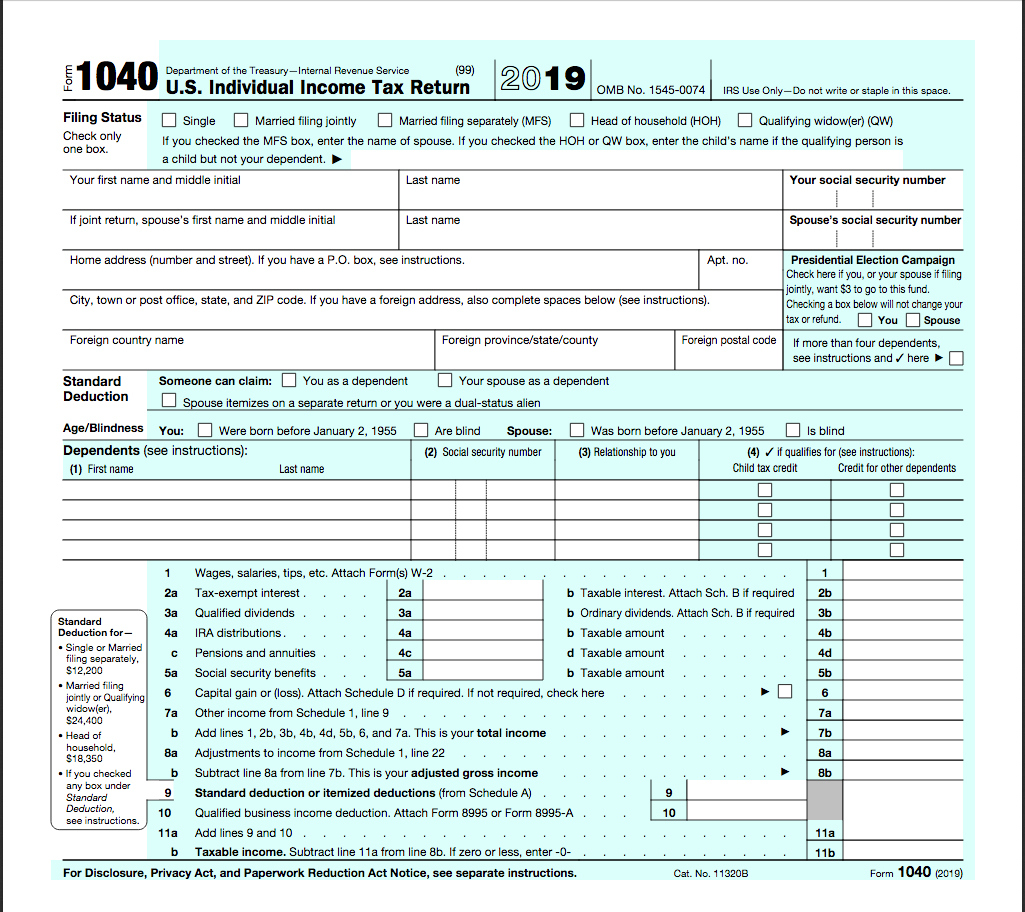

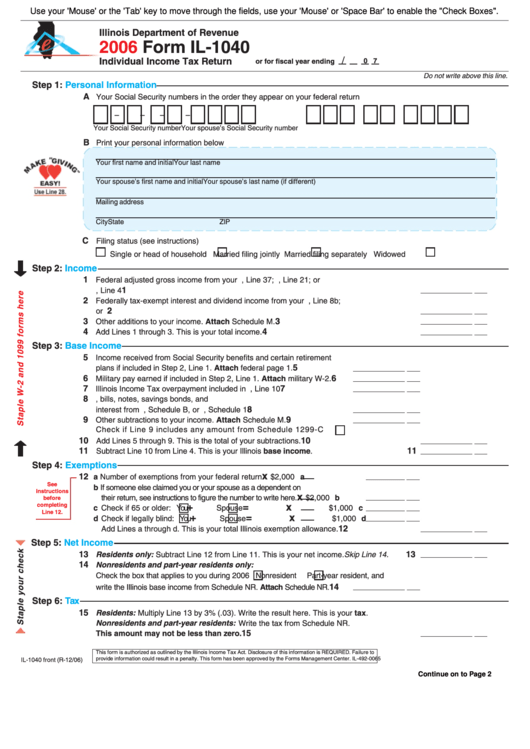

Illinois 1040 Tax Form Printable Individual Income Tax Return 60012231W or for fiscal year ending Enter personal information and Social Security numbers SSN You must provide the entire SSN s no partial SSN Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11

