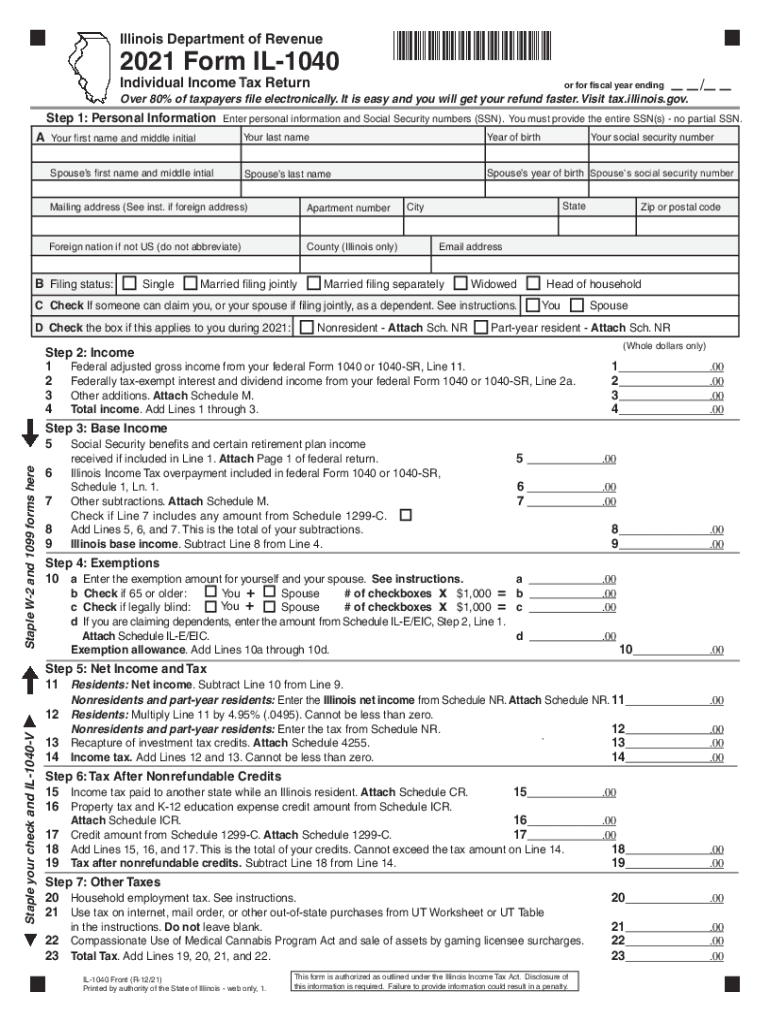

Illinois Tax Withholding Form Printable IL 1040 X V Payment Voucher for Amended Individual Income Tax IL 505 I Automatic Extension Payment for Individuals Filing Form IL 1040 IL 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer IL 2210

