Illinois State Tax Forms Printable 1 2 3 Next Printed all of your Illinois income tax forms Head over to the Federal income tax forms page to get any forms you need for completing your Federal Income Tax return in April Illinois Income Tax Form Addresses Illinois has multiple mailing addresses for different tax forms and other forms of correspondence

Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11 Federally tax exempt interest and dividend income from your federal Form 1040 or 1040 SR Line 2a Other additions Attach Schedule M Total income Add Lines 1 through 3 Whole dollars only Step 3 Base Income Printable Illinois state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023 The Illinois income tax rate for tax year 2023 is 4 95 The state income tax rate is displayed on the Illinois 1040 form and can also be found inside the Illinois 1040 instructions booklet

Illinois State Tax Forms Printable

Illinois State Tax Forms Printable

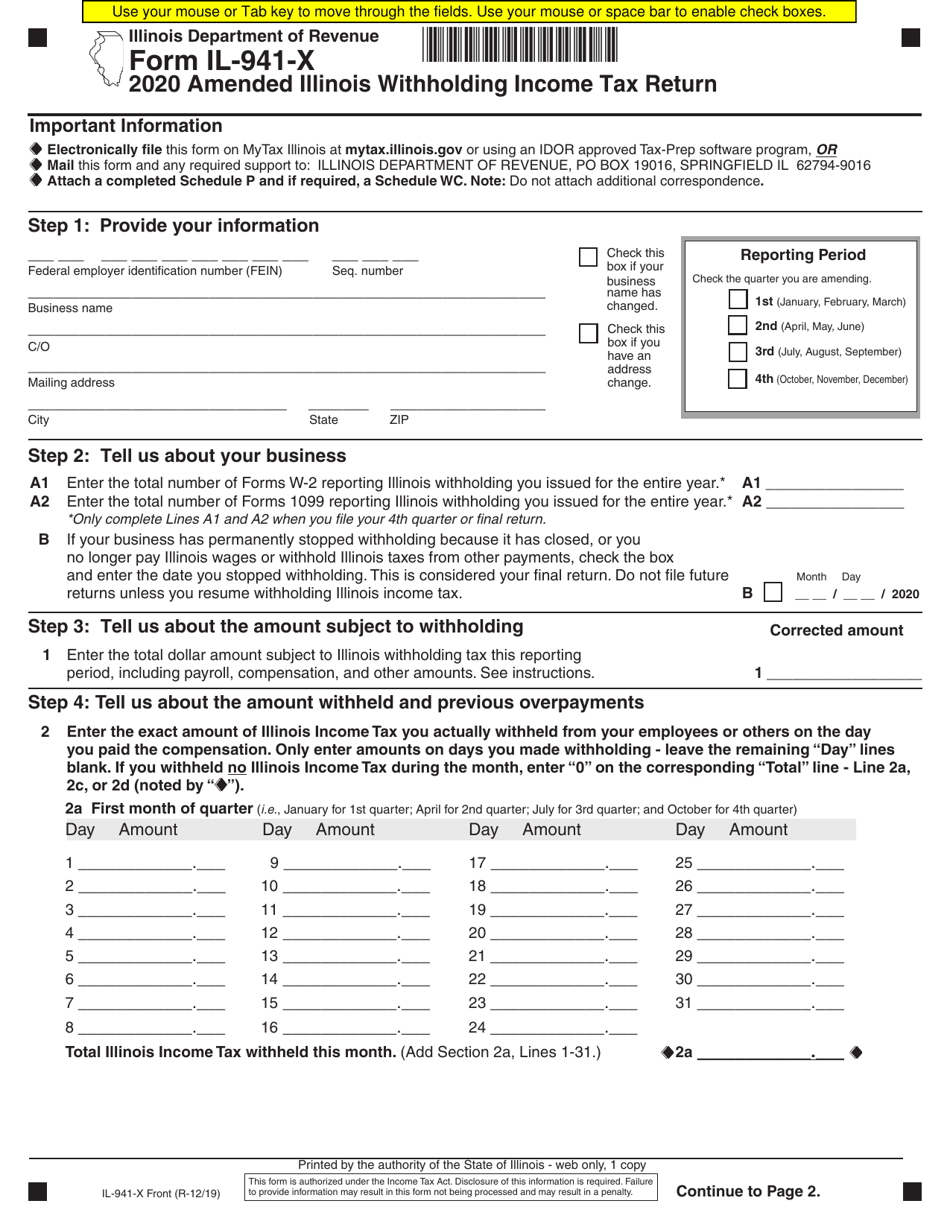

https://data.templateroller.com/pdf_docs_html/2063/20638/2063864/form-il-941-x-amended-illinois-withholding-income-tax-return-illinois_print_big.png