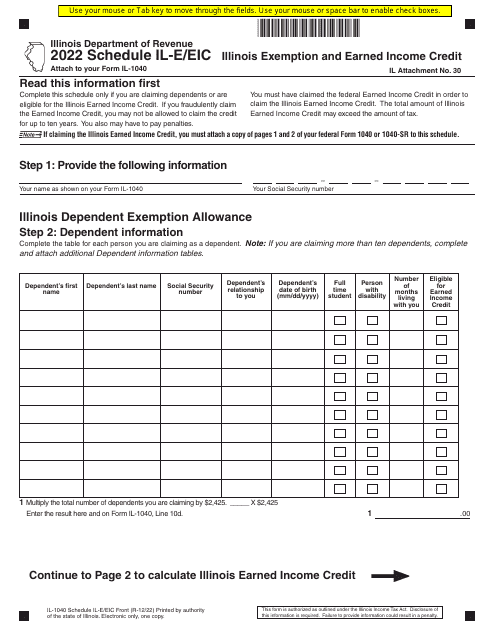

The due date for filing your 2022 Form IL 1040 and paying any tax you owe is April 18 2023 Income Tax Rate The Illinois income tax rate is 4 95 percent 0495 Exemption Allowance The personal exemption amount for tax year 2022 is 2 425 Form IL 1040 Refund and amount you owe were combined under Step 11 Form IL 1040 is the standard Illinois income tax return for all permanent residents of Illinois We last updated the Individual Income Tax Return in January 2024 so this is the latest version of Form IL 1040 fully updated for tax year 2023 You can download or print current or past year PDFs of Form IL 1040 directly from TaxFormFinder

Illinois 1040 Tax Form Printable

Illinois 1040 Tax Form Printable

https://1044form.com/wp-content/uploads/2020/08/2020-illinois-tax-filing-season-began-monday-january-27-2.jpg