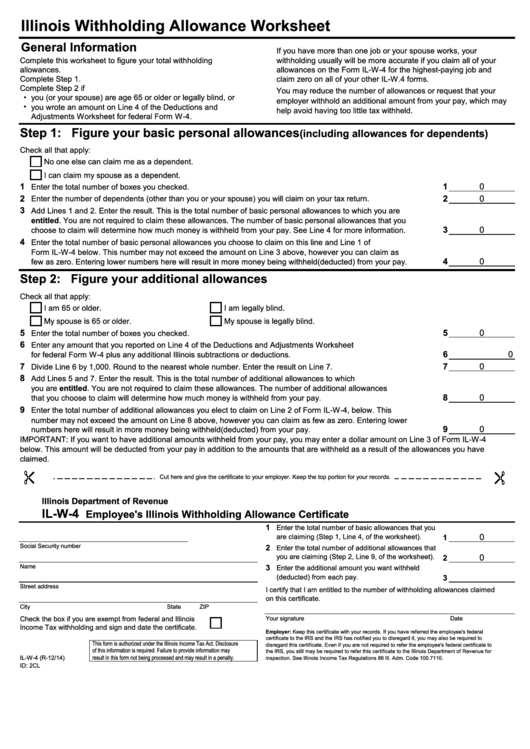

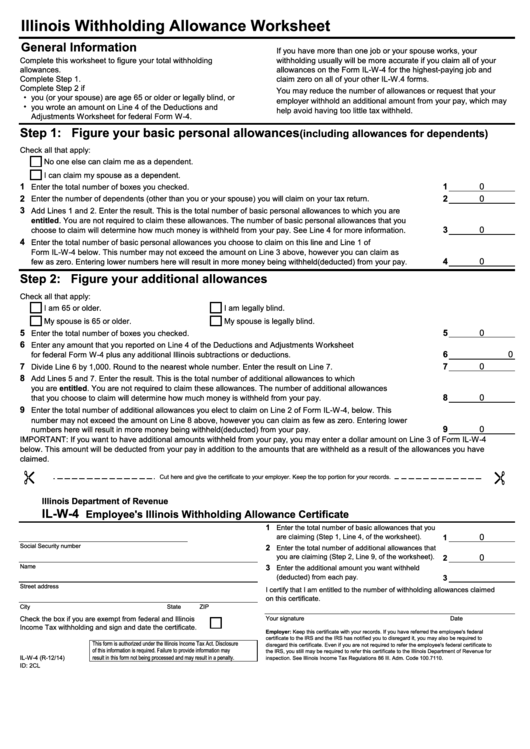

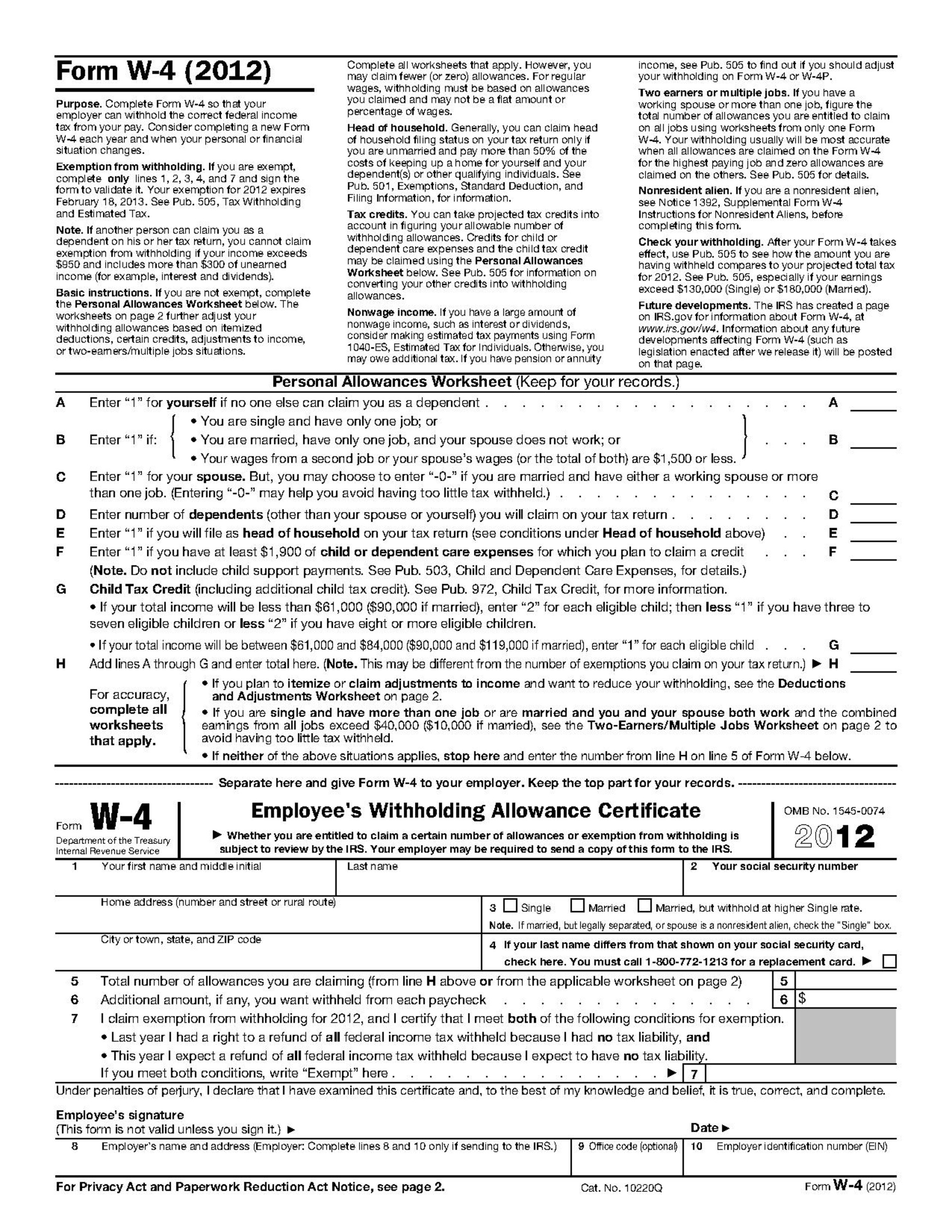

You must file Form IL W 4 when Illinois Income Tax is required to be withheld from compensation that you receive as an em ployee You should complete this form and Check the box if you are exempt from federal and Illinois Income Tax withholding and sign and date the certificate IL W 4 R 12 12 If you have more than one job or your spouse Write the total number of basic personal allowances you elect to claim on Line 4 and on Form IL W 4 Line 1 