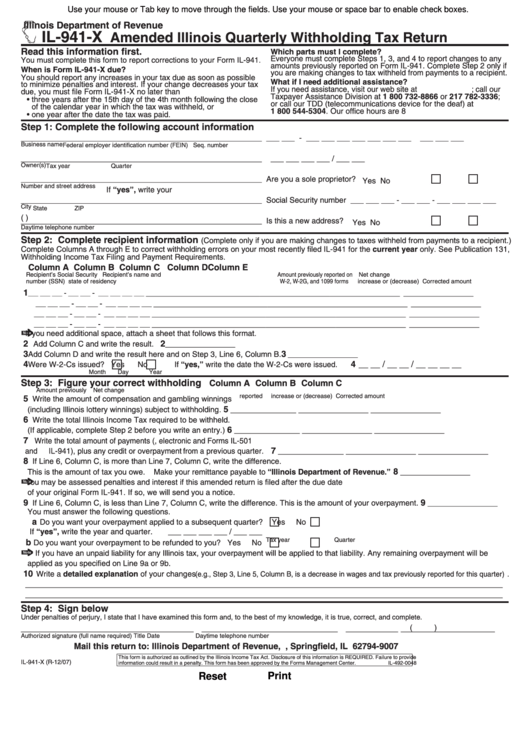

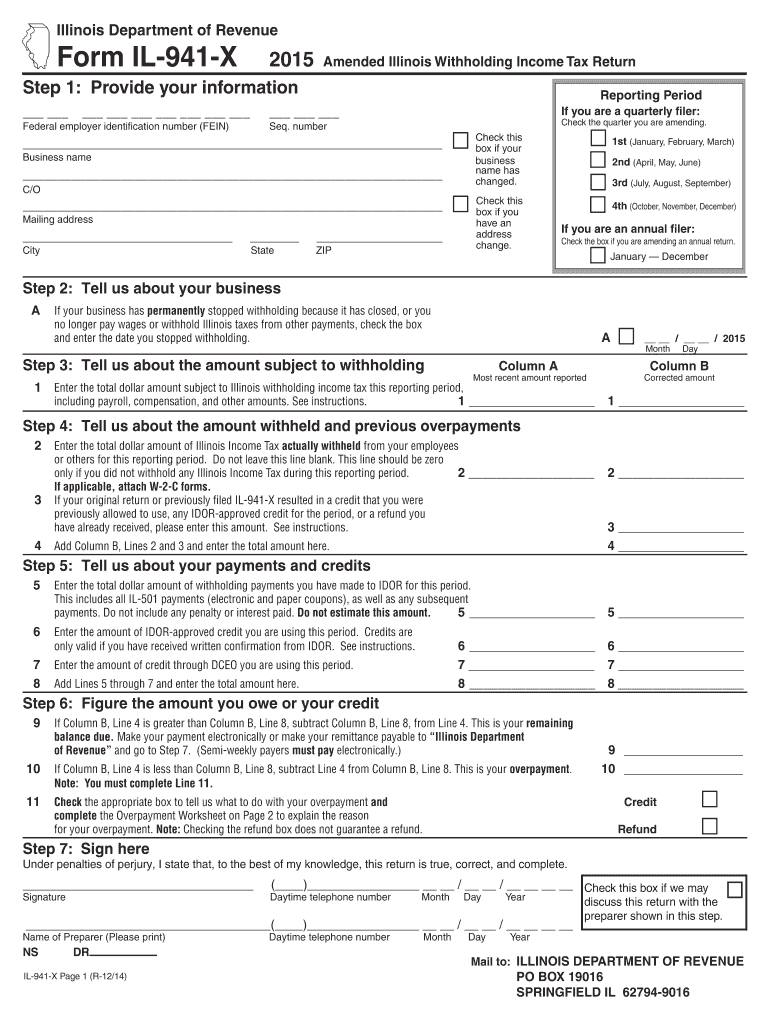

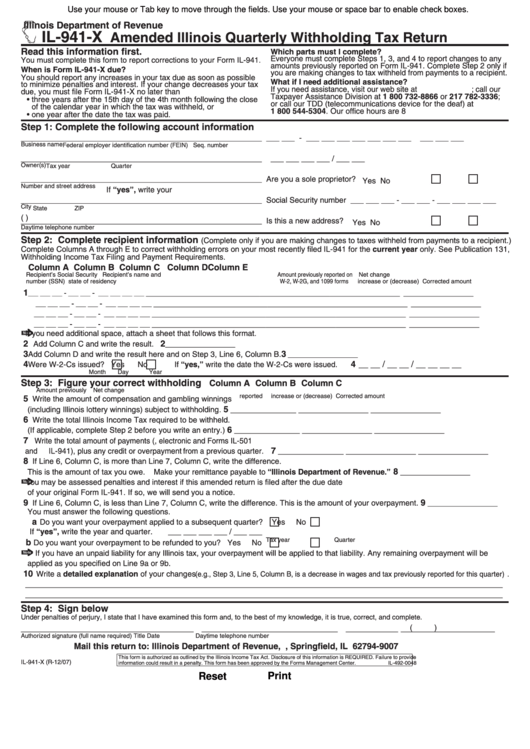

Fillable Form Il 941 X Amended Illinois Quarterly Withholding Tax Return Form State Of

https://data.formsbank.com/pdf_docs_html/236/2360/236014/page_1_thumb_big.png

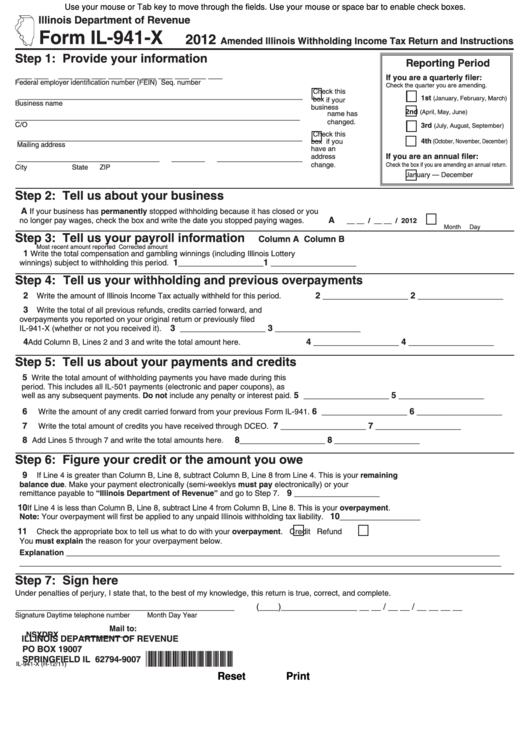

Form Il 941 X Amended Illinois Withholding Income Tax Return And Instructions 2012 Printable