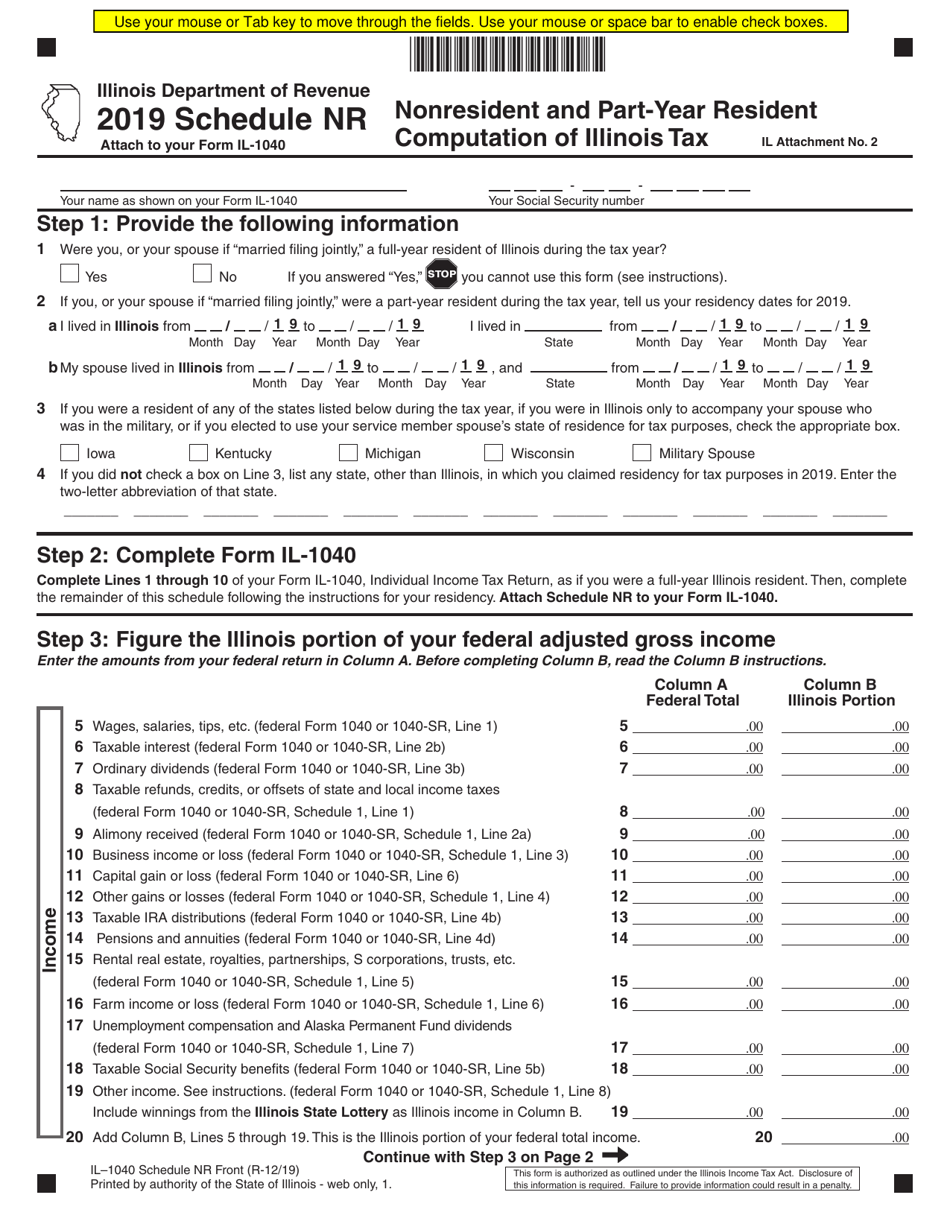

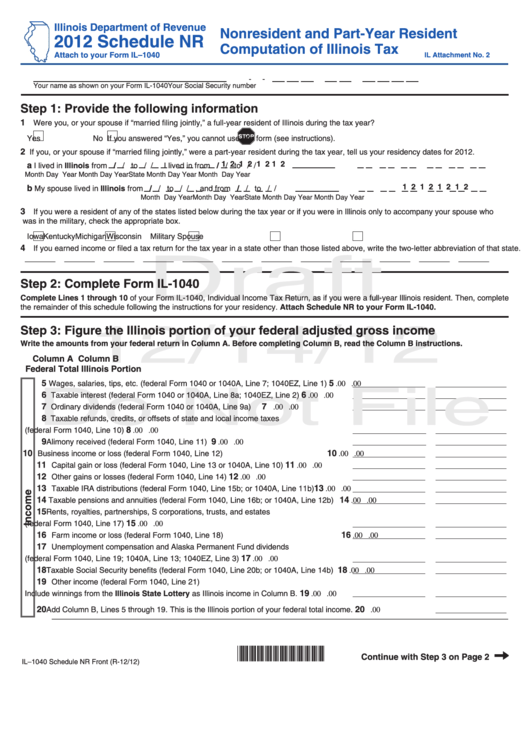

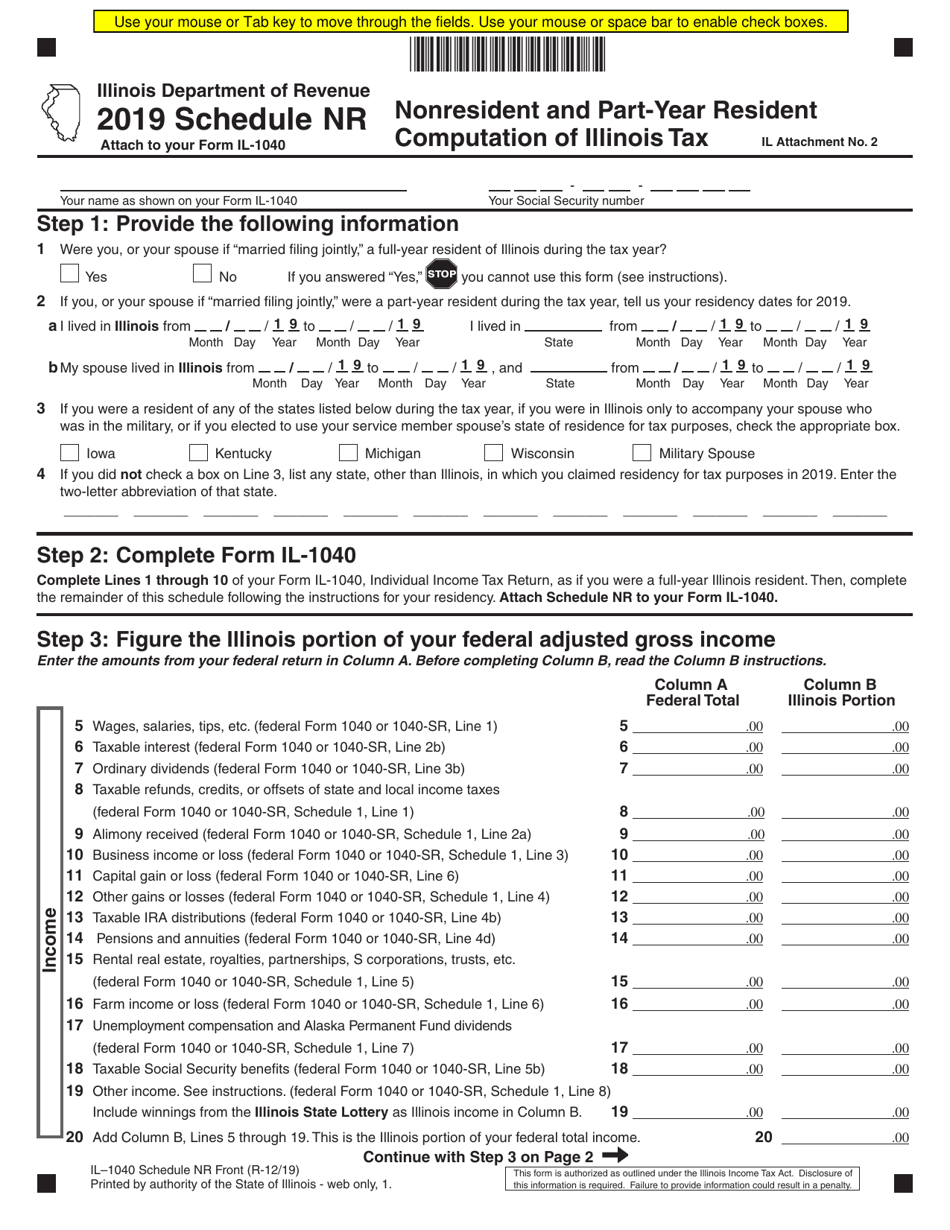

Form IL 1040 Schedule NR Fill Out Sign Online And Download Fillable PDF Illinois

https://data.templateroller.com/pdf_docs_html/2063/20638/2063895/form-il-1040-schedule-nr-nonresident-and-part-year-resident-computation-of-illinois-tax-illinois_print_big.png