Step 2 Figure your additional allowances Check all that apply I am 65 or older I am legally blind My spouse is 65 or older My spouse is legally blind 5 Write the total number of boxes you checked

Illinois Tax Withholding Form Printable

Illinois Tax Withholding Form Printable

https://w4formsprintable.com/wp-content/uploads/2021/07/form-il-w-4-illinois-withholding-allowance-worksheet.png

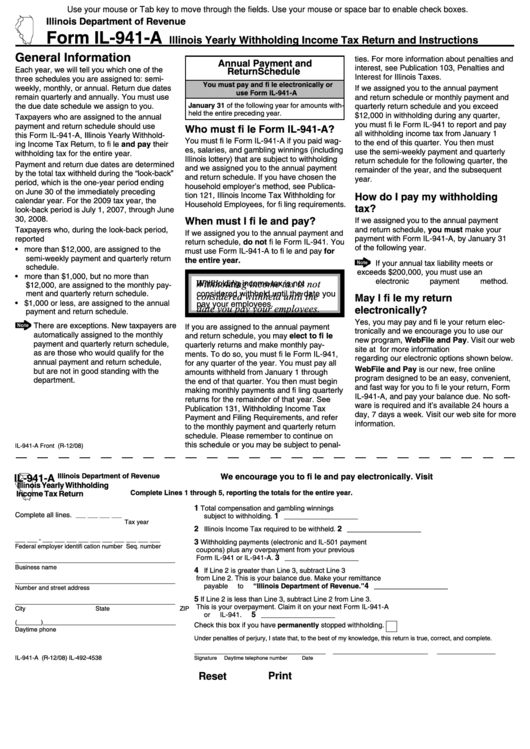

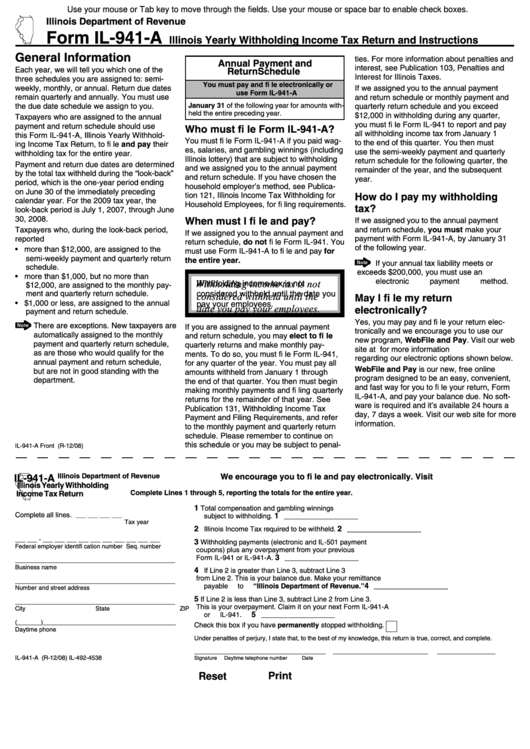

Fillable Form Il 941 A Illinois Yearly Withholding Income Tax Return Illinois Department Of