https://data.formsbank.com/pdf_docs_html/336/3368/336839/page_1_thumb_big.png

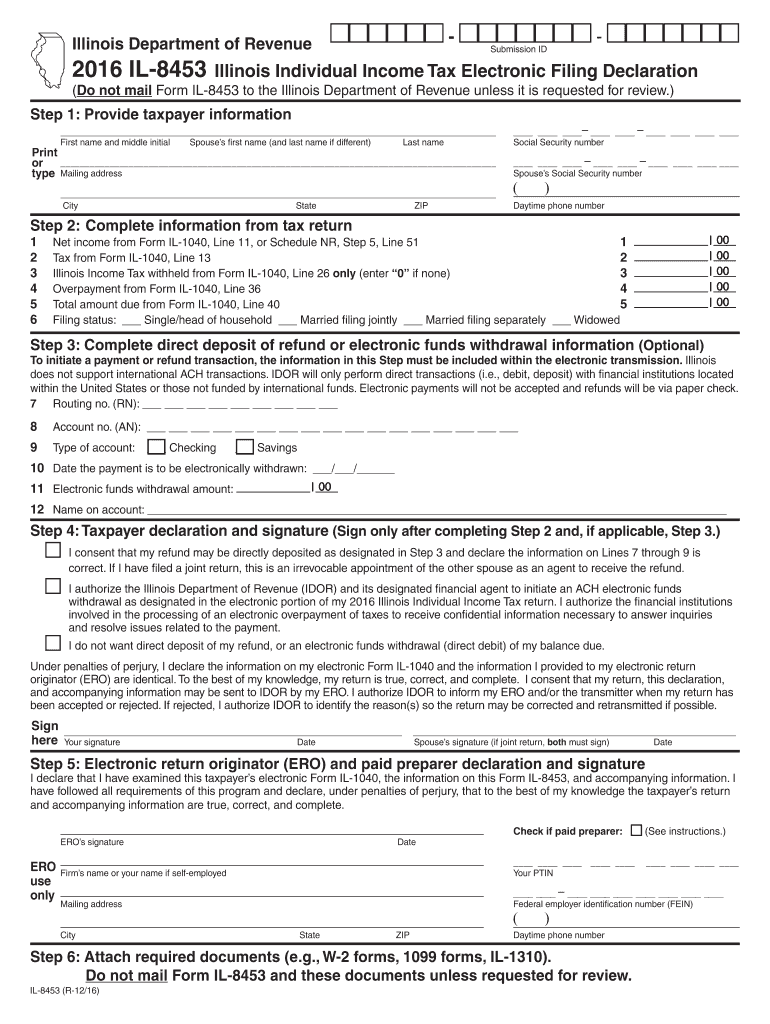

Where Do I Find Illinois State Tax Forms If you are trying to locate download or print state of Illinois tax forms you can do so on the Illinois Department of Revenue Website Illinois Income Tax Forms Instructions The most common Illinois income tax form is the IL 1040 File income taxes online with MyTax Illinois Go to Service Provided by Department of Revenue Go to Agency Contact Agency 800 732 8866 View All Services Footer Back to top Stay Informed Emergencies and Disasters Flag Honors State of Illinois

Please let us know so we can fix it Tax Form Sources Illinois Department of Revenue https www2 illinois gov rev Pages default aspx Department of Revenue Income Tax Forms https www2 illinois gov rev forms Pages default aspx Form Sources Illinois usually releases forms for the current tax year between January and April We last updated Illinois Form IL 1040 from the Department of Revenue in January 2024 Show Sources Form IL 1040 is an Illinois Individual Income Tax form

