Illinois State Income Tax Form For Trusts Printable Revenue 2023 Individual Income Tax Forms 2023 Individual Income Tax Forms Name Description IL 1040 Instructions Individual Income Tax Return IL 1040 X Instructions Amended Individual Income Tax Return IL 1040 PTR Instructions Property Tax Rebate Form Use this form to request your one time property tax rebate IL 1040 ES

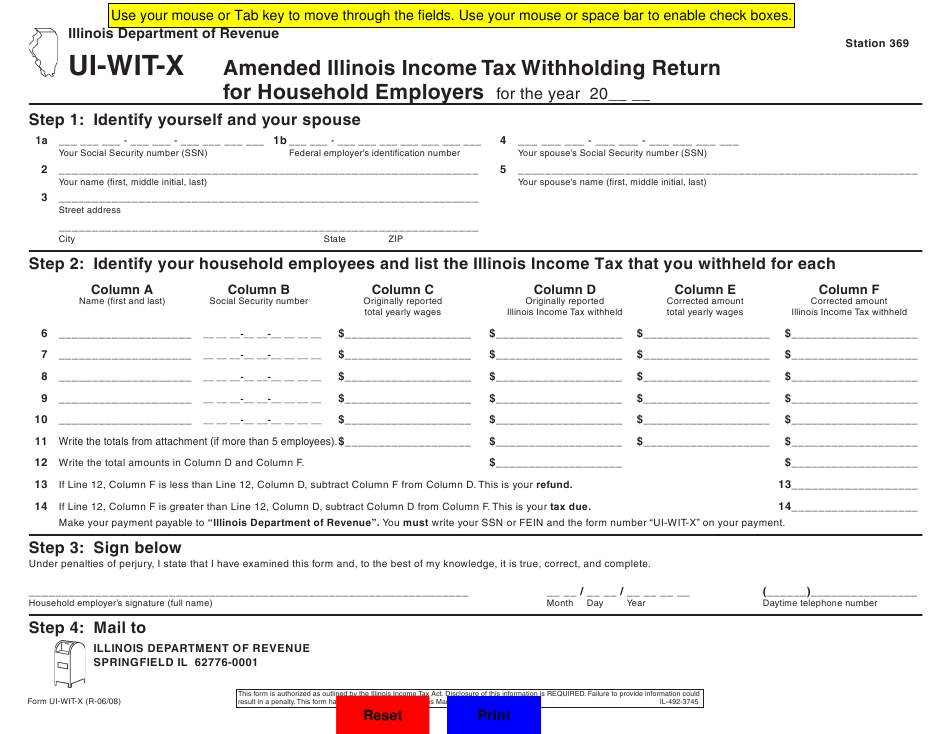

Registration Sales Related Withholding Tax Federal Tax Forms Request Certain Forms from IDOR Documents are in Adobe Acrobat Portable Document Format PDF Before viewing these documents you may need to download Adobe Acrobat Reader Having problems viewing and or printing a form State ZIP C Check the box that identifies your fiduciary Trust Estate Check the box if any of the following apply You may check multiple boxes Electing small business trust ESBT Check this box if you completed federal Form 8886 and attach a copy to this return

Illinois State Income Tax Form For Trusts Printable

Illinois State Income Tax Form For Trusts Printable

https://w4formsprintable.com/wp-content/uploads/2021/07/form-ui-wit-x-download-fillable-pdf-or-fill-online-amended.png

Printable State Tax Forms

https://www.pdffiller.com/preview/100/101/100101112/large.png

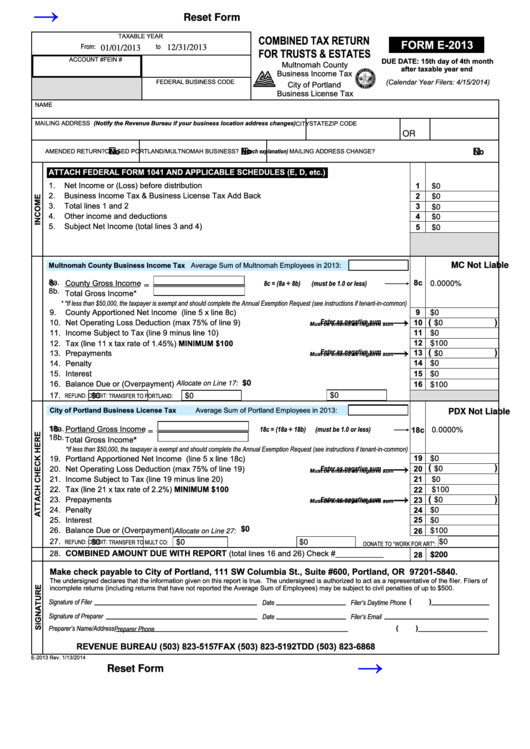

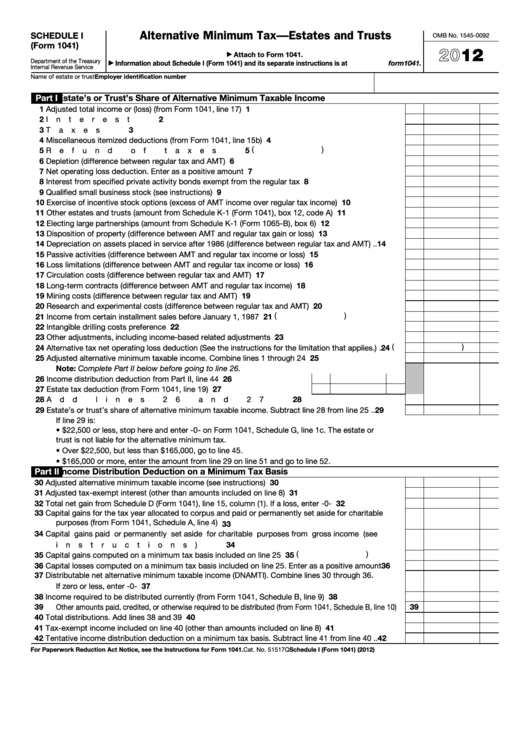

Fillable Form E 2013 Combined Tax Return For Trusts Estates Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/267/2670/267095/page_1_thumb_big.png