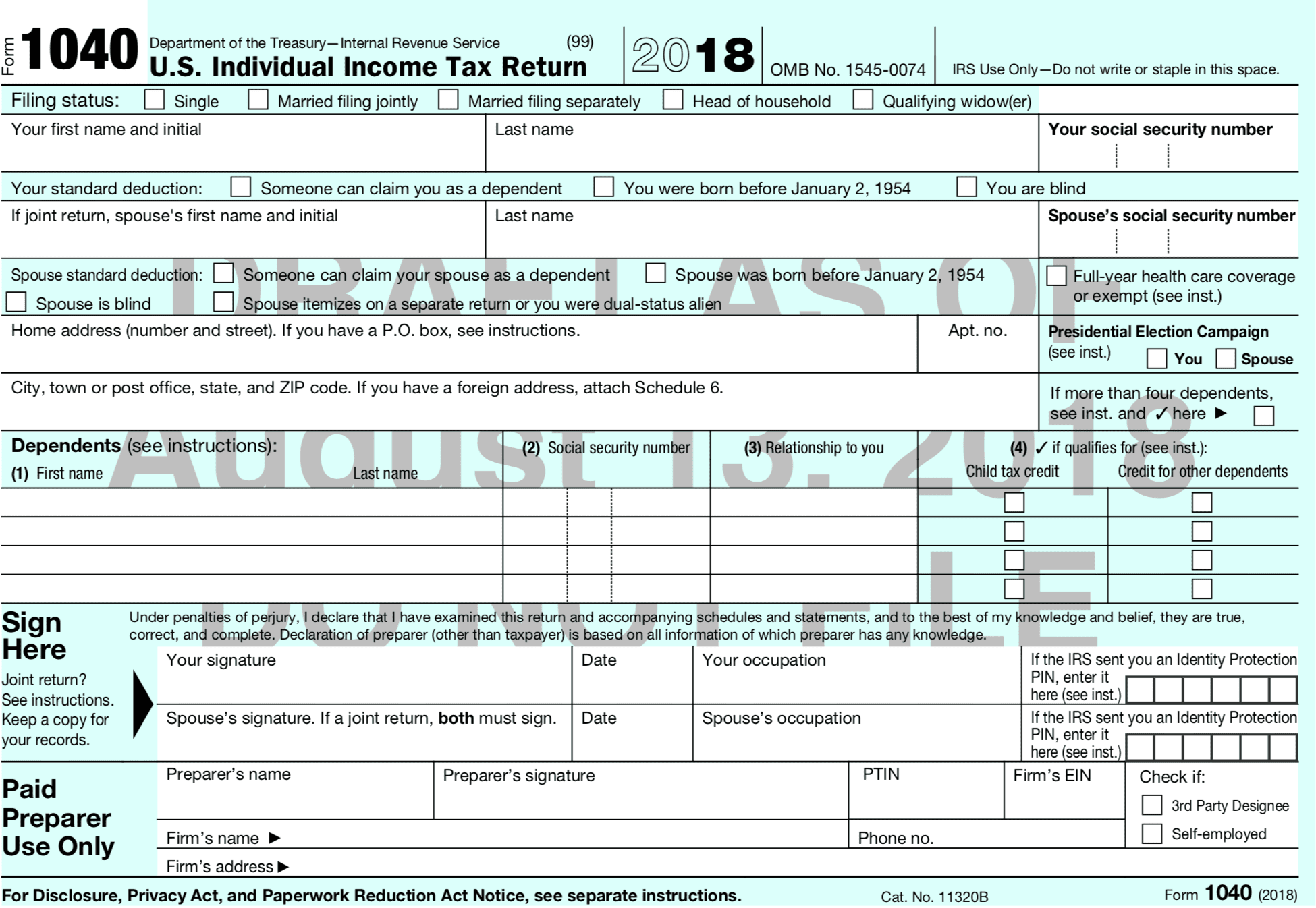

2018 Form Il 1040 V 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/the-new-2018-form-1040-9.png

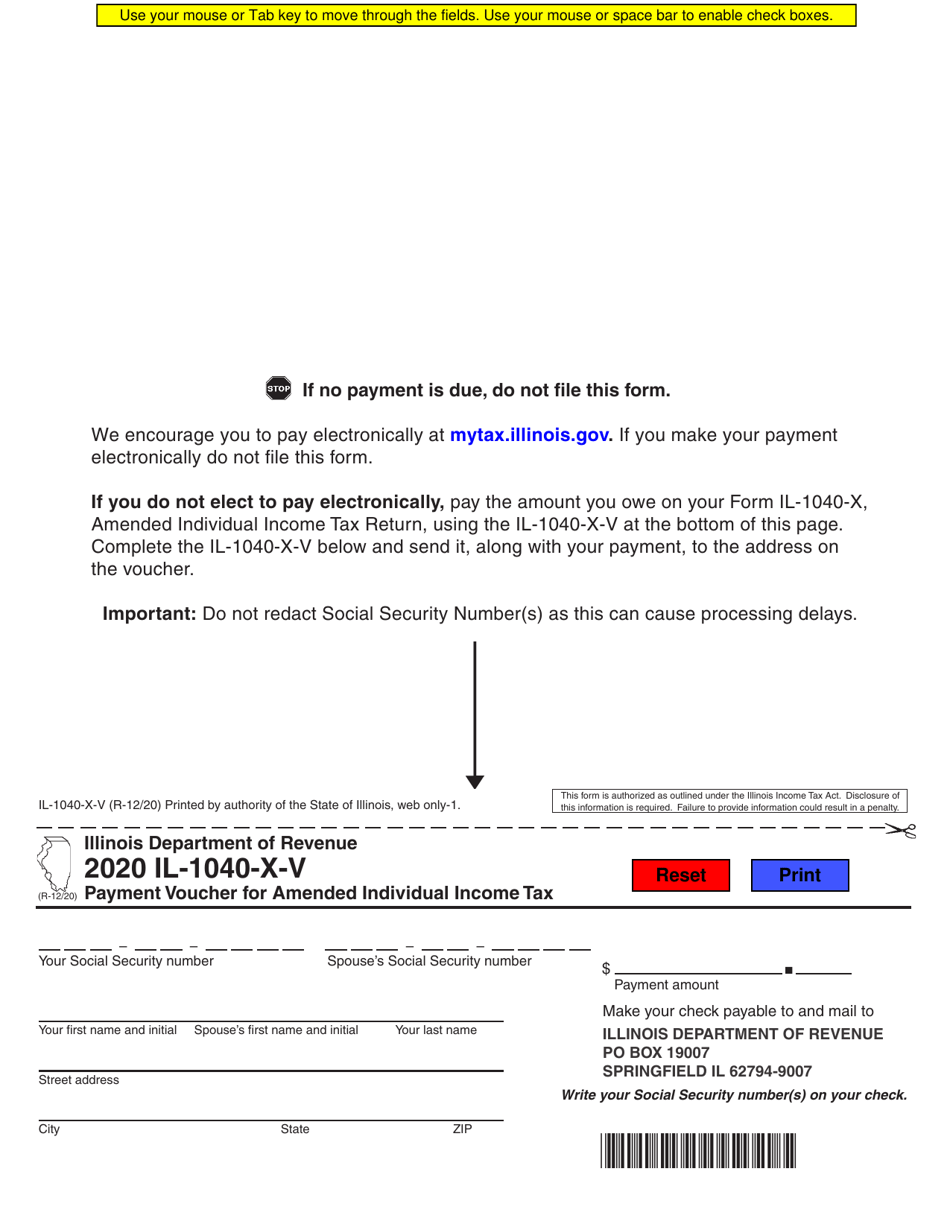

Services Illinois Income Tax Filing IL 1040 Use MyTax Illinois to electronically file your original Individual Income Tax Return Go to Service Provided by Department of Revenue Go to Agency Contact Agency 800 732 8866 Search Services IL 1040 X V Payment Voucher for Amended Individual Income Tax IL 505 I Automatic Extension Payment for Individuals Filing Form IL 1040 IL 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer IL 2210 Computation of Penalties for Individuals IL 4562

Illinois has a flat state income tax of 4 95 which is administered by the Illinois Department of Revenue TaxFormFinder provides printable PDF copies of 76 current Illinois income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 62 Illinois Form IL 1040 is used by full year residents part year residents and nonresidents to file their state income tax return The purpose of Form IL 1040 is to determine your tax liability for the state of Illinois Nonresident and part year resident filers are also required to complete Illinois Schedule NR

More picture related to Illinois 1040 Tax Form Printable

Illinois Tax Form 1040 Schedule Nr 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/form-il-1040-draft-schedule-nr-nonresident-and-part-1.png

