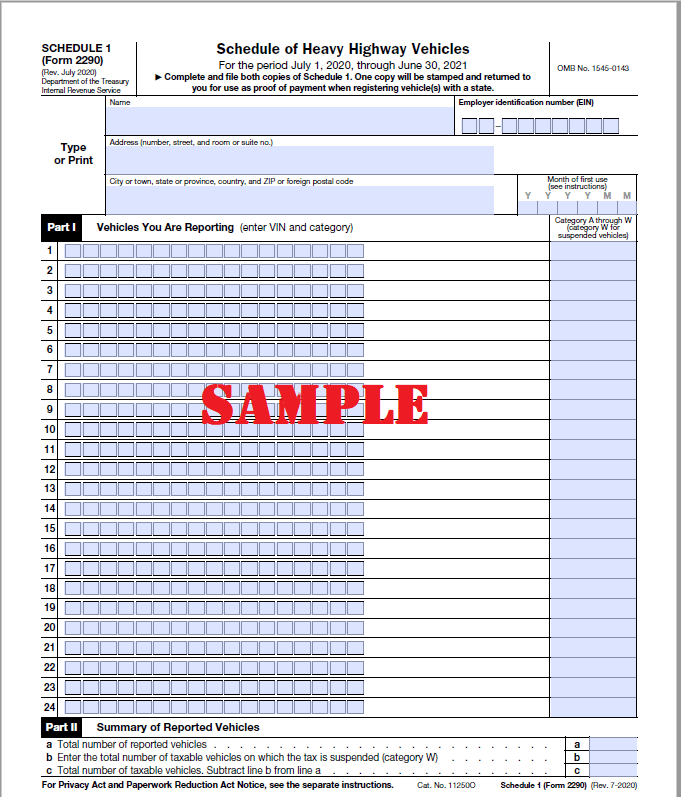

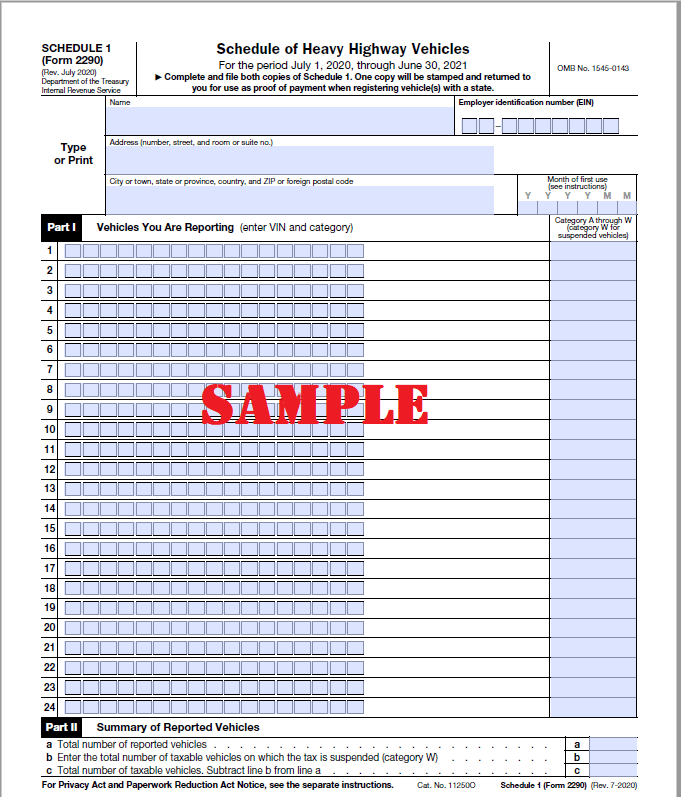

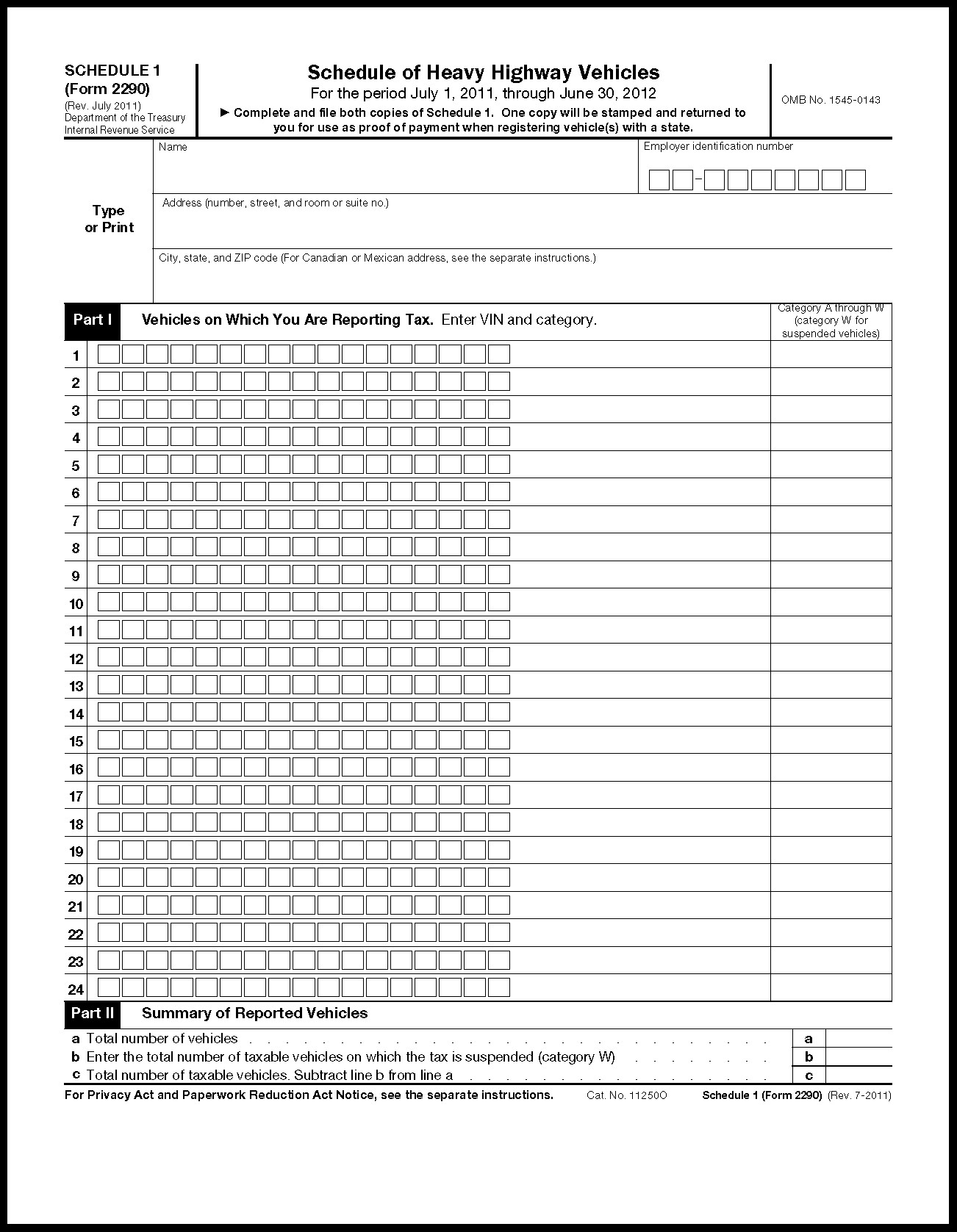

Add the amounts in column 4 Enter the total here and on Form 2290 line 2 W Tax Suspended Vehicles See Part II on page 7 of the instructions Complete both copies of Schedule 1 Form 2290 and attach them to Form 2290 See page 2 of the instructions for information on logging vehicles Form 2290 Rev 7 2019 Polling Question 1 The Heavy Highway Vehicle Use Tax is Based on a vehicle s taxable gross weight Applies to highway motor vehicles with a Taxable Gross weight of 55 000 pounds or more Applies to highway motor vehicles used on public roads All of the above Communications Liaison STAKEHOLDER LIAISON Taxable Vehicle Weight