More picture related to Illinois State Tax Forms Printable

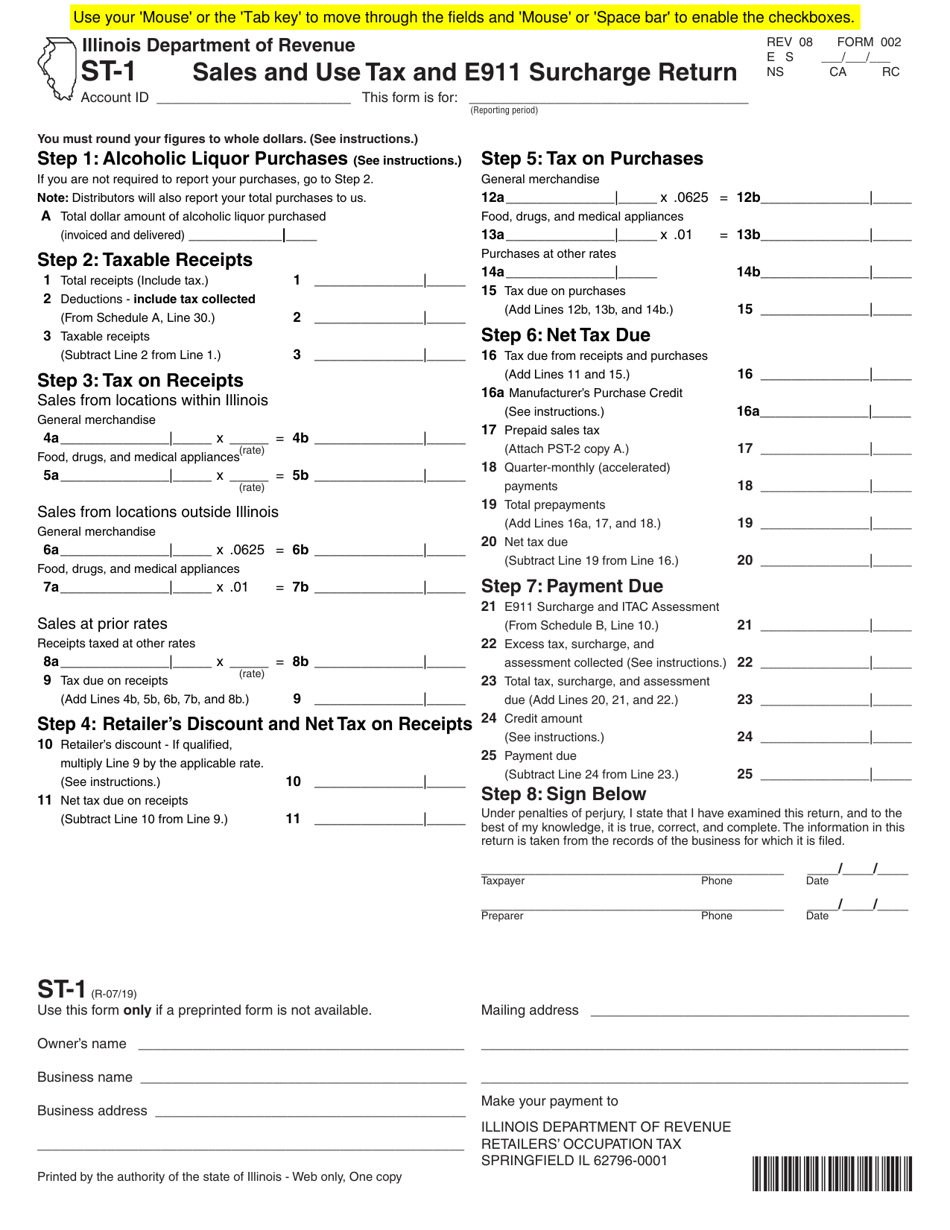

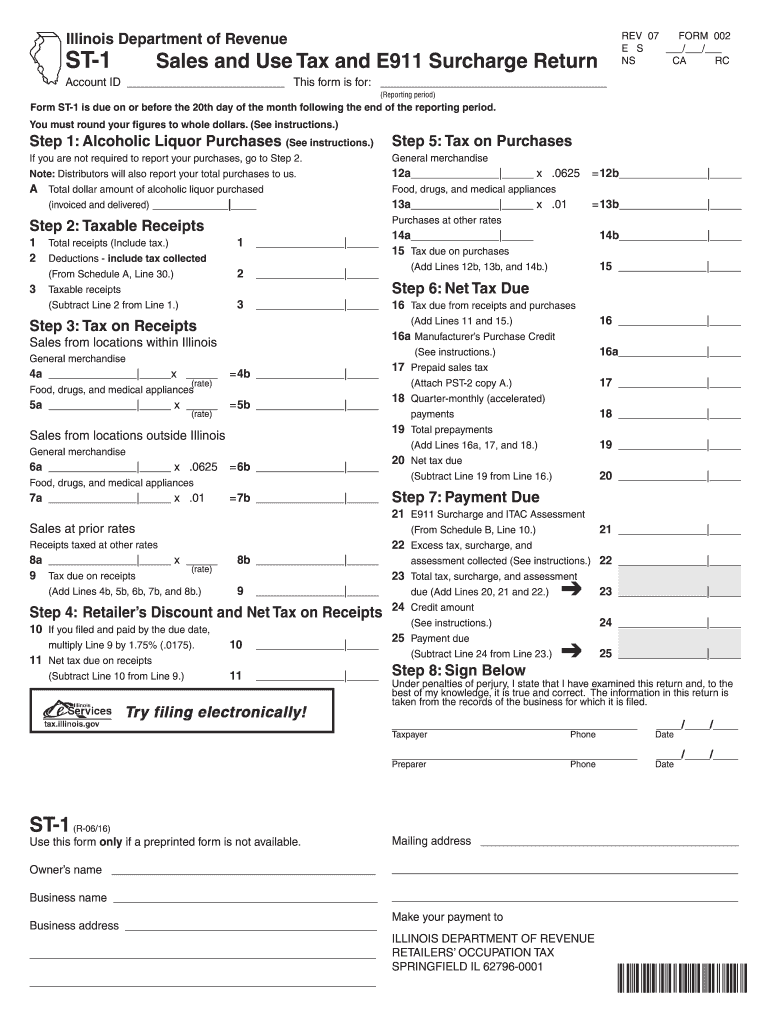

Form ST 1 Fill Out Sign Online And Download Fillable PDF Illinois Templateroller

https://data.templateroller.com/pdf_docs_html/1999/19996/1999688/form-st-1-sales-and-use-tax-and-e911-surcharge-return-illinois_print_big.png