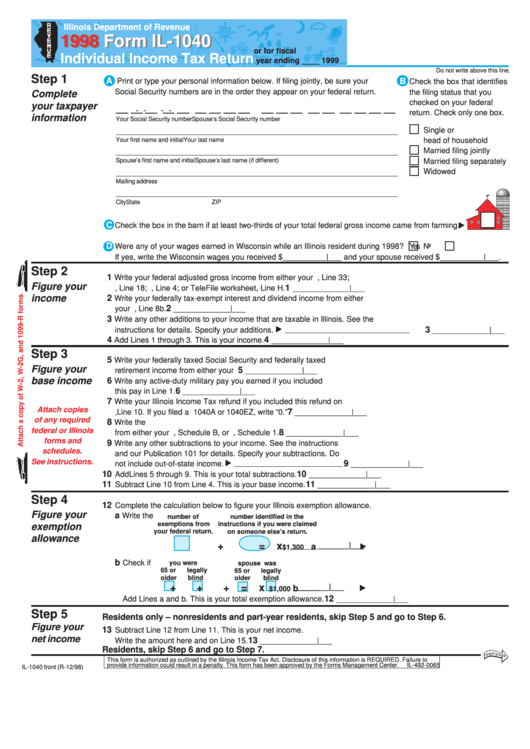

Fillable Form Il 1040 Individual Income Tax Return 1998 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/271/2716/271645/page_1_thumb_big.png