https://data.formsbank.com/pdf_docs_html/176/1765/176521/page_1_thumb_big.png

Il W 4 2020 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need.png

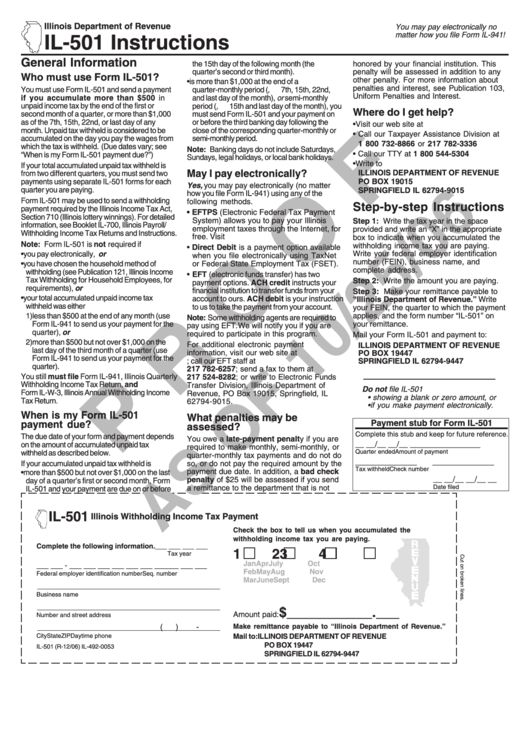

Visit our website at tax illinois gov Call our Taxpayer Assistance Division at 1 800 732 8866 or 217 782 3336 Call our TDD telecommunications device for the deaf at 1 800 544 5304 Write to ILLINOIS DEPARTMENT OF REVENUE PO BOX 19044 SPRINGFIELD IL 62794 9044 Illinois Withholding Allowance Worksheet General Information Use At 1 800 732 8866 or 217 782 3336 Complete this worksheet to figure your total withholding allowances Everyone must complete Step 1 Adjustments Worksheet for federal Form W 4 If you have more than one job or your spouse works you should figure the total number of allowances you are entitled to claim

Illinois has a flat state income tax of 4 95 which is administered by the Illinois Department of Revenue TaxFormFinder provides printable PDF copies of 76 current Illinois income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 62 Download or print the 2023 Illinois Form Schedule IL WIT Illinois Income Tax Withheld for FREE from the Illinois Department of Revenue include all W 2 and 1099 forms that show Illinois withholding Your Social Security number Your name as shown on Form IL 1040 Column A Column B Form type Employer Payer Identification Number Column C

More picture related to Illinois Tax Withholding Form Printable

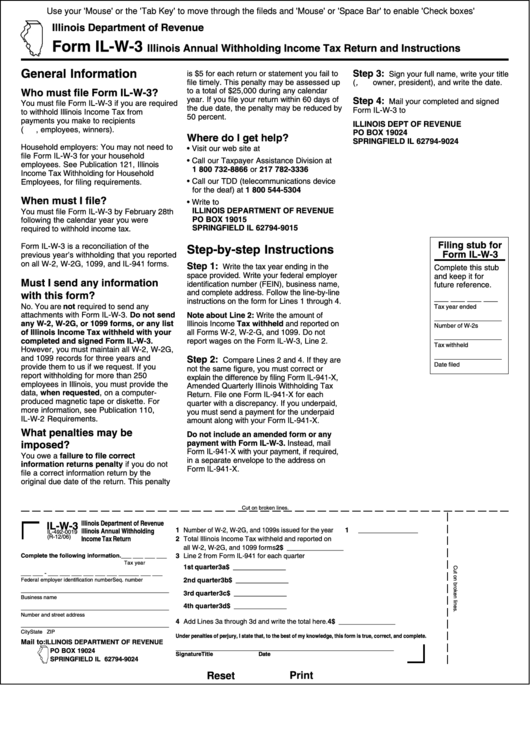

Form Il W 3 Illinois Annual Withholding Income Tax Return And Instructions 2006 Printable