Income Tax Rate The Illinois income tax rate is 4 95 percent 0495 Exemption Allowance The personal exemption amount for tax year 2022 is 2 425 Form IL 1040 Refund and amount you owe were combined under Step 11 State general revenues top 50 billion for first time in FY 2022 676 FY22 Q2 Report 676 FY22 Q3 Report File Only Grants Quarterly Reports Public Act 102 0783 Comptroller Mendoza deposits another 100 million into the Rainy Day Fund State adds 100 million to Rainy Day Fund Election year tax rebates to go out to Illinois taxpayers before election

You must file Form IL 1041 if you are a fiduciary of a trust or an estate and the trust or the estate has net income or loss as defined under the Illinois Income Tax Act IITA regardless of any deduction for distributions to beneficiaries or is a resident of Illinois and files or is required to file a federal income tax return regar For information or forms Visit our website at tax illinois gov File your return online at mytax illinois gov Email us at Individual income tax questions REV TA IIT illinois gov Business and withholding income tax questions REV TA BIT WIT illinois gov Call us at 1 800 732 8866 or 217 782 3336 Call our TDD telecommunications

More picture related to Illinois State Income Tax Form For Trusts Printable

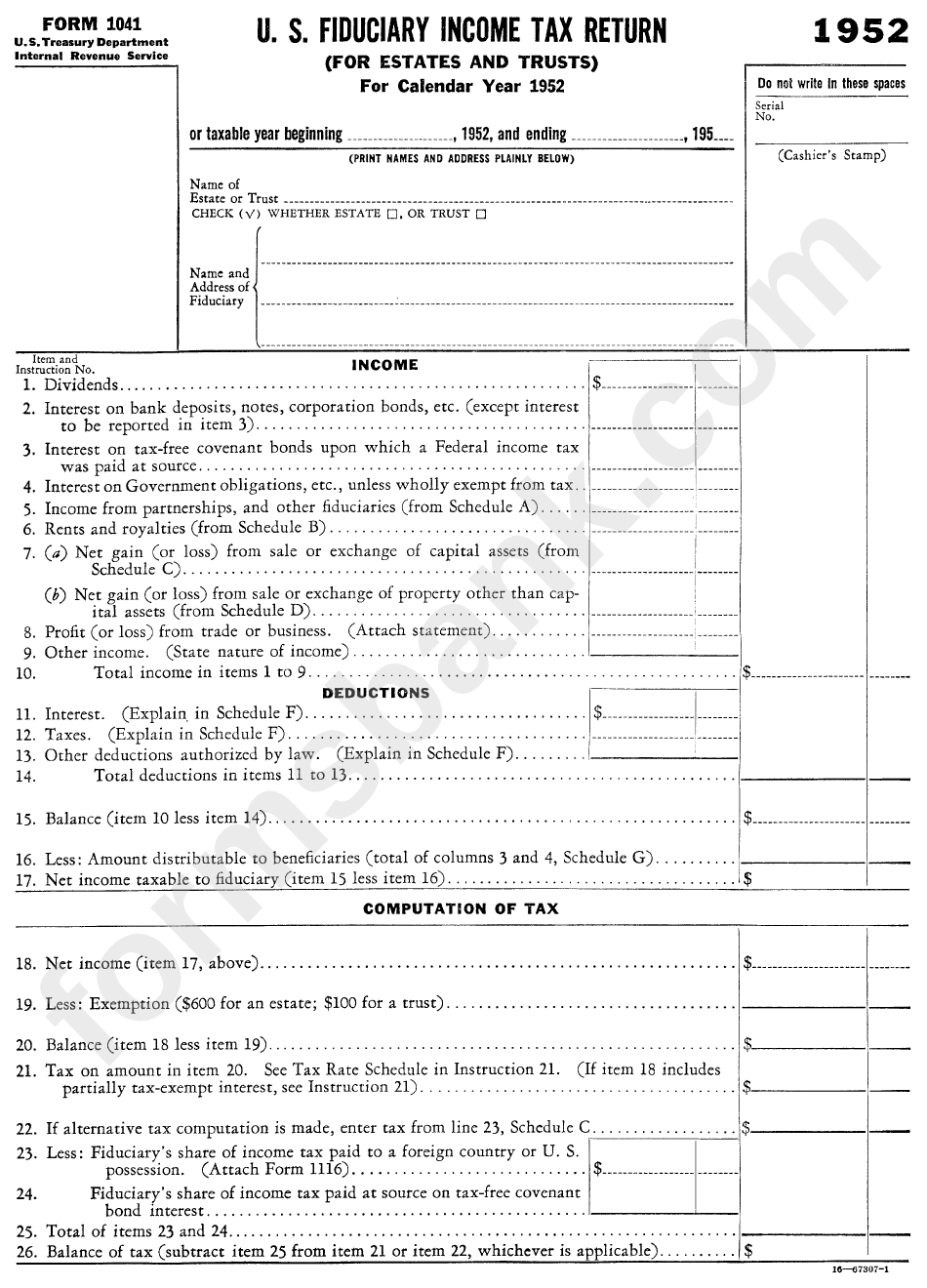

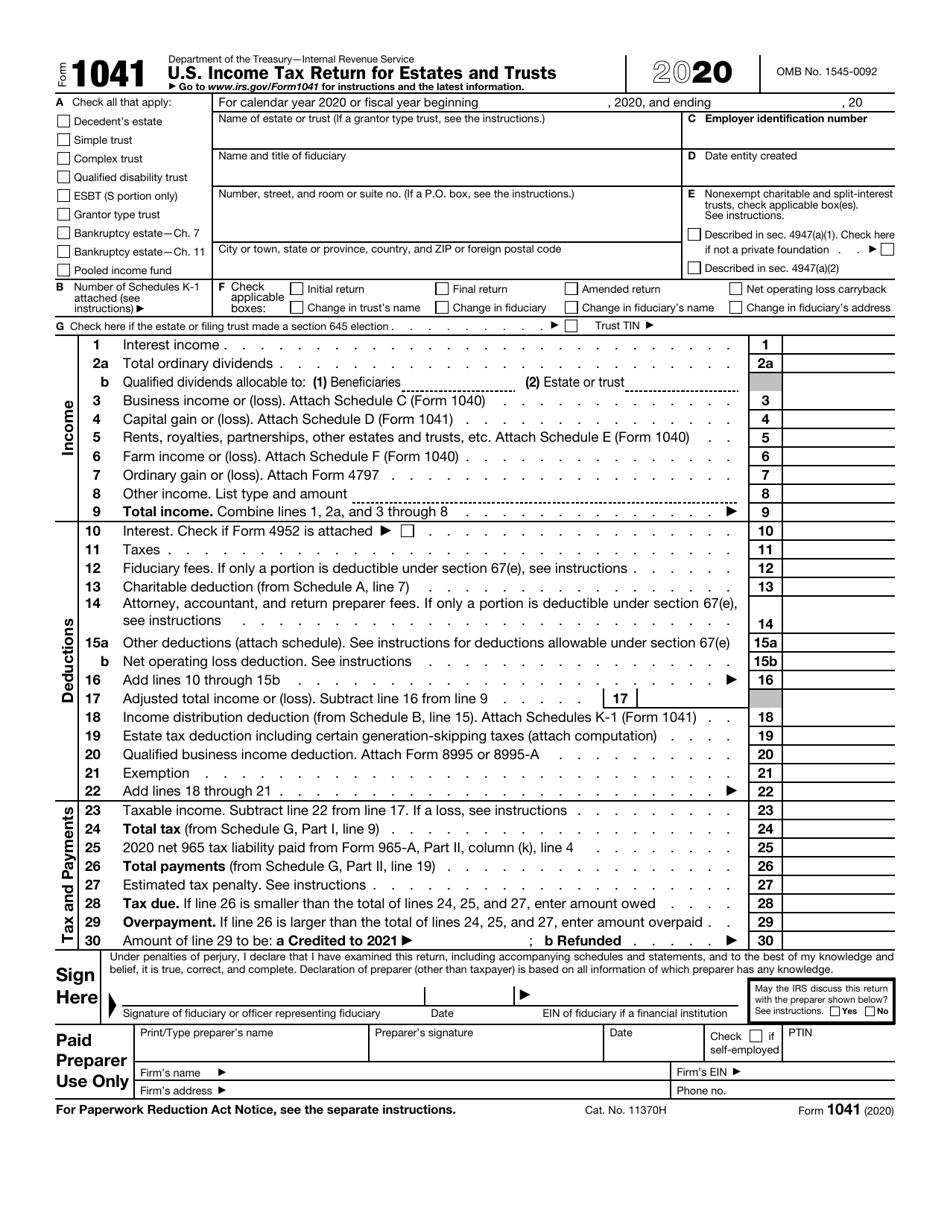

Form 1041 U s Fiduciary Income Tax Return For Estates And Trusts 1952 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/282/2826/282652/page_1_bg.png