IL IL 1040 Schedule ICR 2020 2021 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/549/447/549447420/large.png

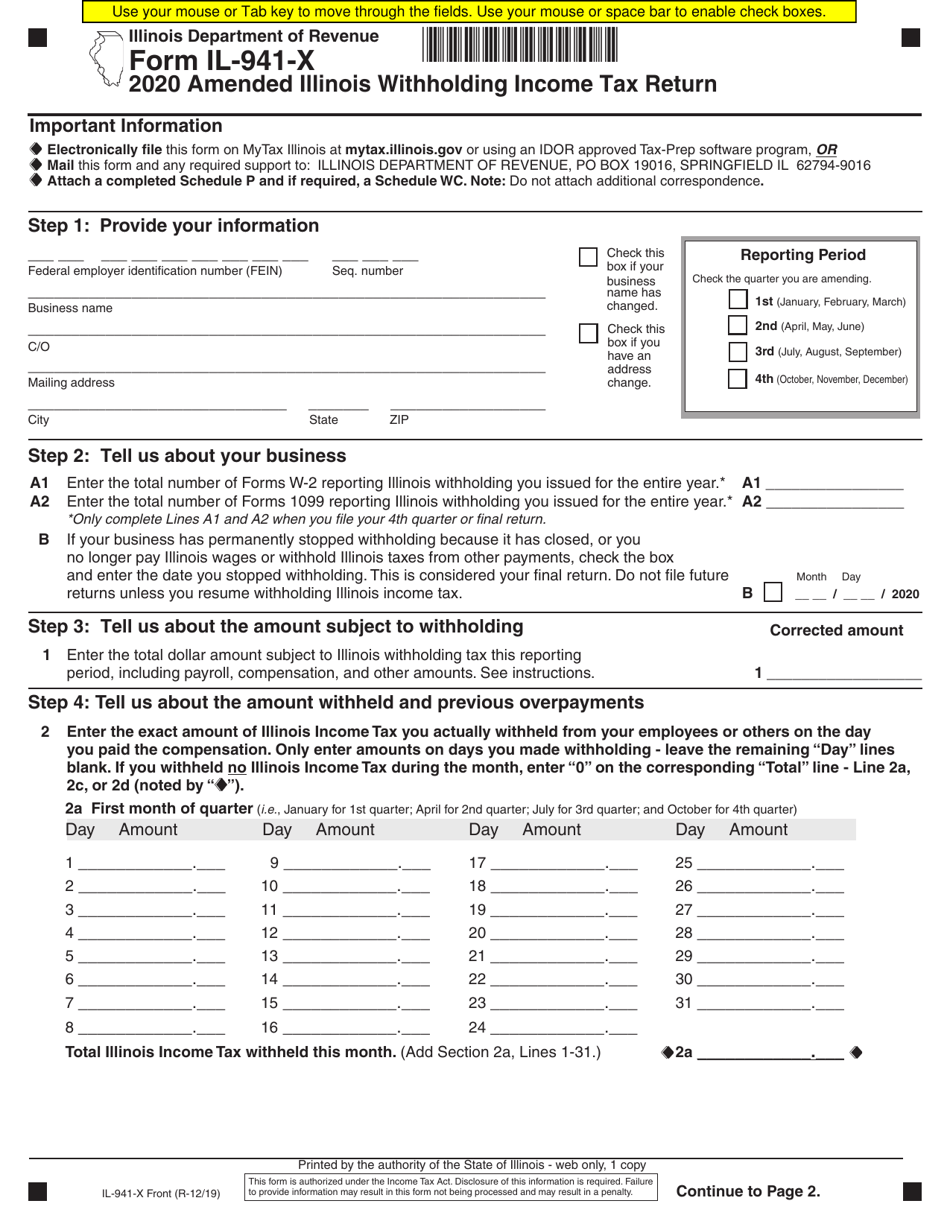

IL 941 X Amended Illinois Withholding Income Tax Return Fill Out And Sign Printable PDF

https://www.signnow.com/preview/6/962/6962503/large.png

For information or forms Visit our website at tax illinois gov File your return online at mytax illinois gov Email us at Individual income tax questions REV TA IIT illinois gov Business and withholding income tax questions REV TA BIT WIT illinois gov Call us at 1 800 732 8866 or 217 782 3336 Call our TDD telecommunications If you owe more then 500 a year in income tax on April 15th because of self employment or other income without tax withholding you must file a quarterly income tax payment using the worksheet and payment voucher included in Illinois form IL 1040 ES 11 0001 Form IL 1040 Illinois Individual Income Tax Return

Federal Tax Withholding Tables 2023 Illinois State Income Tax Exemptions 2023 Fiscal Year 2022 Illinois Comptroller Susana Mendoza joined WXAN to talk about the Rainy Day Fund established by the State of Illinois and how the recent budget deposited 850 million dollars into that fund December 2022 December 2022 Fiscal Year 2023 Quarter 2 Form Sources Illinois usually releases forms for the current tax year between January and April We last updated Illinois Income Tax Instructions from the Department of Revenue in January 2024 Show Sources About the Individual Income Tax