https://data.formsbank.com/pdf_docs_html/173/1738/173833/page_1_thumb_big.png

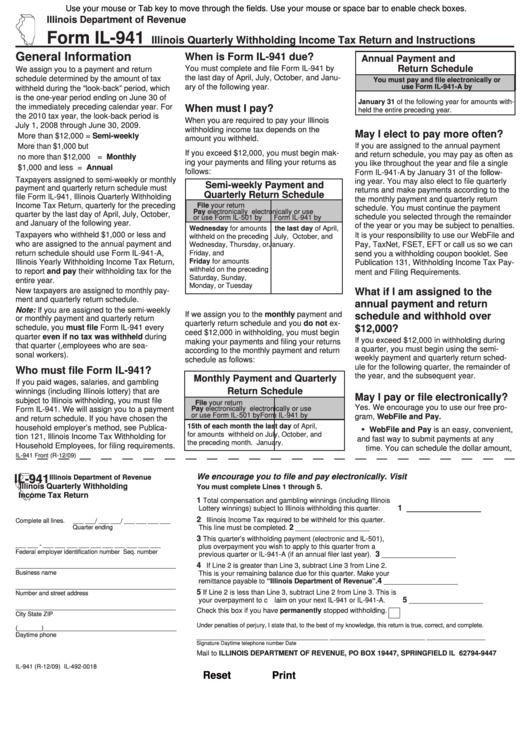

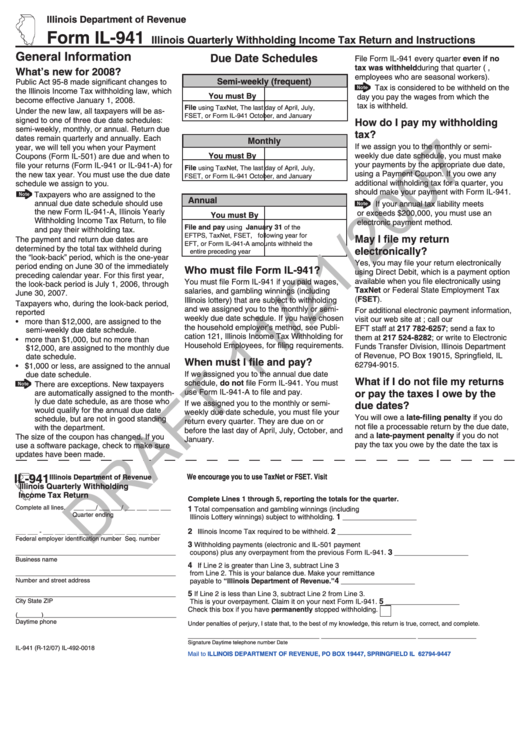

Form Il 941 Illinois Quarterly Withholding Income Tax Return And Instructions 2009 Printable

https://data.formsbank.com/pdf_docs_html/173/1739/173905/page_1_thumb_big.png

Form IL 1040 X 2019 Fill Out Sign Online And Download Fillable PDF Illinois Templateroller

https://data.templateroller.com/pdf_docs_html/2063/20638/2063882/form-il-1040-x-amended-individual-income-tax-return-illinois_print_big.png

The Illinois Form IL W4 Employee s Illinois Withholding Allowance Certificate must be completed so that you know how much state income tax to withhold from your new employee s wages The importance of having each employee file a state withholding certificate as well as a federal Form W 4 cannot be overstated so make its completion a priority If an employee does not complete the Form W 4 federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations The federal default rate is the status of a single filer with no adjustments The State of Illinois default rate is withholding with no allowances Printable W 4 Instructions

For information or forms Visit our website at tax illinois gov File your return online at mytax illinois gov Email us at Individual income tax questions REV TA IIT illinois gov Business and withholding income tax questions REV TA BIT WIT illinois gov Call us at 1 800 732 8866 or 217 782 3336 Call our TDD telecommunications How to Fill Out Form IL W 4 Employee s Illinois Withholding Allowance Certificate The actual IL W 4 form is located under Step 2 of the worksheet in the last quarter of Page 2 If you are filling out a paper version of the form cut the form at the dotted line to separate the certificate from the worksheets then mail the certificate to