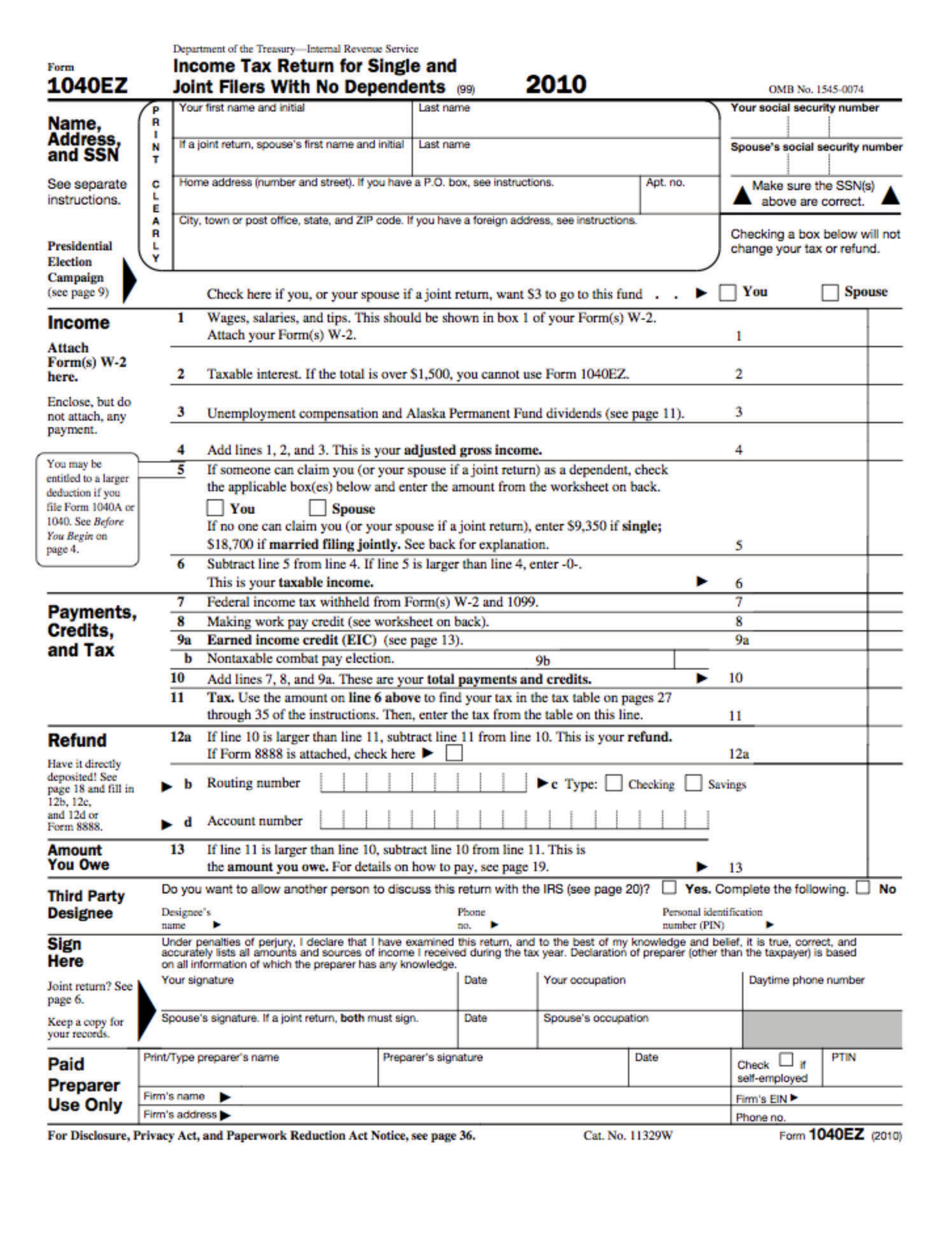

Income Tax E Filing Form Download Osekits

https://saylordotorg.github.io/text_macroeconomics-theory-through-applications/section_16/c4cf23e13afd687b61733ccc4ee9b960.jpg

Printable K 1 Tax Form Printable World Holiday

https://data.formsbank.com/pdf_docs_html/322/3225/322595/page_1_thumb_big.png

Download or print the 2023 Illinois Form IL 1041 Fiduciary Income and Replacement Tax Return Includes Schedule D for FREE from the Illinois Department of Revenue Step 5 Figure your net replacement tax For trusts only estates go to Step 6 37 Replacement tax credit for income tax paid to another state while an Illinois resident Step 6 Tax Issues Income Taxes Fiduciary Form 1041 Determine tax year Generally calendar year but may want to treat trust as an estate Section 645 Election Ensure return is filed timely Step 6 Tax Issues Income Taxes Fiduciary Form 1041 Get W 9 sfrom residuary beneficiaries Maximize tax advantage

Form IL 1040 is the standard Illinois income tax return for all permanent residents of Illinois We last updated the Individual Income Tax Return in January 2024 so this is the latest version of Form IL 1040 fully updated for tax year 2023 You can download or print current or past year PDFs of Form IL 1040 directly from TaxFormFinder Download This Form Print This Form More about the Illinois Schedule K 1 T 1 Estate Tax TY 2022 We last updated the Instructions for Trusts and Estates Completing Schedule K 1 T and Schedule K 1 T 3 in March 2023 so this is the latest version of Schedule K 1 T 1 fully updated for tax year 2022