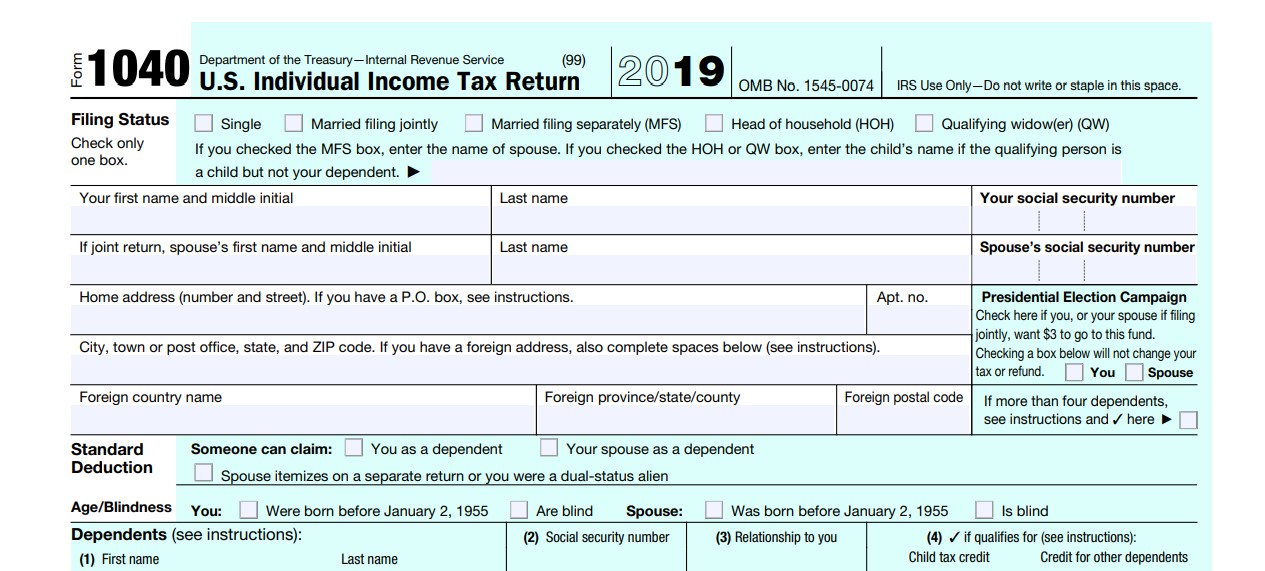

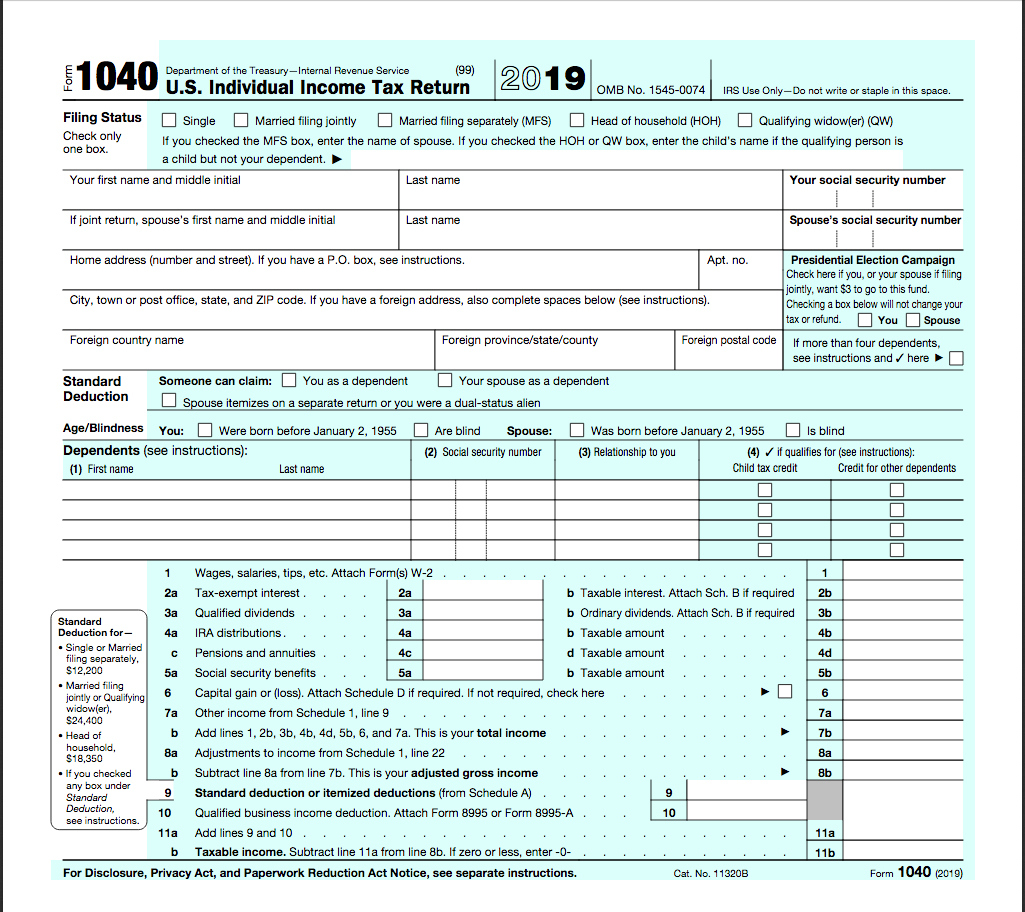

Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form Printable It Is Divided

https://printablee.website/wp-content/uploads/2020/11/1040-Form-Printable.jpg

Estimated Income Tax Return If you owe more then 500 a year in income tax on April 15th because of self employment or other income without tax withholding you must file a quarterly income tax payment using the worksheet and payment voucher included in Illinois form IL 1040 ES 11 0001 Illinois Income Tax Instructional Booklet Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 illinois form il 1040 pdf and you can print it directly from your computer More about the Illinois Form IL 1040 Tax Return eFile your Illinois tax return now eFiling is easier faster and safer than filling out paper tax forms