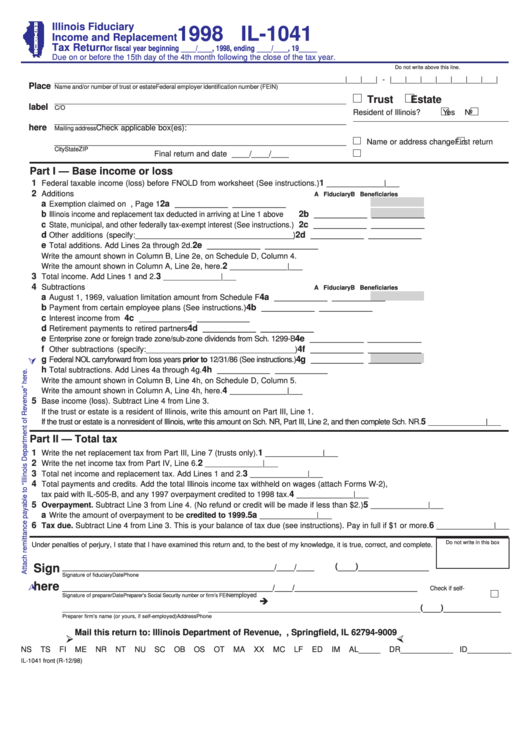

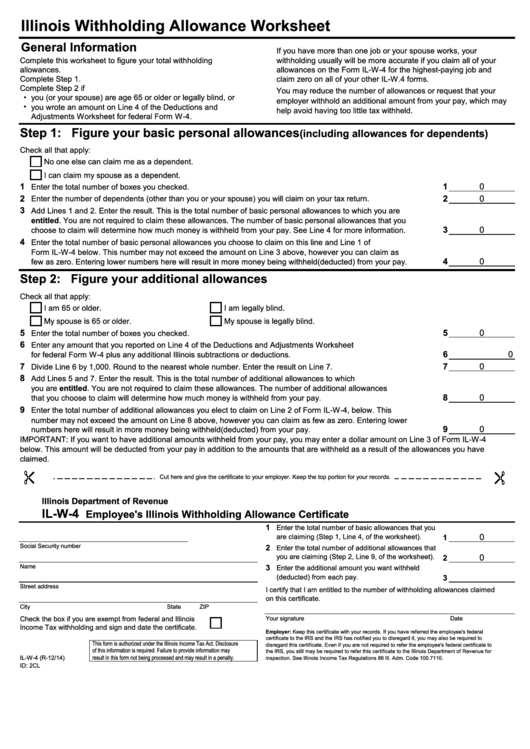

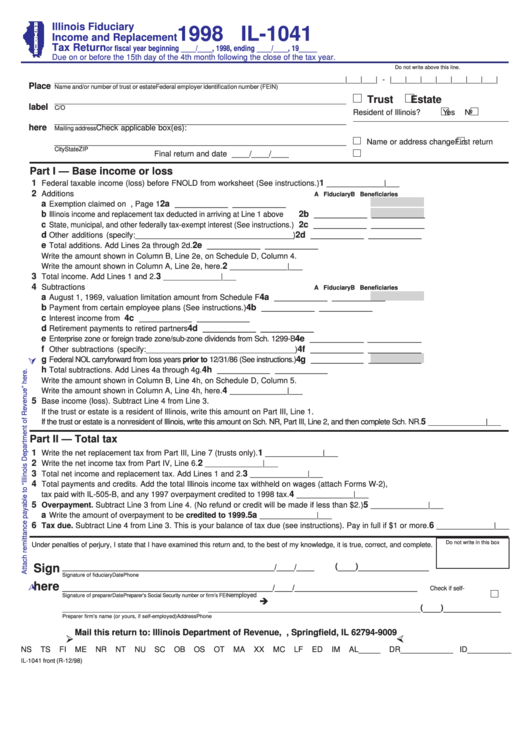

Fillable Il 1041 Form Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/274/2740/274040/page_1_thumb_big.png

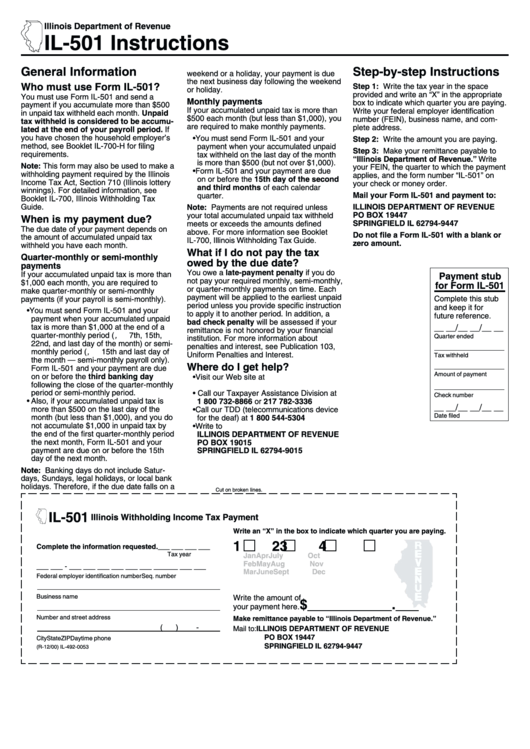

Form Il 501 Illinois Withholding Income Tax Payment Illinois Department Of Revenue Printable

https://data.formsbank.com/pdf_docs_html/195/1958/195882/page_1_thumb_big.png

https://www.taxformfinder.org/illinois

1 2 3 Next Printed all of your Illinois income tax forms Head over to the Federal income tax forms page to get any forms you need for completing your Federal Income Tax return in April Illinois Income Tax Form Addresses Illinois has multiple mailing addresses for different tax forms and other forms of correspondence

https://tax.illinois.gov/content/dam/soi/en/web/tax/forms/incometax/documents/currentyear/individual/il-1040.pdf

Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11 Federally tax exempt interest and dividend income from your federal Form 1040 or 1040 SR Line 2a Other additions Attach Schedule M Total income Add Lines 1 through 3 Whole dollars only Step 3 Base Income

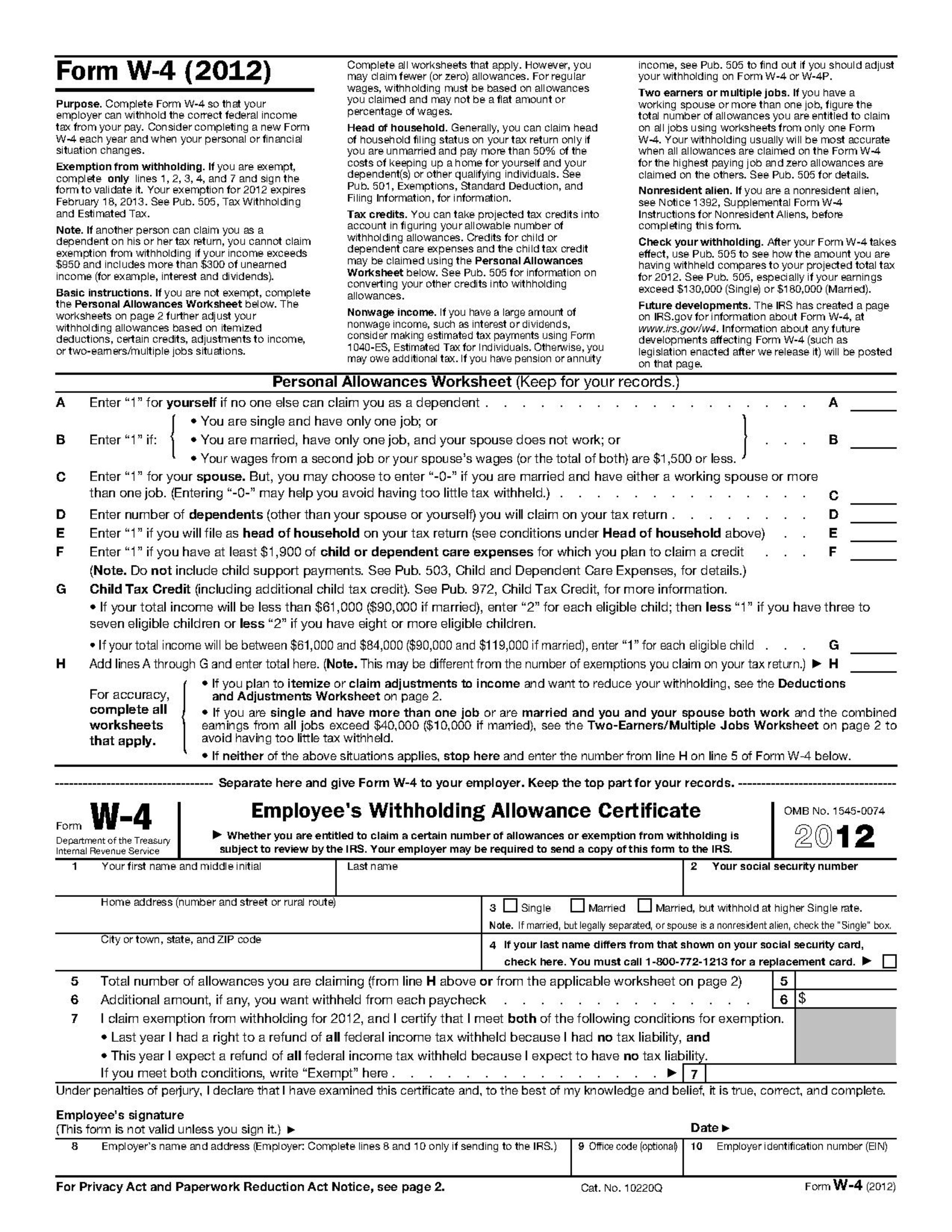

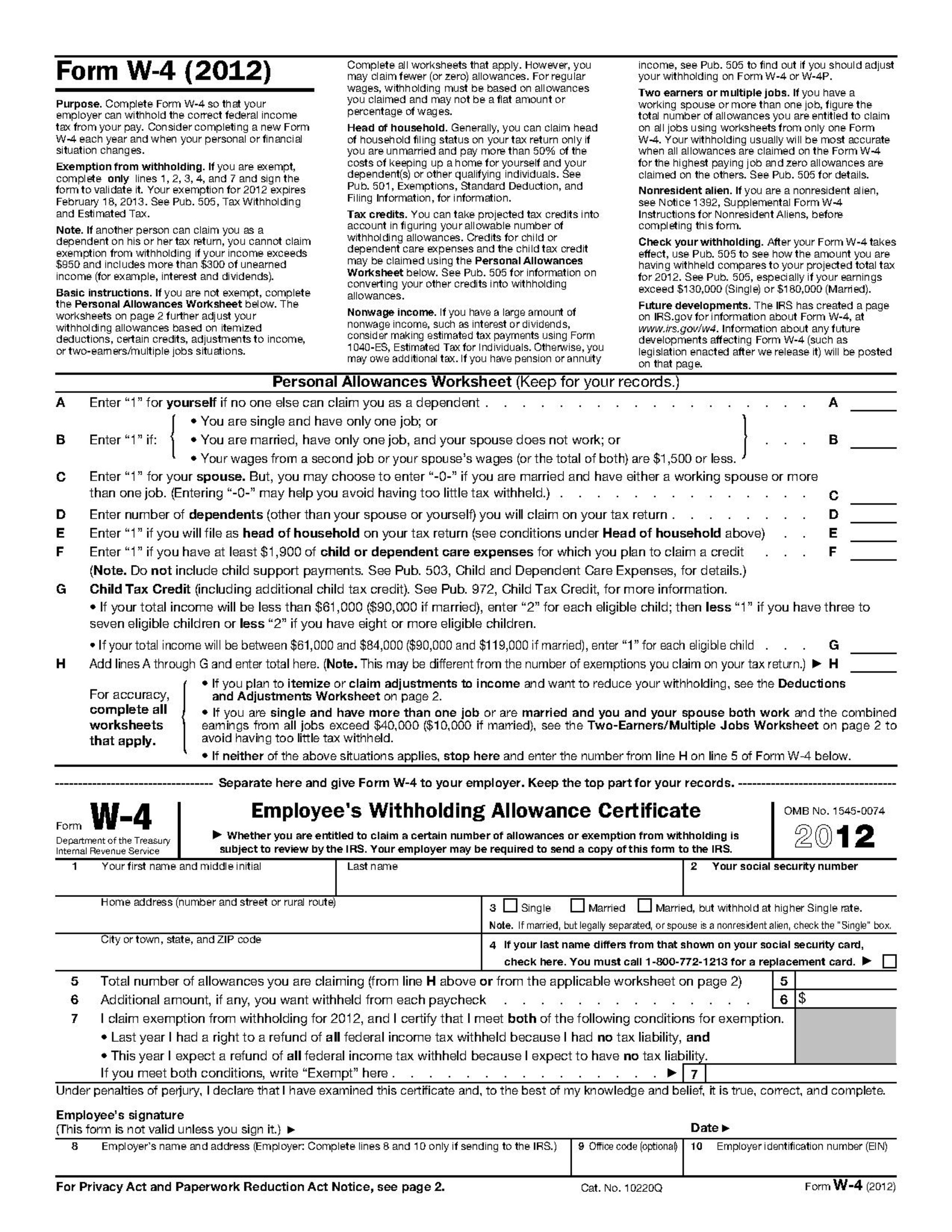

Irs Form W 4 Printable 2022 W4 Form Images

Fillable Il 1041 Form Printable Forms Free Online

Illinois State Income Tax Form For Trusts Printable Printable Forms Free Online

Printable State Tax Forms

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