Illinois State Income Tax Form For Trusts Printable Printable Forms Free Online

https://www.signnow.com/preview/397/787/397787297/large.png

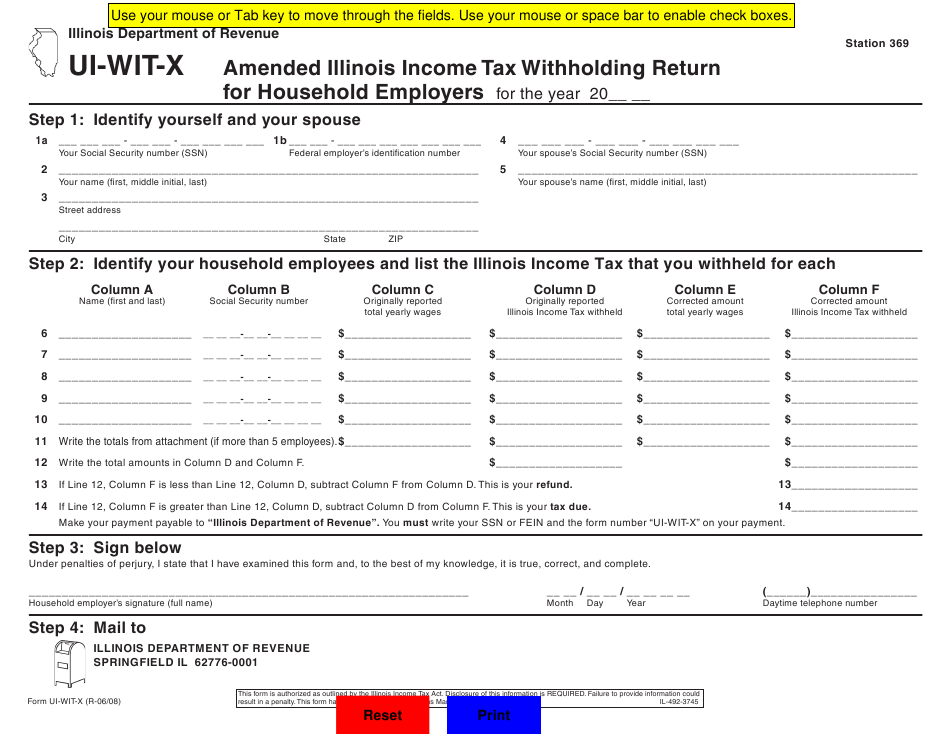

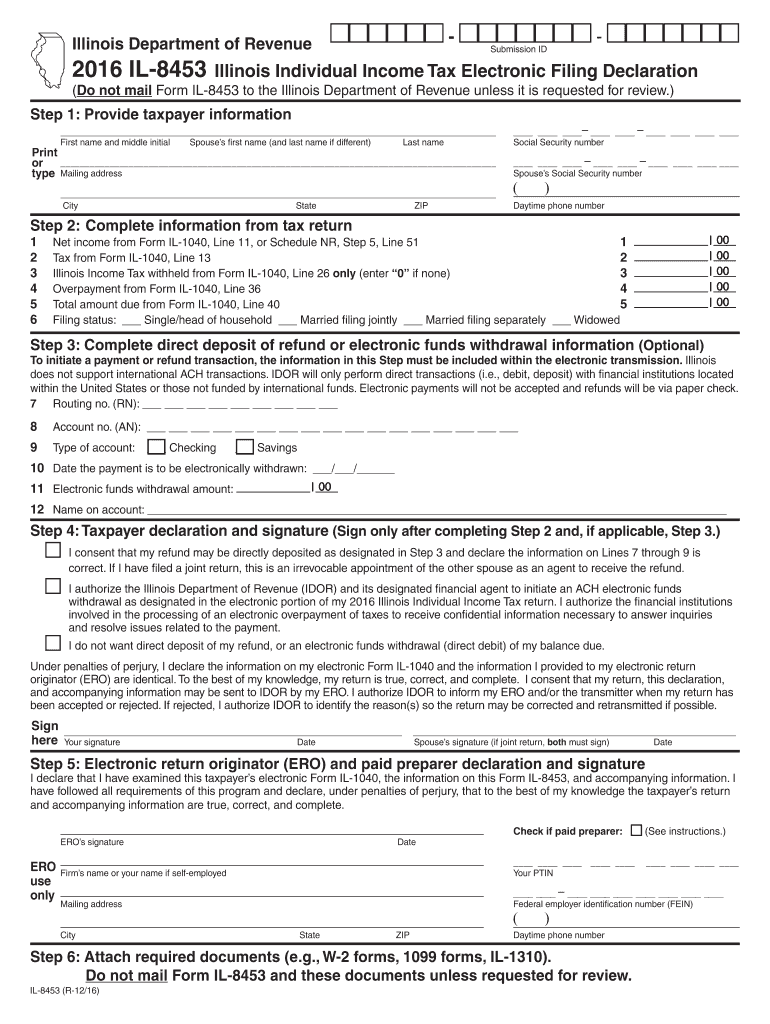

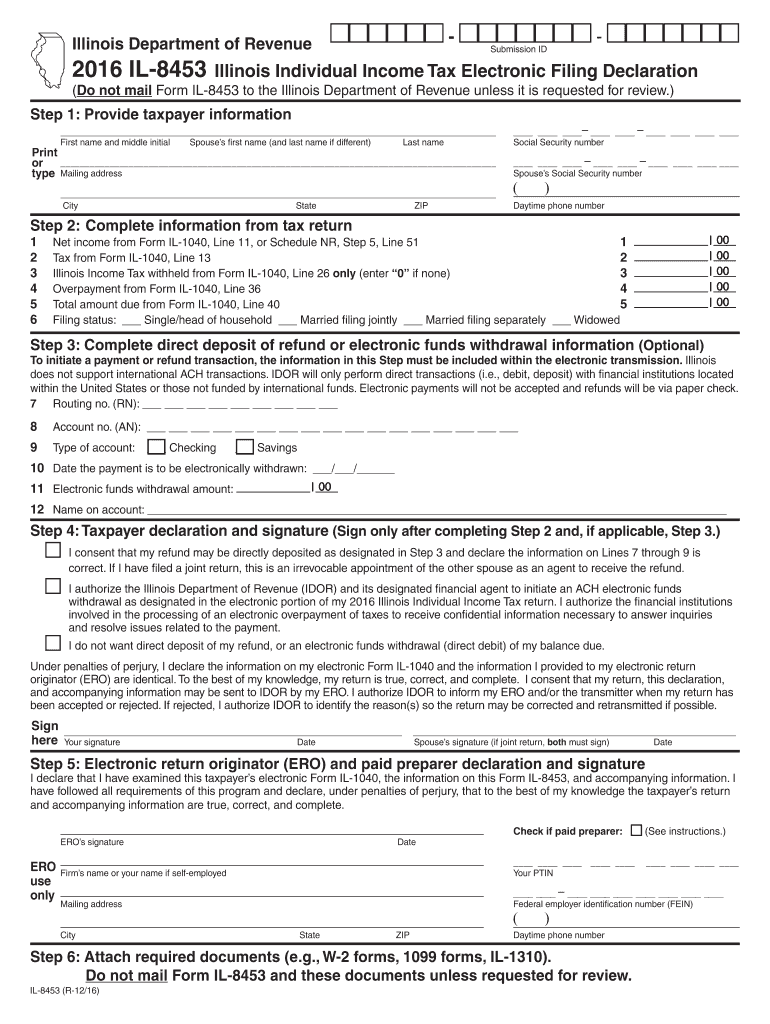

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/6/960/6960443/large.png

https://tax.illinois.gov/forms/incometax/currentyear/individual.html

Revenue 2023 Individual Income Tax Forms 2023 Individual Income Tax Forms Name Description IL 1040 Instructions Individual Income Tax Return IL 1040 X Instructions Amended Individual Income Tax Return IL 1040 PTR Instructions Property Tax Rebate Form Use this form to request your one time property tax rebate IL 1040 ES

https://tax.illinois.gov/forms.html

Registration Sales Related Withholding Tax Federal Tax Forms Request Certain Forms from IDOR Documents are in Adobe Acrobat Portable Document Format PDF Before viewing these documents you may need to download Adobe Acrobat Reader Having problems viewing and or printing a form