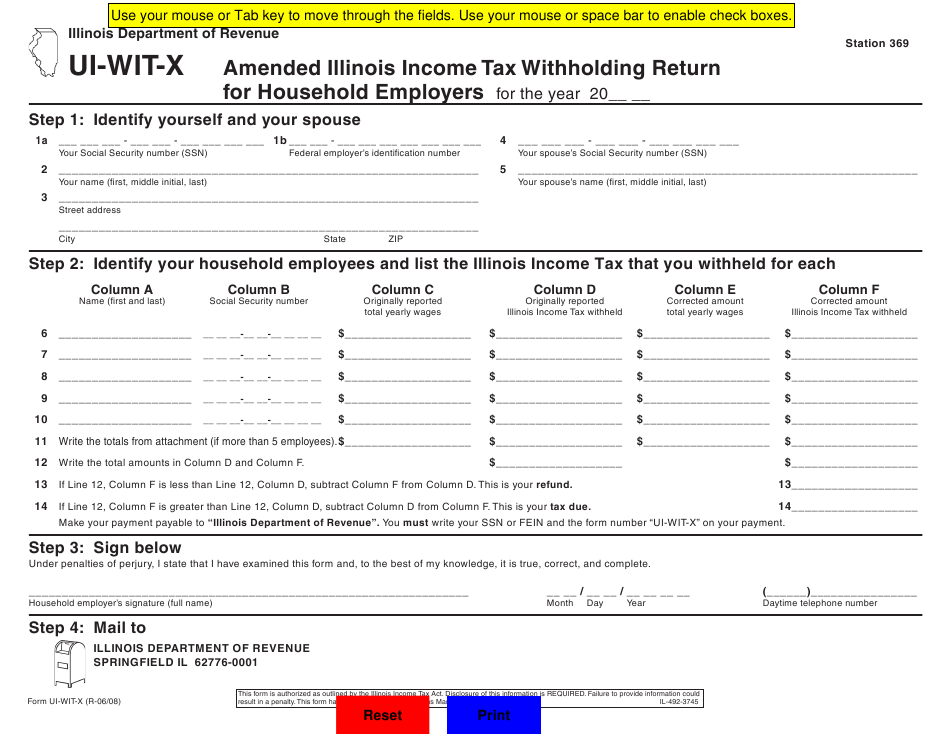

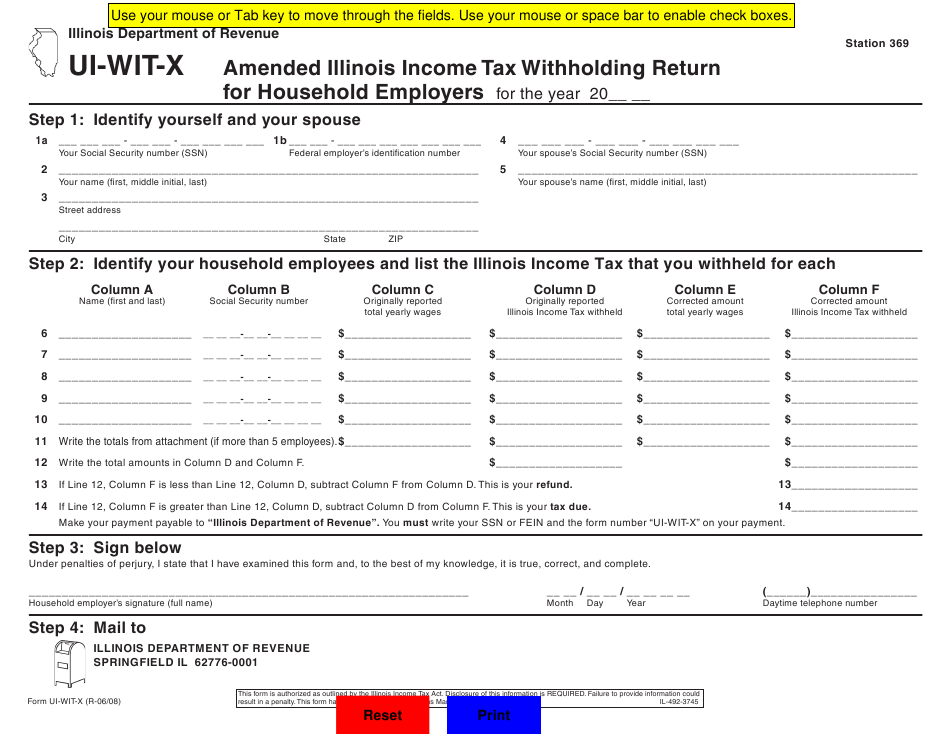

Illinois Income Tax Withholding Forms 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-ui-wit-x-download-fillable-pdf-or-fill-online-amended.png

