Independent Contractor Printable 1099 Form Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification This form can be used to request the correct name and Taxpayer Identification Number or TIN of the payee

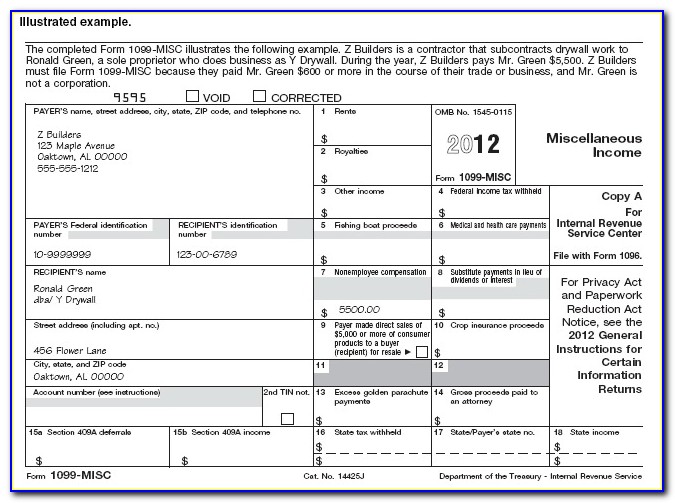

If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in Last Updated April 4 2023 Are you an independent contractor who needs to know more about the 1099 form Understanding this form is essential for independent contractors as it helps them keep track of their income federal income tax and other financial information

Independent Contractor Printable 1099 Form

Independent Contractor Printable 1099 Form

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://s30311.pcdn.co/wp-content/uploads/2020/03/form-1099-misc-fold.png

Form 1099 NEC is specifically designed to report nonemployee compensation which includes payments made to independent contractors freelancers and other service providers who are not considered employees This form is used to report payments of 600 or more for services provided during the tax year 2023 A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

How Does Form 1099 Affect Independent Contractor Taxes Unlike regular employees who have taxes withheld from each paycheck independent contractors are responsible for setting aside money for their own taxes Your 1099 form aids in determining how much you owe Remember 1099 forms are printable and having a physical copy can often be Form 1099 NEC reports how much a business paid annually to nonemployees including independent contractors Form 1099 MISC reports a business s miscellaneous payments e g rents paid to property managers Form 1099 K reports payment card transactions through third party networks

More picture related to Independent Contractor Printable 1099 Form

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2018/12/1099-form-independent-contractor-2018.jpg

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

Updated January 18 2024 An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee If you send the IRS a 1099 that you ve printed on plain paper you ll be charged a penalty just as if you d failed to file the form at all 1099s get printed at least three times sometimes four These are called copies A B C and 1 and here s who gets them Copy A For the IRS Copy B For the person you paid Copy C For your own records

Form 1099 MISC This form is used by employers to report payments made to independent contractors or other non employees for goods and services Employers must submit Form 1099 MISC to the IRS and provide a copy to each independent contractor by January 31st of the following year Using accounting software Some accounting software programs can prepare print and e file Form 1099 NEC Step 4 Provide Form 1099 to Independent Contractors File With IRS Provide one copy of Form 1099 NEC to each contractor or vendor and file all Forms 1099 NEC with the IRS You will also have a copy you can send to your state tax

Irs 1099 Forms For Independent Contractors Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor.jpg

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i0.wp.com/eforms.com/download/2018/05/Subcontractor-Agreement-Template.png?ssl=1

https://www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification This form can be used to request the correct name and Taxpayer Identification Number or TIN of the payee

https://www.irs.gov/businesses/small-businesses-self-employed/reporting-payments-to-independent-contractors