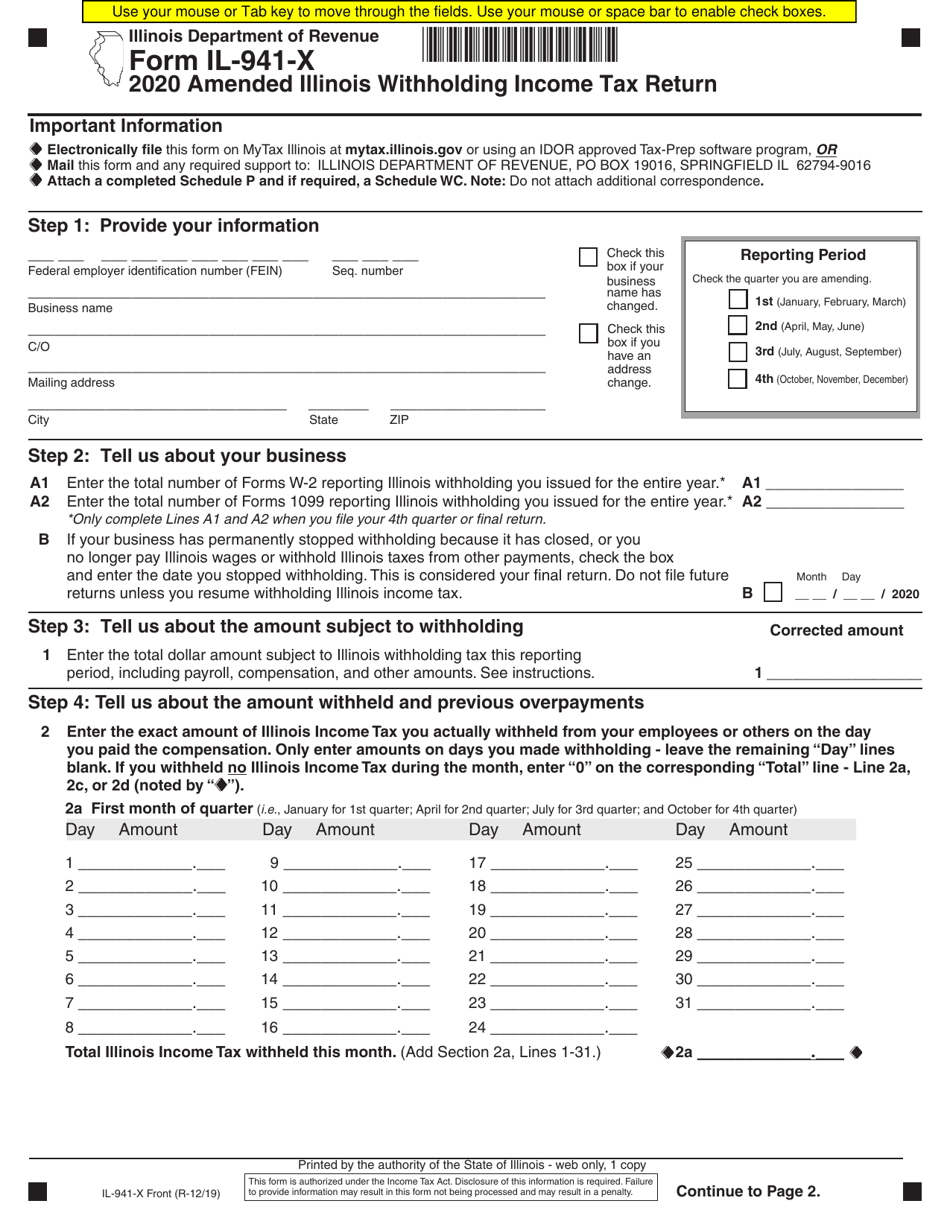

Form IL 941 X 2020 Fill Out Sign Online And Download Fillable PDF Illinois Templateroller