Form 2290 encompasses taxable weight categories from A to V each representing a specific range of taxable gross weight Here s the table summarizing the taxable gross weight for each category Taxable Gross Weight Category What is Category W Tax suspended vehicles designated as Category W are commonly known as low mileage vehicles IRS Form 2290 Heavy Highway Vehicle Use Tax Return is used to calculate the use tax for heavy highway vehicles such as tractor trailer rigs logging trucks etc The tax is based on vehicle weight and the annual reporting period is from July 1 through June 30 Form 2290 includes two copies of Schedule 1 listing the business s vehicles

More picture related to Heavy Weight Truck Income Tax Ca Form 2290 Printable

2290 Printable Form

https://www.expresstrucktax.com/Content/Images/frm2290-sch1-img.jpg

Printable 2290 Form Customize And Print

https://cdn.formtemplate.org/images/600/form-2290-3.png

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/328/3286/328680/page_1_thumb_big.png

1 Determine Your Taxable Gross Weight The taxable gross weight for your vehicle is based on the maximum loaded weight of your vehicle including any trailers or other equipment To find out the taxable gross weight look at the manufacturer s statement of origin or contact your state s department of motor vehicles 2 Determine Your Tax Rate Heavy vehicle tax credits Form 2290 In certain circumstances you can also claim a tax credit for heavy vehicles on your Form 2290 For example if your truck is registered as a Heavy Highway Motor Vehicle and it was stolen destroyed sold or did not exceed mileage credit you can count it as a tax credit

Step 2 Add the vehicle identification numbers VINs of your taxable or suspended vehicles Step 3 Review your information Step 4 Submit the 2290 return directly to the IRS Step 5 Once we get your 2290 return approved with the IRS approves your return we will email you the watermarked Schedule 1 document Form 2290 Heavy Highway Vehicle Use Tax Return is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55 000 pounds or more A highway motor vehicle for use tax purposes is defined inside the instructions booklet Self propelled vehicles designed to carry a load over public highways including but

Printable 2290 Form Customize And Print

https://www.universalnetworkcable.com/wp-content/uploads/2019/02/2290-heavy-highway-tax-form-2017.jpg

File IRS Form 2290 Online Heavy Vehicle Use Tax HVUT Return

https://www.expresstrucktax.com/Content/Images/form2290.jpg

https://www.irs.gov/pub/irs-pdf/f2290.pdf

Heavy Highway Vehicle Use Tax Return For the period July 1 2023 through June 30 2024 Attach both copies of Schedule 1 to this return Go to www irs gov Form2290 for instructions and the latest information Keep a copy of this return for your records OMB No 1545 0143 Type or Print Name Employer identification number EIN

https://www.2290online.com/resources/frequently-asked-questions

Anyone who registers a heavy highway motor vehicle in their name with a taxable gross weight of 55 000 pounds or more must file Form 2290 and pay the tax Vehicles that are used for 5 000 miles or less 7 500 for farm vehicles are required to file a return but are excluded from paying the tax

Truck Tax E File Form 2290 Online

Printable 2290 Form Customize And Print

Renew Heavy Truck Tax Form 2290 Electronically In 3 Simple Steps Tax 2290 Blog

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Heavy Truck Tax Form 2290 Electronic Filing Is Made Easy Heavy Truck Tax Return 2290

Schedule 1 IRS Form 2290 Proof Of Payment EPay2290

Schedule 1 IRS Form 2290 Proof Of Payment EPay2290

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples 3nOlRnYDa0

2022 Form 2290 Printable IRS 2290 Tax Form Instructions For Online PDF To File In 2023

Download IRS Form 2290 For Free Page 2 FormTemplate

Heavy Weight Truck Income Tax Ca Form 2290 Printable - How to Calculate Your Heavy Vehicle Weight Tax for E Filing Form 2290 How to Calculate Your Heavy Vehicle Weight Tax for E Filing Form 2290 August 18 2023 Calculating Heavy vehicle Tax is not a difficult process but understanding the steps can determine the amount easily