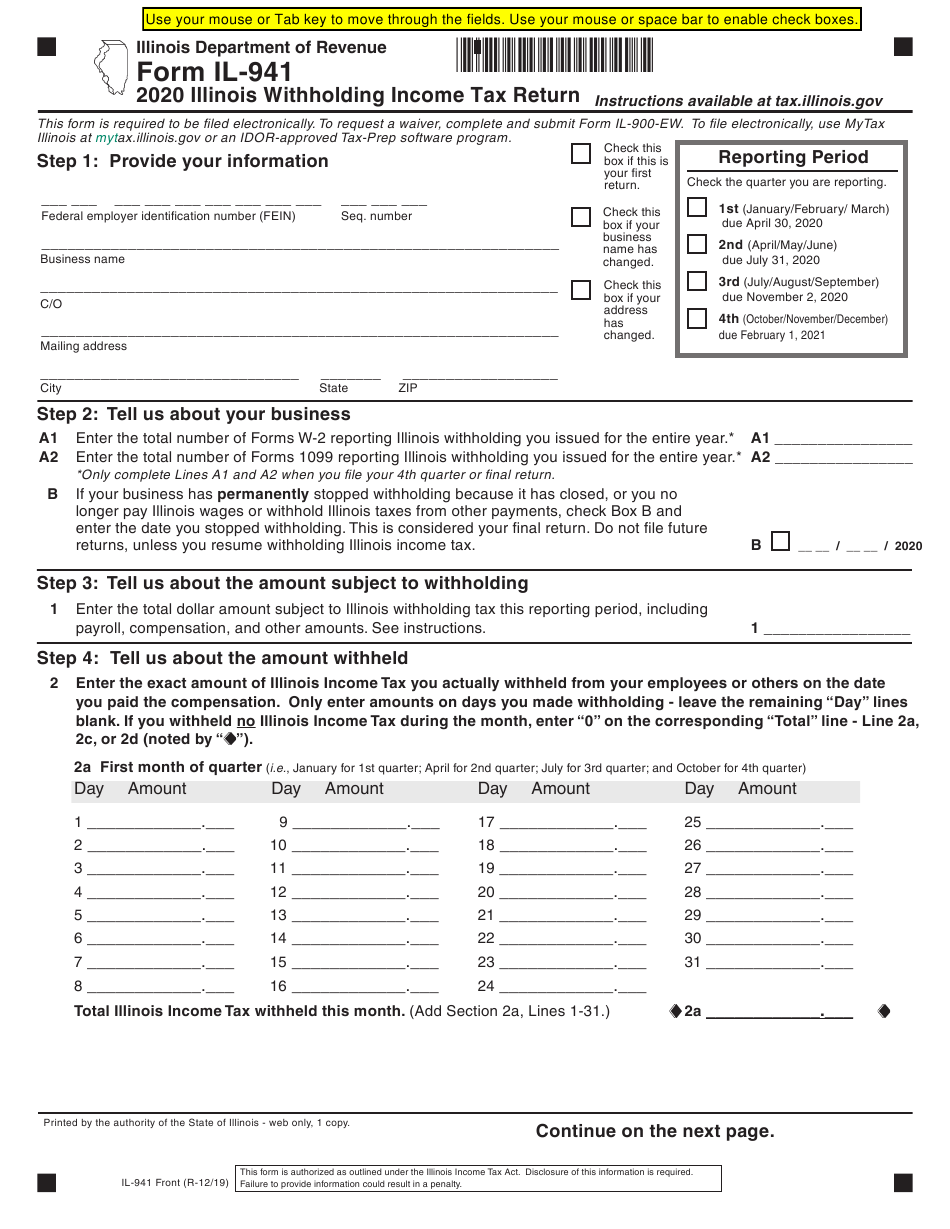

2021 Illinois Withholding Form 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-il-941-download-fillable-pdf-or-fill-online-illinois.png

https://tax.illinois.gov/forms/incometax/currentyear/individual.html

IL 1040 X V Payment Voucher for Amended Individual Income Tax IL 505 I Automatic Extension Payment for Individuals Filing Form IL 1040 IL 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer IL 2210

https://financialservices.wustl.edu/wp-content/uploads/2021/01/2021-IL-W-4.pdf

You must file Form IL W 4 when Illinois Income Tax is required to be withheld from compensation that you receive as an em ployee You should complete this form and Check the box if you are exempt from federal and Illinois Income Tax withholding and sign and date the certificate IL W 4 R 12 12 If you have more than one job or your spouse

Il State Withholding Form 2023 Printable Forms Free Online

Illinois Income Tax Withholding Forms 2022 W4 Form

Illinois W4 Form 2021 Printable 2022 W4 Form

Form Il 501 Proof Illinois Withholding Income Tax Payment Printable Pdf Download

Form Il 941 Draft Illinois Quarterly Withholding Income Tax Return And Instructions 2007