Illinois State Income Tax Form For Trusts Printable Printable Forms Free Online

Wisconsin State Tax Forms Printable Fill Out Sign Online DocHub

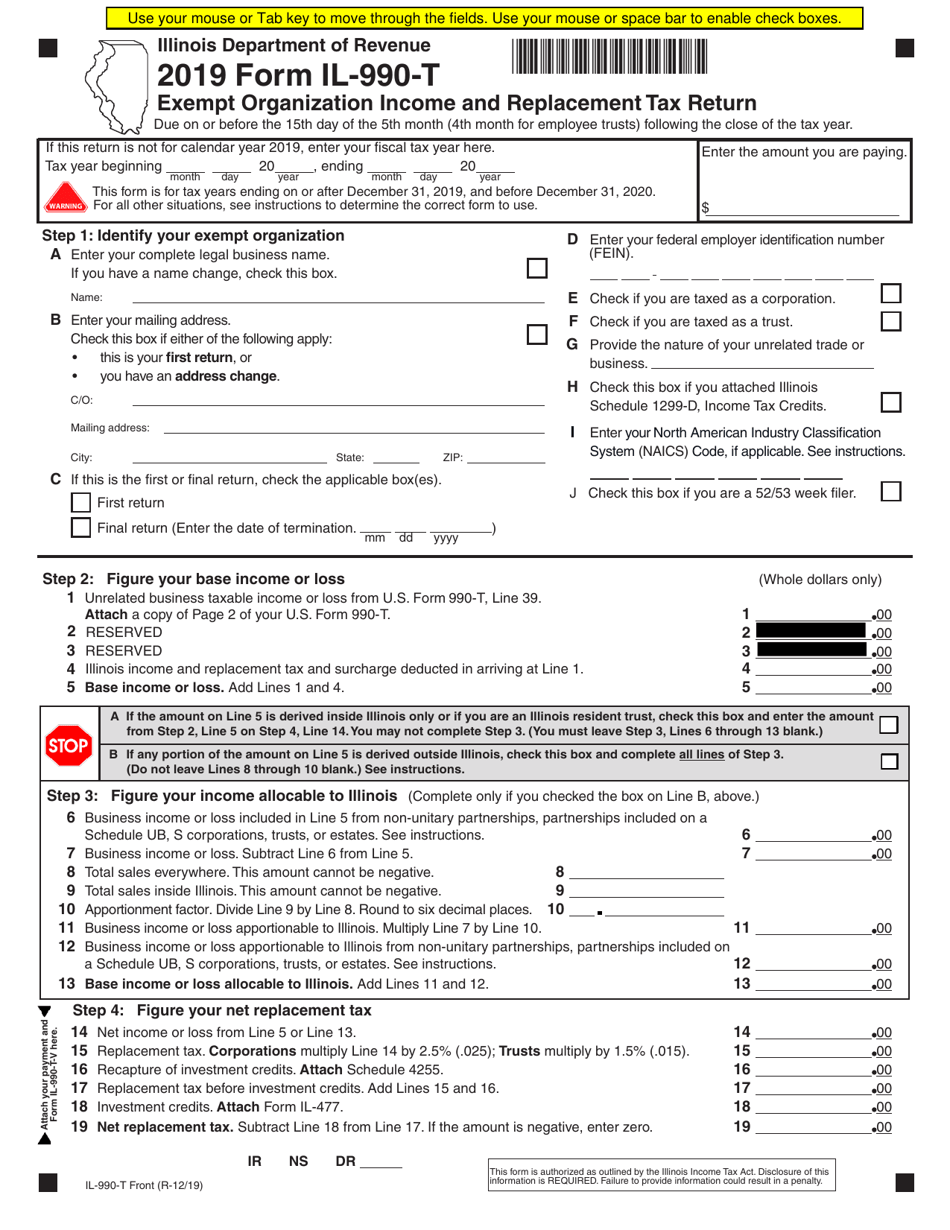

Form IL 990 T 2019 Fill Out Sign Online And Download Fillable PDF Illinois Templateroller