If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in

Form 1099 For Independent Contractors A Guide For Recipients

Irs 1099 Forms For Independent Contractors Form Resume Examples

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

How To File A 1099 Form Independent Contractor Universal Network

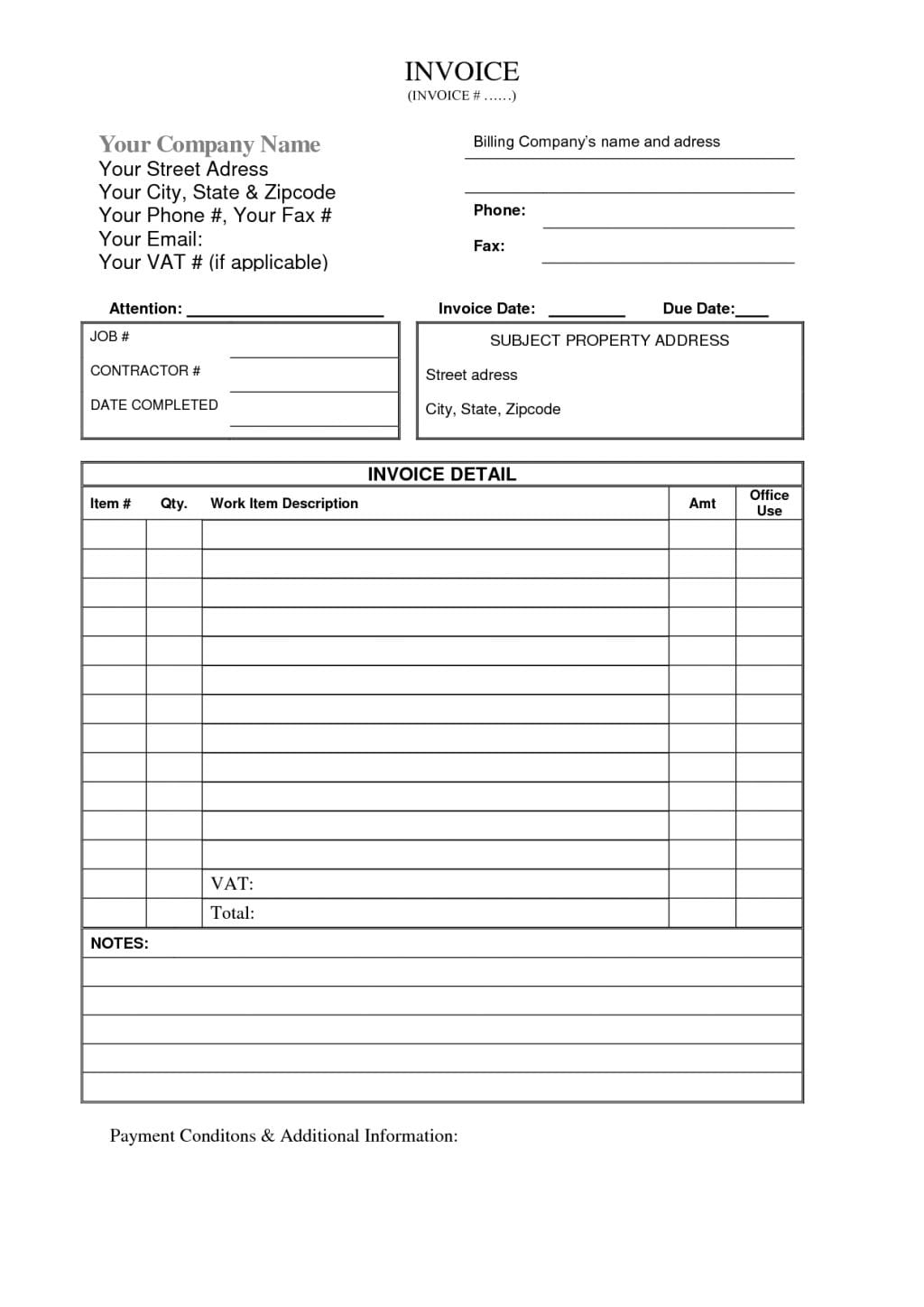

1099 Contractor Invoice Template Excelxo

1099 Form Independent Contractor Pdf Free Independent Contractor Agreement Templates Pdf Word

1099 Form Independent Contractor Pdf Free Independent Contractor Agreement Templates Pdf Word

Printable 1099 Forms For Independent Contractors

Printable 1099 Form Independent Contractor Form Resume Examples

Independent Contractor 1099 Form A Step by Step Guide

Independent Contractor Printable 1099 Form - Form 1099 NEC is specifically designed to report nonemployee compensation which includes payments made to independent contractors freelancers and other service providers who are not considered employees This form is used to report payments of 600 or more for services provided during the tax year 2023