Illinois State Income Tax Fill Out Sign Online DocHub

Illinois State Income Tax Fill Out Sign Online DocHub

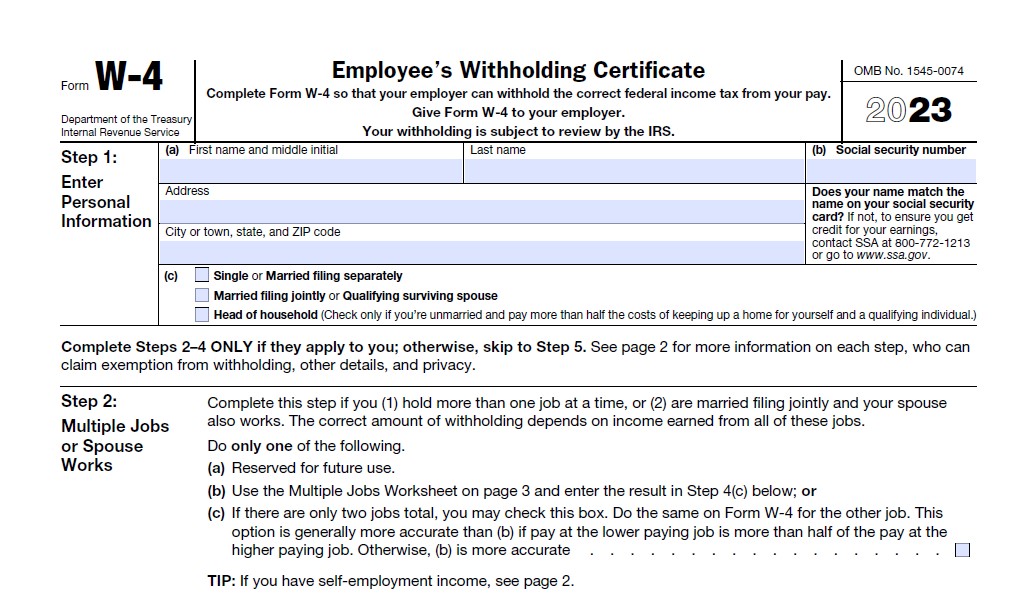

IRS W 4 Form 2023 Printable IRS Tax Forms 2024

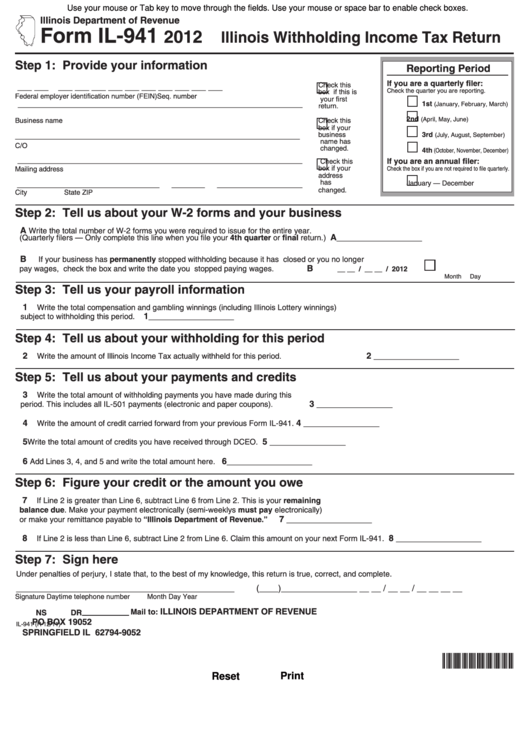

Fillable Form Il 941 Illinois Withholding Income Tax Return 2012 Printable Pdf Download

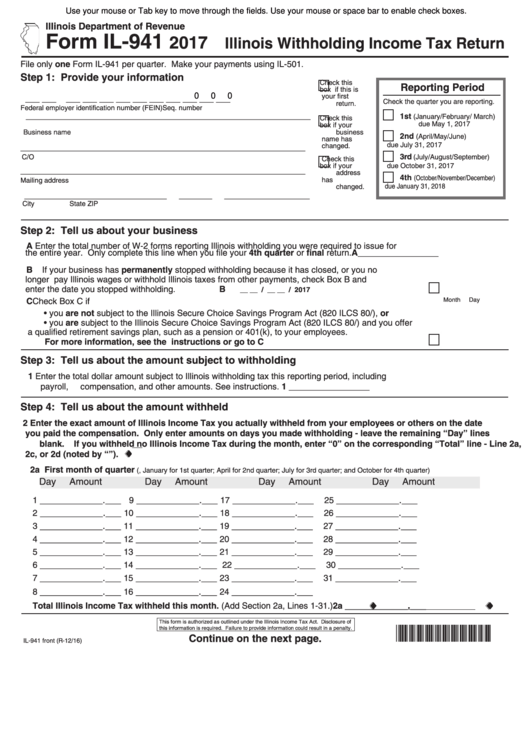

Fillable Form Il 941 Illinois Withholding Income Tax Return 2017 Printable Pdf Download

Illinois Tax Withholding Form Printable - The IRS recently released an updated version of Form W 4 for 2024 which can be used to adjust withholdings on income earned in 2024 The main difference between the 2023 and 2024 W 4 is Step 2