State Of Illinois W4 Printable 2022 W4 Form

State Of Illinois W4 Printable 2022 W4 Form

St 1 Form Illinois PDF Fill Out And Sign Printable PDF Template SignNow

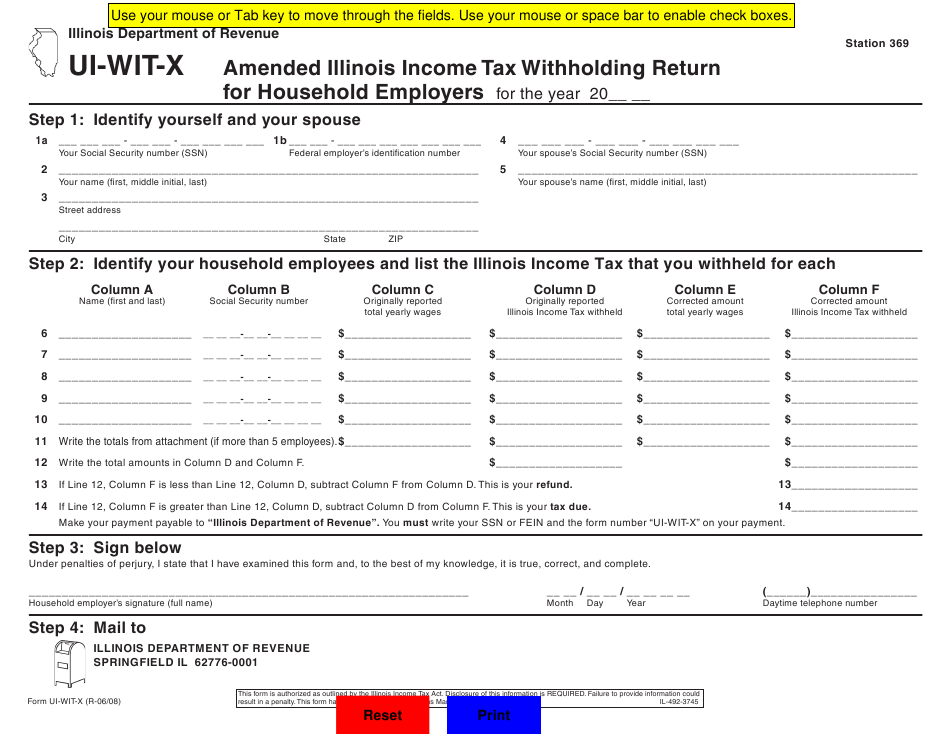

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign Printable PDF Template

Illinois Income Tax Withholding Forms 2022 W4 Form

Illinois State Tax Forms Printable - 7 8 Enter the amount of credits for Illinois Property Tax paid income tax paid to other states education expenses earned income pass through entity tax credit and tax credits from Schedule 1299 C you expect to claim on your 2023 return 8 9 Add Lines 7 and 8