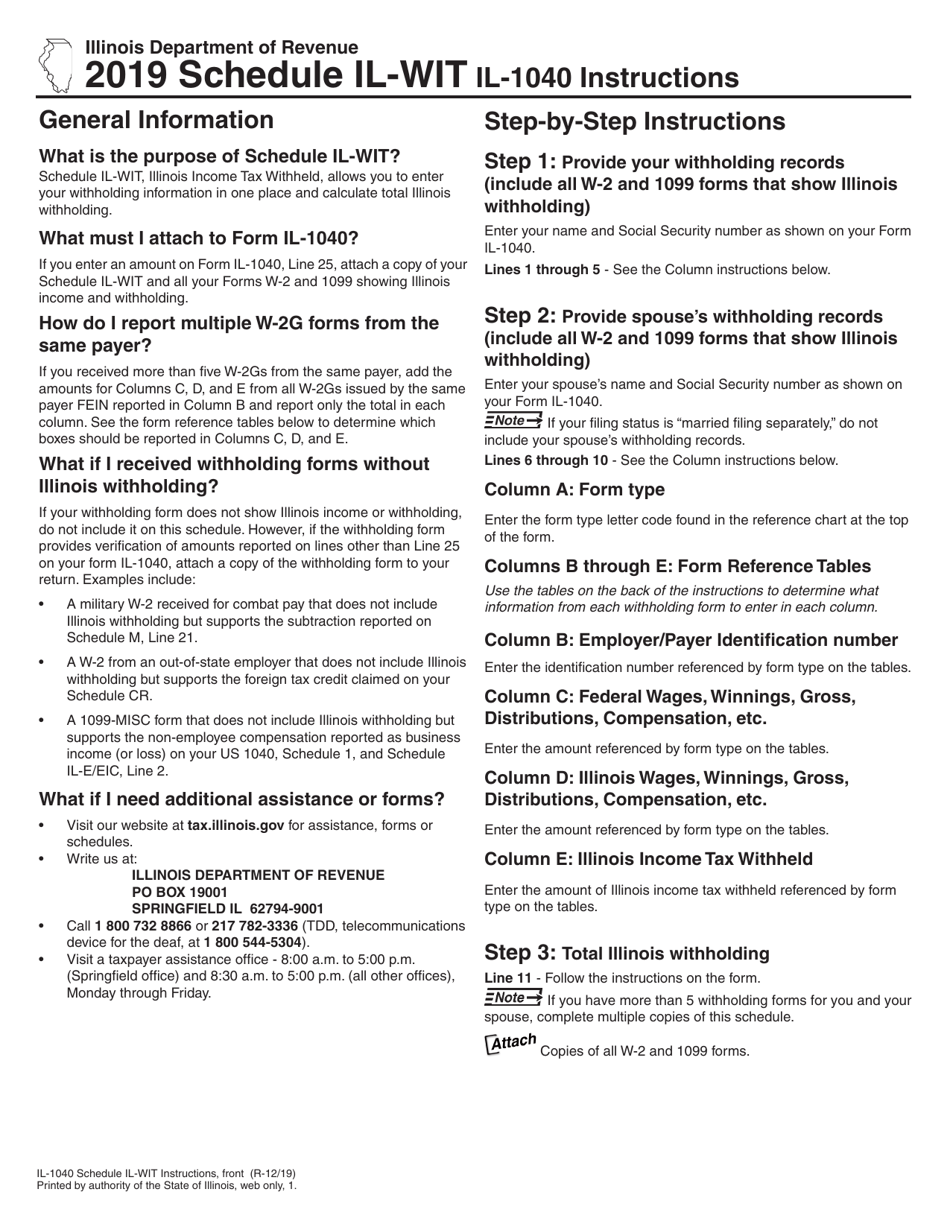

For information or forms Visit our website at tax illinois gov File your return online at mytax illinois gov Email us at Individual income tax questions REV TA IIT illinois gov Business and withholding income tax questions REV TA BIT WIT illinois gov Call us at 1 800 732 8866 or 217 782 3336 Call our TDD telecommunications Form Sources Illinois usually releases forms for the current tax year between January and April We last updated Illinois Form IL 1040 ES from the Department of Revenue in April 2023 Show Sources Form IL 1040 ES is an Illinois Individual Income Tax form

Fill Free Fillable Forms For The State Of Illinois

https://var.fill.io/uploads/pdfs/html/65477c08-7438-4c54-a61f-b50e5e410c03/1577803634_thm.png

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

https://tax.illinois.gov/content/dam/soi/en/web/tax/forms/incometax/documents/currentyear/individual/il-1040.pdf

Individual Income Tax Return 60012231W or for fiscal year ending Enter personal information and Social Security numbers SSN You must provide the entire SSN s no partial SSN Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11

https://tax.illinois.gov/content/dam/soi/en/web/tax/forms/incometax/documents/currentyear/individual/il-1040-instr.pdf

The due date for filing your 2022 Form IL 1040 and paying any tax you owe is April 18 2023 Income Tax Rate The Illinois income tax rate is 4 95 percent 0495 Exemption Allowance The personal exemption amount for tax year 2022 is 2 425 Form IL 1040 Refund and amount you owe were combined under Step 11

Form IL 1040 Schedule IL E EIC 2022 Fill Out Sign Online And Download Fillable PDF

Fill Free Fillable Forms For The State Of Illinois

Fillable Form Il 1040 Individual Income Tax Return 2006 Printable Pdf Download

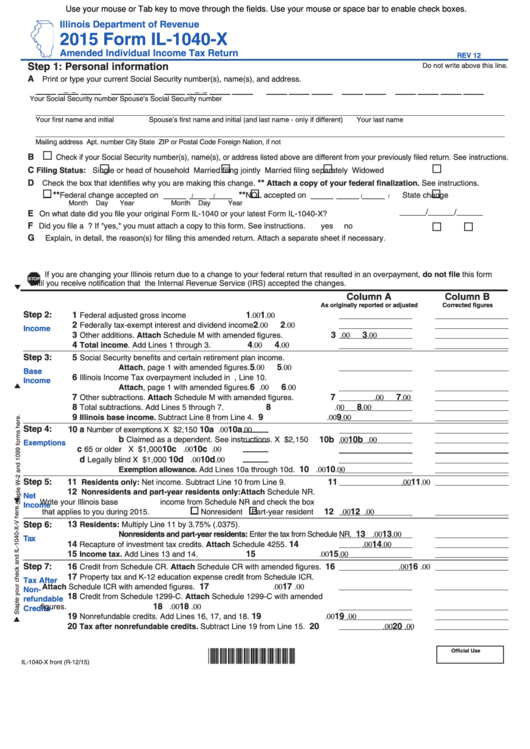

Fillable Form Il 1040 X Amended Individual Income Tax Return 2015 Printable Pdf Download

Download Instructions For Form IL 1040 Schedule IL WIT Illinois Income Tax Withheld PDF 2019

Irs Fillable Form 1040 Printable Forms Free Online

Irs Fillable Form 1040 Printable Forms Free Online

Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form Printable It Is Divided

Form IL 1040 X V Download Fillable PDF Or Fill Online Payment Voucher For Amended Individual

Form IL 1040 X 2019 Fill Out Sign Online And Download Fillable PDF Illinois Templateroller

Illinois 1040 Tax Form Printable - Services Illinois Income Tax Filing IL 1040 Use MyTax Illinois to electronically file your original Individual Income Tax Return Go to Service Provided by Department of Revenue Go to Agency Contact Agency 800 732 8866 Search Services