2020 Form KS DoR K 40 Fill Online Printable Fillable Blank PdfFiller

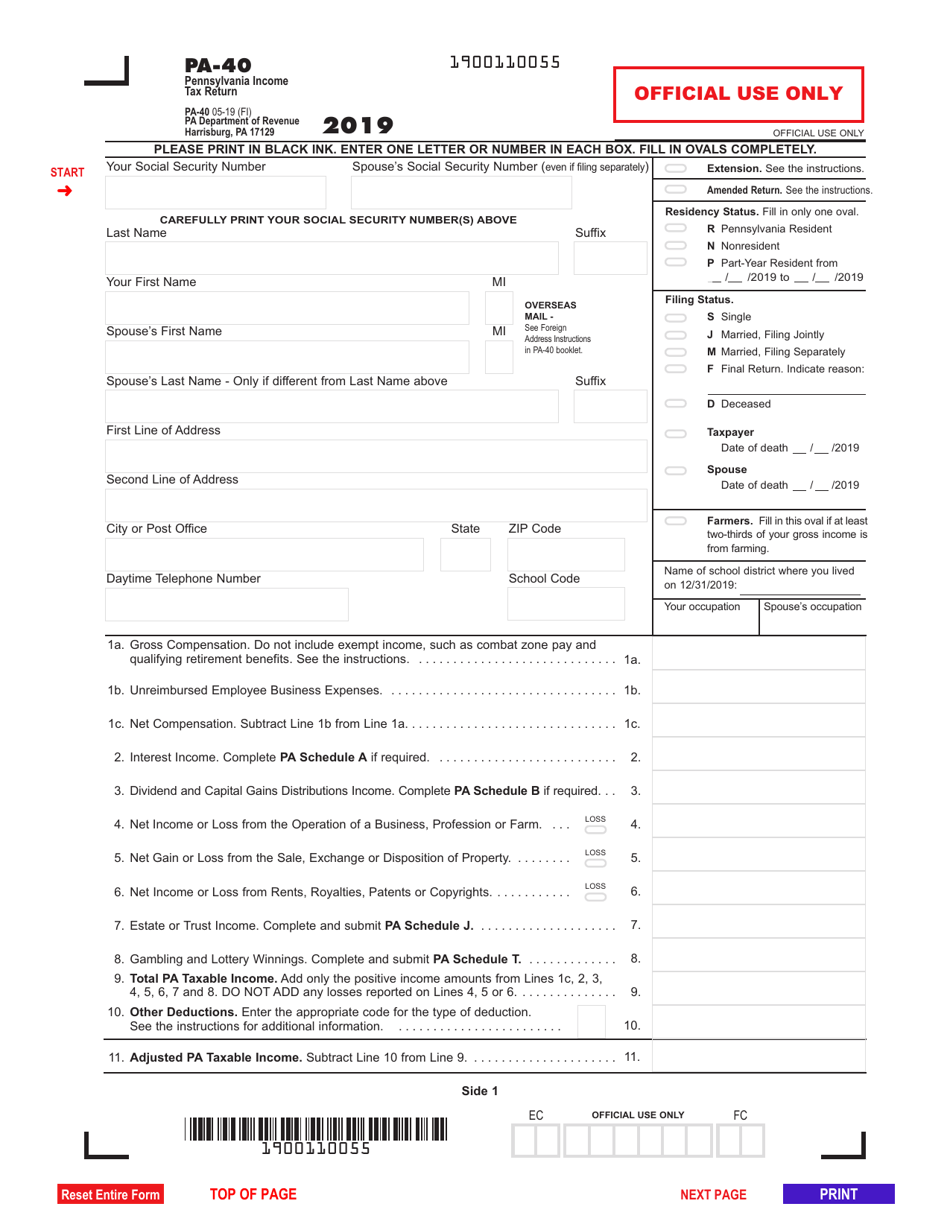

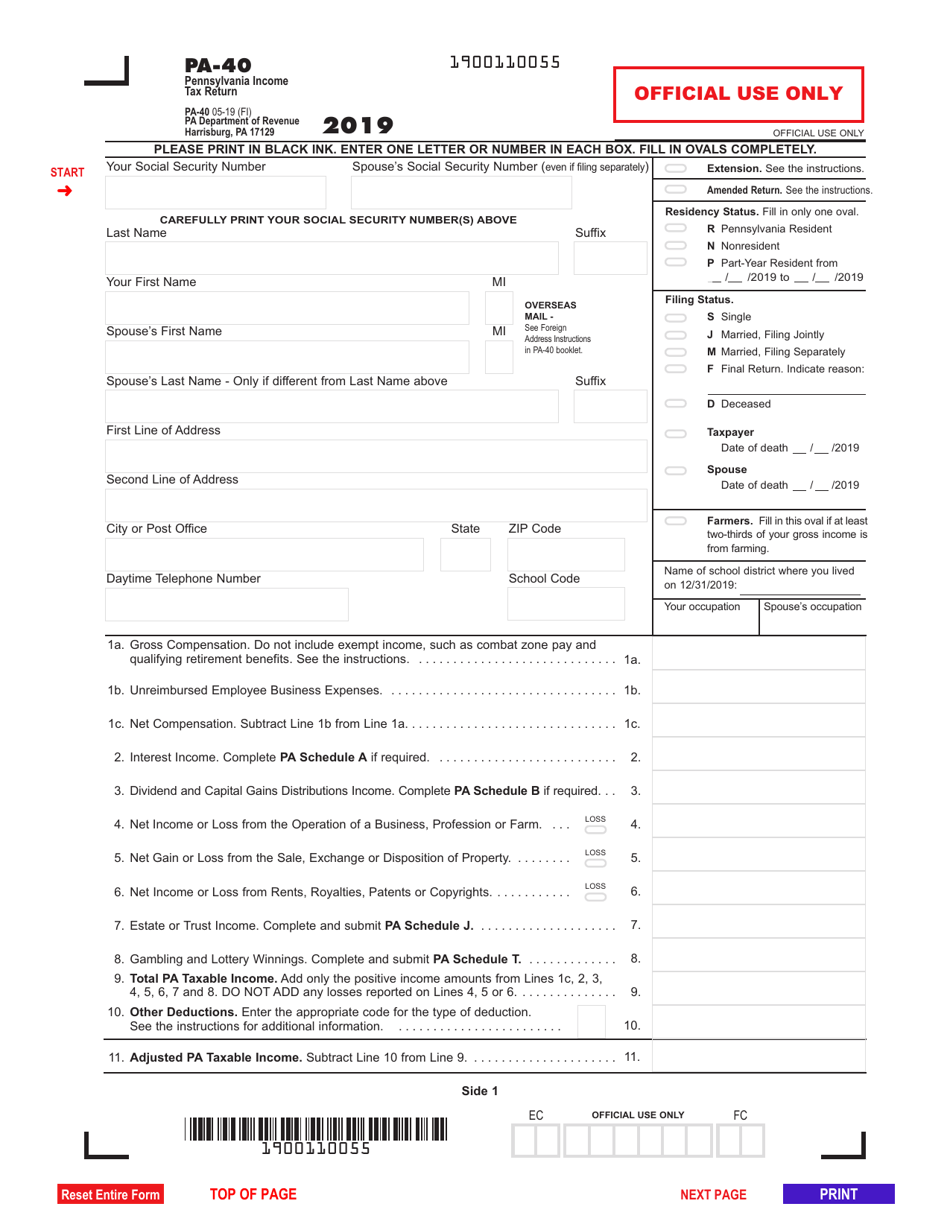

Printable State Tax Forms

Printable State Tax Forms

Illinois State Income Tax Fill Out Sign Online DocHub

IRS Form 1041 Download Fillable PDF Or Fill Online U S Income Tax Return For Estates And Trusts

Recommendation What Expenses Are Deductible On Form 1041 Why Is Teamwork Important In Education

Illinois State Income Tax Form For Trusts Printable - You must file Form IL 1041 if you are a fiduciary of a trust or an estate and the trust or the estate has net income or loss as defined under the Illinois Income Tax Act IITA regardless of any deduction for distributions to beneficiaries or is a resident of Illinois and files or is required to file a federal income tax return regar